6 Sep 2022 Afternoon Session Analysis

Euro remain pressured as energy crisis risk heightened.

The Euro, which is the single currency of the Eurozone, continued to hover near the 20-year low following natural gas flow halted to Europe. Yesterday, Russia said it was shutting the natural gas pipeline – Nord Steam 1, which supplies gas to Europe, for maintenance. The Nord Stream 1 pipeline, which has been operational since 2011, is the single biggest gas pipeline carrying gas between Russian and Western Europe. According to the latest statement from the Moscow, Russian gas supplies to Europe will not resume until sanctions against Moscow are lifted. The Kremlin said on Monday the Western sanctions were the sole reason behind Russia’s decision to shut the Nord Stream 1 pipeline. With the gas pipeline halted, the market fears over the energy crisis in Eurozone heightened, whereby the Europe would face further imbalances between the energy supply and demand before the winter season. As the investors reckon the hit to its economy will be huge, hence, sell-off activities have been taken by the investor, urging the value of the Euro depreciated further. As of writing, the pair of EUR/USD up by 0.29% to 0.9955.

In the commodities market, crude oil prices edged down by -0.54% to $88.90 per barrel as the market participants digested the news of small oil production cut by OPEC+. Besides, gold prices appreciated 0.39% to $1717.35 per troy ounce amid the weakening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Aug) | 48.9 | 48.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Aug) | 56.7 | 55.1 | – |

Technical Analysis

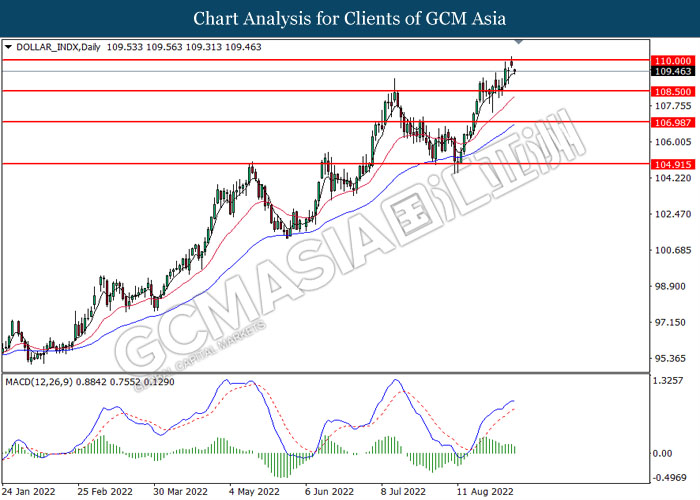

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level at 110.00. MACD which illustrated diminishing bullish momentum suggest the index to extend its losses toward the support level at 108.50.

Resistance level: 110.00, 112.20

Support level: 108.50, 107.00

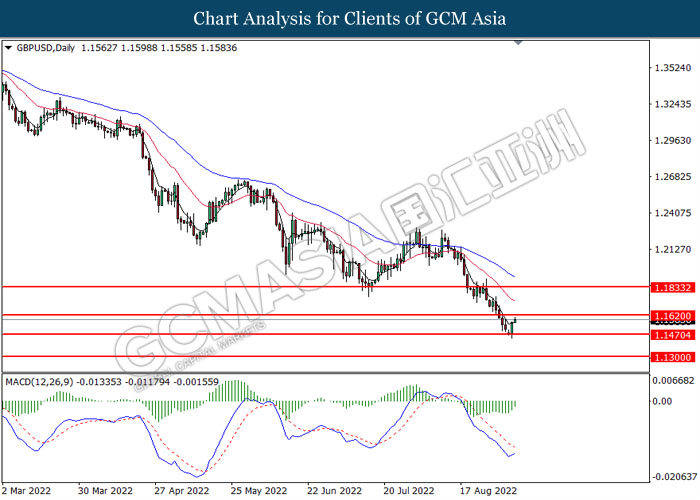

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1620, 1.1835

Support level: 1.1470, 1.1300

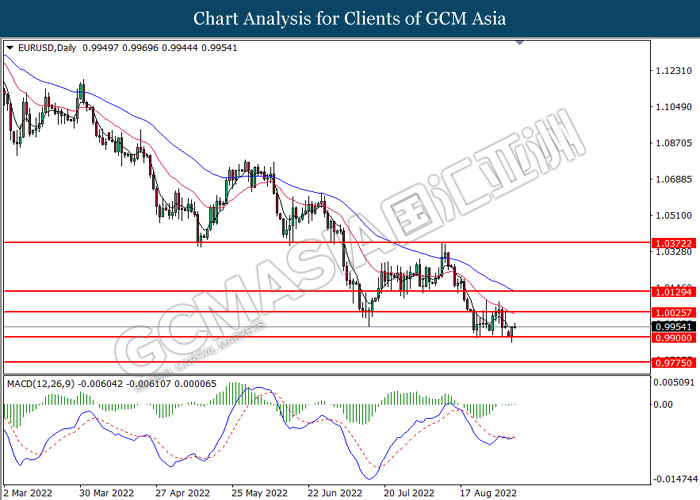

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 0.9900. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9900, 0.9775

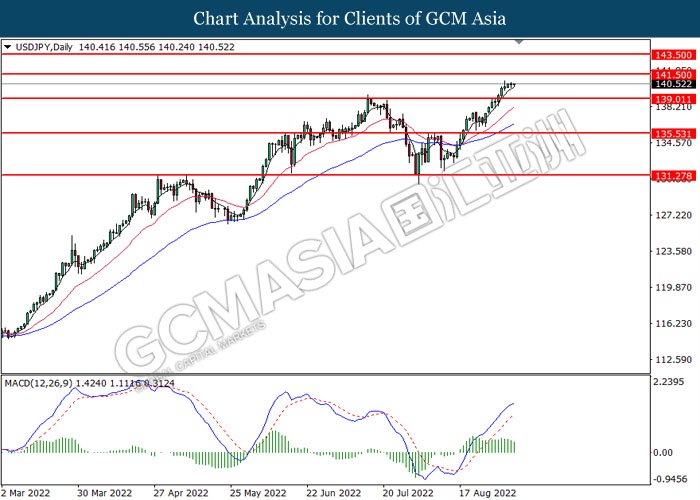

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 139.00. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 141.50, 143.50

Support level: 139.00, 135.55

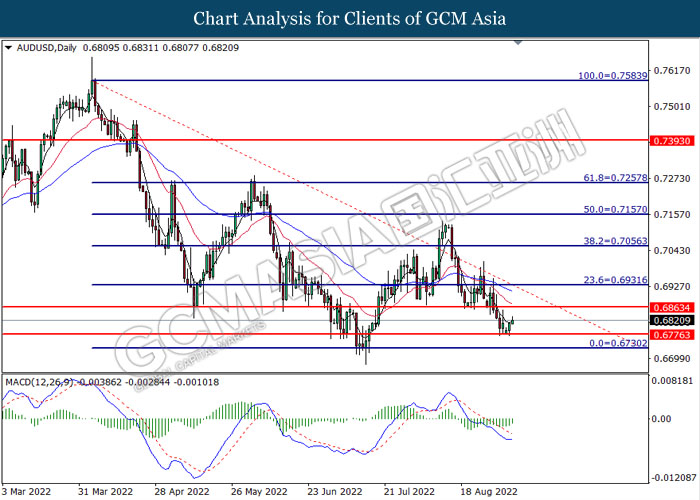

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6775. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6865.

Resistance level: 0.6865, 0.6930

Support level: 0.6775, 0.6730

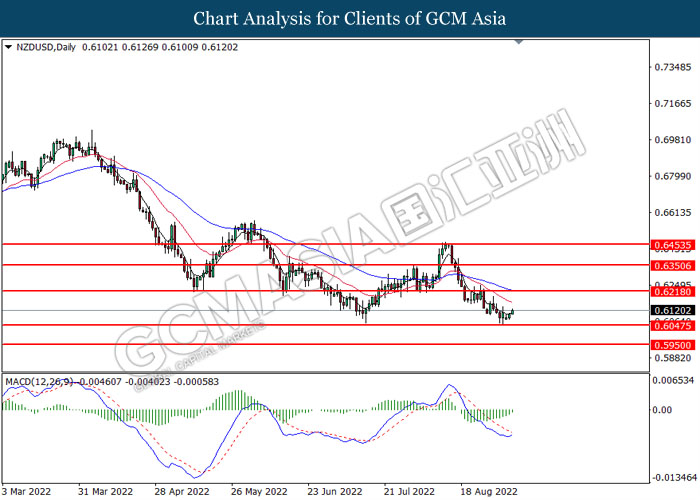

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6045. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6220.

Resistance level: 0.6220, 0.6350

Support level: 0.6045, 0.5950

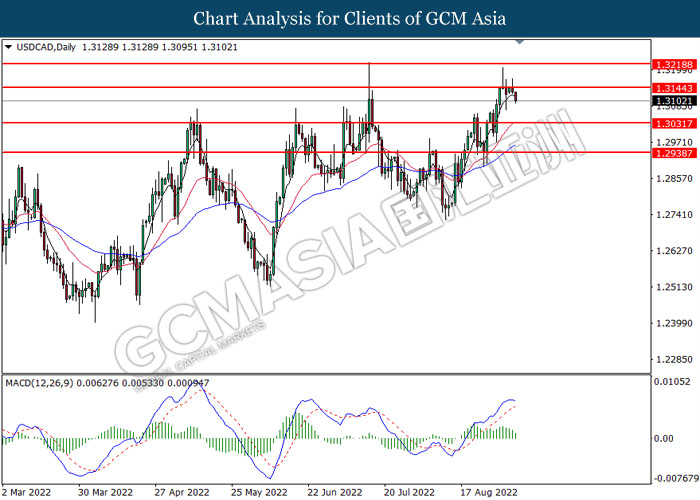

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3145. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.3030.

Resistance level: 1.3145, 1.3220

Support level: 1.3030, 1.2940

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9840. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9720.

Resistance level: 0.9840, 1.0030

Support level: 0.9720, 0.9625

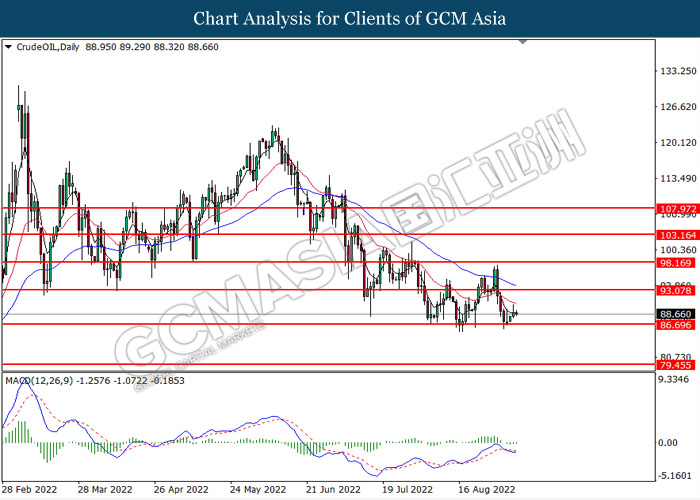

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 86.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 93.05.

Resistance level: 93.05, 98.15

Support level: 86.70, 79.45

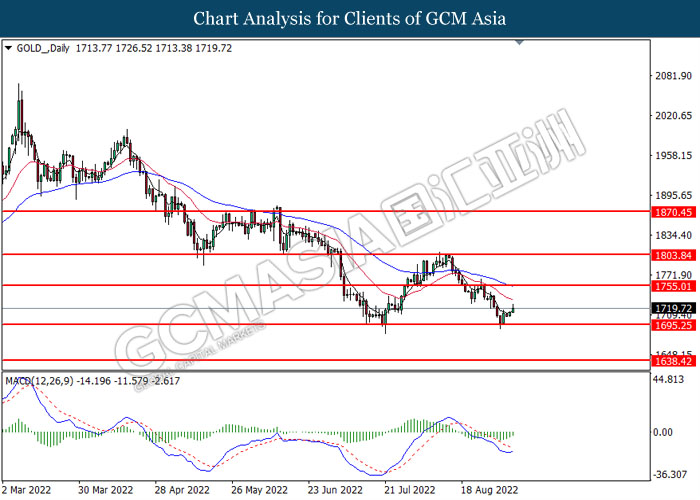

GOLD_, Daily: Gold price was traded higher following prior retracement from the support level at 165.25. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1755.00.

Resistance level: 1755.00, 1803.85

Support level: 1695.25, 1638.40