6 September 2022 Morning Session Analysis

Pound rose upon the optimistic speech from new UK Prime Minister.

The GBP/USD, which traded by majority of investors edged up on yesterday with the background of new UK Prime Minister announcement. According to Bloomberg, the new UK Prime Minister has been announced. Liz Truss, who was the foreign secretary of the nation, has won the vote to succeed Boris Johnson as UK prime minister. She would take responsible to tackle brutal economic headwinds that threaten to plunge millions of Britons into poverty this winter. The new UK Prime Minister has claimed after winning the vote that the tax cut would be implemented in order to rescue citizens from the soaring energy and living prices, which brought positive prospects toward economic progression of UK. Though, the current UK economy still facing recession as the downbeat economic data has been unleashed, which limited the gains of Pound Sterling. A series of data such as UK Services Purchasing Managers Index (PMI) and UK Composite Purchasing Managers’ Index (PMI) has given a figures that lower-than-expected. As of writing, GBP/USD appreciated by 0.60% to 1.1585.

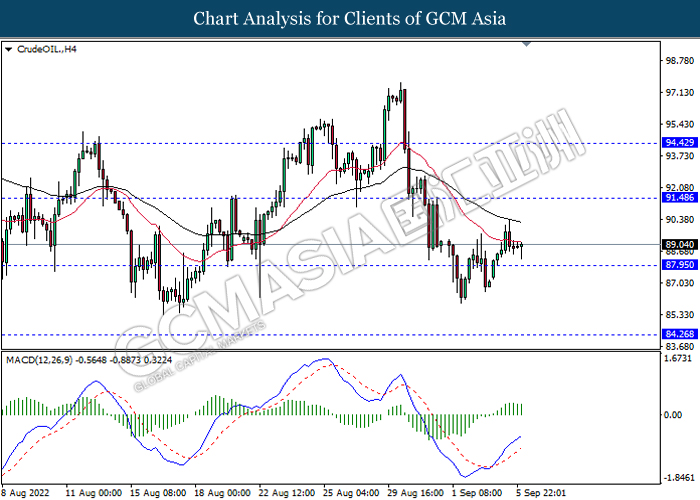

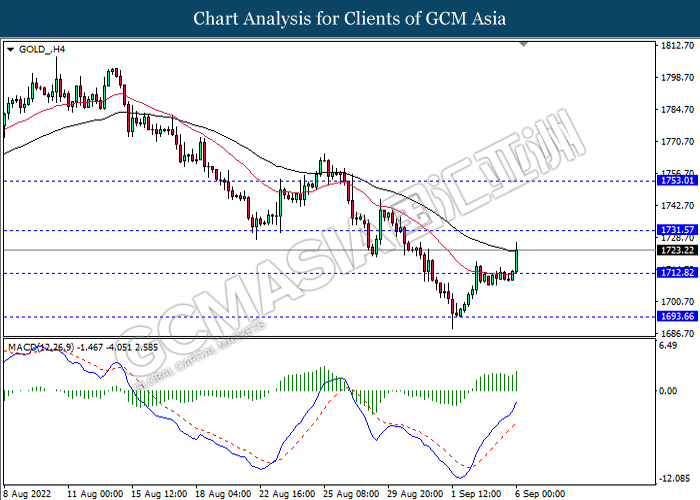

In the commodities market, the crude oil price raised by 2.31% to $88.88 per barrel as of writing following the OPEC+ decided to diminish the oil output. On the other sides, the gold price rose by 0.57% to $1732.20 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

12:30 AUD RBA Interest Rate Decision (Sep)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Aug) | 48.9 | 48.0 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Aug) | 56.7 | 55.5 | – |

Technical Analysis

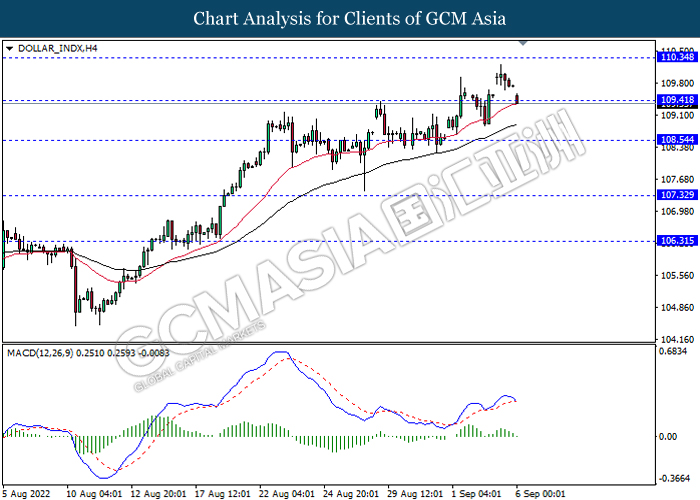

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

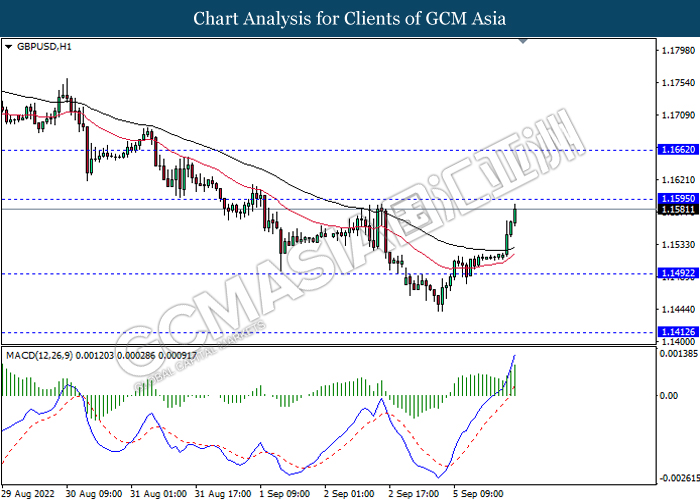

GBPUSD, H1: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1595, 1.1660

Support level: 1.1490, 1.1410

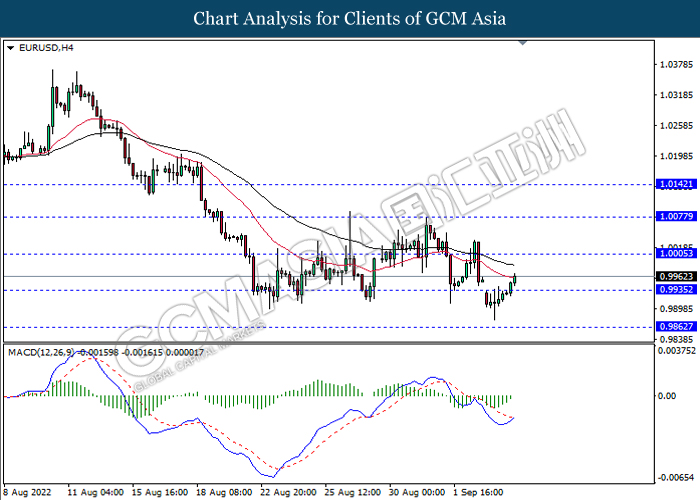

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0075

Support level: 0.9935, 0.9860

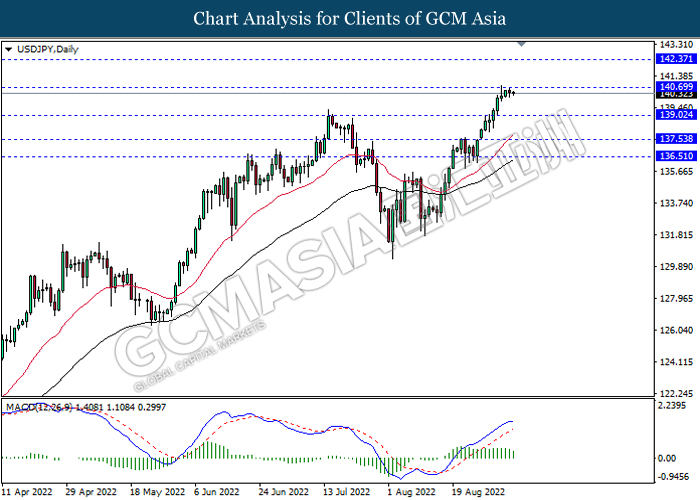

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

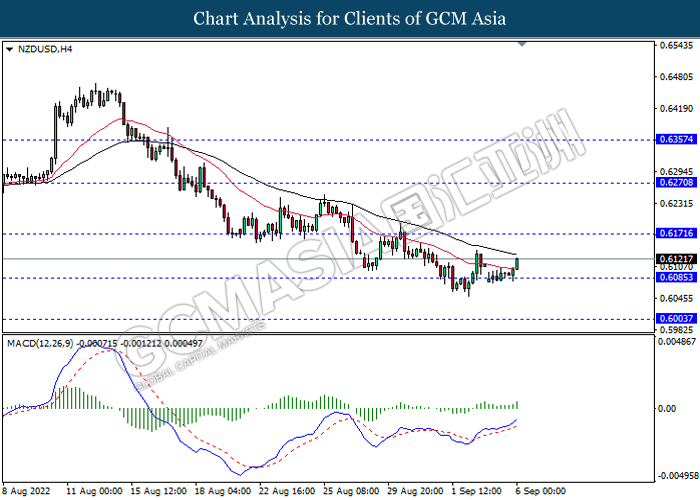

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

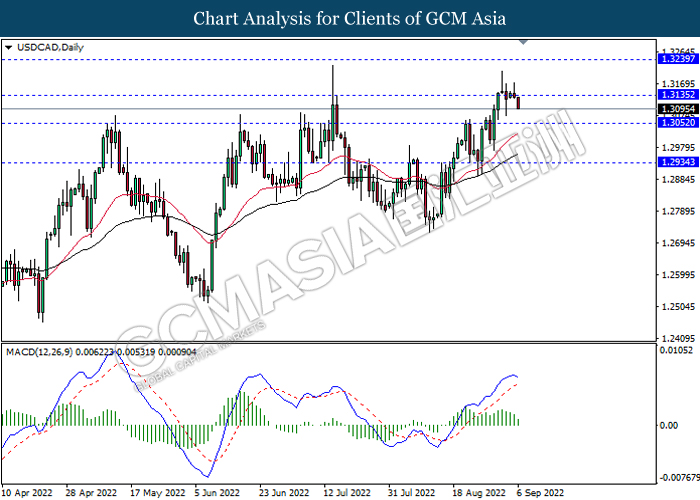

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3135, 1.3240

Support level: 1.3050, 1.2935

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses of successfully breakout the support level.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.25

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1731.55, 1753.00

Support level: 1712.80, 1693.65