07 February 2022 Afternoon Session Analysis

Rate hike expectation, insinuate demand for Euro.

The overall trend for the Euro remained bullish following the European Central Bank (ECB)’s governing council unleashed their hawkish tone toward the economic momentum in the European region. According to Reuters, Klass Knot claimed on Sunday that he expects the European Central Bank (ECB) would initiate a rate hike in the fourth quarter of this year in order to combat the high inflation risk. Earlier, the Eurozone inflation rate hit record levels for third month in a row, jeopardizing the growth in consumer spending while spurring the odds for the ECB to implement contractionary monetary policy. Market participants will continue to observe if there is any shift in the European Central Bank’s outlook to receive further trading signal. As of writing, EUR/USD surged 0.03% to 1.1440.

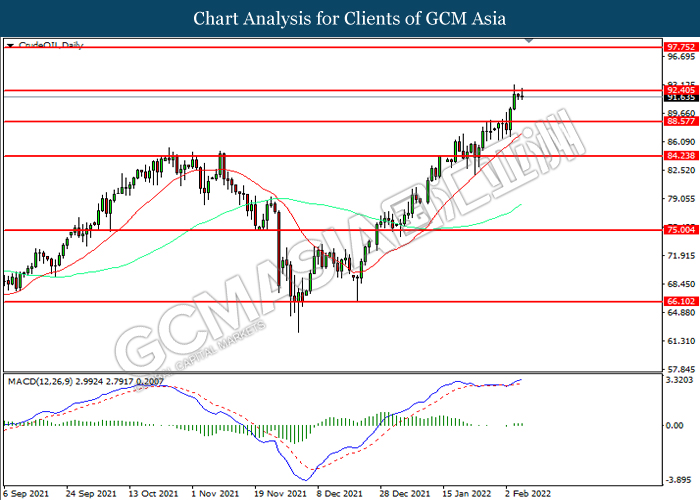

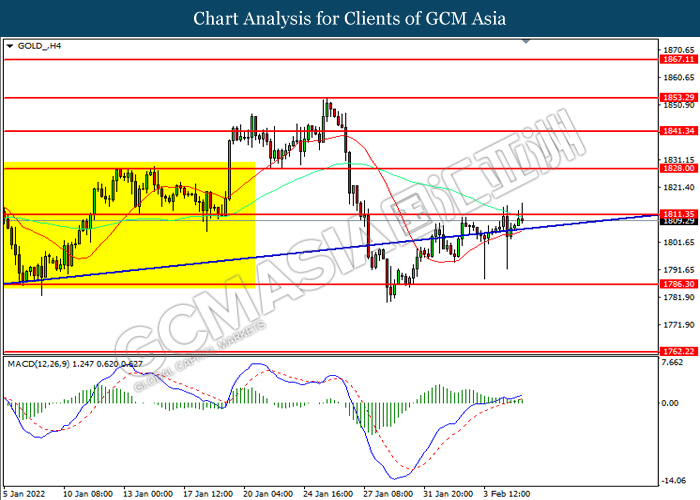

In the commodities market, the crude oil price depreciated by 0.38% to $92.00 per barrel as of writing amid technical correction following a run of seven consecutive weekly gains. Nonetheless, the overall trend for the oil market remained bullish amid tight supply disruption fears due to the massive winter storm across the United States continue to spur bullish momentum for this black-commodity. On the other hand, the gold price depreciated by 0.05% to $1809.70 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

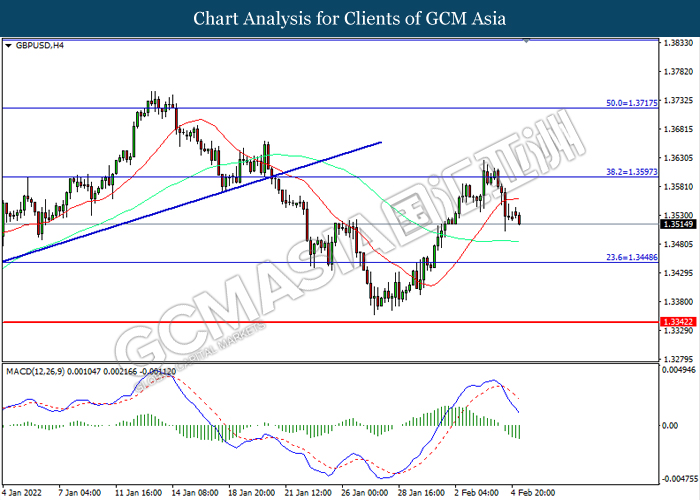

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

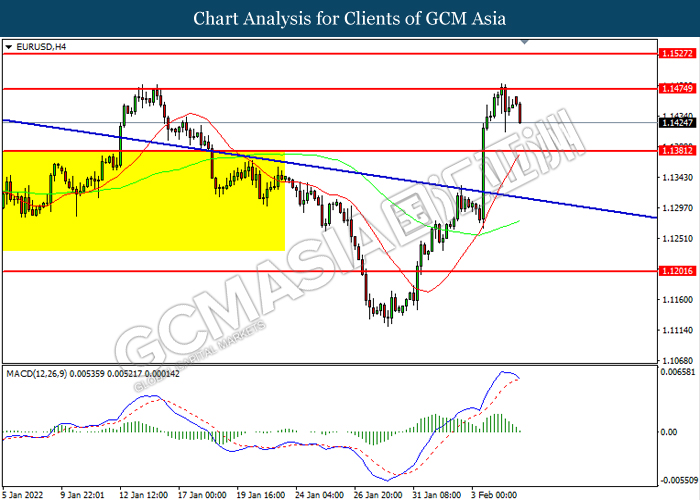

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1380.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1200

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.35. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.35, 116.25

Support level: 112.85, 110.90

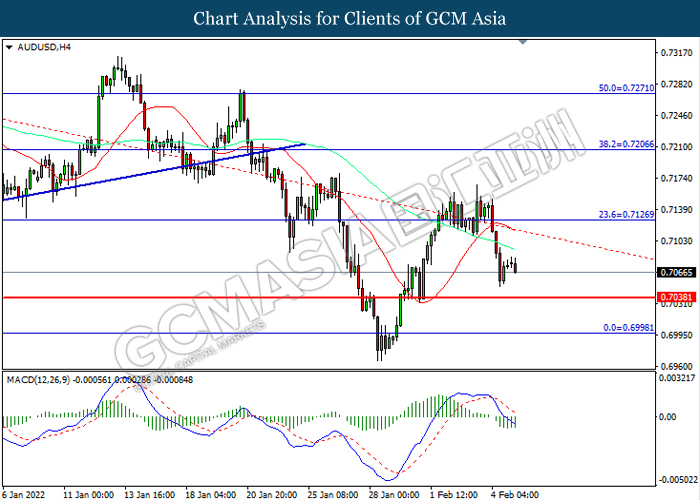

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.7040. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 0.7040.

Resistance level: 0.7125, 0.7205

Support level: 0.7040, 0.7000

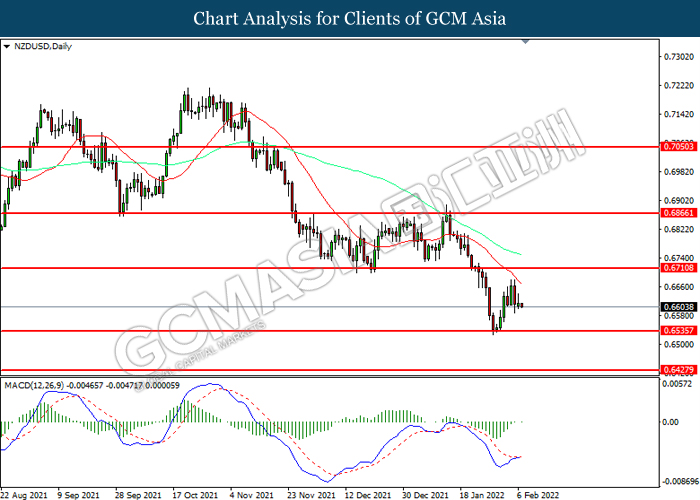

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6710. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 0.6710, 0.6865

Support level: 0.6550, 0.6430

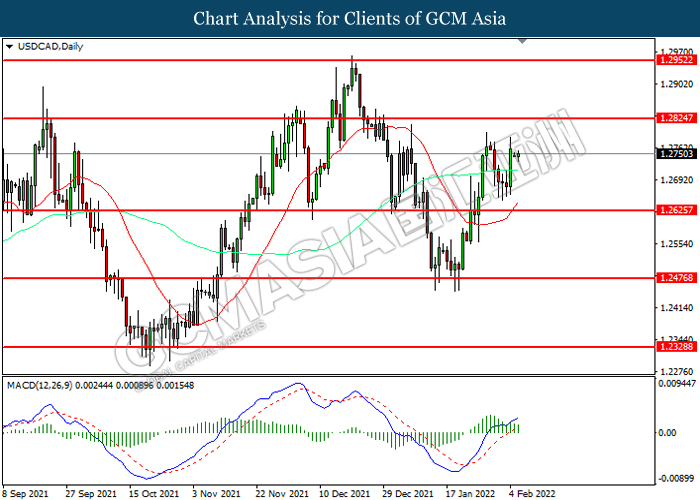

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2625. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

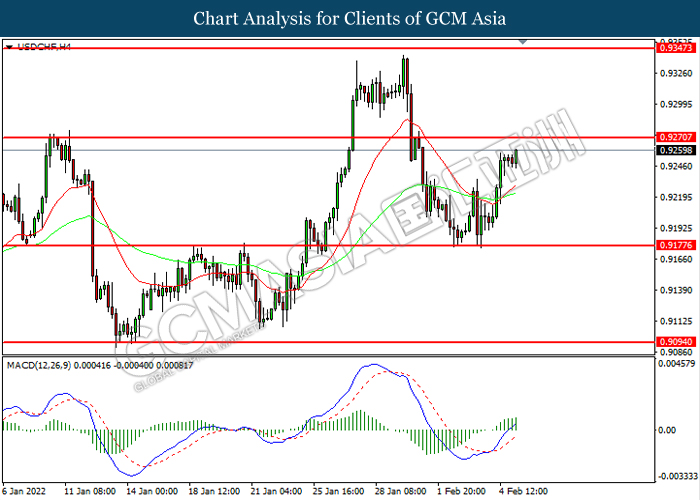

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 92.40. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 92.40, 97.75

Support level: 88.55, 84.25

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1811.35. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower in short-term as technical correction.

Resistance level: 1811.35, 1828.00

Support level: 1786.30, 1762.20