7 February 2022 Morning Session Analysis

Nonfarm Payrolls out of expectation.

Greenback rebounds slightly on last Friday as investors digest better-than-expected Nonfarm Payrolls report for last month. According to Bureau of Labor Statistics, Nonfarm Payrolls came in at 467K for the month of January, significantly higher than forecast of 150K. Previously, investors speculated Nonfarm Payrolls report to shows significant job losses as ADP Nonfarm Employment Change came in with a negative reading. The data shows that US jobs market remains resilient despite rising Omicron cases throughout the country during last month. In addition, US Average Hourly Earnings rose by 0.7% for last month. The data has cemented the course for further monetary policy tightening from Federal Reserve in order to prevent spillover effect upon inflation. As of writing, the dollar index was up 0.02% to 95.40.

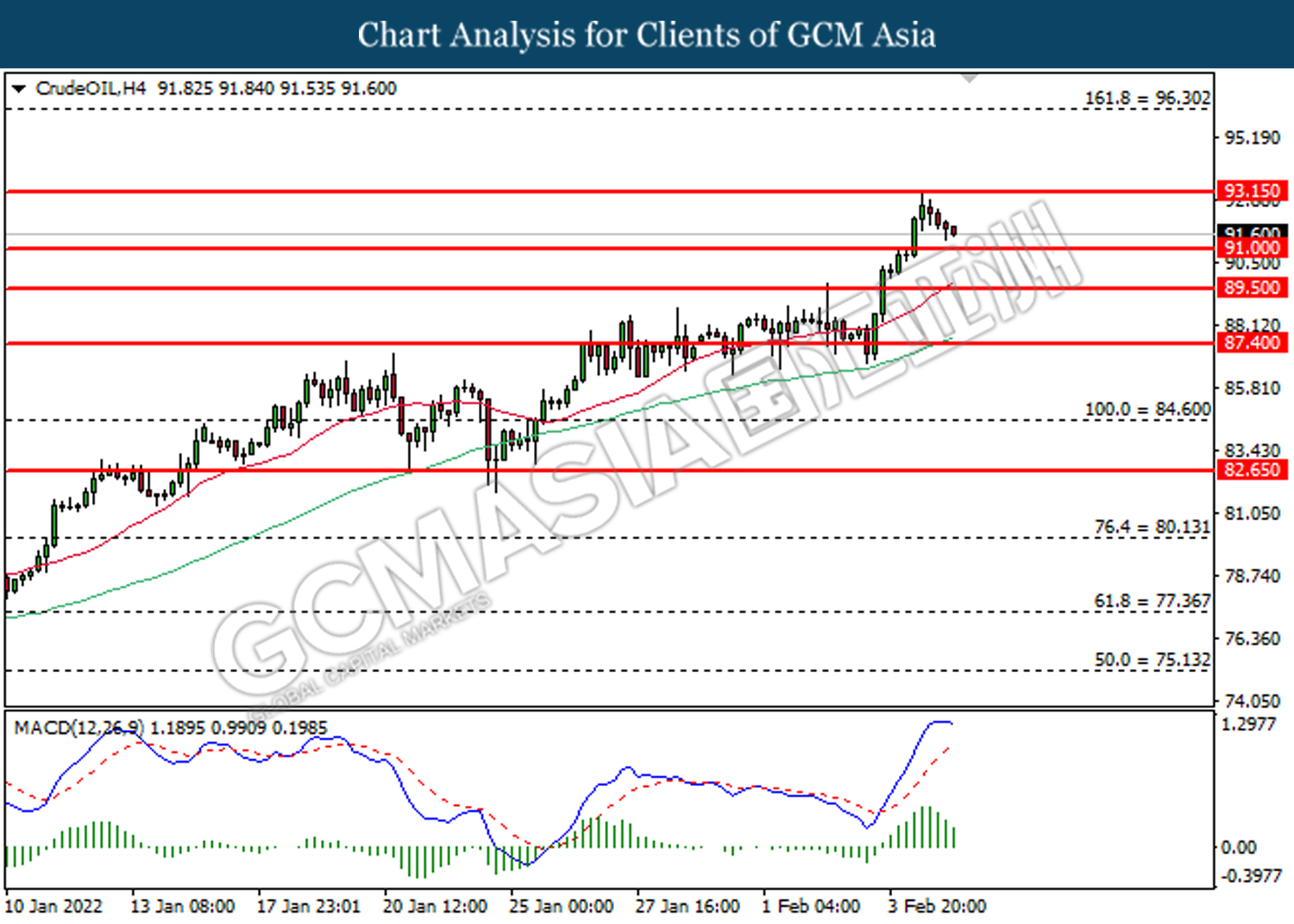

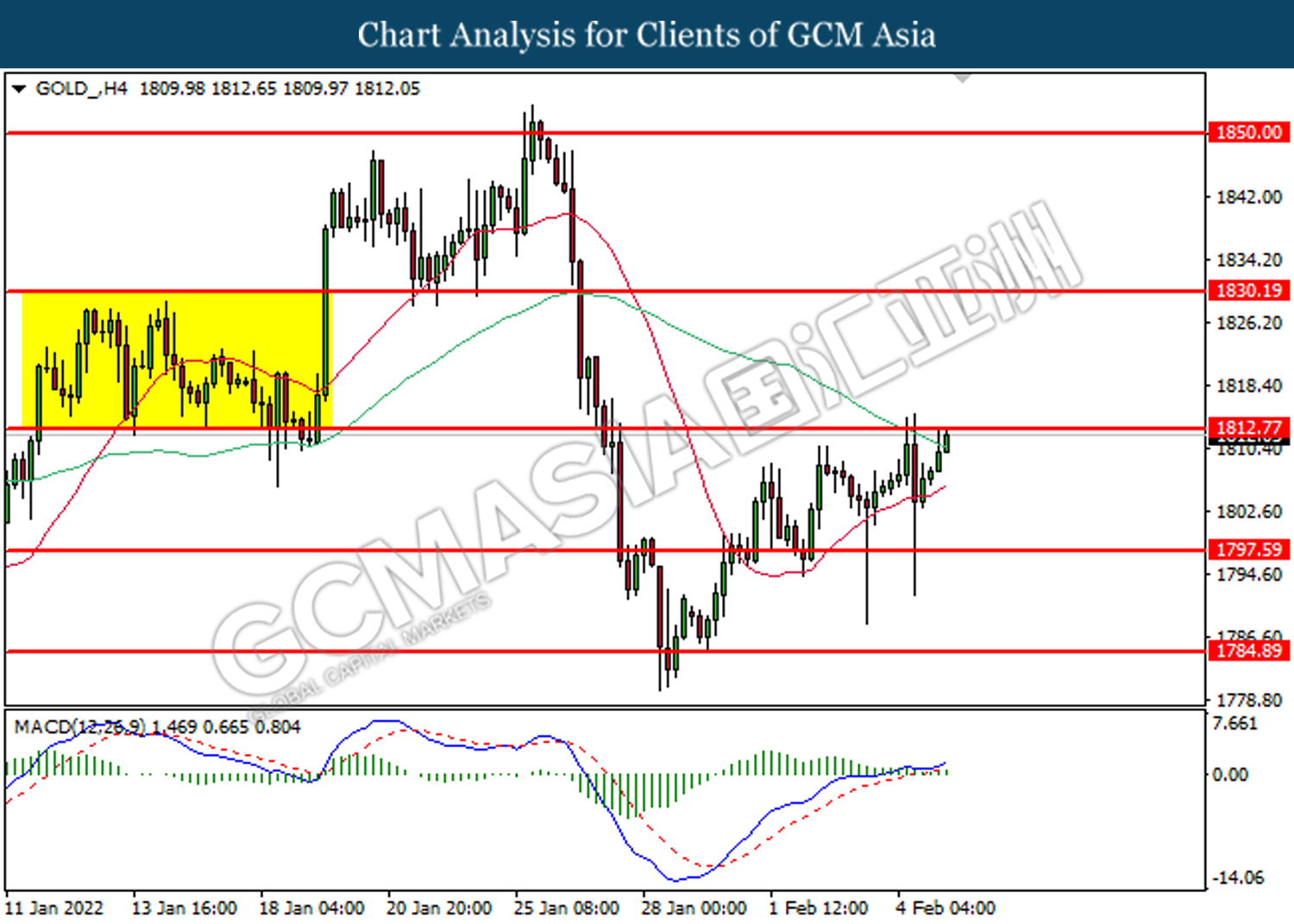

As for commodities, crude oil price slumped by 0.52% to $91.74 per barrel due to technical correction from higher levels. On the other hand, gold price rose 0.13% to $1,810.04 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

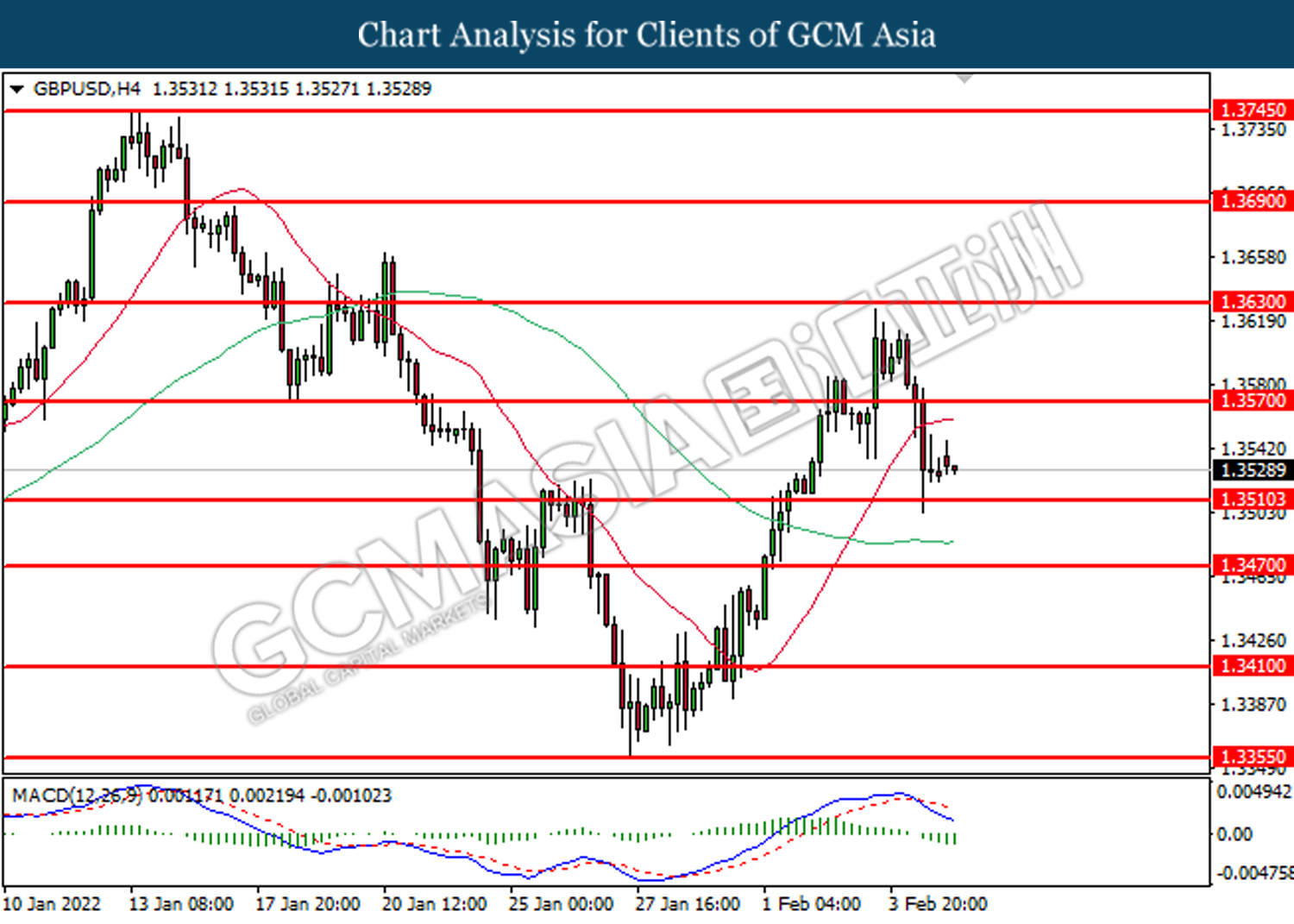

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

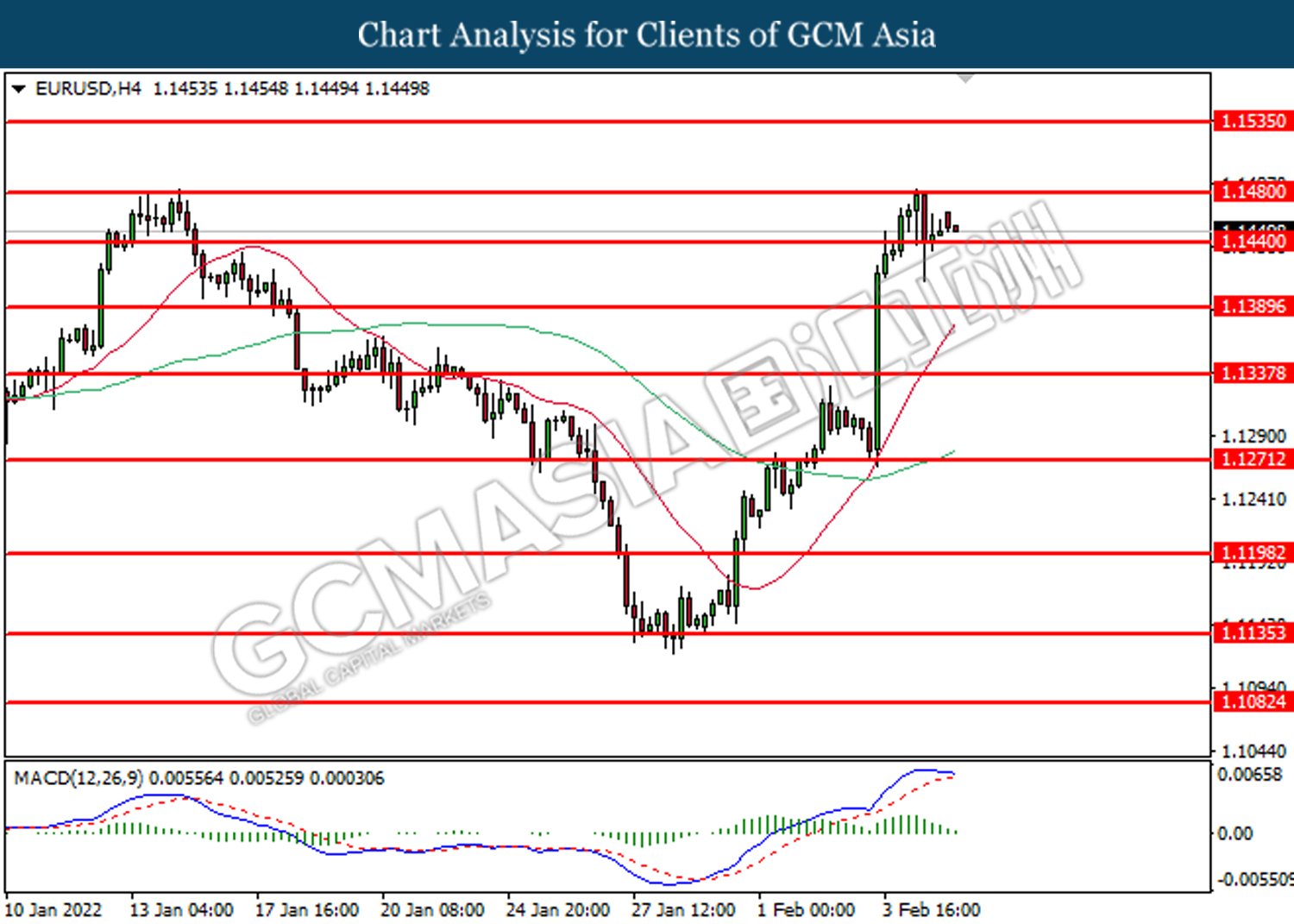

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.1480, 1.1535

Support level: 1.1440, 1.1390

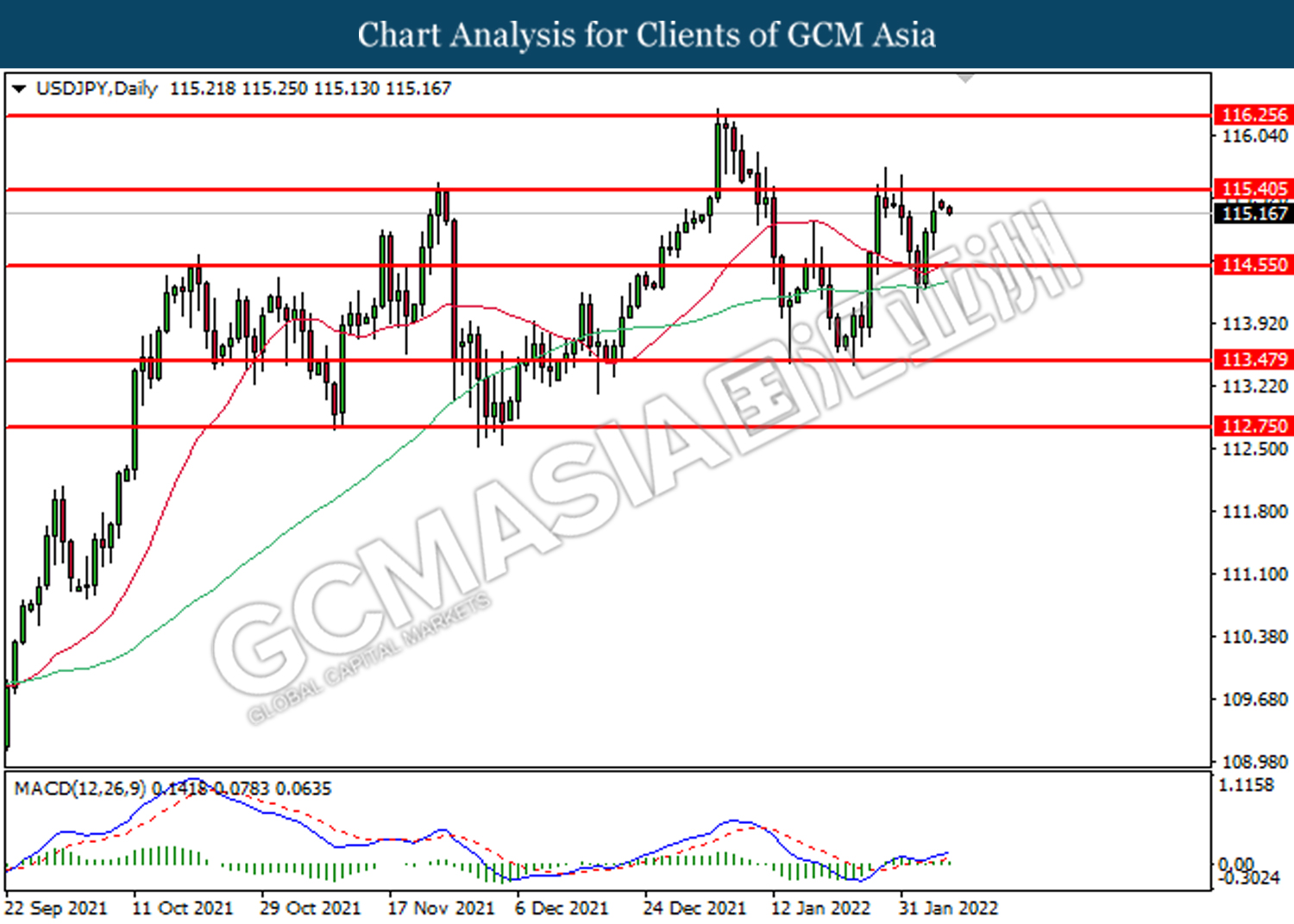

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

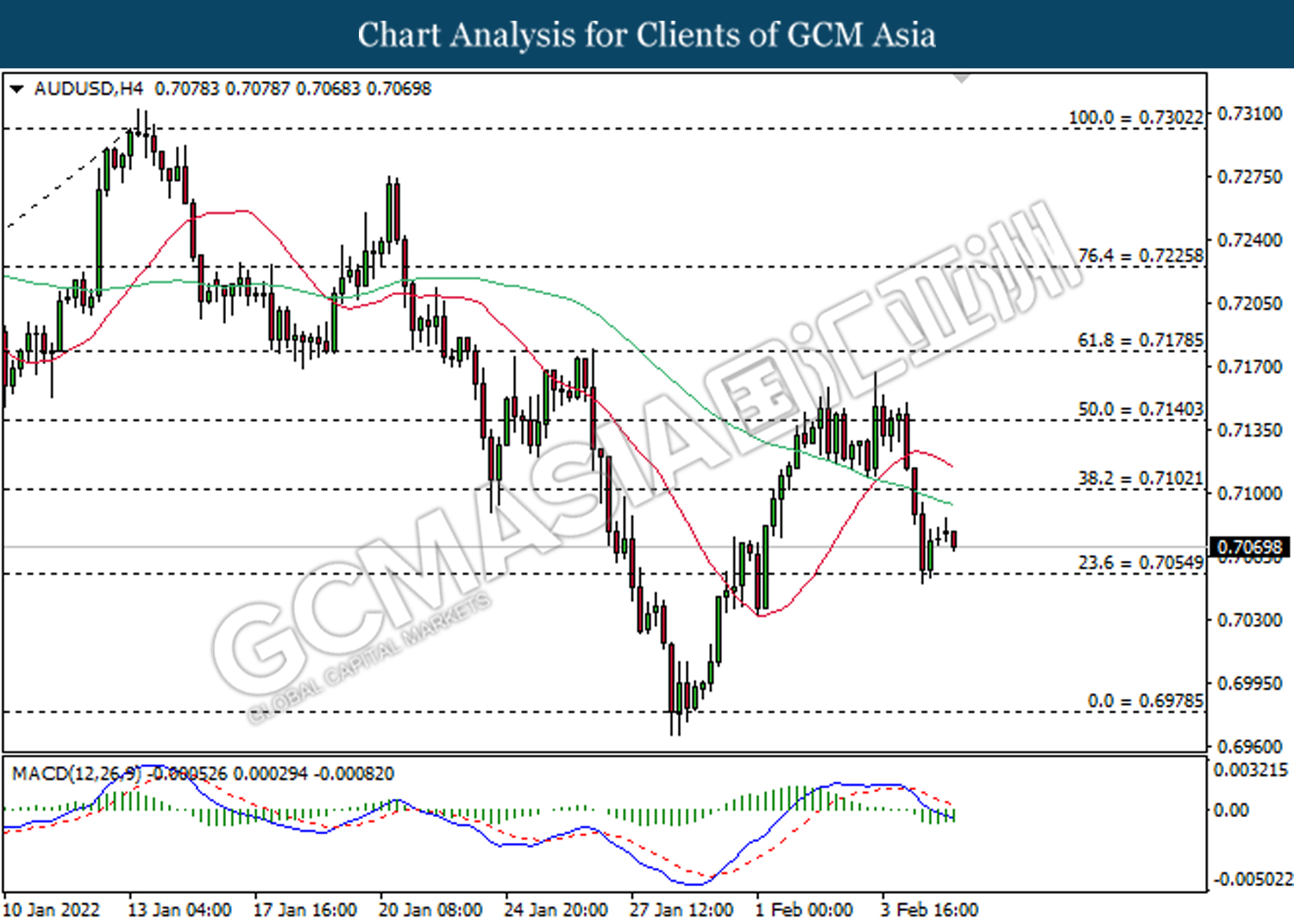

AUDUSD, H4: AUDUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.7100, 0.7140

Support level: 0.7055, 0.6980

NZDUSD, H4: NZDUSD was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking the support level.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

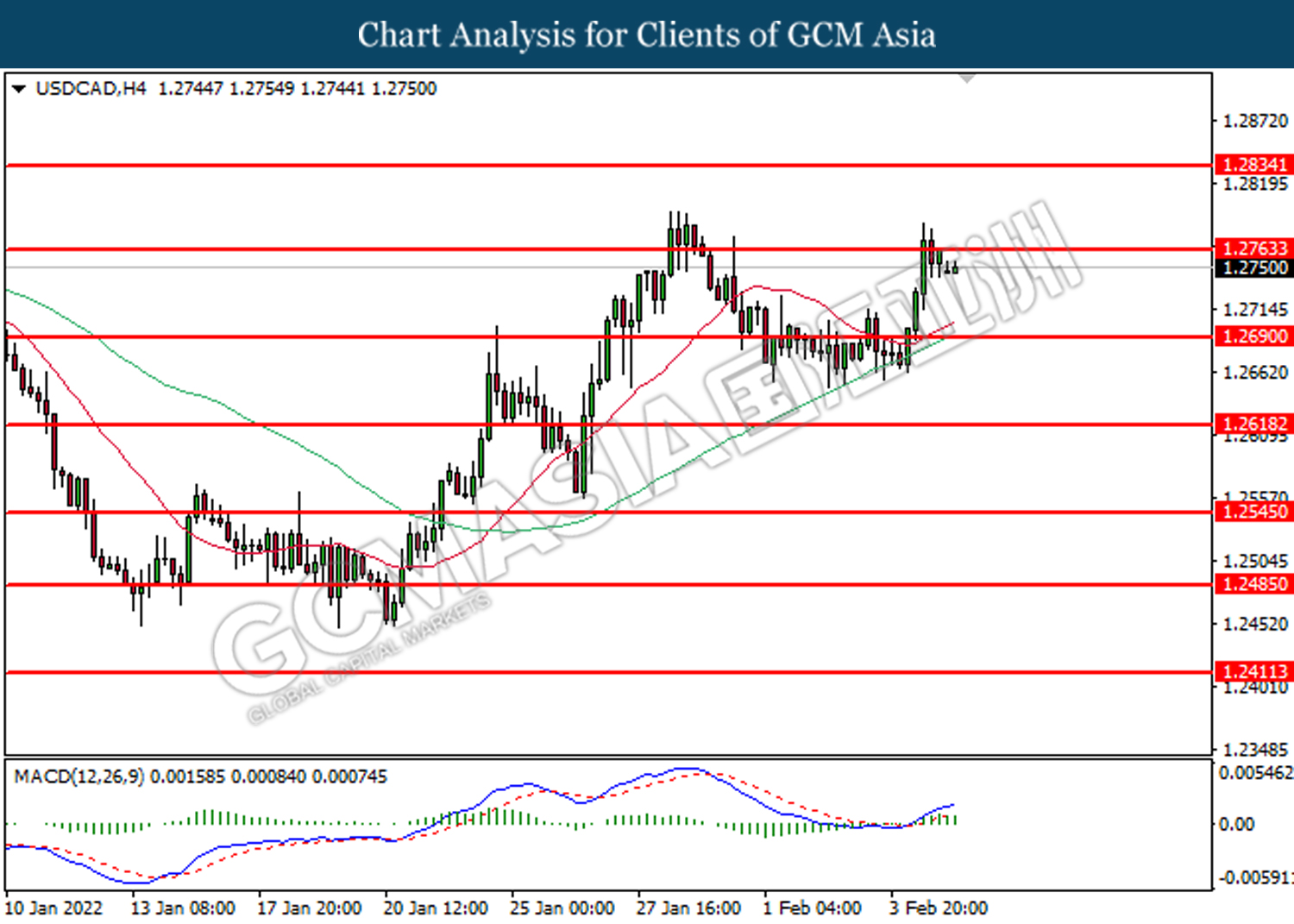

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2765, 1.2835

Support level: 1.2690, 1.2620

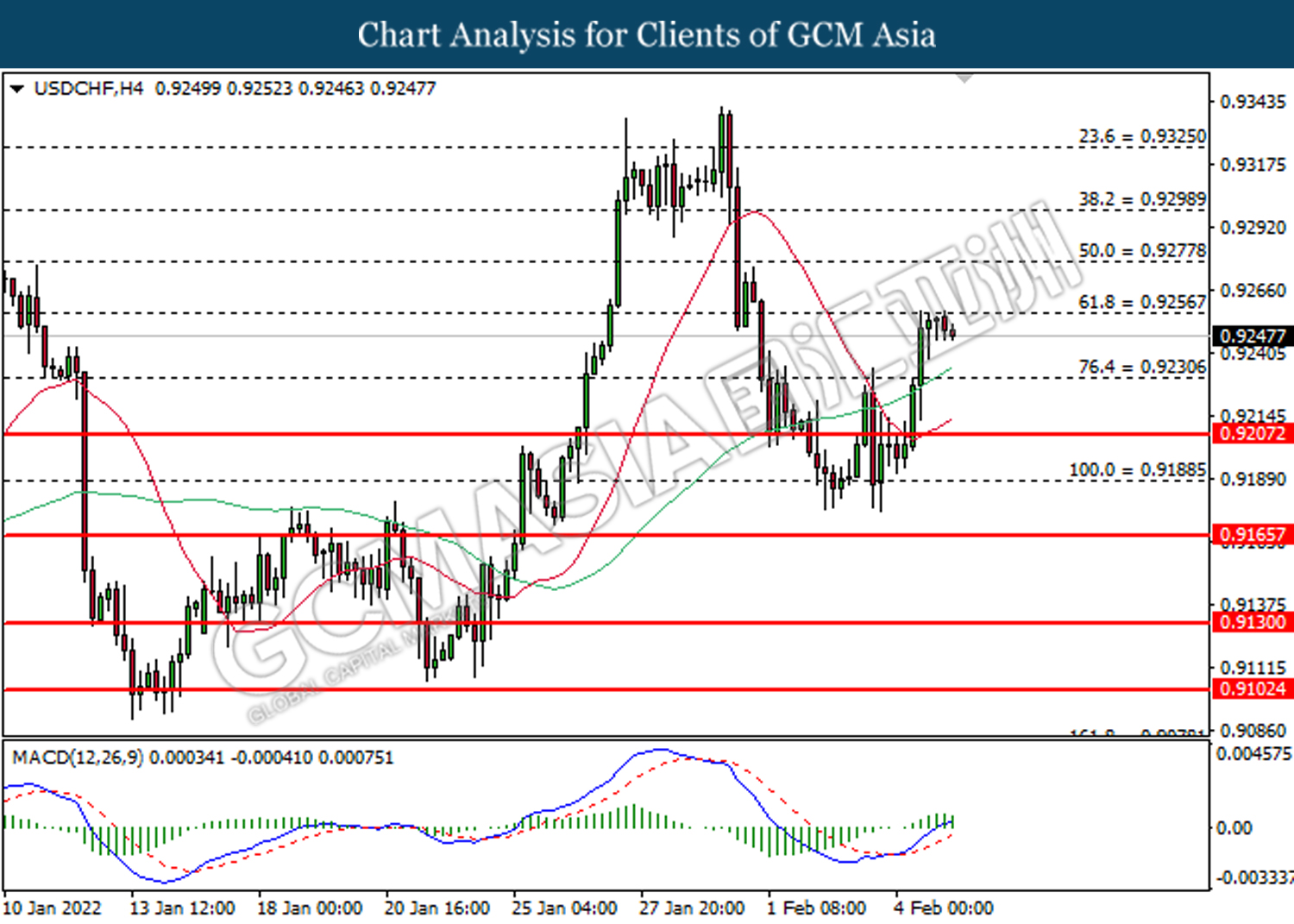

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1812.80, 1830.20

Support level: 1797.60, 1784.90