7 February 2023 Morning Session Analysis

US Dollar’s bull extended over the red-hot employment report.

The Dollar Index which traded against a basket of six major currencies extended its upward movement on Monday, which supporting by the robust US employment data. On the last Friday, the Bureau of Labor Statistics has reported a series of upbeat employment data, which surprising the market participants that the labor market in the US was remaining resilience and hot even the prior aggressive rate hike move by Fed. With that, it might stoke a shift of stance from the Fed, whereby the hefty rate hike process would likely to be continued as well as sparked the appeal of US Dollar. On the other hand, the gains experienced by Dollar Index was extended amid the positive speech from the US government. According to Reuters, the US Treasury Secretary Janet Yellen claimed on Monday that the US economy would likely to avoid recession with the strong labor market and the easing inflation risk. As she emphasized about the truth of far-better NFP data and the lowest unemployment rate in 53 years, the market optimism upon US economy prospects has been dialed up. As of writing, the Dollar Index appreciated by 0.72% to 103.49

In the commodity market, the crude oil price dropped by 0.04% to $74.41 per barrel as of writing. Yesterday, the oil price has found its ground over the optimism upon reopening of China. In addition, the gold price edged up by 0.02% to $1867.62 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Feb) | 3.10% | 3.35% | – |

Technical Analysis

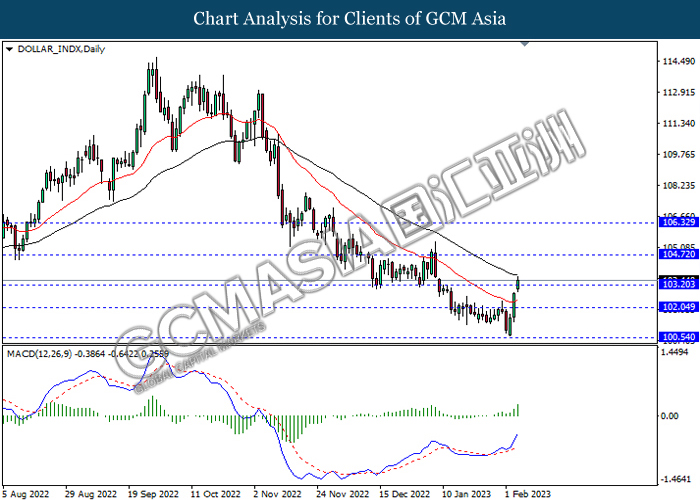

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

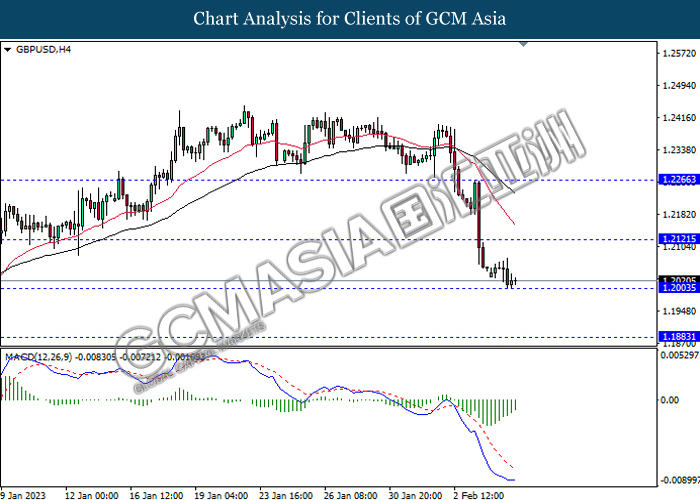

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

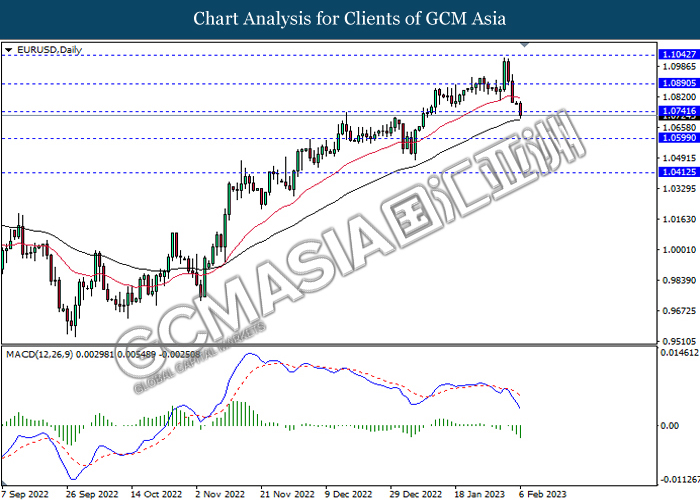

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

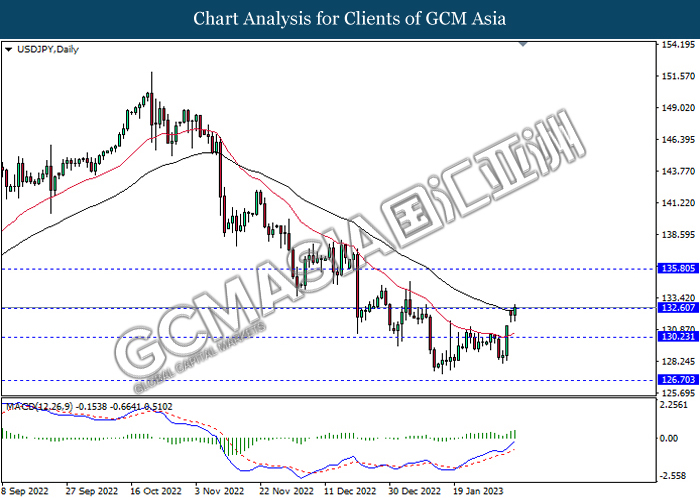

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 132.60, 135.80

Support level: 130.25, 126.70

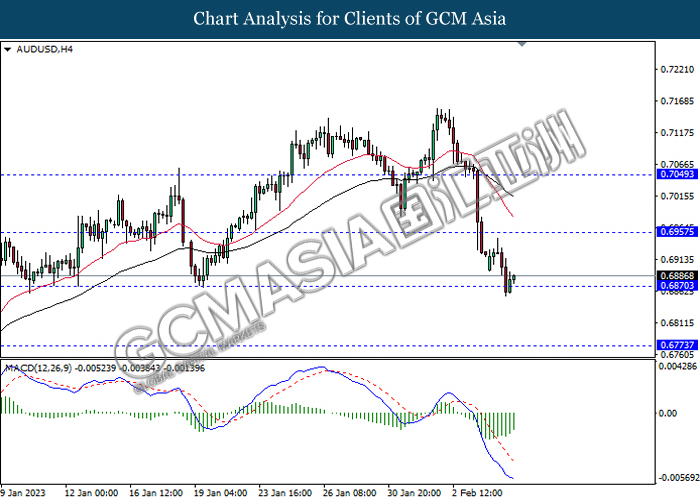

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

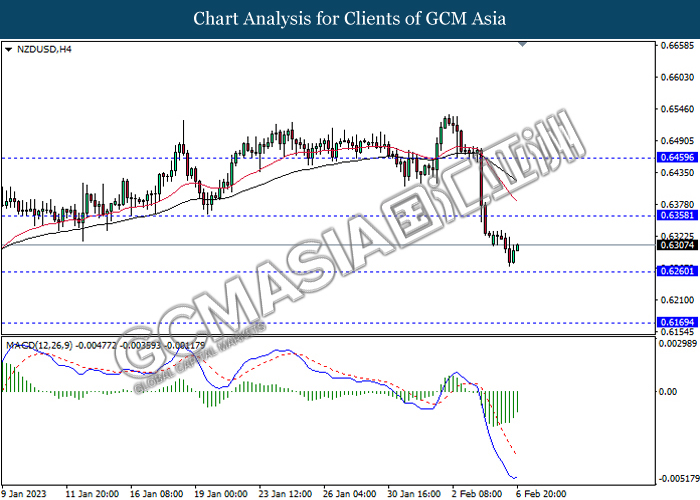

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

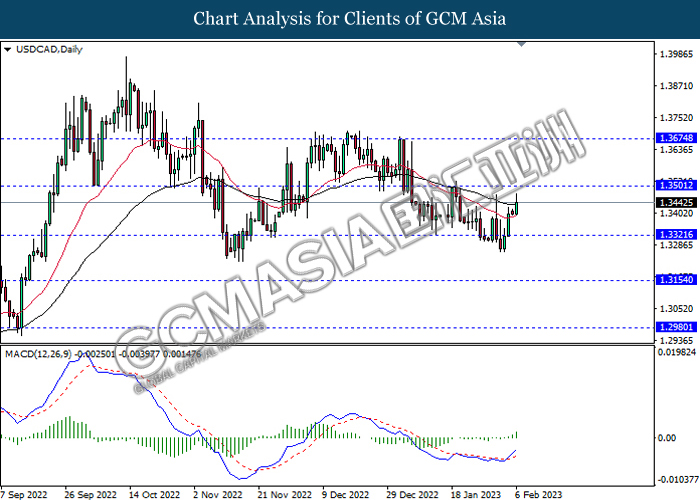

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

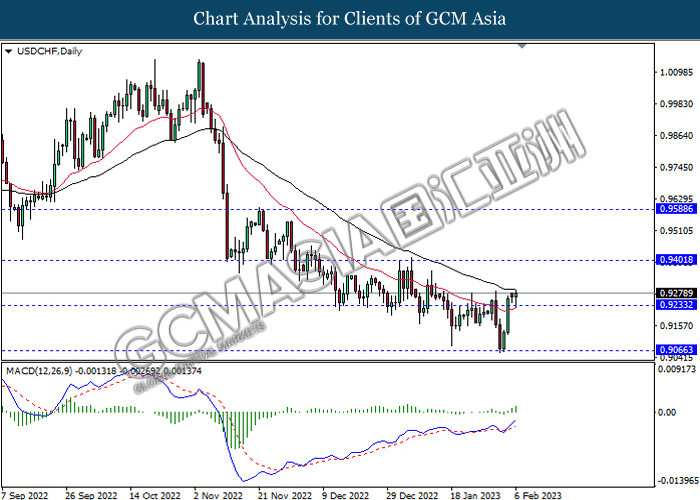

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

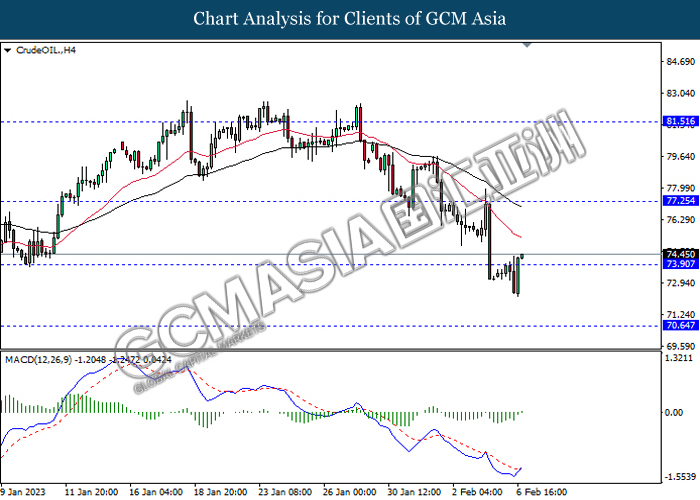

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

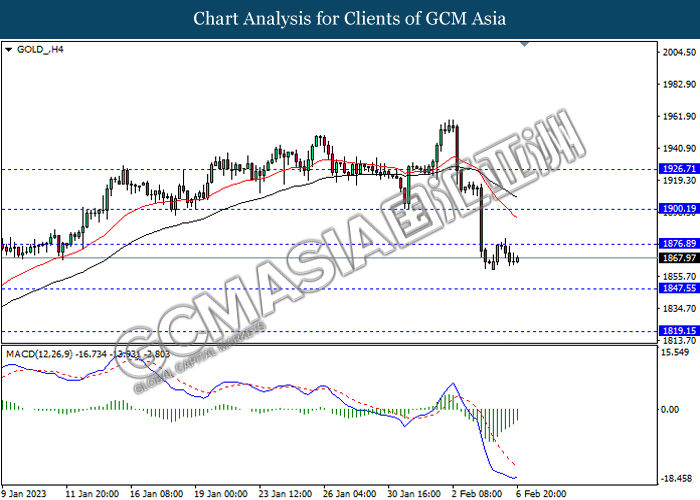

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15