7 March 2022 Morning Session Analysis

Safe-haven rises as tension continues.

Safe-haven such as US dollar extended its gains on Monday after market participants reshuffles their portfolio to brace higher tensions in between Russia and Ukraine. Last weekend, White House released a statement stating that Russia’s attack on Ukraine’s nuclear facility is “highly irresponsible” and targeting upon a country’s infrastructure is an act of war crime. On a separate report, UK Ministry of Defense confirmed that high level of Russian air strikes was launched over several Ukrainian cities such as Kharkiv, Mykolaiv and Chernihiv. Russia has pushed forward with their objectives despite two rounds of talks were being held between both countries. In addition, US dollar received subsequent bullish support following the release of upbeat Nonfarm Payrolls report. The latest reading shows that US jobs market continues to progress further, spurring speculation for more frequent interest rate hikes from Federal Reserve. As of writing, the dollar index was up 0.02% to 98.44.

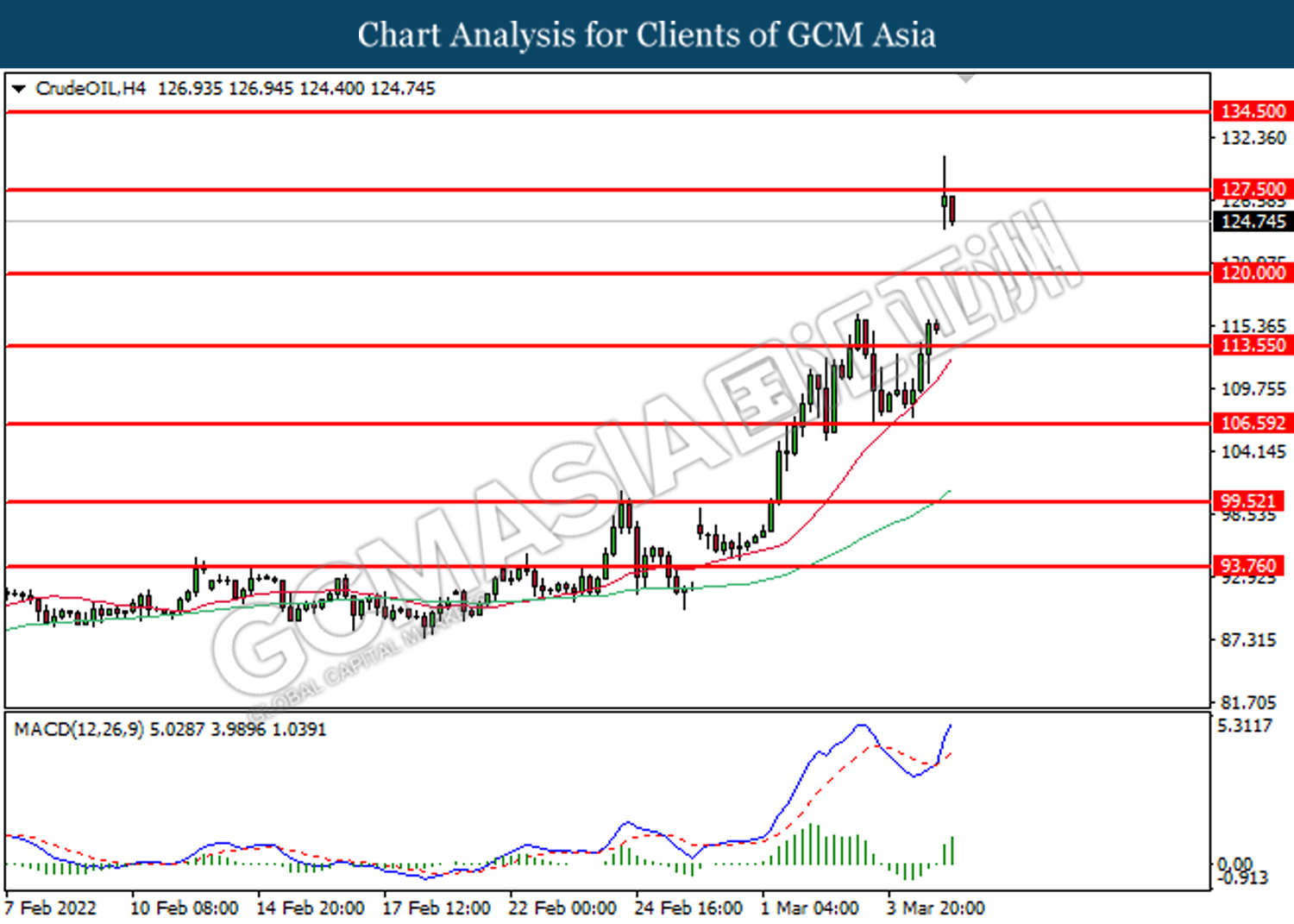

As for commodities, crude oil price rose 8.97% to $126.05 per barrel after US contemplates to ban Russian oil imports. On the other hand, gold price was up 0.99% to $1,986.55 a troy ounce due to tensions in between Russia and Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 98.80, 99.80

Support level: 97.65, 96.55

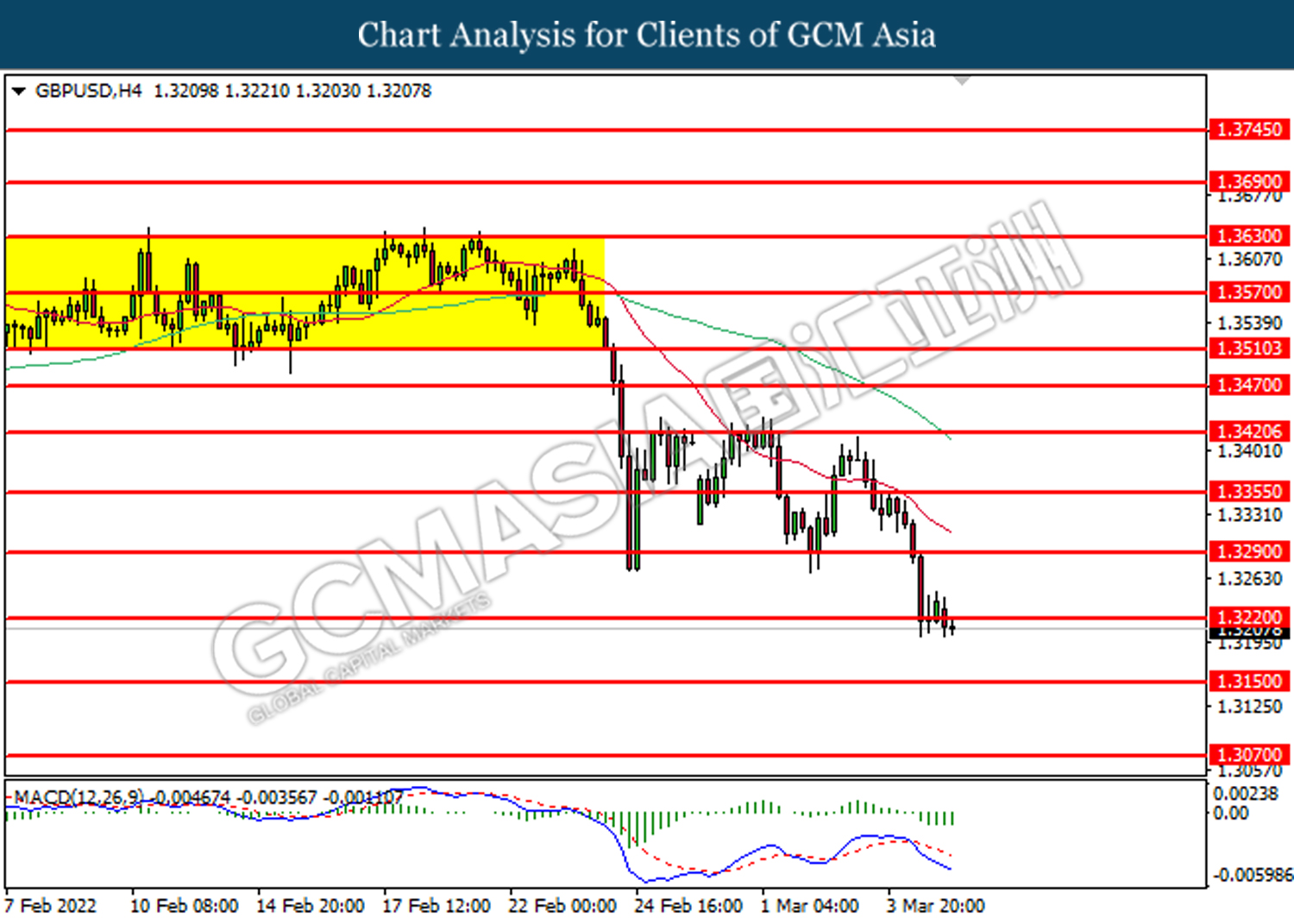

GBPUSD, H4: GBPUSD was traded lower following prior retracement from higher level. MACD which diminished bearish signal suggests the pair to be traded lower in short-term.

Resistance level: 1.3220, 1.3290

Support level: 1.3150, 1.3070

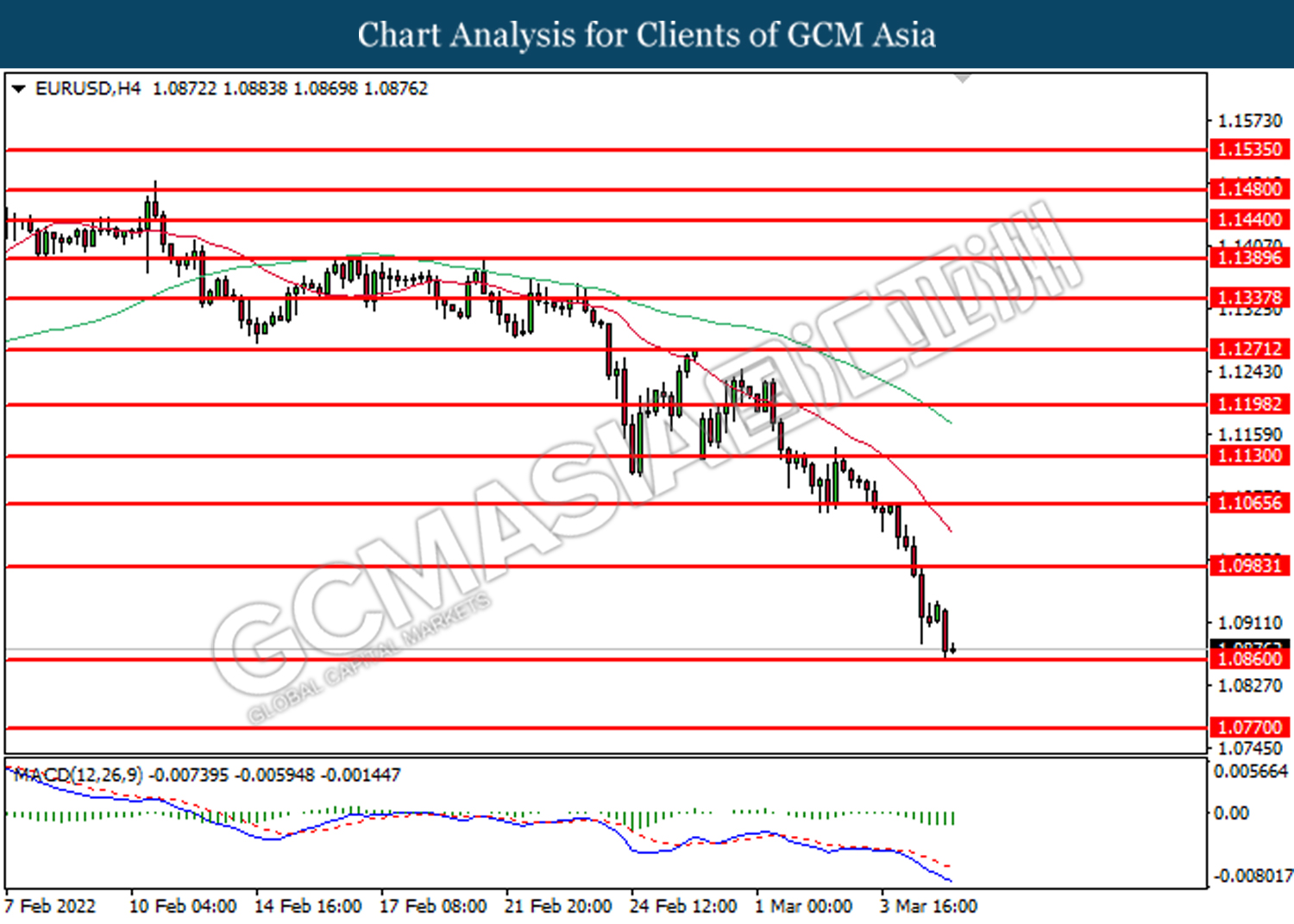

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.0985, 1.1065

Support level: 1.0860, 1.0770

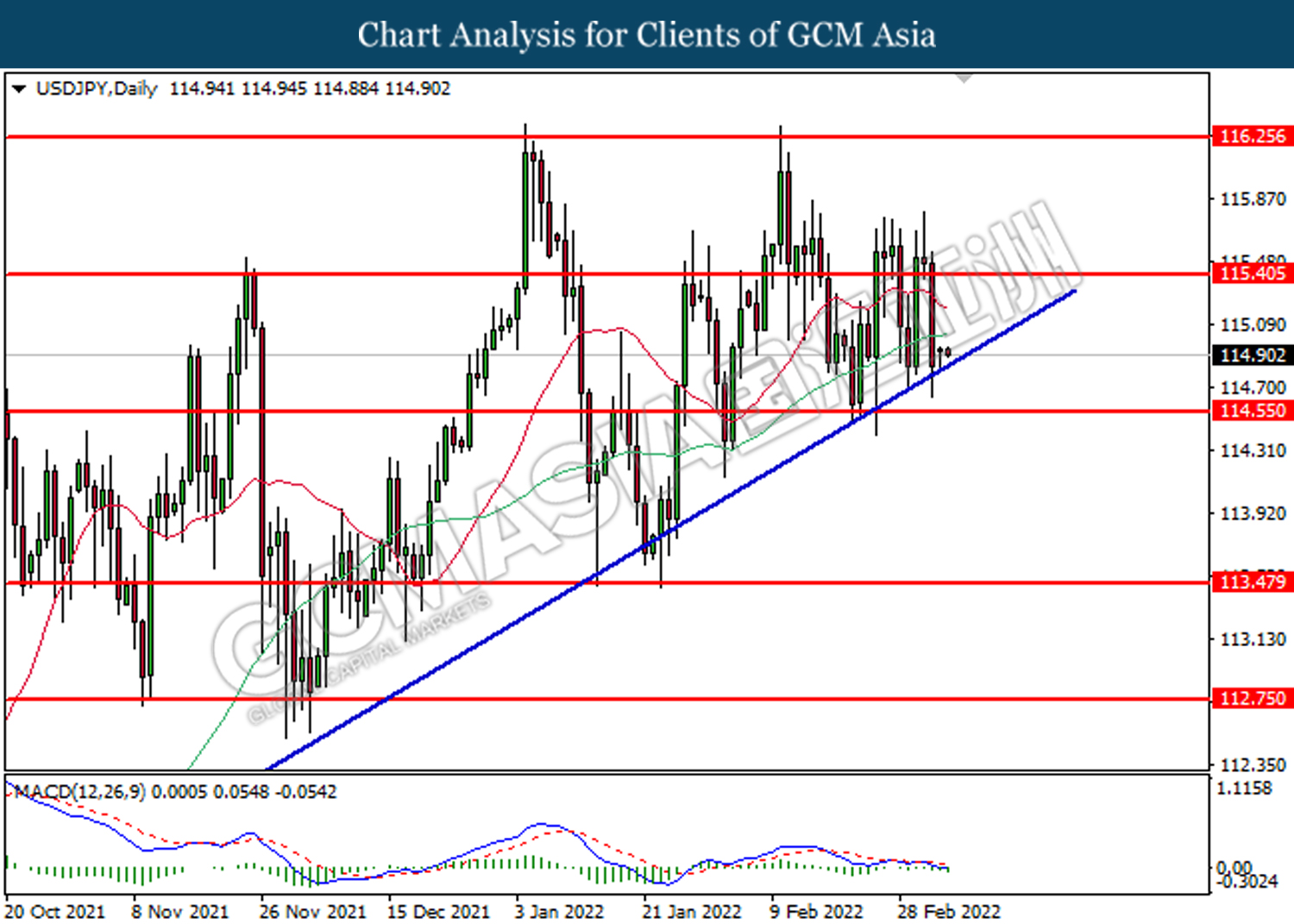

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

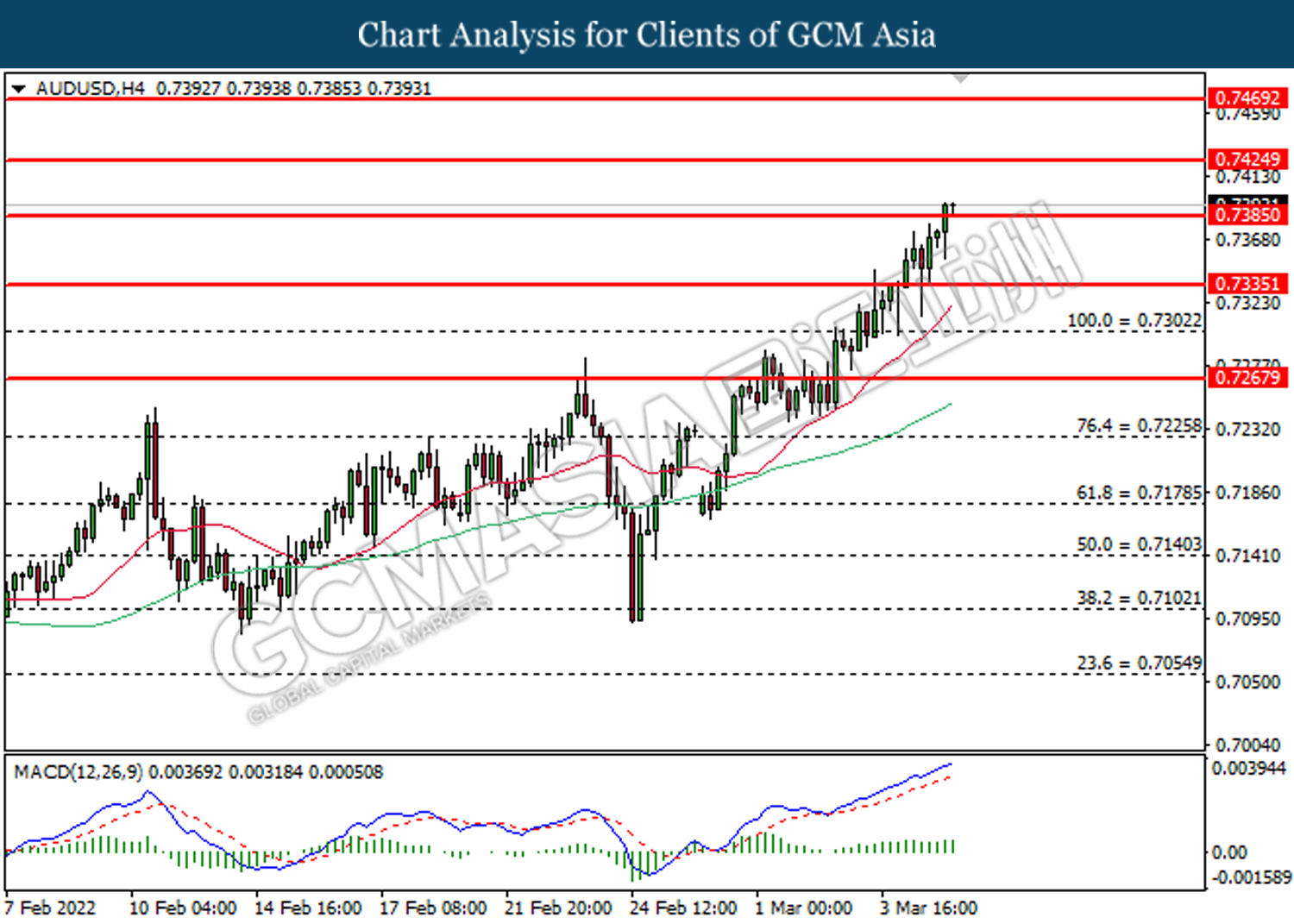

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7425, 0.7470

Support level: 0.7385, 0.7335

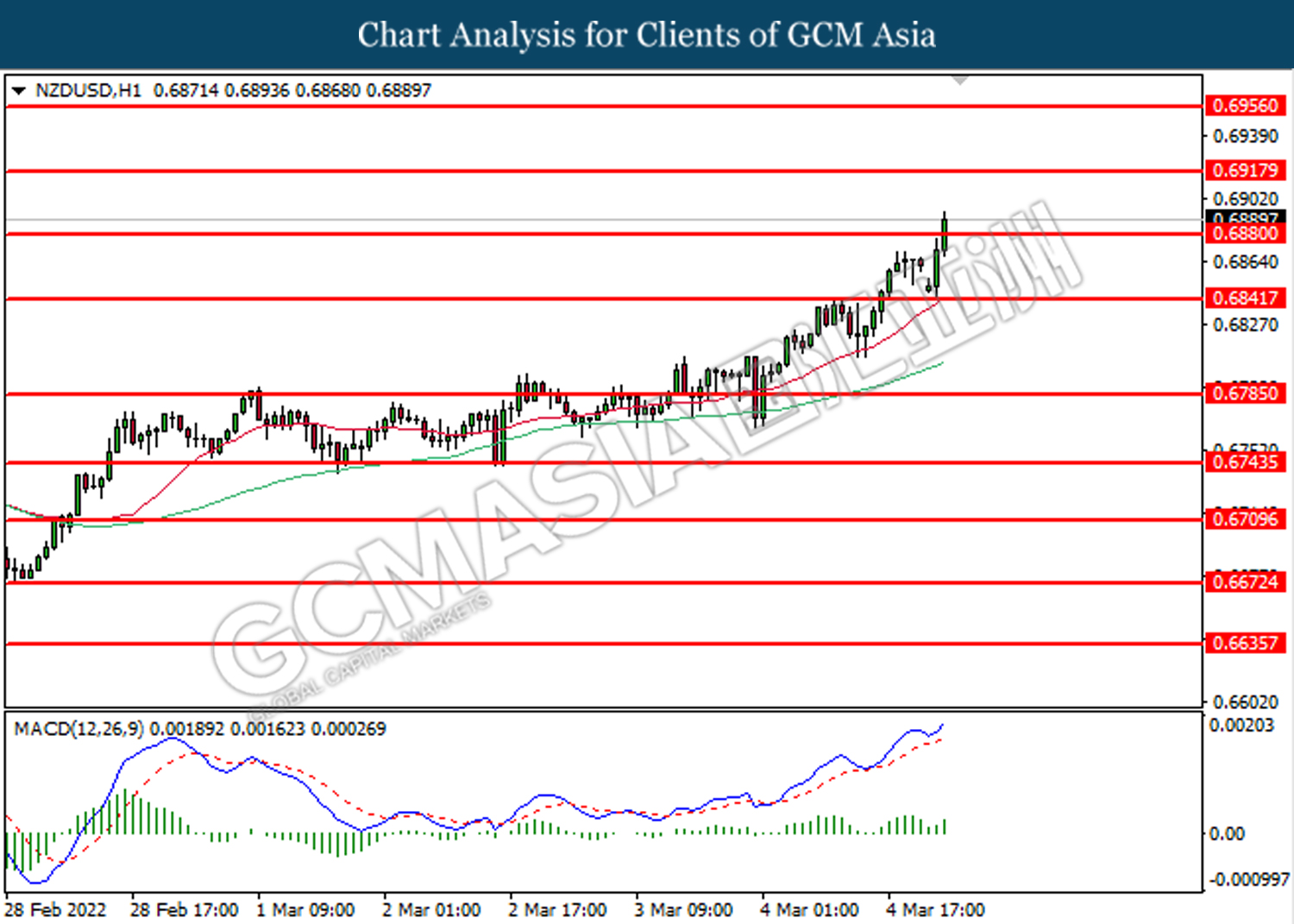

NZDUSD, H1: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded hihger in short-term.

Resistance level: 0.6920, 0.6955

Support level: 0.6880, 0.6840

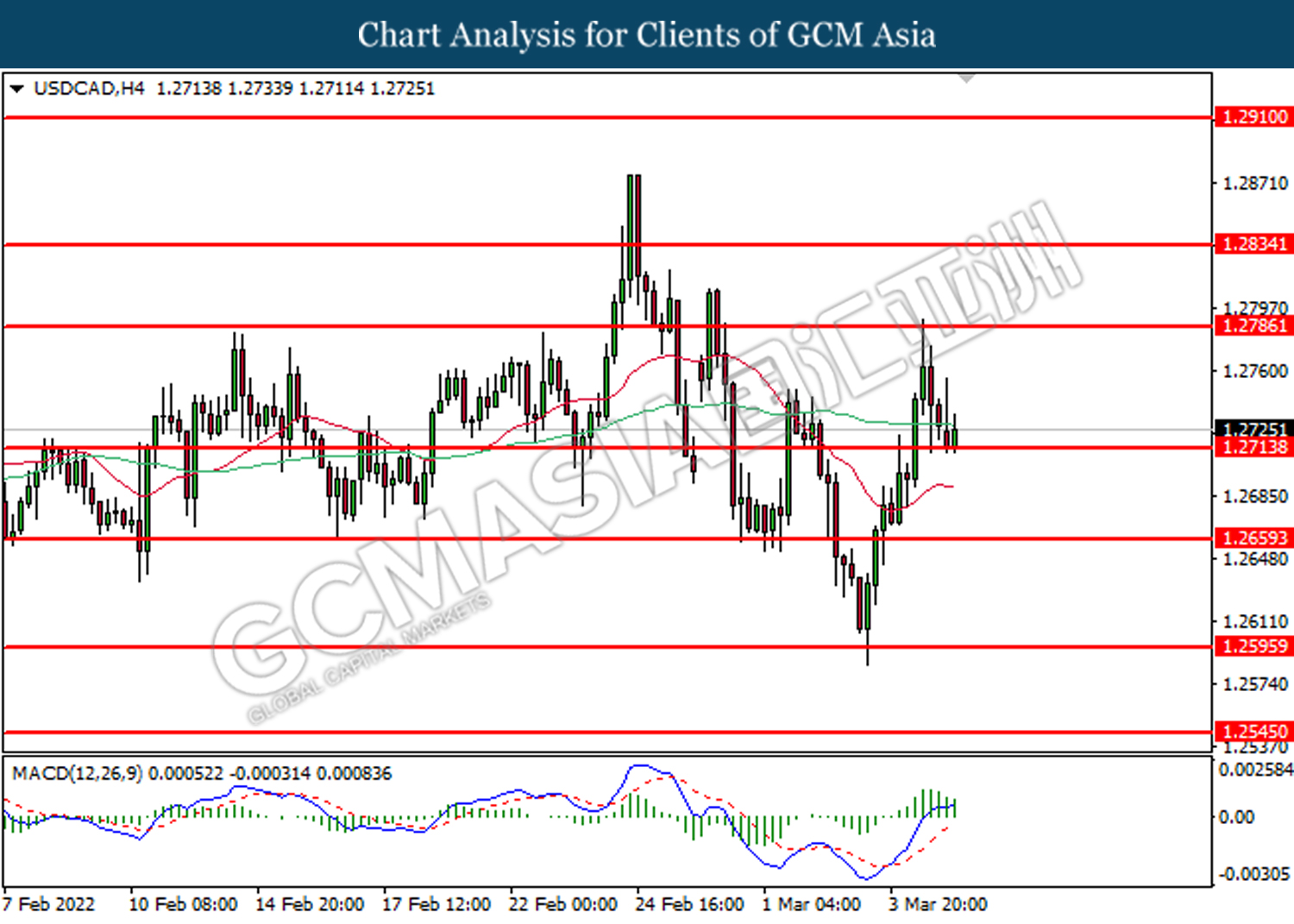

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2785, 1.2835

Support level: 1.2715, 1.2660

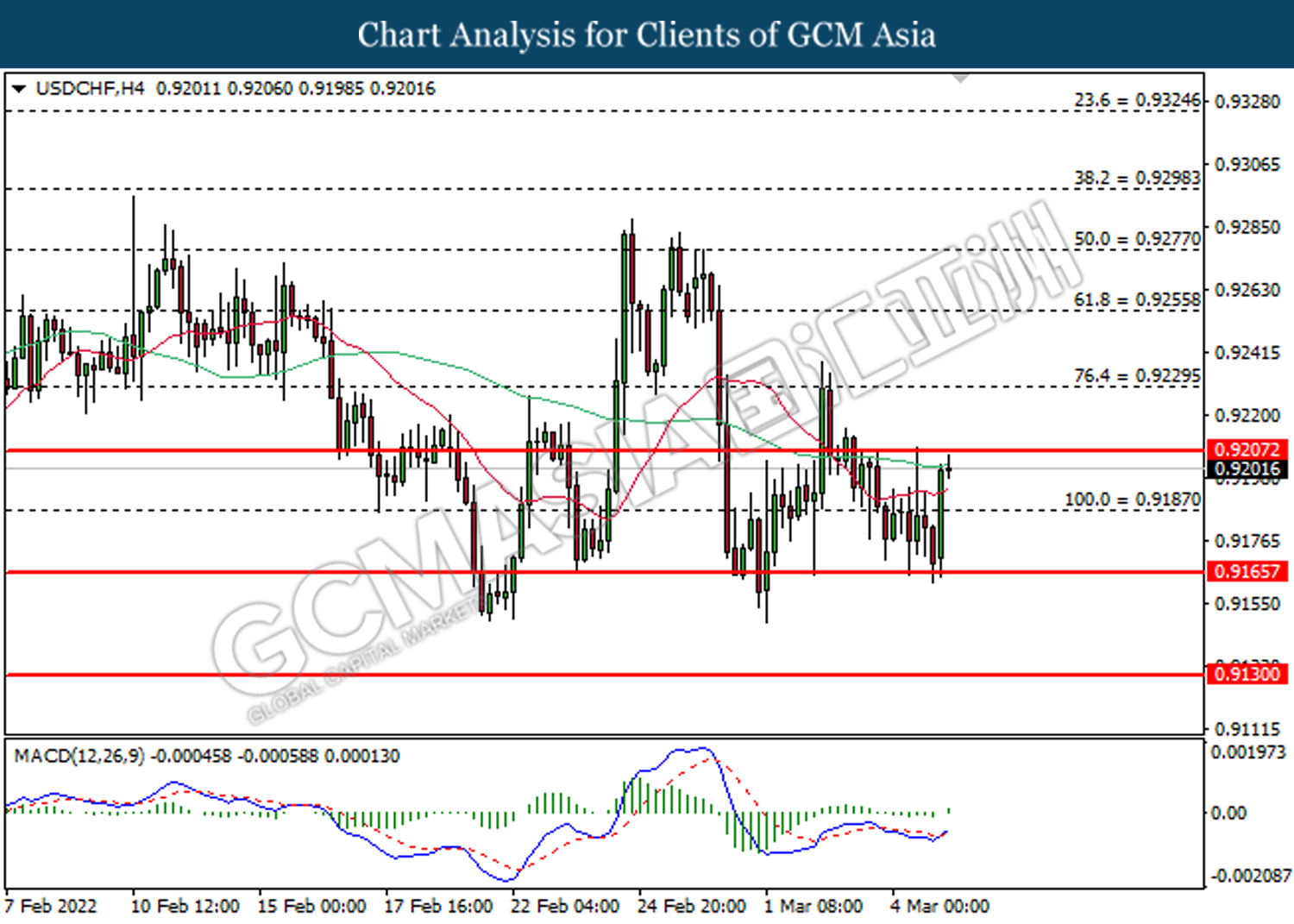

USDCHF, H4: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9210, 0.9230

Support level: 0.9190, 0.9165

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 127.50, 134.50

Support level: 120.00, 113.55

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 1991.50, 2035.00

Support level: 1960.55, 1921.95