07 March 2023 Afternoon Session Analysis

Euro jumped amid ECB’s aggressive rate-hike comments.

The Euro, which is majorly traded by the global investors, extended its gains for the third consecutive days amid ECB members’ hawkish-titled monetary policy stance. Recently, the ECB Chief economist Philip Lane revealed that more rate hikes are needed at this point in time in order to tackle the still-high inflation. Besides, the Austria’s central bank governor, Robert Holzmann, stimulated the euro market by commenting that next week’s move will be just the first of four in 50 basis-point increments. The aggressive rate-hike comments came after Eurostat reported the CPI figure at 8.5%, missing the consensus forecast at 8.2%, showing that the nation’s economy is still beset by sky-high inflation. At this juncture, investors have priced in the possibility of 50 basis point of rate hike in the upcoming March meeting, however, the attention of the market is now focused on the rate hike beyond the next week’s meeting. With the aggressive rate-hike outlook in Eurozone, the pair of EUR/USD rose by 0.09% to 1.0688.

In the commodities market, crude oil prices jumped by 0.34% as the theme of China reopening and the Russia’s plan of production cut continued to play out in the market. Besides, gold prices edged up 0.07% to $1848.25 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

01:00 CrudeOIL EIA Short-Term Energy Outlook

Today’s Highlight Economic Data

N/A

Technical Analysis

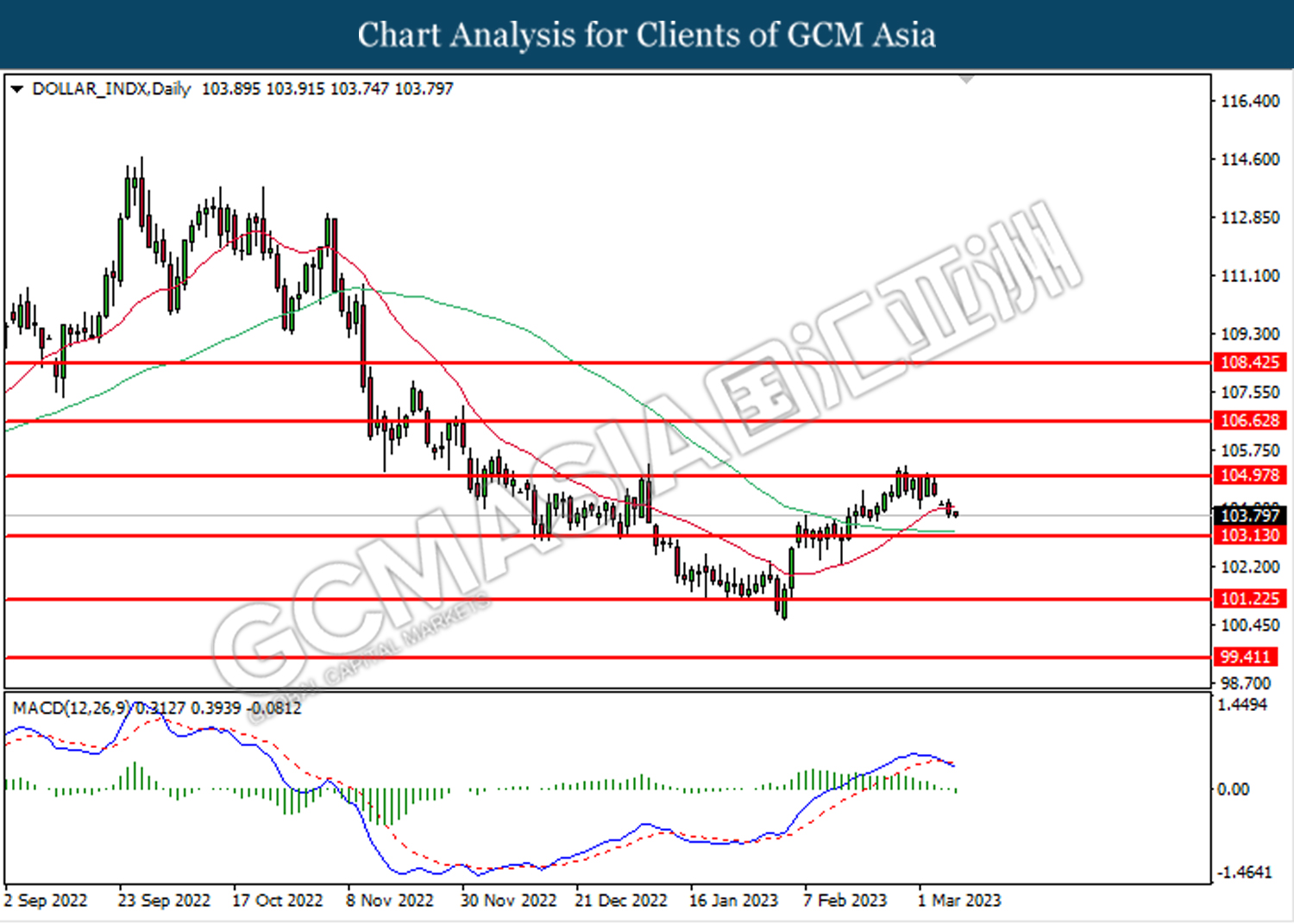

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

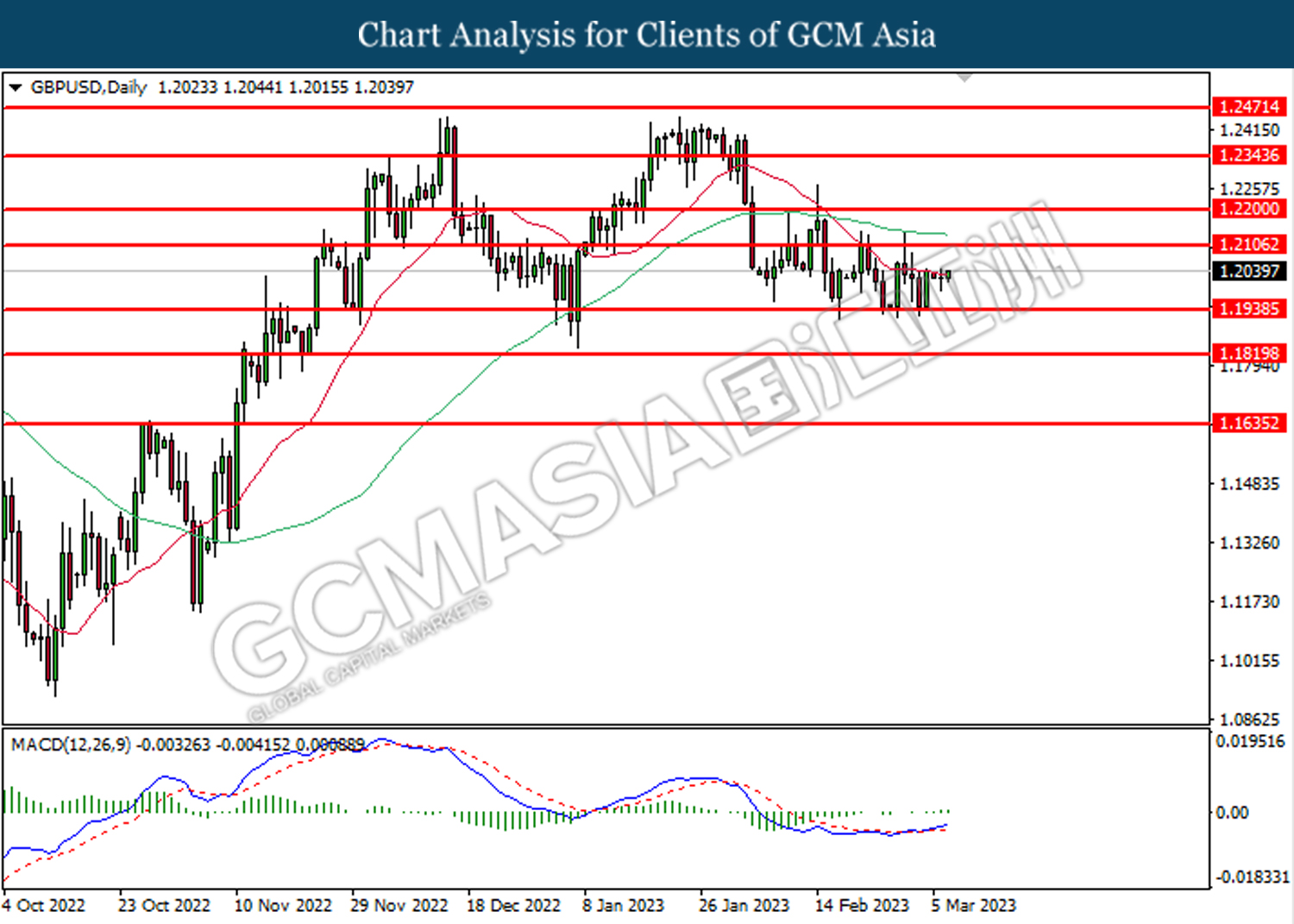

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.1940. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

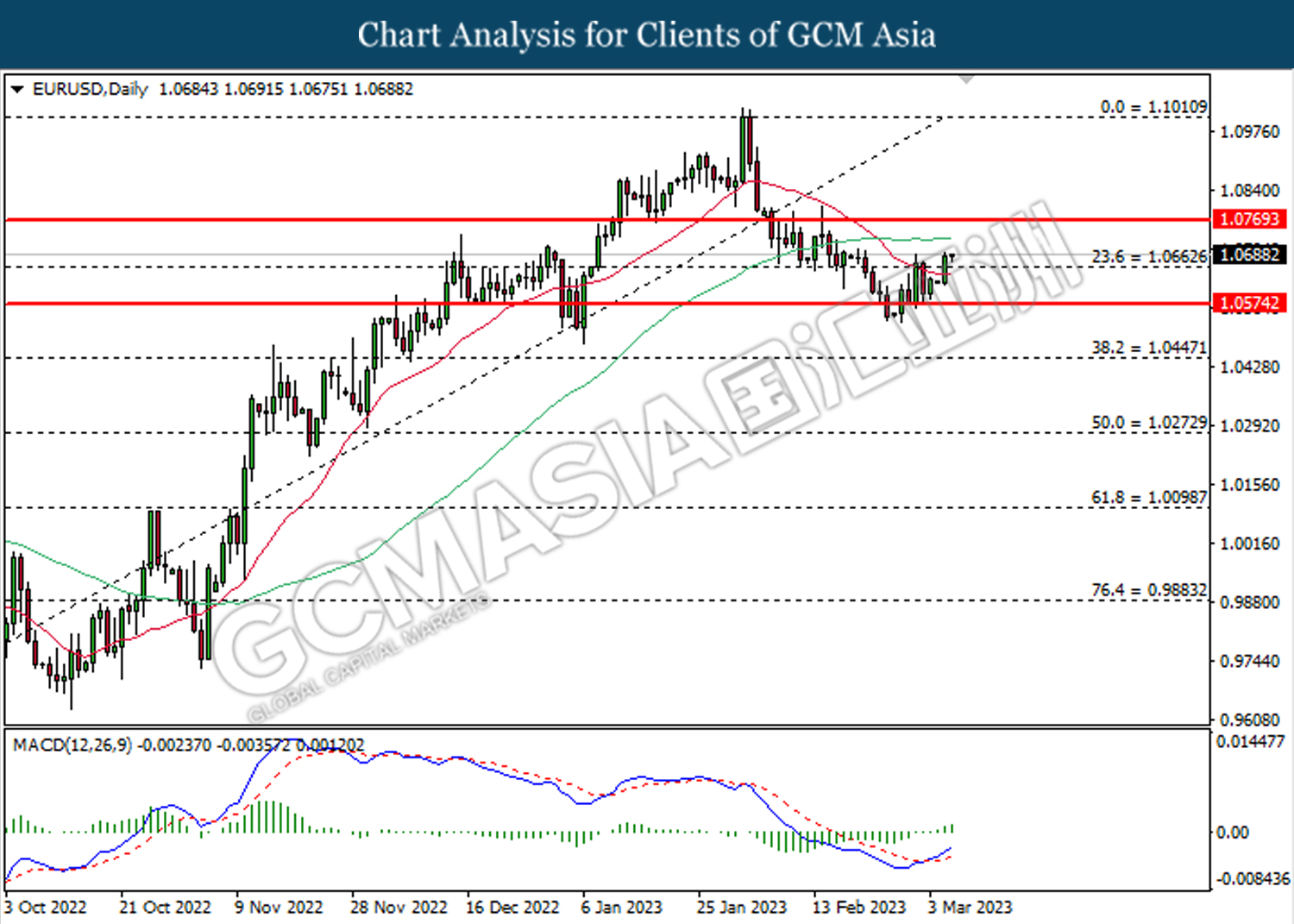

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

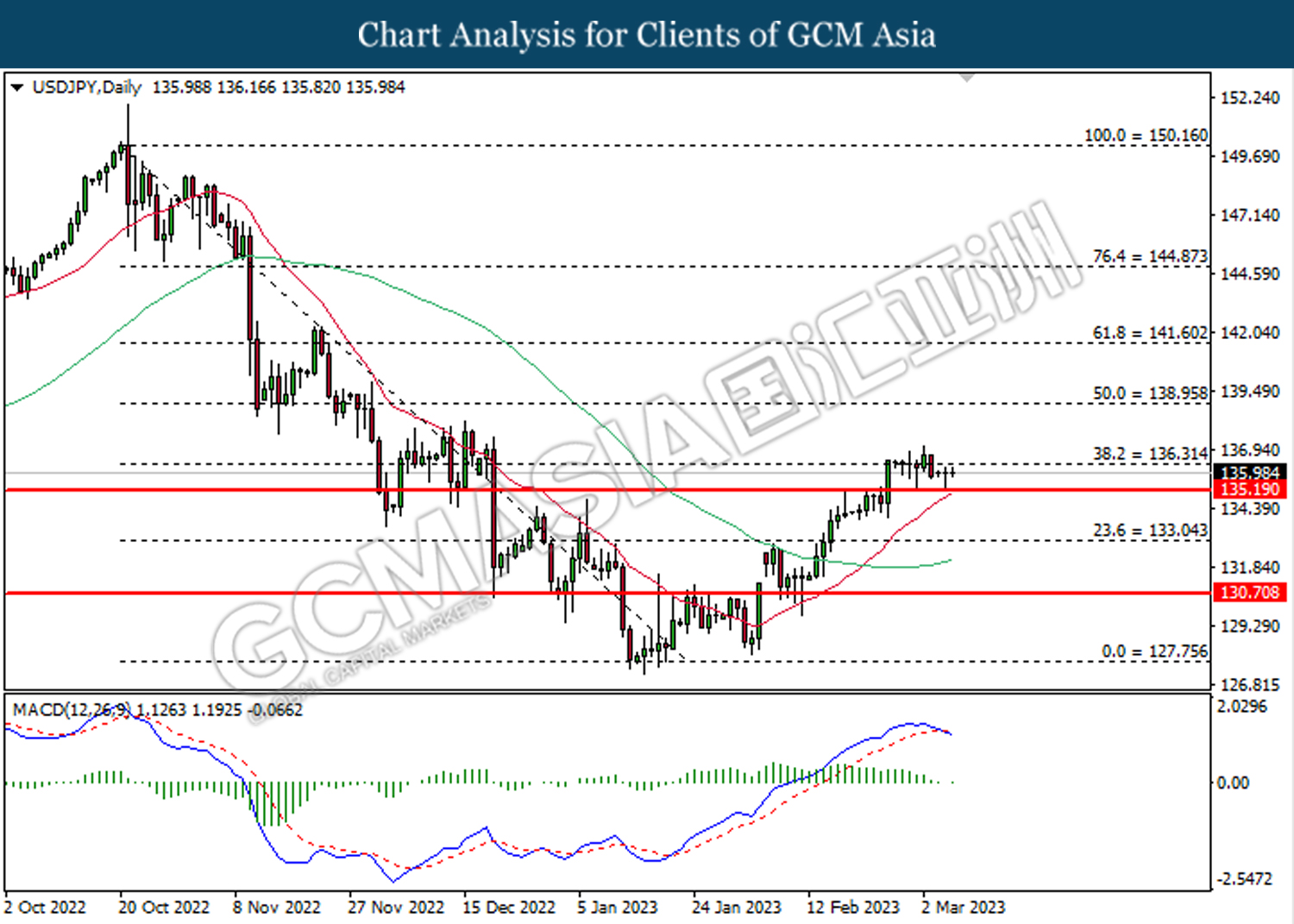

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 135.20. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 136.30, 138.95

Support level: 135.20, 133.05

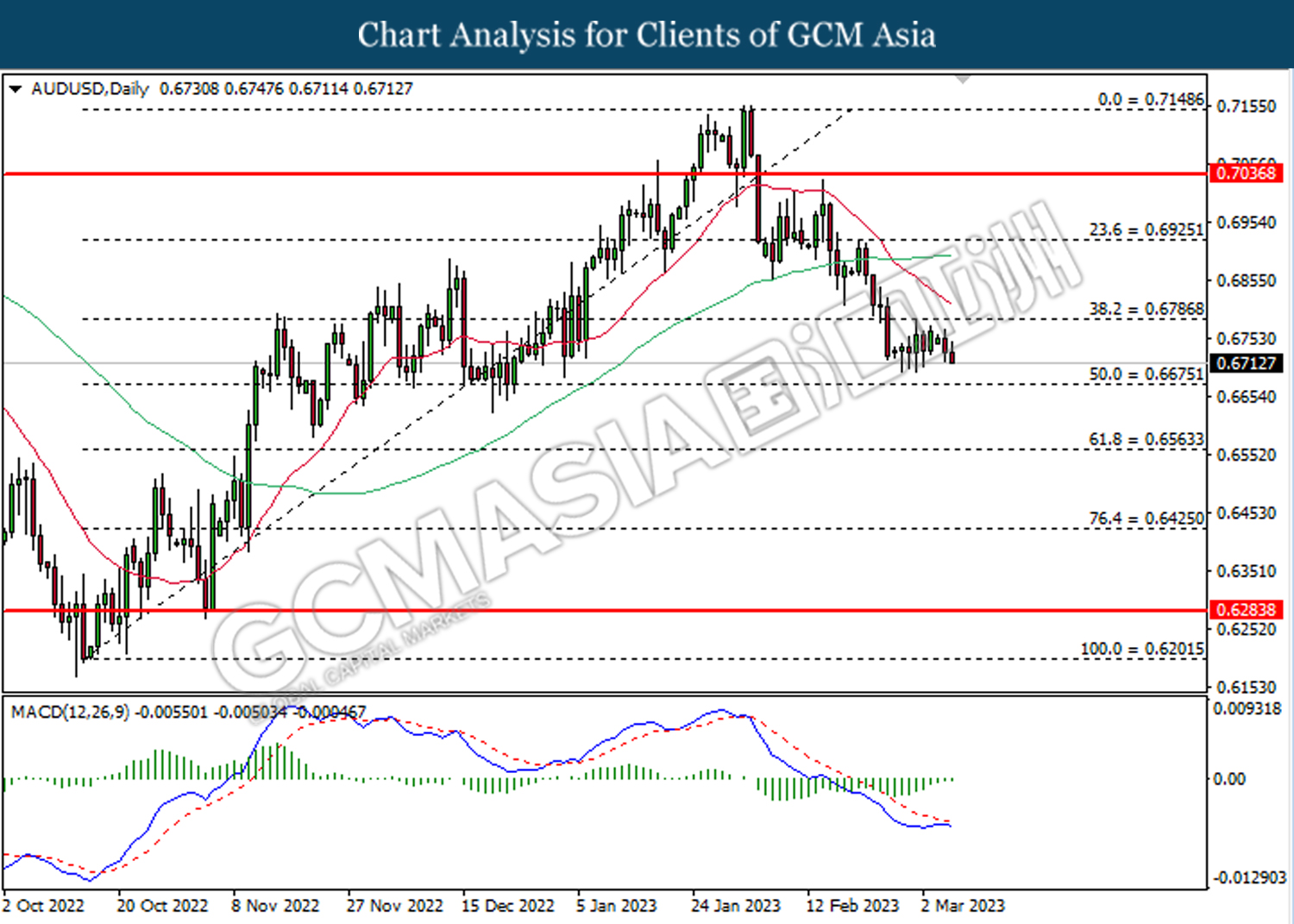

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

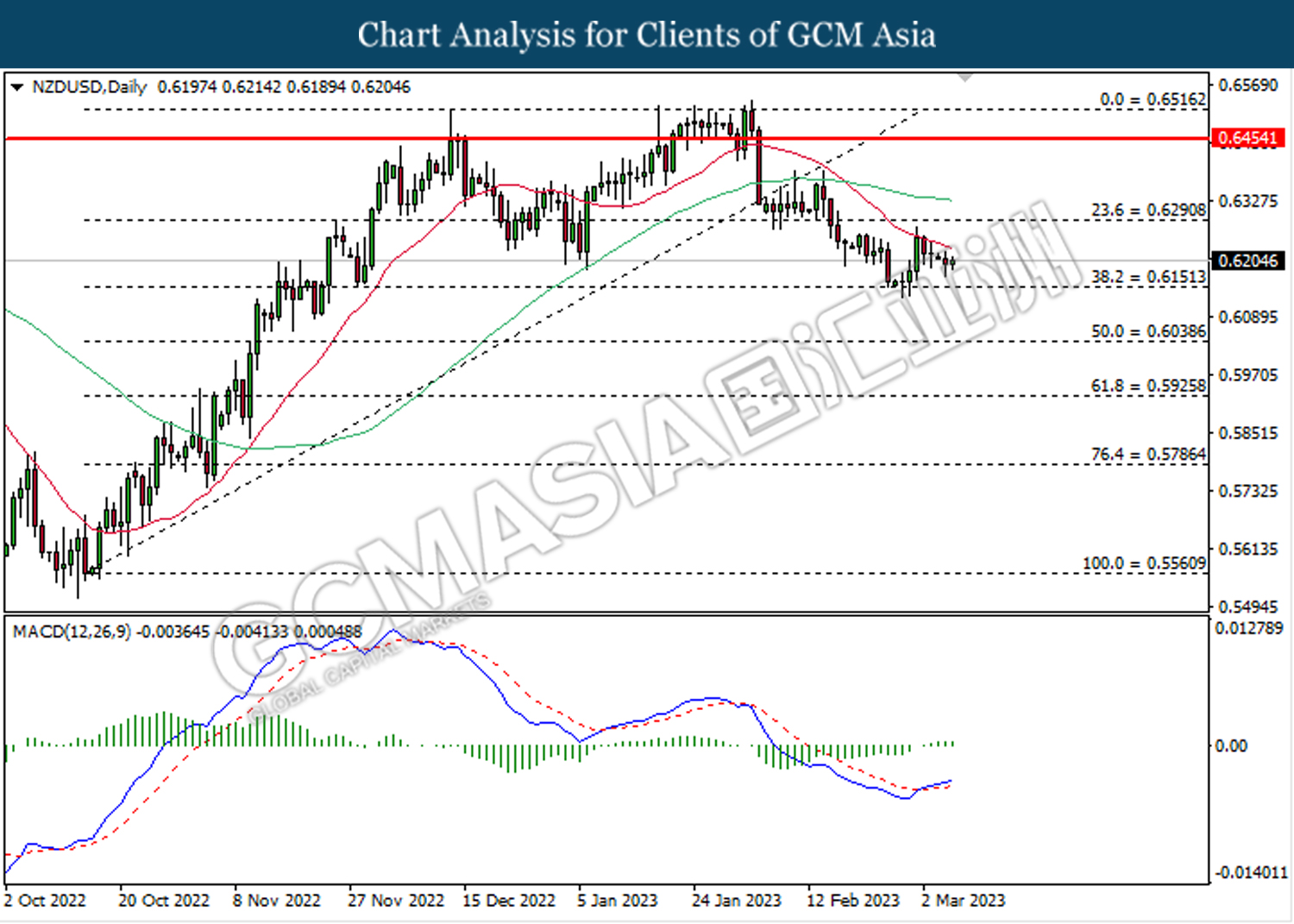

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

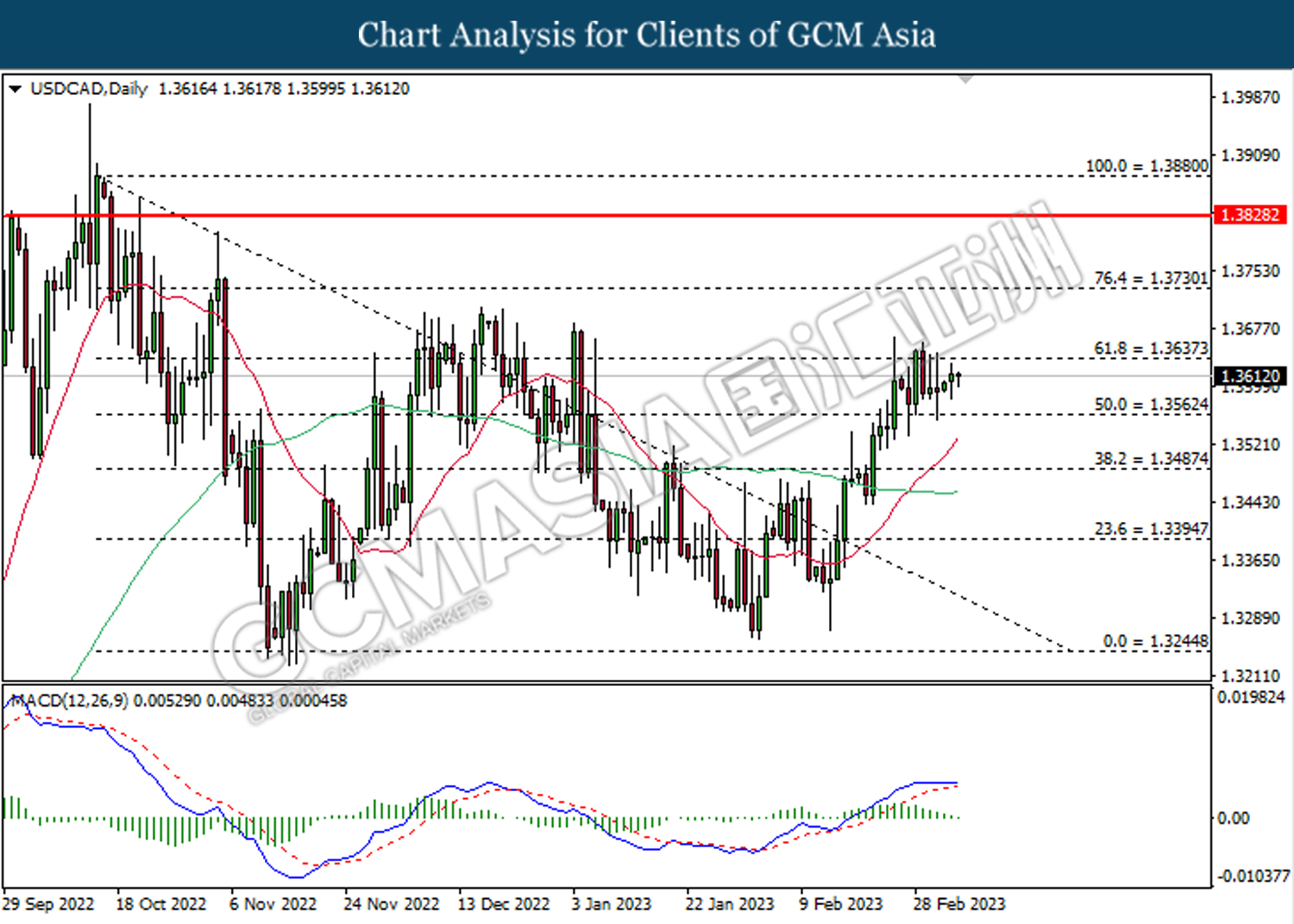

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3560. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

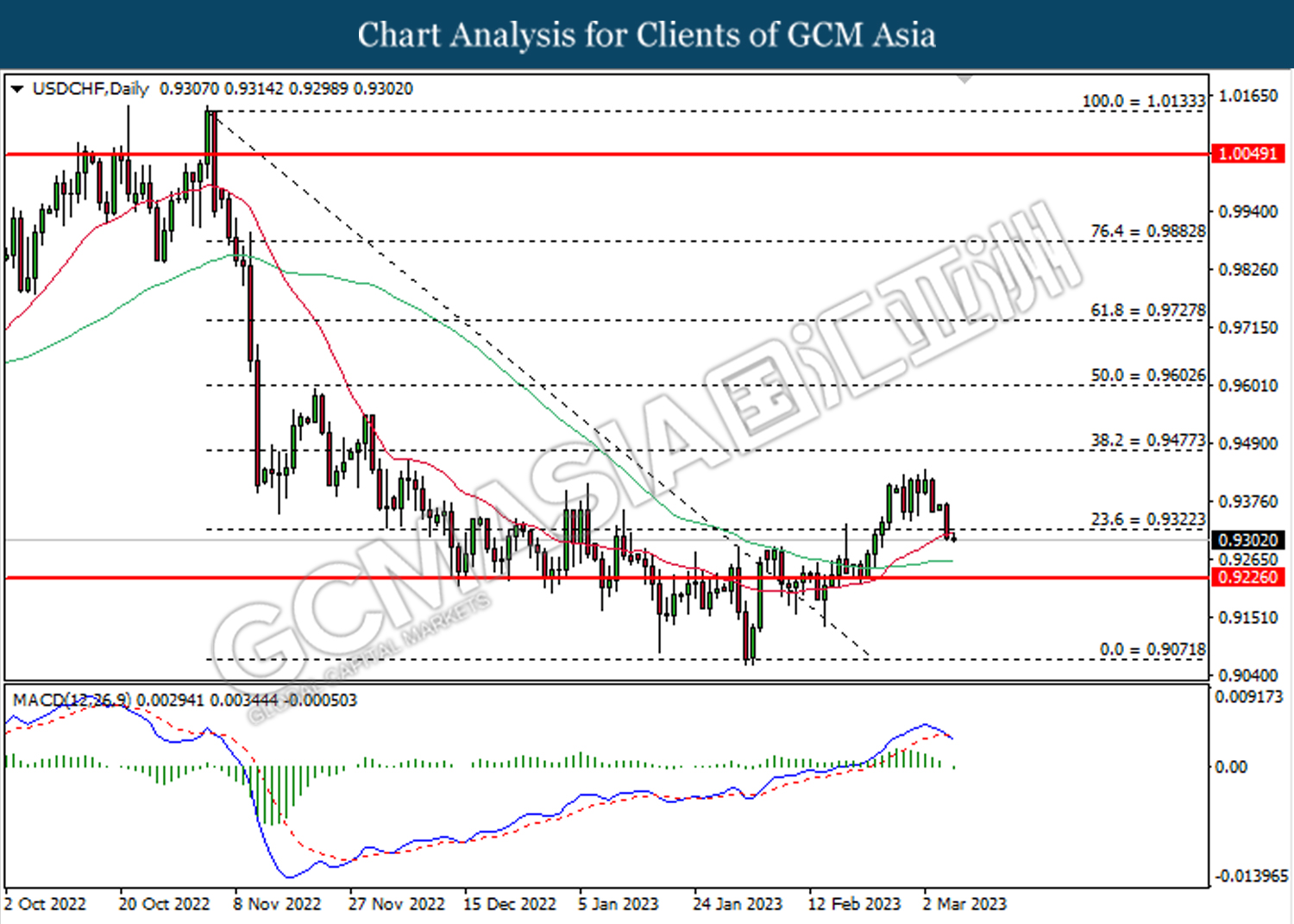

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9320. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

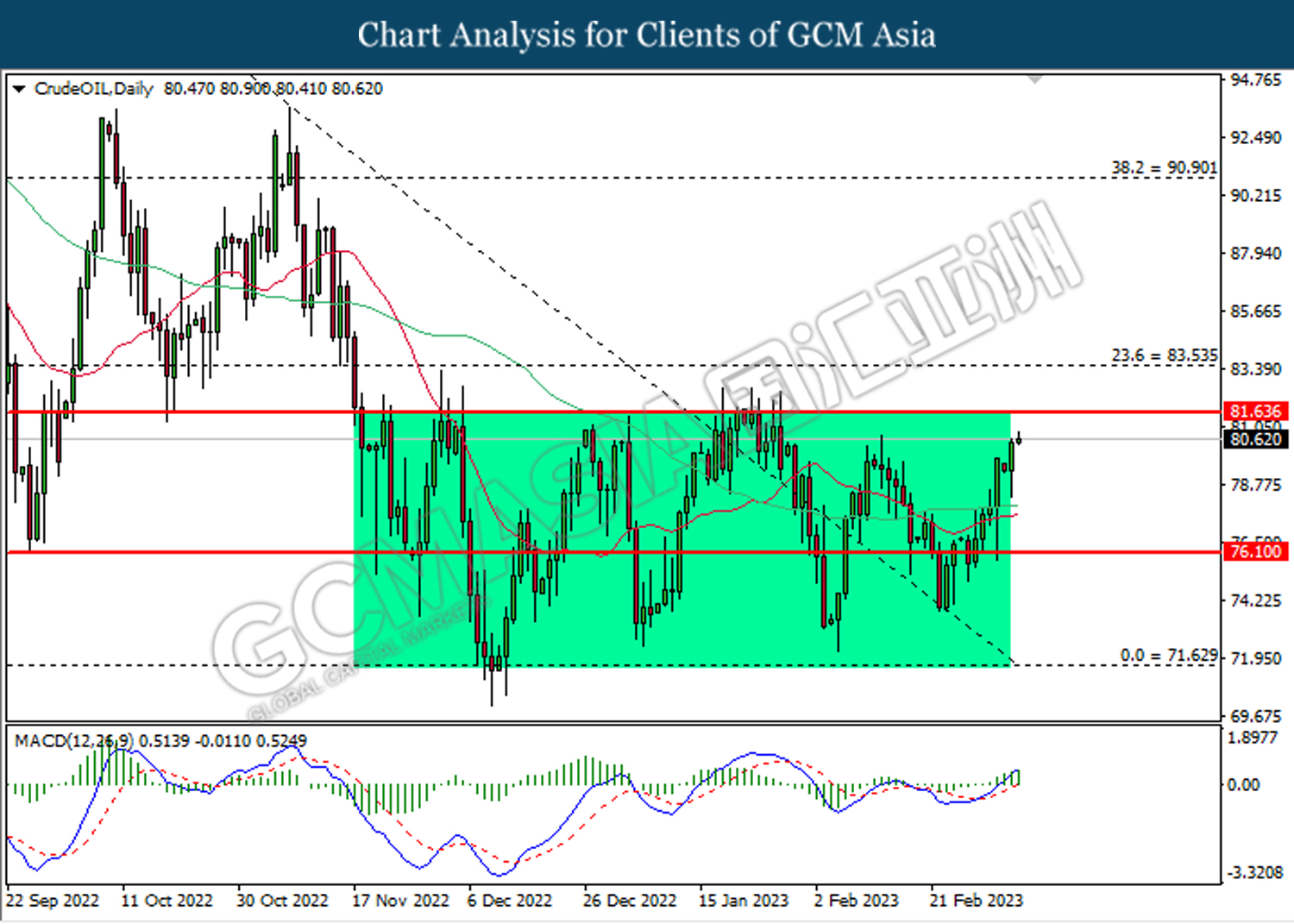

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 81.65.

Resistance level: 81.65, 83.55

Support level: 76.10, 71.65

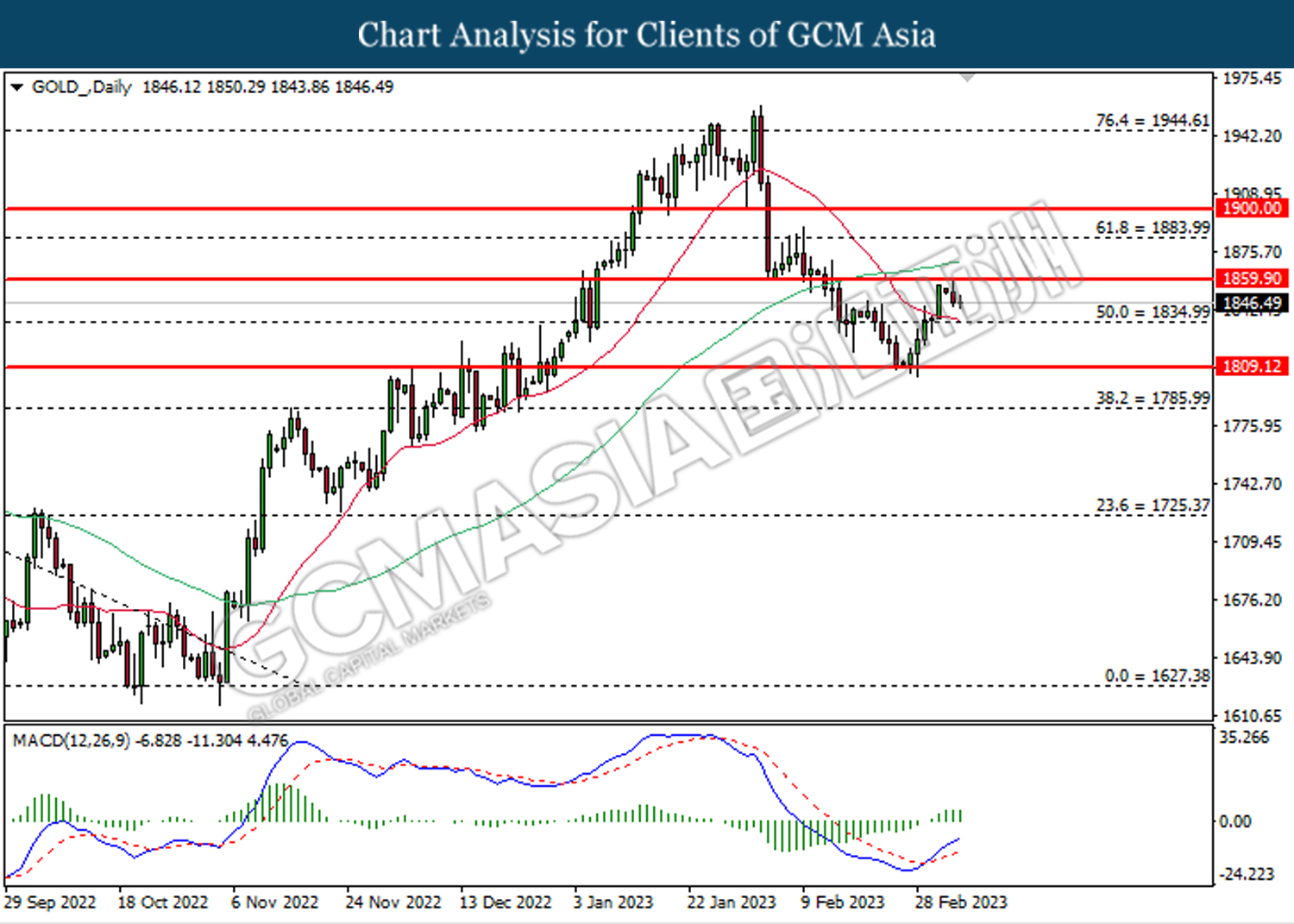

GOLD_, Daily: Gold price was traded lower following the prior retracement from the resistance level at 1859.90. However, MACD which illustrated bullish bias momentum suggests the commodity to undergo technical rebound in short term.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1809.10