7 March 2023 Morning Session Analysis

US Dollar beaten down ahead Powell’s speech.

The Dollar Index, which gauge its value against a basket of six major currencies dropped significantly on yesterday as investors are awaiting the testimony from Federal Reserve Chair. Federal Reserve Chairman Jerome Powell would publish his testifies on Tuesday and Wednesday, whereas the market participants will be looking to the event for clues on the Fed’s interest rate decisions. Prior to that, the opinions among Fed members are simply divided. Most of the officials said that the aggressive rate hike path should be continued in order to quickly restore price stability. Though, part of member suggested the central bank to hike rates by 25 basis point in the next meeting for avoiding economy recession. Such situation has confused the market participants. On the other hand, investors would also eyeing on the announcement of NFP data for speculating the next step of Fed, which prompting investors to step back from the market. In addition, the Dollar Index has extended its losses after the ECB official called for more rate hikes. According to Reuters, the Austrian central bank chief Robert Holzmann claimed on Monday that the ECB should raise interest rates by 50 basis points at each of its next four meetings as inflation is proving to be stubborn. As of writing, the Dollar Index depreciated by 0.23% to 104.25.

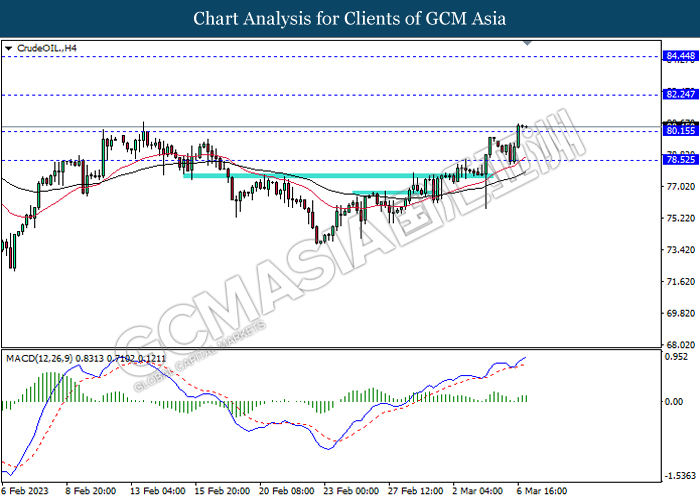

In the commodity market, the crude oil price edged down by 0.01% to $80.50 per barrel as of writing following the China economic growth did not meet market forecast. Besides, the gold price dropped by 0.11% to $1844.73 per troy ounce as of writing following the market’s cautious mood ahead of the key data and events.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Mar) | 3.35% | 3.60% | – |

Technical Analysis

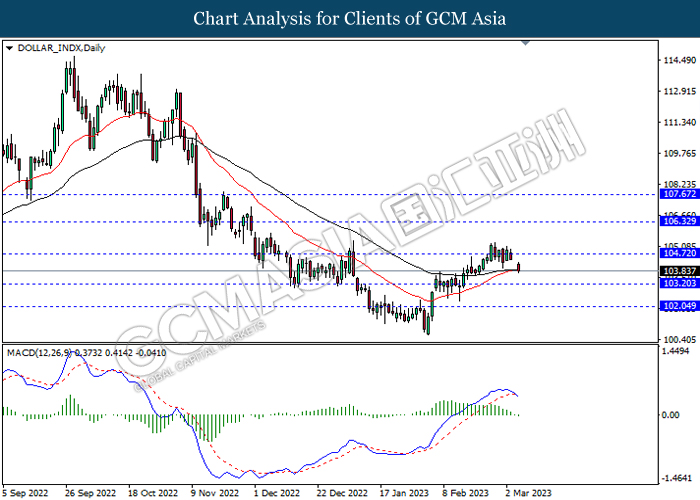

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

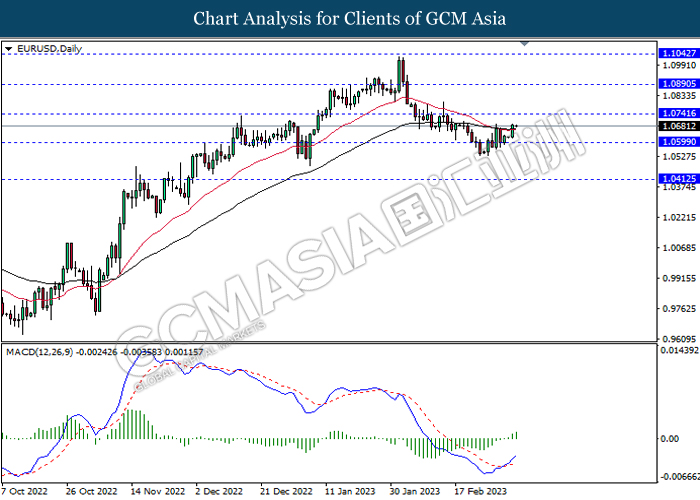

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

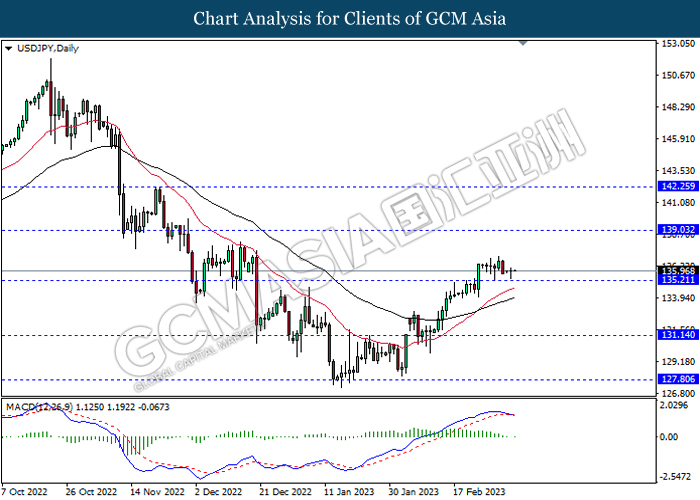

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

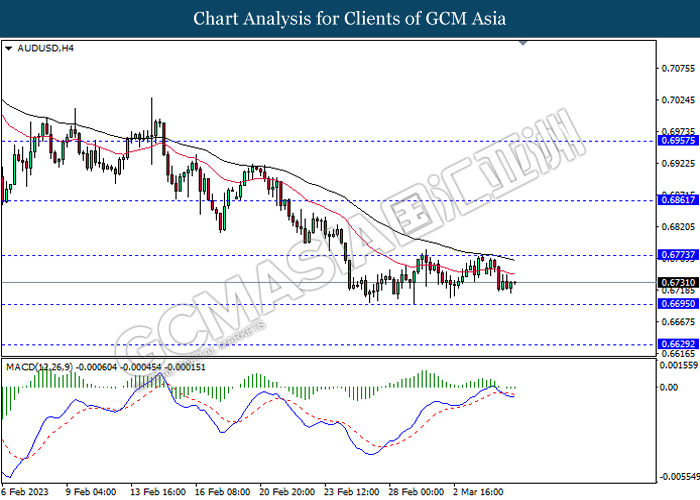

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6860

Support level: 0.6695, 0.6630

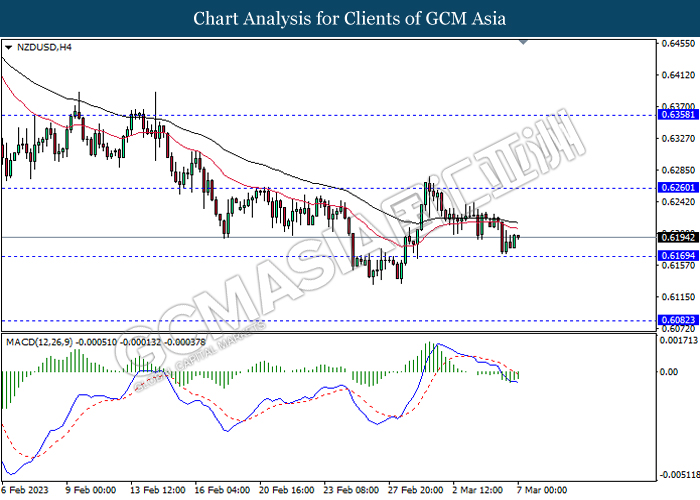

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

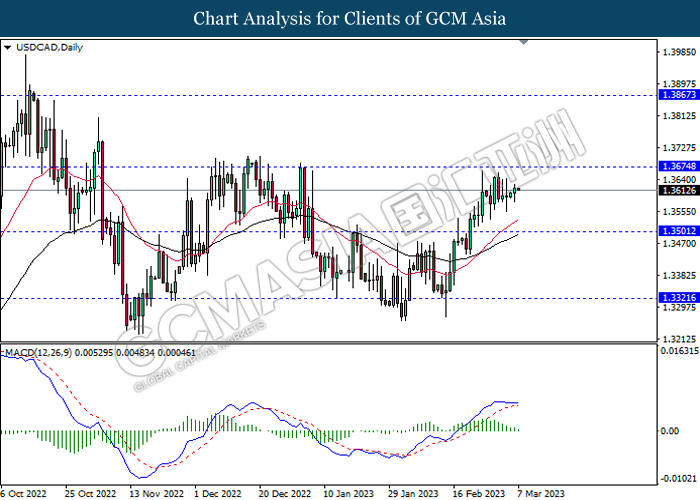

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

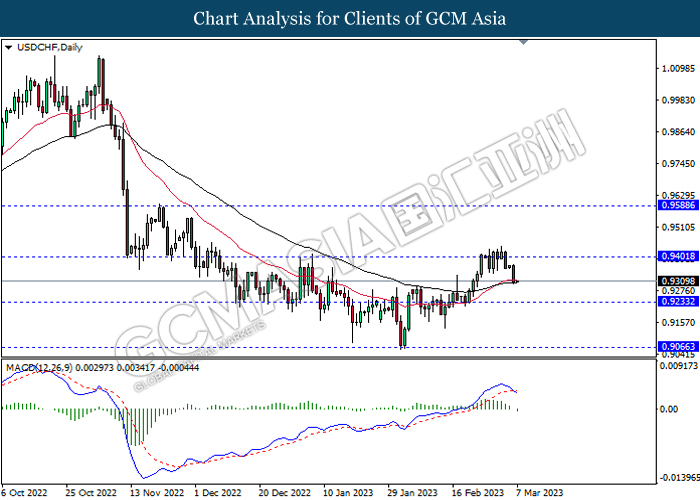

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 82.25, 84.45

Support level: 80.15, 78.50

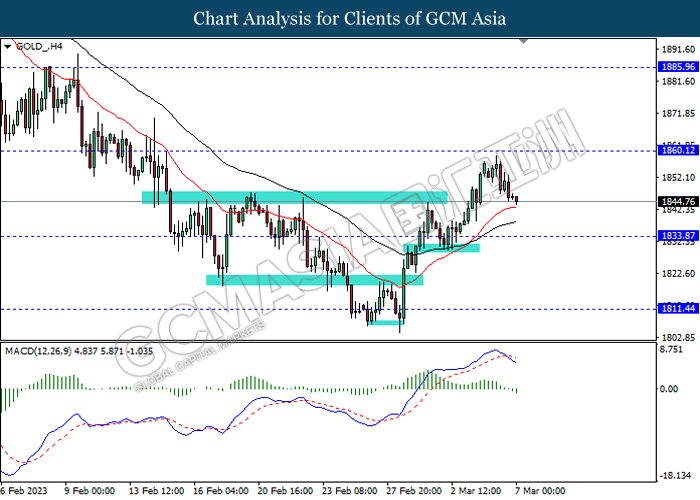

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1860.10, 1885.95

Support level: 1833.85, 1811.45