7 April 2022 Afternoon Session Analysis

Australia Dollar eased following possibility of sanction on China.

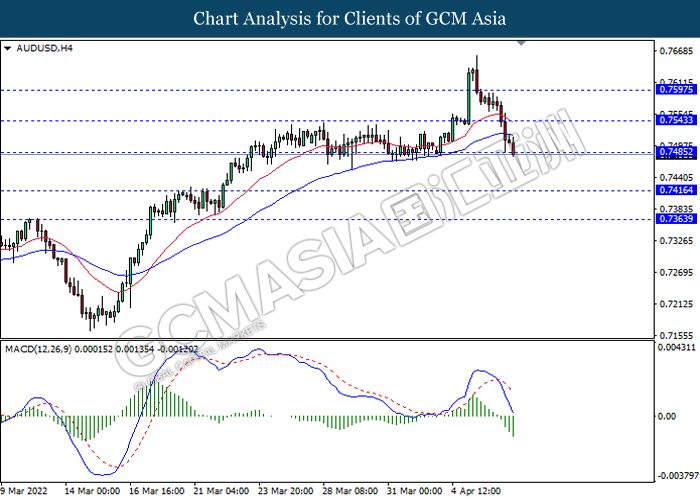

The AUDUSD extend its losses on Thursday amid the backdrop of market speculated US might impose sanctions upon China. According to Reuters, US Deputy Secretary of State Wendy Sherman has claimed that China would likely to face sanctions if China provide its supports to Russia. She also reiterated that sanctions imposed on Russia over its war in Ukraine should give China a “good understanding” of the consequences it could face if it provides material support to Moscow. As the sanctions was imposed to China, it would bring negative prospects toward economic progression in China region. Indirectly, the economic momentum of Australia would be dragged down as China was the largest trading partner for Australia. It dialed down the market optimism toward Australia Dollar. Besides, in a major test of China’s zero-tolerance strategy to eliminate the novel coronavirus, the China government widened the lockdown to eastern parts of the city and extended until further notice restrictions in western districts, which had been due to expire on Tuesday, according to Reuters, spurring further bearish momentum on the Australia Dollar. Investors would continue to scrutinize the latest update with regards of the sanction decision upon Russia in order to gauge the likelihood movement of the pair. As of writing, AUDUSD depreciated by 0.33% to 0.7488.

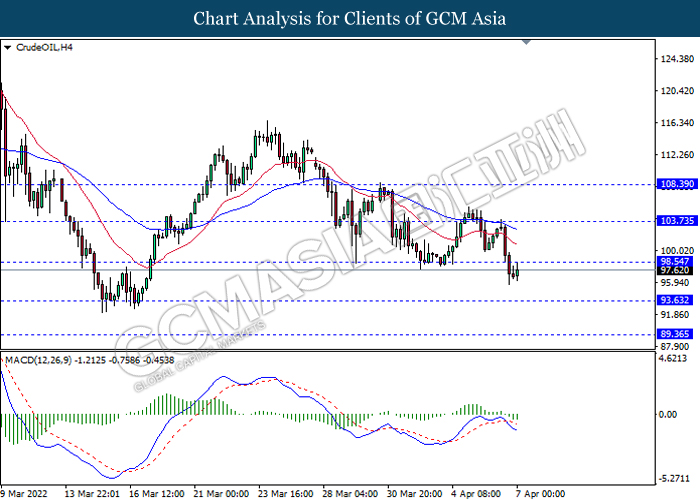

In commodities market, crude oil price appreciated by 1.66% to $97.83 per barrel as of writing. Nonetheless, the overall trend for oil price remained bearish following oil release from IEA. On the other hand, gold price edged up by 0.09% to 1924.90 per troy ounces as of writing. However, gold price still under pressure over the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 202K | 200K | – |

Technical Analysis

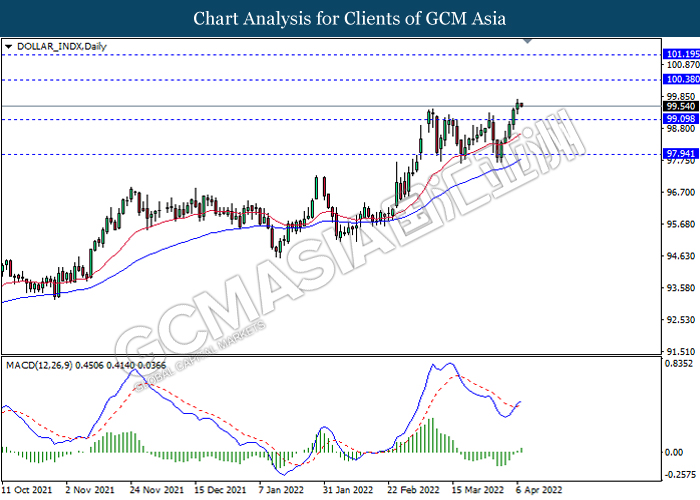

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

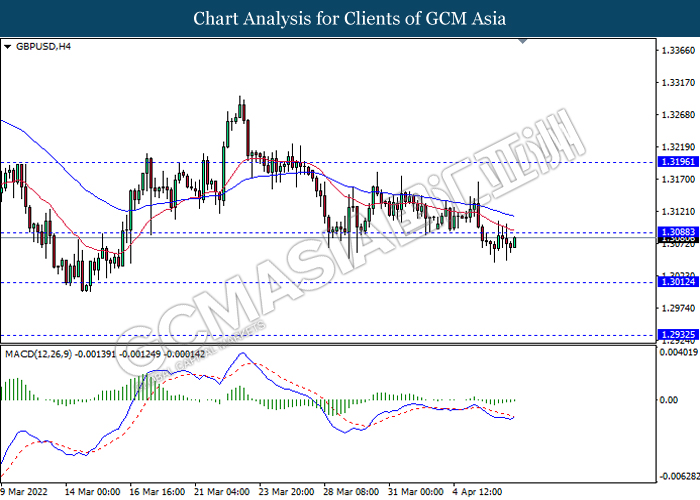

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

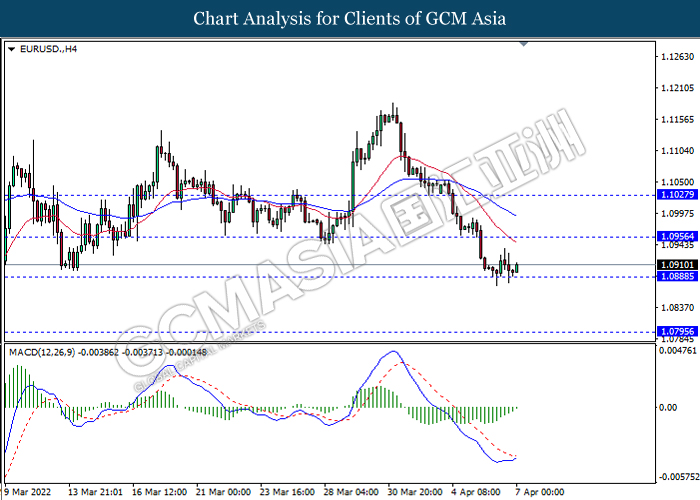

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0955, 1.1025

Support level: 1.0890, 1.0795

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7485, 0.7545

Support level: 0.7415, 0.7365

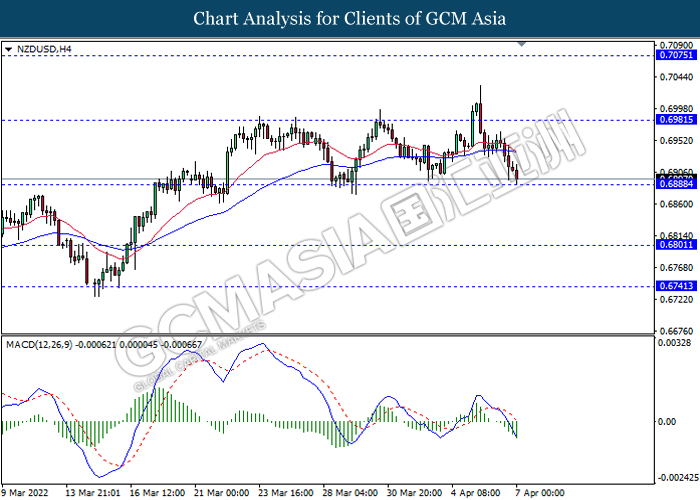

NZDUSD, H4: NZDUSD was traded lower following while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses id successfully breakout the support level.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

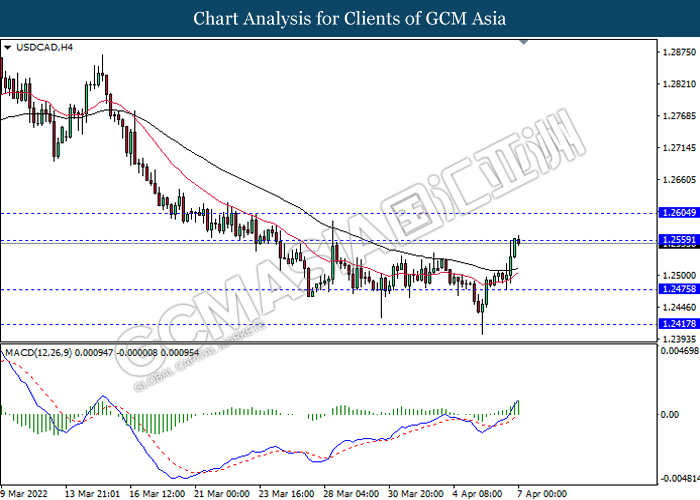

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

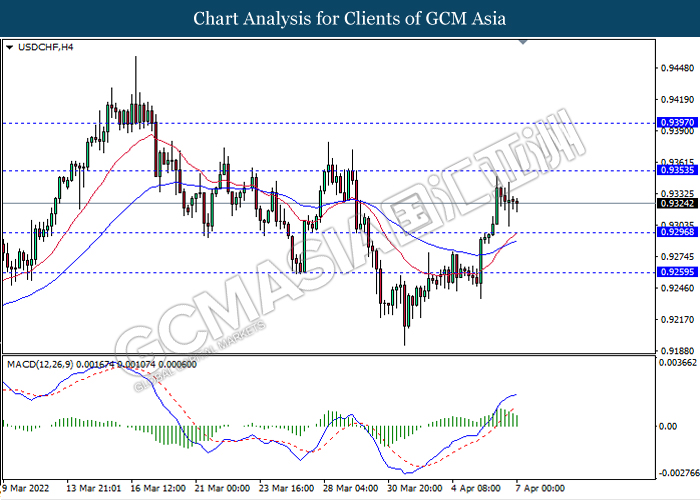

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 98.55, 103.75

Support level: 93.65, 89.35

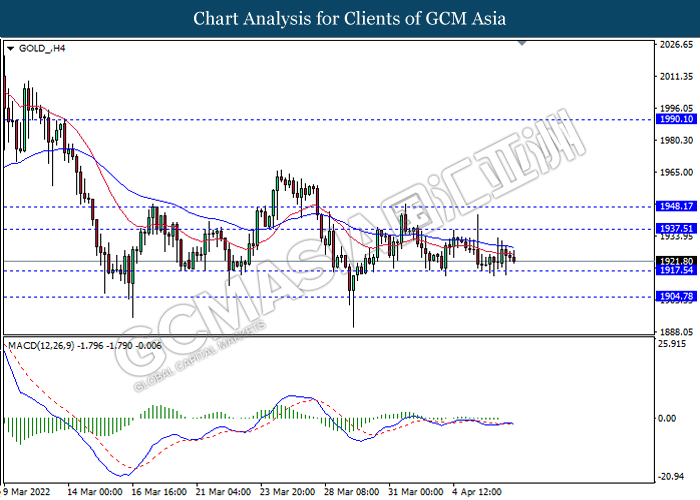

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1937.50, 1948.15

Support level: 1917.55, 1904.80