7 April 2023 Afternoon Session Analysis

Canada slips as investors shrug off jobs gain.

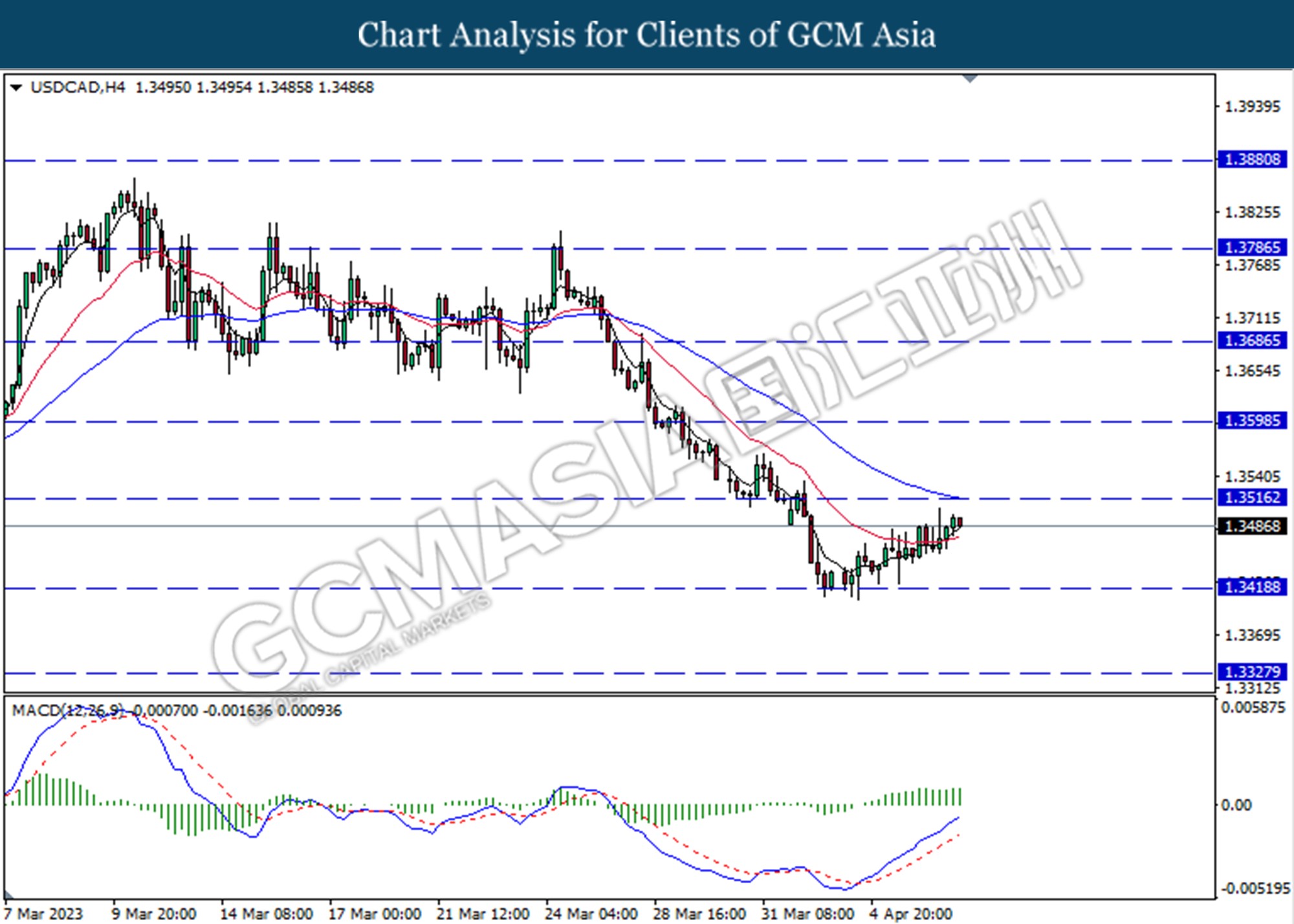

The Canadian dollar edged lower against its US counterpart as investors shrugged off jobs gain. According to Statistics Canada, the country added 34.7k jobs to the market upbeat market expectations of 21.8k and prior reading 12k. That suggests that labor conditions are improving as unexpectedly strong job growth typically signals a strong economy. Data also suggests consumer spending in Canada will improve as positive employment changes. However, the Canada unemployment rate remained sticky at 5.0%, same as previous reading, upbeat the market expectations of 5.1%. The Canadian economic activity seemed to expand as Ivey’s PMI rose to 58.2 from 51.6 in February. The main contributions of the PMI in March are from employment and inventory orders climbed. The stronger-than-expected labor data and PMI index will spur the Bank of Canada to resume its rate hike. However, the positive economic data failed to stop the gains of USD/CAD as the greenback rebounded yesterday. The weekly initial jobless claims reduced from 246k to 228k, and it is lower than the reading of 4 weeks average at 237k, which had boosted the dollar rebounded from its recent low. As of writing, the pair of USD/CAD slipped -0.02% to $1.3489.

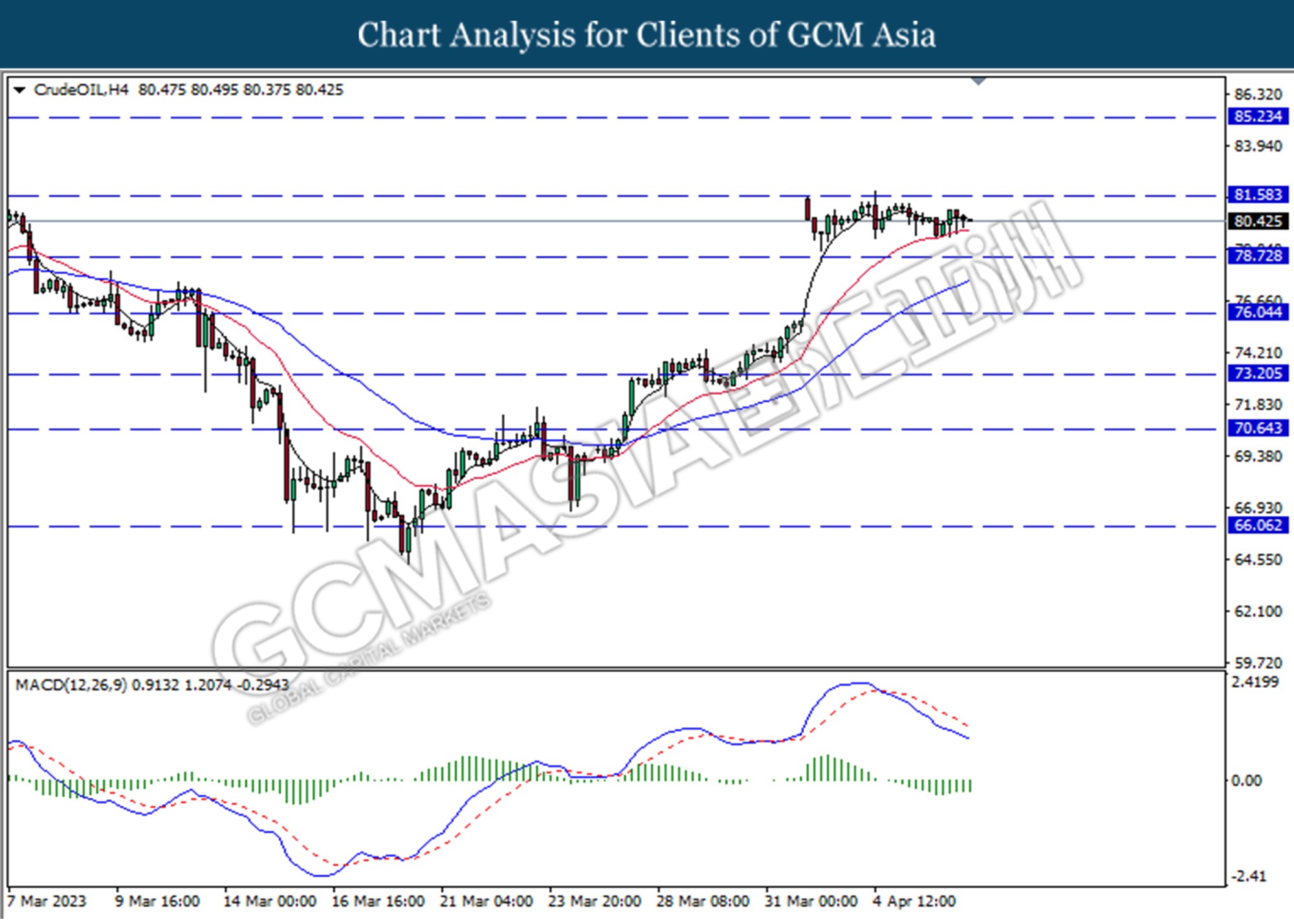

In the commodity market, the crude oil prices were traded lower by -0.17% to $80.47 per barrel as of writing amid the investor has priced in the impact of OPEC supply cut. Besides, the gold price edged down by -0.57% to $2023.90 per troy ounce as of writing as investors awaits for Non-farm payroll data to release.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Zealand – Good Friday

All Day CAD Canada – Good Friday

All Day GBP United Kingdom – Good Friday

All Day AUD Australia – Good Friday

All Day CHF Switzerland – Good Friday

All Day EUR Germany – Good Friday

All Day USD United States – Good Friday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 311K | 238K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.6% | 3.6% | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the index to extended its gains toward the resistance level at 101.70

Resistance level: 101.70, 103.00

Support level: 100.35, 99.35

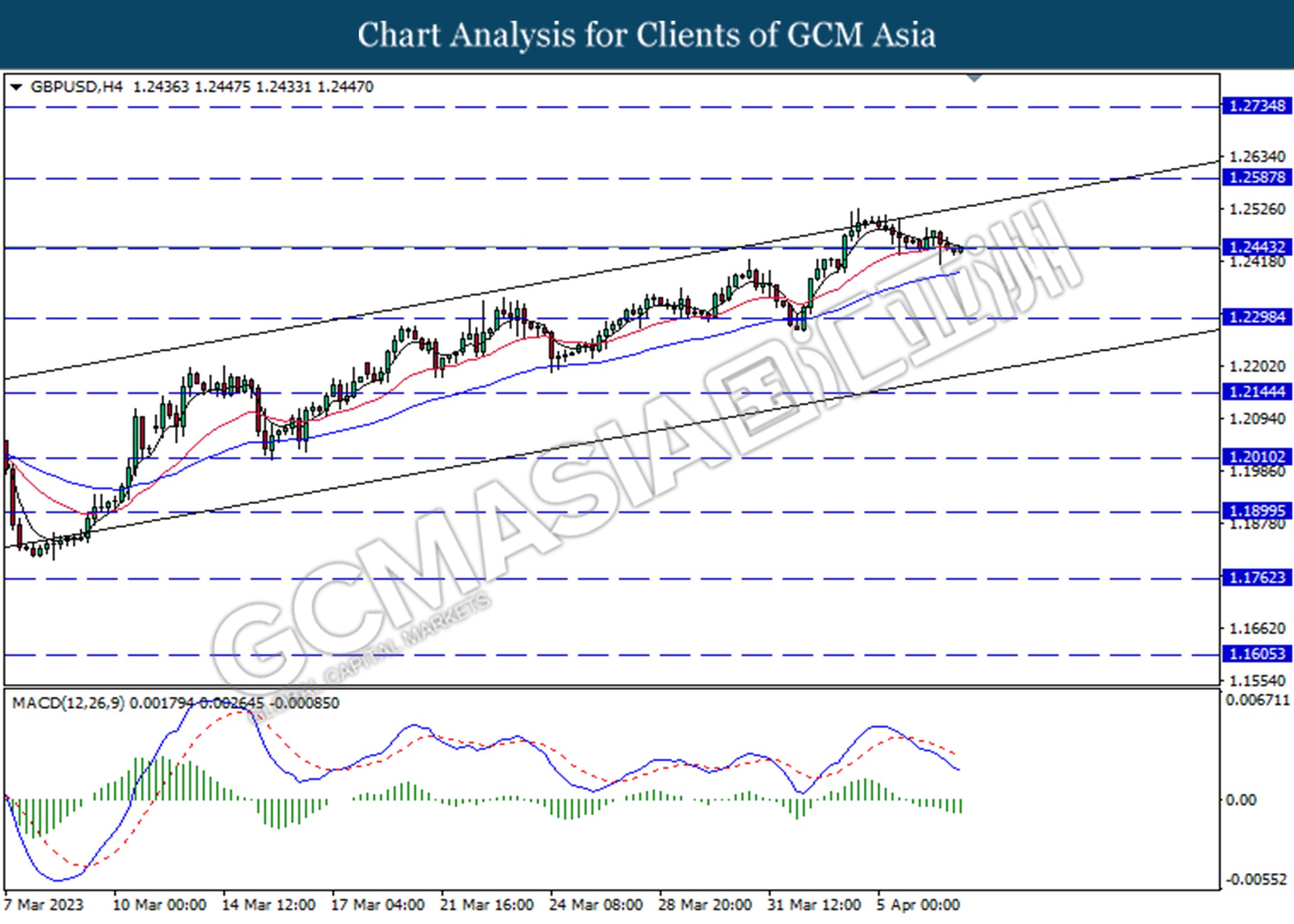

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2445. MACD which illustrated decreasing bearish momentum suggests the extended its gains after it successfully breakout below the resistance level.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

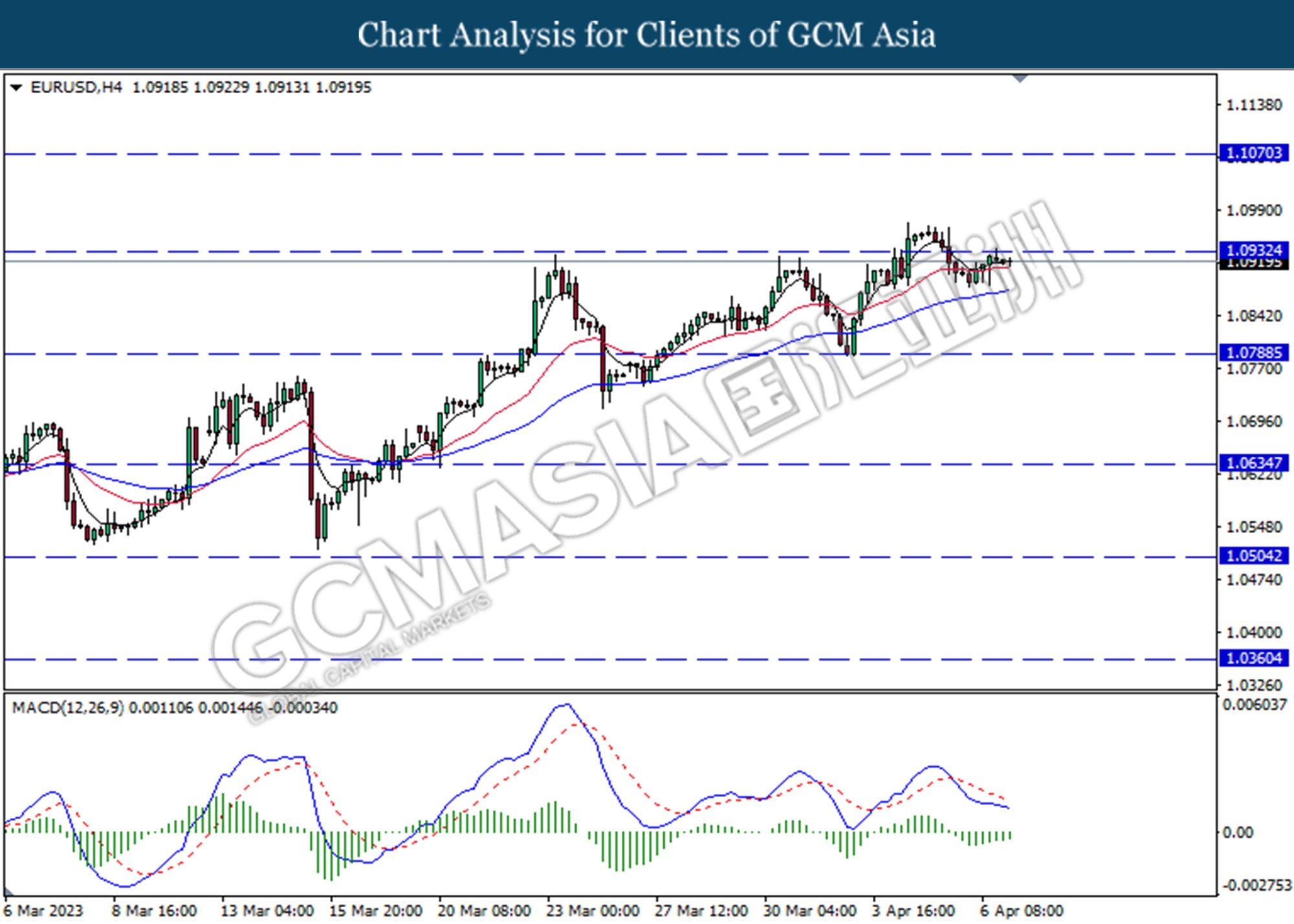

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.0930. However, MACD which illustrated decreasing bearish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

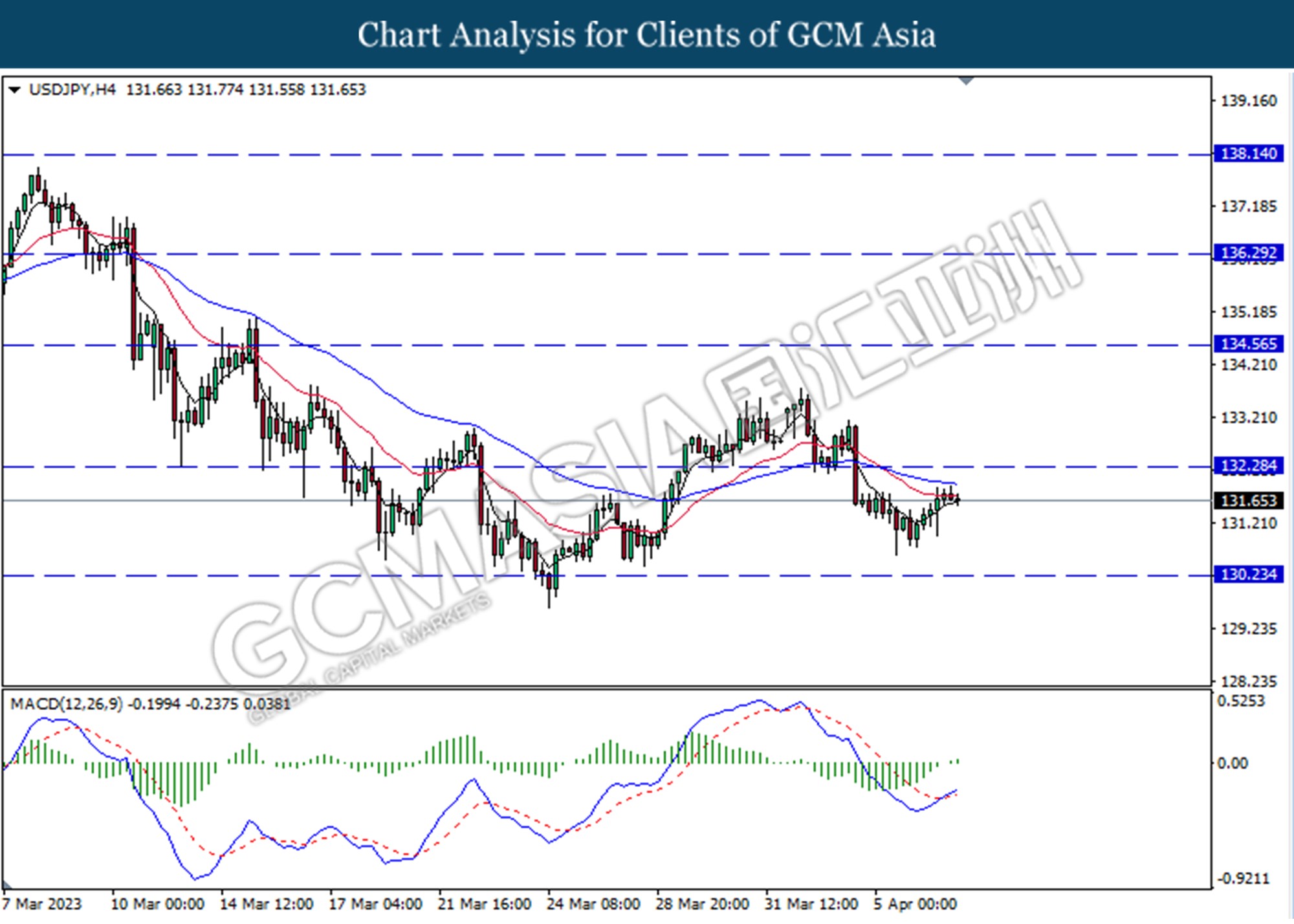

USDJPY, H4: USDJPY was traded lower following a prior retracement from the resistance level at 1.0930. However, MACD which illustrated increasing bullish momentum suggests the pair to be traded higher as technical correction.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

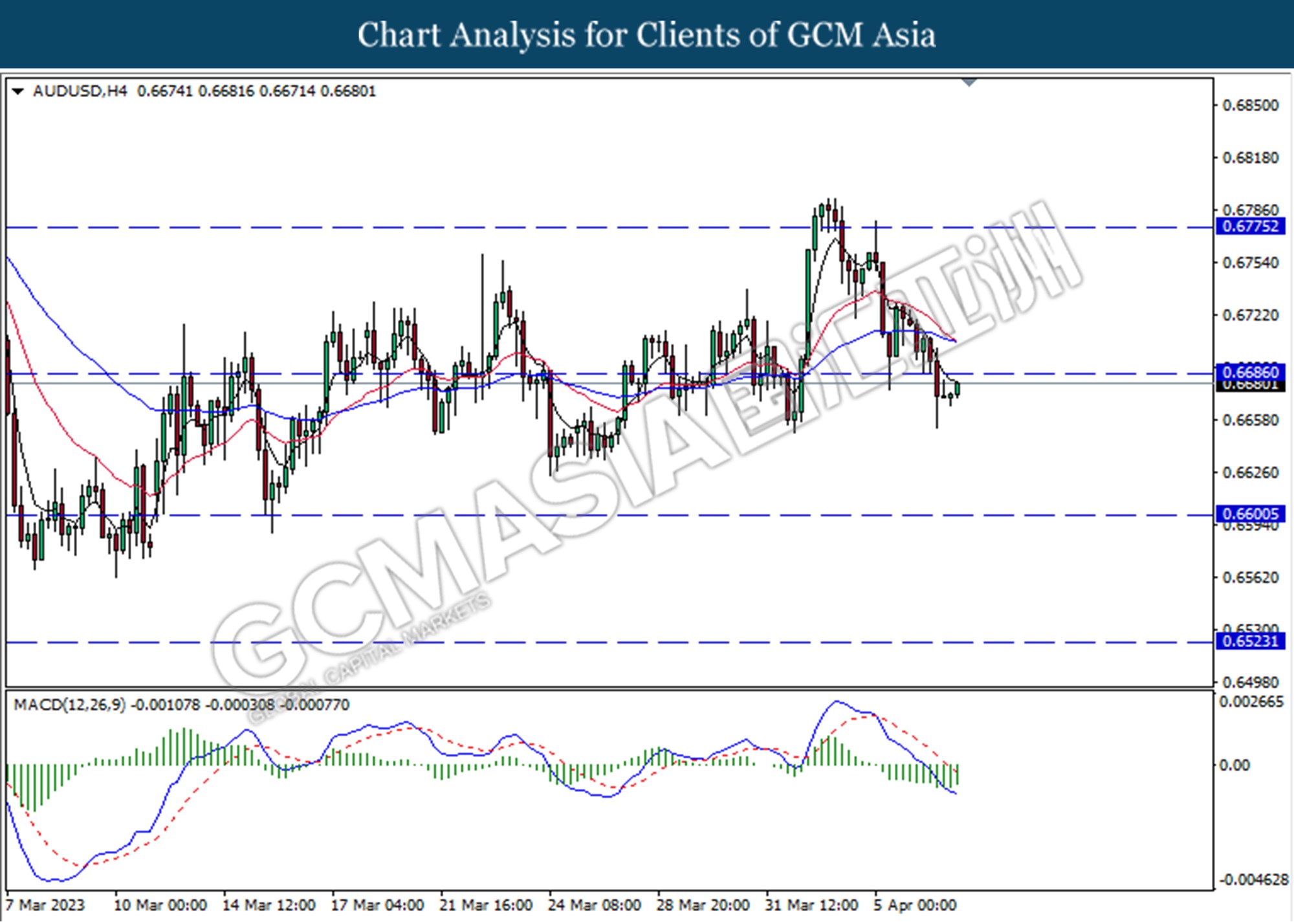

AUDUSD, H4: AUDUSD was traded higher following a prior rebounded from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6605, 0.6525

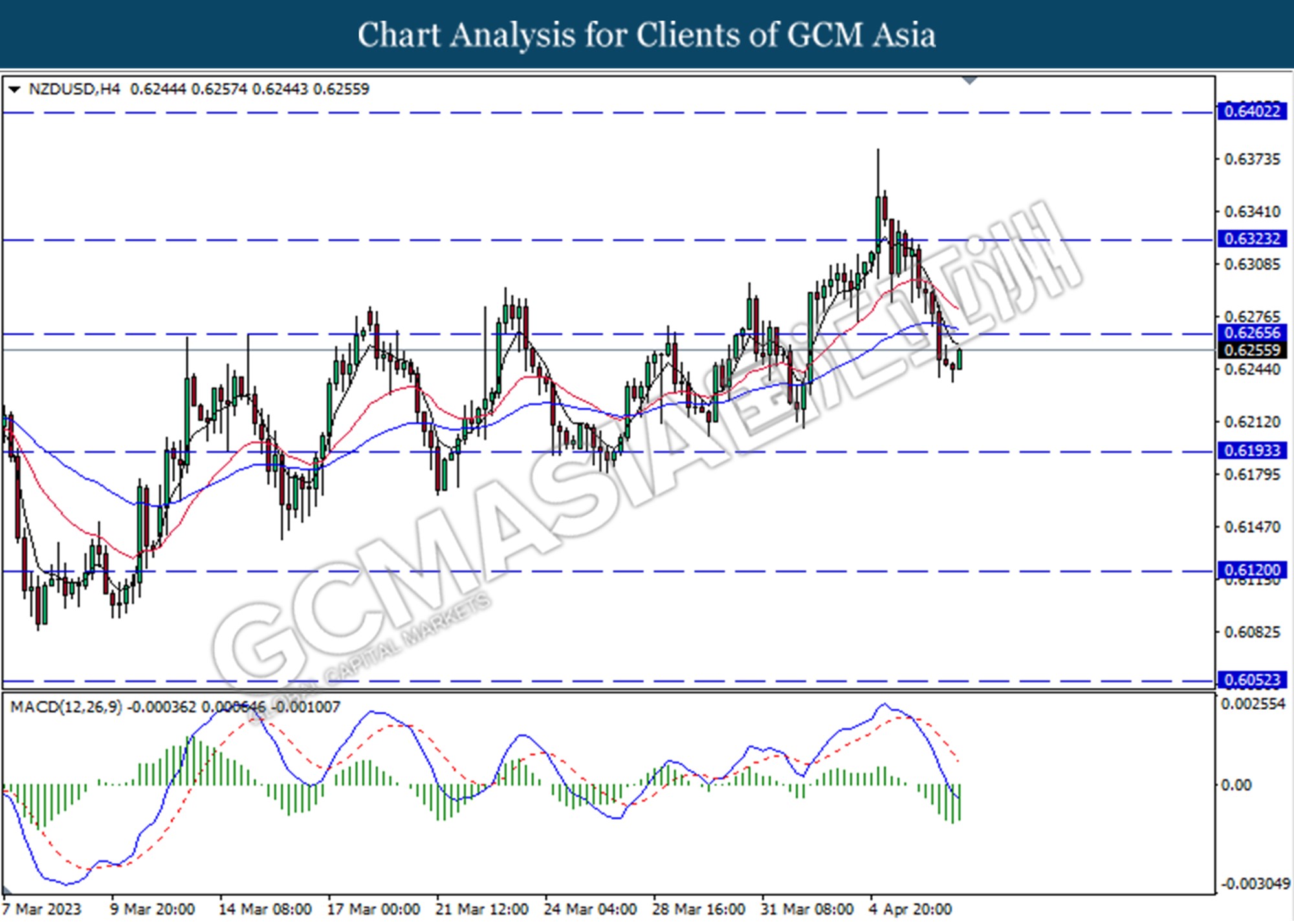

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

USDCAD, H4: USDCAD was traded higher following rebounded from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 1.3515

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

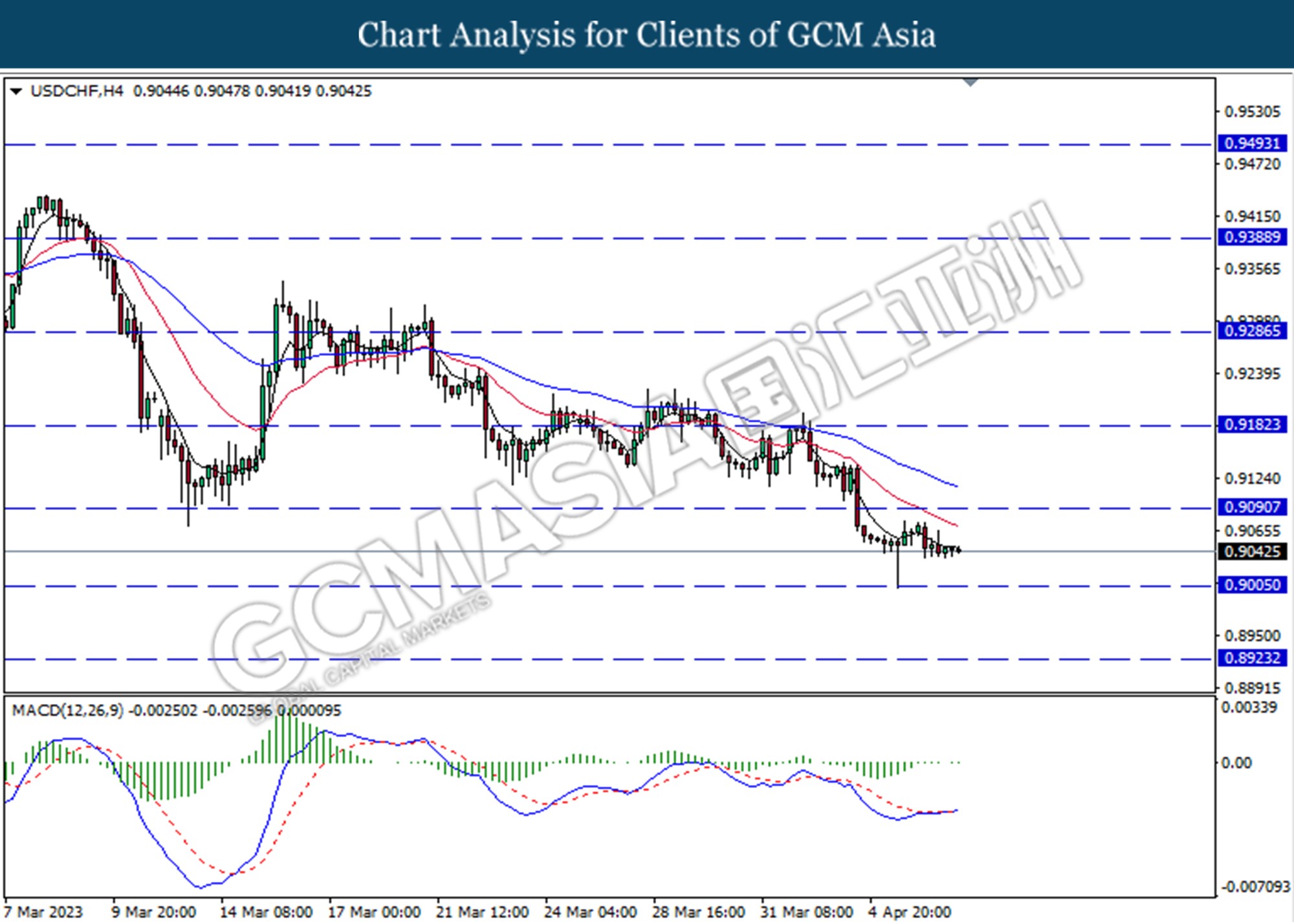

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity to be traded higher as technical correction.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

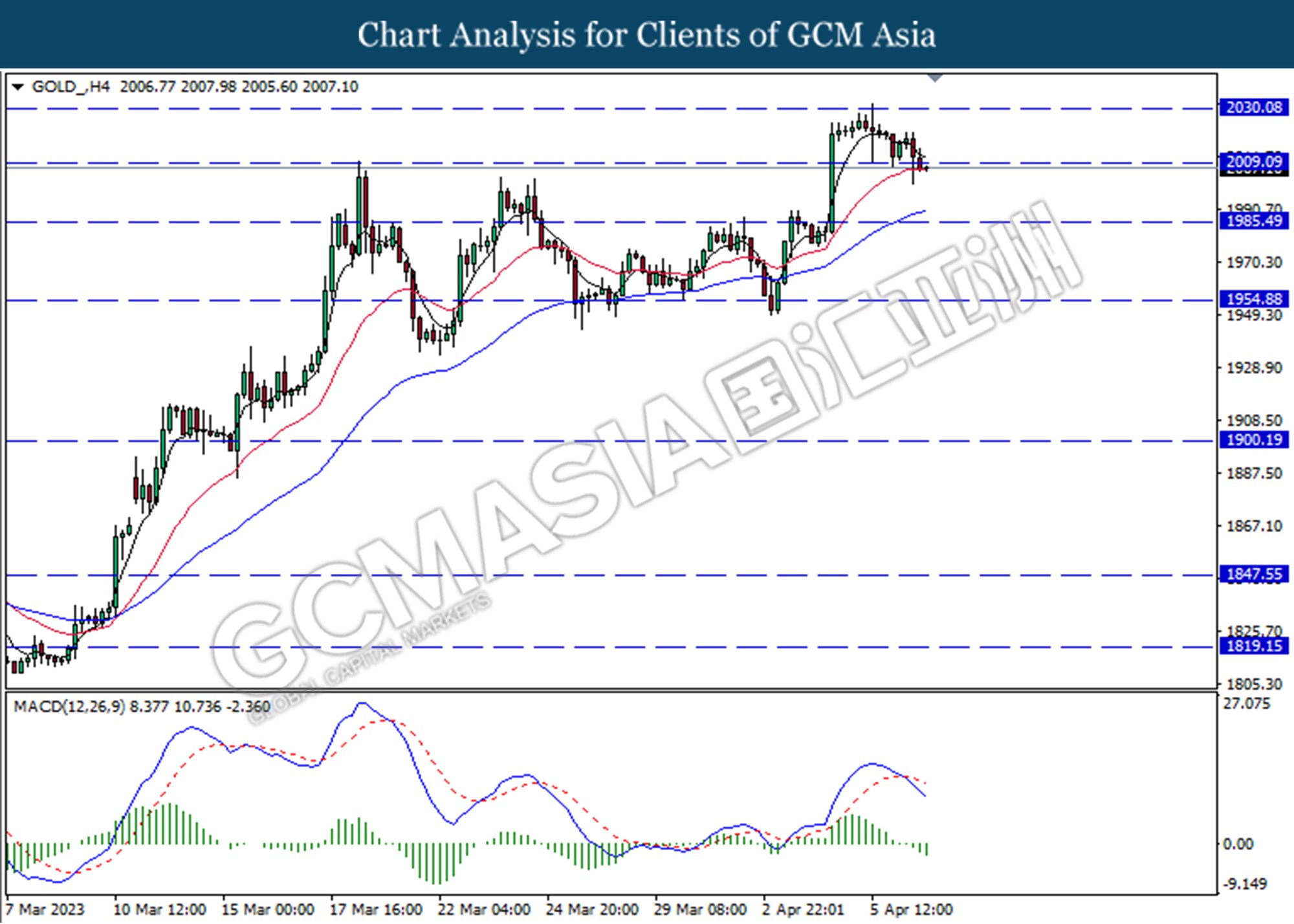

GOLD_, H4: Gold price was traded lower following a prior break below from the previous support level at 2009.10. MACD which illustrated increasing bearish momentum suggests the commodity extended its losses toward the support level at 1985.50.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90