7 April 2023 Morning Session Analysis

US Dollar beaten down by bearish economic data reading.

The Dollar Index which traded against a basket of six major currencies lost its appeal on yesterday after the pessimistic economic data has been unleashed. According to the US Department of Labor, the US Initial Jobless Claims came in at the reading of 228K, exceeding the market expectation of 200K. Not only that, a series of employment data released this week such as JOLTs Job Openings and ADP Nonfarm Employment Change had also disappointed most of investors, while it indicated that the fatigued and weakness of the US labor market. On the other hand, it also signaled that the bankruptcy of big banks which happened last month has brought much negative impacts toward economic progression in the US. As evidence, the weakened economic data such as ISM Non-Manufacturing Purchasing Managers Index bear this out. Consequences, market participants would likely to anticipate a pause on Fed’s rate hike path when the initial jobless claims reports announced. Nonetheless, the losses of Dollar Index was limited following the hawkish statement presented by Fed officials. St. Louis Fed President James Bullard claimed on Thursday that the Fed should keep on raising interest rate as the inflation risk still remained ‘too high’. At this juncture, the announcement of NFP data tonight would gather most attention of investors. As of writing, the Dollar Index appreciated by 0.06% to 101.60.

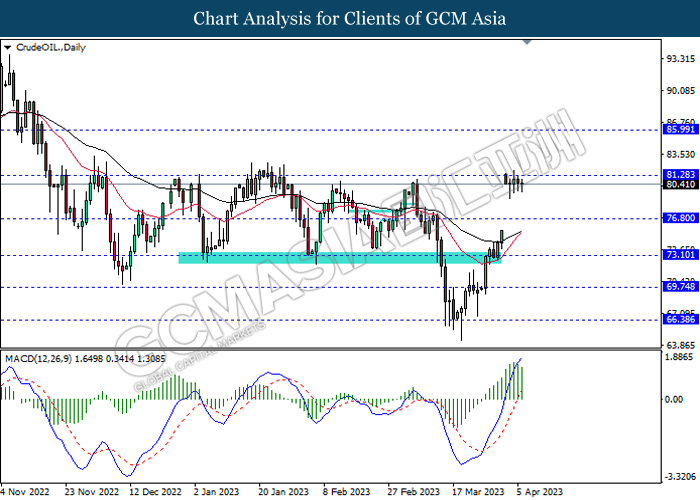

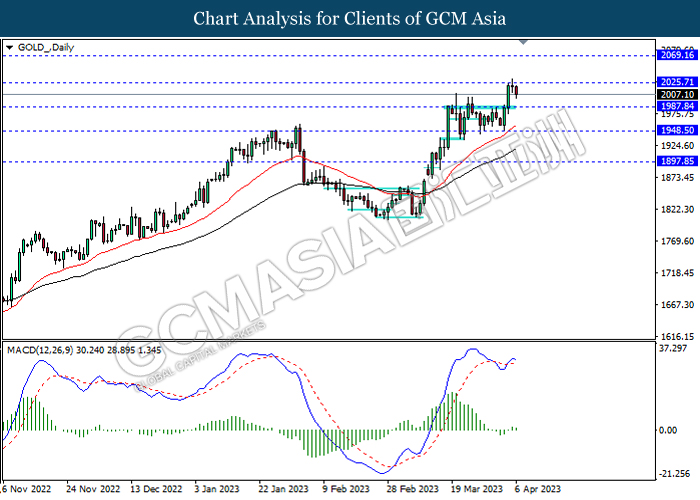

In the commodity market, the crude oil price dropped by 0.17% to $80.47 per barrel as of writing following the bearish economic data has dialed down the market demand for oil. Besides, the gold price edged up by 0.03% to $2008.01 per troy ounce as of writing over the depreciation of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day NZD New Zealand – Good Friday

All Day CAD Canada – Good Friday

All Day GBP United Kingdom – Good Friday

All Day AUD Australia – Good Friday

All Day CHF Switzerland – Good Friday

All Day EUR Germany – Good Friday

All Day USD United States – Good Friday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 311K | 238K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.6% | 3.6% | – |

Technical Analysis

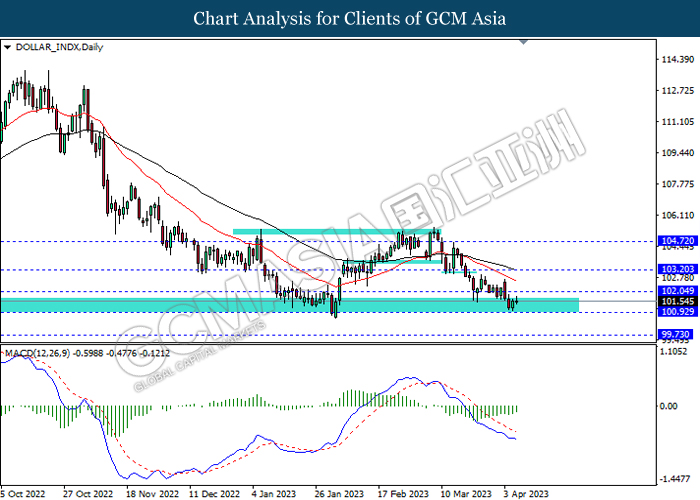

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

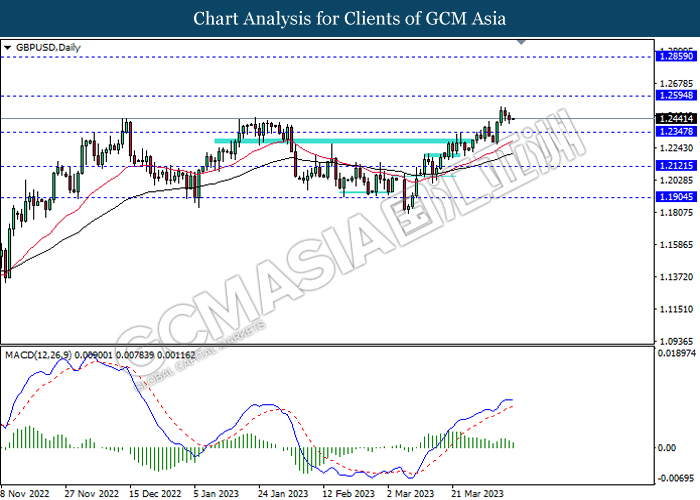

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

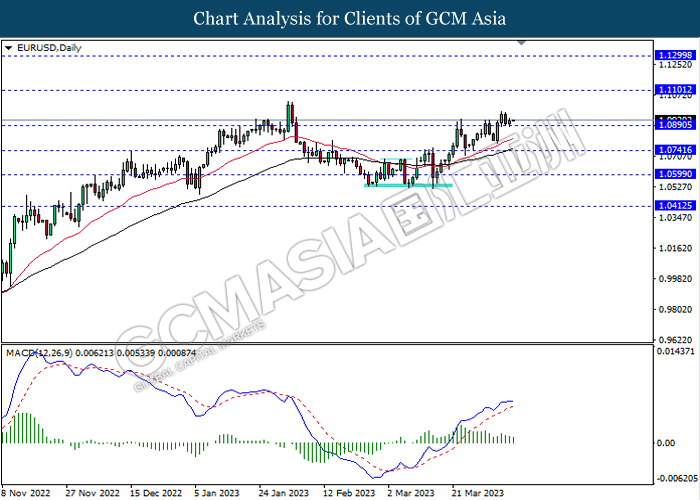

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

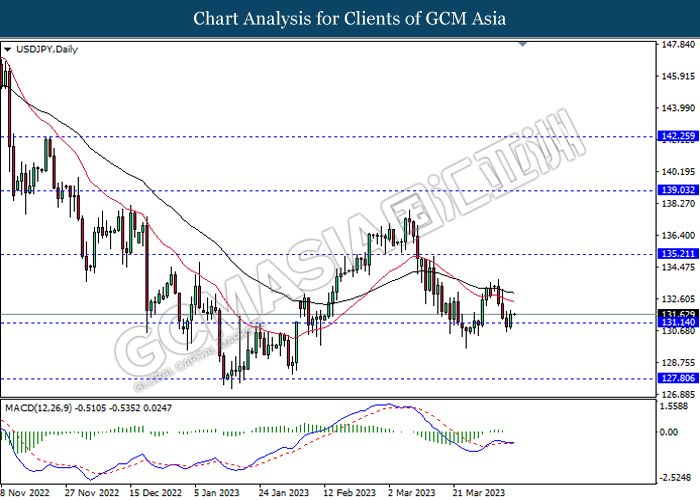

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

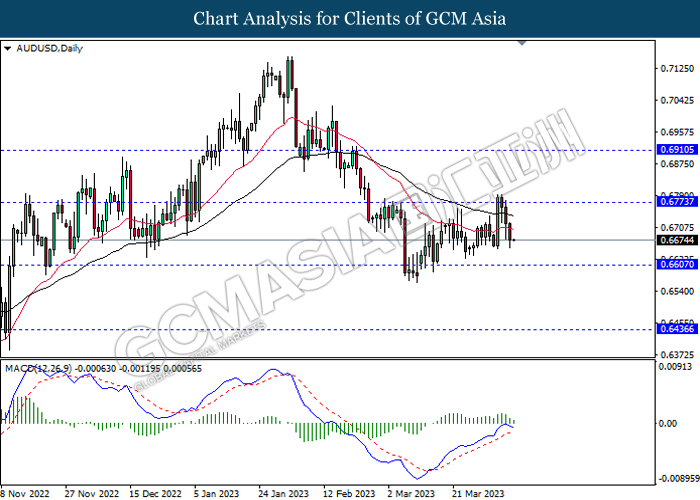

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

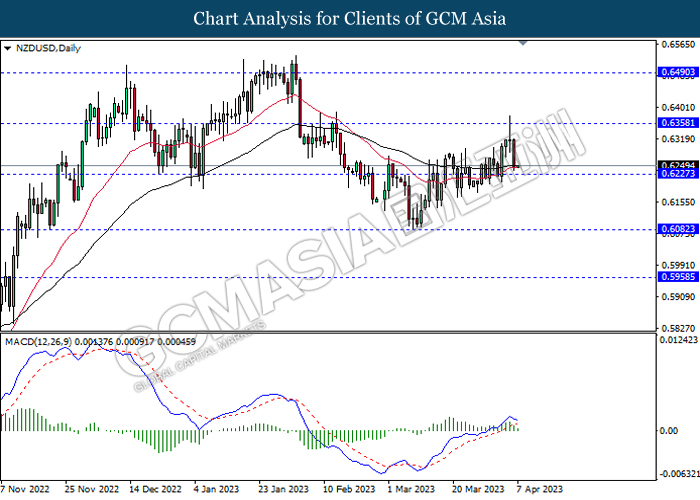

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

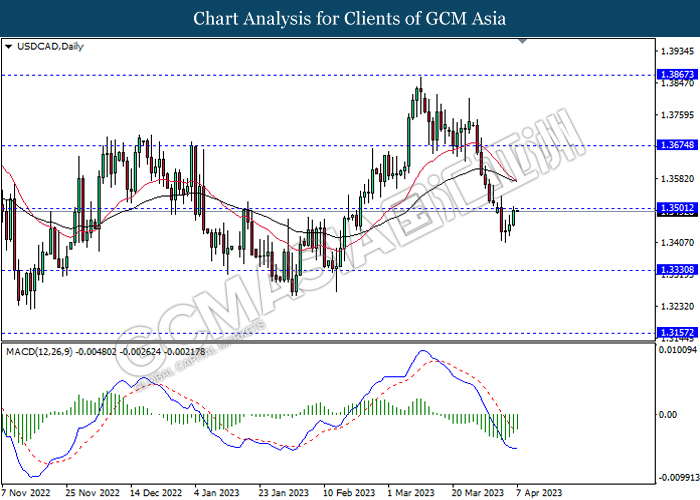

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

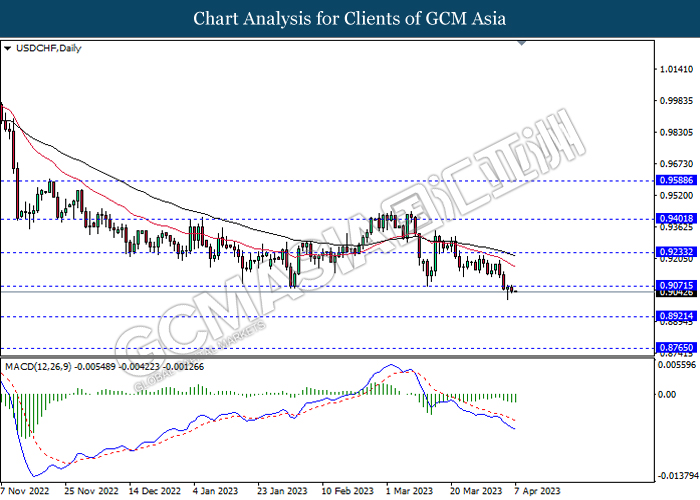

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50