7 June 2022 Afternoon Session Analysis

Euro beaten down by downbeat economic data.

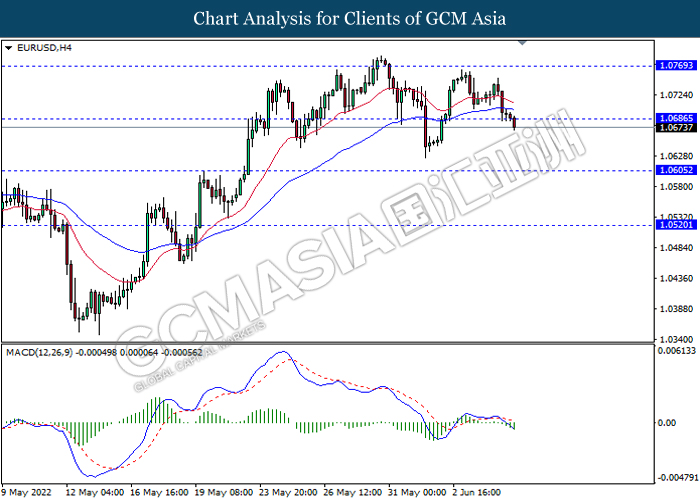

The EURUSD slumped since yesterday over the bearish economic data was released. According to Eurostat, Eurozone Retail Sales MoM for April notched down from the previous reading of 0.3% to -1.3%. The Eurozone Retail Sales MoM was used as an indicator to present the consumer spending in Europe region. While the lower-than-expected data showed that the diminishing of consumer spending, it had brought negative prospect toward economic progression in Europe region. Besides, the Euro extended its losses following the upbeat Nonfarm Payrolls data. The US Nonfarm Payrolls for May came in at the reading of 390K, which higher than the market expectation of 325K. As the number of people employed had increased, it had dialed up the market optimism toward the economic momentum in US, which prompted investors to shift their capitals into US Dollar. As of writing, EURUSD eased by 0.16% to 1.0676.

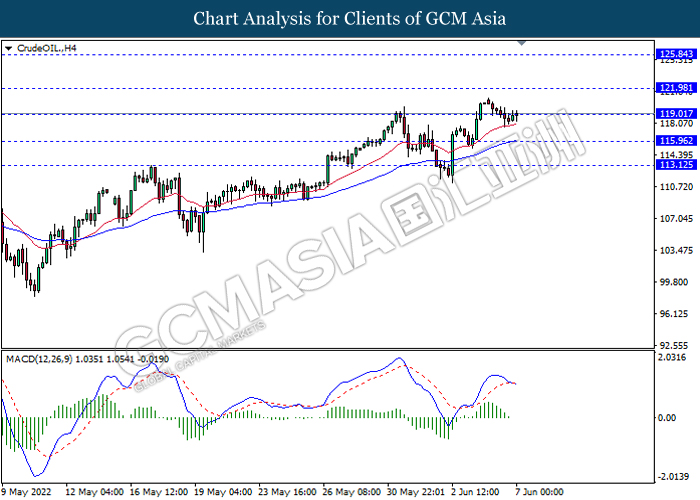

In the commodities market, crude oil price appreciated by 0.66% to $119.27 per barrel as of writing amid the expected demand recovery in China as it relaxed tough COVID curbs. On the other hand, gold price depreciated by 0.07% to $1842.45 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (May) | 51.8 | 51.8 | – |

| 16:30 | GBP – Services PMI (May) | 51.8 | 51.8 | – |

| 22:00 | CAD – Ivey PMI (May) | 66.3 | – | – |

Technical Analysis

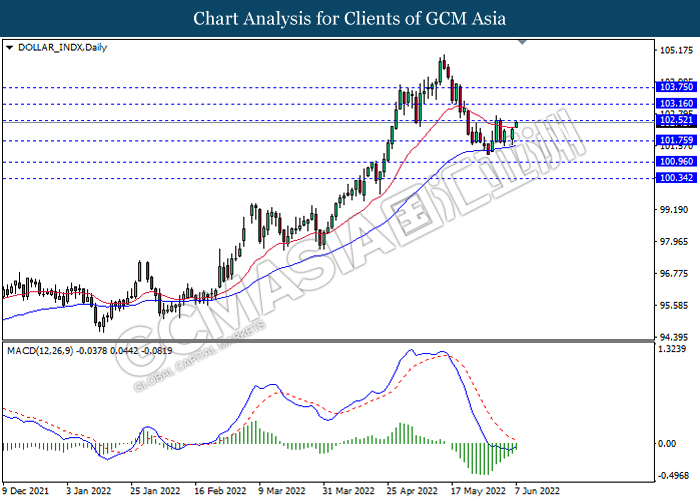

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

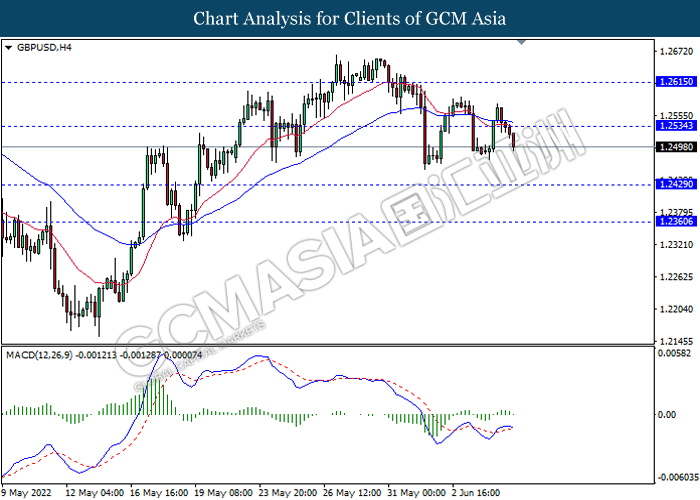

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0520

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 133.10, 134.25

Support level: 131.95, 130.95

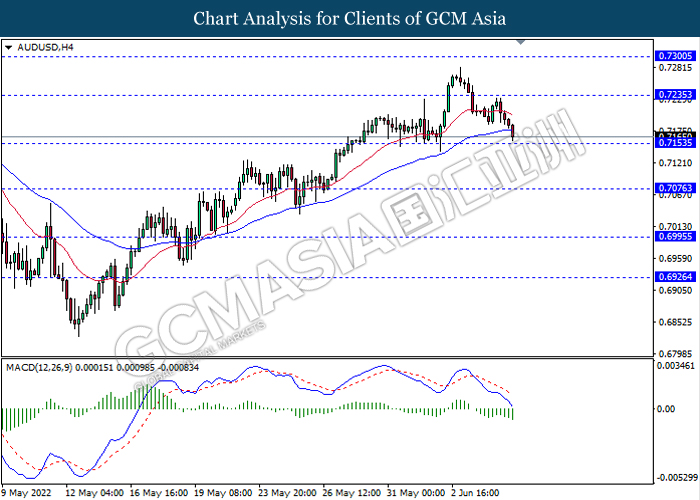

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

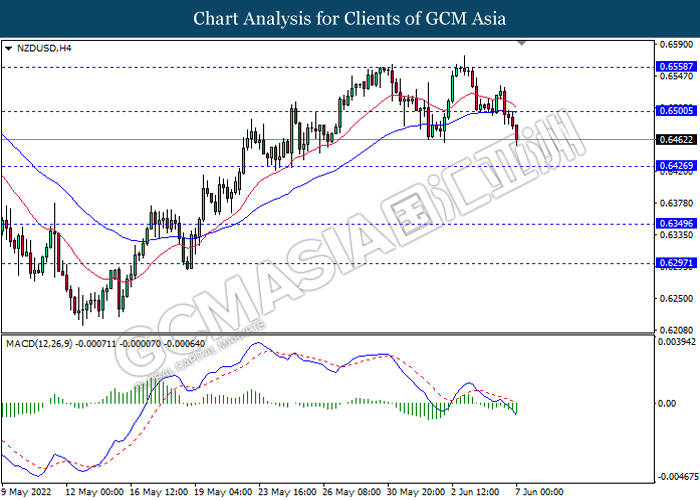

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6500, 0.6560

Support level: 0.6425, 0.6350

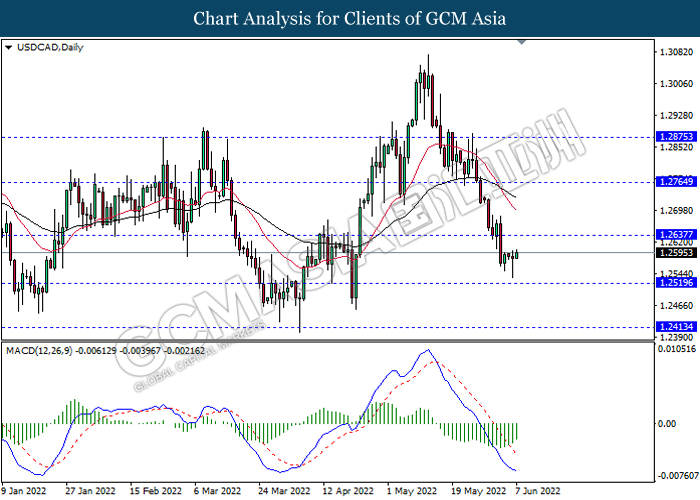

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

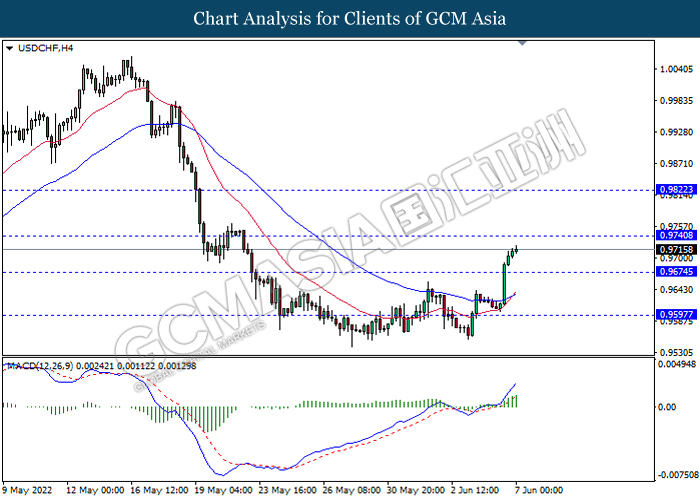

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 122.00, 125.85

Support level: 119.00, 115.95

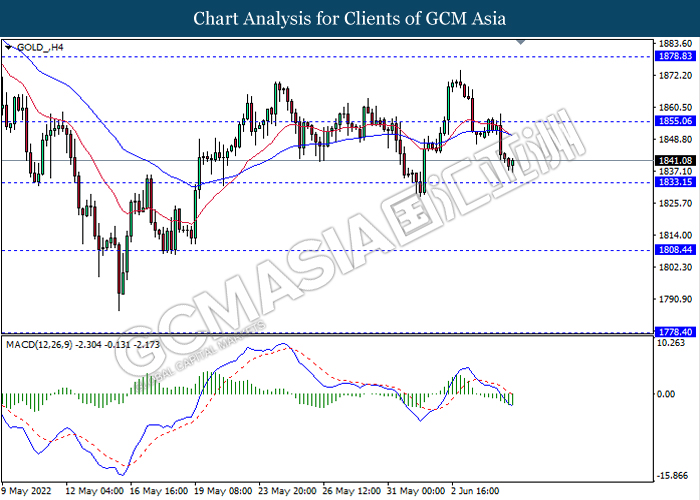

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45