7 June 2022 Morning Session Analysis

US Dollar seesawed ahead of crucial monetary policy event and CPI data.

The Dollar Index which traded against a basket of six major currencies was still trading within a range amid mixed economic data on last Friday while investors continue to eye on the latest Federal Reserve’s monetary policy announcement to receive trading signal. On the economic data front, the Bureau of Labor Statistics announced that the US Nonfarm Payrolls came in at 390K, exceeding the market forecast at 325K while adding odds for the Federal Reserve to implement contractionary monetary policy to stabilize the inflation rate. Meanwhile, the unemployment rate came in at 3.6%, missing the economist forecast at 3.5%. On the other hand, US ISM Non-Manufacturing Purchasing Managers Index (PMI) notched down significantly from the previous reading of 57.1 to 55.9, missing the market forecast at 56.4. As for now, investors would continue to scrutinize the US consumer price index (CPI) data which would be released on Friday for more clues about the monetary policies. The Dollar Index appreciated by 0.23% to 102.41 as of writing.

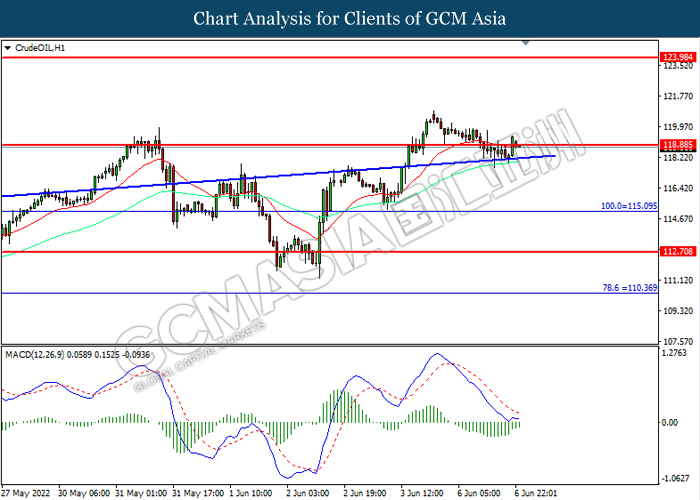

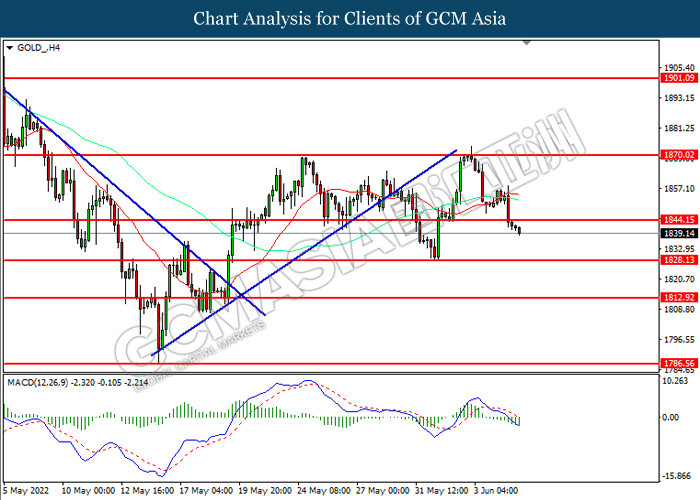

In the commodities market, the crude oil price depreciated by 0.46% to $118.70 per barrel as of writing following the Organization of the Petroleum Exporting Countries and allies (OPEC+) boost output for July and August by 648,000 barrel per day, 50% higher than previously planned. On the other hand, the gold price slumped 0.03% to $1841.00 per troy ounces as of writing amid rate hike expectation from Federal Reserve.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (May) | 51.8 | 51.8 | – |

| 16:30 | GBP – Services PMI (May) | 51.8 | 51.8 | – |

| 22:00 | CAD – Ivey PMI (May) | 66.3 | – | – |

Technical Analysis

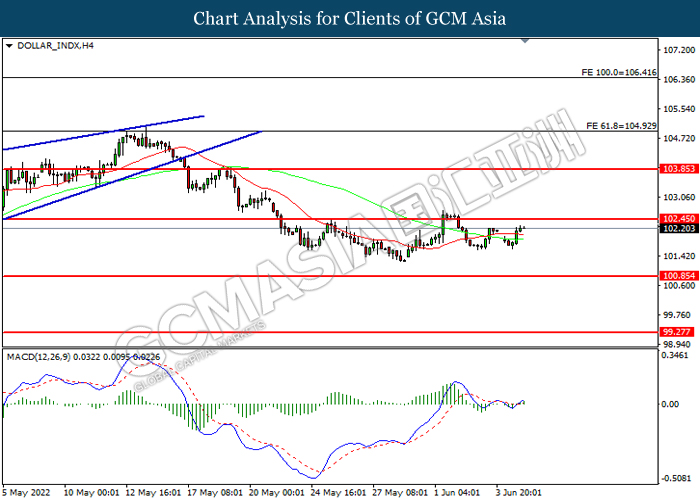

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

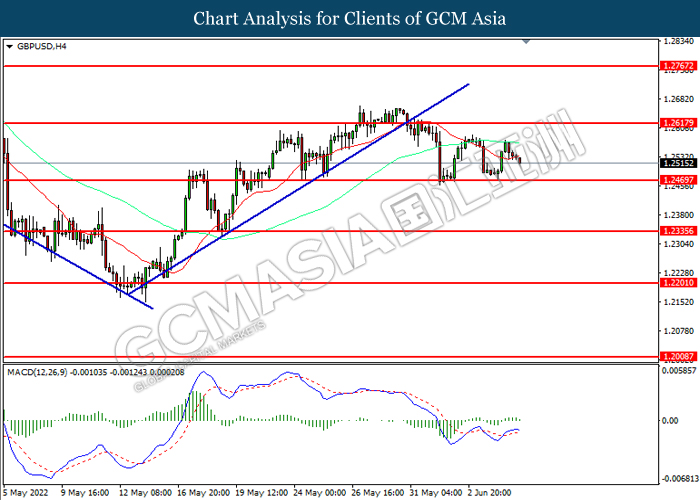

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2620, 1.2765

Support level: 1.2670, 1.2335

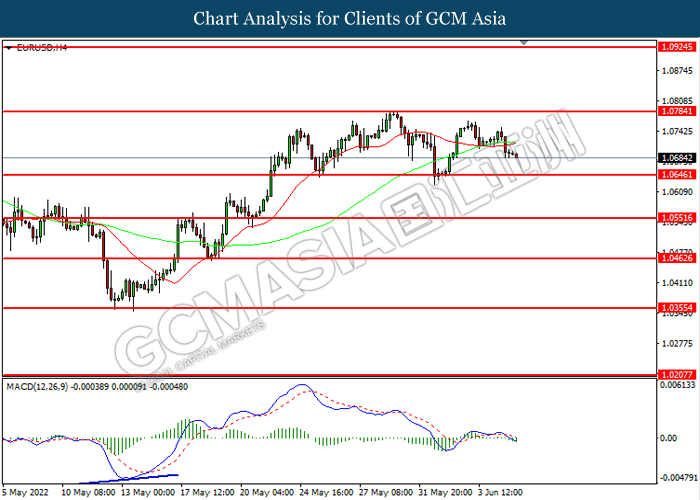

EURUSD, H4: EURUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0785, 1.0925

Support level: 1.0645, 1.0550

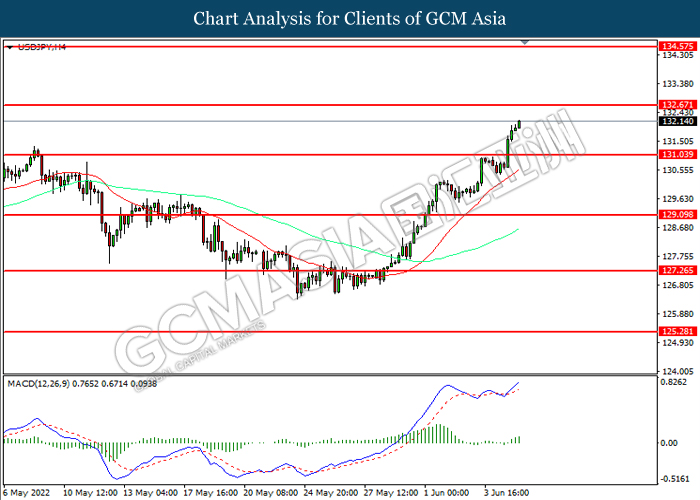

USDJPY, H4: USDJPY was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 132.65, 134.55

Support level: 131.05, 129.10

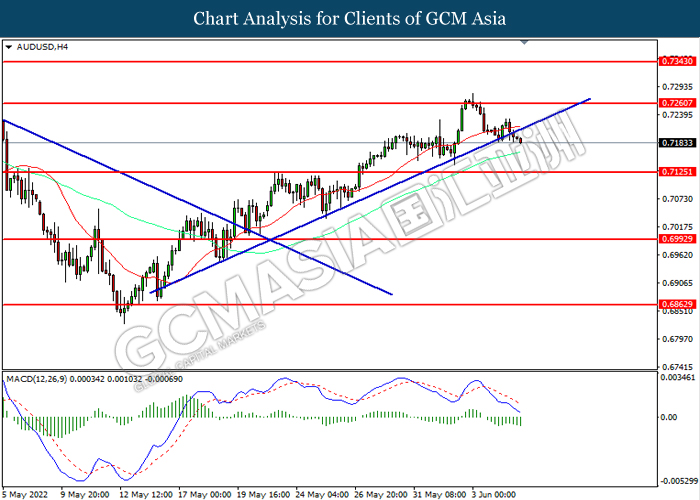

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7260, 0.7345

Support level: 0.7115, 0.6995

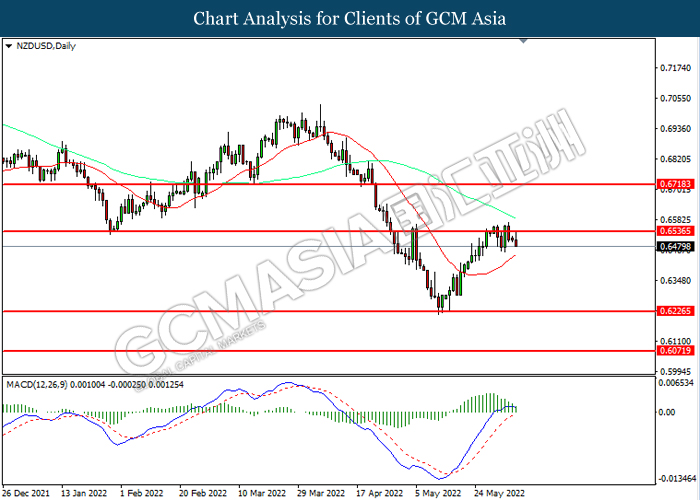

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

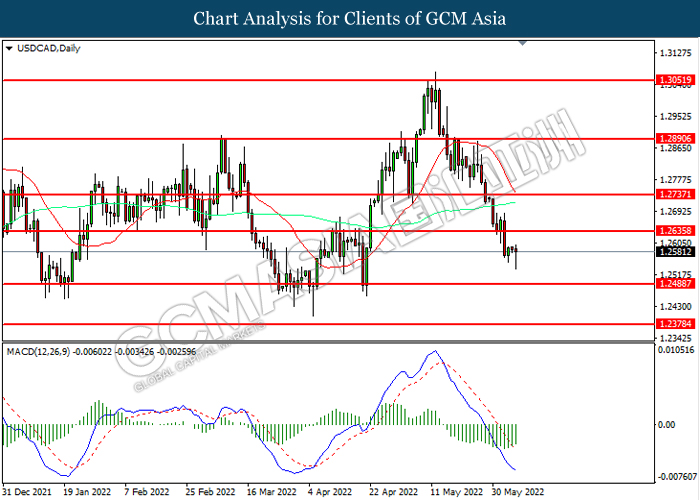

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2735

Support level: 1.2490, 1.2380

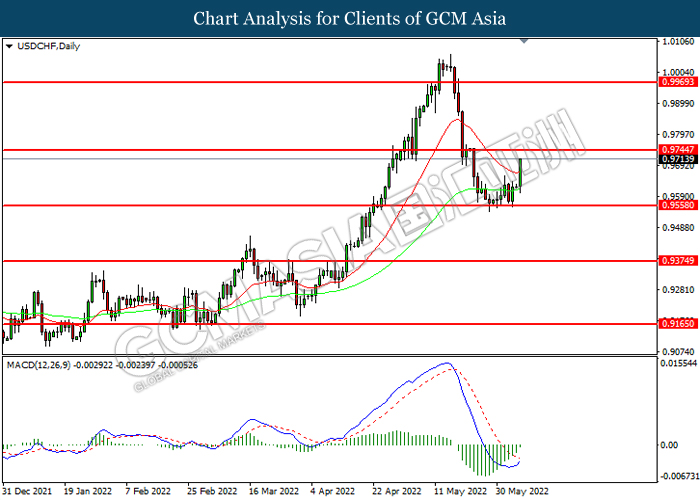

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9745, 0.9970

Support level: 0.9590, 0.9375

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 118.90, 124.00

Support level: 115.10, 112.70

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1844.15, 1870.00

Support level: 1828.15, 1812.90