07 June 2023 Afternoon Session Analysis

AUDUSD soars on RBA rate hike quarter basis points.

The pair of the Australian dollar against the dollar index, extended its gains to its one-week highest after the Reserve Bank of Australia (RBA) hiked interest rate by a quarter basis points to 4.10%. The central bank remarked the risk of ongoing high inflation contributes to both prices and wages rising, given the limited spare capacity in the economy. Although inflation has passed its peak in Australia, it is still far from the RBA’s 2-3% target range. Meanwhile, the labor market remains in tightening conditions as the unemployment rate was recorded at 3.7% in April, giving RBA space to hike the rate. Following the rate hike, RBA Governor Philip Lowe made the following hawkish comments early in the morning. Governor Lowe said there was evidence that higher interest rates were working and that inflation was falling, but that did not mean the board would tolerate higher inflation persisting. However, the gains of the pairs of AUD/USD were limited after the Gross Domestic Product (GDP) growth was less than market expectations. GDP in the first three months rose to 0.2%, weaker than the prior month’s reading of 0.6%, as well as market estimates of 0.8%. The weak reading was driven by a slowdown in household spending as higher interest rates environment consumer tightened their purse. As of writing, the pair of AUDUSD edged up by 0.065 to 0.6675.

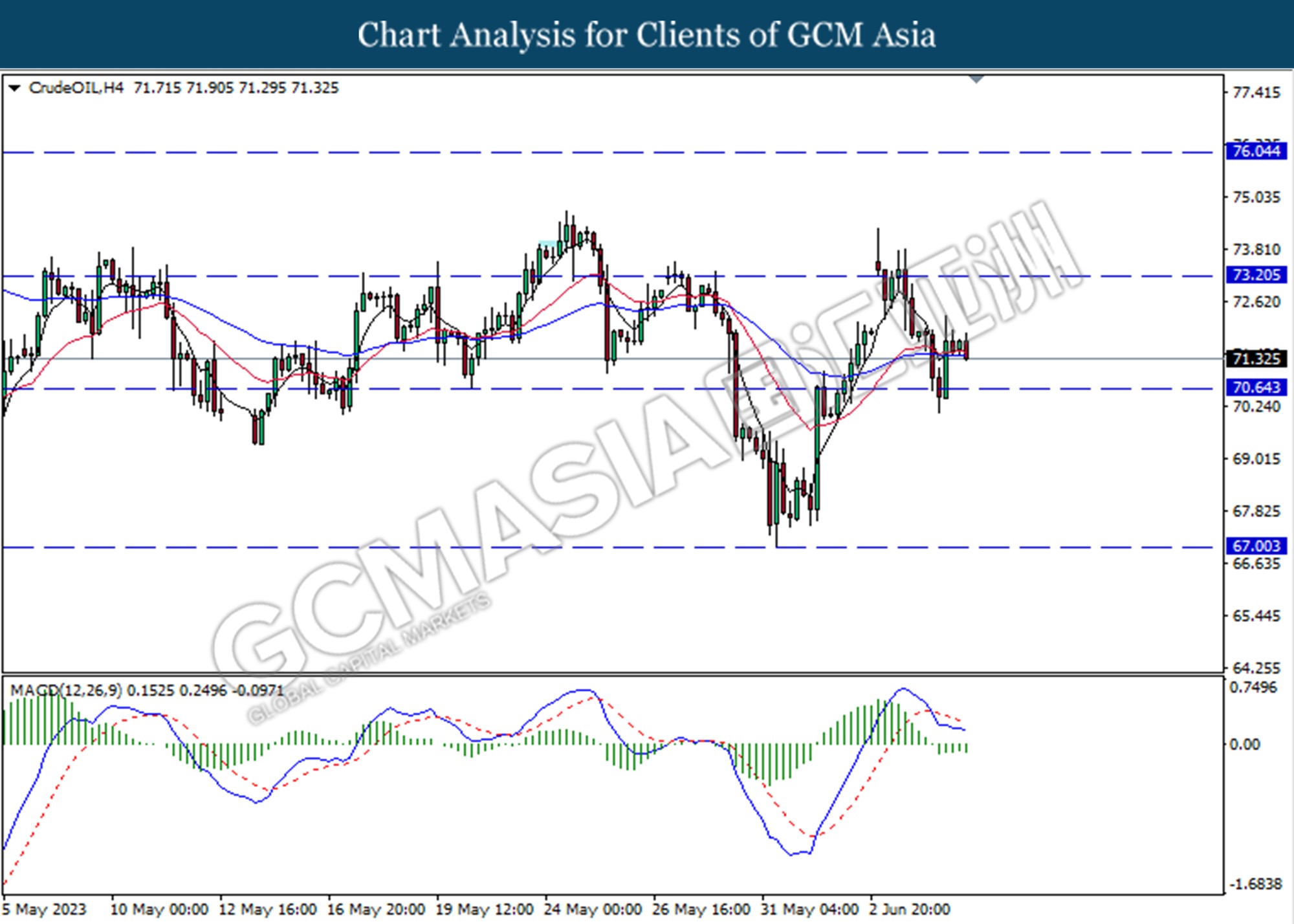

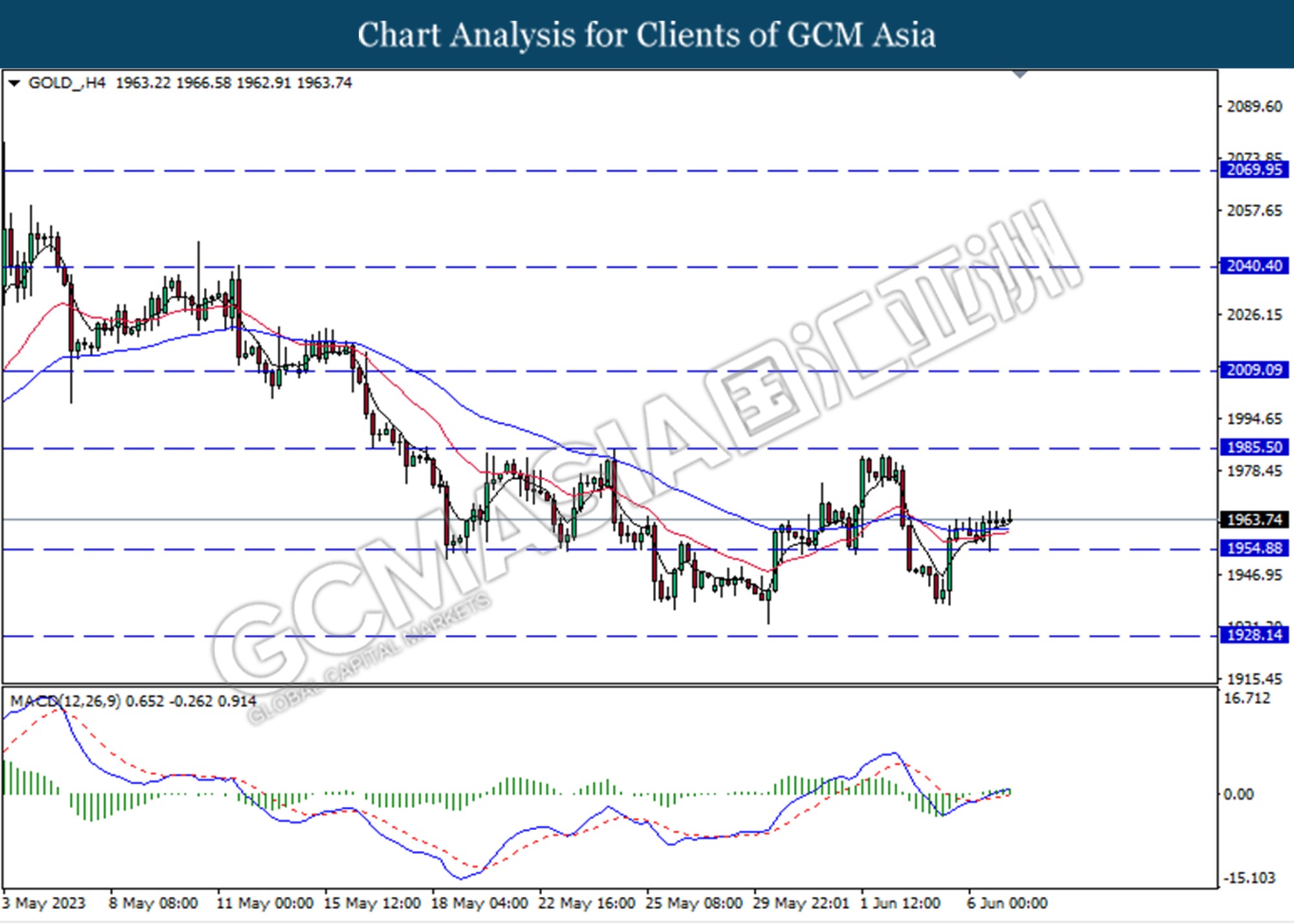

In the commodities market, crude oil prices ticked down by -0.36% to $71.48 per barrel after weak Chinese economic data was released. Besides, gold prices appreciated by 0.01% to $1963.41 per troy ounce amid Fed uncertainty on monetary policy.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.488M | 1.152M | – |

Technical Analysis

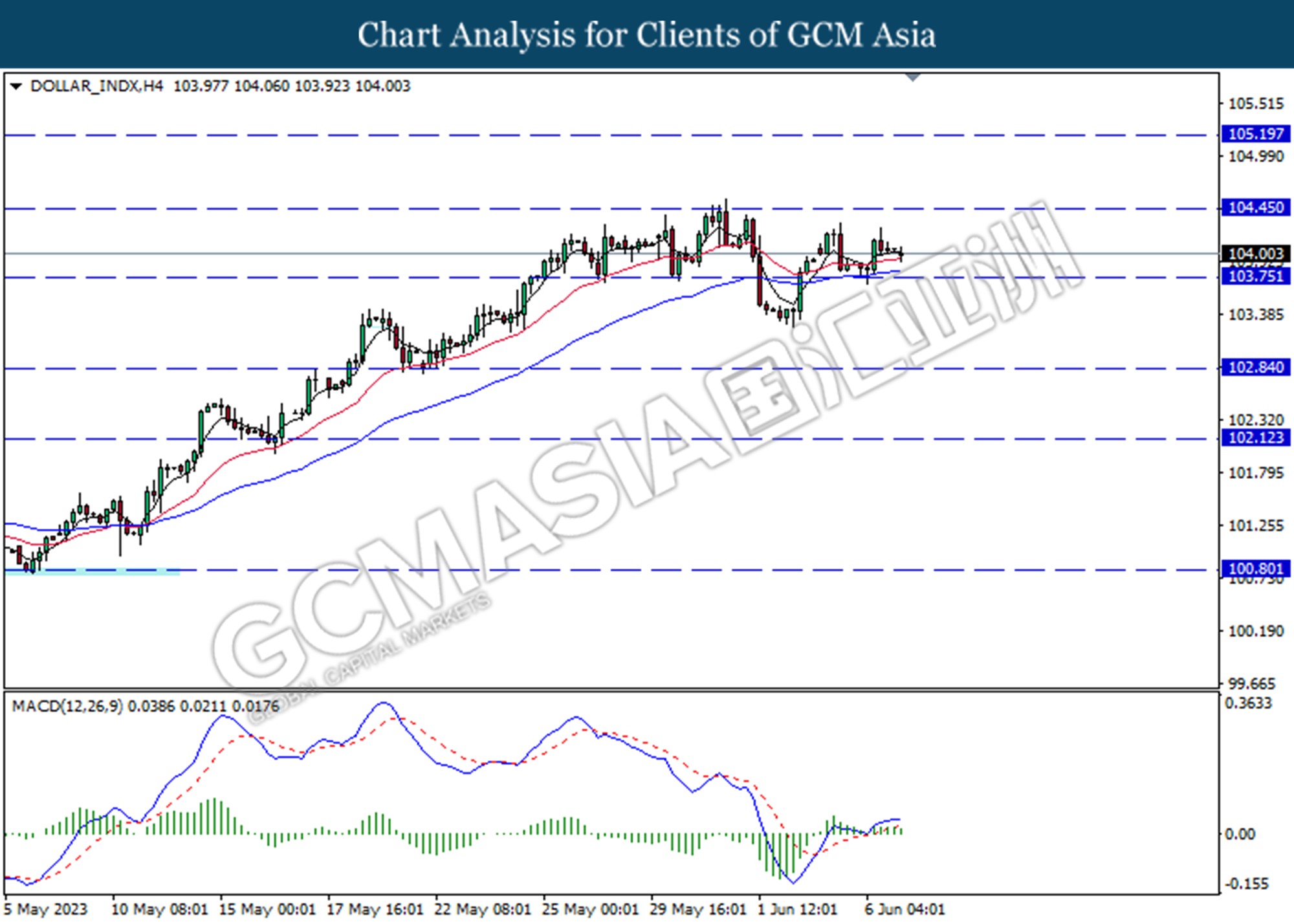

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

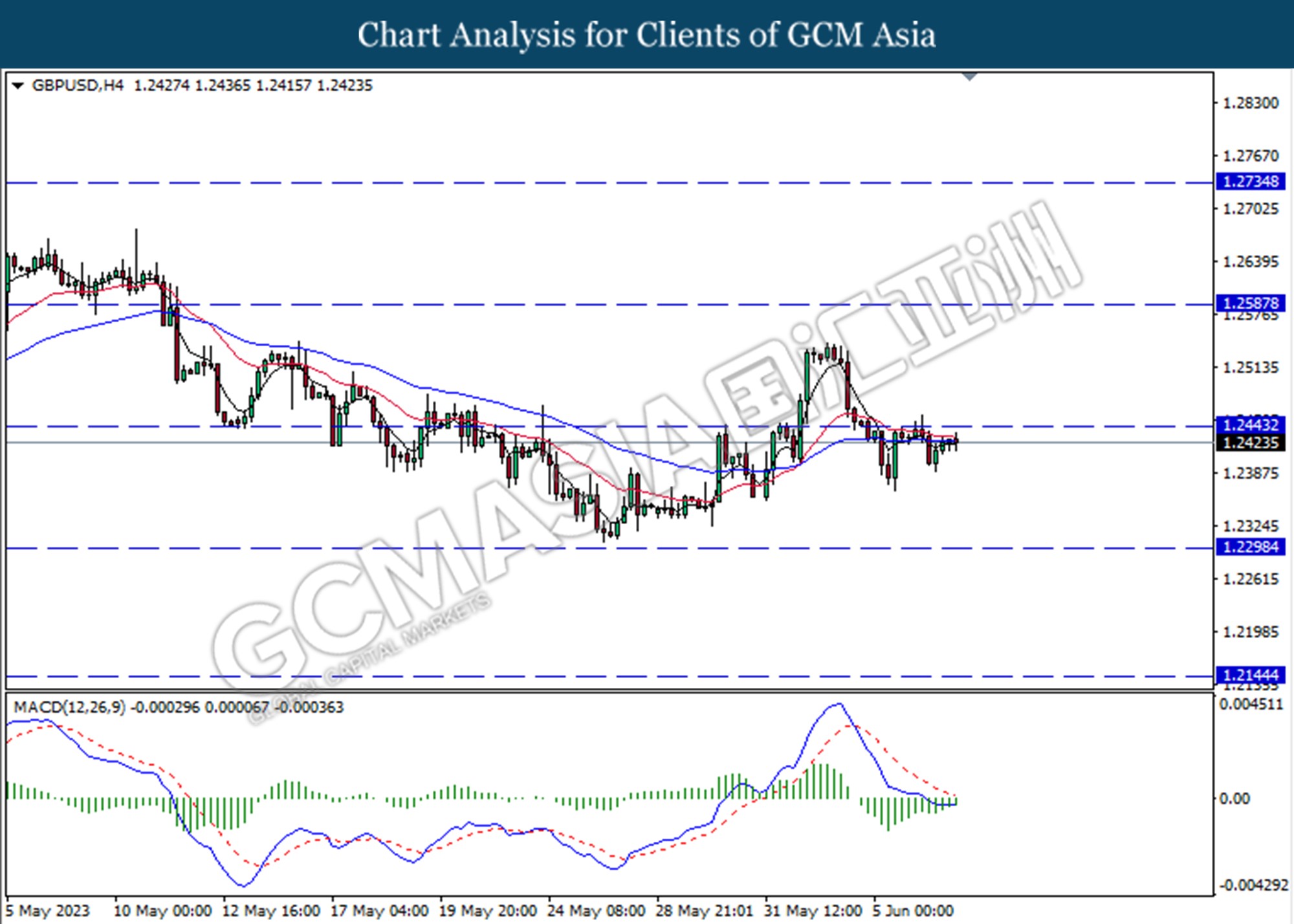

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 1.2445.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

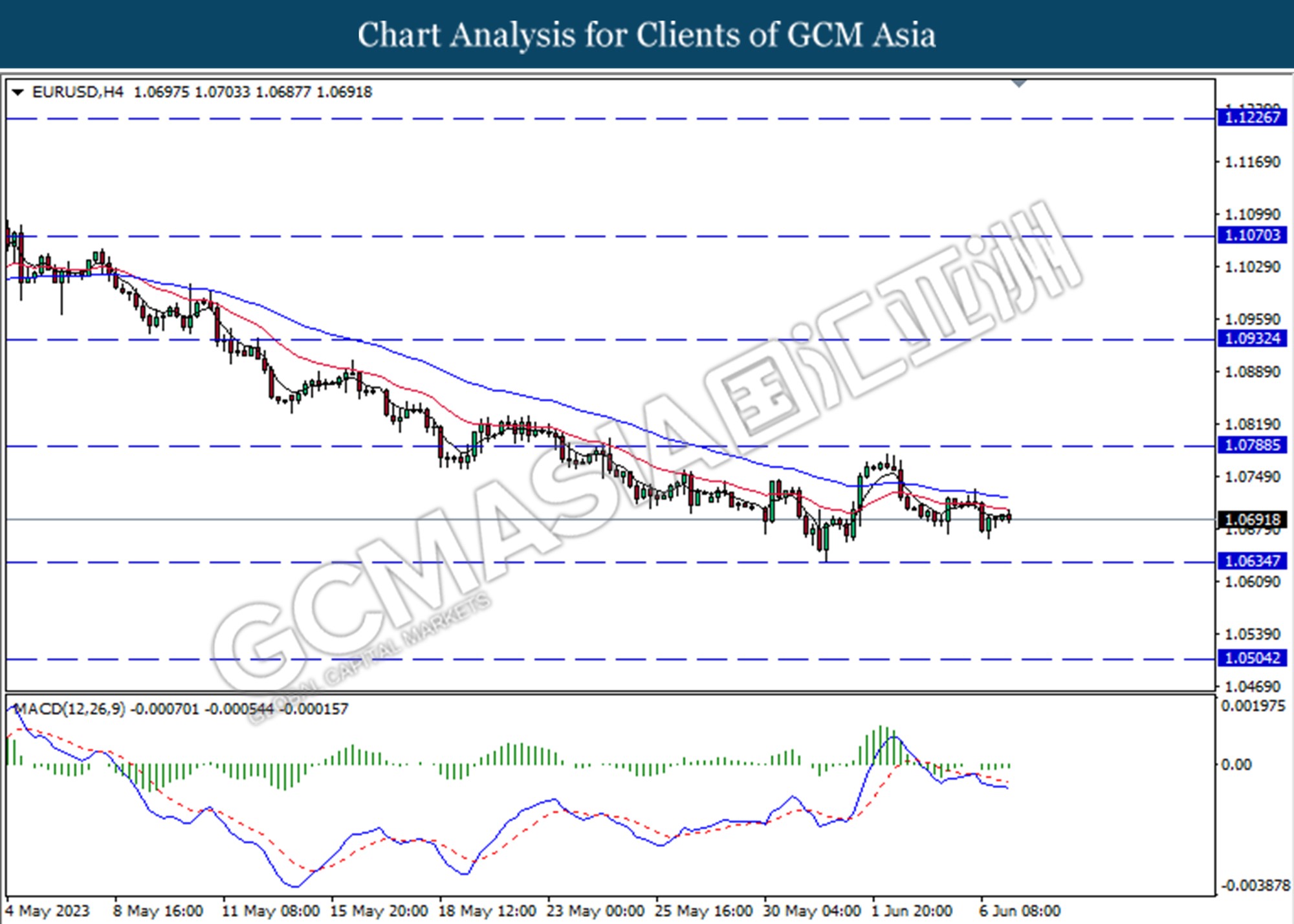

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

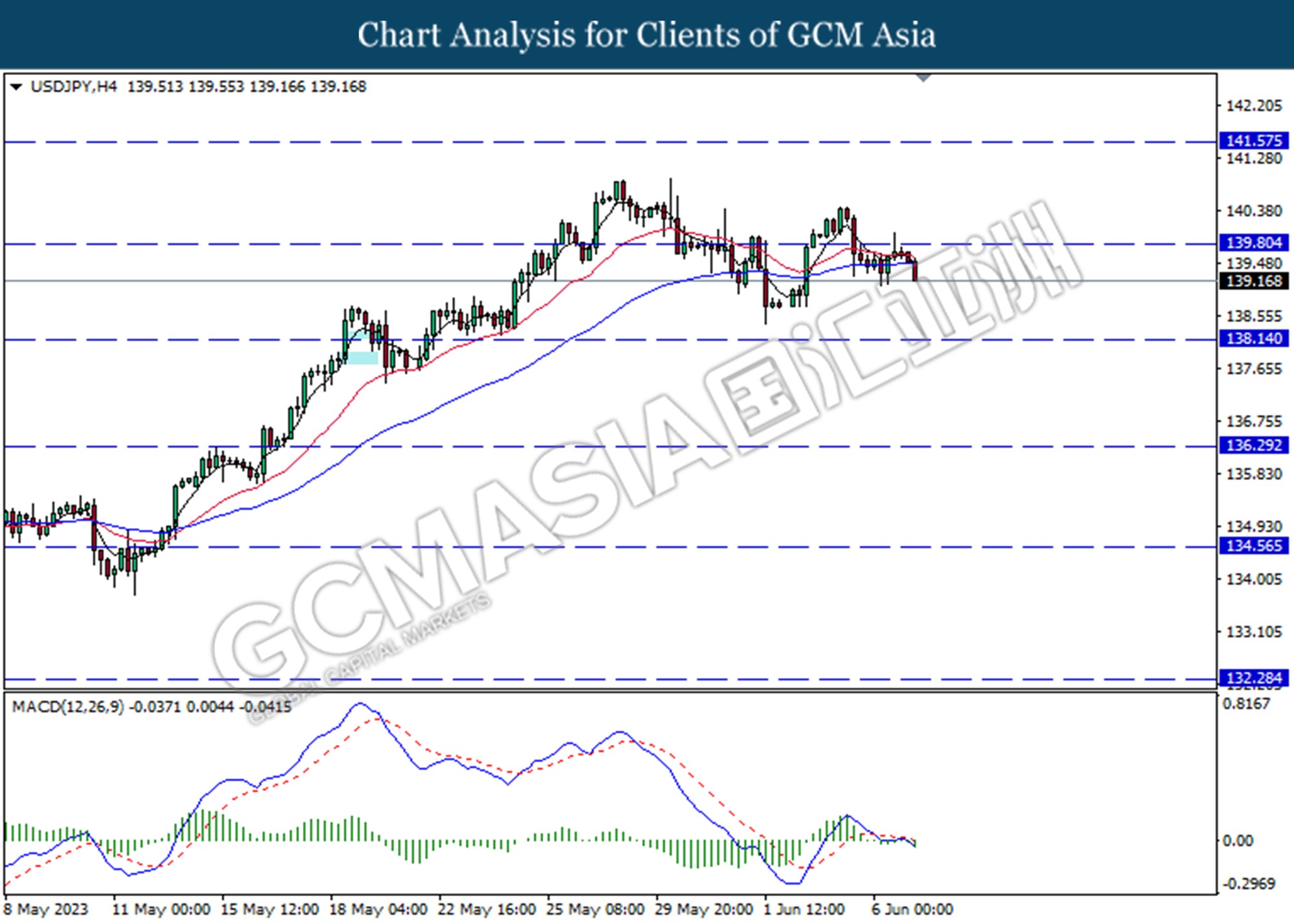

USDJPY, H4: USDJPY was traded lower following the prior retracement from the resistance level at 139.80. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

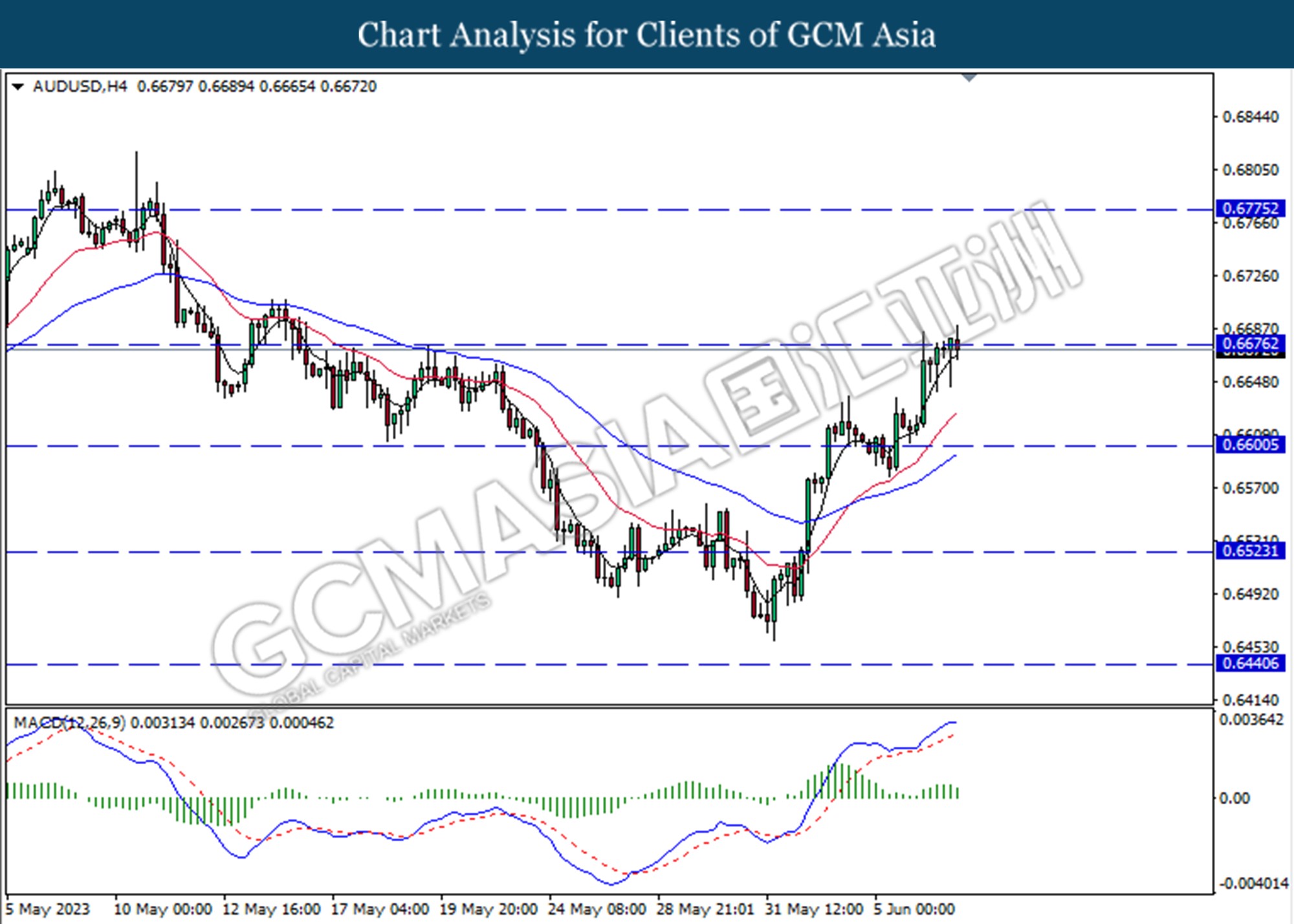

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below from the previous resistance level at 0.6675. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

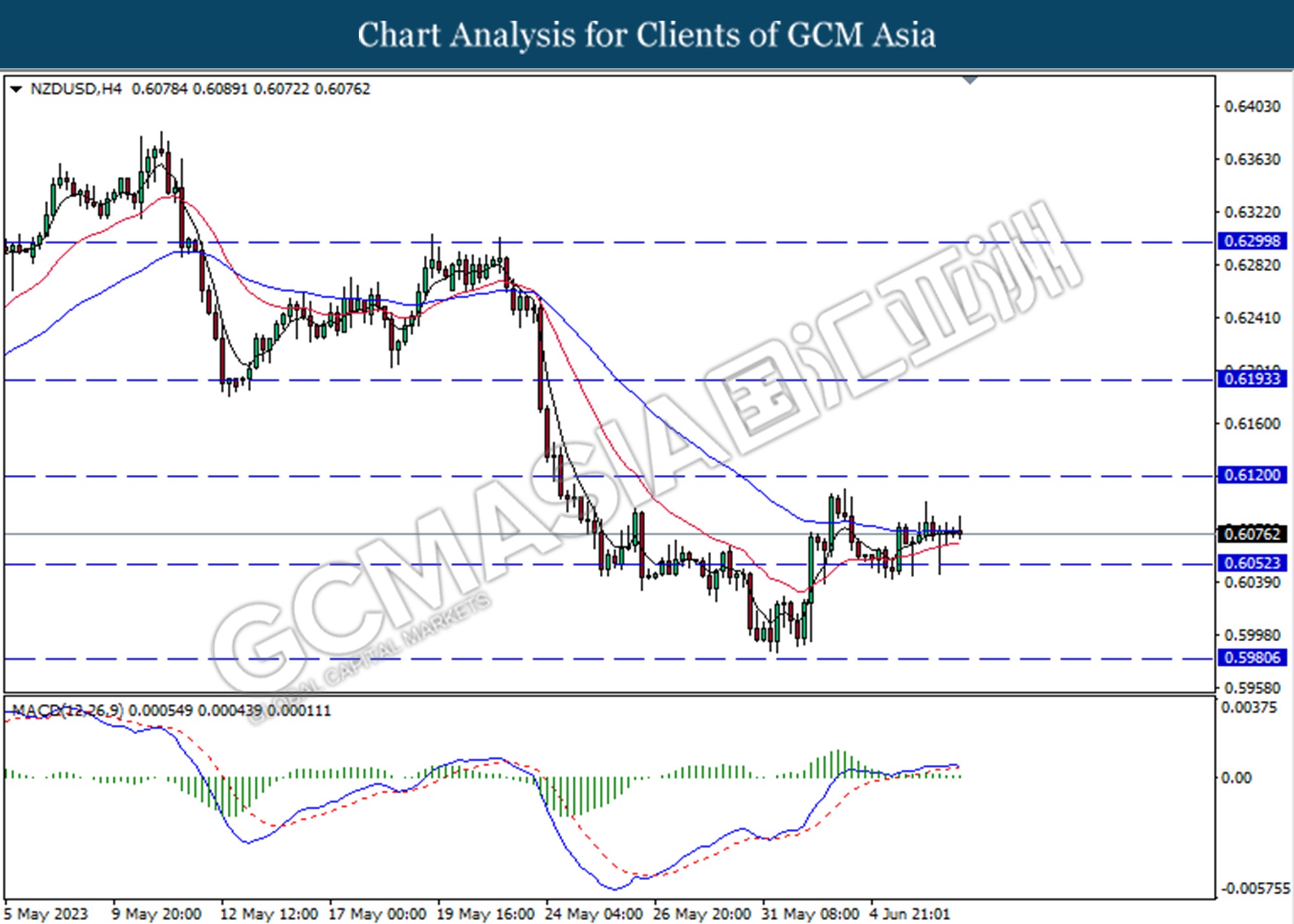

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6050. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6120.

Resistance level: 0.6120, 0.6190

Support level: 0.6050, 0.5980

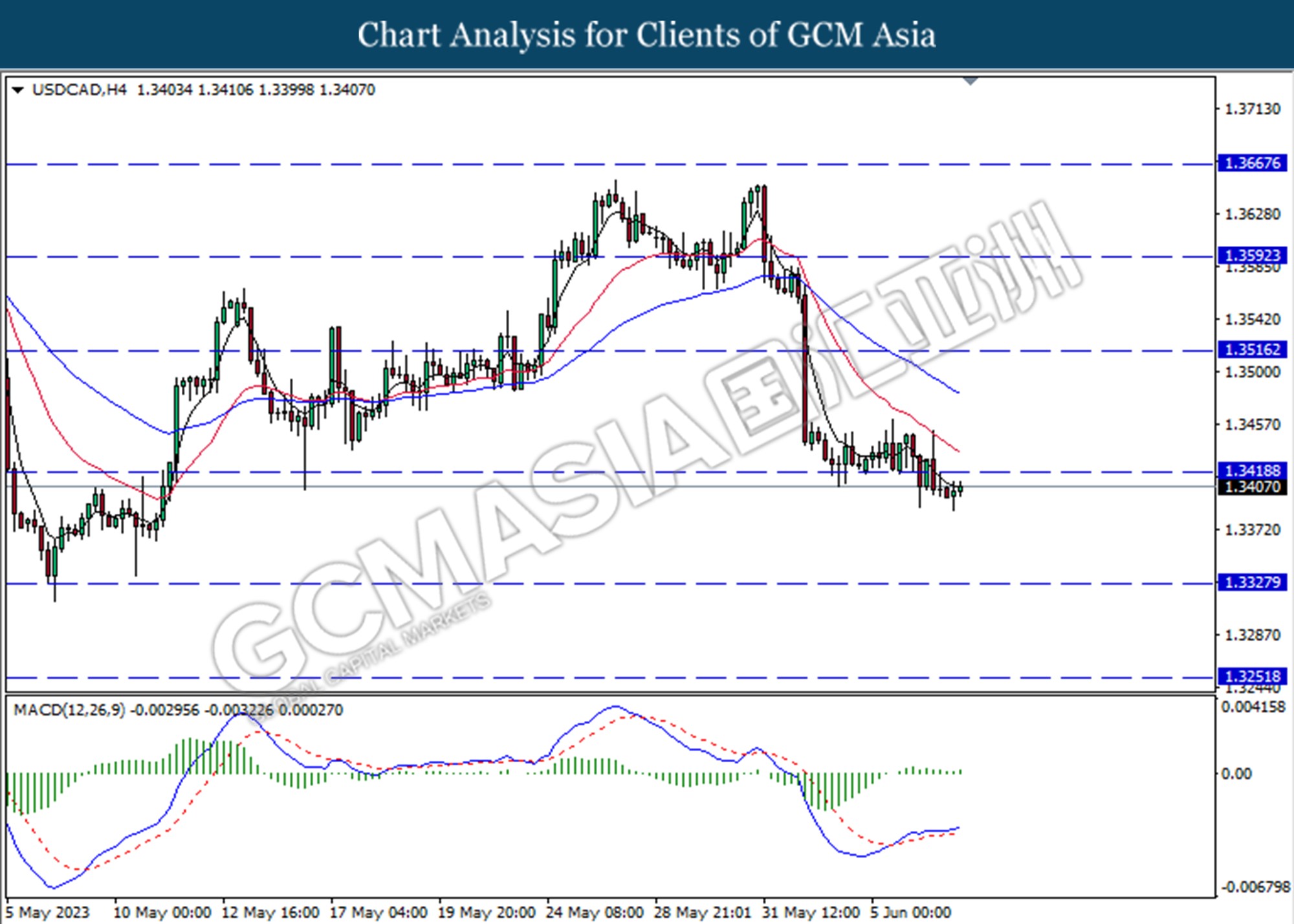

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its losses toward the resistance level at 1.3420

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

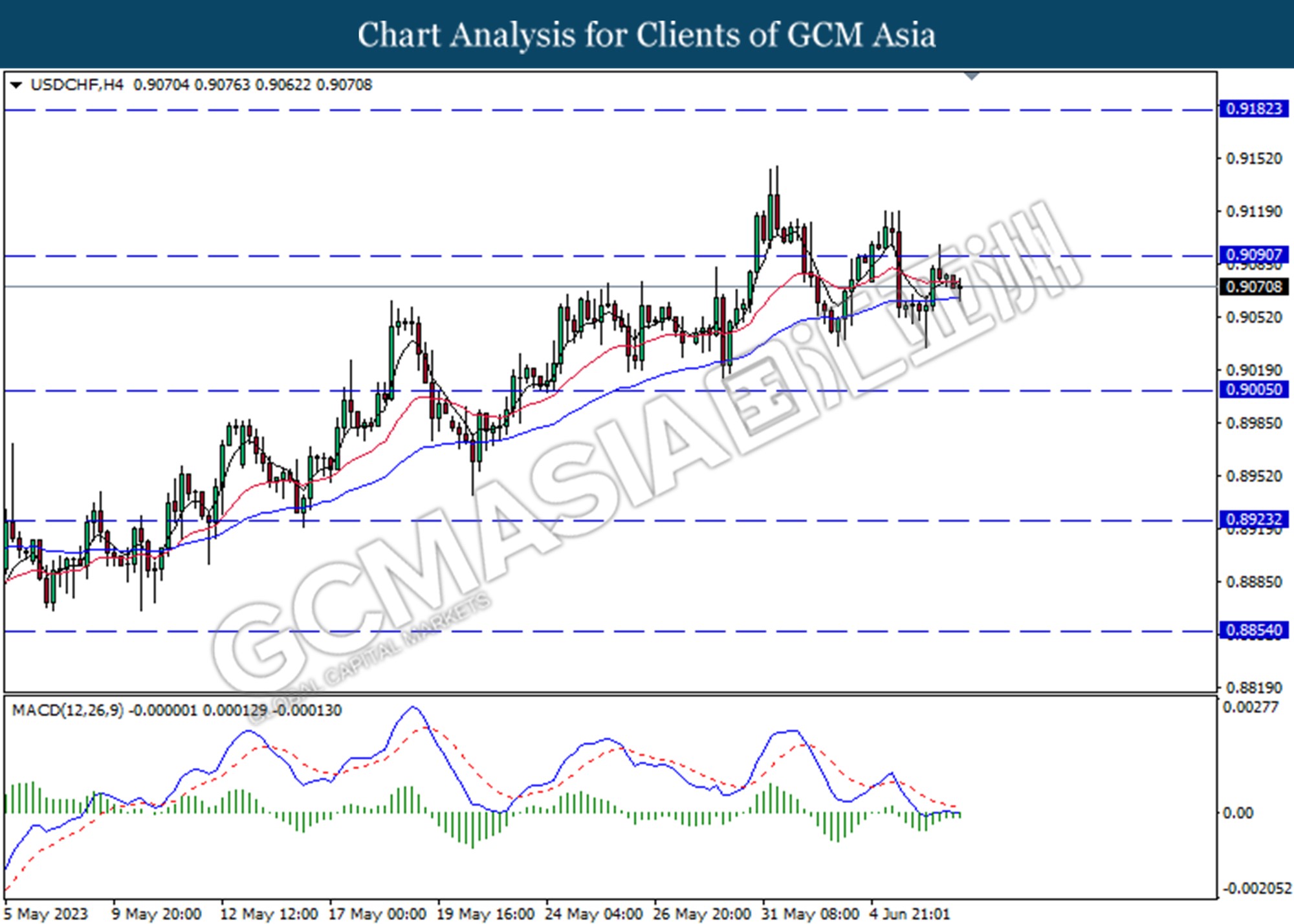

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1954.90. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15