07 June 2023 Morning Session Analysis

Greenback lingered amid Fed blackout and a light calendar.

The dollar index, which was traded against a basket of six major currencies, hovered near its recent high as the market was weighed by the uncertainty of rate hike in the upcoming meeting. At this point in time, the investors are still unsure about the future path of the Fed’s rate hike plan as there is a divergence among the Fed’s officials. Before the FOMC blackout period, some of the members had given their own outlook regarding the path of monetary policy over the past 2 weeks. Take an example, the Fed’s members such as Bostic and Jefferson were in the camp who would like to hold interest rates steady in the next meeting, while James Bullard aimed for more rate hikes in the coming meeting. Also, a series of positive economic data had provided a more than sufficient of room for Fed to increase the interest rate if necessary. With that, investors are blurred with the future path of the US monetary policy ahead of the monetary policy meeting and the major inflation data in next week. It is also noteworthy to mention that the Fed officials are in a blackout period, where no members are allowed to speak publicly between a week prior to the Saturday preceding a Federal Open Market Committee (FOMC) meeting and the Thursday following that meeting. As of writing, the dollar index dipped -0.02% to 104.15.

In the commodities market, crude oil prices edged down by -0.51% to $71.60 per barrel ahead of the major economic releases today, which includes the trade balances from China. Besides, gold prices were up by 0.02% to $1963.80 per troy ounce as the greenback ticked down.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 4.488M | 1.152M | – |

Technical Analysis

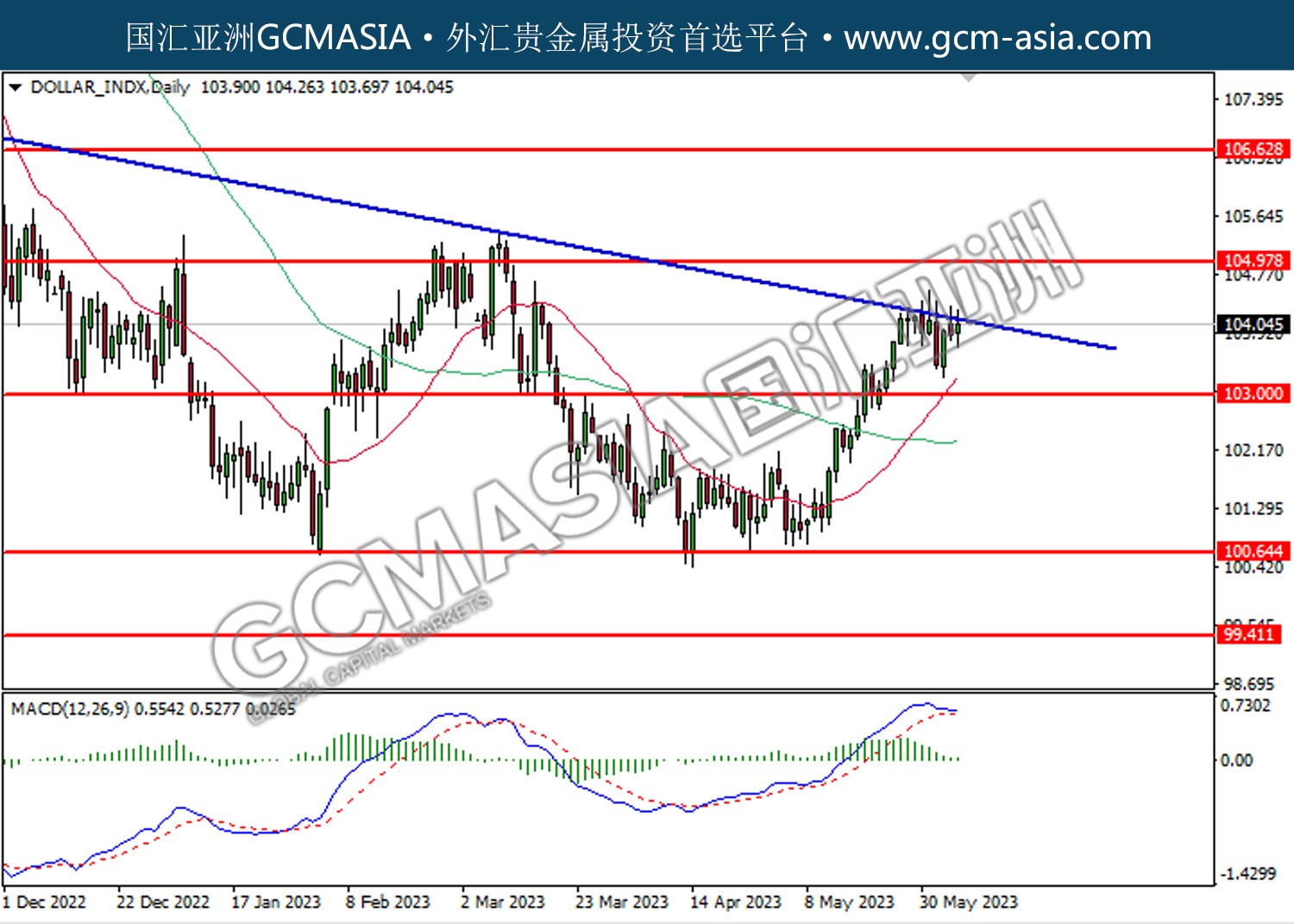

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

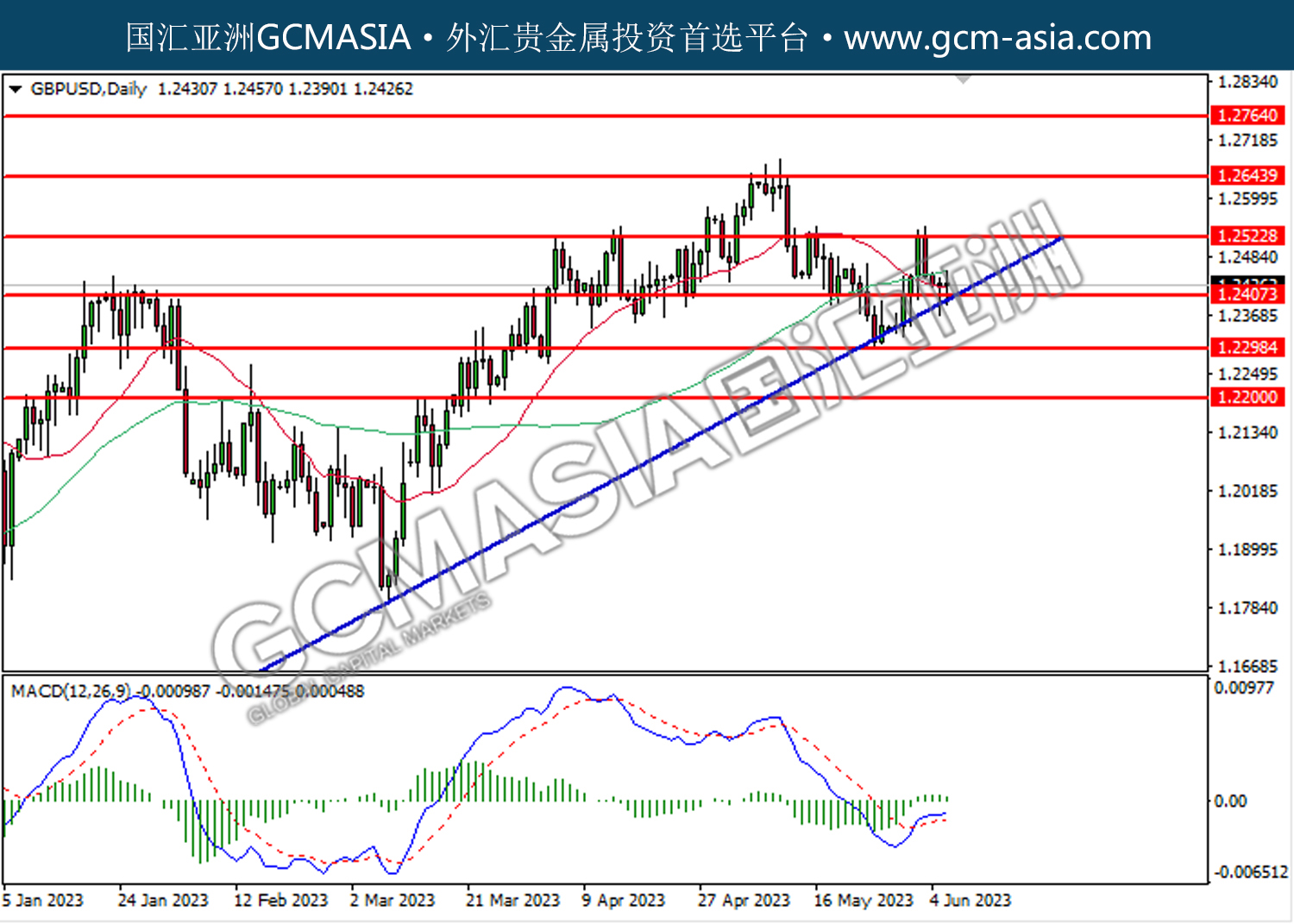

GBPUSD, Daily: GBPUSD was traded lower while currently testing support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

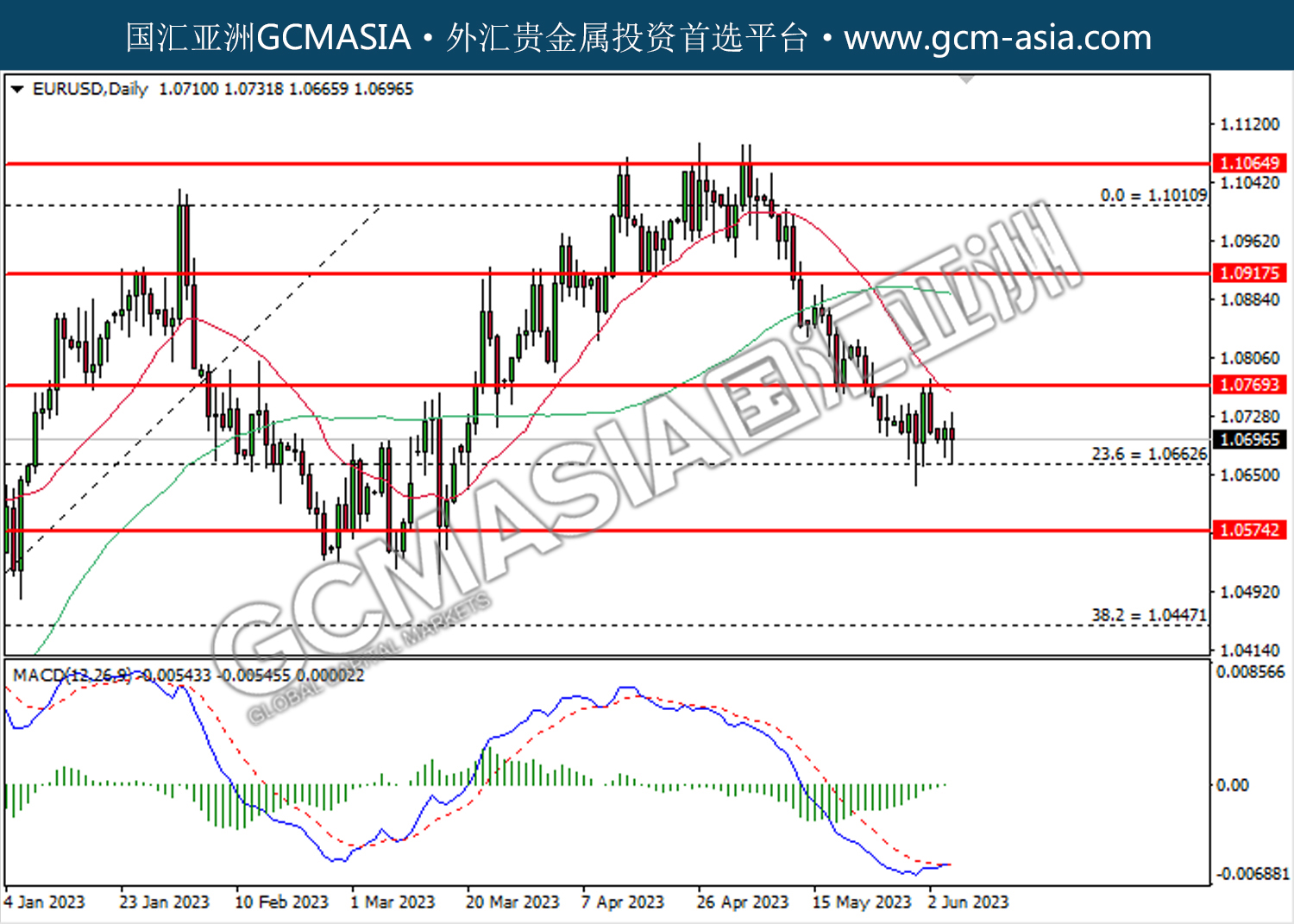

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

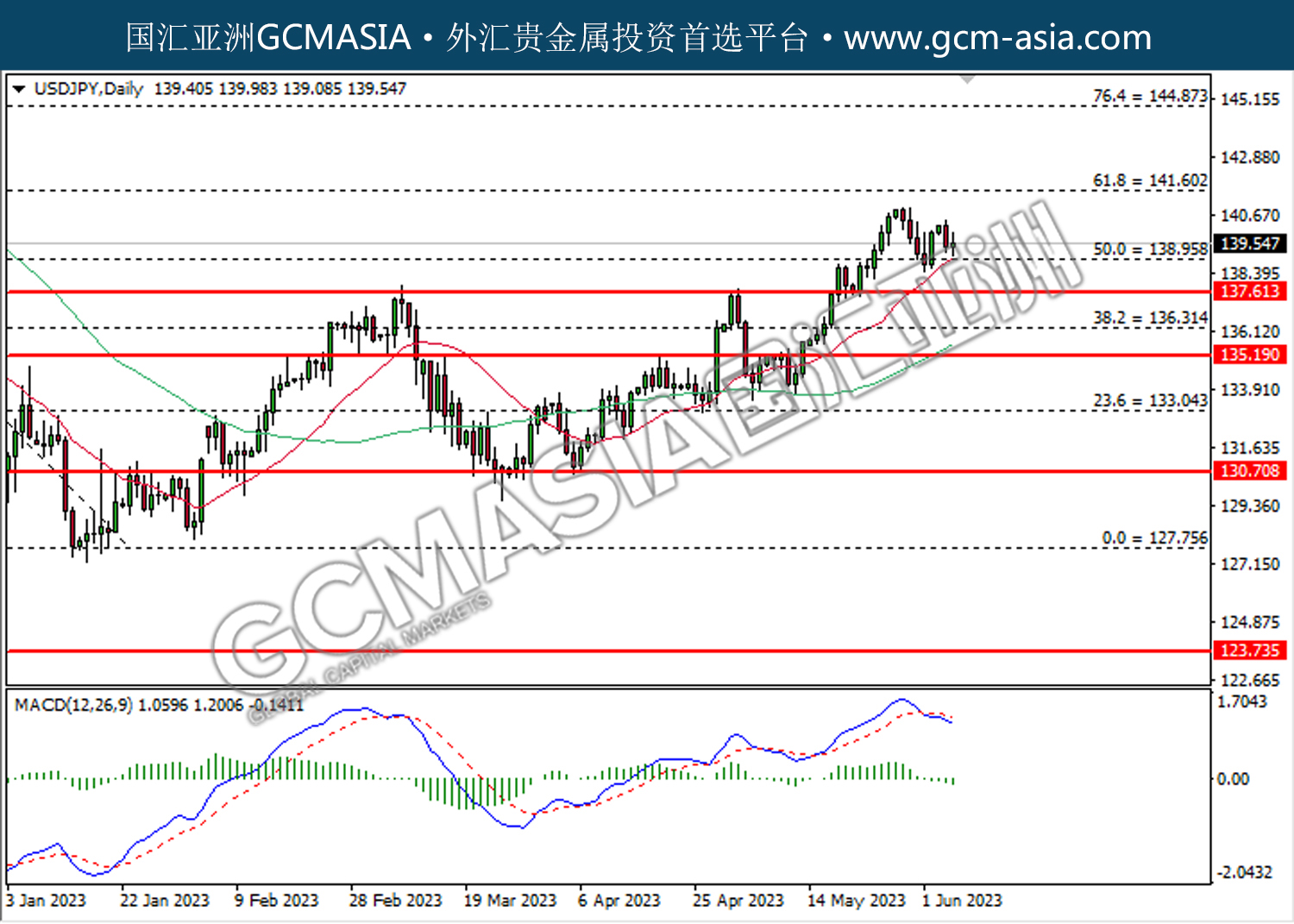

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

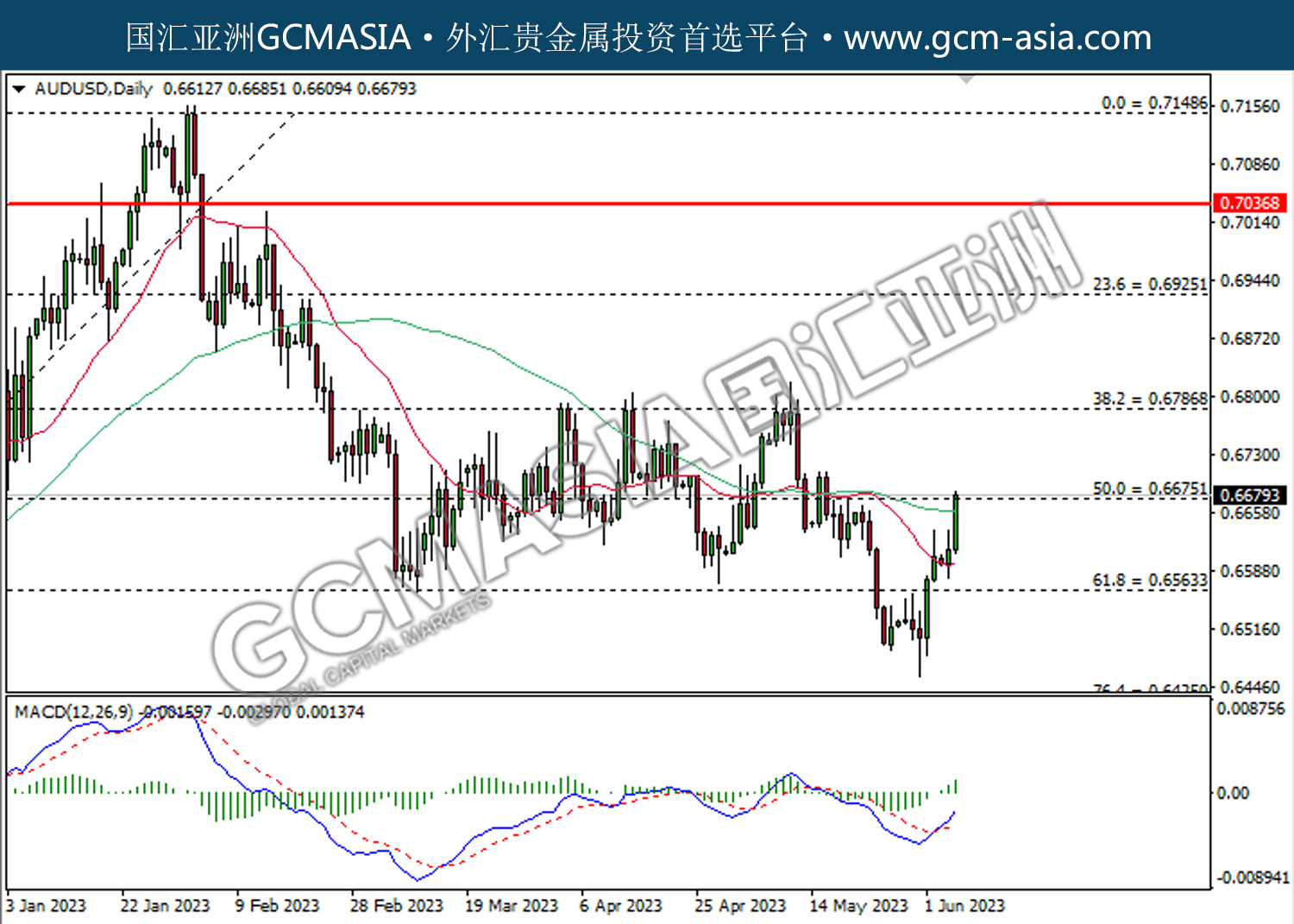

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

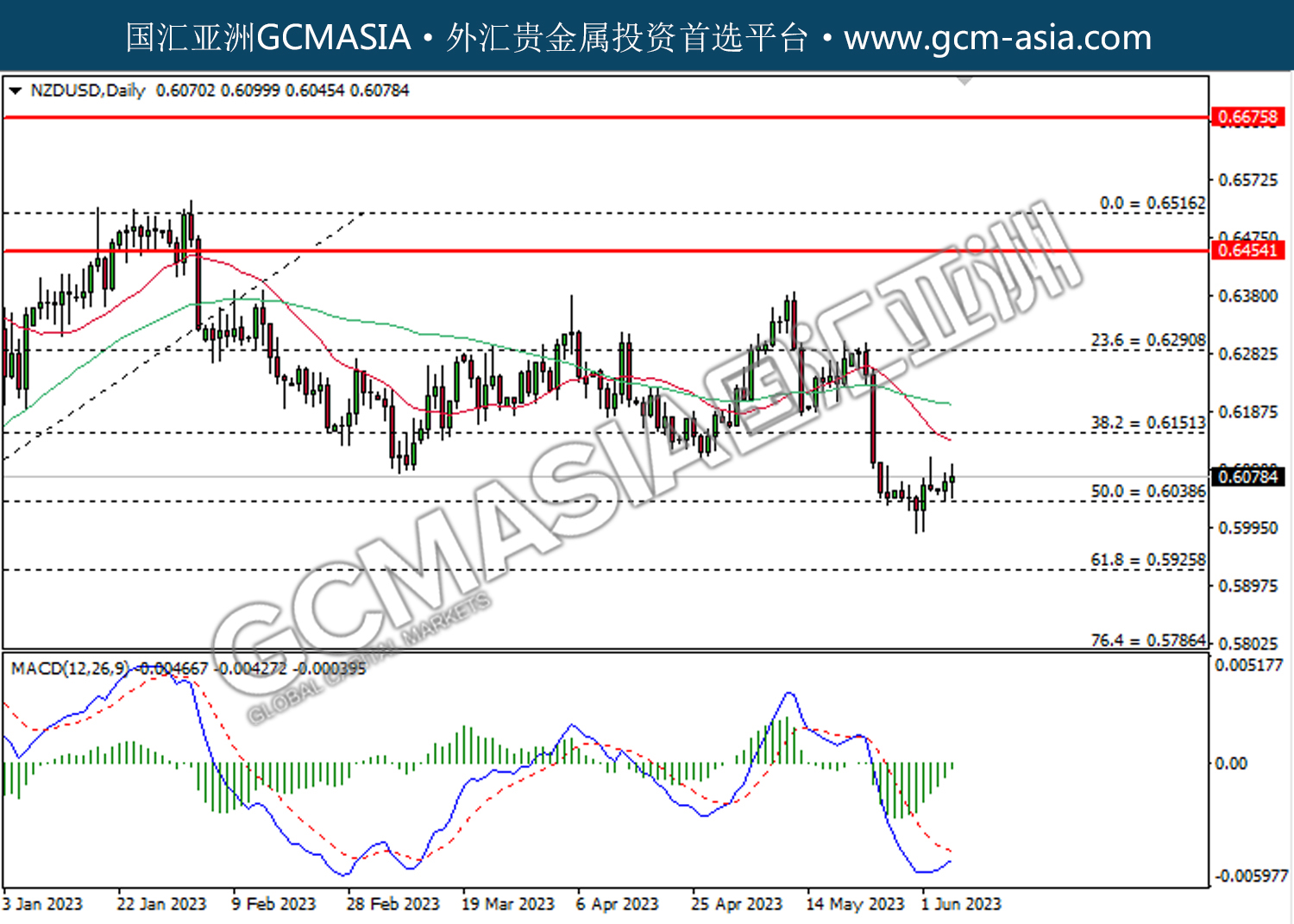

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

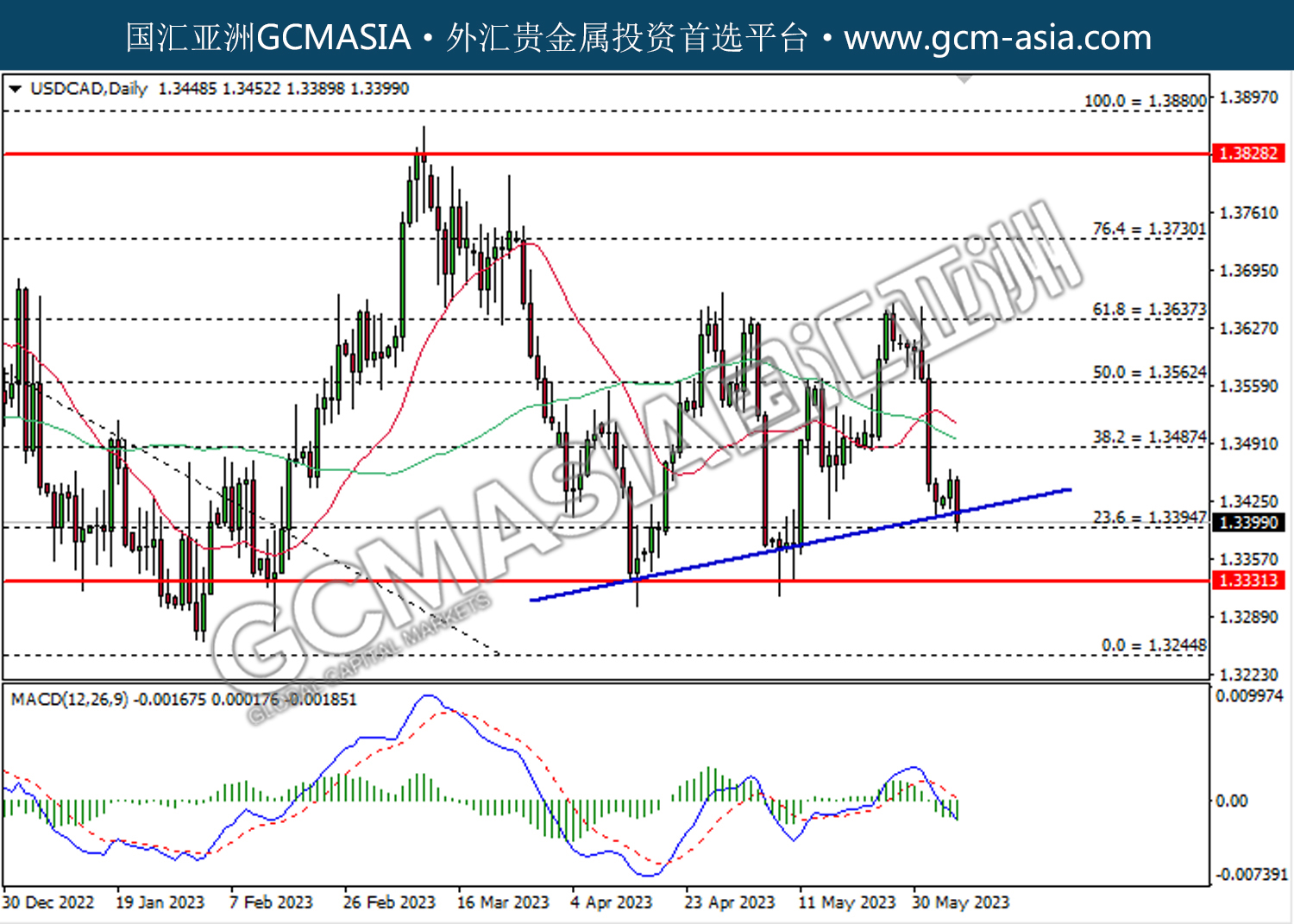

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3485, 1.3565

Support level: 1.3395, 1.3330

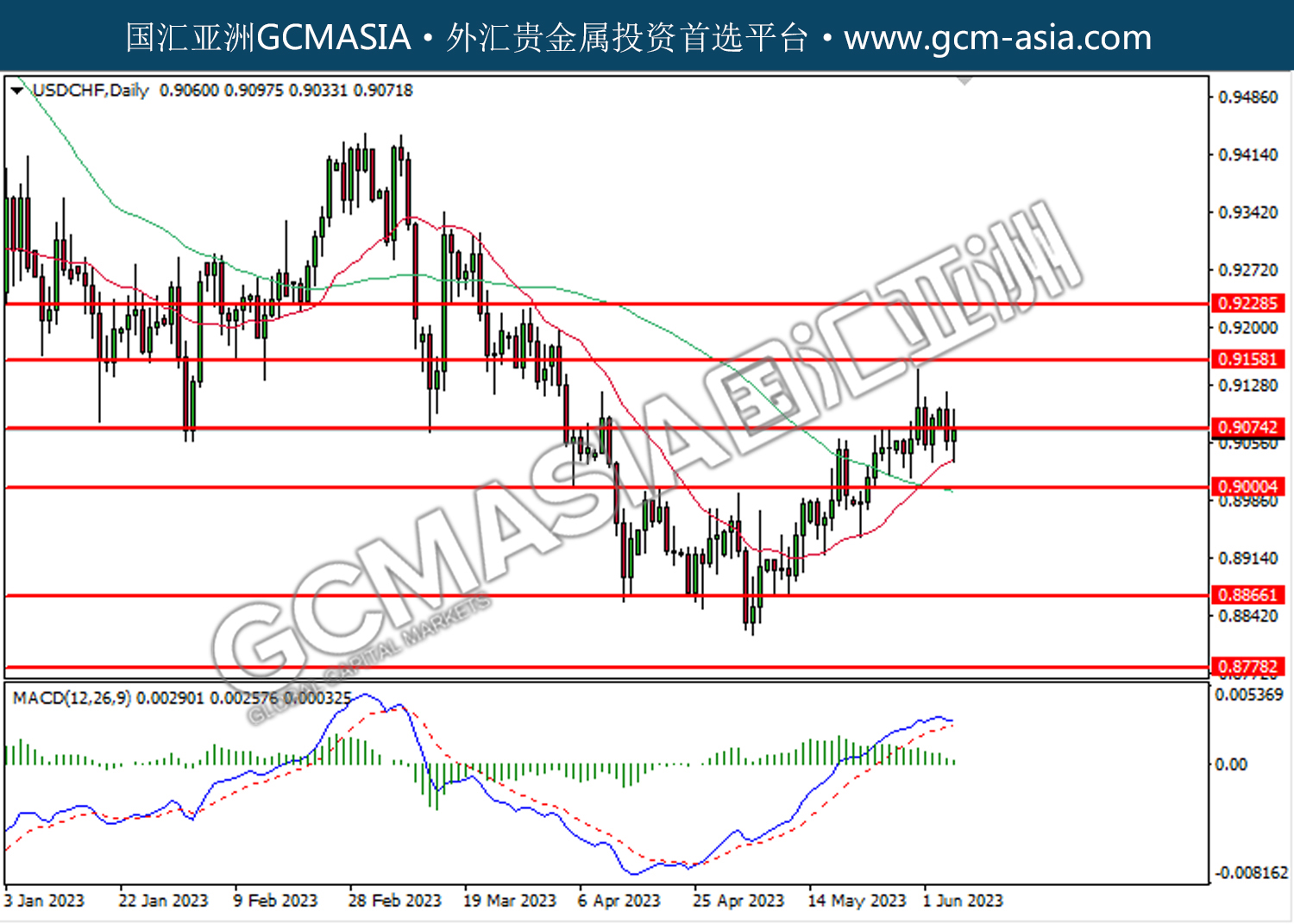

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

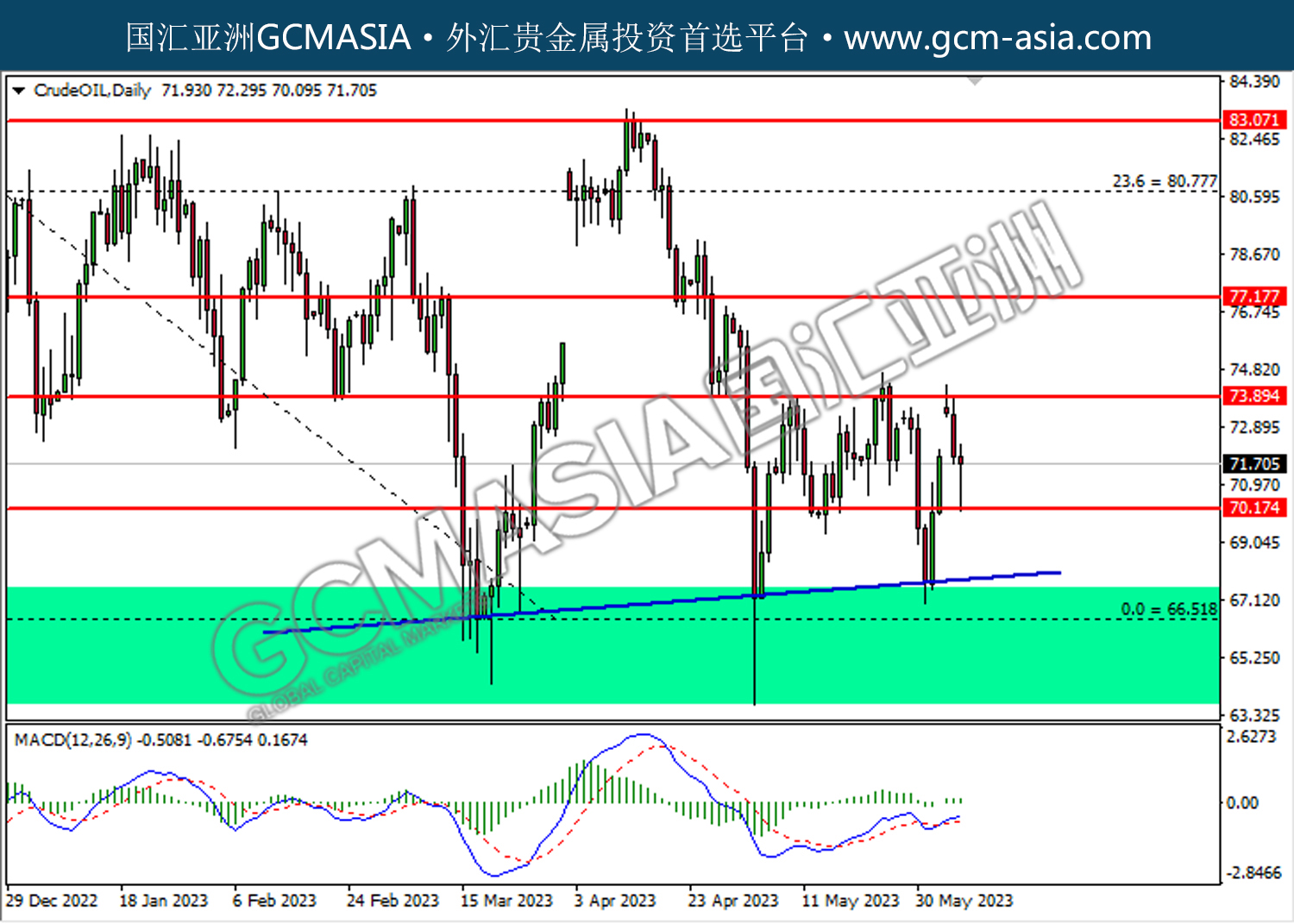

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 73.90. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

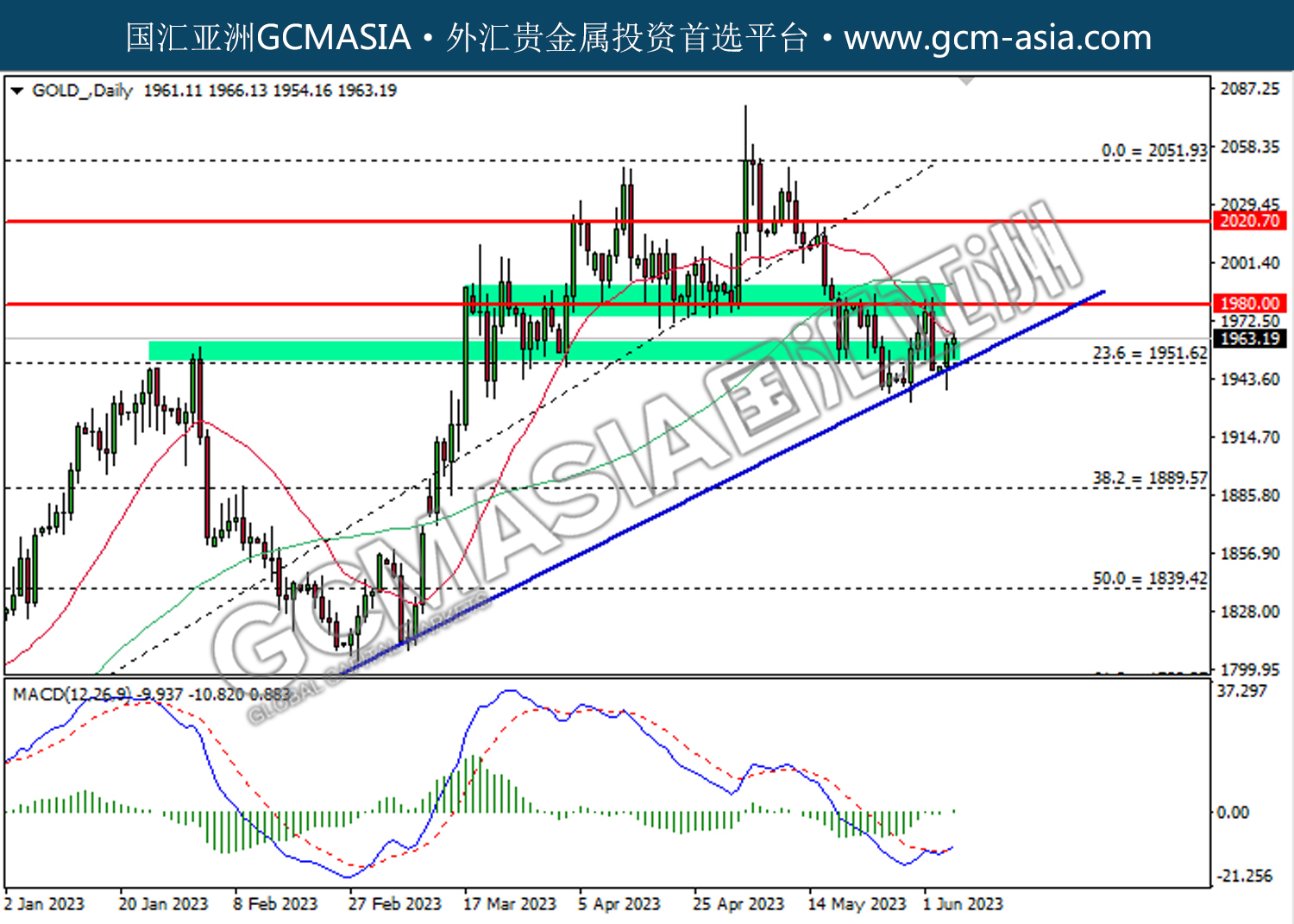

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55