07 July 2022 Afternoon Session Analysis

Euro slumped amid recession risk linger in market.

The Euro extends its losses significantly on yesterday following Germany posted its first foreign trade deficit in more than three decades, spurring further fears upon the recession risk in the financial market. According to the latest data, Germany posted a foreign trade deficit of 1 billion euros, its first monthly trade deficit since 1911. Earlier, its high level of exports had been a crucial economic booster in the Germany, such negative reading would likely to add further tensions for the economic momentum. Germany’s exports in May were still notched up by 11.7% compared to a year ago, according to the country’s statistics office, though 0.5% lower from the previous month. Though, the cost for the import went up by 27.8% from a year ago as rising commodities prices continue to trigger further cost for the country. Germany has been paying more for energy and food since the tensions between Russia-Ukraine intensified while the implementation of sanction continues to jeopardize the economic growth. As of writing, EUR/USD depreciated by 0.01% to 1.0200.

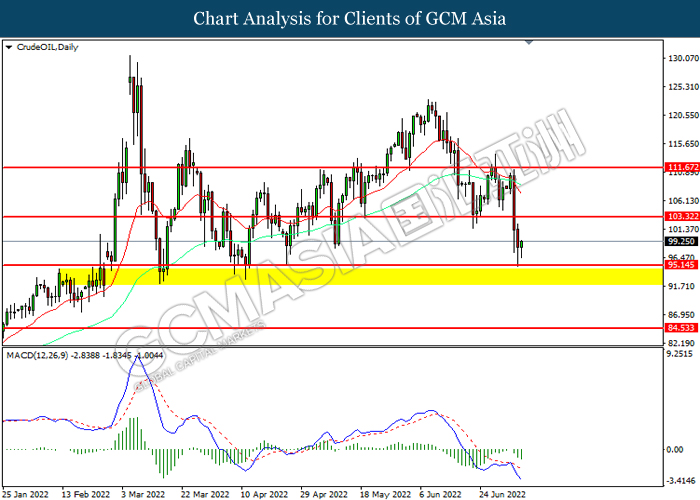

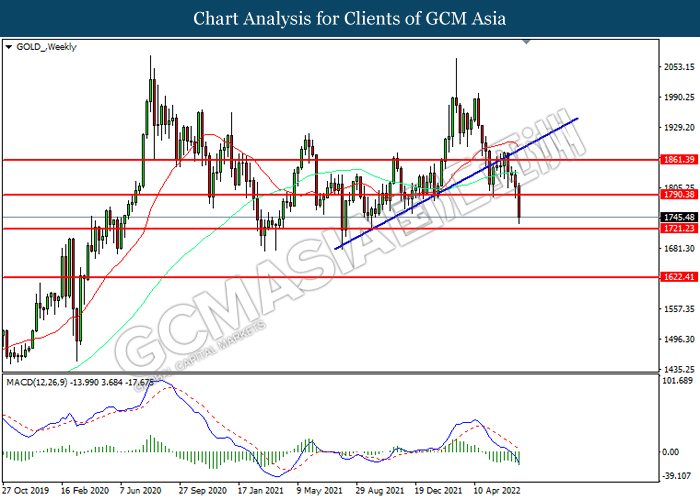

In the commodities market, the crude oil price appreciated by 0.89% to $99.05 per barrel as of writing amid technical correction. Though, the overall trend for the crude oil still remained bearish amid the recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold price depreciated by 0.01 to $1745.00 amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 231K | 230K | – |

| 22:00 | CAD – Ivey PMI (Jun) | 72.0 | – | – |

| 23:00 | USD – Crude Oil Inventories | -2.762M | -0.569M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

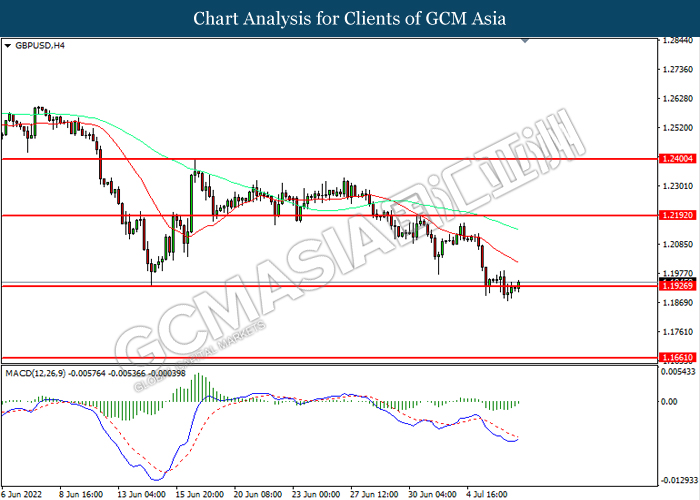

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2400

Support level: 1.1235, 1.1660

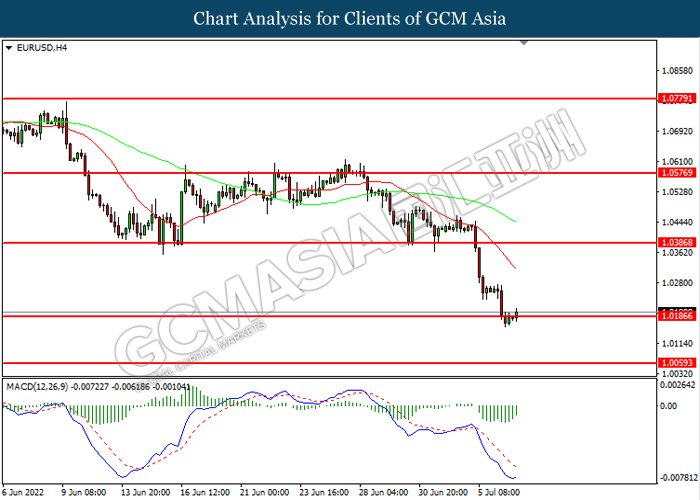

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0385, 1.0575

Support level: 1.0185, 1.0060

USDJPY, H4: USDJPY was traded lower higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

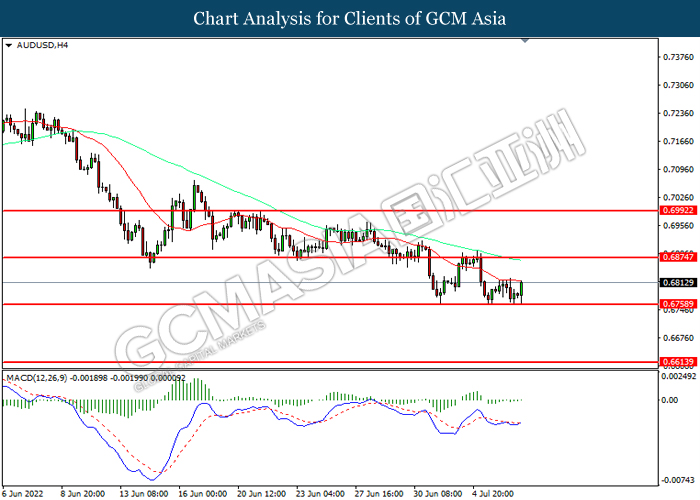

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6875, 0.6990

Support level: 0.6760, 0.6615

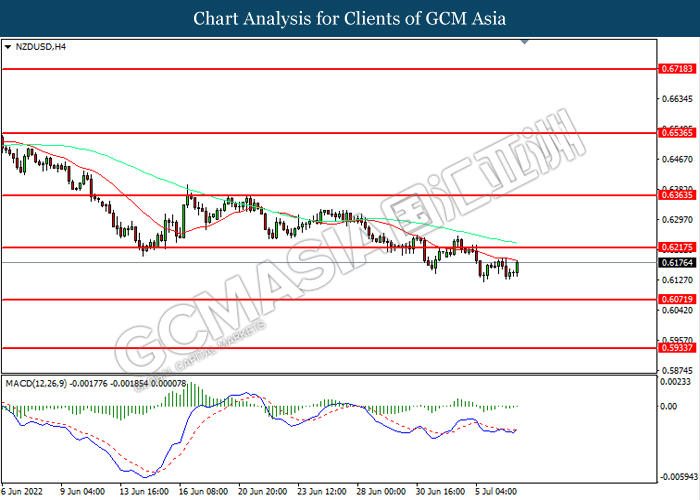

NZDUSD, H4: NZDUSD was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

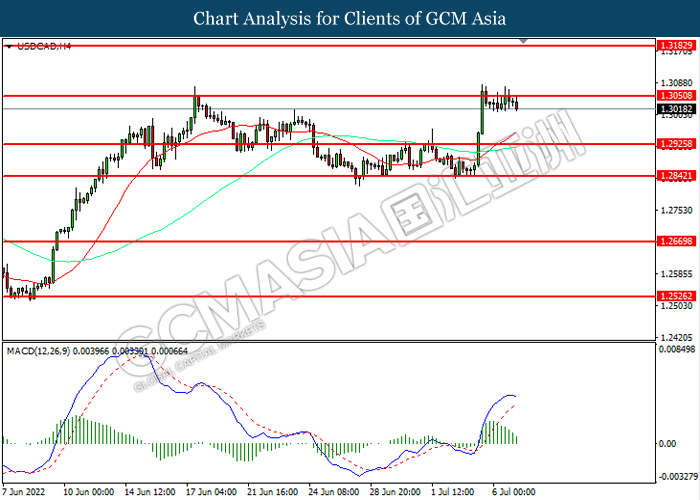

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

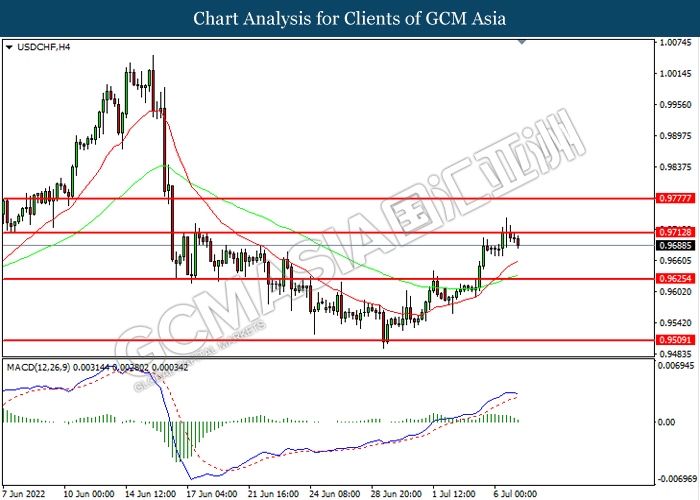

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9715, 0.9780

Support level: 0.9625, 0.9510

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 103.40, 111.65

Support level: 95.15, 84.55

GOLD_, Weekly: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1790.40, 1861.40

Support level: 1721.25, 1622.40