7 August 2017 Weekly Analysis

GCMAsia Weekly Report: August 7 – 11

Market Review (Forex): July 31 – August 4

U.S. Dollar

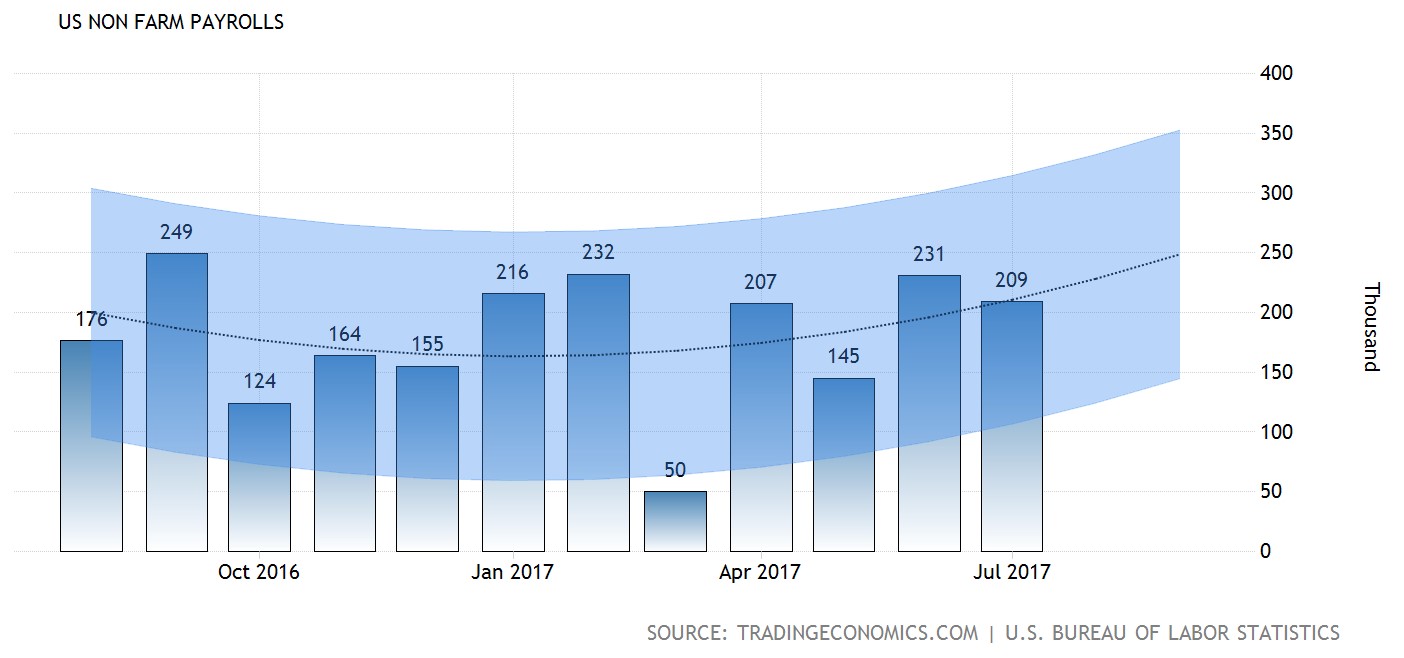

Greenback rallied against a basket of major peers on Friday following exceed expectation performance of US jobs report. The labor department reported that the economy generated 209,000 jobs during July, beating economist expectation for a gain of 183,000. Similarly, unemployment rate ticked down to 4.3% while average hourly earnings gained within forecast of 0.3%. When compared with year-over-year, wages have increased by 2.5%, matching June’s increase.

The uptick in wage growth indicates sustainability in inflationary pressure which would enable the US Federal Reserve to hike its interest rate gradually. Additionally, the dollar received further bullish support following director of White House National Economic Council, Gary Cohn whom revived hopes for a tax reform. Overall, the dollar index was up 0.72% to 93.37 during late Friday trading. For the week, it has gained around 0.33% while notching its first weekly appreciation in four weeks.

US Nonfarm Payrolls

—– Forecast

US economy added 209,000 jobs last month, indicating further tightening in labor market.

US Unemployment Rate

—– Forecast

Unemployment rate ticked down 0.1% to 4.3% in July.

US Average Hourly Earnings

—– Forecast

Average hourly earnings came in within expectation with 0.3%.

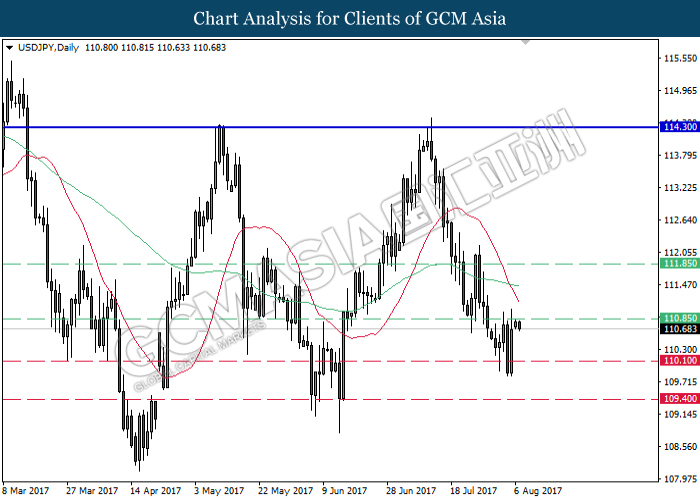

USD/JPY

Pair of USD/JPY rebounds by 0.6% to 110.69, not far from daily high of 111.04.

EUR/USD

Euro sheds 0.83% to $1.1770 against the greenback, off from prior two-and-a-half-year high.

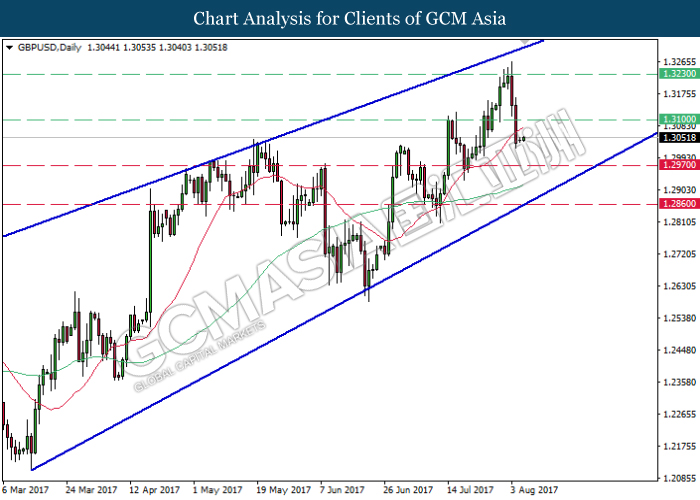

GBP/USD

Pound sterling slides down by 0.73% to $1.3042 during late Friday trading.

Market Review (Commodities): July 31 – August 4

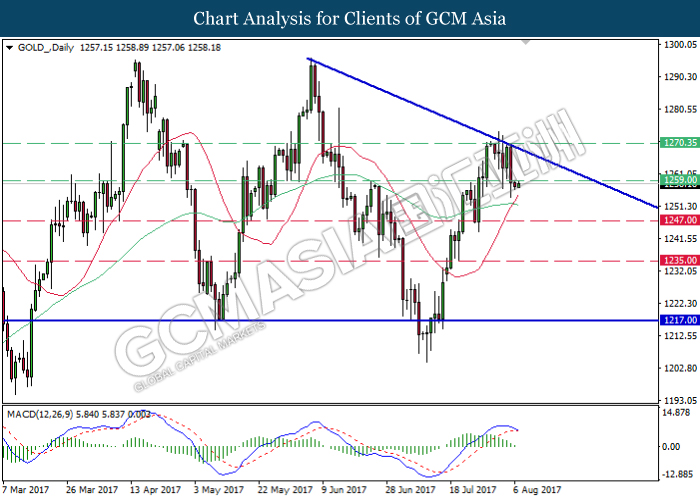

GOLD

Gold price fell on Friday following the release of solid US employment report for the month of July which has revived overall expectation for another interest rate hike within this year. Price of the yellow metal settled down to $1,258.28 while ended the week with a loss of 0.80%. Higher expectation for an interest rate hike in the future tend to weigh on gold price as it is denominated in dollar and struggles to compete with yield-bearing assets when borrowing cost arises.

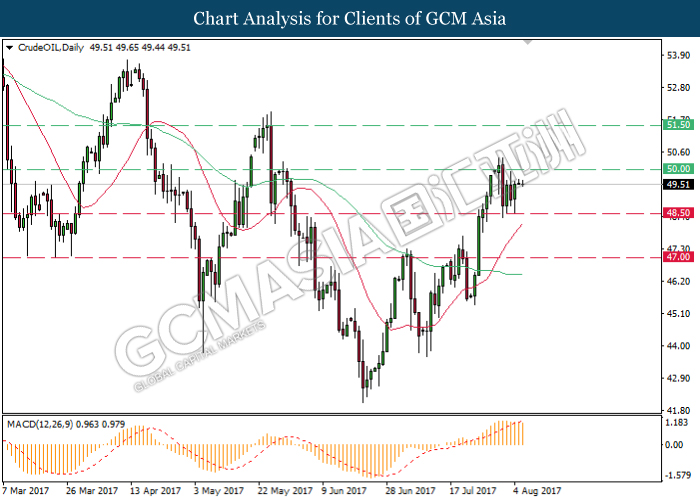

Crude Oil

Oil prices extended its advance on Friday following further signs of a possible slowdown in US shale production. Its prices appreciate by 55 cents or 1.1% to $49.58, few ticks away from $50 threshold. According to US oilfield services provider Baker Hughes, the number of active drilling rigs fell by one to 765 last week, suggesting early signs of moderating domestic production growth. Despite optimism from US data, its prices has recorded a loss around 13 cents or 0.30% for the week due to rising exports from OPEC members which has achieved its yearly high.

Since the start of the year, OPEC and some non-OPEC members has agreed to reduce 1.8 million barrels per day in supply until March 2018. However, such plans has done little impact in global crude inventory levels due to rising supply from non-participating producers such as Libya and Nigeria while coupled with a rebound in US shale output.

U.S. Baker Hughes Oil Rig Count

Active drilling rigs was down by 1 to a total of 765.

Weekly Outlook: August 7 – 11

For the week ahead, investors will be looking forward to Friday’s US inflation figures to monitor the economy is strong enough for the Fed to continue their gradual tightening of monetary policy. Likewise, appearance by a number of Fed speakers will also be in the limelight.

Meanwhile, oil traders will be focusing on monthly reports delivered by Organization of the Petroleum Exporting Countries and the International Energy Agency to assess global oil supply and demand levels. Likewise, some members and non-members of OPEC will be meeting on Monday and Tuesday to discuss compliances upon the agreed production cut plans that may shed further light on the future of crude oil market.

Highlighted economy data and events for the week: August 7 – 11

| Monday, August 7 |

Data NZD – Inflation Expectations (QoQ) CHF – CPI (MoM) (Jul) GBP – Halifax House Price Index (MoM) (Jul)

Events USD – FOMC Member Bullard Speaks USD – FOMC Member Kashkari Speaks

|

| Tuesday, August 8 |

Data AUD – NAB Business Confidence (Jul) CNY –Trade Balance (USD) (Jul) CAD – Housing Starts (Jul) USD – JOLTs Job Openings (Jul)

Events N/A

|

| Wednesday, August 9 |

Data CrudeOIL – API Weekly Crude Oil Stock CNY – CPI (MoM) (Jul) CNY – PPI (MoM) (Jul) USD – Nonfarm Productivity (QoQ) (Q2) USD – Unit Labor Costs (QoQ) (Q2) CrudeOIL – Crude Oil Inventories

Events N/A

|

| Thursday, August 10 |

Data NZD – RBNZ Interest Rate Decision GBP – Manufacturing Production (MoM) (Jun) USD – Initial Jobless Claims USD – PPI (MoM) (Jul) CAD – New Housing Price Index (MoM) (Jun)

Events NZD – RBNZ Monetary Policy Statement NZD – RBNZ Rate Statement NZD – RBNZ Gov Wheeler Speaks CrudeOIL – OPEC Monthly Report USD – FOMC Member Dudley Speaks

|

|

Friday, August 11

|

Data EUR – German CPI (MoM) (Jul) USD – Core CPI (MoM) (Jul) CrudeOIL – US Baker Hughes Oil Rig Count

Events CrudeOIL – IEA Monthly Report

|

Technical weekly outlook: August 7 – 11

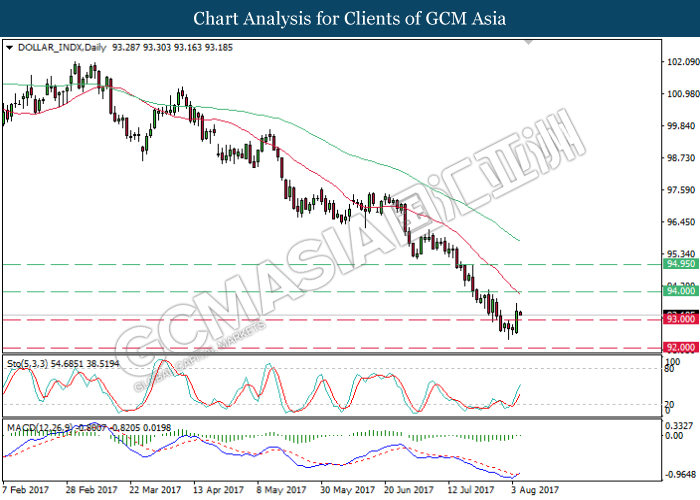

Dollar Index

DOLLAR_INDX, Daily: Dollar index halts its decline following prior closure above the 93.00 threshold. Both Stochastic Oscillator and MACD histogram which illustrates an upward signal suggests the dollar index to extend further upwards after closing above the resistance level of 94.00.

Resistance level: 94.00, 94.95

Support level: 93.00, 92.00

GBPUSD

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the upper level of rising wedge. Recent closure below the 20-MA line (red) suggests further downside bias to extend its losses towards the support level of 1.2970.

Resistance level: 1.3100, 1.3230

Support level: 1.2970, 1.2860

USDJPY

USDJPY, Daily: USDJPY remains under pressure following prior formation of death cross by both MA lines. A retracement from the strong resistance level of 110.85 would suggests USDJPY to extend its losses towards the next target at 110.10.

Resistance level: 110.85, 111.85, 114.30

Support level: 110.10, 109.40

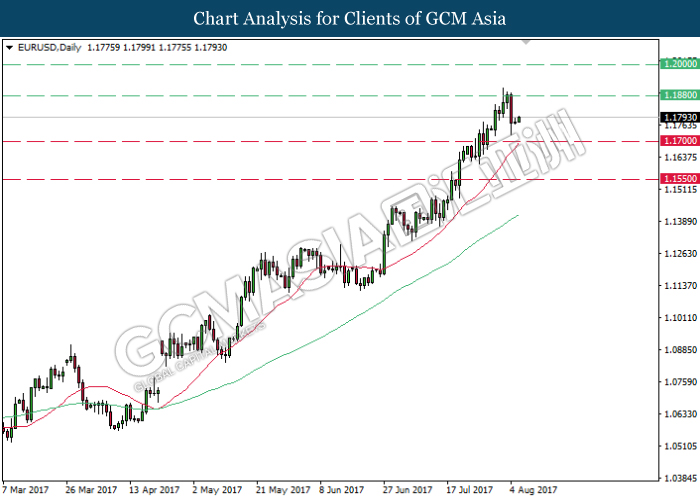

EURUSD

EURUSD, Daily: EURUSD halts its ascend following prior retracement from the recent high of 1.1880. However, as both moving average line continues to expand upwards, EURUSD is expected to advance further up and retest at the resistance level of 1.1880.

Resistance level: 1.1880, 1.2000

Support level: 1.1700, 1.1550

GOLD

GOLD_, Daily: Gold price were traded within a descending triangle following prior retracement from the top level. MACD histogram which begins to form a negative divergence suggests gold price to extend its downward momentum after a successful closure below the 20-MA line (red). Next target of support level is at 1247.00.

Resistance level: 1259.00, 1270.35

Support level: 1247.00, 1235.00, 1217.00

Crude Oil

CrudeOIL, Daily: Crude oil price were traded higher following prior rebound from the strong support level of 48.50. However, MACD which illustrate diminishing upward momentum suggests crude oil price to experience brief retracement period in the short-term before extending its uptrend in the long-term.

Resistance level: 50.00, 51.50

Support level: 48.50, 47.00