7 August 2019 Afternoon Session Analysis

Kiwi suffered major losses amid huge rate cut.

New Zealand Kiwi crashed to multi-month lows after RBNZ delivered an unexpected huge rate cut. The Reserve Bank of New Zealand (RBNZ) have reduce its official cash rate by 50 basis points to 1.0%, much higher than market expectation of 25 basis points. The Monetary Policy Committee of New Zealand have stated that a lower official cash rate (OCR) is necessary to meet its employment and inflation objectives. In the official statement, RBNZ added that low interest rates and increased government spending will support a pick-up in demand over the coming year. Business investment is expected to rise given low interest rates and some ongoing capacity constraints. Likewise, an increased in construction activity will also likely to contributes towards a pick-up in demand. Besides that, the central bank also lowered its forecast on future interest rate for next year with prior forecast of 1.36% being revised to 0.91%. The revision has fueled extended selloff on the New Zealand dollar which hit its lowest level since 20th January 2016. As of writing, pair of NZD/USD plunged 1.41% to 0.6721 while the dollar index slips 0.10% to 97.25.

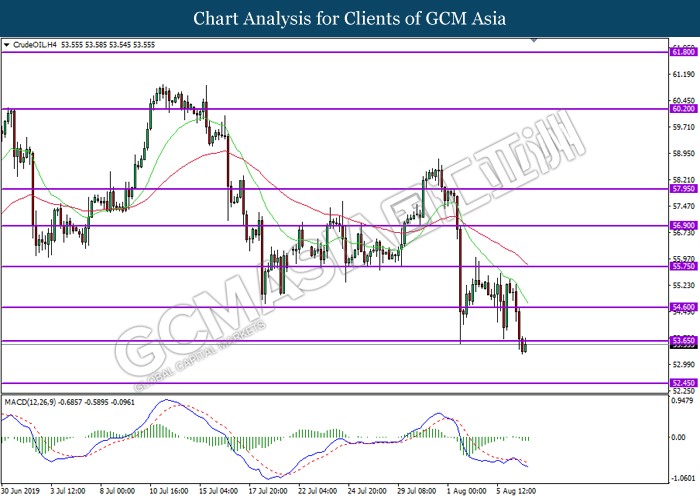

As for commodities, crude oil sags 0.10% to $53.35 per barrel at the time of writing following heightened concerns upon global demand. As trade war between U.S and China continues to intensify, investors remained fixated upon the possibility of a lower demand of crude oil in the future. Next, gold price skyrocketed 0.66% to $1484.59 a troy ounce following global uncertainty which has boosted the demand for the safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – Ivey PMI (Jul) | 52.4 | 53.0 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -8.496M | -2.845M | – |

Technical Analysis

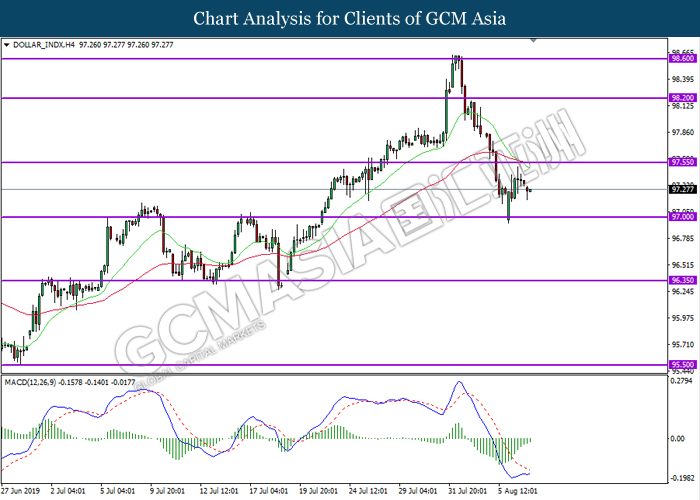

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from its top levels. However, MACD which illustrate diminishing bearish momentum suggest index to undergo short-term technical correction and rebound towards the resistance level 97.55.

Resistance level: 97.55, 98.20

Support level: 97.00, 96.35

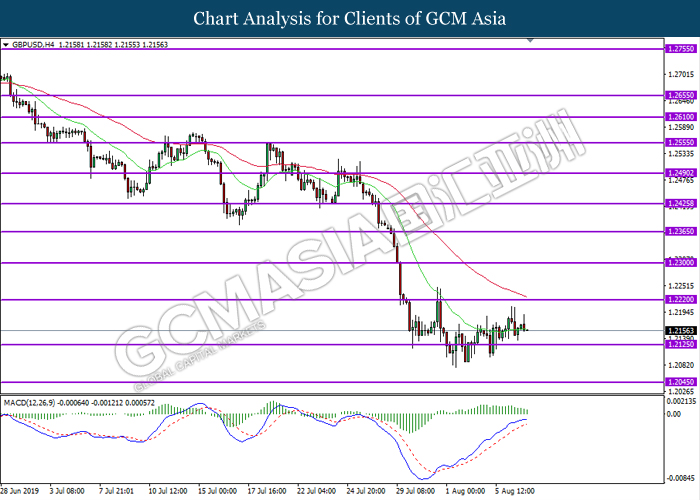

GBPUSD, H4: GBPUSD was traded lower while currently testing the 20-MA line (green). MACD which display diminishing bullish momentum suggest the pair to extend its losses after successfully closing below the 20-MA line.

Resistance level: 1.2220, 1.2300

Support level: 1.2125, 1.2045

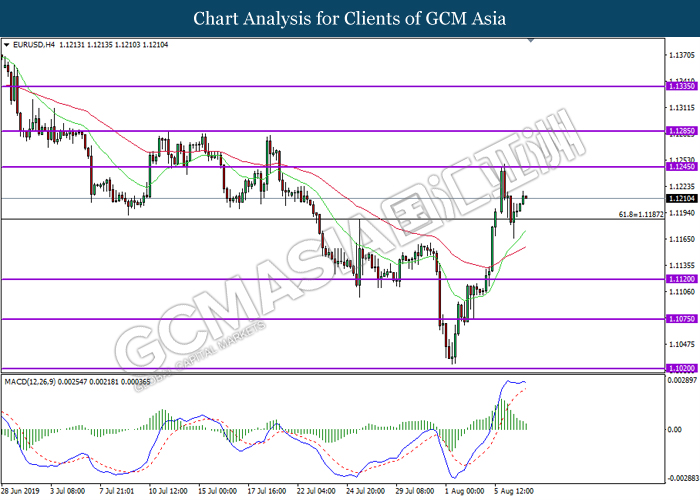

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1185. However, MACD which display diminishing bullish momentum suggest the pair to be traded lower back towards the support level 1.1185.

Resistance level: 1.1245, 1.1285

Support level: 1.1185, 1.1120

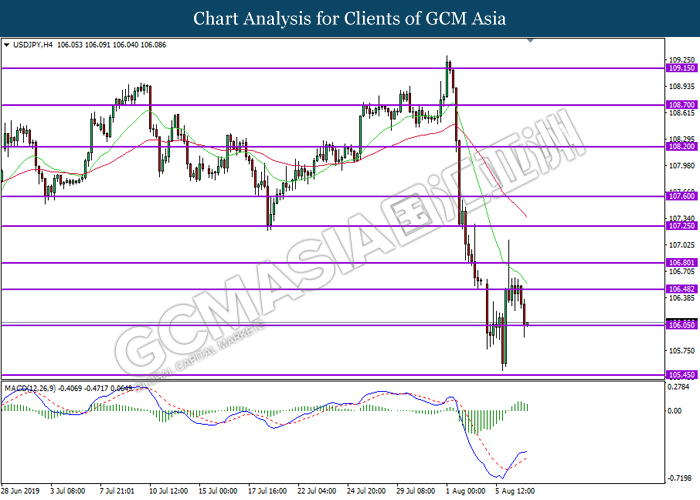

USDJPY, H4: USDJPY was traded lower while currently testing the support level 106.05. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after successfully breaking below the support level.

Resistance level: 106.45, 106.80

Support level: 106.05, 105.45

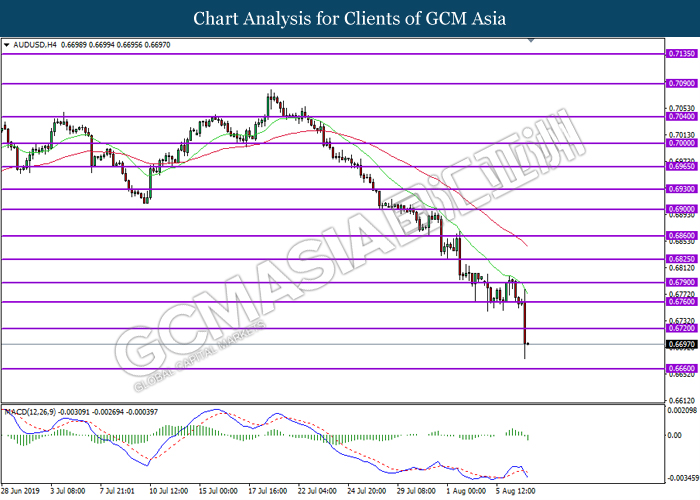

AUDUSD, H4: AUDUSD was traded lower following prior breaking below the previous support level 0.6720. MACD which display bearish bias signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.6660.

Resistance level: 0.6720, 0.6760

Support level: 0.6660, 0.6605

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6395. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its losses after successfully breaking below the support level.

Resistance level: 0.6430, 0.6470

Support level: 0.6395, 0.6350

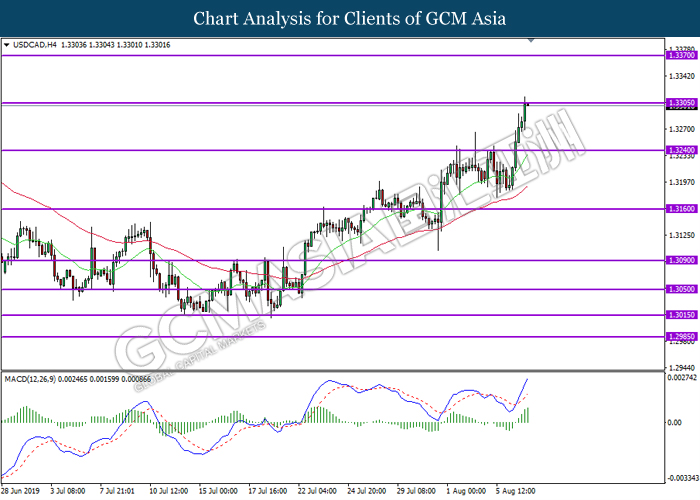

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level 1.3305. MACD which display bullish bias momentum suggest the pair to extend its gains after successfully breaking above the resistance level.

Resistance level: 1.3305, 1.3370

Support level: 1.3240, 1.3160

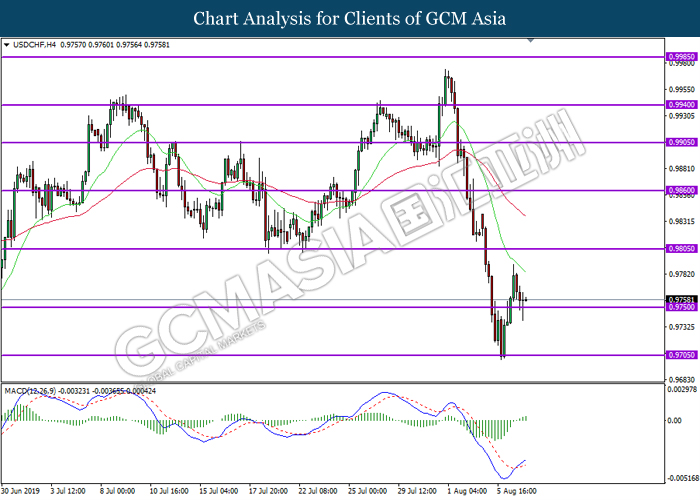

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9750. However, MACD which display bullish bias signal with the formation of golden cross suggest the pair to undergo short-term technical correction and rebound towards the resistance level 0.9805.

Resistance level: 0.9805, 0.9860

Support level: 0.9750, 0.9705

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below previous support level 53.65. MACD which display bearish momentum suggest the commodity to extend its losses towards the support level 52.45.

Resistance level: 53.65, 54.60

Support level: 52.45, 50.90

GOLD_, H4: Gold price was traded higher following prior breakout above previous resistance level 1476.00. MACD which display persistent bullish momentum suggest gold to extend its gains towards the resistance level 1495.60.

Resistance level: 1495.60, 1515.55

Support level: 1476.00, 1456.50