7 September 2022 Afternoon Session Analysis

Aussie slumped as pessimistic economic outlook.

The Australia Dollar extends its losses yesterday over the backdrop of downbeat economic data from the Australia region. According to Australian Bureau of Statistics, Australian Gross Domestic Product (GDP) for last quarter came in at 0.9%, which missing the market forecast at 1.0%. The pessimistic reading had indicated that the economic momentum in the Australia region may now be slowing down amid rising price pressures as well as the downbeat economic outlook for the Australia’s largest trading partner (China) due to the implementation of the Chinese “zero-Covid” strategy. Nonetheless, the loses experienced by the Aussie was still limited by the rate hike decision from Reserve Bank of Australia. According to the Monetary Policy Statement, the RBA has raised its benchmark interest for a fifth month in a row into 2.35% to curb the spiking inflation risk. As of writing, AUD/USD depreciated by 0.51% to 0.6700.

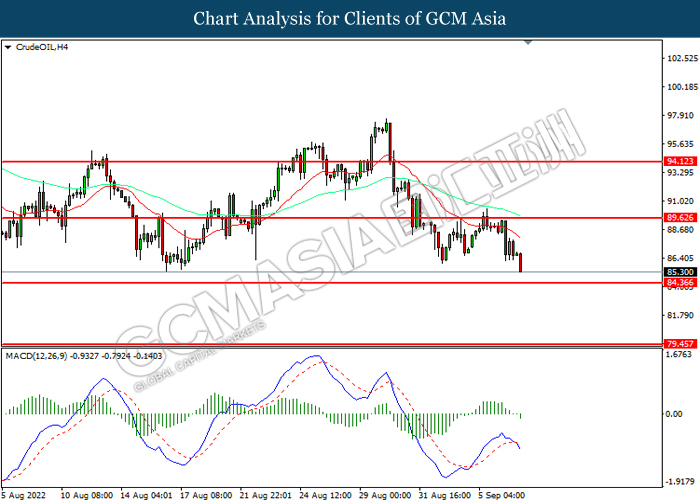

In the commodities market, the crude oil price slumped by 1.88% to $85.35 per barrel as of writing. The crude oil price down significantly on Wednesday as Covid-19 restriction in top crude importer China as well as the rate hike expectation from global central bank had continue to spur concerns on global economic recession. On the other hand, the gold price retreated by 0.54% to $1692.50 per troy ounces as of writing.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 GBP BoE Gov Bailey Speaks

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 2.50% | 3.25% | – |

| 22:00 | CAD – Ivey PMI (Aug) | 49.6 | 48.3 | – |

Technical Analysis

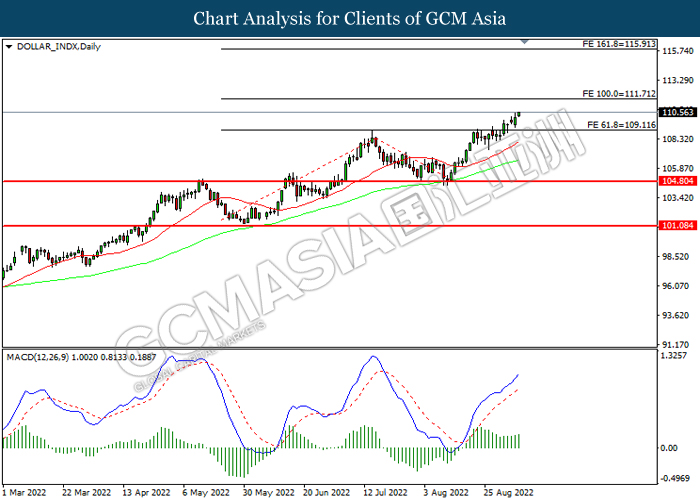

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 111.70, 115.90

Support level: 109.10, 104.80

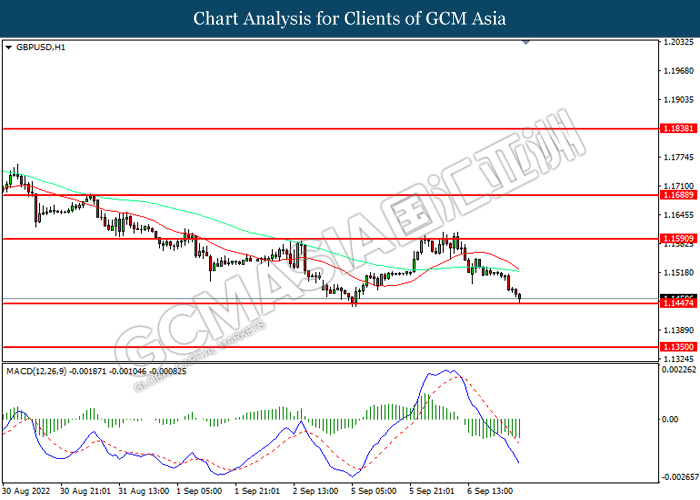

GBPUSD, H1: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.1590, 1.1690

Support level: 1.1445, 1.1350

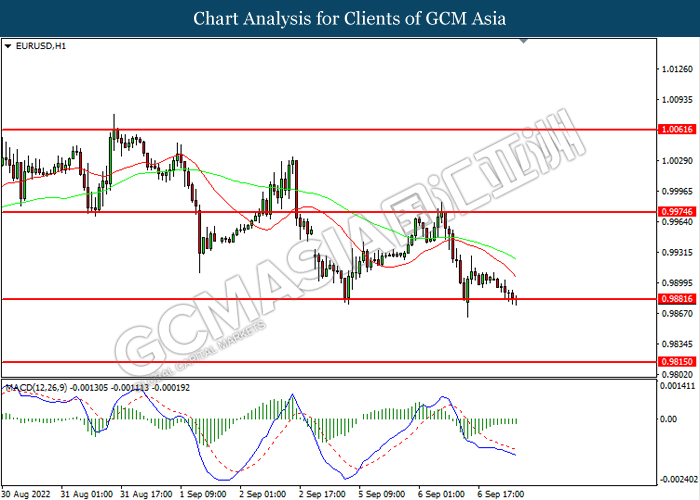

EURUSD, H1: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9975, 1.0060

Support level: 0.9880, 0.9815

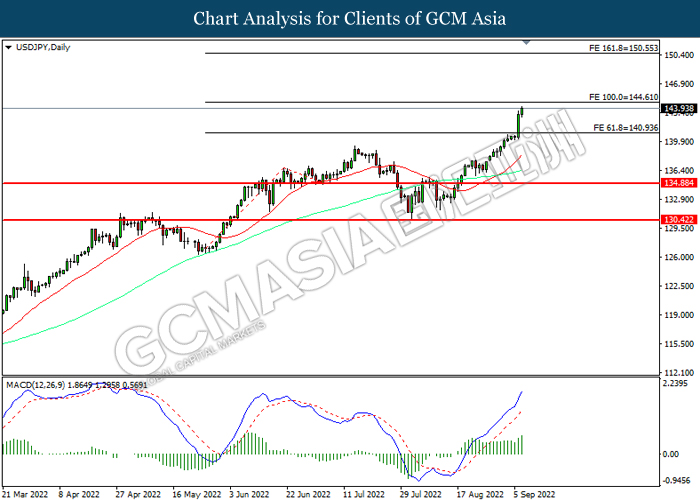

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 144.60, 150.55

Support level: 140.95, 134.90

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6570

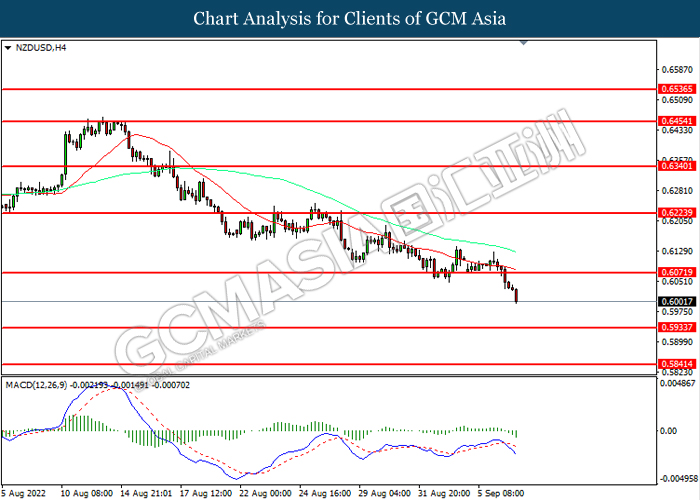

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6070, 0.6225

Support level: 0.5935, 0.5840

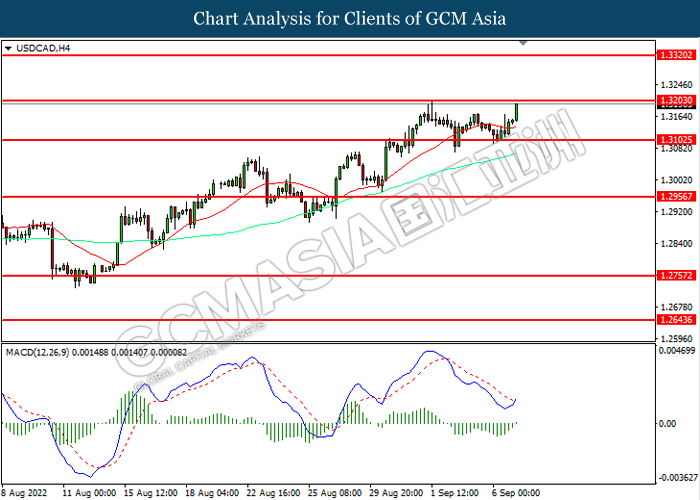

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3205, 1.3320

Support level: 1.3105, 1.2955

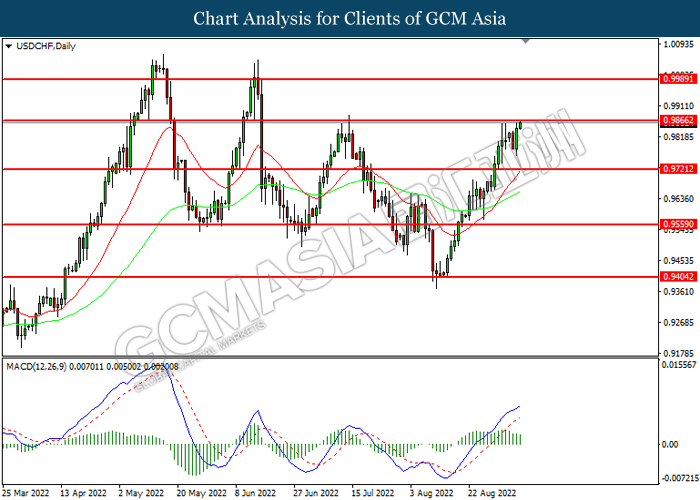

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9865, 0.9990

Support level: 0.9720, 0.9560

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 89.65, 94.10

Support level: 84.35, 79.45

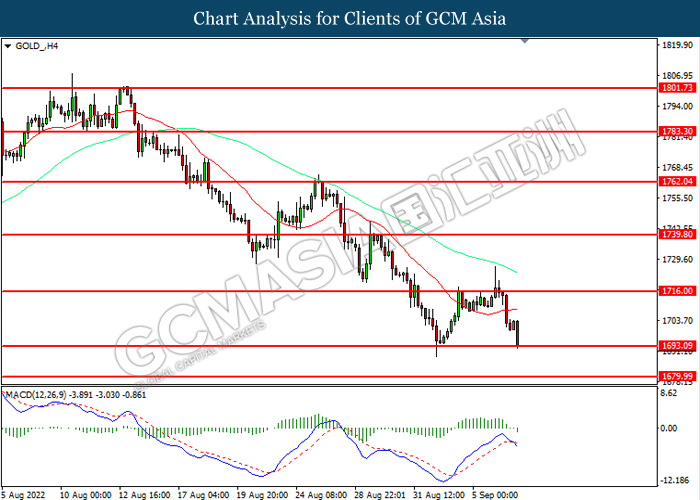

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1716.00, 1739.80

Support level: 1695.10, 1680.00