7 September 2022 Morning Session Analysis

Greenback jumped as momentum remained in services sector.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its gains yesterday as the services sector accelerated unexpectedly in August. According to the ISM, US Non-Manufacturing PMI rose from the prior month’s reading 56.7 to 56.9 for the month of August, while recording a higher figure compared to the consensus forecast at 55.1. The stronger-than-expected data was mainly attributed to the stronger order growth and employment in the US, which denied the market views that the economy was in a recession. Prior to now, the majority of the investors were worried that the economy had entered into a recession phase as the gross domestic product contracted in the first half of the year. On the other hand, the appeal of the greenback as a safe haven currency strengthened as the energy crisis in Europe loomed. Earlier this week, Russia revealed that the closure of Nord Stream 1 will be continued until the western sanction is removed. The sudden pause in natural gas flow from Russia to Europe exacerbated the energy imbalance, arousing investors’ curiosity about how Europe faced the winter months with insufficient stocks. As of writing, the dollar index is up 0.39% to 110.25.

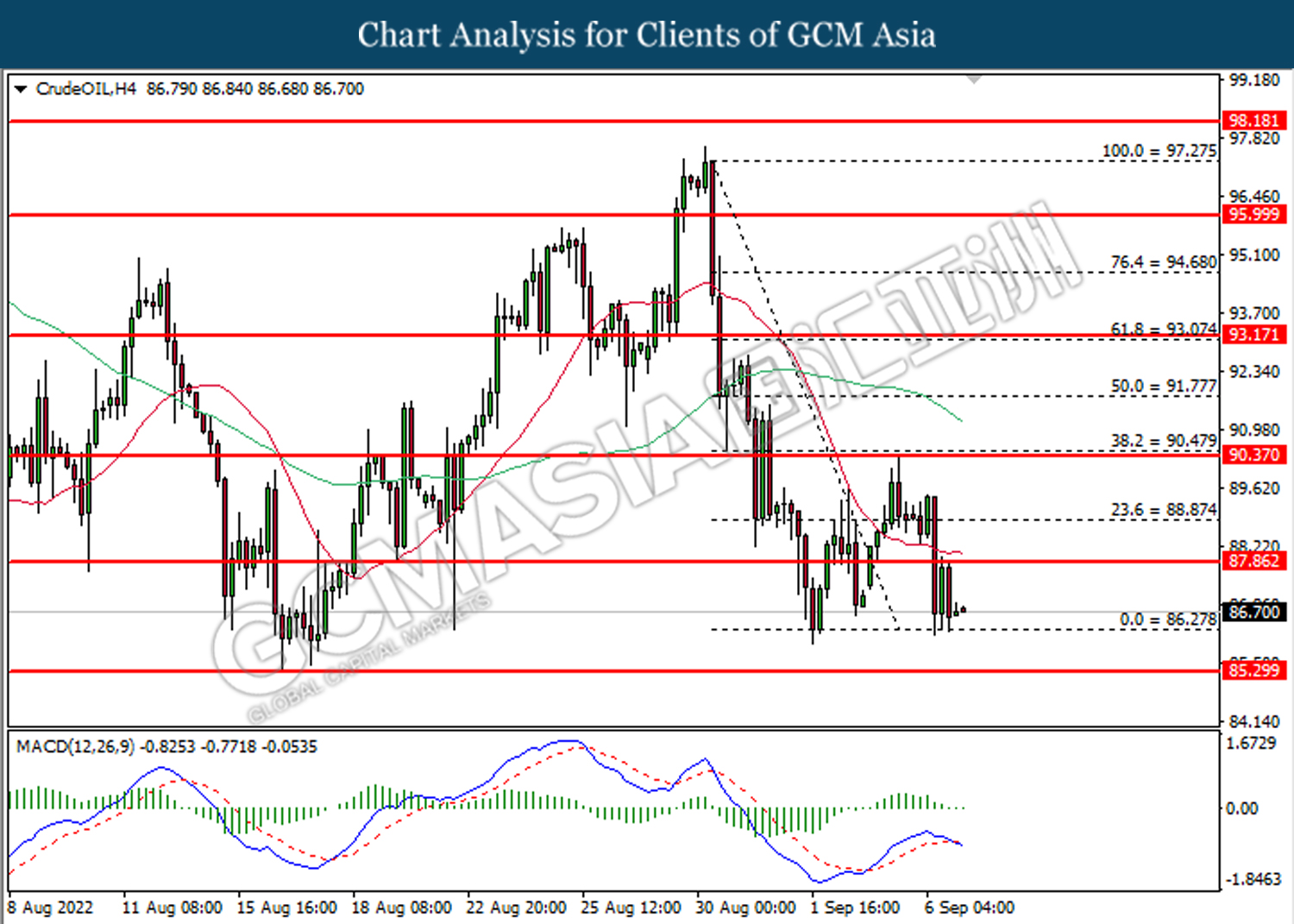

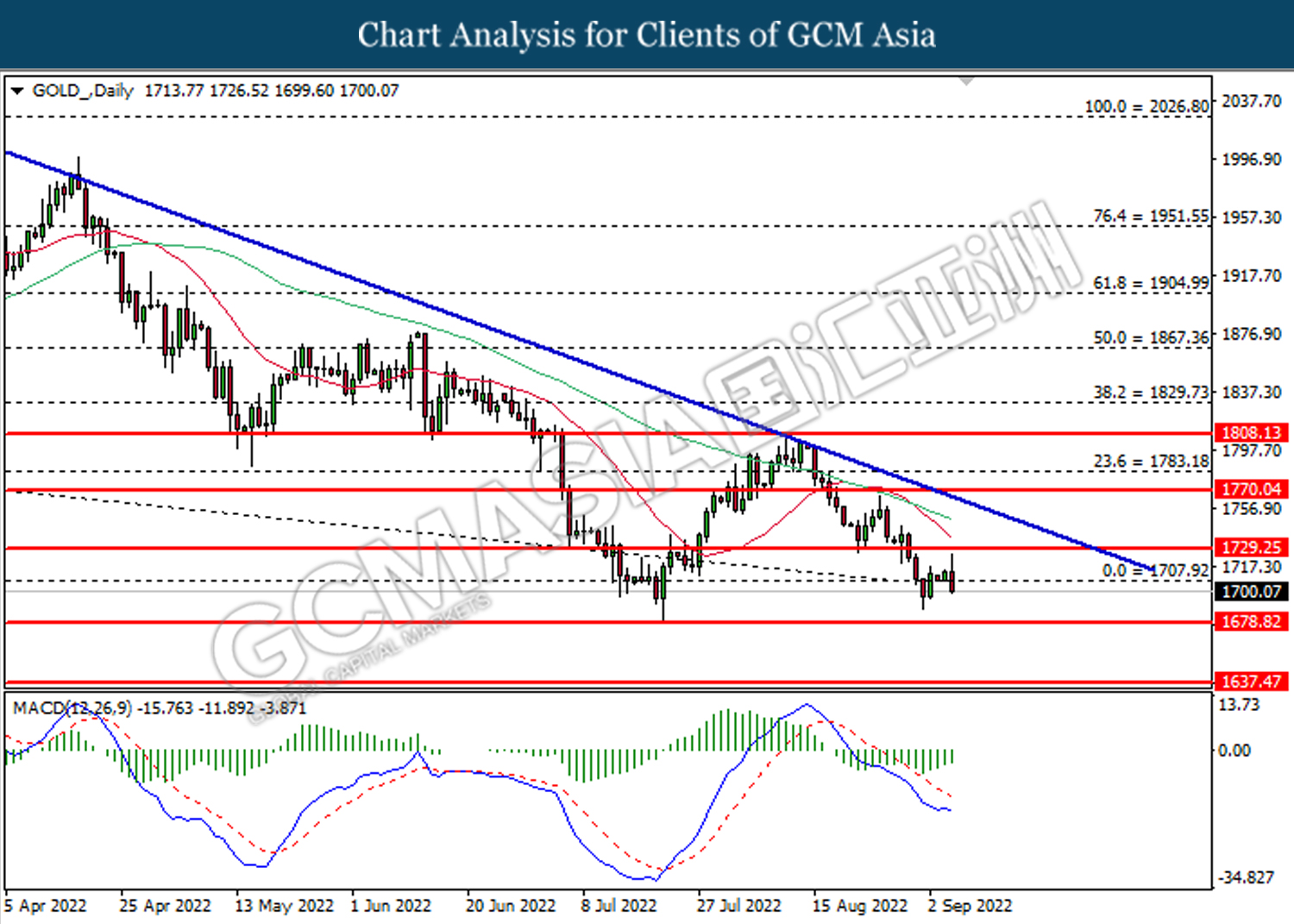

In the commodities market, the crude oil price dropped by -2.71% to $86.85 a barrel as demand concerns outweighed the symbolic production cut by OPEC+. Besides, the gold prices edged down by -0.08% to $1700.65 per troy ounce as the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 GBP BoE Gov Bailey Speaks

22:15 GBP BoE MPC Treasury Committee Hearings

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | CAD – BoC Interest Rate Decision | 2.50% | 3.25% | – |

| 22:00 | CAD – Ivey PMI (Aug) | 49.6 | 48.3 | – |

Technical Analysis

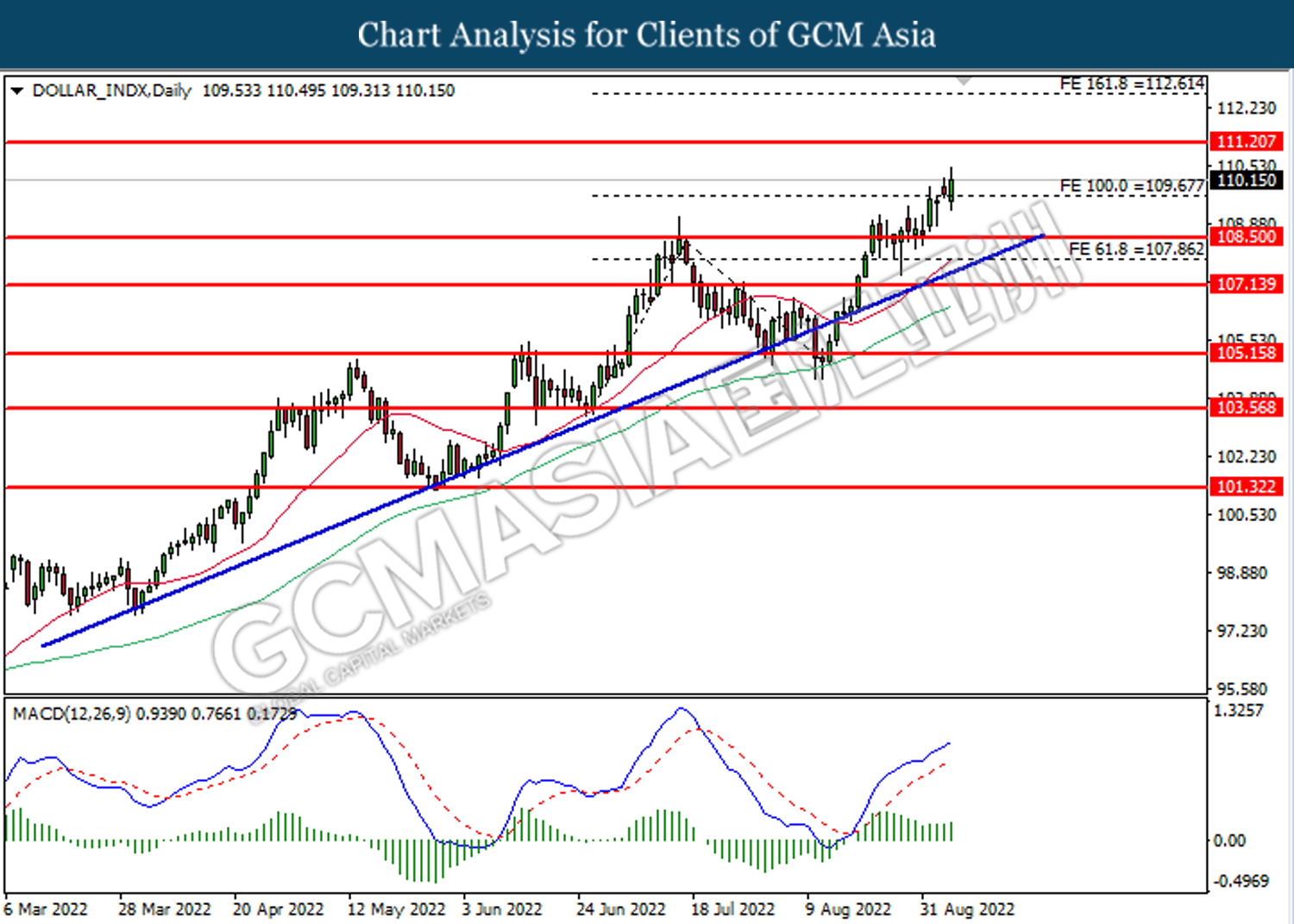

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 109.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the next resistance level at 111.20.

Resistance level: 111.20, 112.60

Support level: 109.65, 108.50

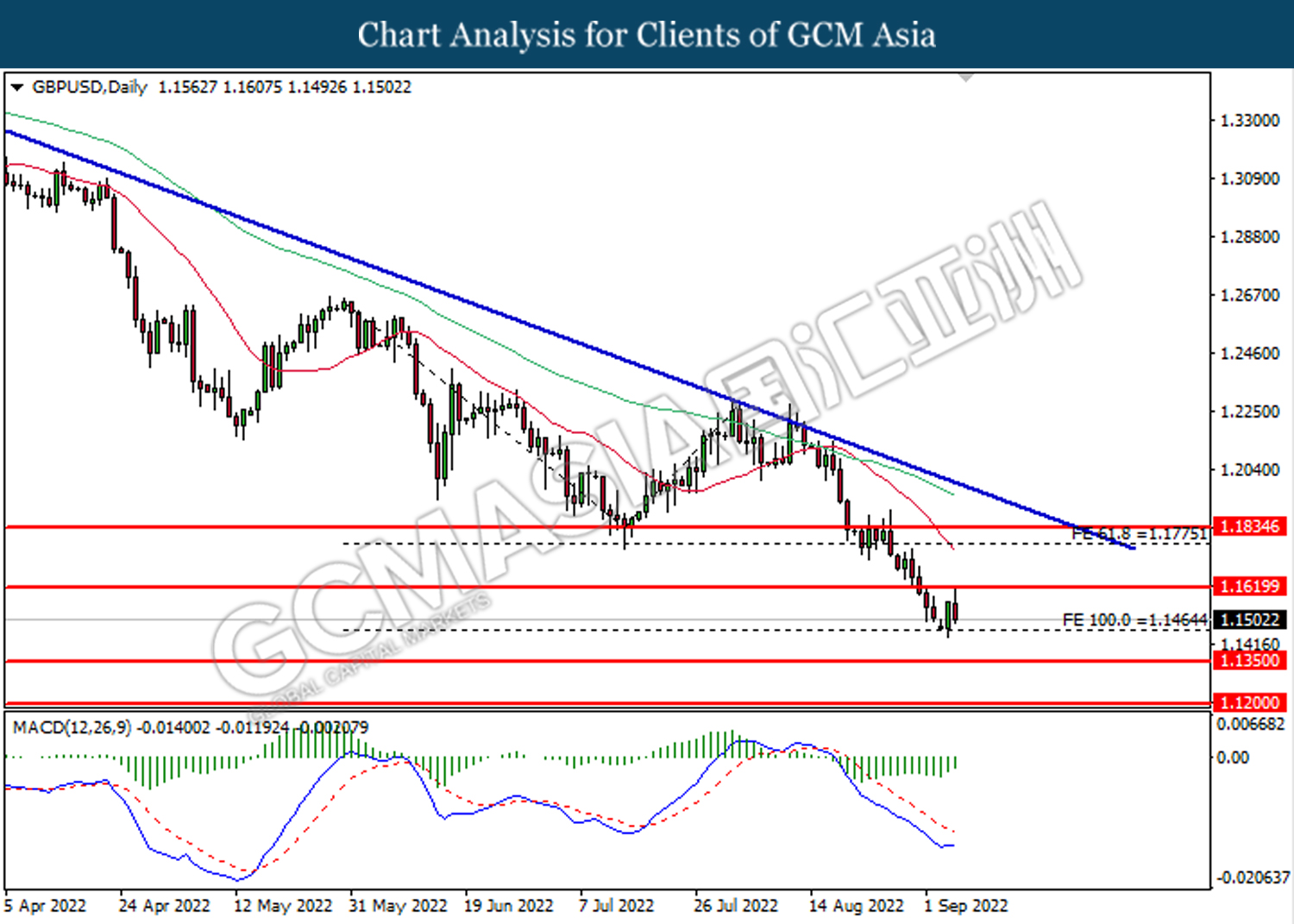

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1465.

Resistance level: 1.1620, 1.1775

Support level: 1.1465, 1.1350

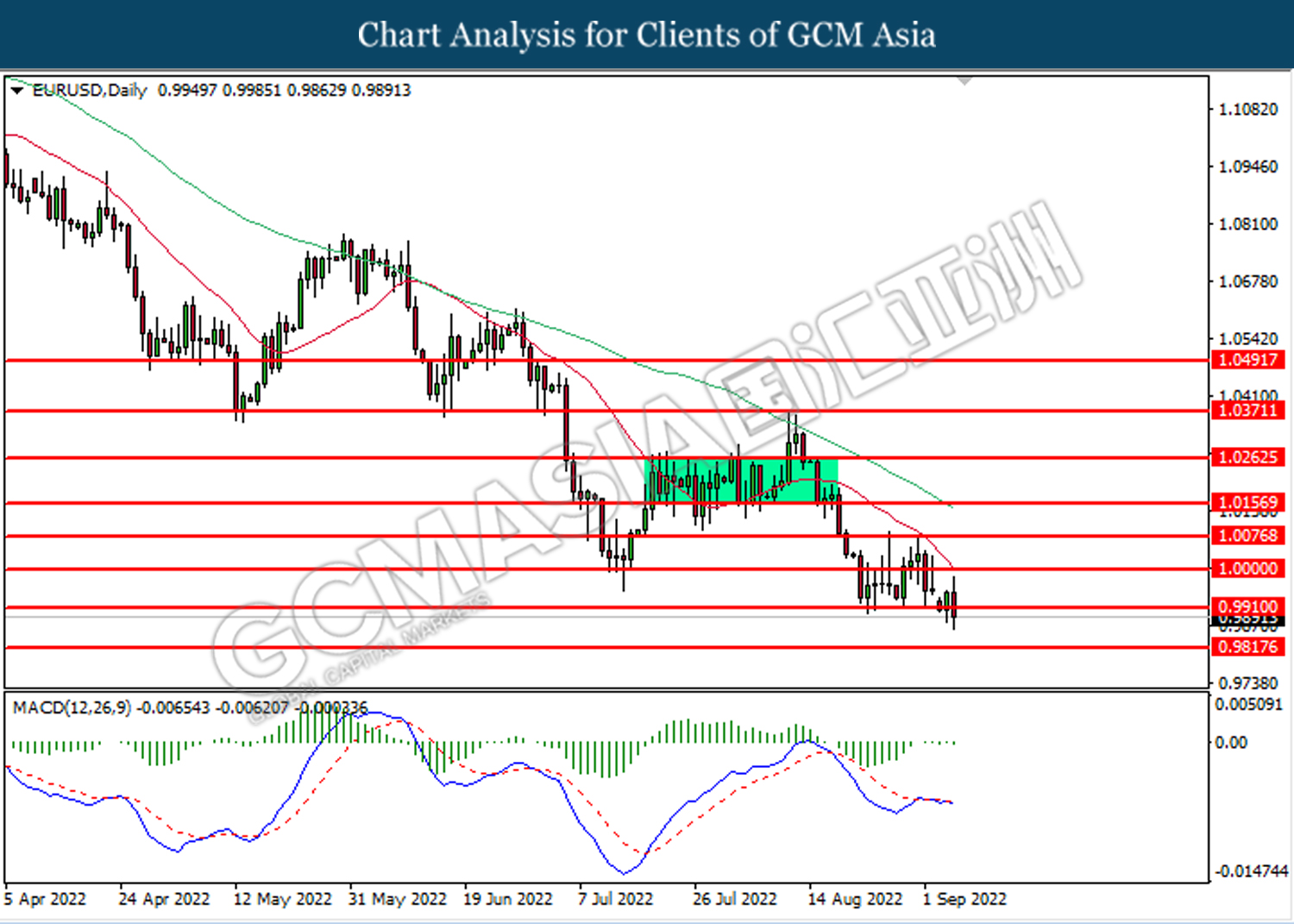

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 0.9910. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0000, 1.0075

Support level: 0.9910, 0.9820

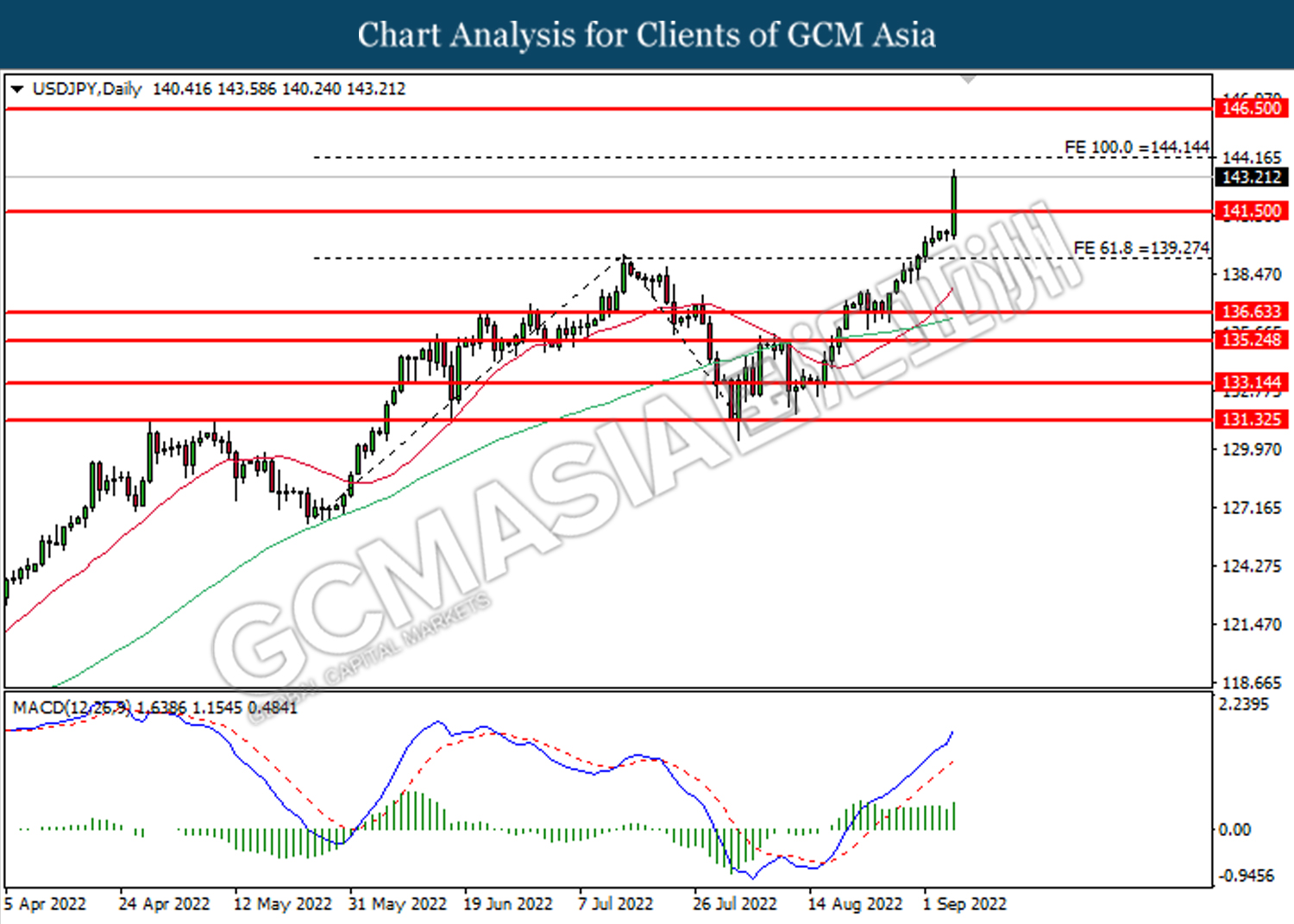

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 141.50. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 144.15.

Resistance level: 144.15, 146.50

Support level: 141.50, 139.25

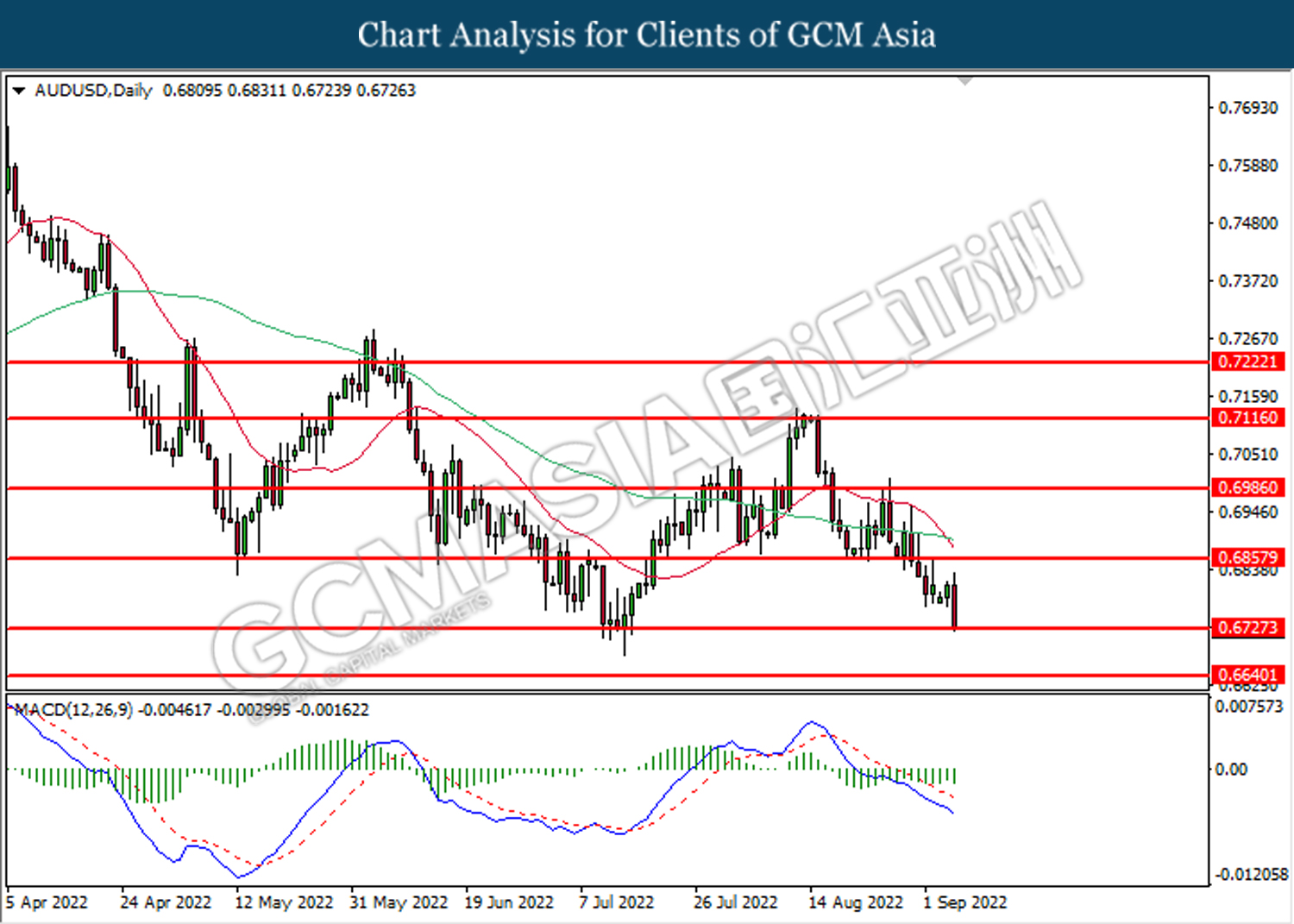

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

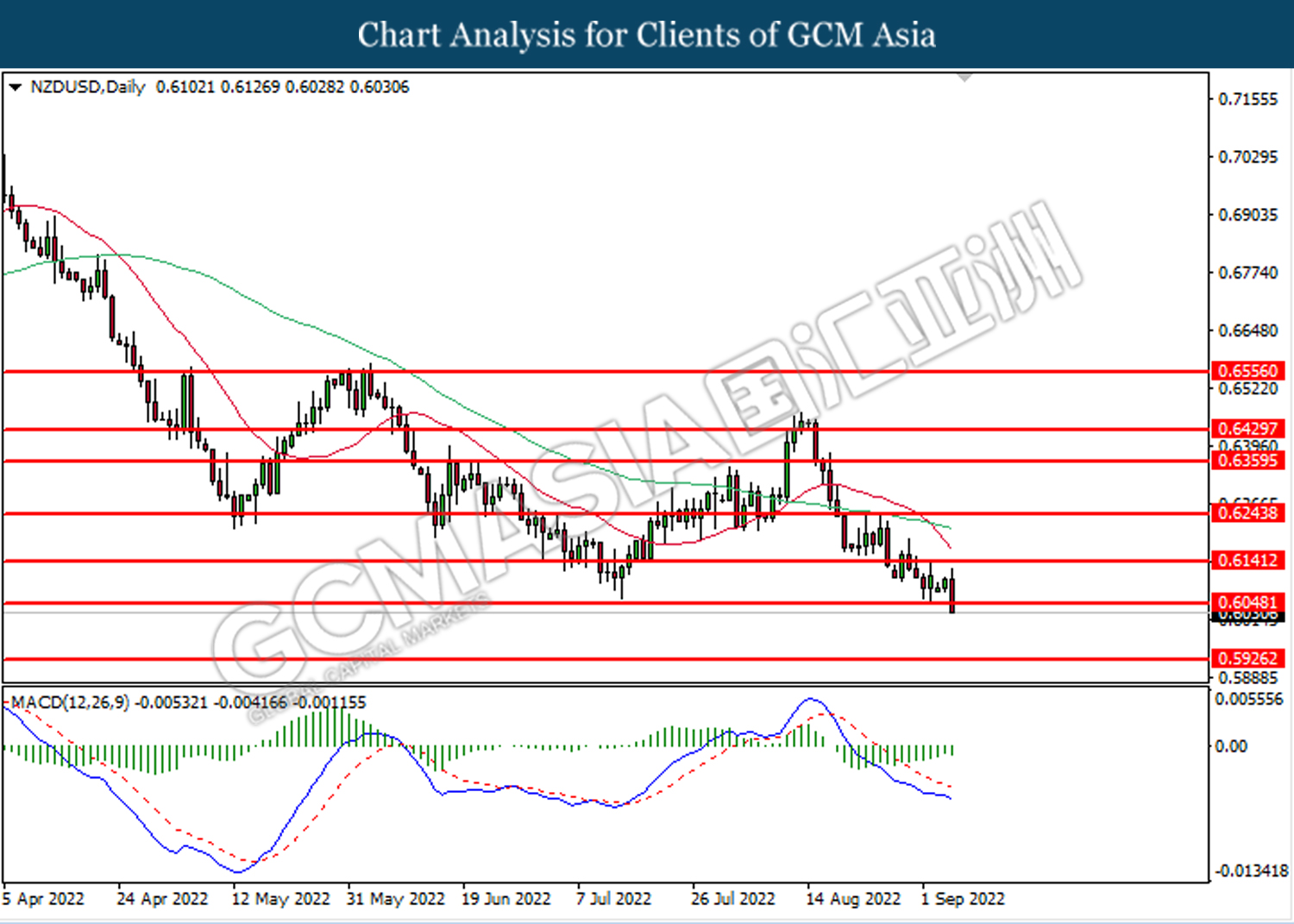

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

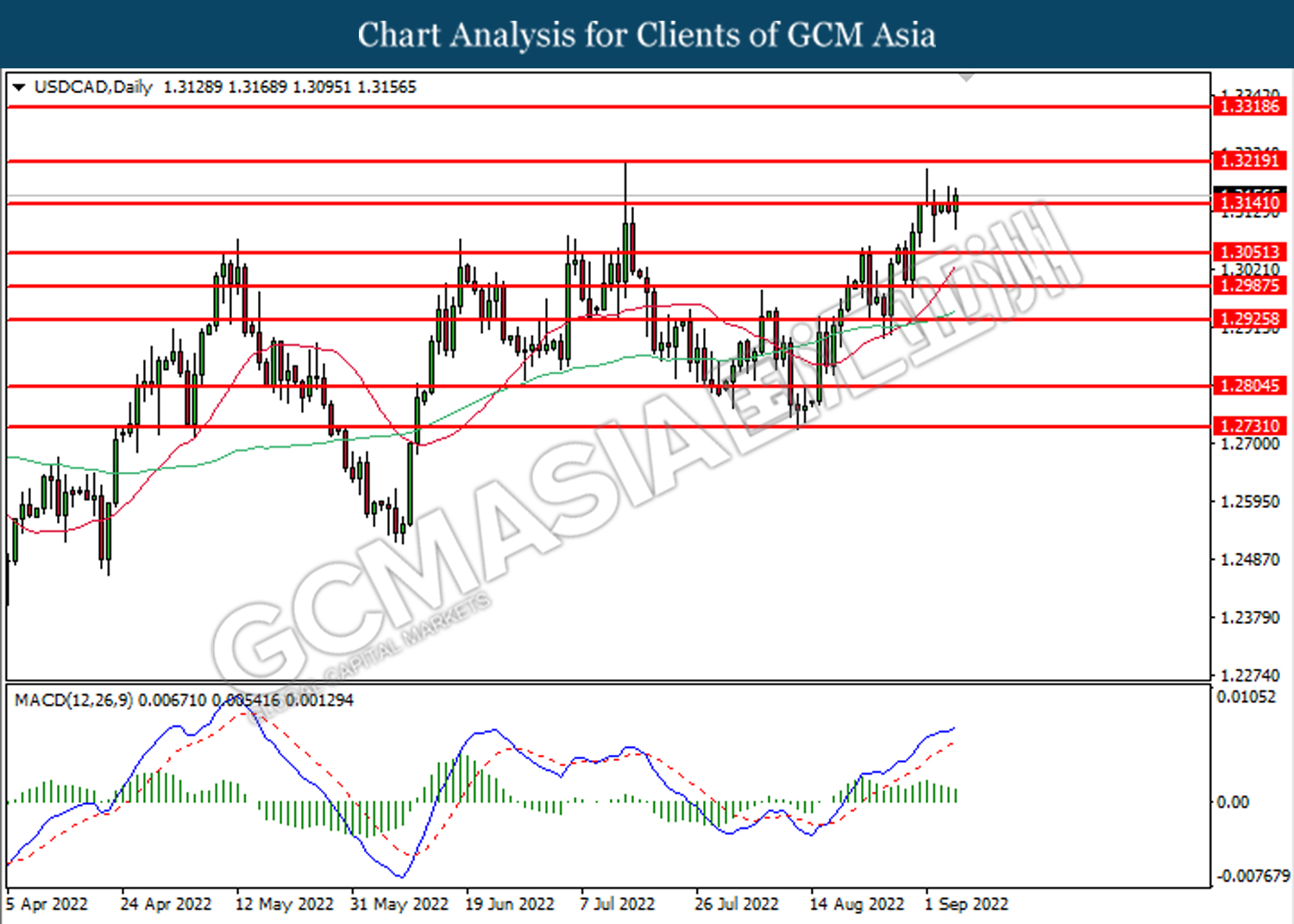

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3140. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3140, 1.3220

Support level: 1.3050, 1.2985

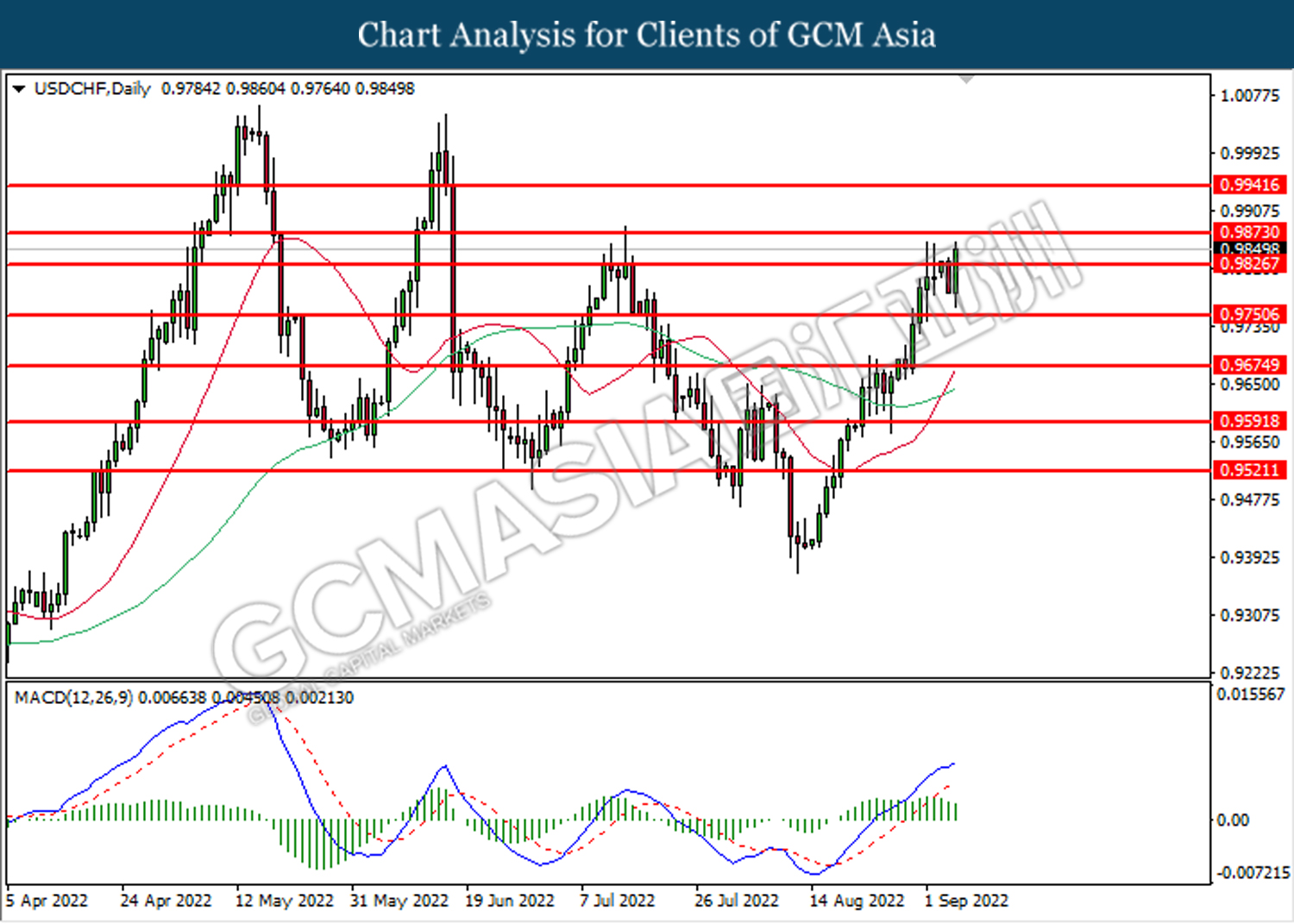

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9825. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 86.30. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 87.85, 88.85

Support level: 86.30, 85.30

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1707.90. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80