7 November 2018 Afternoon Session Analysis

Dollar remains pressured amid Congress expected to split.

Dollar index was pressured against its basket of six major rival pairs during early Asian session amid election and political turmoil in US. As of writing, the dollar index fell 0.23% to 95.97 during Asian trading session. Based on the polling website FiveThirtyEight, the likelihood of the Democrats winning the House has jumped to 70 percent but Republicans are also likely to retain the Senate. A Democratic-controlled House with majority Republican Senate will cause President Trump having a hard time to introduce major new legislation and also it may pursue further investigations into Trump’s affairs, causing fear and loss of confidence in the dollar. On the other hand, EUR/USD soared 0.27% amid positive data. According to Markit, the composite index has improved to 53.1, higher than forecasted reading of 52.7. The positive reading illustrates further improvement in EU’s economy while changing investor’s sentiment towards bullish for the currency.

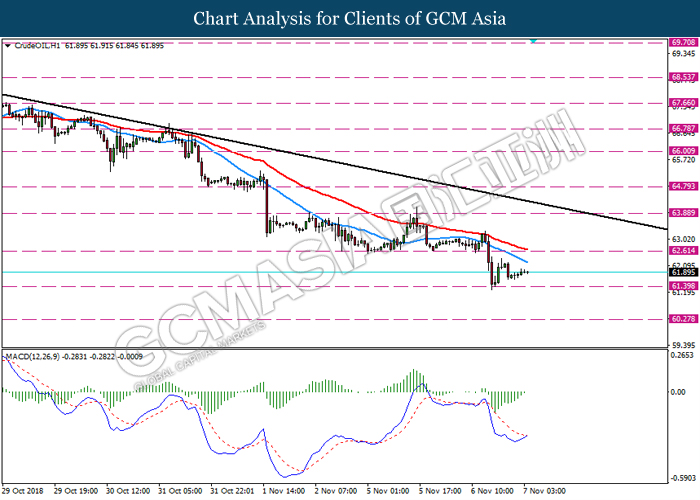

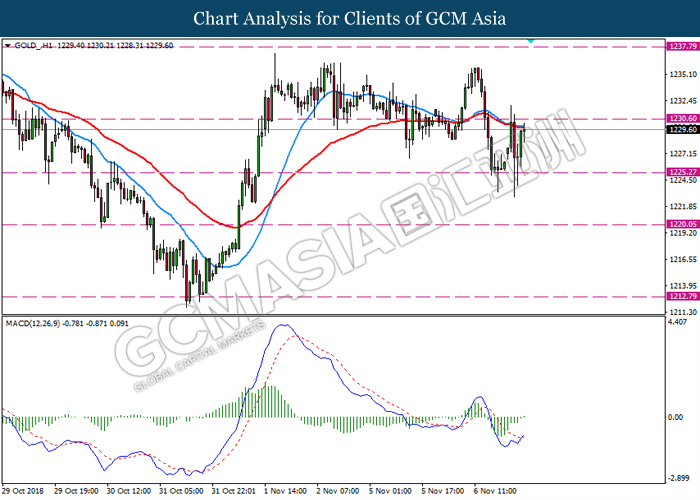

As for commodities market, crude oil price has rebound from lows by 0.31% to $61.99 per barrel. However, its recovery remains limited amid Iran sanction waiver that has been granted 8 countries such as China, India and South Korea. On the other hand, gold price extends its gains by 0.22% to $1,229.58 a troy ounce following dollar’s weakness caused by uncertainty in the mid-term election.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

04:00 (8th) NZD RBNZ Rate Statement

05:00 NZD RBNZ Press Conference

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German Industrial Production (MoM) (Sep) | -0.3% | 0.1% | – |

| 18:00 | EUR – Retail Sales (MoM) (Sep) | -0.2% | 0.1% | – |

| 23:00 | CAD – Ivey PMI (Oct) | 50.4 | 50.9 | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 3.217M | 2.433M | – |

| 04:00 (8th) | NZD – RBNZ Interest Rate Decision | 1.75% | 1.75% | – |

Technical Analysis

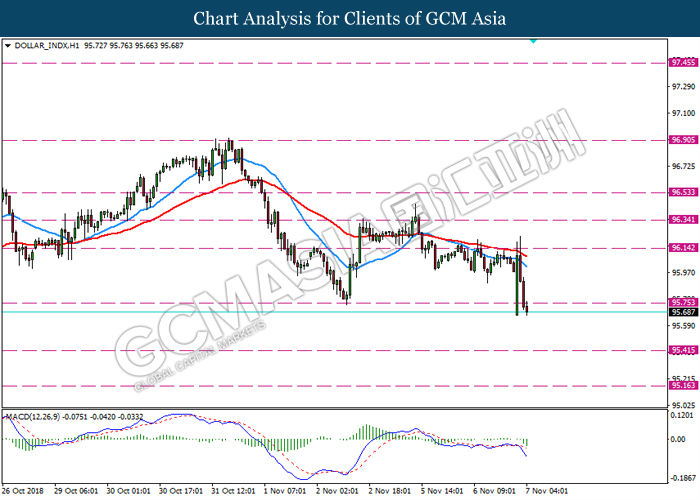

DOLLAR_INDX, H1: Dollar index was traded lower following a breakout below the previous support 95.75. MACD which illustrate bearish momentum signal with death cross suggest the dollar to extend its losses towards the support level 95.40.

Resistance level: 96.15, 96.35

Support level: 95.40, 95.15

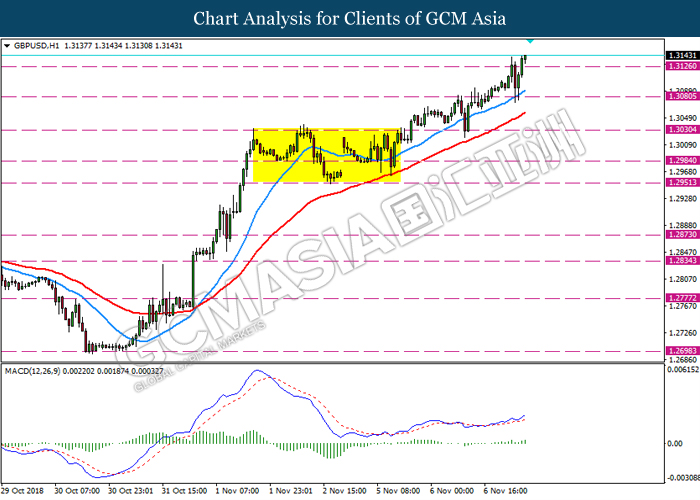

GBPUSD, H1: GBPUSD was traded higher following a breakout above previous resistance level 1.3125. MACD which illustrate persistent bullish momentum suggest the pair to extend its gains towards the resistance level 1.3175.

Resistance level: 1.3175, 1.3275

Support level: 1.3125, 1.3080

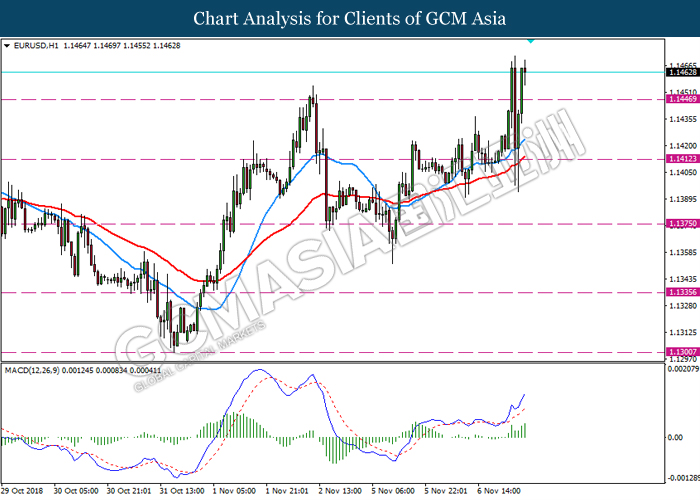

EURUSD, H1: EURUSD was traded higher following breakout above the previous resistance level 1.1445. MACD which illustrate continuous bullish momentum suggest the pair to extend its gains towards the resistance level 1.1485.

Resistance level: 1.1485, 1.1540

Support level: 1.1445, 1.1410

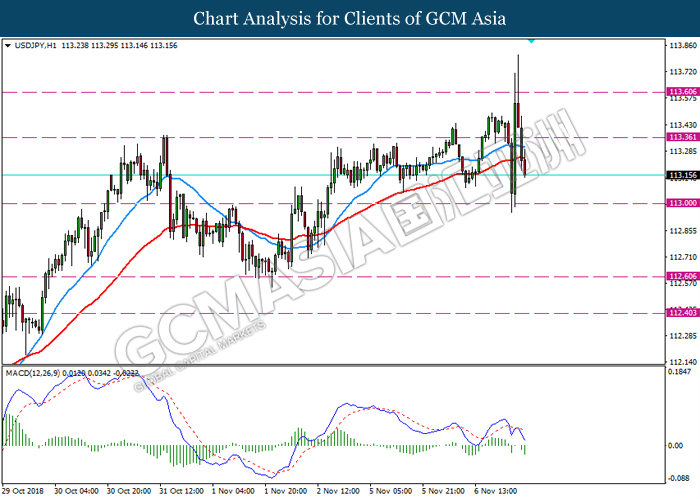

USDJPY, H1: USDJPY was traded lower following breakout below the previous support level 113.35. MACD which display bearish momentum with formation of death cross suggest the pair to extend its losses towards the support level 113.00.

Resistance level: 113.35, 113.60

Support level: 113.00, 112.60

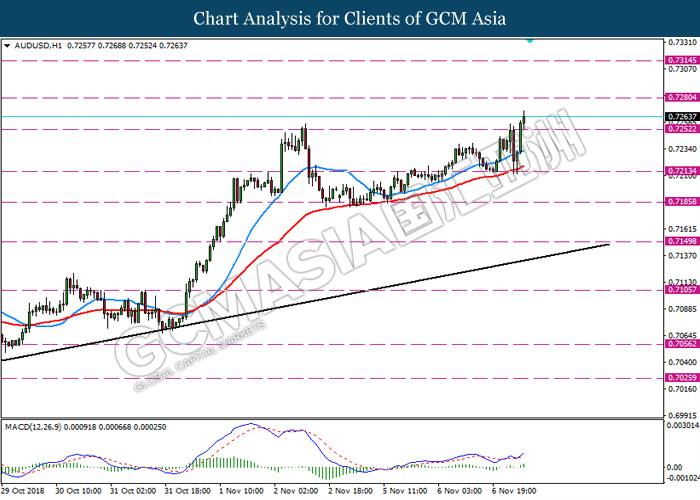

AUDUSD, H1: AUDUSD was traded higher following a breakout above the previous resistance level 0.7250. MACD which illustrate bullish signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.7280.

Resistance level: 0.7280, 0.7315

Support level: 0.7250, 0.7215

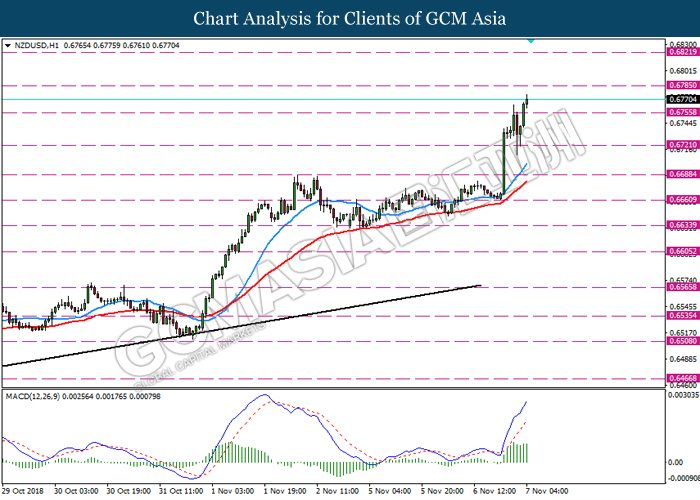

NZDUSD, H1: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6755. MACD which shows persistent bullish momentum suggests the pair to extend its gains towards resistance level 0.6785

Resistance level: 0.6785, 0.6820

Support level: 0.6755, 0.6720

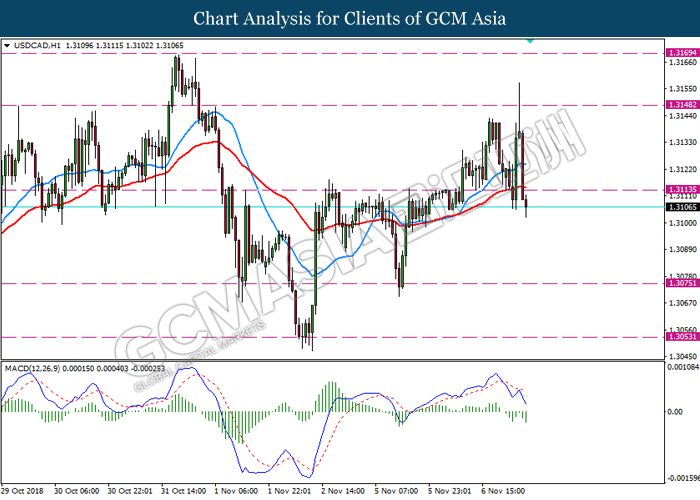

USDCAD, H1: USDCAD was traded lower following recent breakout below the previous support level 1.3115. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.3075.

Resistance level: 1.3115, 1.3150

Support level: 1.3075, 1.3055

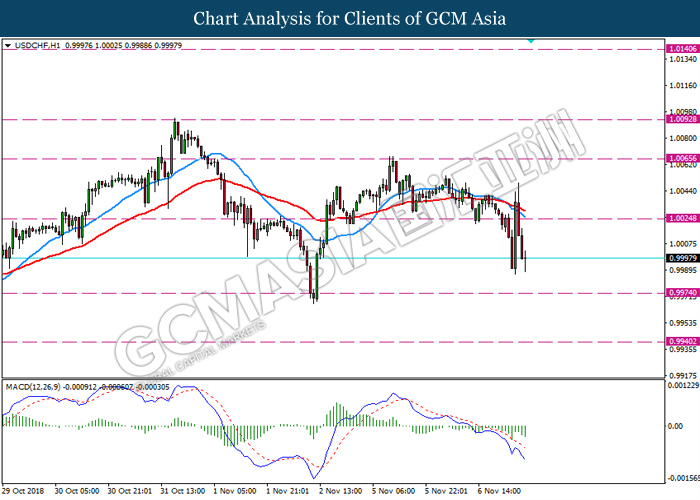

USDCHF, H1: USDCHF was traded lower following prior breakout below previous support level 1.0025. MACD which illustrate persistent bearish signal suggest the pair to extend its losses towards the support level 0.9975.

Resistance level: 1.0025, 1.0065

Support level: 0.9975, 0.9940

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from support level 61.40. MACD which bullish signal with the starting formation of golden cross suggest the pair to extend its rebound towards the resistance level 62.60.

Resistance level: 62.60, 63.90

Support level: 61.40, 60.25

GOLD_, H1: Gold price was traded higher following prior rebound from support level 1225.25. MACD which illustrate bullish momentum with formation of golden cross suggest the pair to extend its rebound in short term towards the resistance level 1230.60

Resistance level: 1230.60, 1237.80

Support level: 1225.25, 1220.00