7 November 2022 Afternoon Session Analysis

Pound Sterling revived upon US labor market weakened.

The GBP/USD, which widely traded by majority of investors rebounded from its recent low on last Friday after the US Unemployment Rate had unexpectedly rose higher than market forecast, which hinted that the current US labor market remained fragile. Thus, it dialed down the market optimism toward economic progression in the US while prompting investors to flee away from the US currency market. Besides that, the gains experienced by Pound Sterling was extended amid the upbeat economic data from UK. According to Markit/CIPS, the UK Construction Purchasing Managers Index (PMI) in October has notched up from the previous reading of 52.3 to 53.2, exceeding the consensus expectation of 50.5. The higher-than-prior data has shown the expansion in the UK construction sector, which brought positive prospects toward UK economic outlook. At this juncture, the market participants would highly focus on the UK GDP data which scheduled on Friday as it can provide more views on upcoming BoE rate hike decisions. As of writing, GBP/USD eased by 0.40% to 1.1330.

In the commodities market, the crude oil price dropped by 1.37% to $91.31 per barrel as of writing after China government claimed that it would less likely to loosening its zero-Covid policy, which weighed down the market demand on oil. On the other hand, the gold price edged down by 0.01% to $1672.83 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:40 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

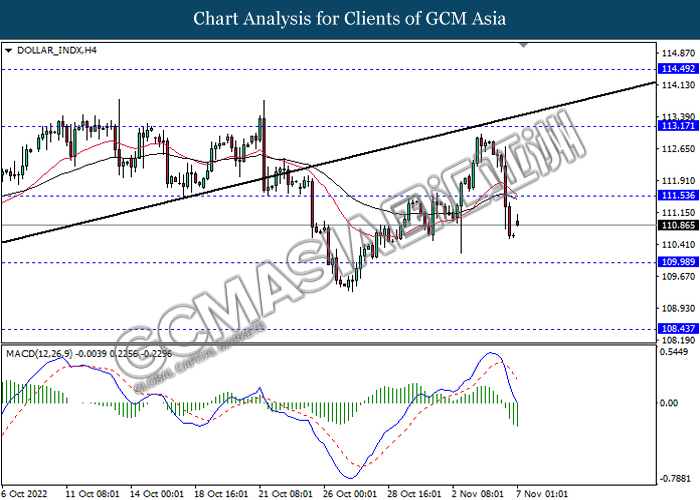

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.1370, 1.1635

Support level: 1.1165, 1.0940

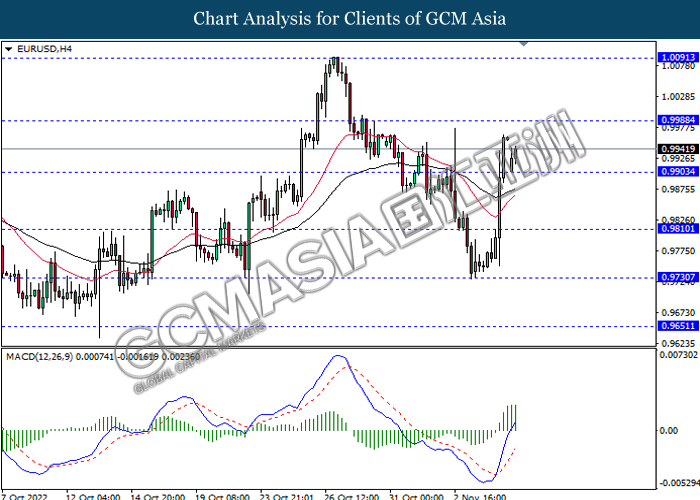

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9990, 1.0090

Support level: 0.9905, 0.9810

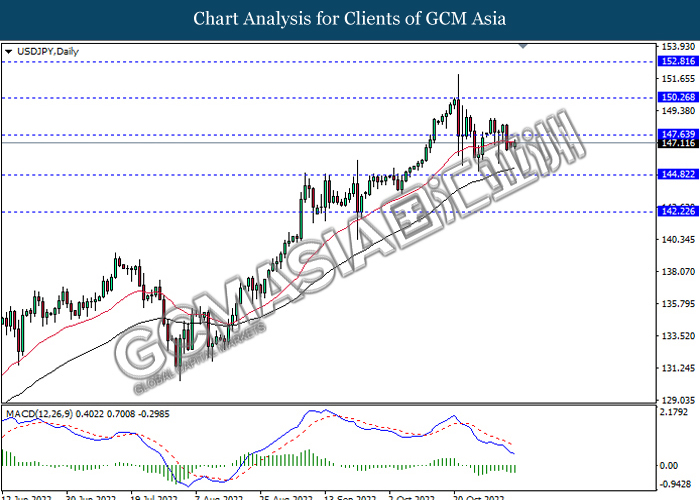

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

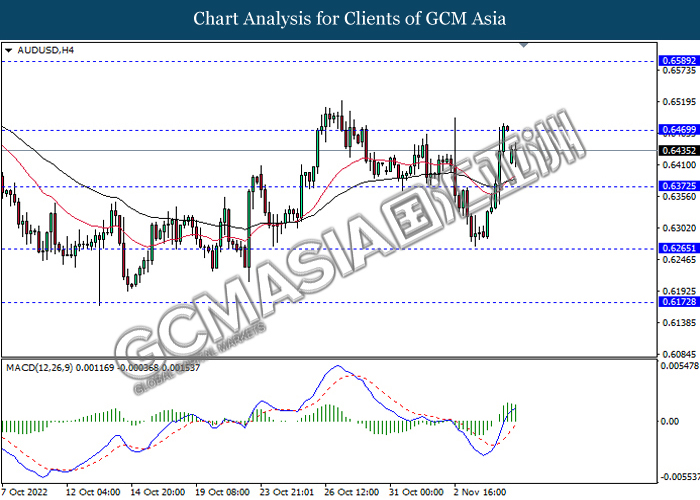

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

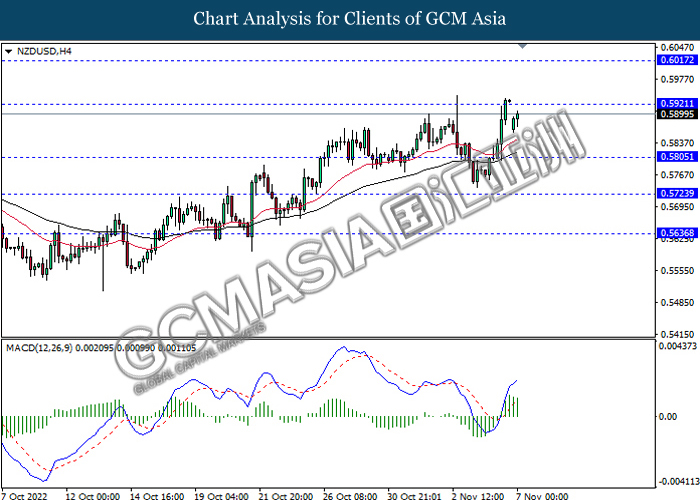

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

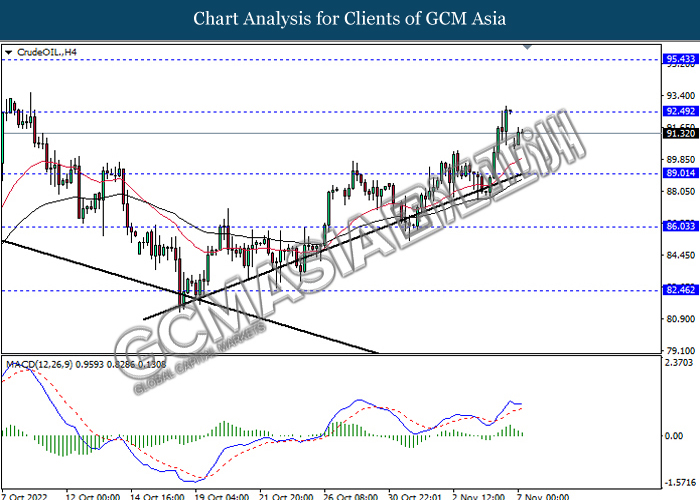

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 92.50, 95.45

Support level: 89.00, 86.05

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1677.85, 1699.70

Support level: 1655.60, 1633.35