7 November 2022 Morning Session Analysis

Greenback slumped following the release of mixed labor data.

The dollar index, which gauges its value against a basket of six major currencies, plunged as the US labor market showed a mixed result last Friday. According to the Bureau of Labor Statistics, the US Nonfarm Payrolls came in at 261K, stronger than the consensus forecast at 200K, showing that huge job creation is happening in the world’s largest economy. However, the market optimism was pared off after the market participants digested the jobs report and paid more attention to the unemployment rate data. Surprisingly, the unemployment rate in the US rose to 3.7% from September’s 3.5%, suggesting some sign of loosening in the US labor market. With these backdrops, the investors took it negatively while recking that the Federal Reserve shift toward a conservative rate hike path, whereby a smaller interest rate increase would happen in December. As of writing, the dollar index dropped 1.90% to 110.80.

In the commodities market, the crude oil price edged up by 0.10% to $92.55 per barrel as the G7 allies’ sanctions on Russian oil go into effect in almost a month, which is largely expected to curtail Russia’s oil exports. Besides, the gold price rose by 0.05% to $1681.15 per troy ounce amid the dollar’s weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:40 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

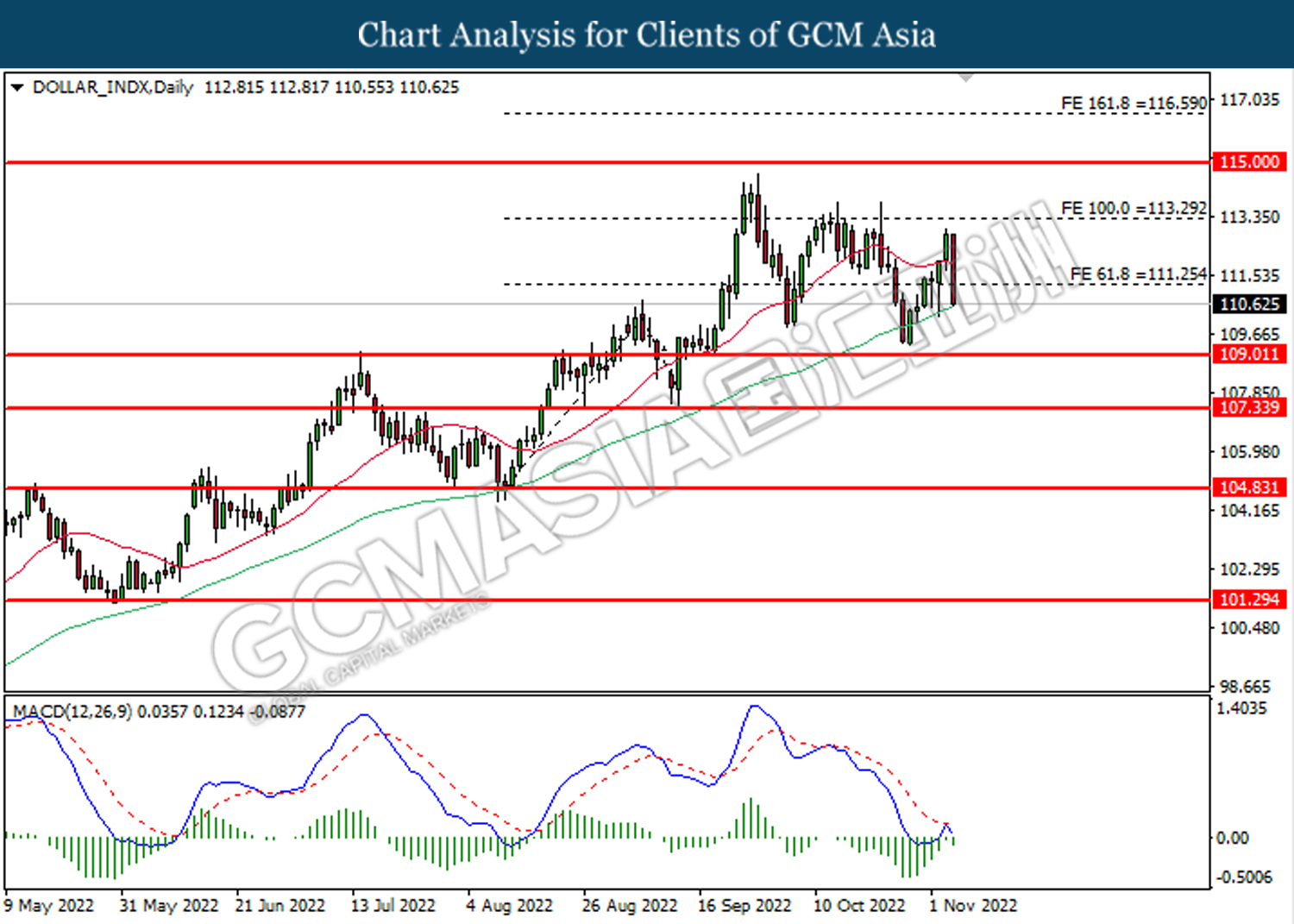

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 109.00.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

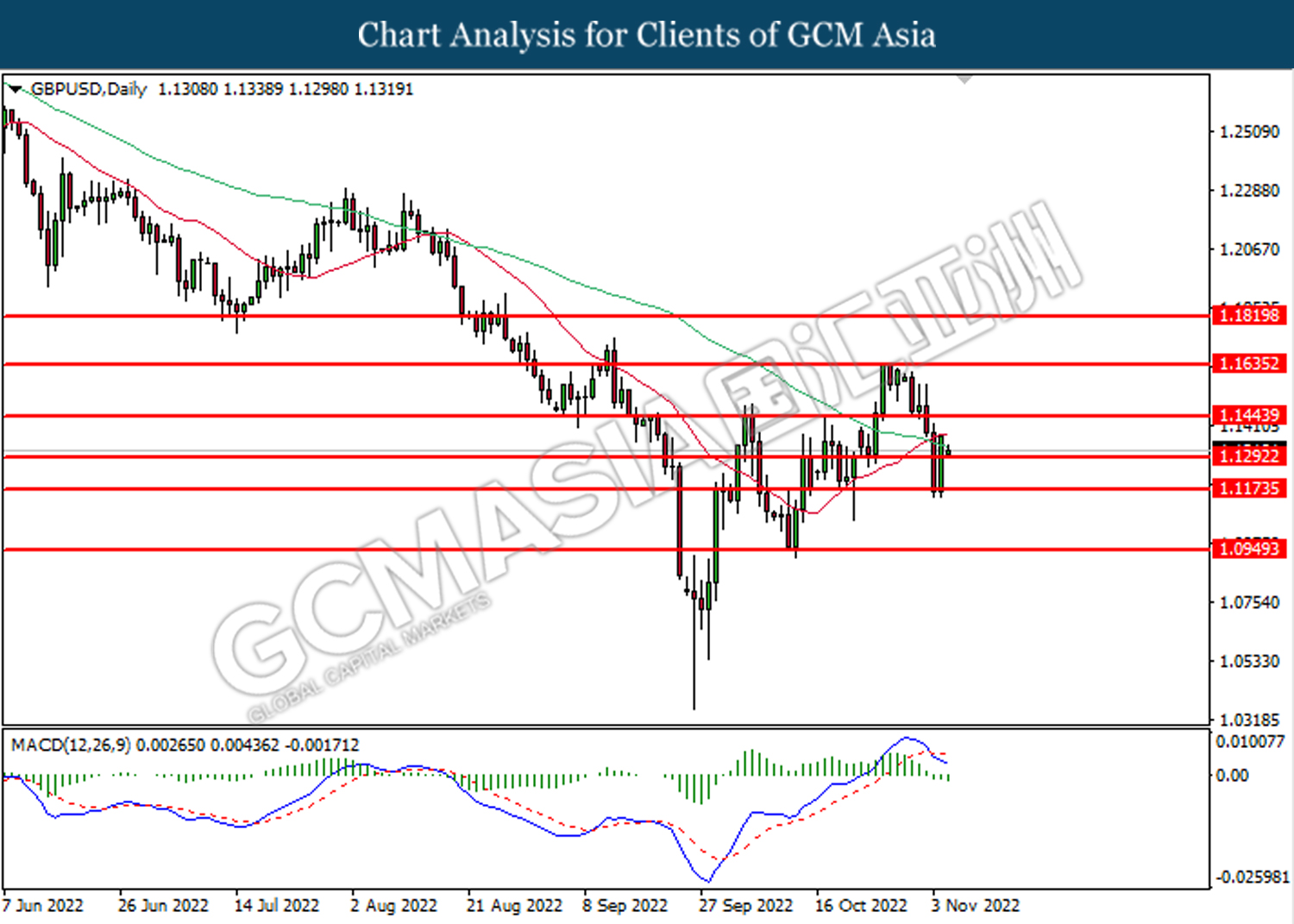

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1290. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.1445, 1.1635

Support level: 1.1290, 1.1175

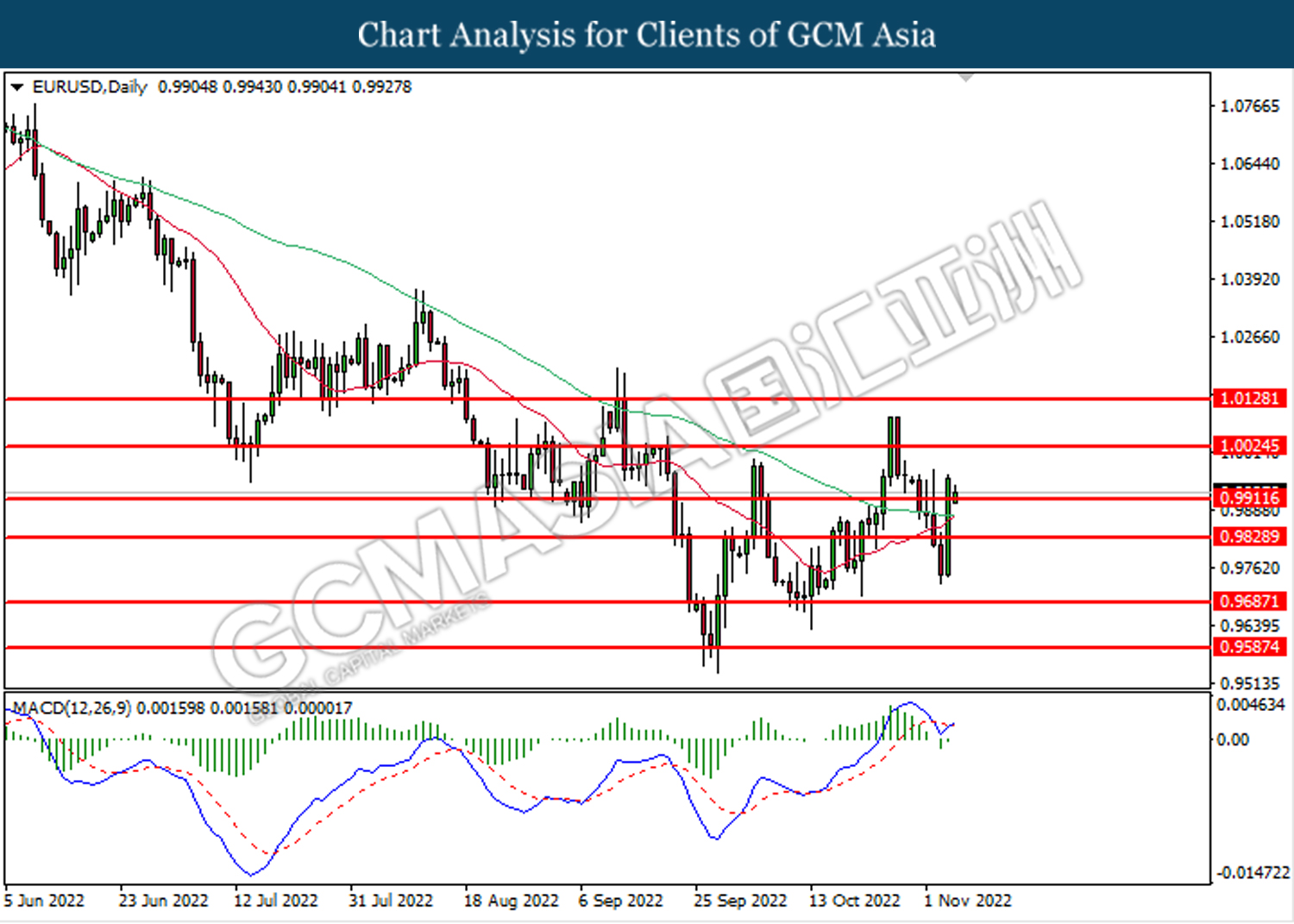

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9910. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9910, 0.9830

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

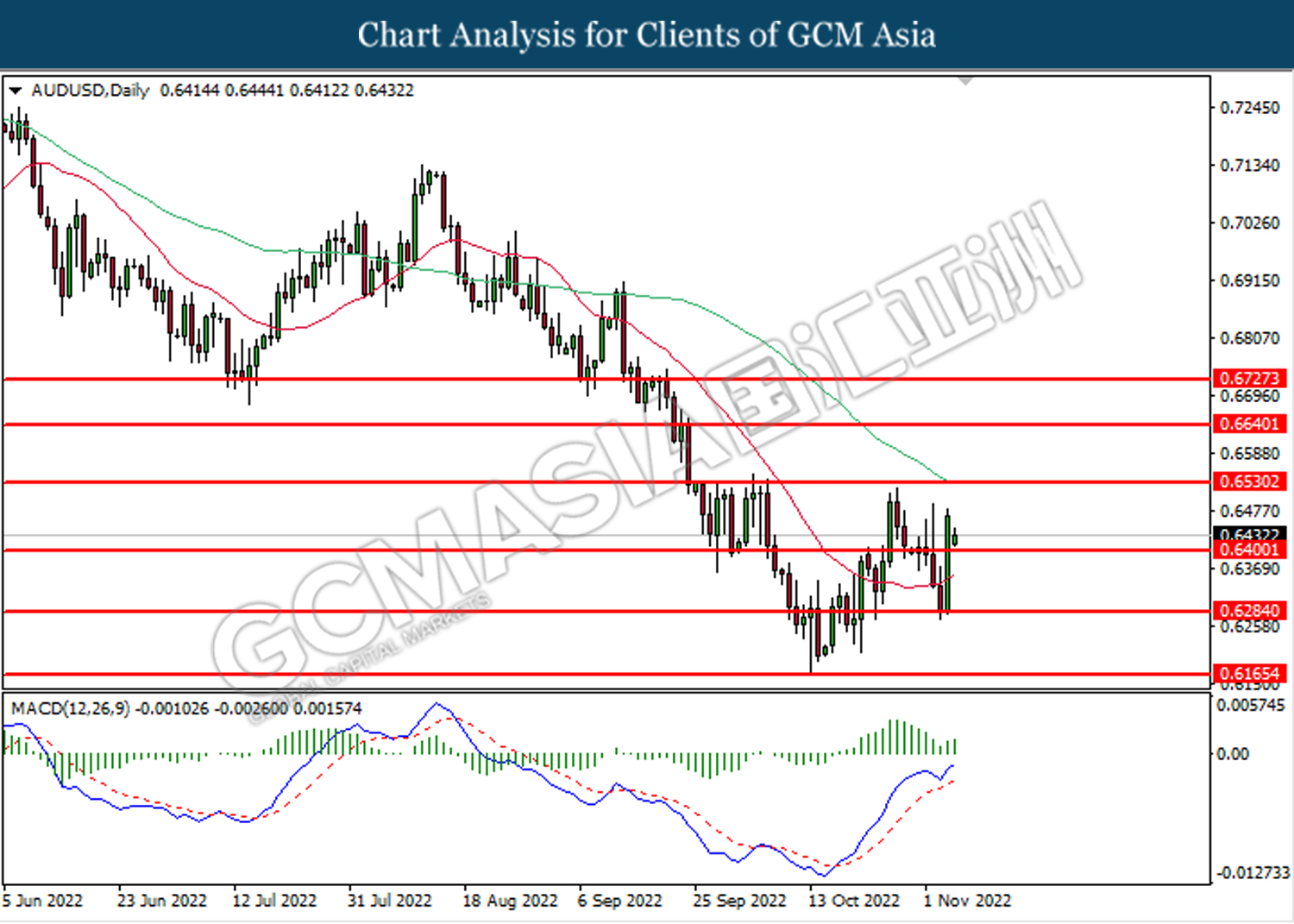

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6530.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

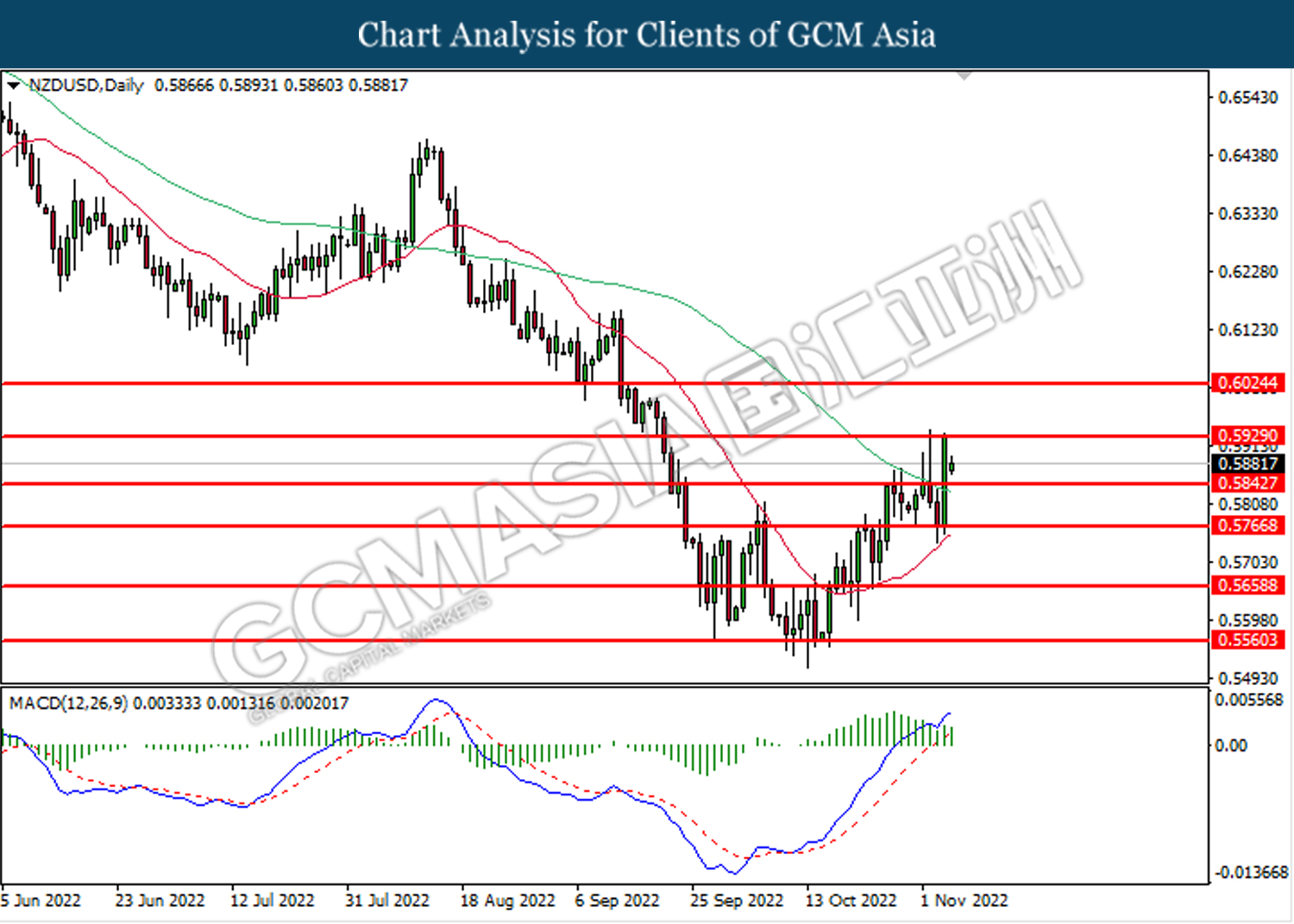

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5845. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.5930.

Resistance level: 0.5930, 0.6025

Support level: 0.5845, 0.5765

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3505. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3505.

Resistance level: 1.3600, 1.3715

Support level: 1.3505, 1.3400

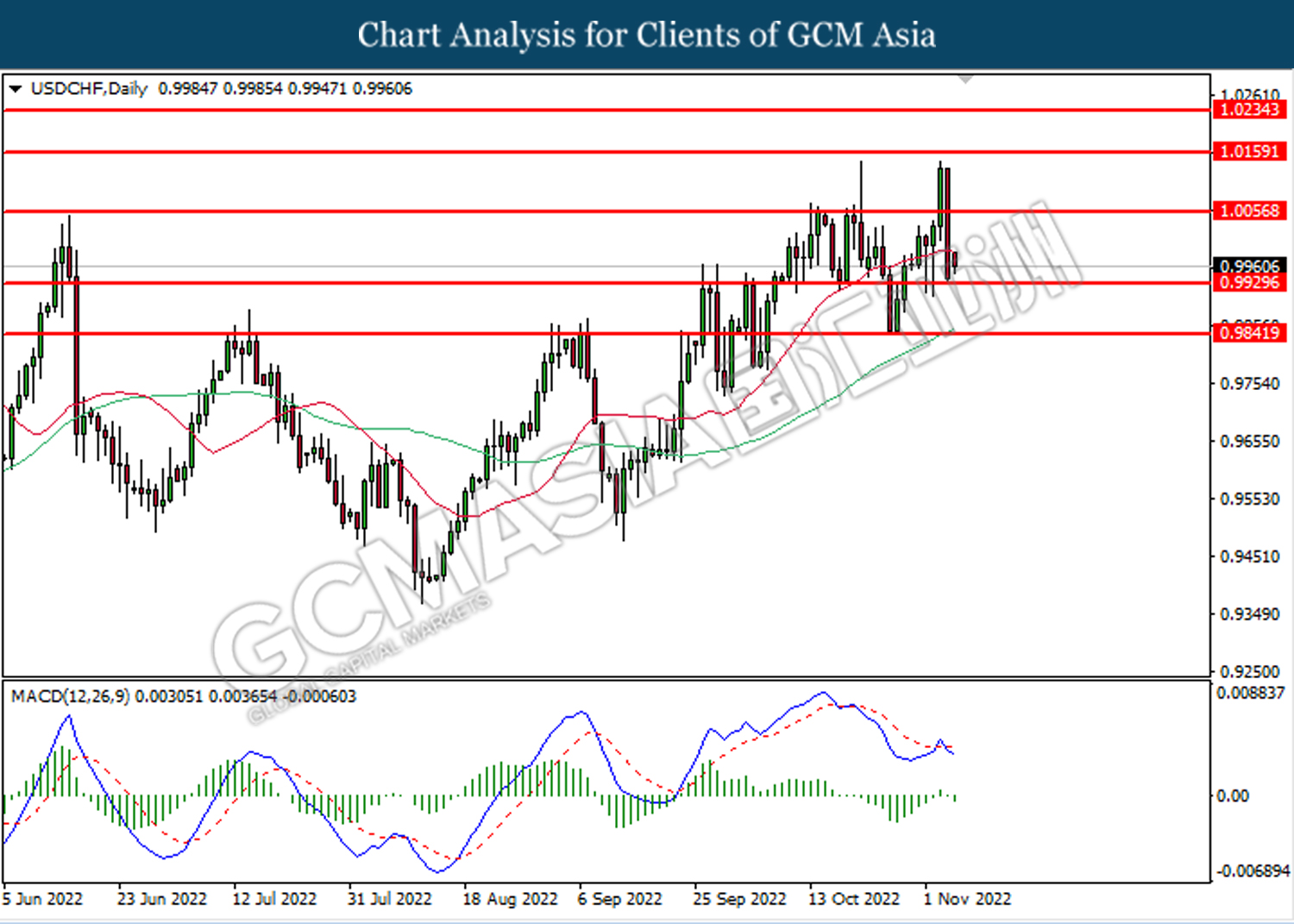

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9930. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

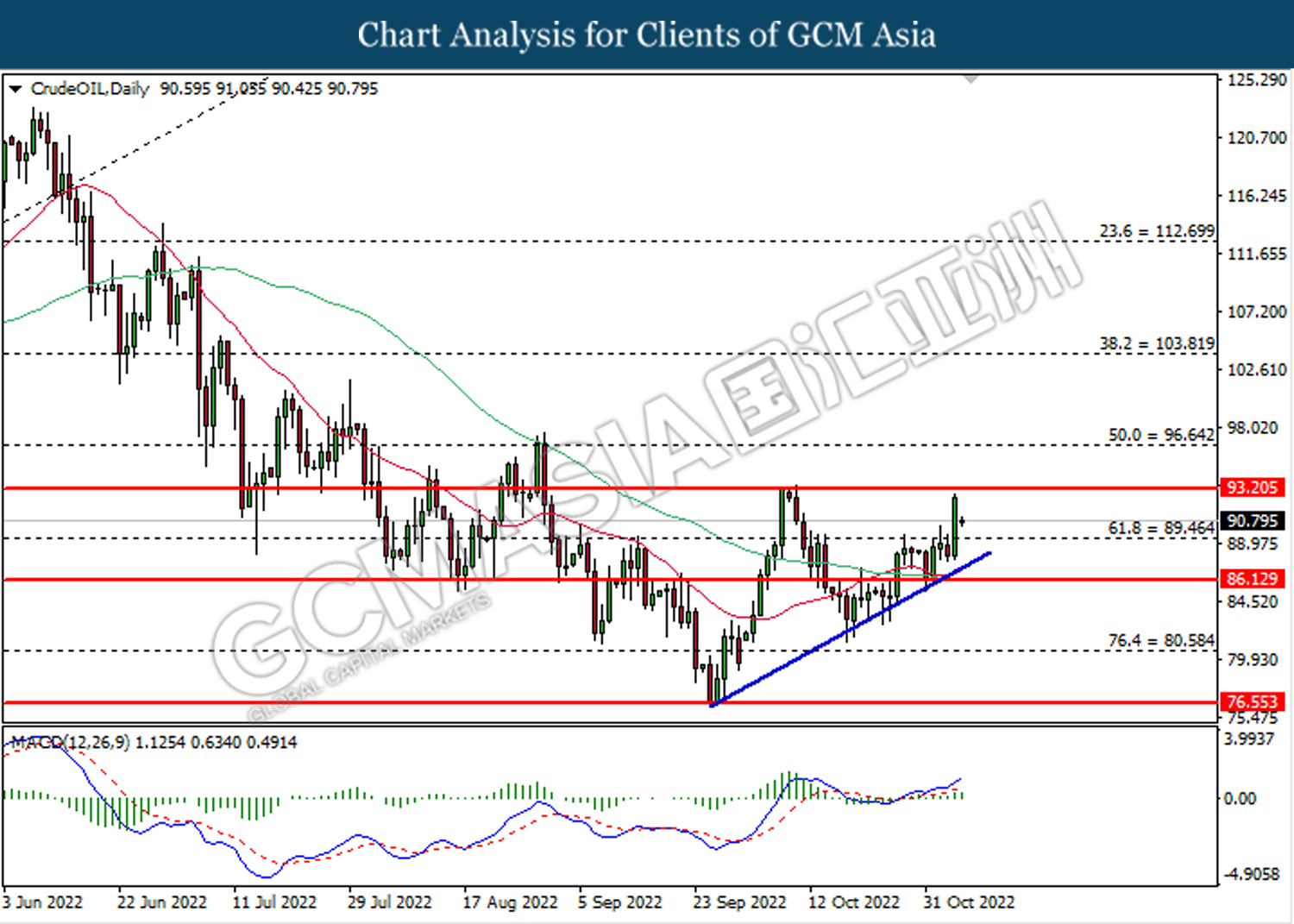

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 93.20.

Resistance level: 93.20, 96.65

Support level: 89.45, 86.15

GOLD_, Daily: Gold price was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the trend line.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60