08 February 2022 Afternoon Session Analysis

Euro Maintains Its Strong Rally.

Euro extended into correction after strong rally from strong data released from US nonfarm payrolls last week. Nonetheless, Euro is still maintaining its bullish position in overall after Italy’s 10-year bond yields rose 23 basis points to 1.64%, highest since May 2020, as well as Germany’s 10-year bond yields jumped 12 basis points to 0.15%, the highest since 2019. With this, investors have higher confidence in riskier securities, thereby speeding up the decision for a rate hike. Furthermore, ECB President Christine Lagarde’s unexpected hawkish statement along with the pressure of inflation and treasury yields increase strengthened the expectations for a rate hike which causes the Euro to consolidate at the upper level. Nonetheless, market participants will be monitoring updates on CPI data and US monetary policy statement in order to gauge the potential movement on the pair. As of writing, EURUSD dropped to 1.1429.

For the commodities market, crude oil prices were down by 0.2% to $91.20 per barrel, signaling a correction after a strong spike due to supply shortage. On the other hand, gold price was up by 0.03% to $1822.40 per troy ounce due to weaker US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

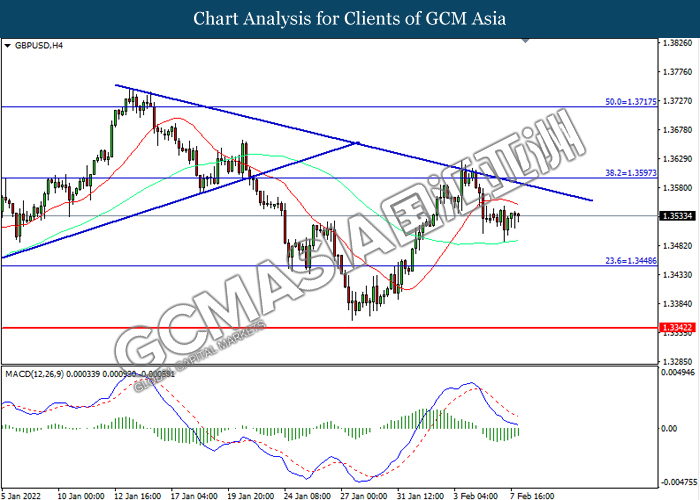

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3450.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

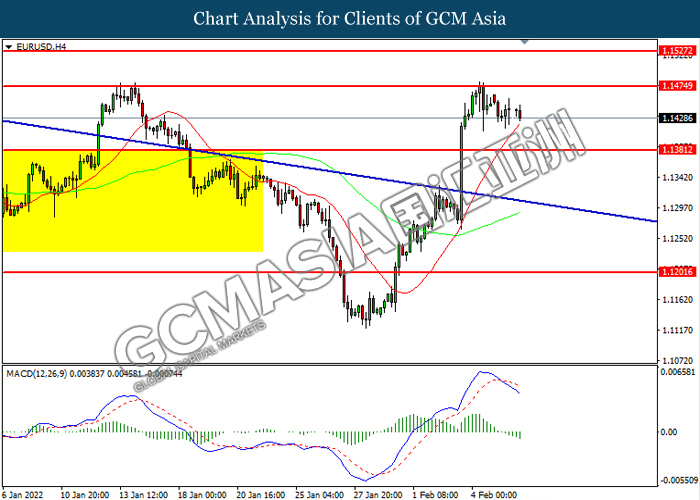

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1380.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1200

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.35, 116.25

Support level: 113.65, 112.85

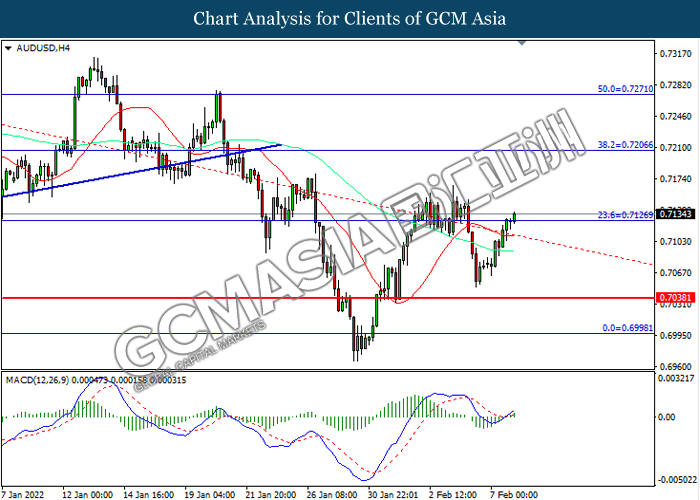

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7125, 0.7205

Support level: 0.7040, 0.7000

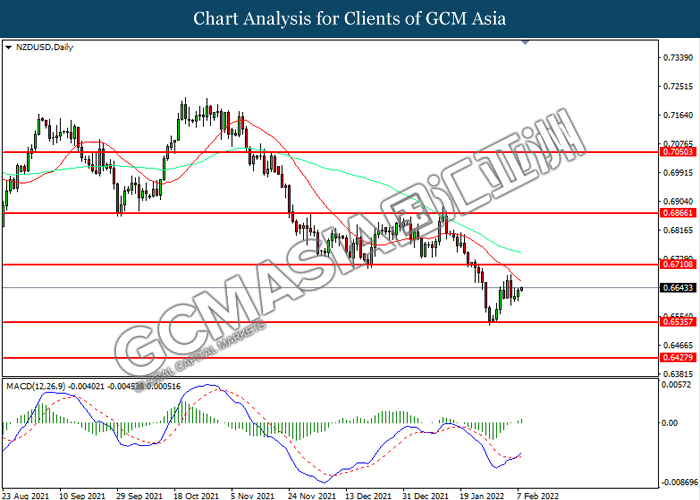

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6535. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

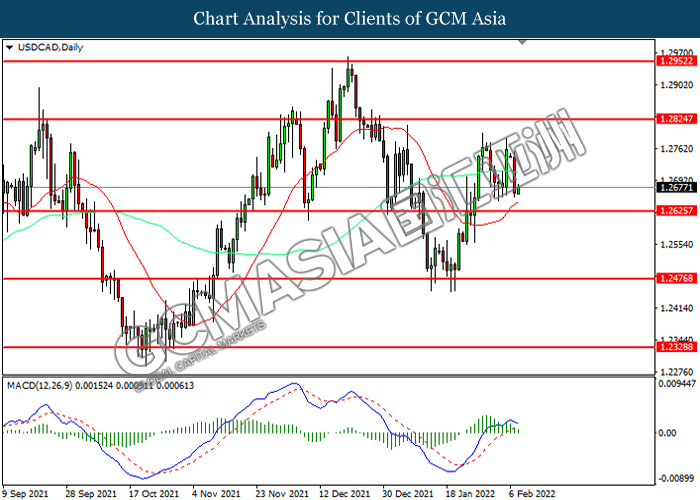

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

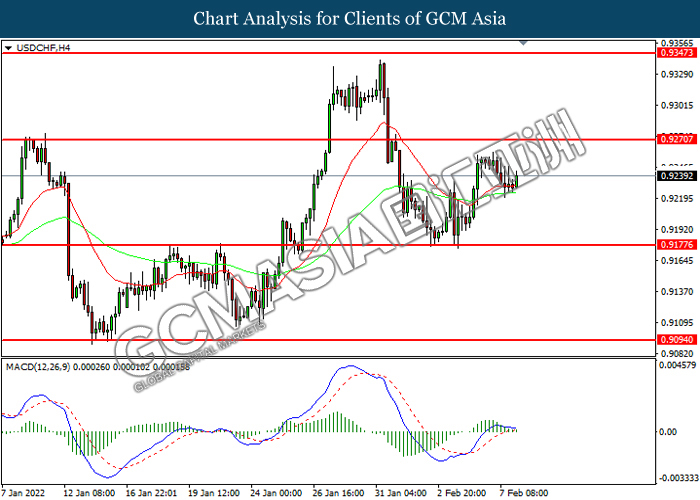

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level at 92.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 88.55.

Resistance level: 92.80, 97.75

Support level: 88.55, 84.25

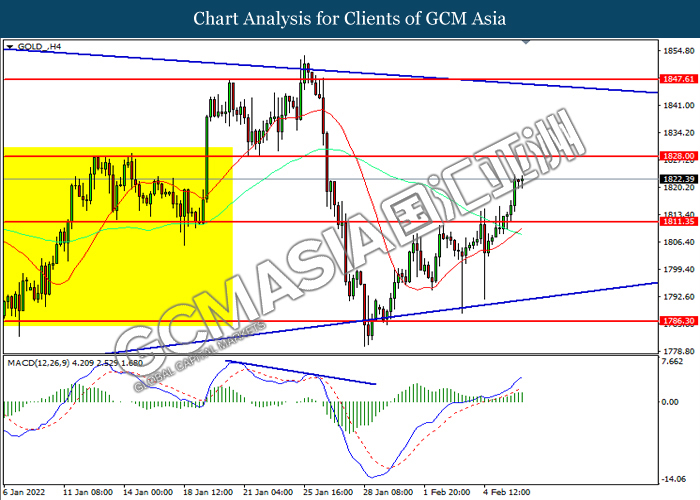

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1828.00. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1828.00, 1847.60

Support level: 1811.35, 1786.30