8 February 2022 Morning Session Analysis

Investors waits for US CPI data.

Greenback was traded flat during Asian trading session as investors waits for the release of Consumer Price Index data due this Thursday. Previously, US dollar received a substantial rebound from lower levels after Nonfarm Payrolls came in higher than expected. The data has cemented investors expectation towards Federal Reserve to tighten monetary policy at a faster pace in order to curb rising inflation in the region. During last policy meeting, Fed Chair Jerome Powell commented that there are enough room to initiate subsequent rate hikes if inflation persists at higher levels. According to CME FedWatch Tool, investors are currently pricing in at a 100% chance for an interest rate hike during March policy meeting. As of writing, the dollar index was up 0.01% to 95.35.

In the commodities market, crude oil price was down 0.04% to $91.39 per barrel following possibility of revived talks in between US and Iran with regards to nuclear agreement. On the other hand, gold price was up 0.01% to $1,821.40 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

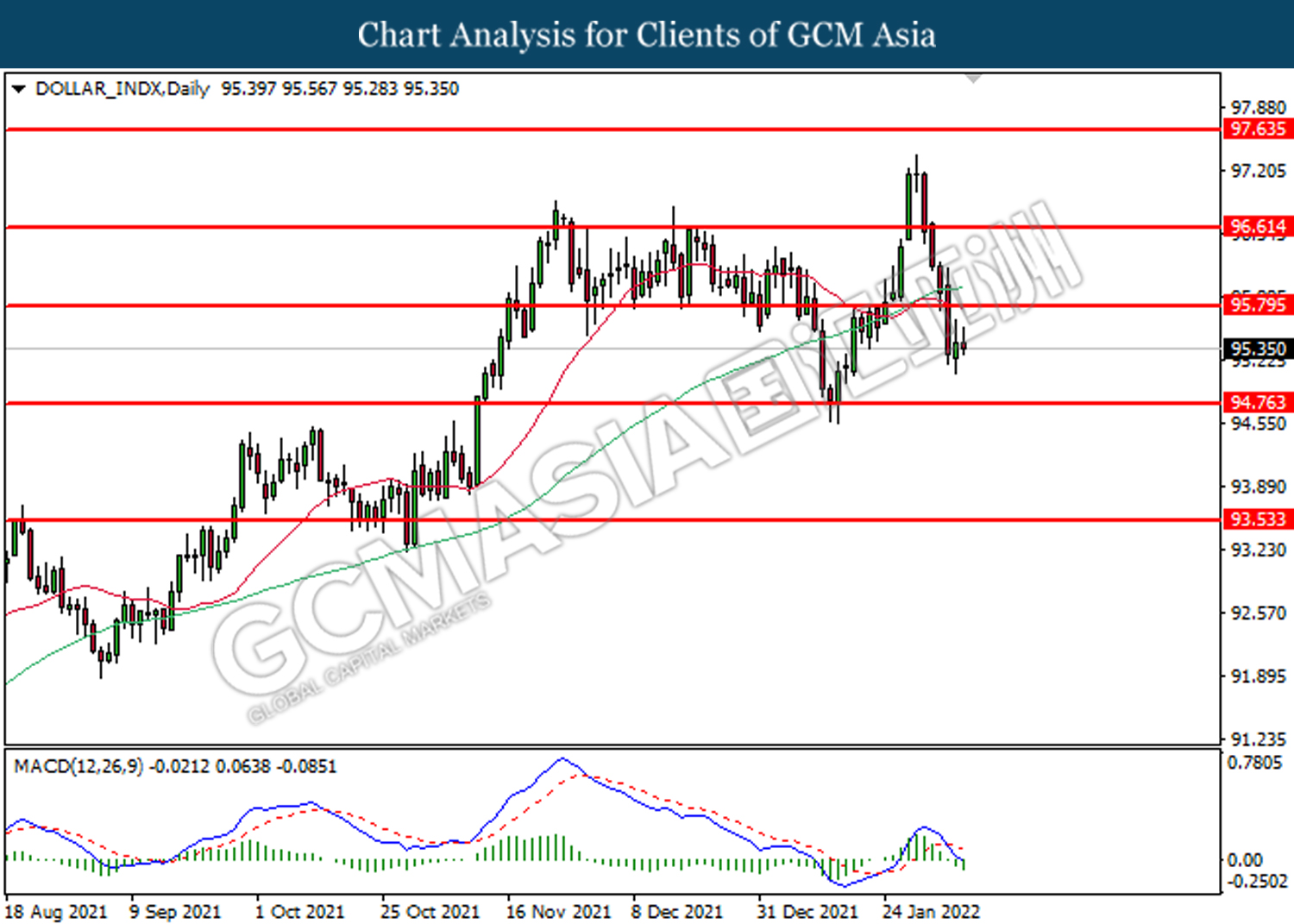

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from higher levels. MACD which illustrate diminished bullish signal suggests the index to be traded lower in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

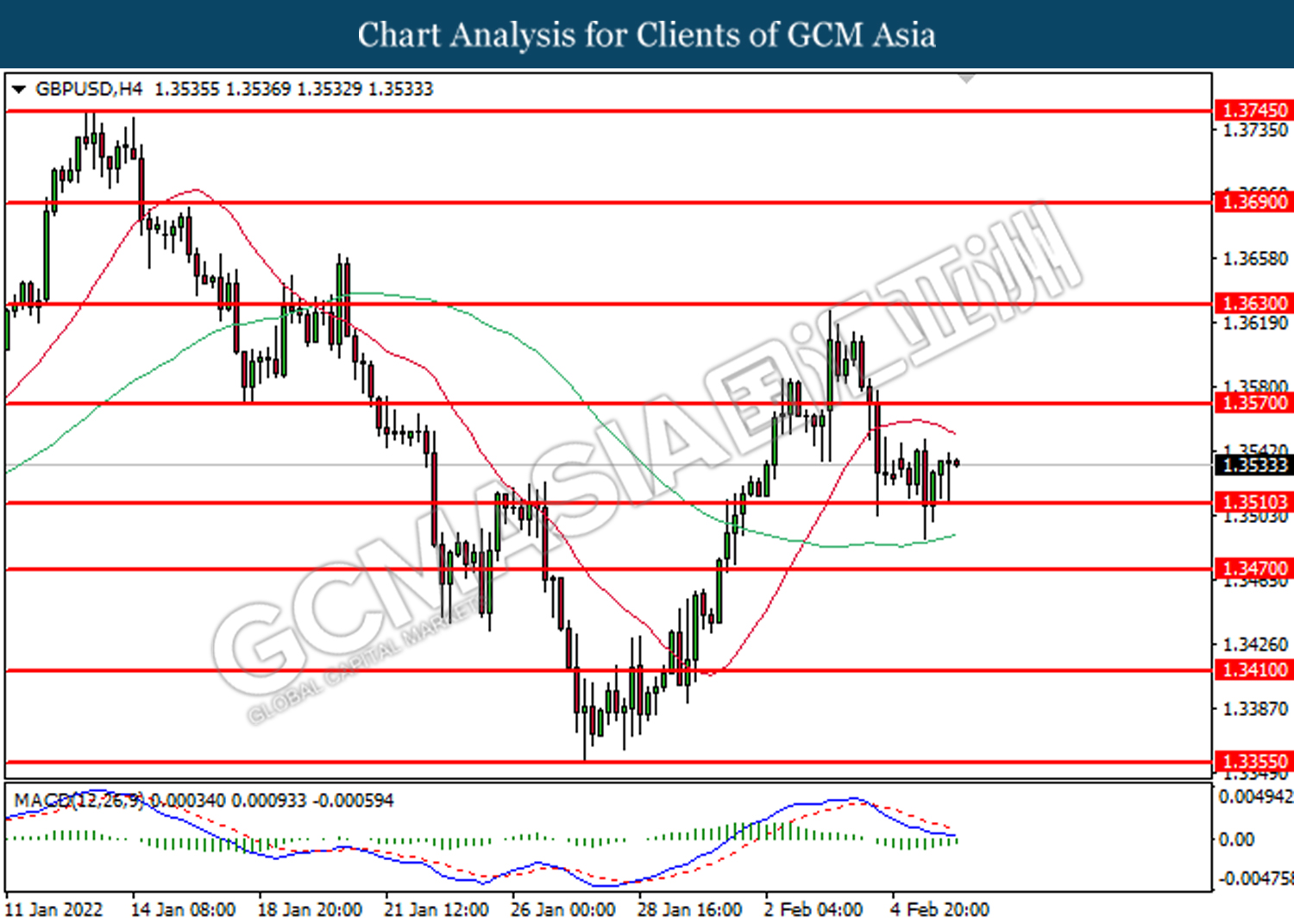

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

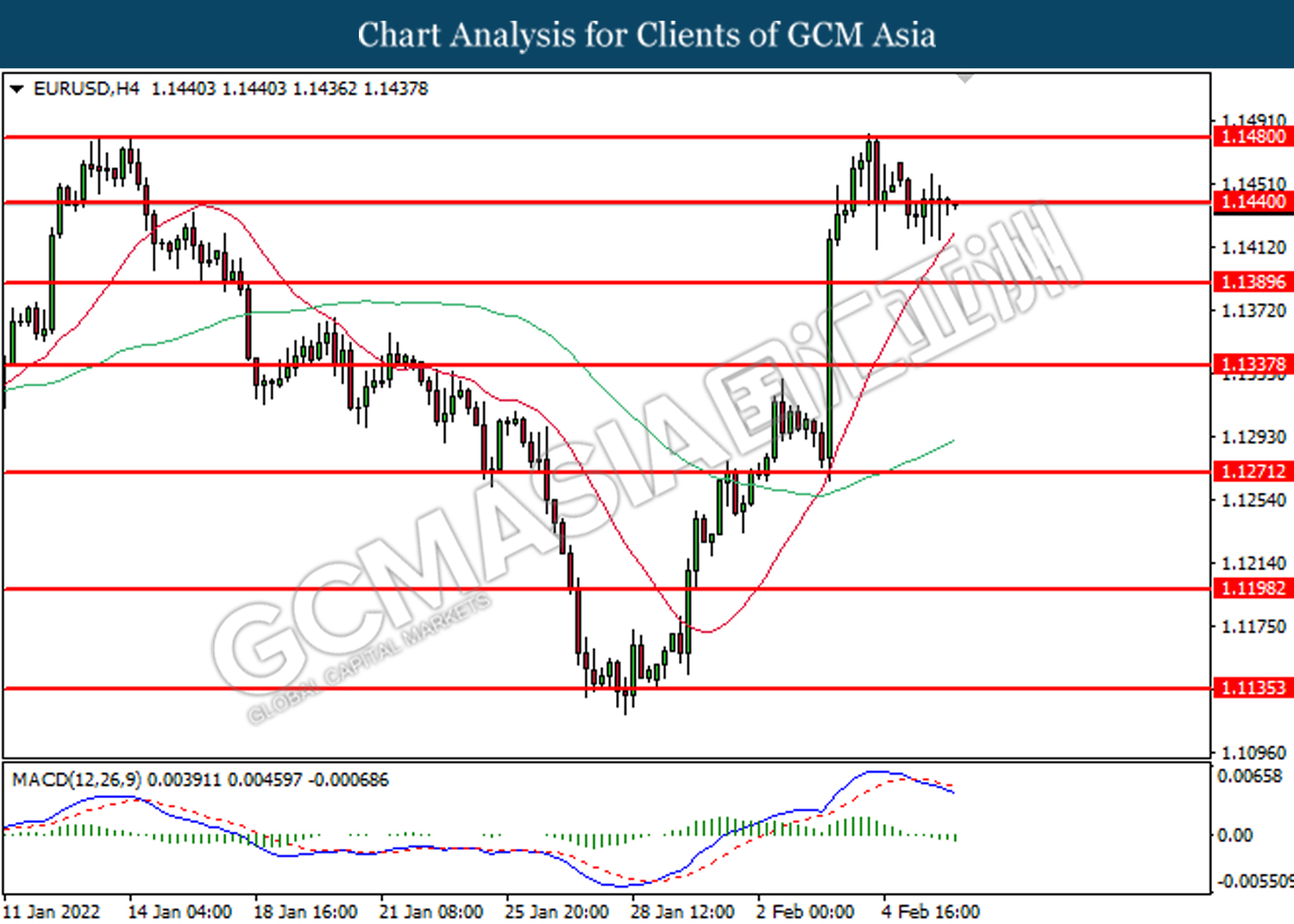

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. MACD which illustrate bearish signal suggests the pair to be traded lower after breaking its support level.

Resistance level: 1.1480, 1.1535

Support level: 1.1440, 1.1390

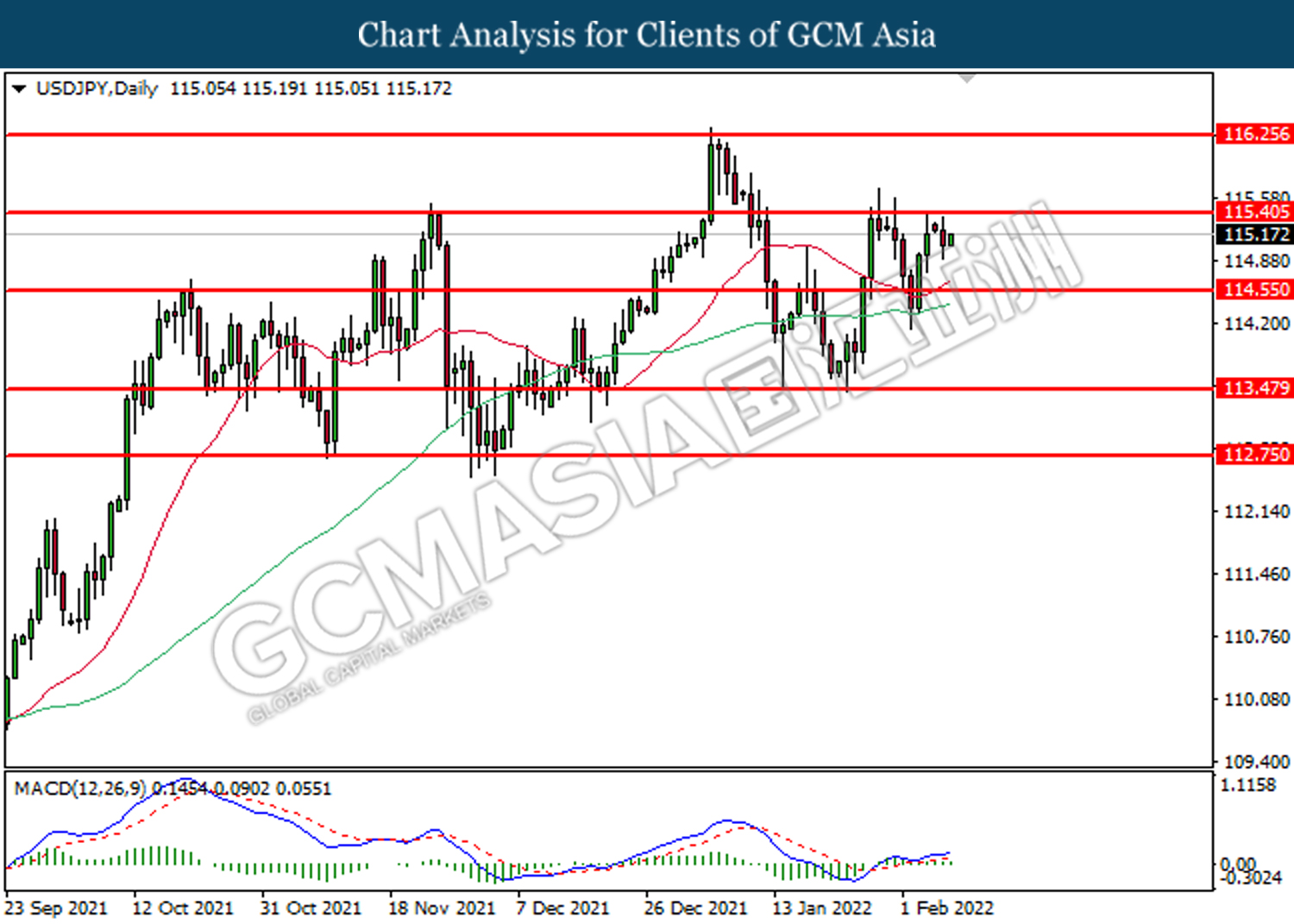

USDJPY, Daily: USDJPY was traded lower following prior retracement from higher level. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 115.40, 116.25

Support level: 114.55, 113.50

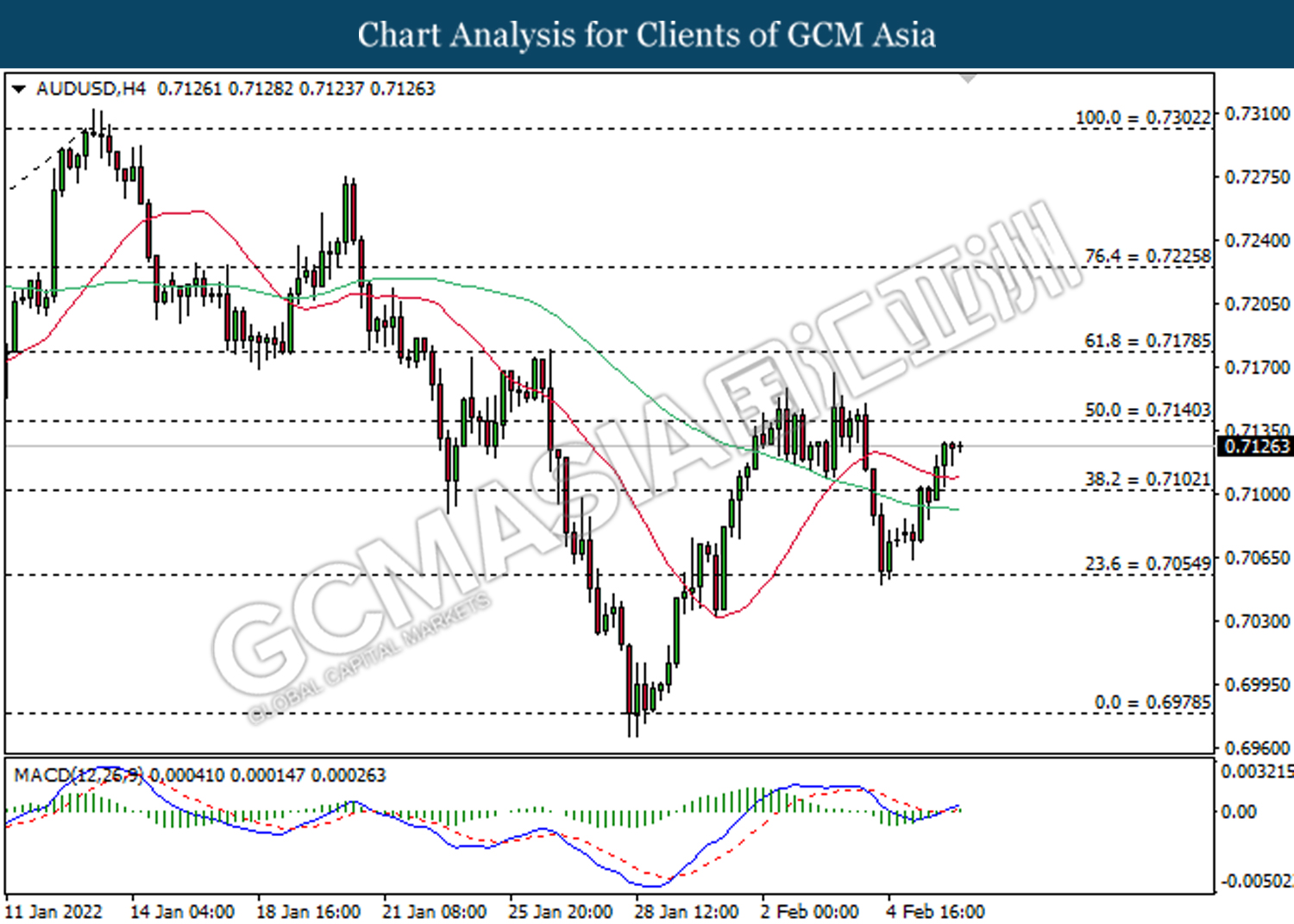

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7140, 0.7180

Support level: 0.7100, 0.7055

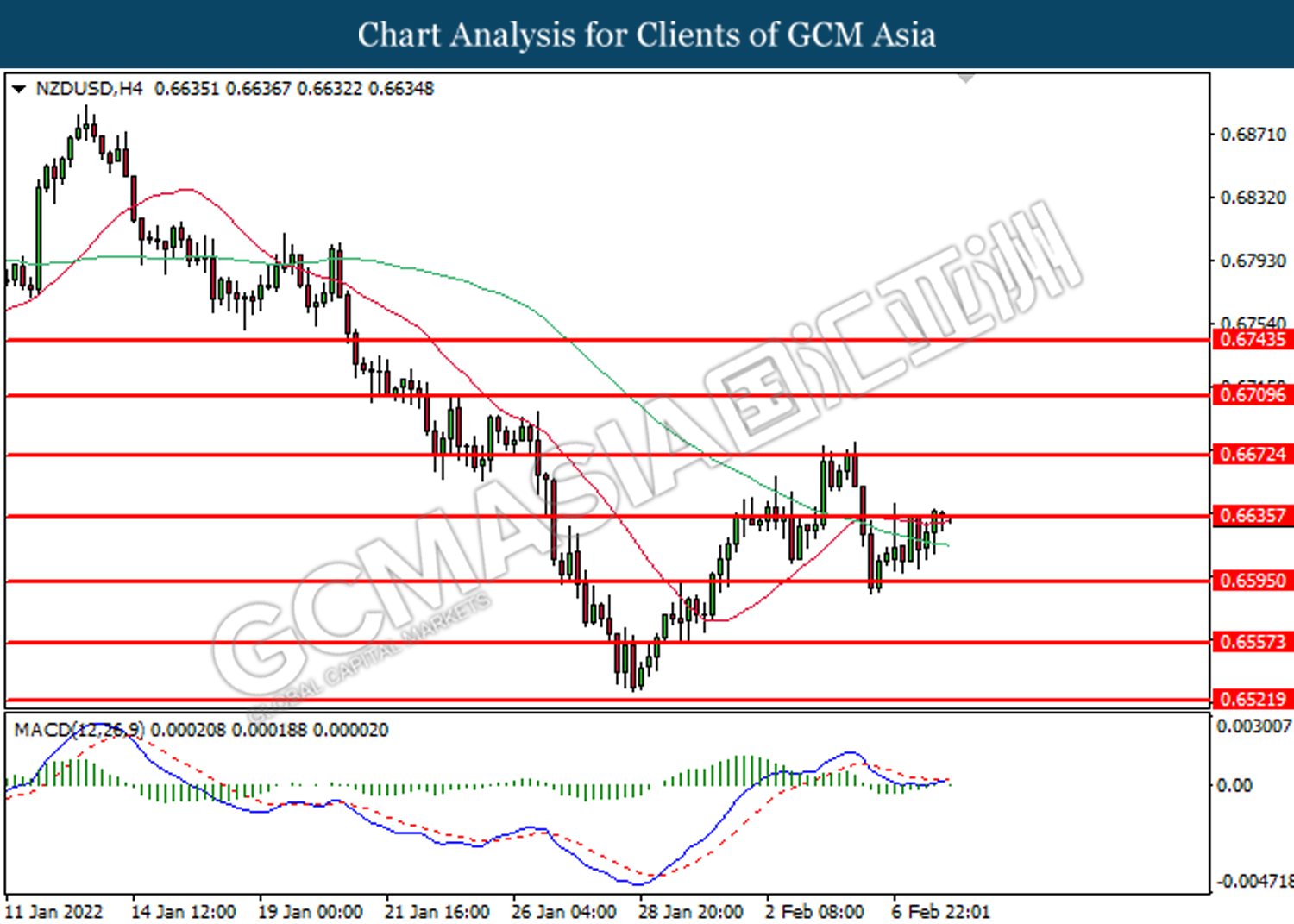

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher after breaking the resistance level.

Resistance level: 0.6635, 0.6670

Support level: 0.6595, 0.6560

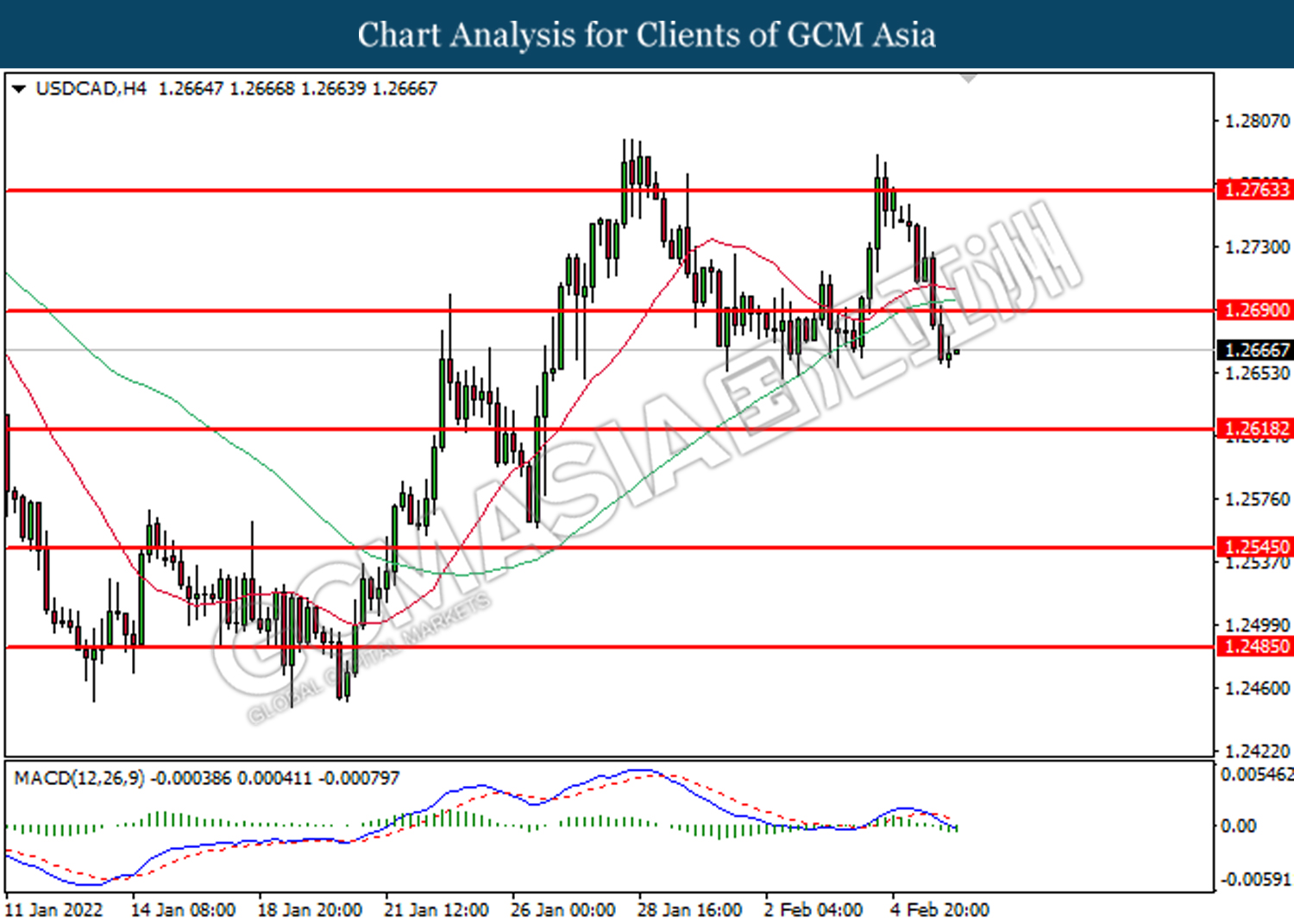

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2690, 1.2765

Support level: 1.2620, 1.2545

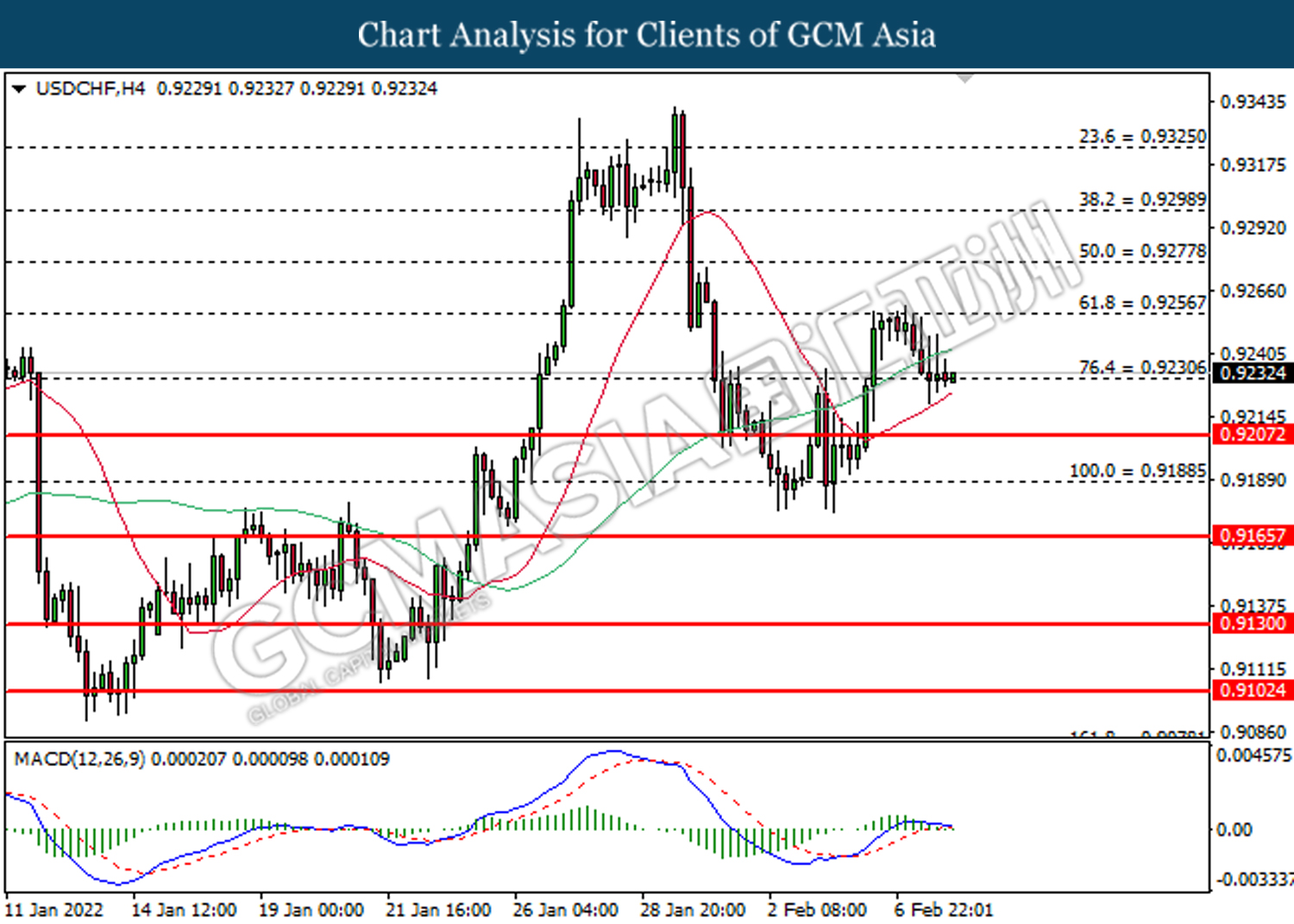

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from higher levels. MACD which illustrate bearish signal suggests its price to be traded lower in short-term.

Resistance level: 93.15, 96.30

Support level: 91.00, 89.50

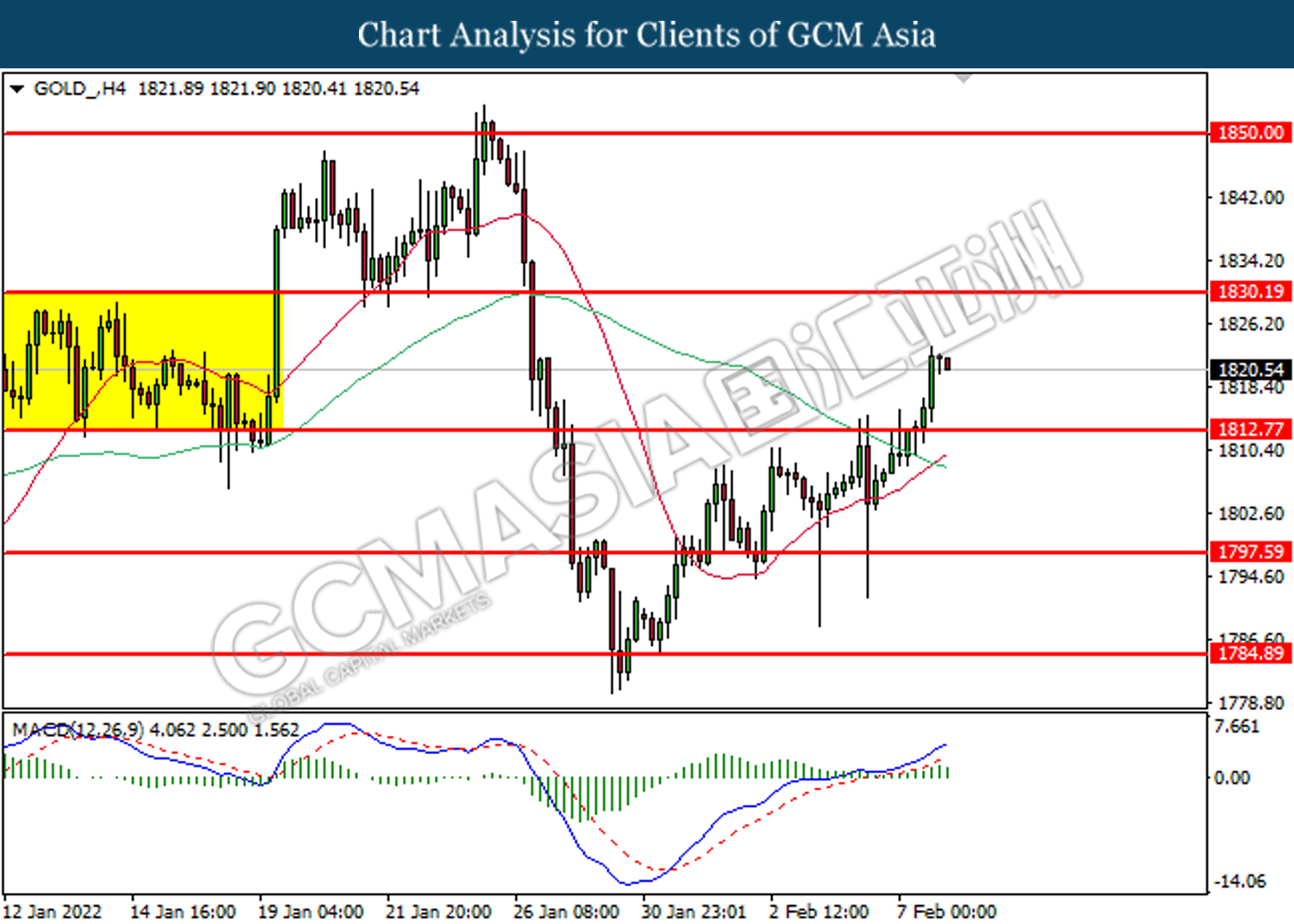

GOLD_, H4: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60