08 February 2023 Morning Session Analysis

US dollar slips amid less-hawkish comment from Powell.

The dollar index, which traded against a basket of mainstream currencies, was teetering on the brink of collapse following the disinflation comment from the Chairman of Federal Reserve, Jerome Powell. Early morning today, Jerome Powell reinstated his disinflation comment, emphasizing that the disinflation has started in the US while expecting the inflation figure to drop further in this year. In the communique, he highlighted the last Friday’s ‘monster’ job report, but not seeing disinflation in services sector. Prior to the speech, majority of the investors were foreseeing the Fed’s chairman would shift his posture to a more aggressive extend following a series of upbeat economic data. Yet, he refused to do so and disappointed the market with a less hawkish statement, urging the dollar index to drop at the end. At this juncture, the investors’ focus point would be gathered on the upcoming inflation figure, which included the CPI and PPI data, to gauge the path of US monetary policy going forward. As of writing, the dollar index edged down -0.26% to 103.35.

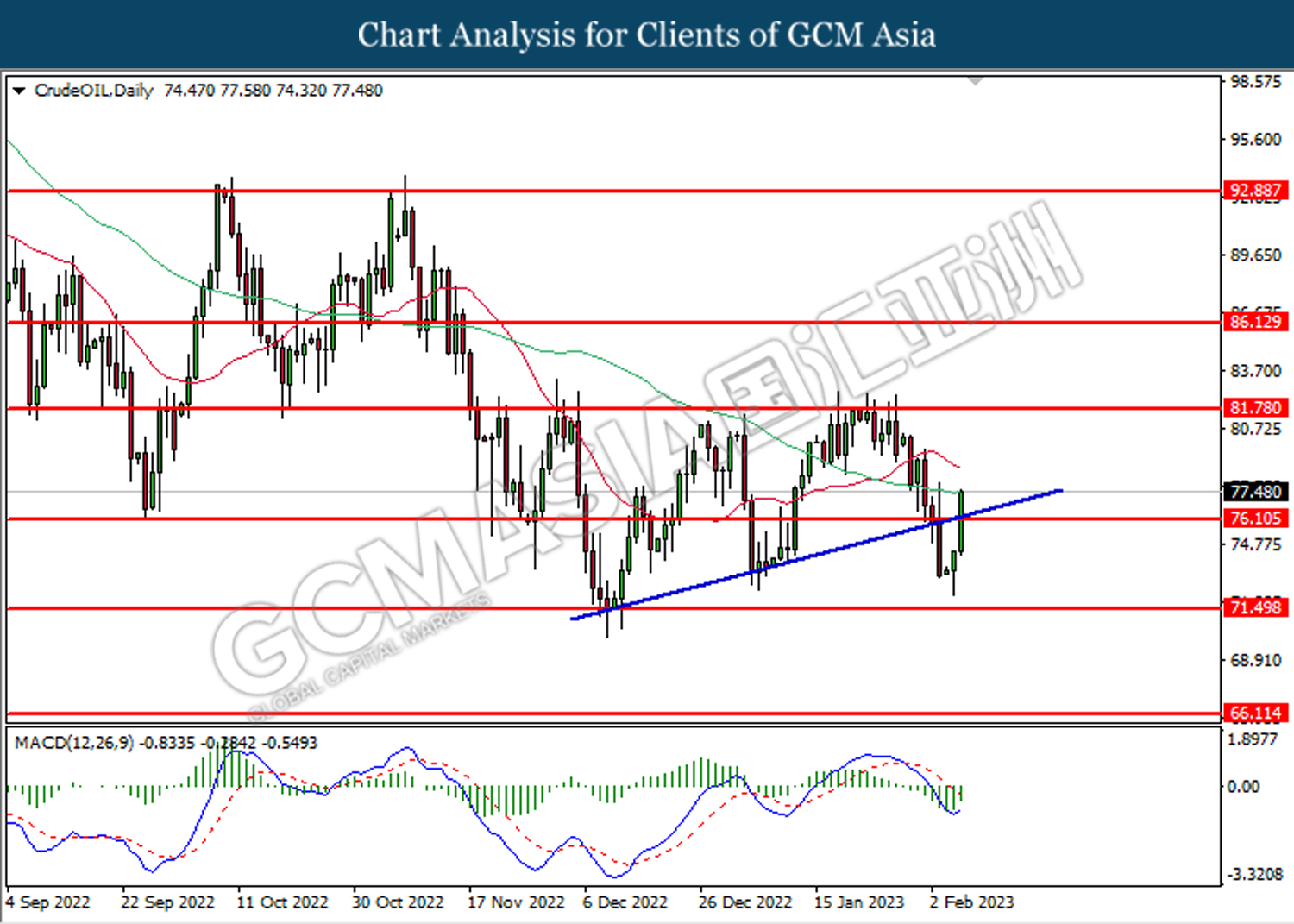

In the commodities market, crude oil price surged 1.82% to $75.70 per barrel as the less hawkish statement from Jerome Powell deteriorated the selling pressure in the US dollar, pushing the oil price to a higher level. Besides, gold prices tipped by 0.33% to $1873.80 per troy ounce after the Fed’s chairman eased the rate hike concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.140M | 2.457M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

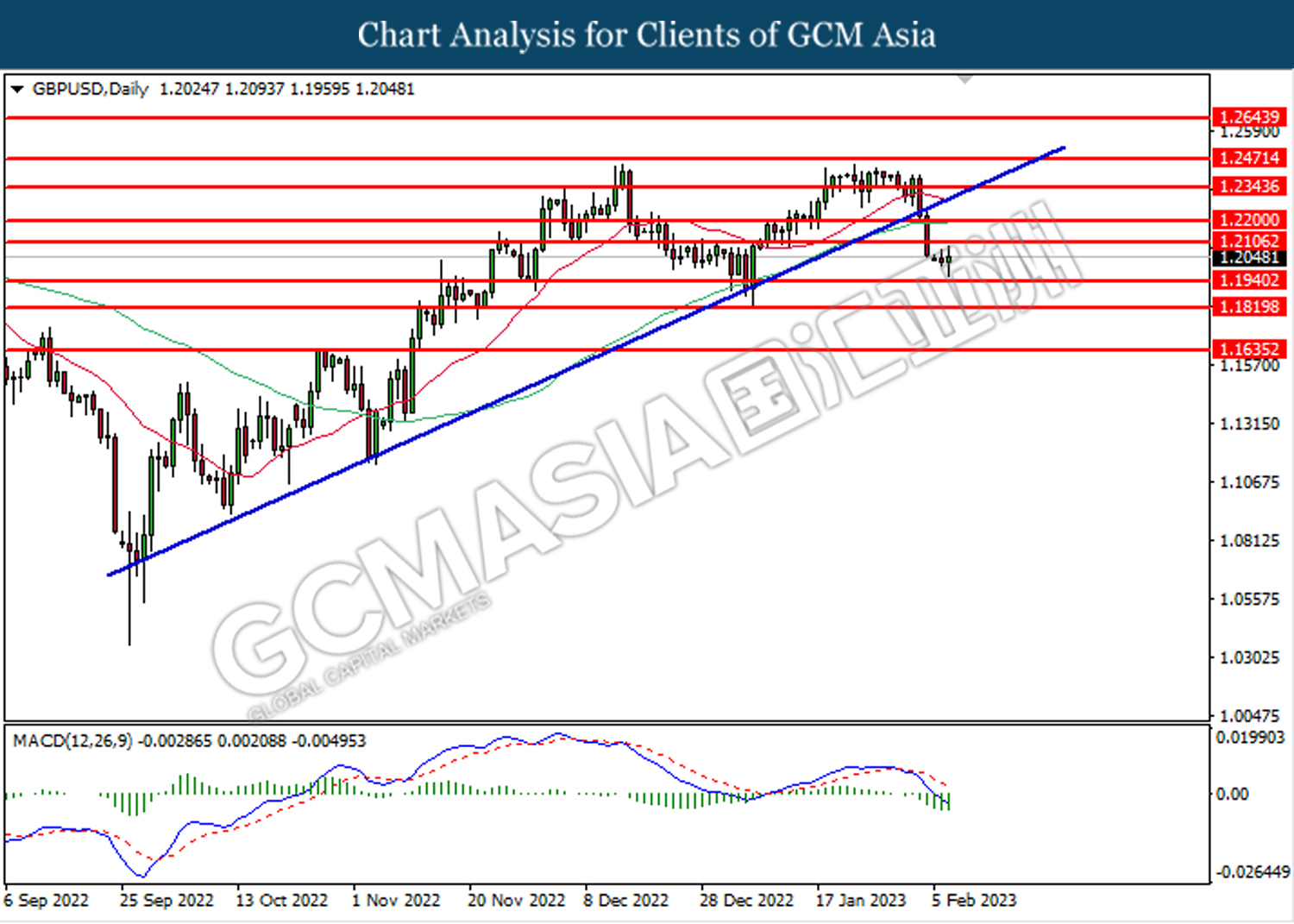

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2105. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1940.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

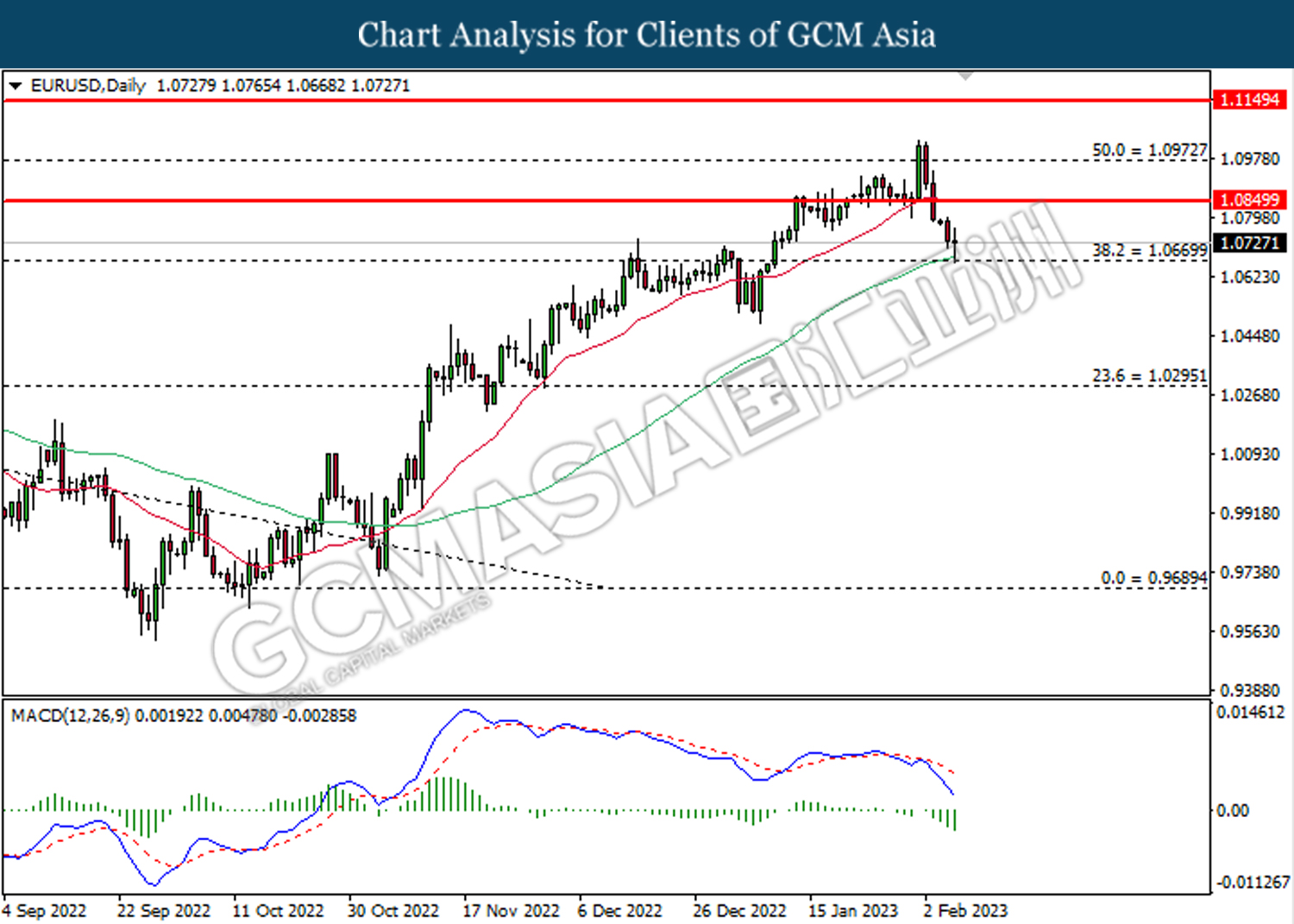

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

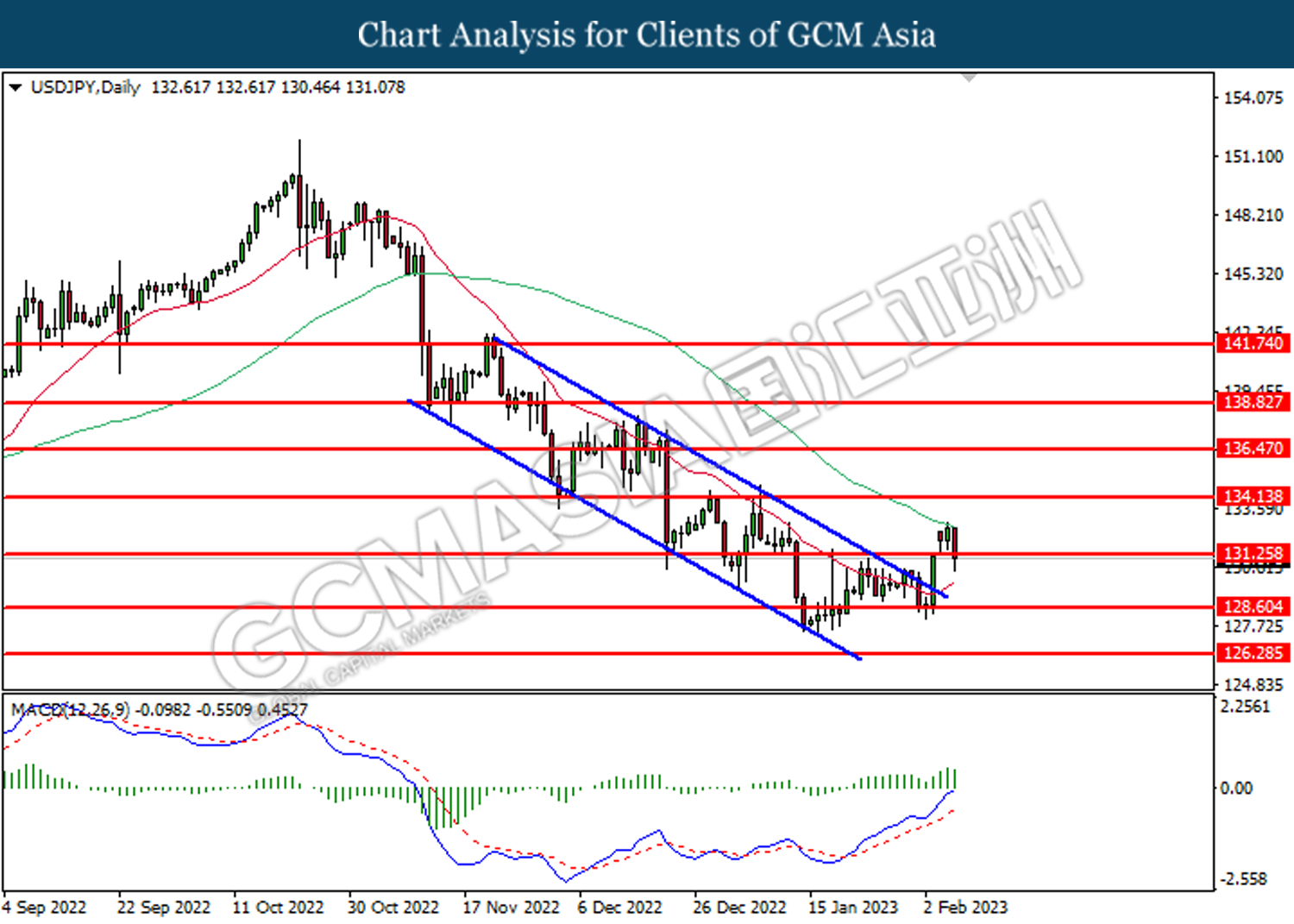

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

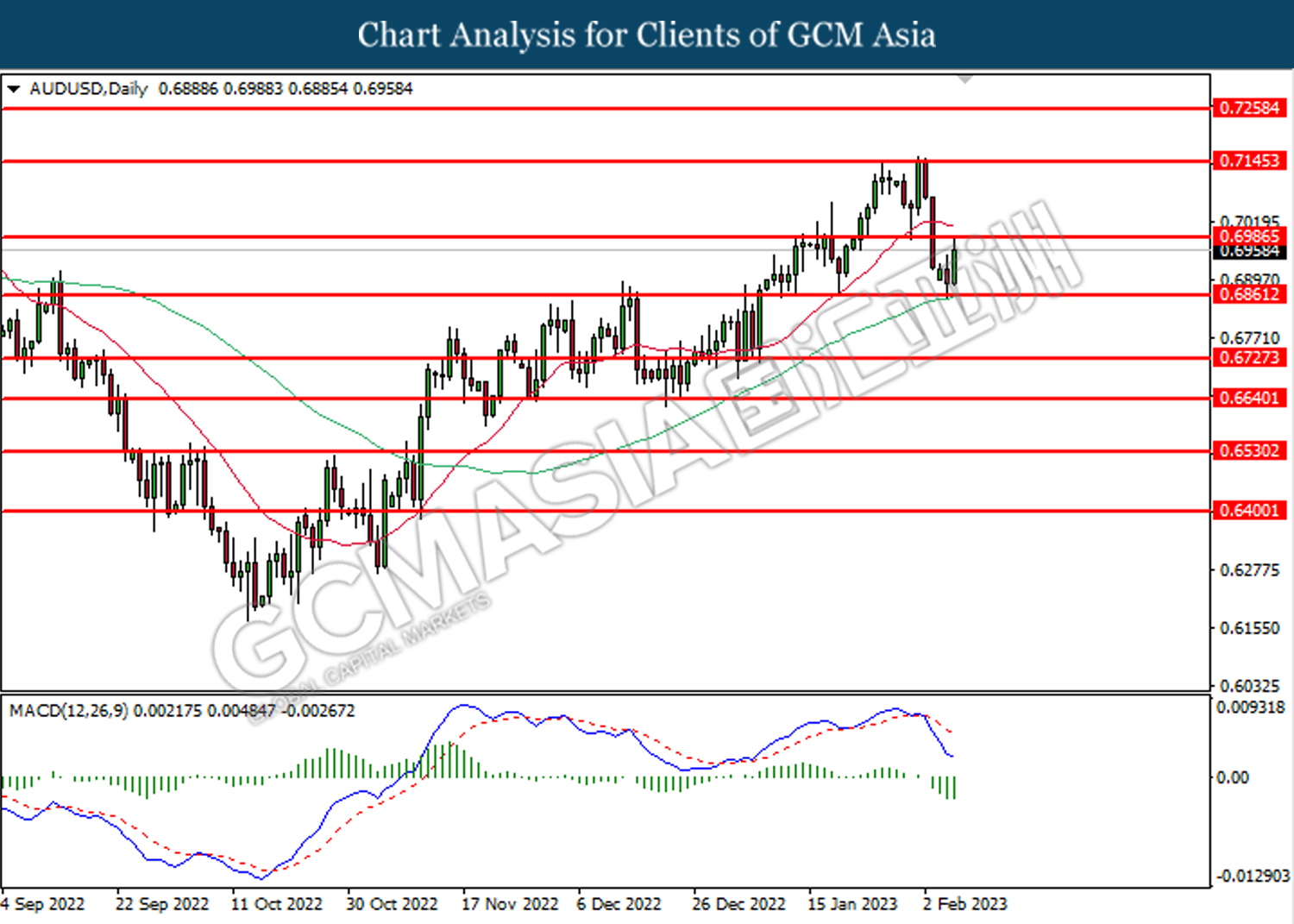

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

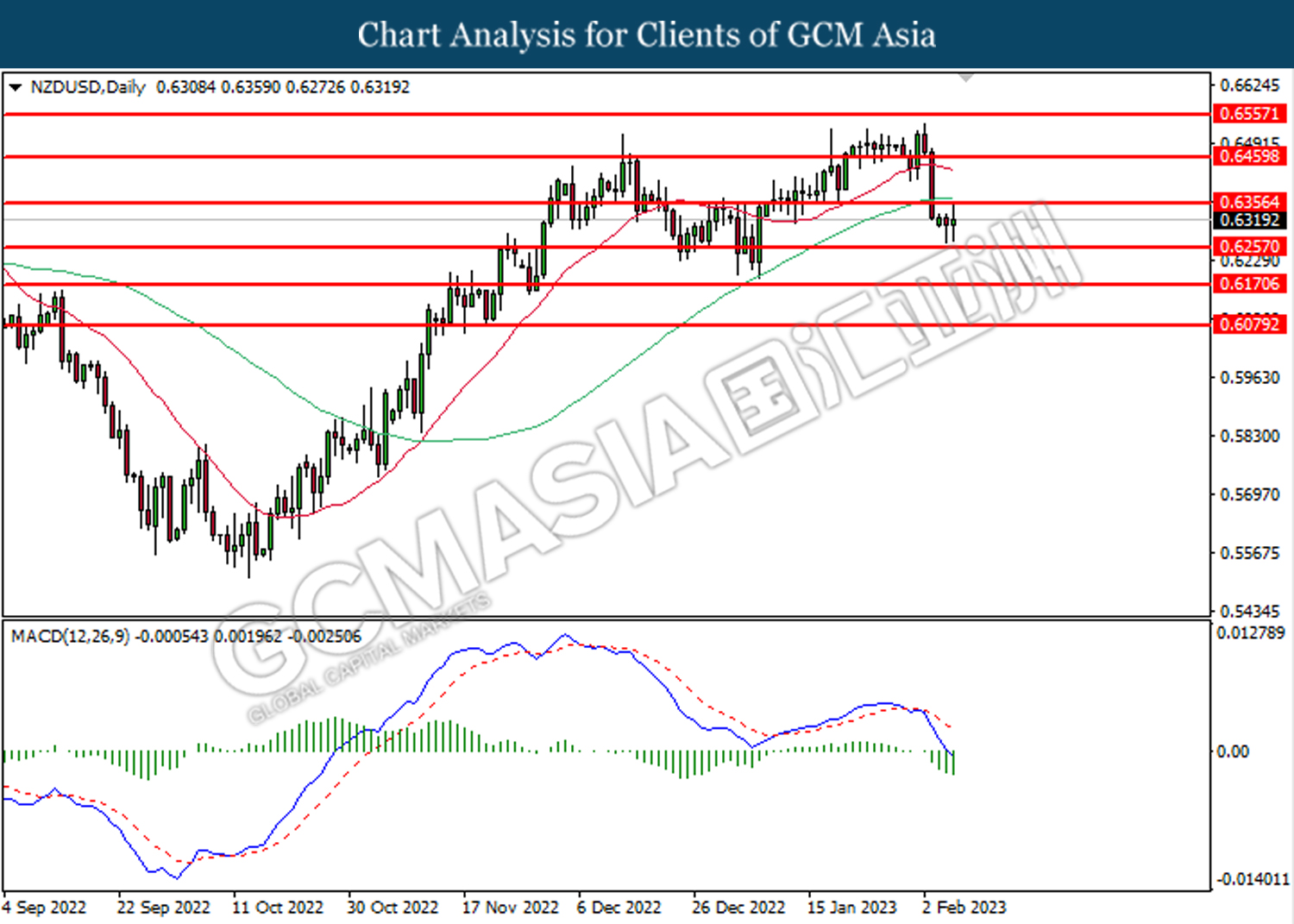

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6255.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

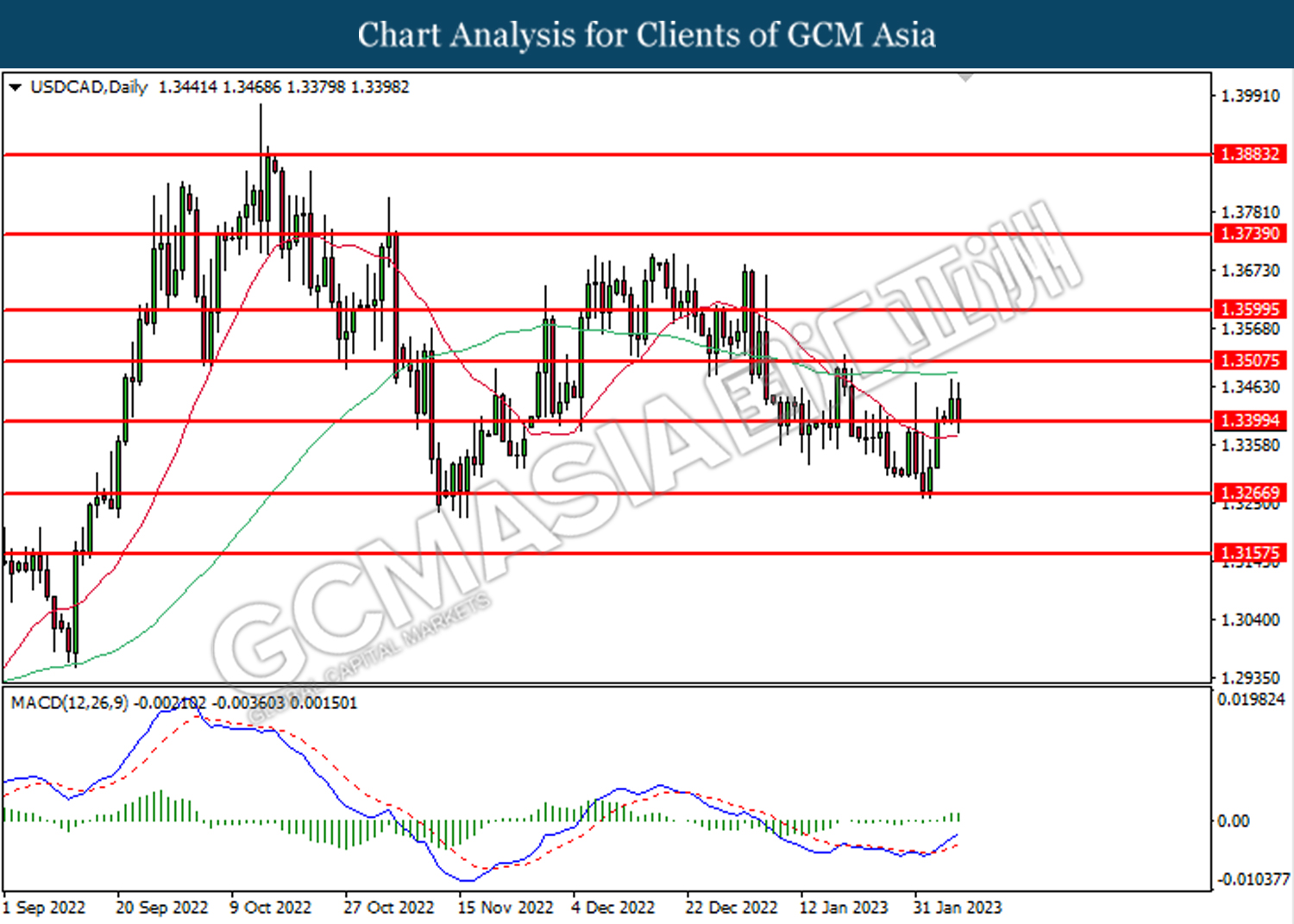

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

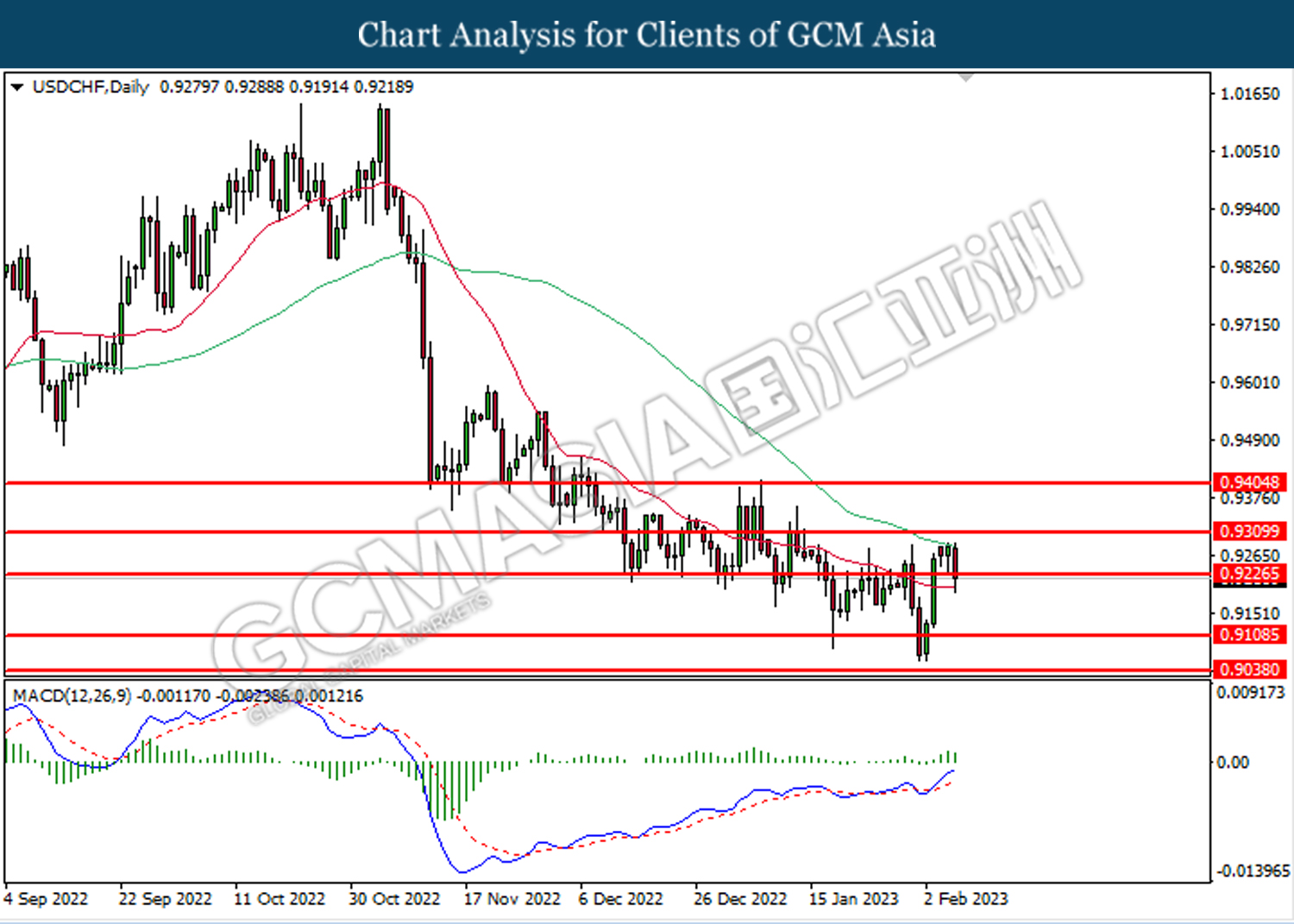

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 81.80

Support level: 71.50, 66.10

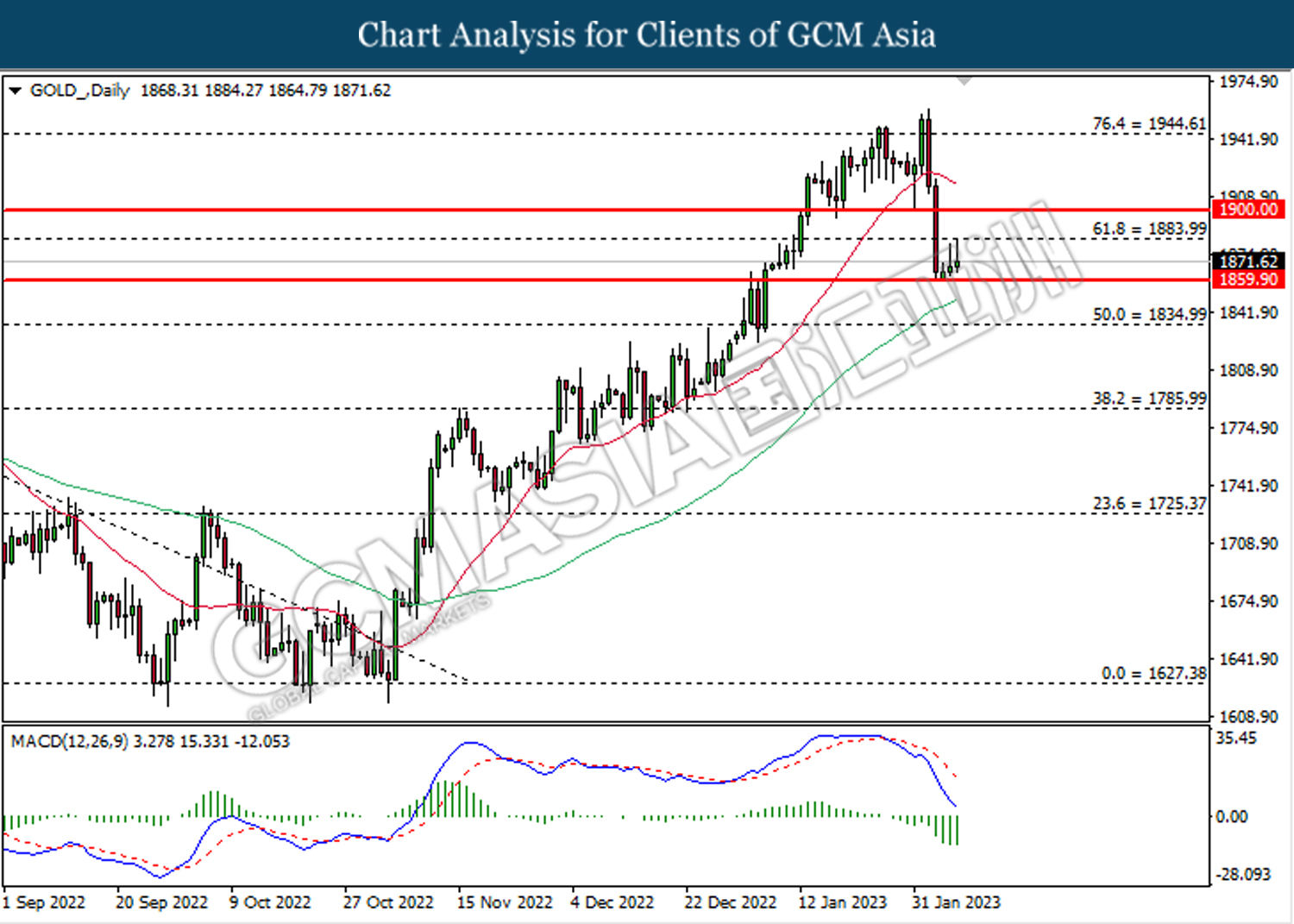

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1859.90. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00