08 March 2022 Afternoon Session Analysis

Euro slumped amid supply disruption spurred stagflation risk.

The Euro extends its losses over the backdrop of intensified tensions between Russia-Ukraine continue to spark negative prospect toward the economic in European region. Market participants continue to speculate that the global supply shortage due to the implementation of sanction would continue to push up the commodities prices in future, leading to stagflation risk for the European countries. Nonetheless, the European Central Bank would be meeting on Thursday to discuss about the monetary policy plan. As for now investors would continue to focus on the monetary policy meeting progress to receive further trading signal. On the other hand, the Japanese Yen slumped over the backdrop of bearish economic data. According to Ministry of Finance, Japan Current Account notched down significantly from the previous reading of -0.371T to -1.189T, missing the market forecast at –0.880T. As of writing, the EUR/USD depreciated by 0.03% to 1.0880 while USD/JPY surged 0.14% to 115.45.

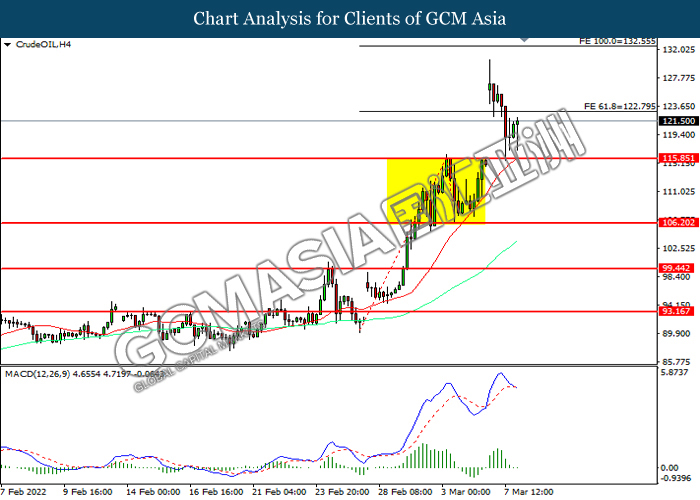

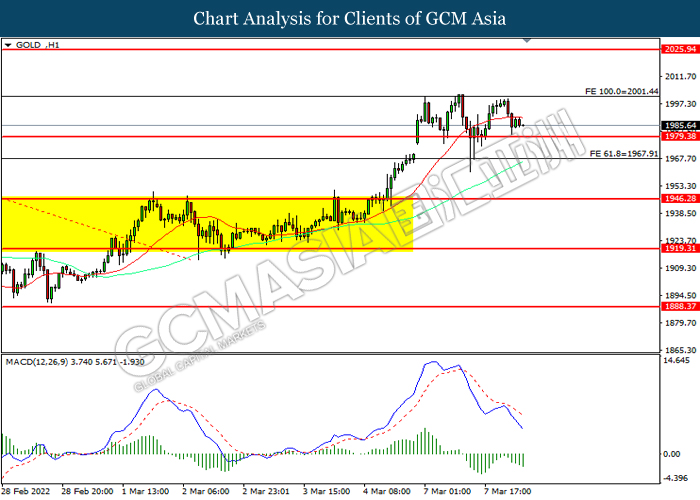

In the commodities market, the crude oil price depreciated by 1.26% to $120.20 per barrel as of writing amid technical correction following it reached recent high. On the other hand, the gold price depreciated by 0.58% to $1986.40 per troy ounces as of writing amid strengthening US Dollar with rate hike expectation from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

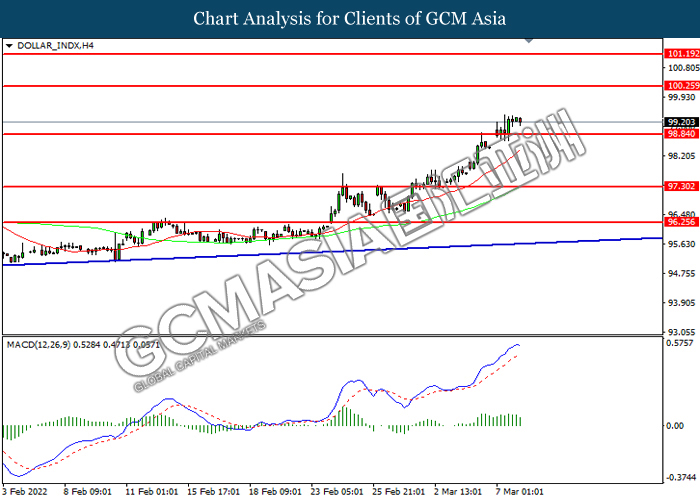

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to extend its gains toward resistance level at 100.25.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

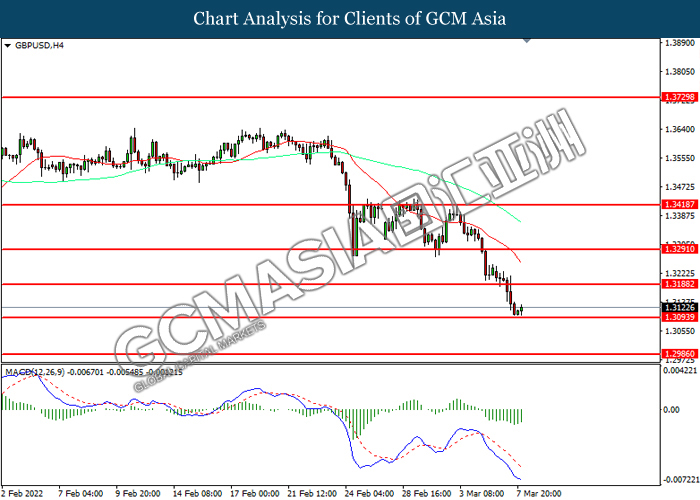

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0945, 1.1075

Support level: 1.0820, 1.0690

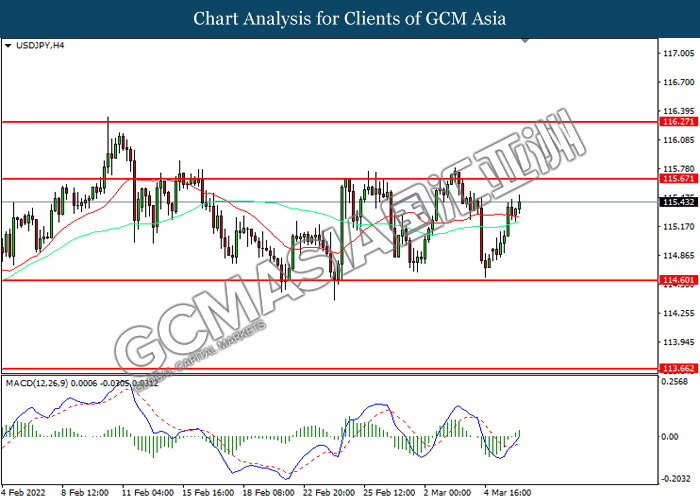

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 115.65.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

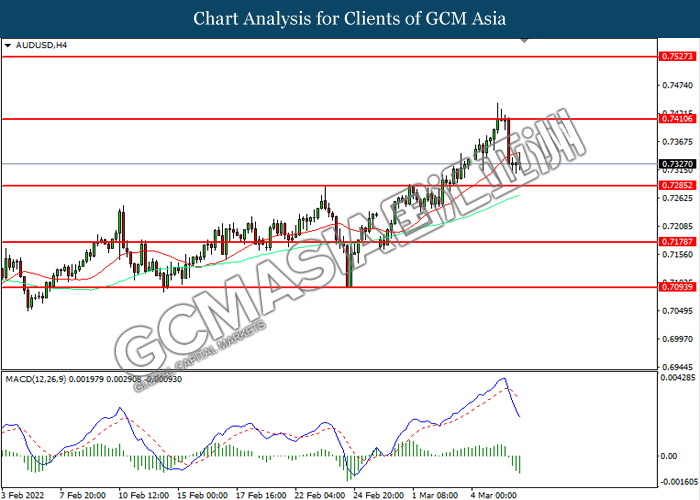

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses towards support level at 0.7285.

Resistance level: 0.7410, 0.7525

Support level: 0.7285, 0.7180

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from lower levels. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

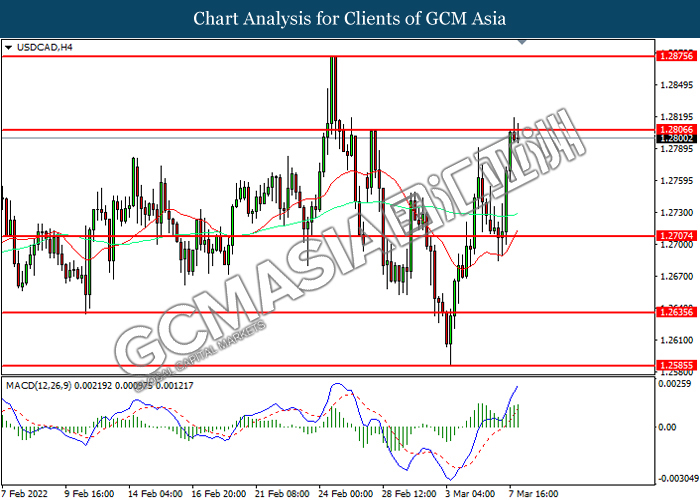

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2805. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2805, 1.2875

Support level: 1.2705, 1.2635

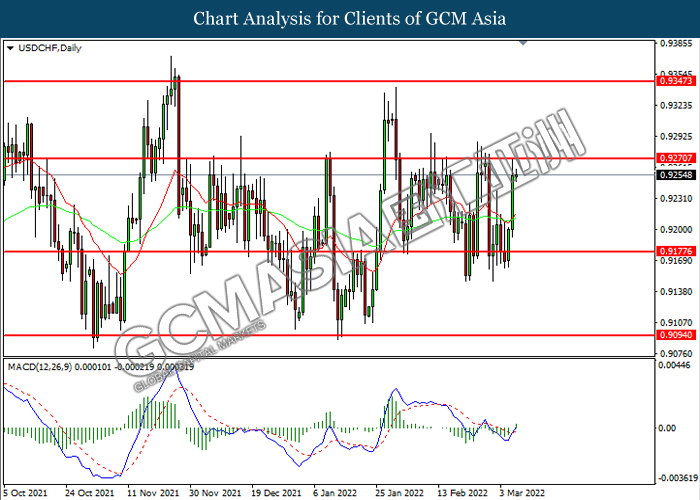

USDCHF, Daily: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 122.80, 132.55

Support level: 115.85, 106.20

GOLD_, H1: Gold price was traded lower while currently testing the support level at 1979.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2001.45, 2025.95

Support level: 1979.40, 1967.90