8 March 2022 Morning Session Analysis

Equity market down, safe-haven US Dollar appreciated.

The Dollar Index which traded against a basket of six major currencies surged on yesterday over the backdrop of diminishing risk appetite in the global financial market, which stoked a shift in sentiment toward safe-haven asset such as US Dollar. Yesterday, the US equity market slumped significantly on the heightening Russia-Ukraine conflict as investors worry that such tensions would likely to spur significantly inflation risk in future, which dialing down the market optimism toward the profit margin on the companies. Besides, US Dollar extends its gains amid hawkish expectation from Federal Reserve. Recently, spiking inflation would increase the odds for Fed to implement a rate hike policy in short-term basis to combat the inflation risk. Tightening monetary policy would reduce the money supply for the US Dollar market, spurring further bullish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.60% to 99.25.

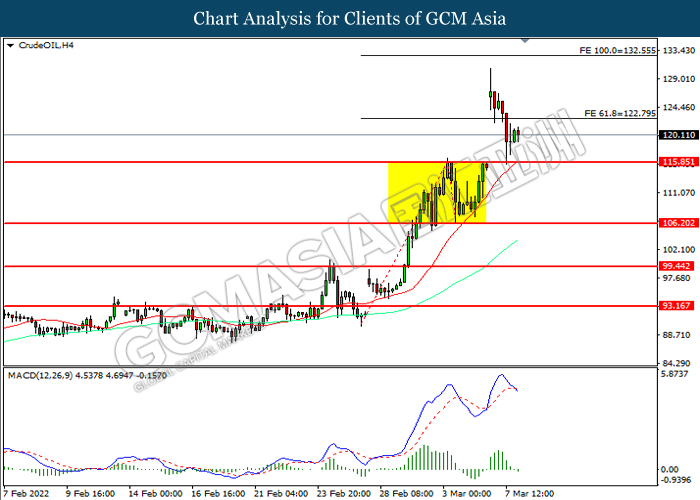

In the commodities market, the crude oil price extends its gains by 0.19% to 121.81 per barrel as of writing. The oil market edged higher as market participant speculated that the implementation of sanction from the West countries to Russia would continue to disrupt the crude oil supply in future. On the other hand, the gold price appreciated by 0.02% to $1998.05 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

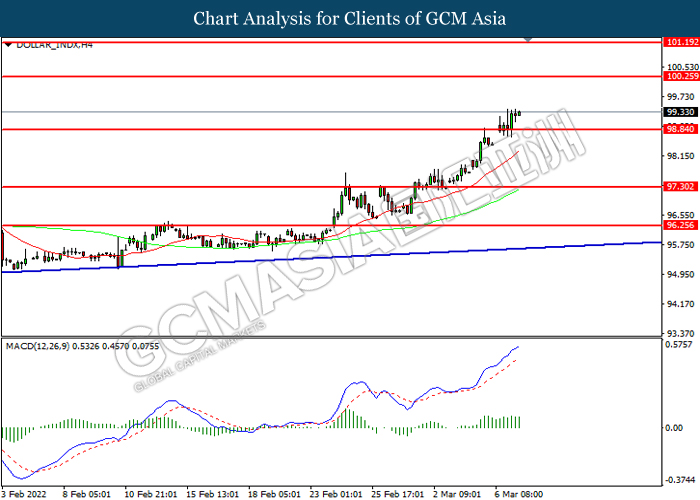

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the index to be traded higher after breaking its resistance level.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

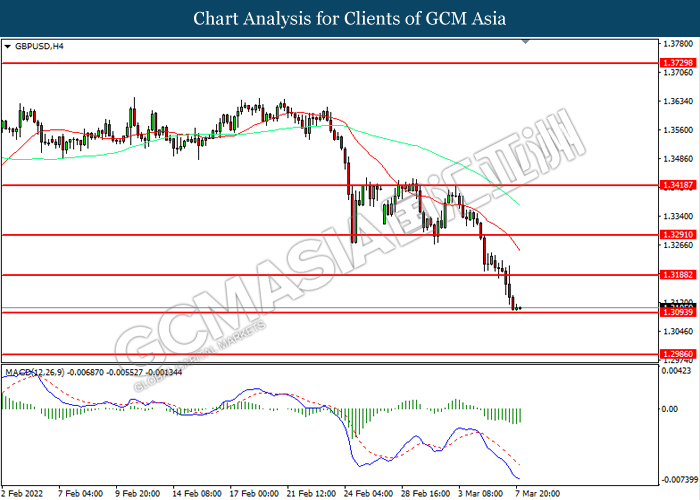

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

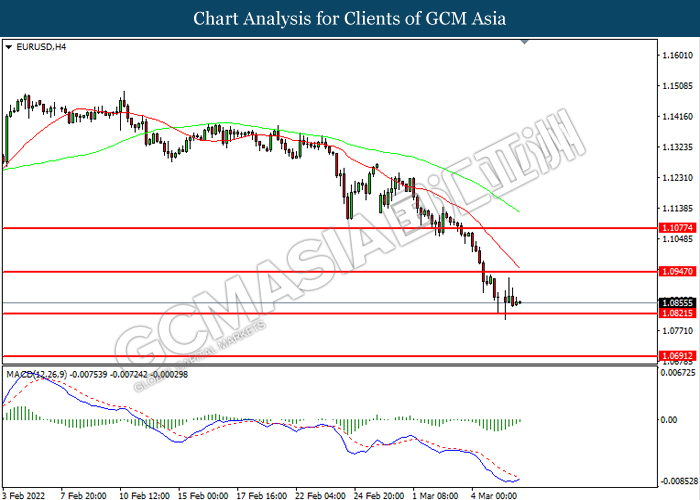

EURUSD, H4: EURUSD was traded lower following prior retracement from higher level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.0985, 1.1065

Support level: 1.0860, 1.0770

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 115.65.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

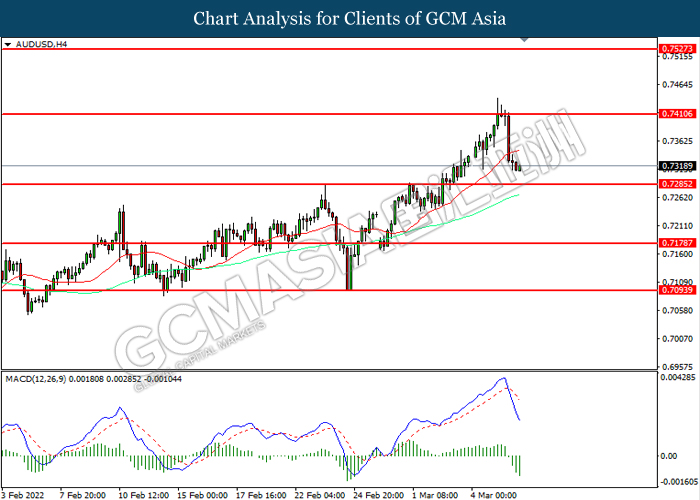

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses towards support level at 0.7285.

Resistance level: 0.7410, 0.7525

Support level: 0.7285, 0.7180

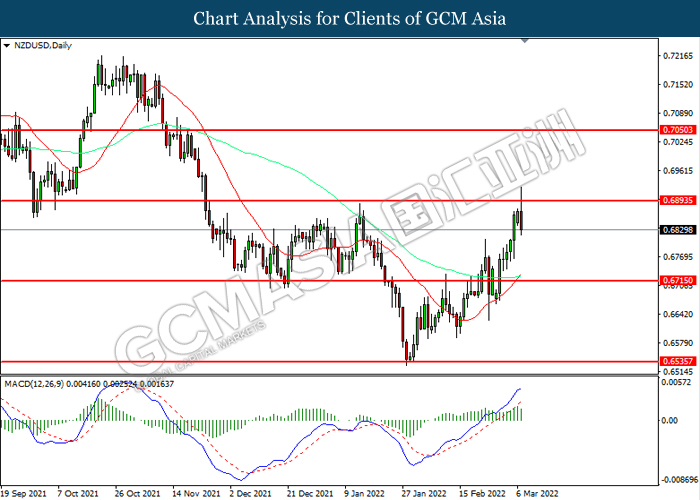

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

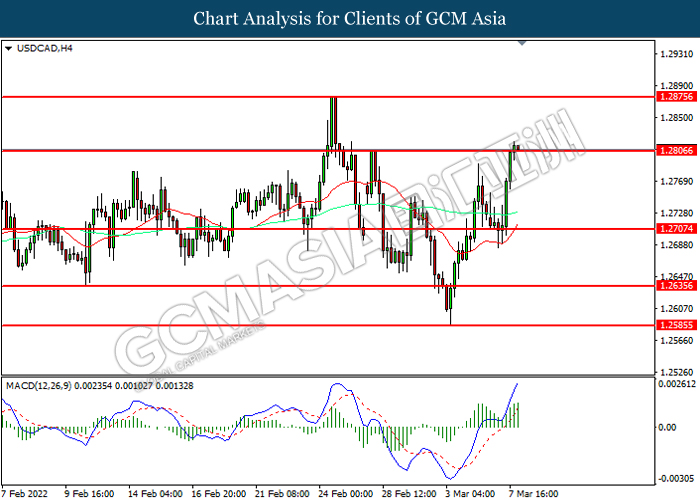

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2805. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout.

Resistance level: 1.2805, 1.2875

Support level: 1.2805, 1.2705

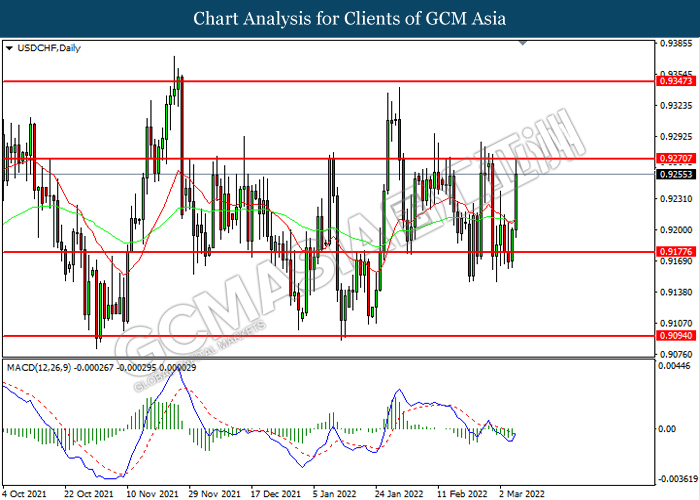

USDCHF, Daily: USDCHF was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 122.80, 132.55

Support level: 115.85, 106.20

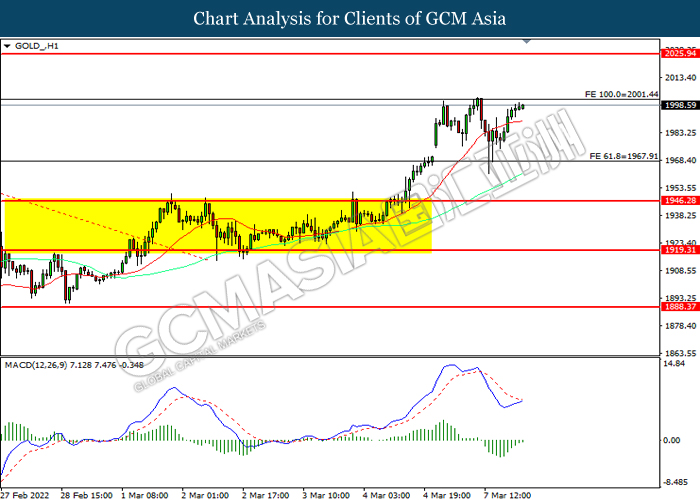

GOLD_, H1: Gold price was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests its price to be traded higher after breaking the resistance level.

Resistance level: 2001.45, 2025.95

Support level: 1967.90, 1946.30