8 March 2023 Morning Session Analysis

US Dollar flied amid hawkish talk by Powell.

The Dollar Index which traded against a basket of six major currencies sky-rocketed on yesterday as Fed Chairman signaled further aggressive rate hike might be implemented. According to Reuters, Federal Reserve Chair Jerome Powell appeared a speech on his testimony which scheduled on Tuesday, that the terminal rate would likely to be raised over the market expectation in order to bring down inflation to long-term 2%. He claimed that the Fed’s decade-old 2% inflation target was the key factor for keeping a lower price pressures in the nation, as well as the officials should all-in their efforts to make it come true. With that, the US central banks has prepared to take a larger steps to reach the goal. Besides that, Jerome Powell reiterated that rate hike path might be continued if the incoming data presented a strong economy condition. Thus, investors has started to anticipate a 50 basis point increase in the March meeting. According to CME FedWatch Tool, the possibility of 50 basis point rate hike has rose significantly, which notched up from the previous 31.4% to 71.2%. As of writing, the Dollar Index surged by 1.23% to 105.60

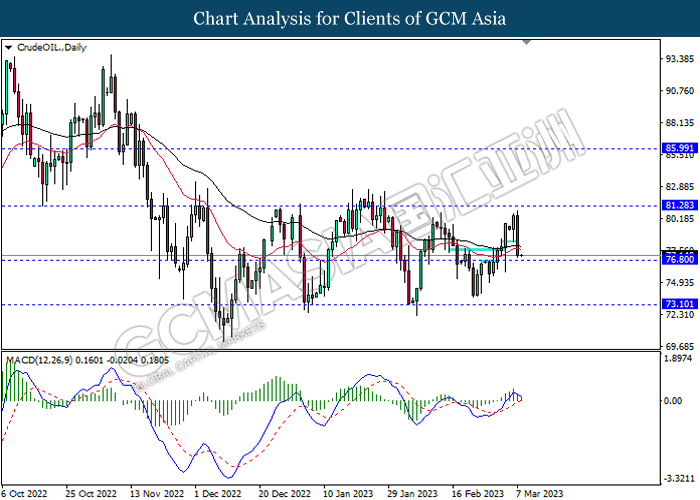

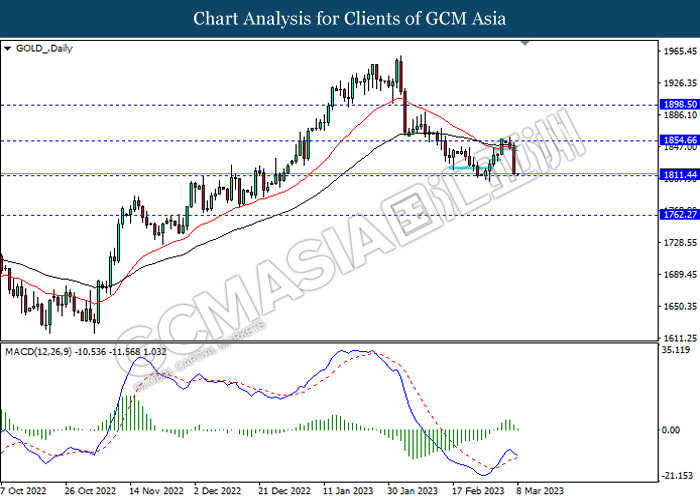

In the commodity market, the crude oil price edged up by 0.01% to $77.22 per barrel as of writing after a sharp decline throughout the overnight trading session over the hawkish statement from Fed President. On the other hand, the gold price rose by 0.01% to $1813.82 per troy ounce as of writing following the slip of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR ECB President Lagarde Speaks

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | 106K | 195K | – |

| 23:00 | USD – JOLTs Job Openings (Jan) | 11.012M | 10.600M | – |

| 23:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.165M | 0.395M | – |

Technical Analysis

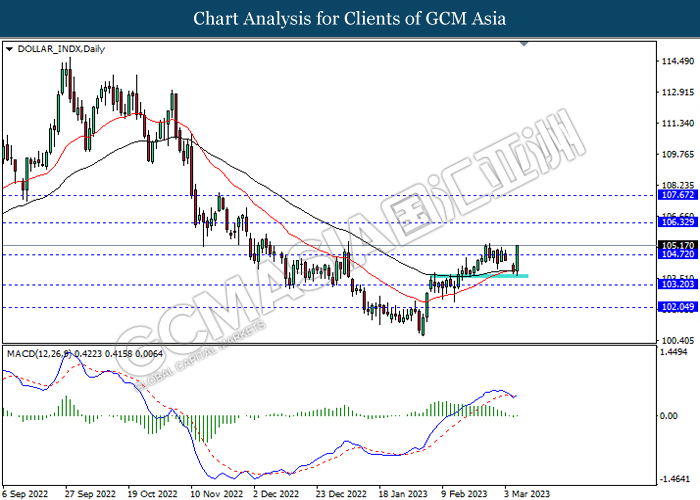

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 106.30, 107.65

Support level: 104.70, 103.20

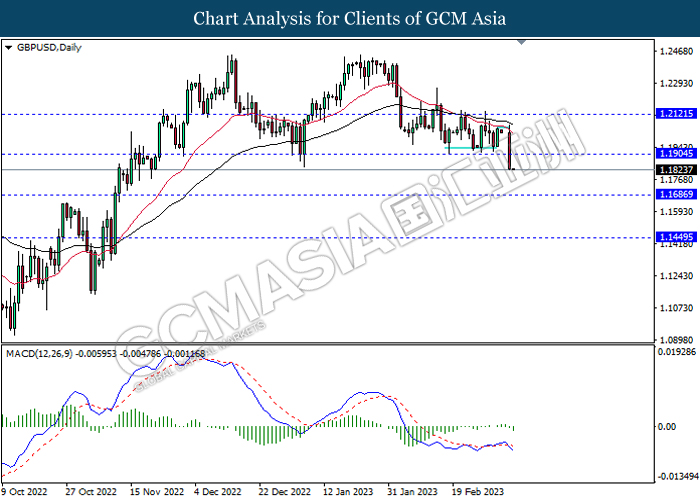

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1905, 1.2120

Support level: 1.1685, 1.1450

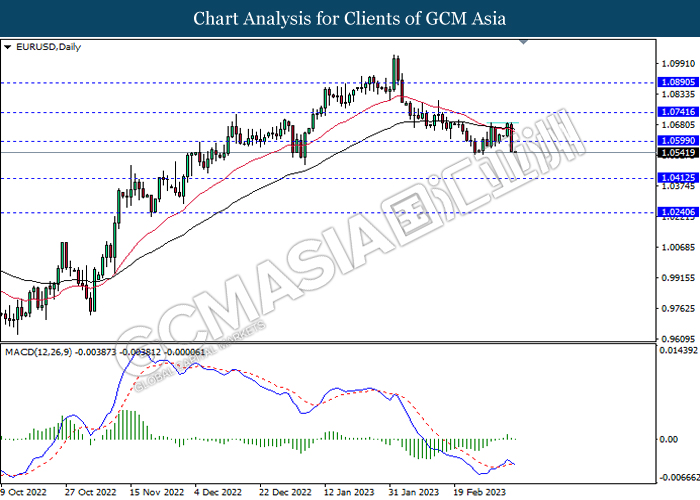

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0600, 1.0740

Support level: 1.0410, 1.0240

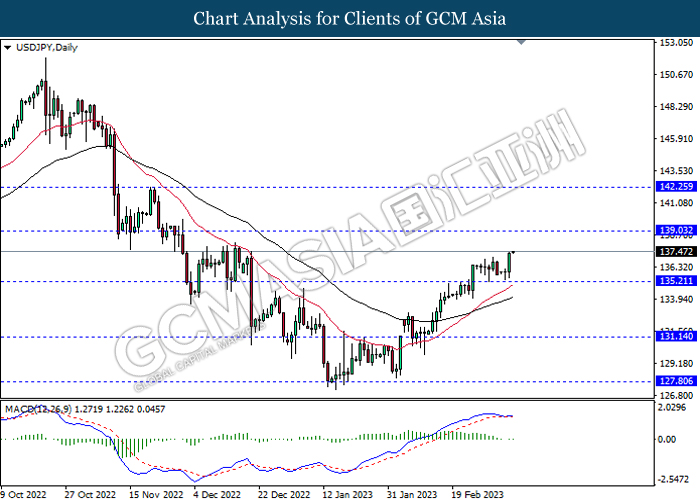

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

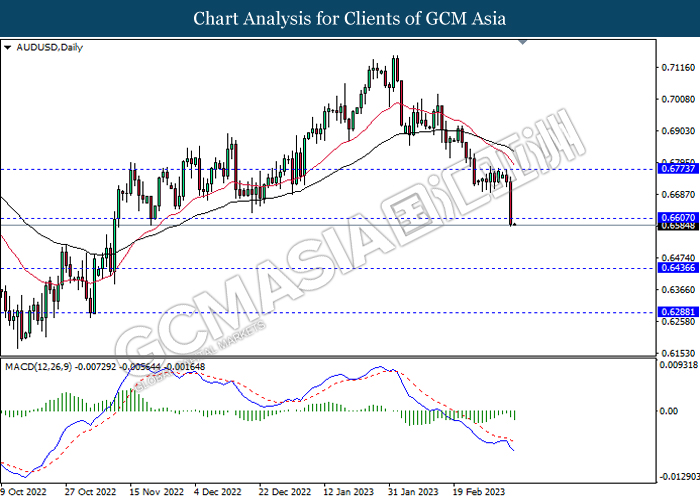

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6605, 0.6775

Support level: 0.6435, 0.6290

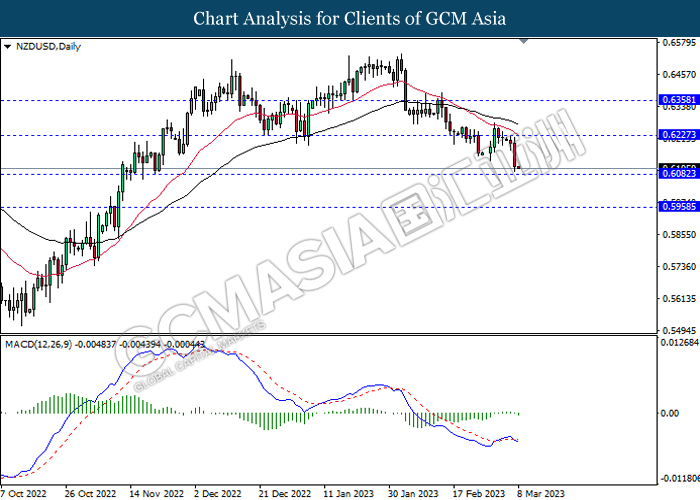

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

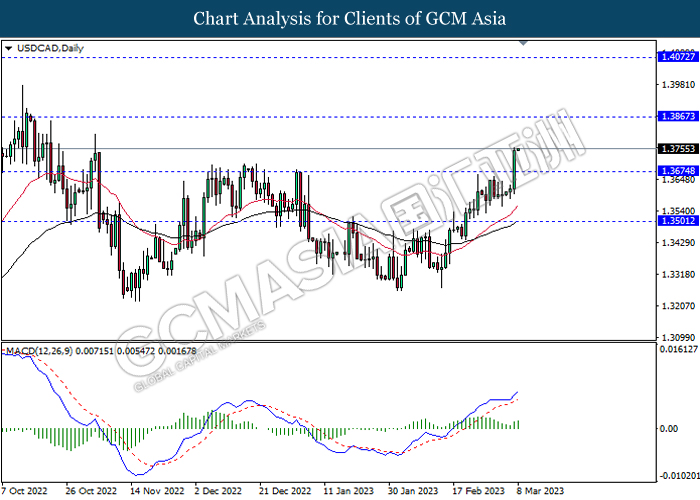

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

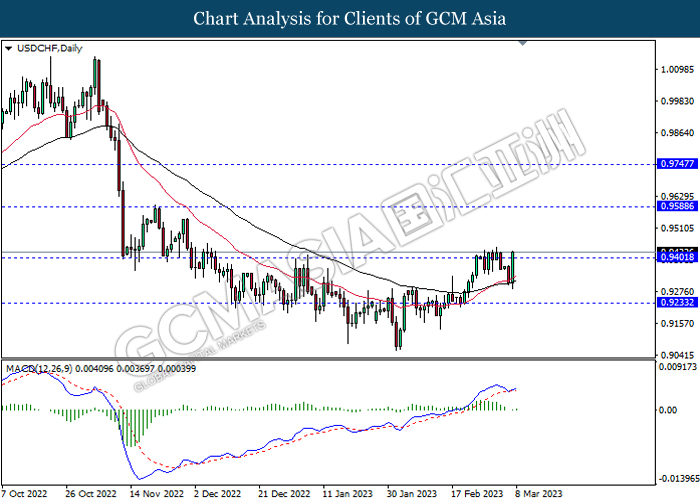

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9590, 0.9745

Support level: 0.9400, 0.9235

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1854.65, 1898.50

Support level: 1811.45, 1762.25