8 April 2022 Afternoon Session Analysis

Euro slumped amid Russia-Ukraine issue intensified.

EURUSD extend its losses on Friday amid the backdrop of expectations of escalation in the Ukraine crisis after Russia ceases to be a member of the United Nations (UN) Human Rights Council. According to Reuters, the members of the UN Human Rights Council voted in favor of stripping Russia from the members’ list after the Russian rebels committed war crimes in Bucha, Ukraine. As world nations are isolating Russia from major communities, Russian leader Vladimir Putin could de-escalate progress talks with Ukraine, and the Ukraine crisis may continue to elevate further. The move of Russia would likely to cause another aggressive sanctions on it. It would likely to bring negative prospects toward economic progression in Europe region as Russia was one of the trading partner for Europe, dialing down the market optimism toward Euro. It prompted investors to selloff Euro and shift their capital toward the currencies which having better prospects such as US Dollar. As of writing, EURUSD depreciated by 0.18% to 1.0858.

In commodities market, crude oil price eased by 0.55% to $95.51 per barrel as of writing over the backdrop of consuming countries agreed to release 240 million barrels of oil from emergency stocks to help offset disrupted Russian supply. Besides, gold price depreciated 0.47% to $1928.75 per troy ounces as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Mar) | 336.6K | 80.0K | – |

Technical Analysis

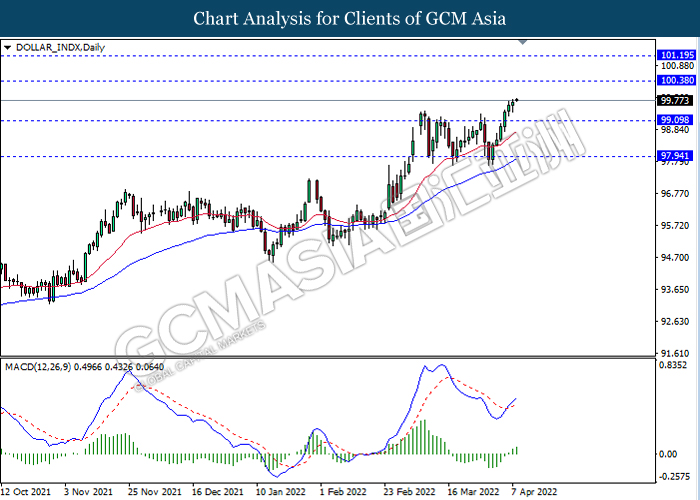

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

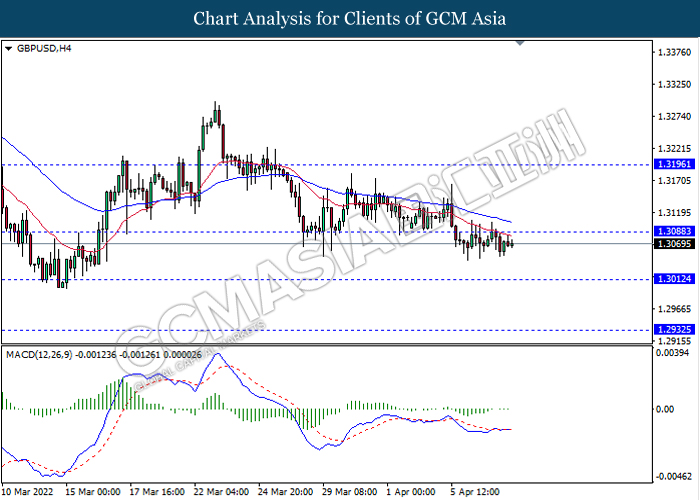

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullsih momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

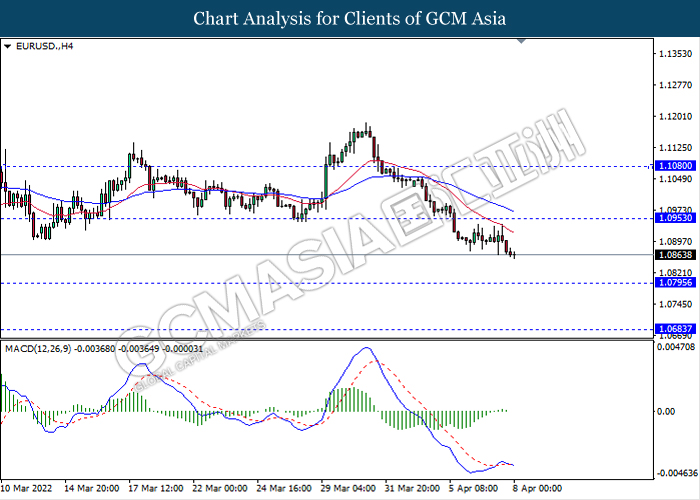

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0955, 1.1080

Support level: 1.0795, 1.0685

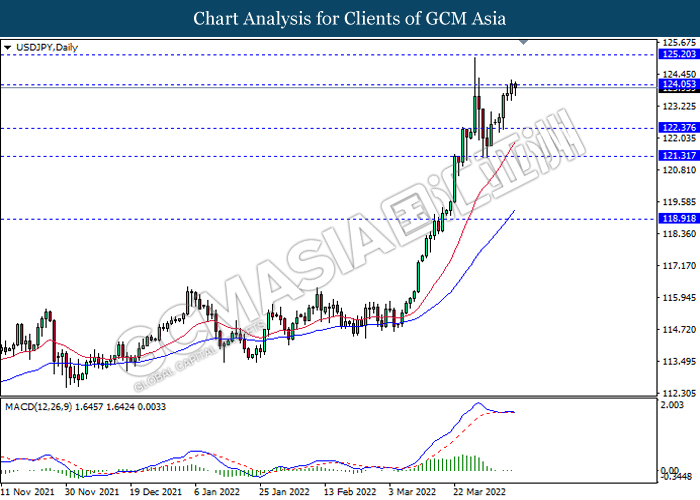

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

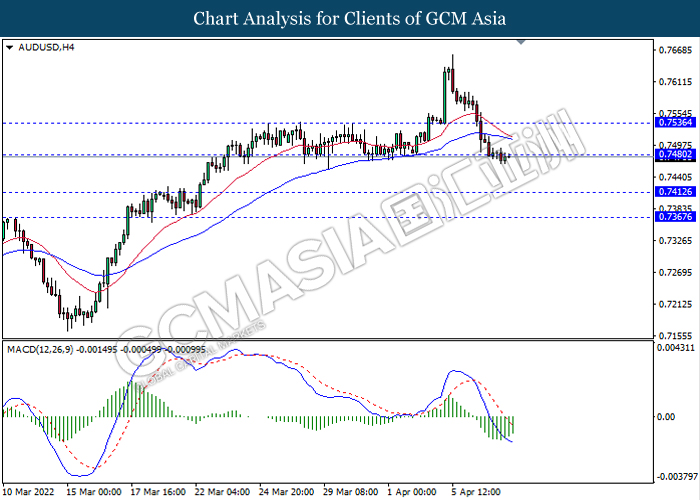

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7480, 0.7535

Support level: 0.7410, 0.7365

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6890, 0.6980

Support level: 0.6800, 0.6740

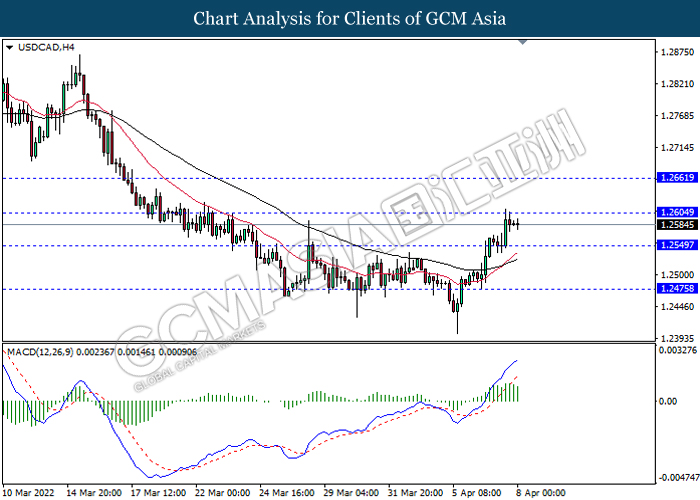

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2605, 1.2660

Support level: 1.2550, 1.2475

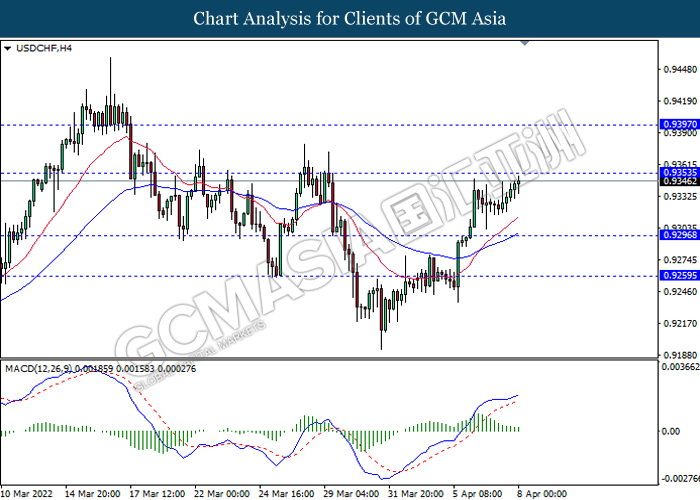

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

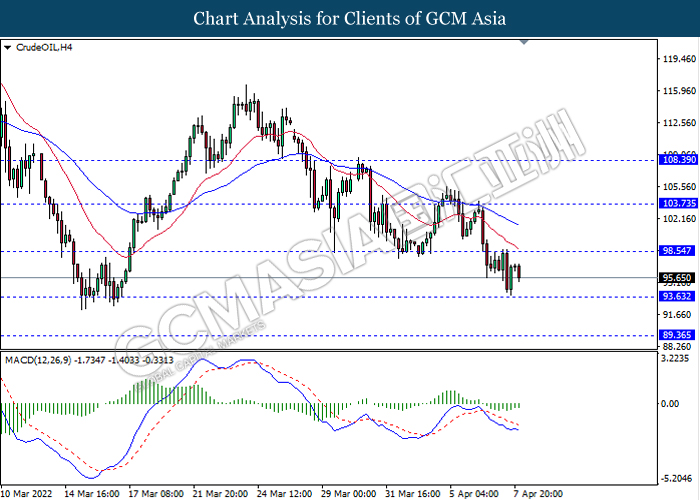

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 98.55, 103.75

Support level: 93.65, 89.35

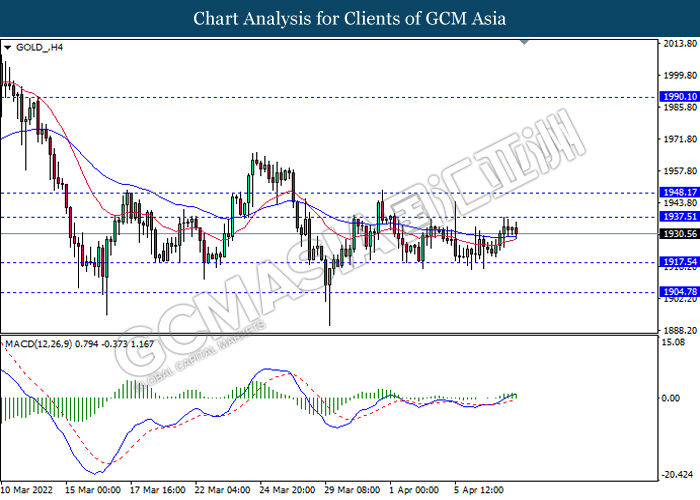

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1937.50, 1948.15

Support level: 1917.55, 1904.80