8 May 2023 Afternoon Session Analysis

The Loonie extended gains after strong labor market conditions.

The Canadian dollar, commonly known as the Loonie, strengthened against the greenback after delivering upbeat job data last Friday. The Canadian labor market is expected to slow down in April with an estimation of 20k. However, the labor market showed resilience by adding 41.4k jobs, stronger than the prior readings of 34.7k and market estimation. Meanwhile, the unemployment data remains solid as the prior reading at 5.0%, slightly lower than the economist’s expectation of 5.1%. The strong labor data fuels the hope of further interest rate hikes from the Bank of Canada (BoC). Besides, the Loonie regains its luster after the oil price recovers from dips. As the world’s fourth largest crude oil exporter, Canada’s crude oil exports account for 6% of the world’s crude oil exports, and the rise in oil prices will lead to a rise in the Canadian dollar. Economists expect the Canadian dollar will strengthen before the end of the year as a recovery in the global stock index and rising oil prices. Apart from this, the US dollar weakened after the US finance minister reiterate the debt ceiling issue that occurred in the US. The Loonie as the counterpart currency extended its gains following the news. U.S. Treasury Secretary Janet Yellen had warned if Congress fails to address the debt ceiling, the US could face a potential constitutional crisis with major consequences to financial markets and interest rates. For the event, President Joe Biden will meet with Republican and Democratic leaders on 9th May to discuss on the debt ceiling before the June 1st deadline. As of writing, the pair of USD/CAD dipped by -0.03% to $1.3369.

In the commodities market, crude oil prices were up by 0.70% to $71.84 per barrel as investors eye on China trade data to get more cues. Besides, gold prices edged up by 0.26% to $2022.87 per troy ounce fallen after upbeat U.S. labor data. Gold fell as risk appetite improved as non-farm payrolls data showed strong employment conditions.

Today’s Holiday Market Close

Time Market Event

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

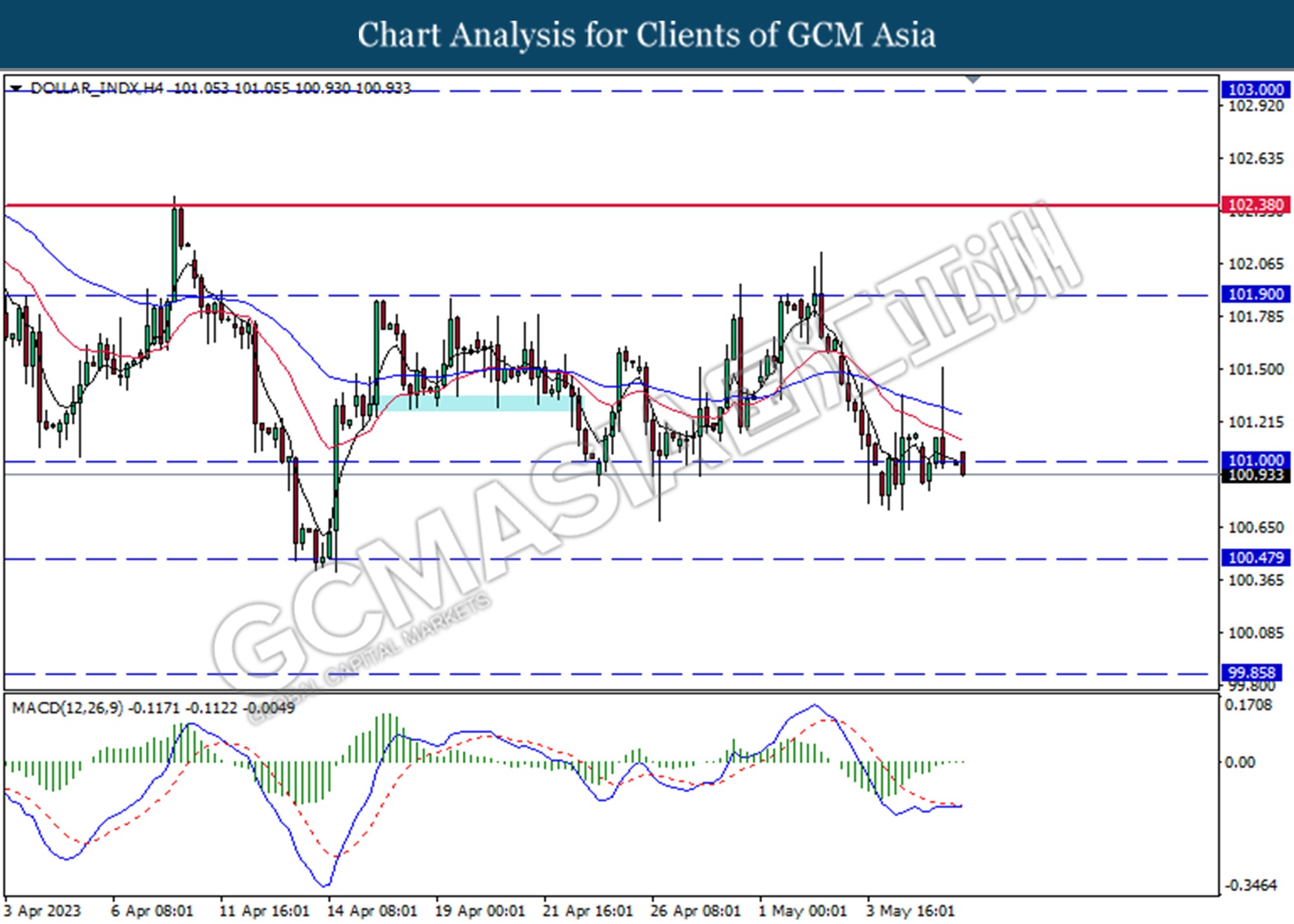

DOLLAR_INDX, H4: Dollar index was traded lower following a prior break below the previous support level at 101.00. However, MACD which illustrated diminishing bearish momentum suggests the index to traded higher as a technical correction.

Resistance level: 101.00, 101.90

Support level: 100.50, 99.85

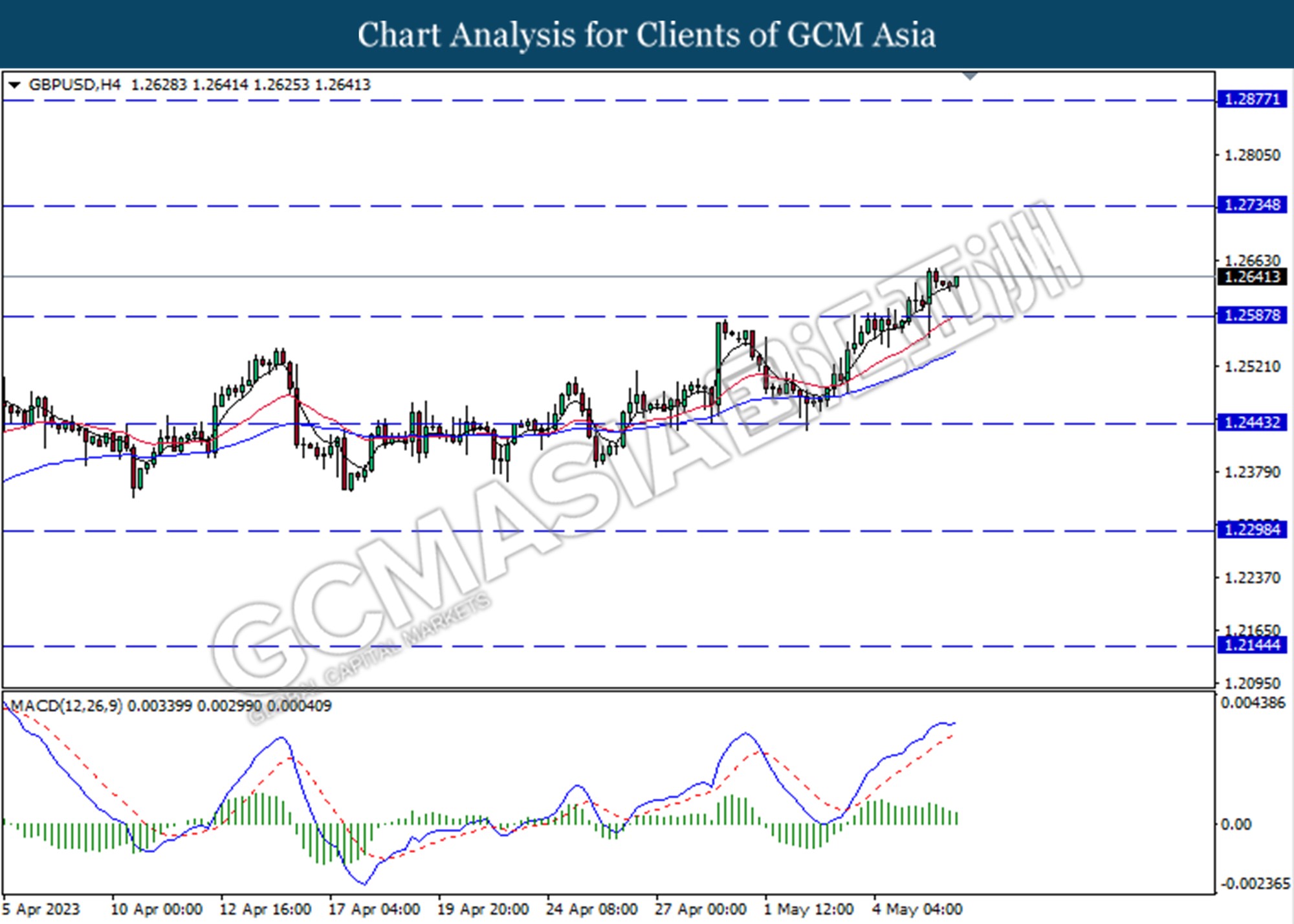

GBPUSD, H4: GBPUSD was traded higher following a prior break above the previous resistance level at 1.2590. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 1.2735, 1.2880

Support level: 1.2590, 1.2445

EURUSD, H4: EURUSD was traded higher following the prior rebound from upward trend line. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

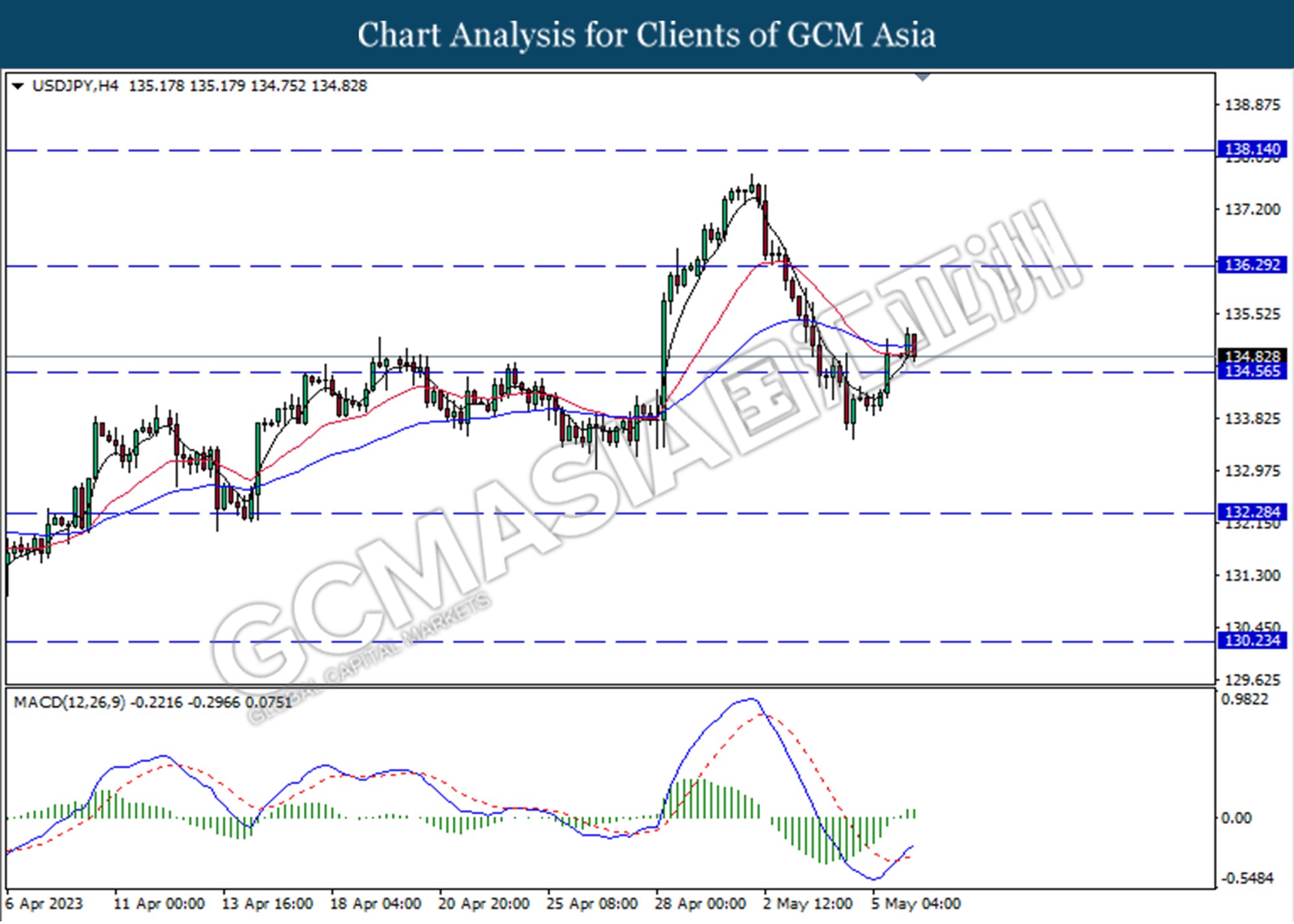

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

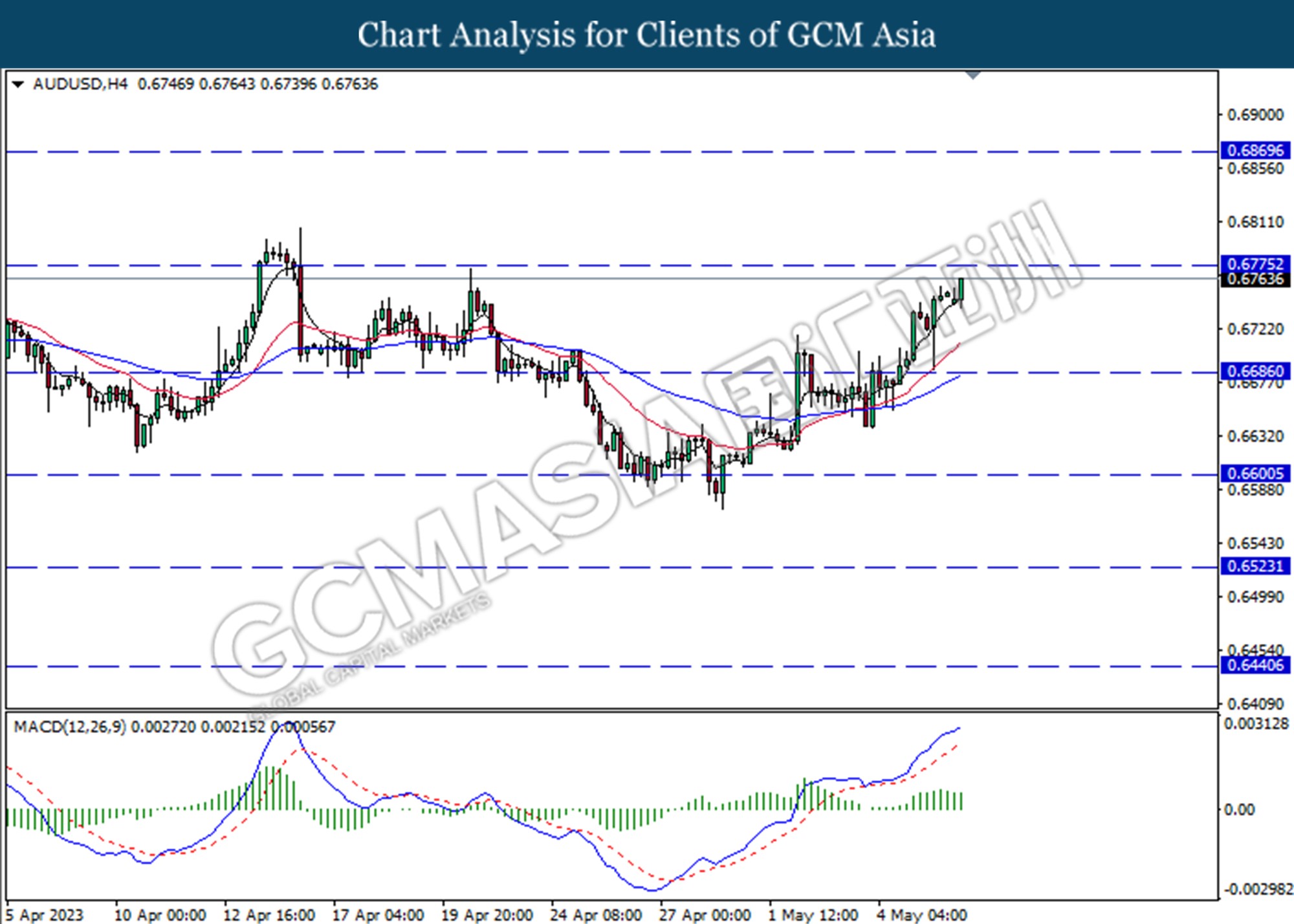

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6685. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6265. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

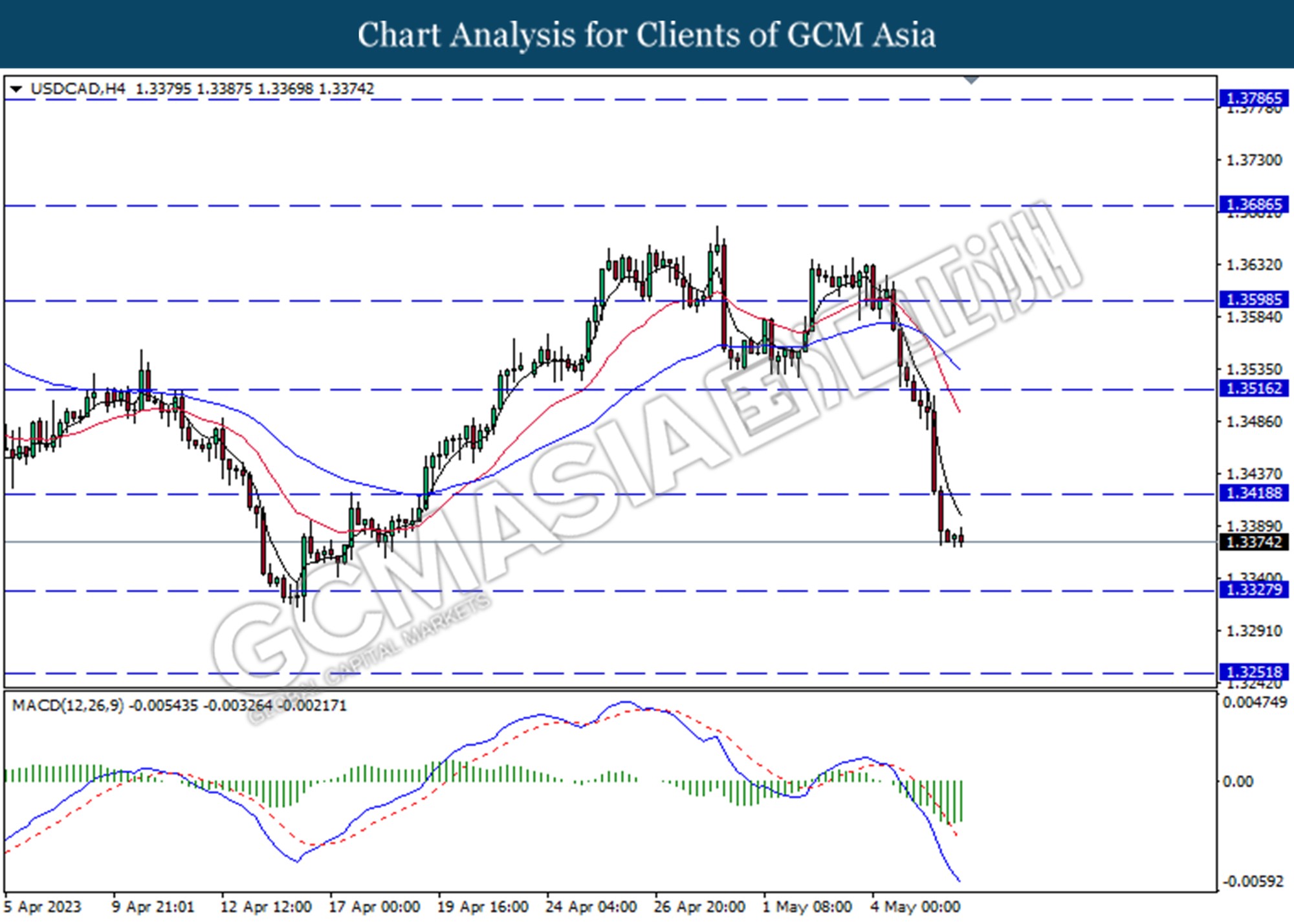

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3420. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

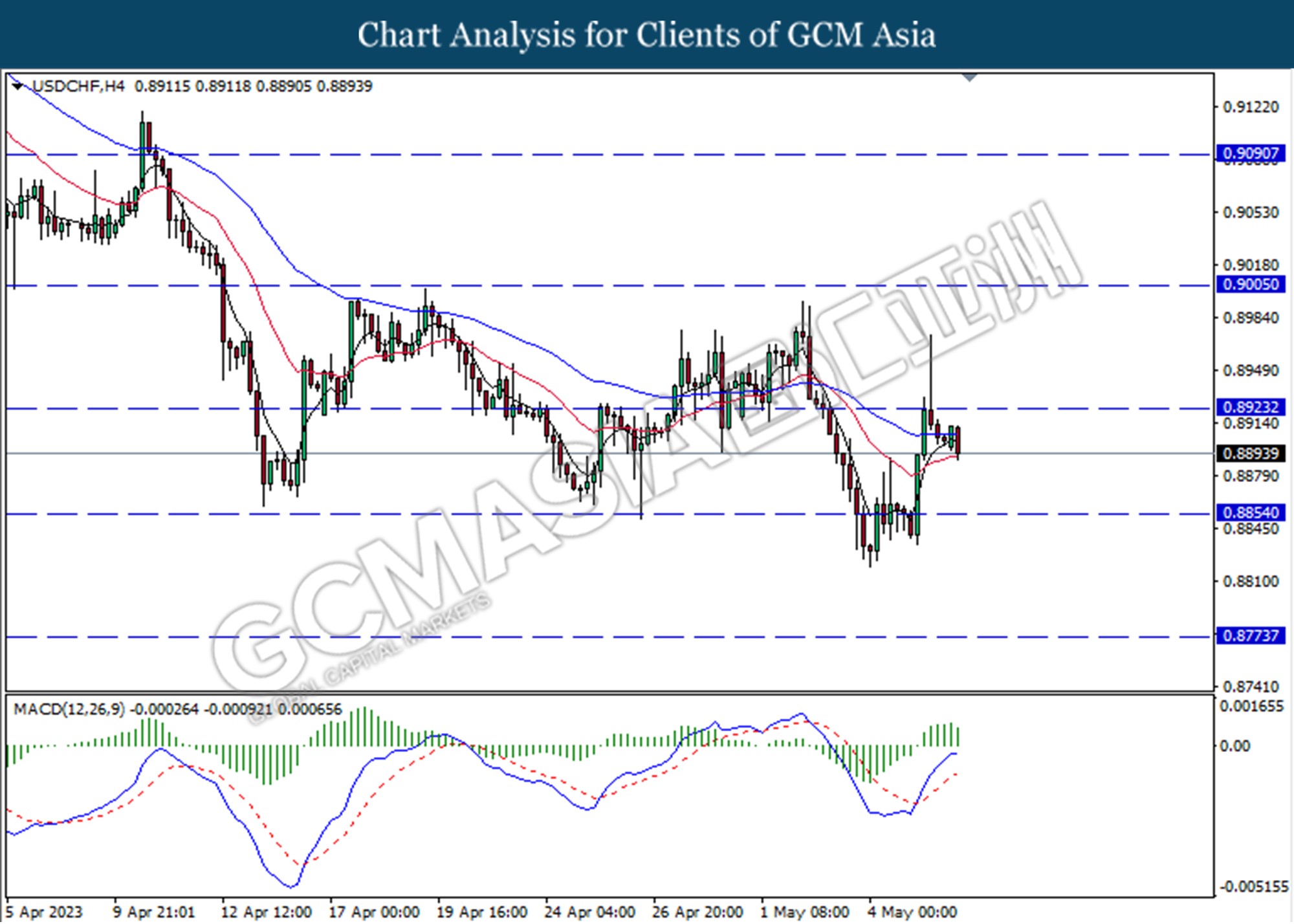

USDCHF, H4: USDCHF was traded lower following the prior retracement from the resistance level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.8855.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

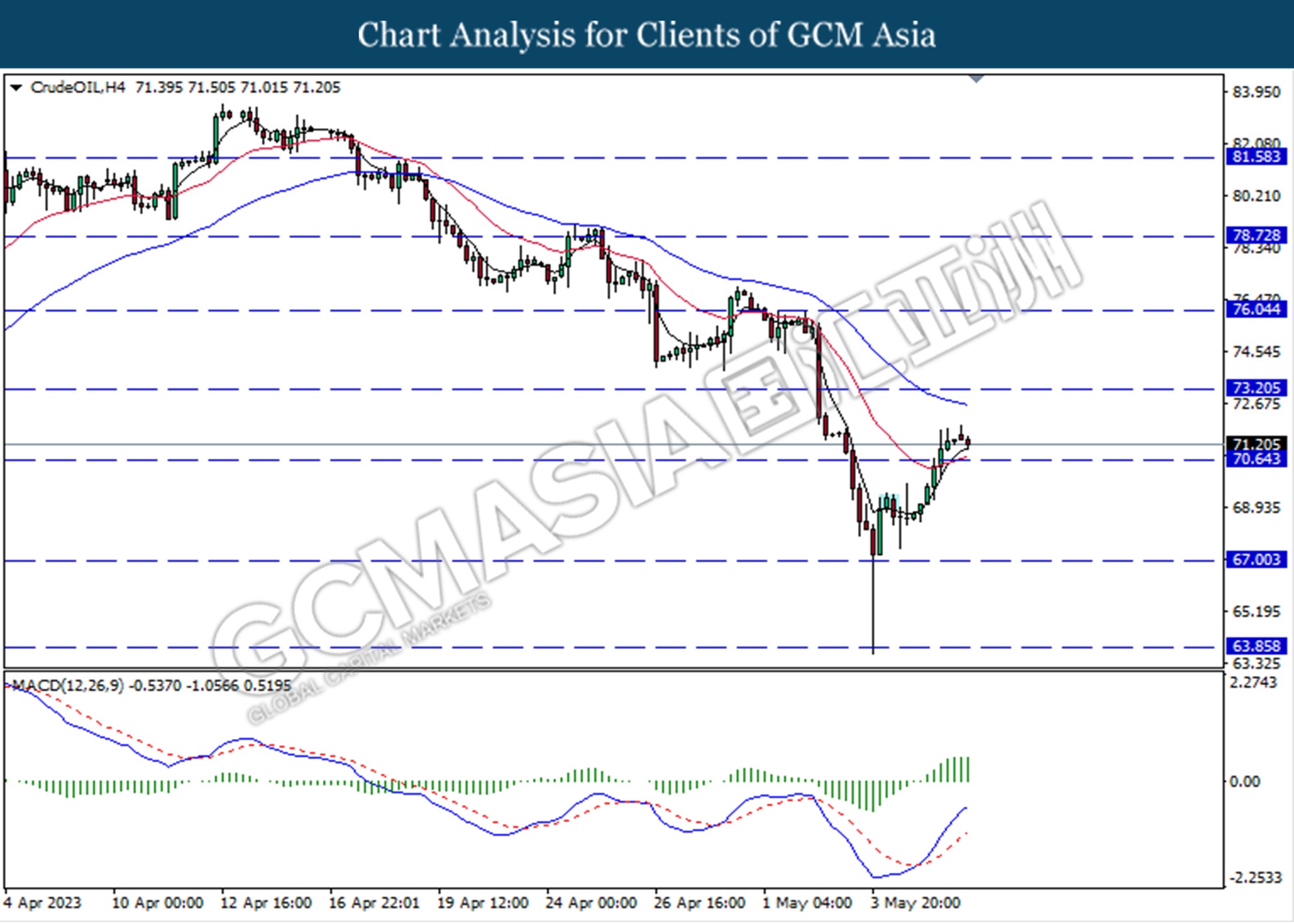

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the commodity to traded higher as a technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

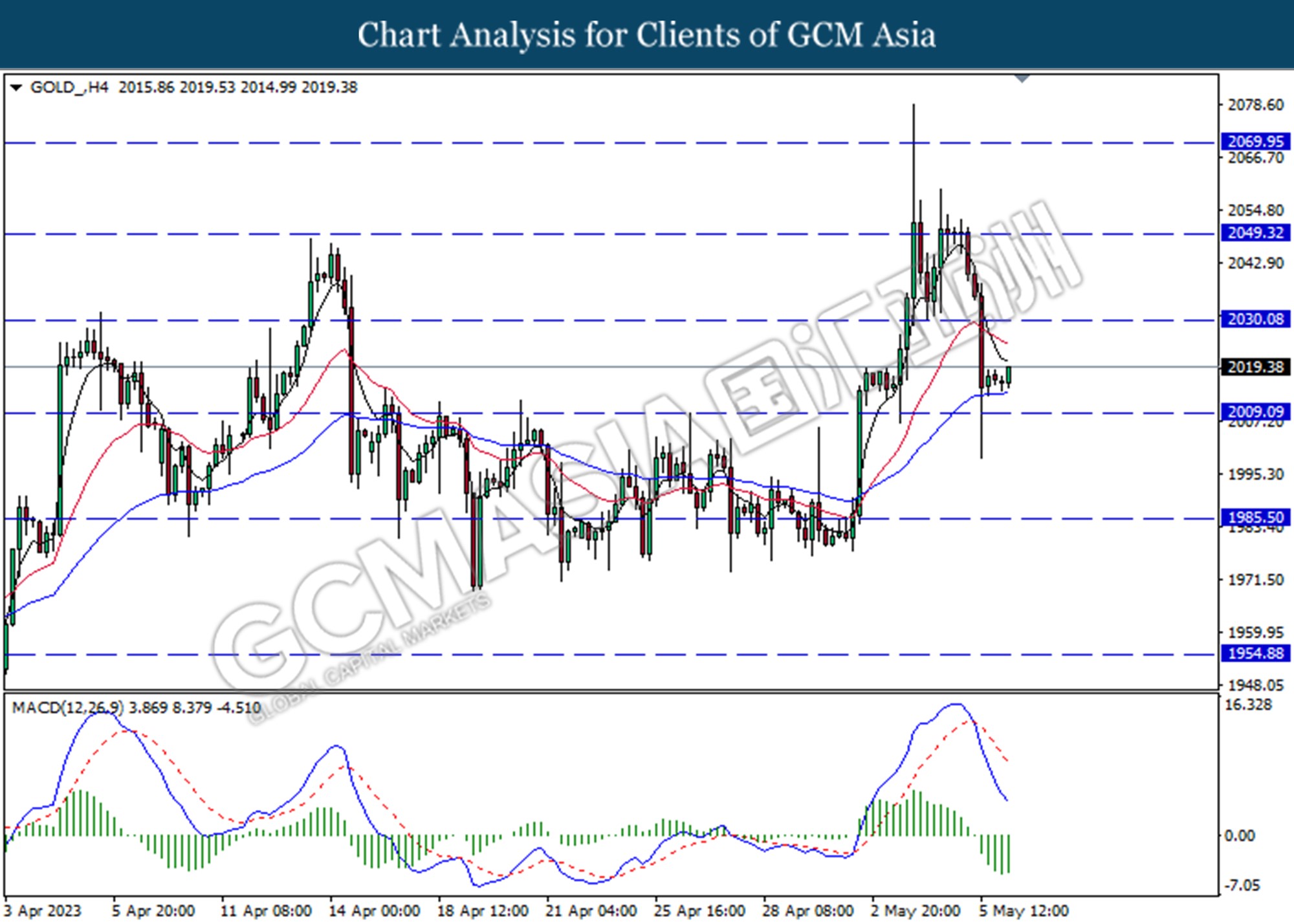

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 2009.10. However, MACD which illustrated bearish momentum suggests the commodity to trade lower as a technical correction.

Resistance level: 2030.10, 2049.32

Support level: 2009.10, 1985.50