8 June 2022 Afternoon Session Analysis

Dollar rebound amid risk-off sentiment heightened.

Dollar index, which gauges its value against a basket of six major currencies, jumped as market risk-off sentiment recovered ahead of the major inflationary data which assumed to be announced on Friday. As of now, Investors are awaiting the US Core CPI data this week for further cues on the economy as central banks worldwide seek to cool surging prices. The inflation data is in the spotlight now as it could provide further implication on US interest rate, where an extremely high reading might indicate Federal Reserve will have aggressive or more rate hike going forward and vice versa. Prior to now, Federal Reserve members did mention that there is likely to have a pause of rate adjustment after two times of 50 basis point rate hike. At this juncture, market participants are paying their attention over the upcoming crucial economic data to gauge the further direction of the dollar index. As of writing, the dollar index rose 0.30% to 102.65.

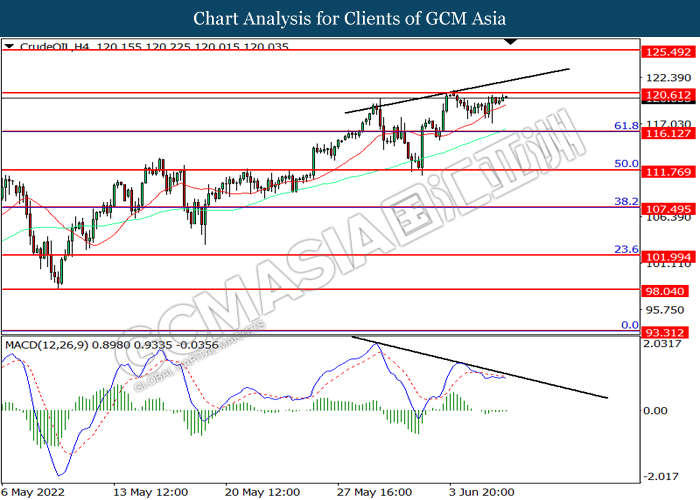

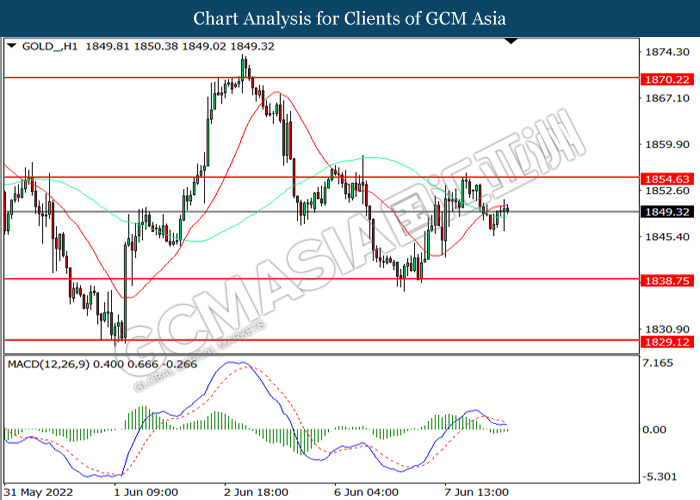

In the commodities market, crude oil prices up by 0.31% to $120.65 per barrel as EIA adjusted the global oil demand forecast upward, while stated that the current oil inventories level is at a very low level. Besides, gold prices dropped -0.18% to $1849.30 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 58.2 | 56.6 | – |

| 22:30 | USD – Crude Oil Inventories | -5.068M | -1.800M | – |

Technical Analysis

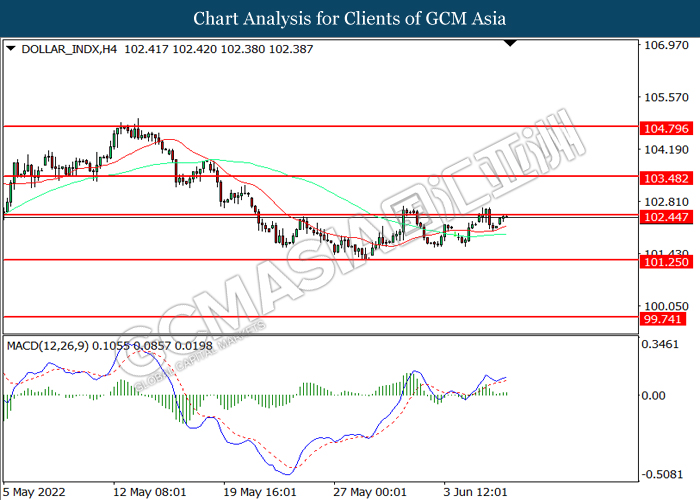

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 102.45, 103.50

Support level: 101.25, 99.75

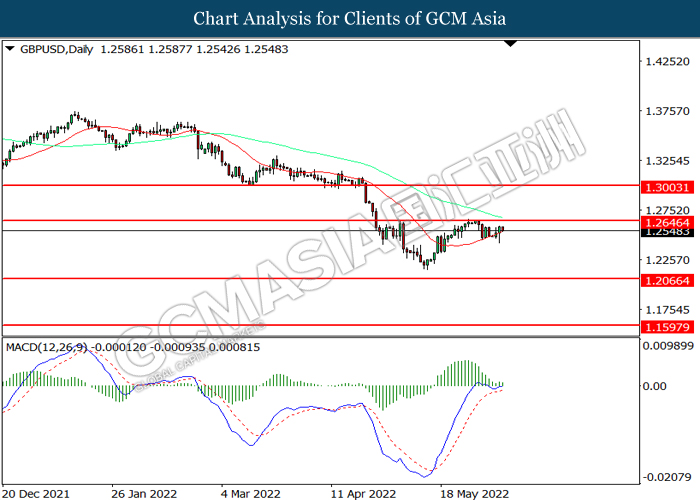

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2645, 1.3005

Support level: 1.2065, 1.1595

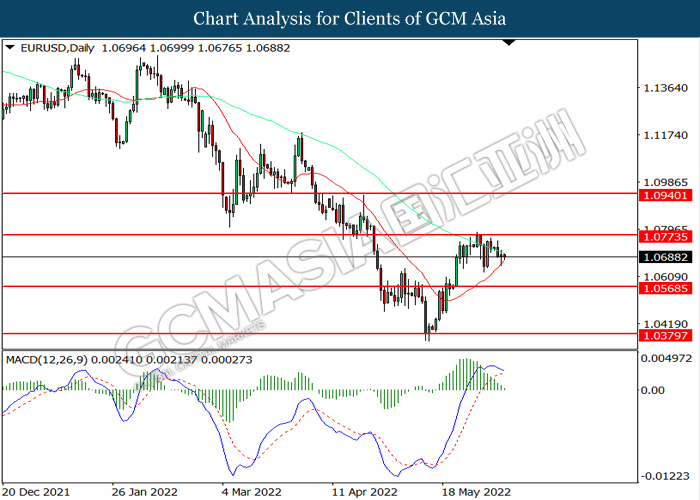

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0775, 1.0940

Support level: 1.570, 1.0380

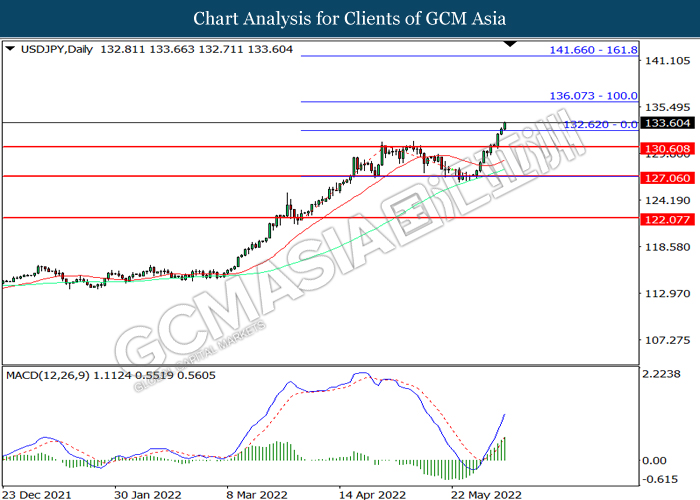

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 136.05, 141.65

Support level: 132.60, 130.60

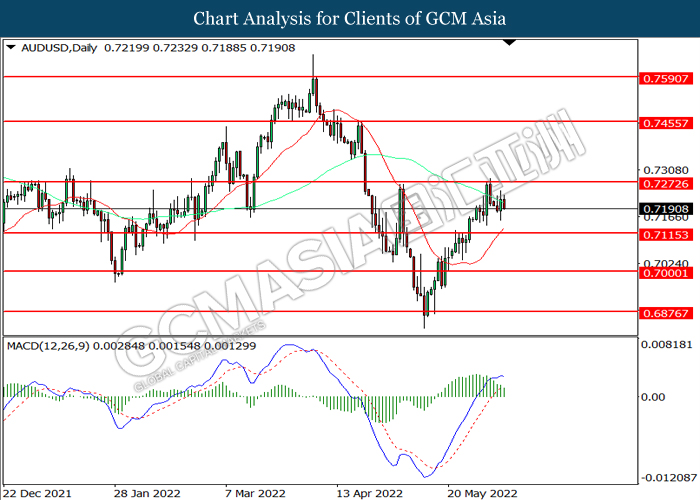

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7275, 0.7455

Support level: 0.7115, 0.7000

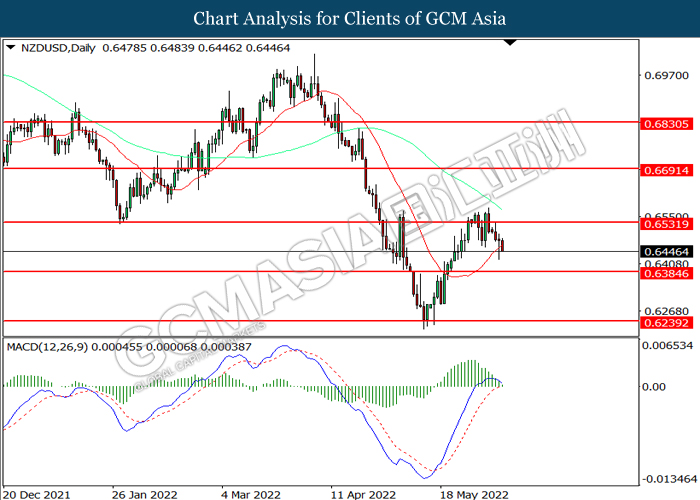

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6535, 0.6690

Support level: 0.6385, 0.6240

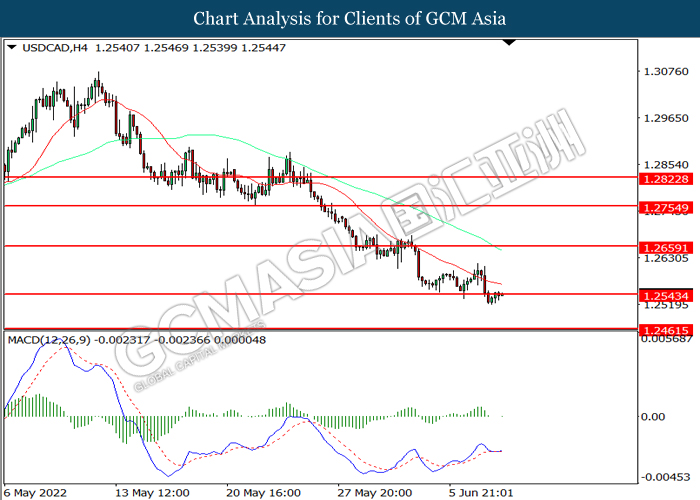

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2660, 1.2755

Support level: 1.2545, 1.2460

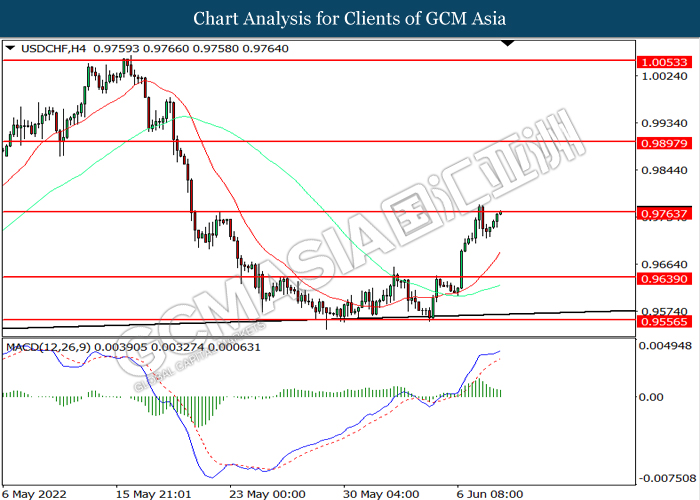

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9765, 0.9895

Support level: 0.9640, 0.9555

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 120.60, 125.50

Support level: 116.15, 111.75

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1854.65, 1870.20

Support level: 1838.75, 1829.10