08 June 2023 Afternoon Session Analysis

Canadian dollar soars as BoC hike interests to 22 years hike.

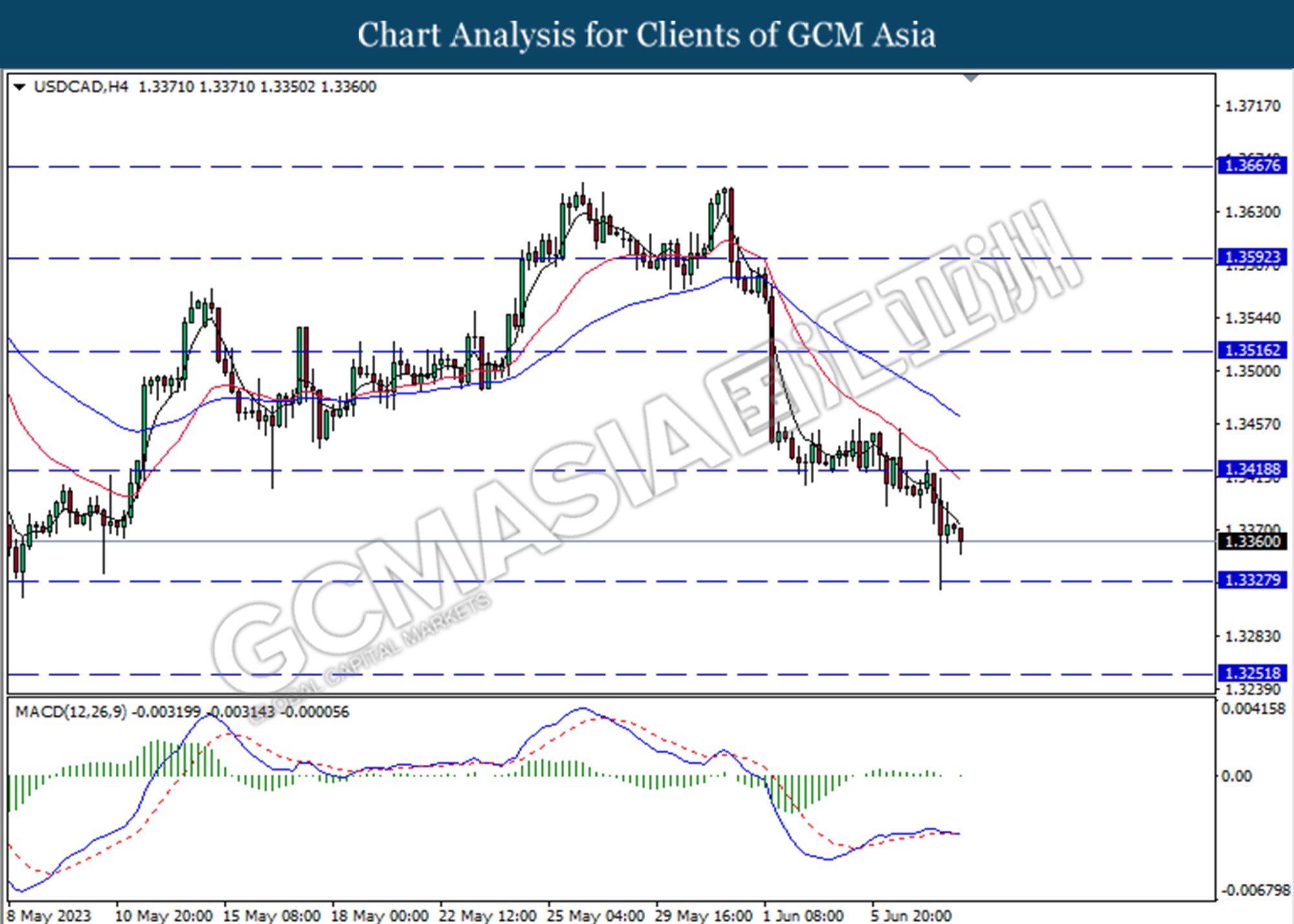

The pair of dollar index against the Canadian dollar plunged amid the Bank of Canada’s (BoC) increase in the interest rate by 25 basis points to 4.75%, a 22-year high. The BoC decisions surprised the economist as they forecast the rate will remain unchanged at 4.50%. Following that,BoC Governor Tiff Macklem commenting on the BoC policy announcement, said there is accumulating evidence that current monetary policy is not sufficient to bring the Canada inflation return to the 2% target, as a result, the central bank hikes the interest.. Although consumer price inflation is coming down driven by lower energy prices compared to a year ago, underlying inflation remains stubbornly high. Based on the consumer price index (CPI) data released on 16th May was unexpectedly rose to 4.4% after several months of decrease. It prompted the central bank to continue rate hikes after Canada’s economy was stronger than expected in the first quarter of 2023 with a GDP growth of 3.1%. However, the pair of the USDCAD limited its losses after investors increase their expectations on bets that the Fed will hike interest rates for another 25 basis points to curb inflation. As of writing, the pair of USDCAD tickled down by -0.08% to 1.3358.

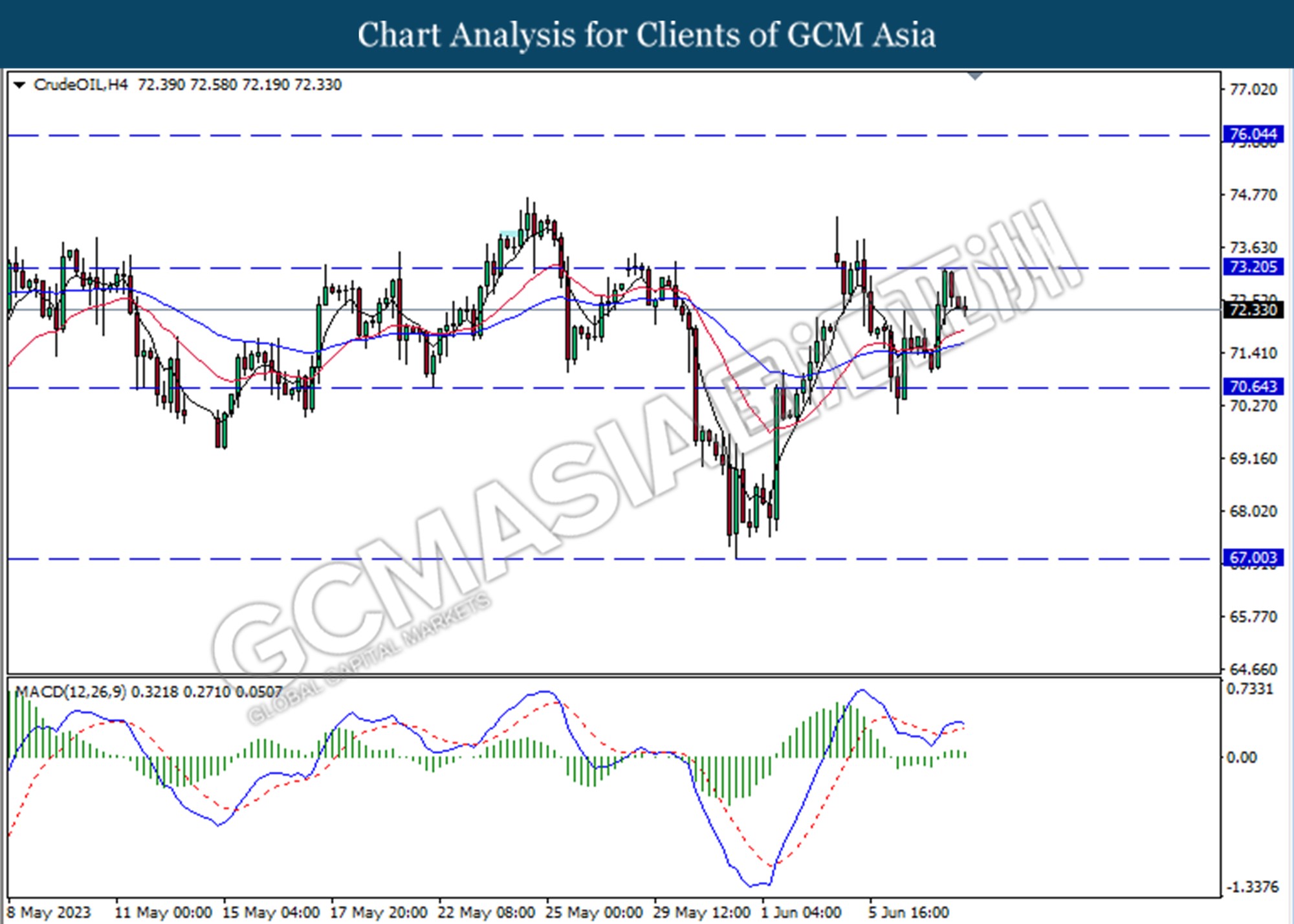

In commodity markets, crude oil prices fell -0.19% to $72.39 a barrel as investors weighed on supply and demand drivers. Besides, gold prices were inched up by 0.35% to $1946.87 per troy ounce ahead of the Fed meeting.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 238K | 232K | – |

Technical Analysis

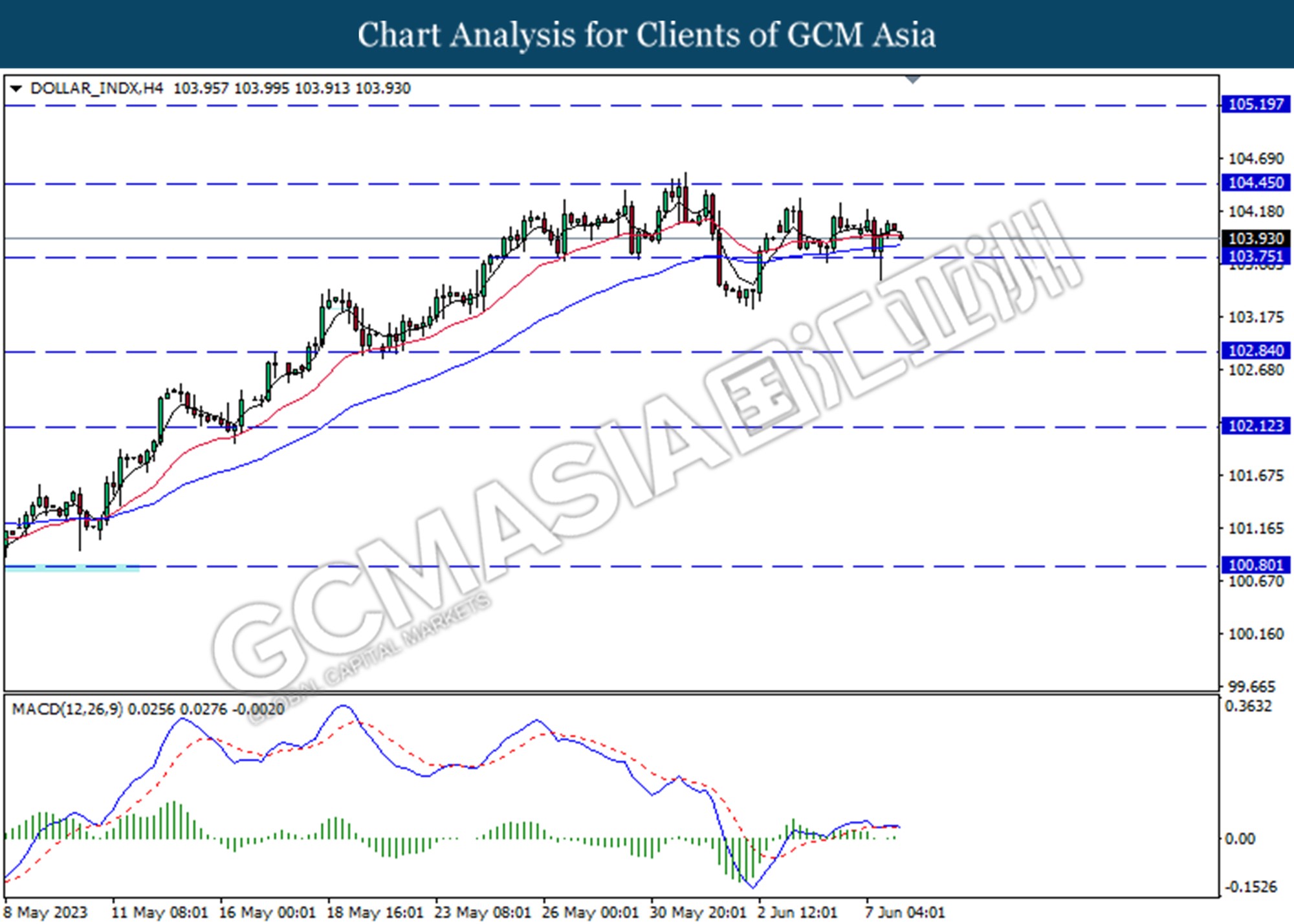

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 104.45, 105.20

Support level: 103.75, 102.85

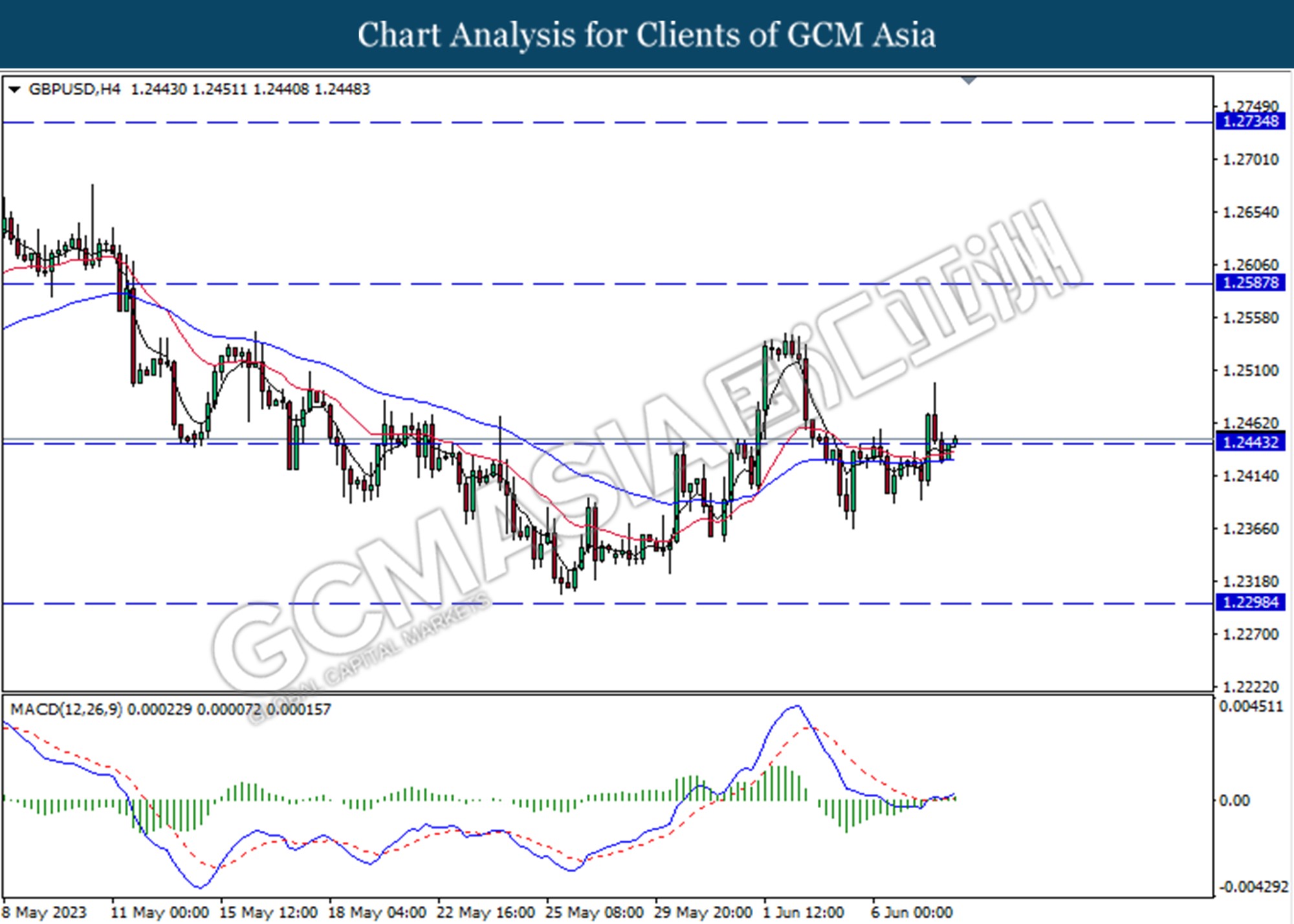

GBPUSD, H4: GBPUSD was traded higher following the prior breaks above the previous resistance level at 1.2445. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

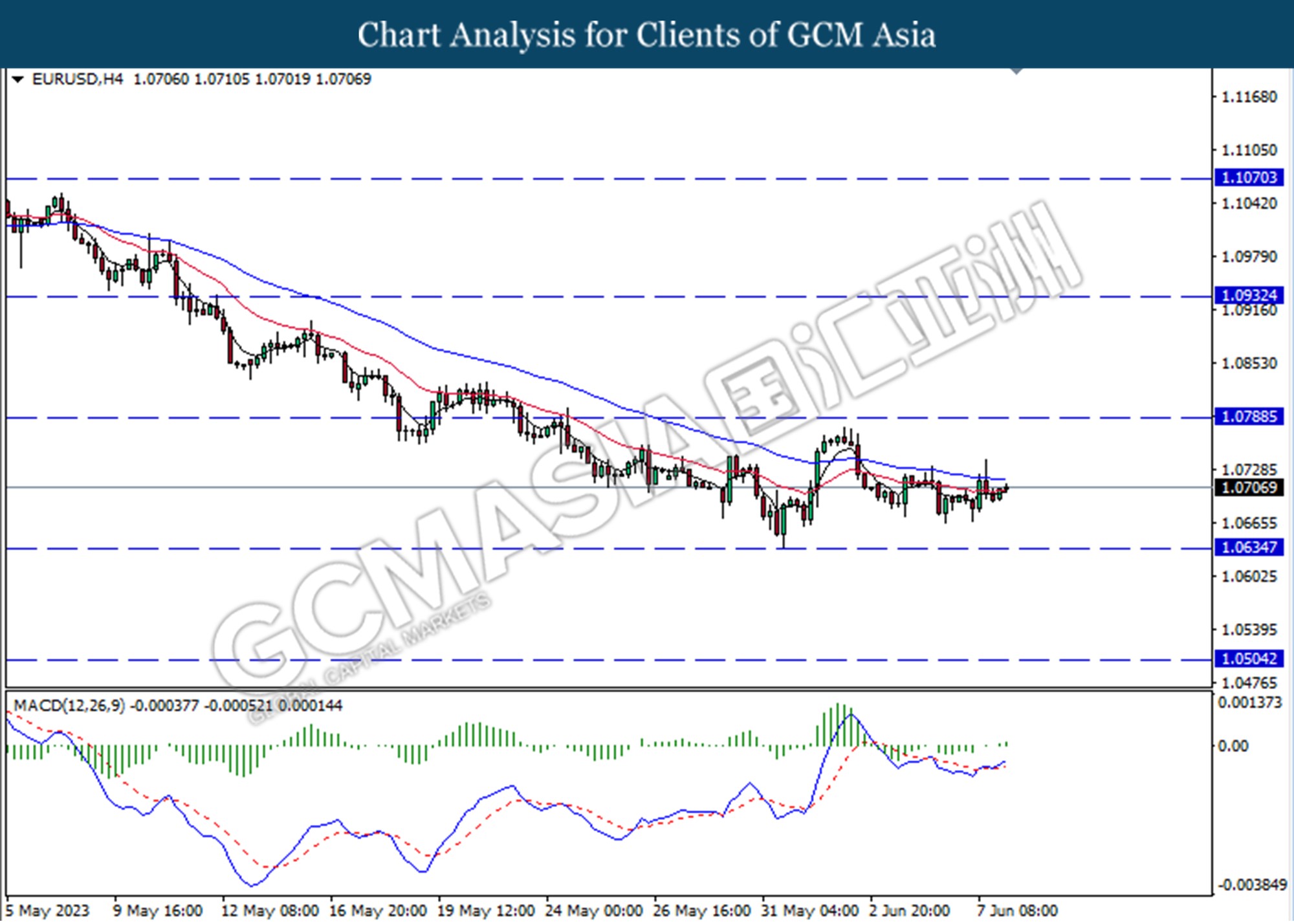

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.0790.

Resistance level: 1.0790,1.0930

Support level: 1.0635, 1.0505

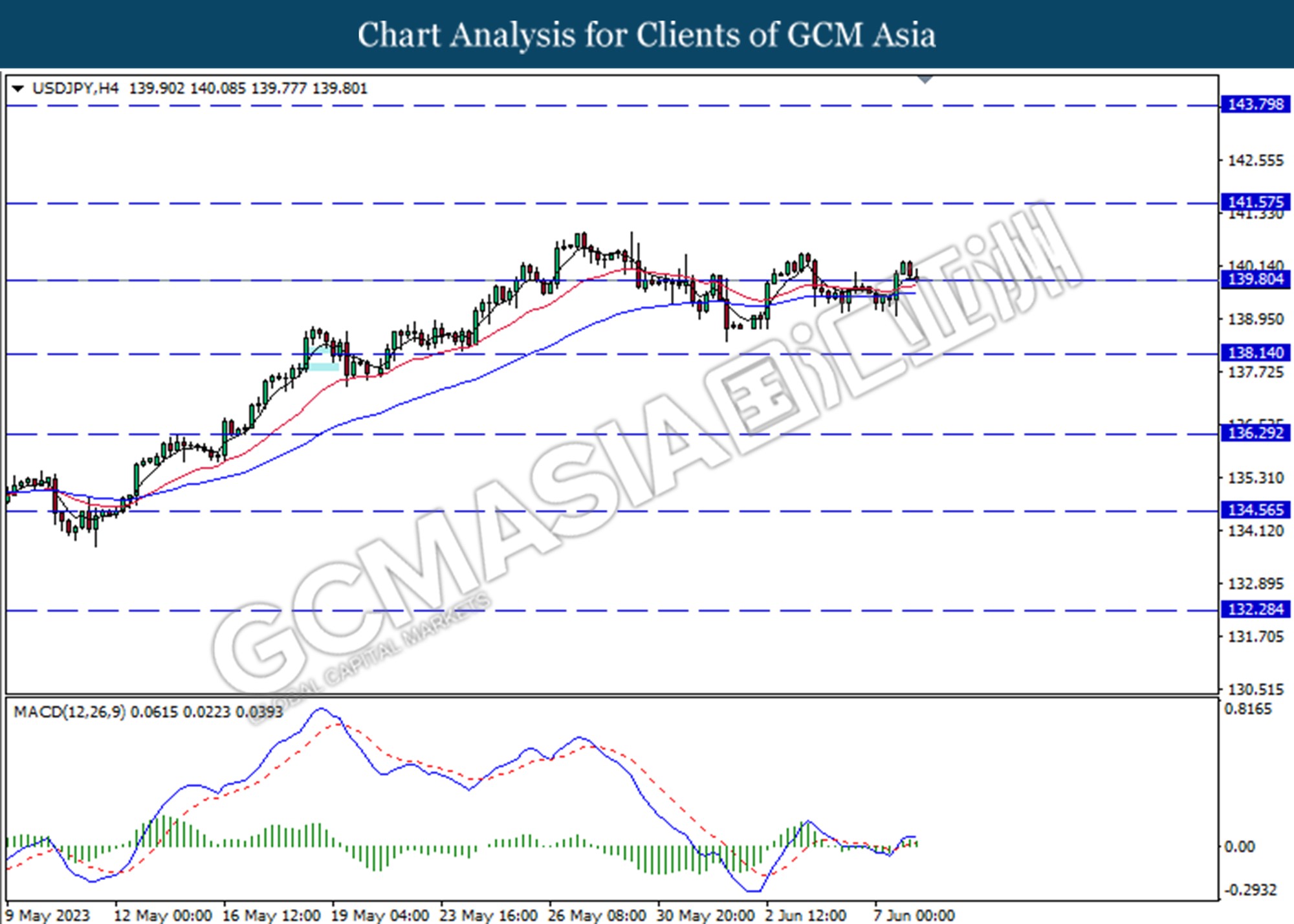

USDJPY, H4: USDJPY was traded lower while currently testing for the support level at 139.80. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses after it successfully break below the support level.

Resistance level: 141.60, 143.80

Support level: 139.80, 138.15

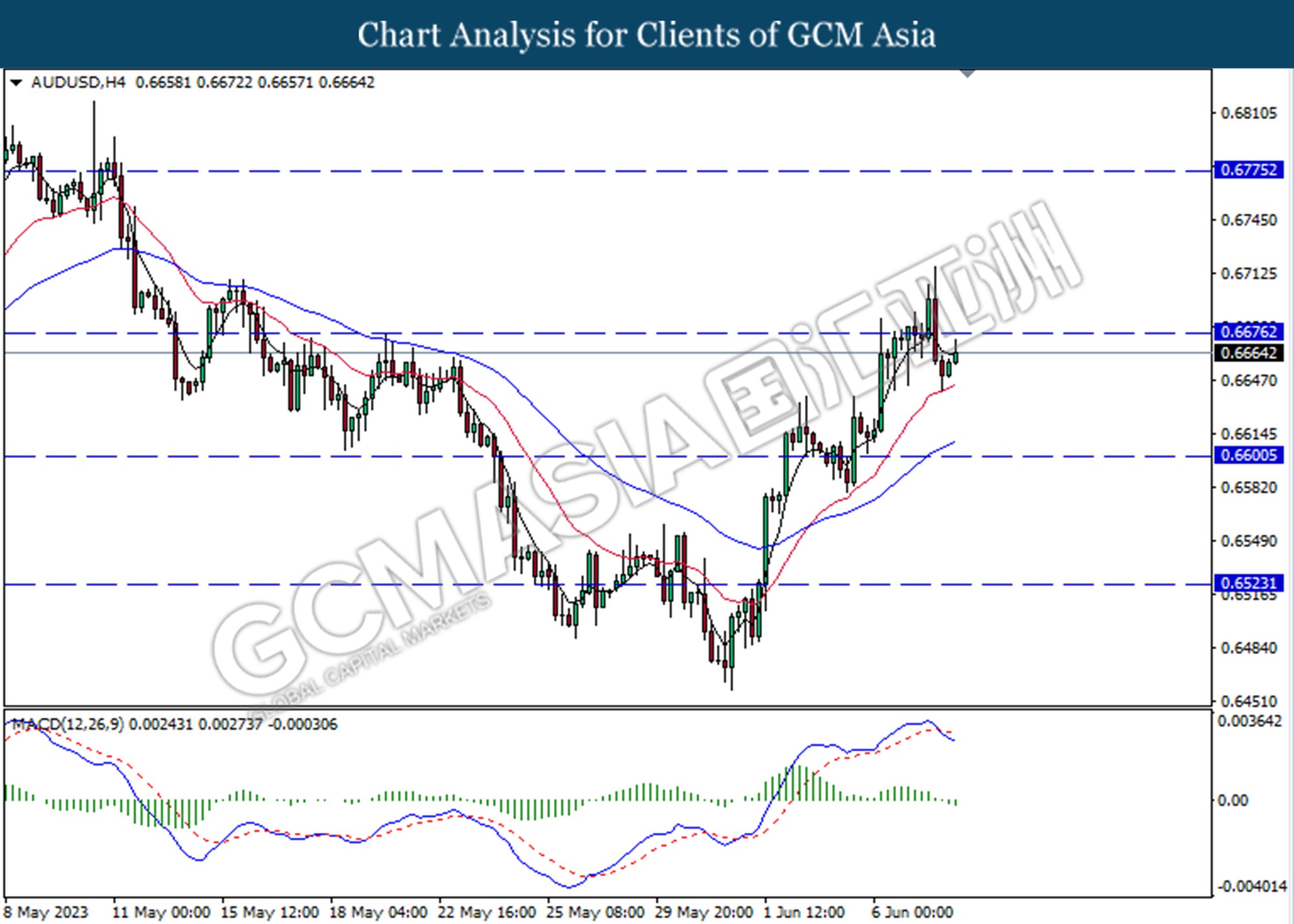

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6675, 0.6775

Support level: 0.6600, 0.6525

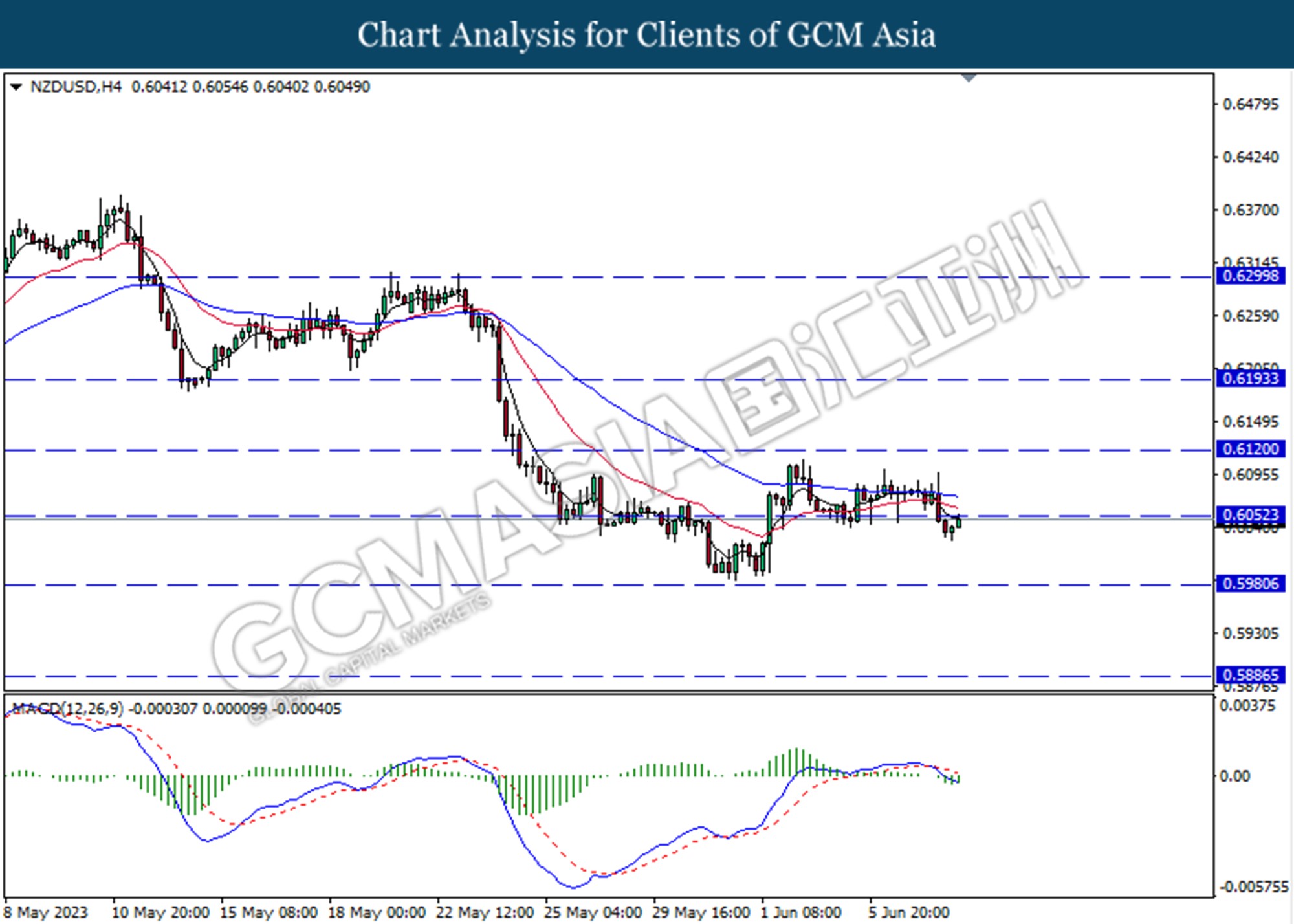

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6050. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 0.6050, 0.6120

Support level: 0.5980, 0.5885

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 1.3330.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower while currently testing the support level at 0.9090. However, MACD which illustrated bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.9180,0.9285

Support level: 0.9090, 0.9005

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 73.20. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 76.05, 73.20

Support level: 70.65, 67.00

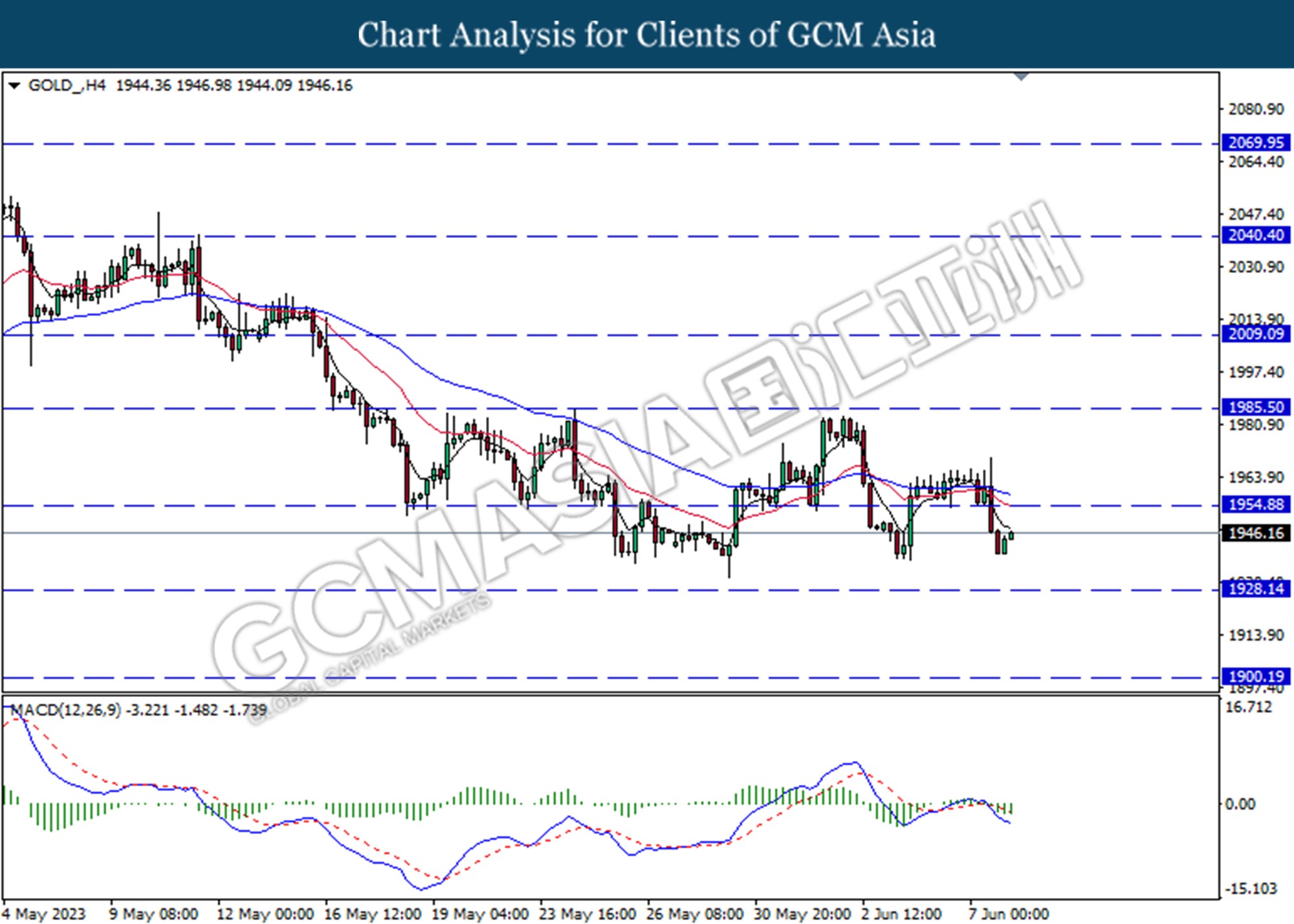

GOLD_, H4: Gold price was traded lower following the prior from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 1954.90.

Resistance level: 1954.90, 1985.50

Support level: 1928.15, 1900.20