8 August 2019 Afternoon Session Analysis

Slow market ahead of inflation data.

Market sentiment remained pressured by a set of dovish events such as increasing uncertainties of global economy slowdown which led to a few rate cuts by central banks around the world. Further pressuring global slowdown is ongoing trade tensions between US and China after recent round of trade talks ended with US President Donald Trump imposing additional tariff on Chinese goods effective 1st September. Some analysts reasoned that the motive behind Trump’s tariff is to pressure China into reaching a deal sooner, while others argued that the motive was due to Trump’s protectionism against its major partners. However, on China’s side, Beijing stated that they do not want a war but its not afraid to fight one, further increasing the tensions as investors expect a further delay of trade war. Tensions between the two countries had dampened global economy, causing central banks such as RBA and RBNZ to further loosen their monetary policy to support the economy downfall as investors largely sold the commodity-backed currencies. Recent outlook for the FX market remains dovish as investors are parking their investment into safe-haven assets while waiting for sentiment to be lifted from possible trade developments before 1st September. As of writing, pair of USD/JPY was down by 0.13% to 106.11 while dollar index inched lower by 0.03% to 97.32.

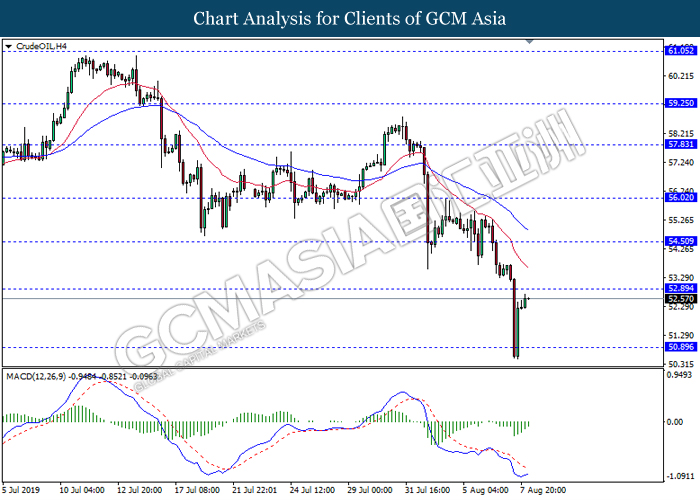

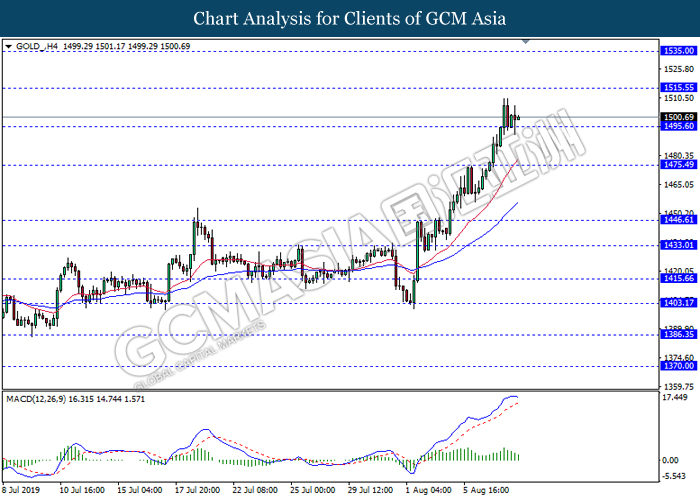

In terms of commodities market, crude oil price extended its rebound by 0.82% to $52.68 per barrel. After plunging more than 5% due to surprise build up in US crude inventories as reported by the EIA, the black commodity managed to pared its losses supported by ongoing Persian Gulf tensions as well as OPEC+ continuous effort to keep global stock lower. Otherwise, gold price falls by 0.08% to $1,499.75 a troy ounce. Gold prices remained well supported following President Trump’s criticism on the Federal Reserve to further its rate cut.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 215K | 215K | – |

Technical Analysis

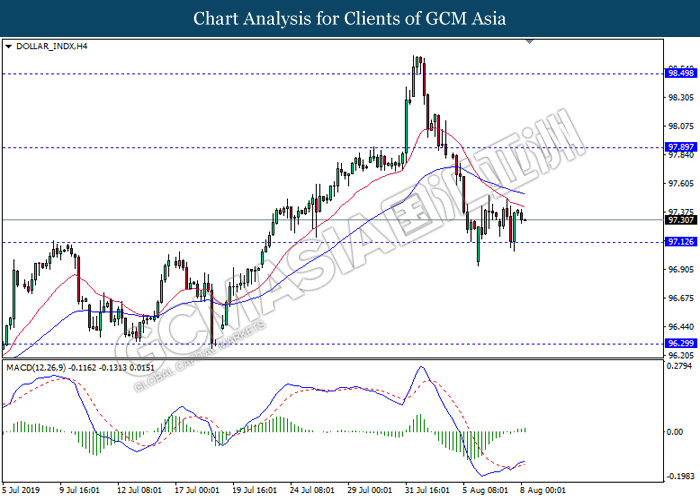

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 97.10. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the dollar to extend its rebound in short term towards the resistance level 97.90.

Resistance level: 97.90, 98.50

Support level: 97.10, 96.30

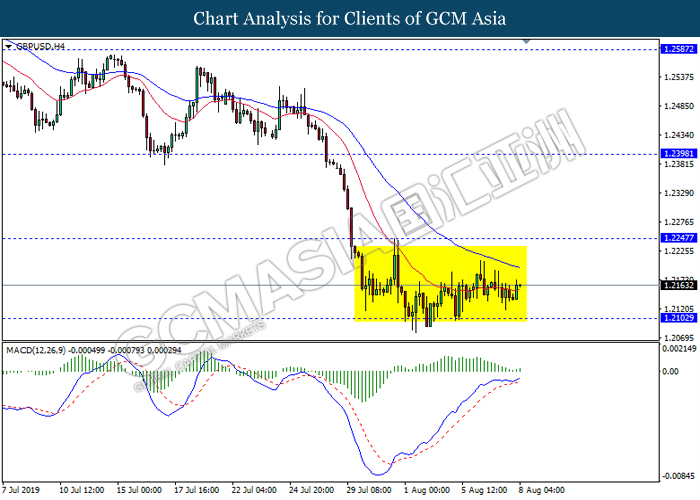

GBPUSD, H4: GBPUSD remain traded in a sideway channel. However, MACD which illustrate bullish bias signal suggest the pair to be traded higher in short term towards the resistance level 1.2245.

Resistance level: 1.2245, 1.2400

Support level: 1.2100, 1.1955

EURUSD, H4: EURUSD was traded higher following prior retracement from its high level. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.1170.

Resistance level: 1.1275, 1.1340

Support level: 1.1170, 1.1100

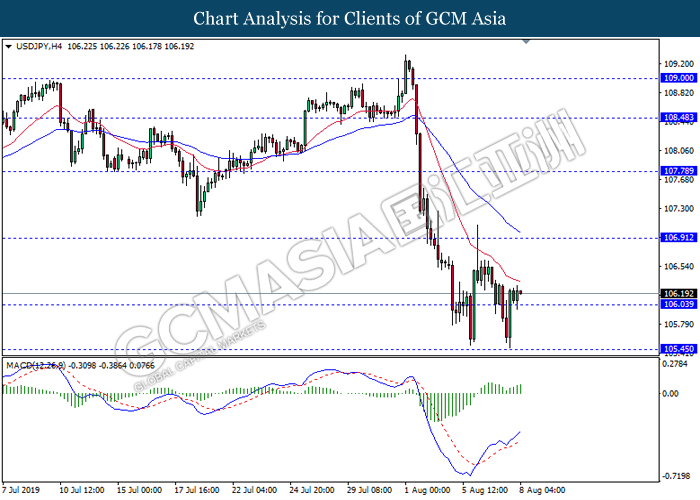

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level 106.05. MACD which illustrate persistent bullish momentum signal suggest the pair to extend its gains towards the resistance level 106.90.

Resistance level: 106.90, 107.80

Support level: 106.00, 105.45

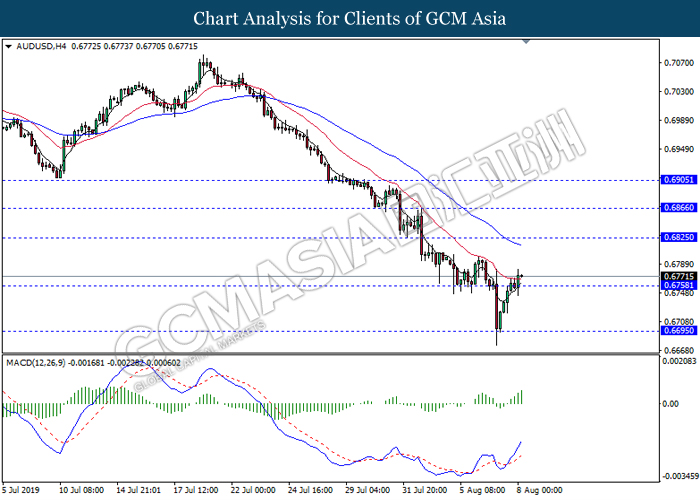

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.6760. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.6825.

Resistance level: 0.6825, 0.6865

Support level: 0.6760, 0.6695

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level 0.6420. MACD which illustrate bullish momentum signal suggest the pair to extend its gains towards the resistance level 0.6490.

Resistance level: 0.6490, 0.6550

Support level: 0.6420, 0.6350

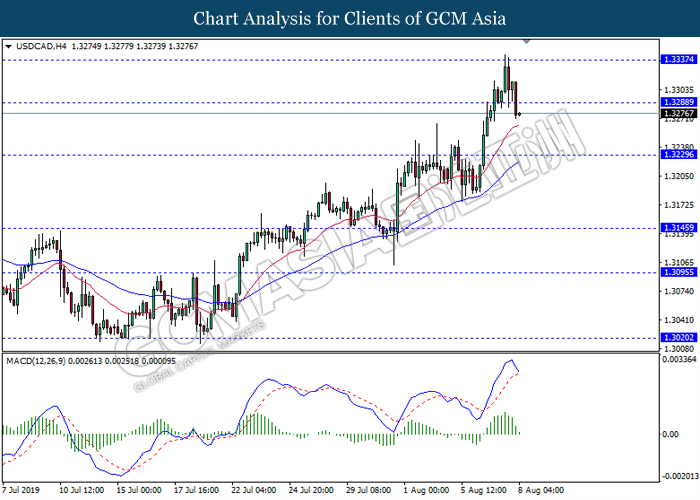

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level 1.3290. MACD which illustrate bearish bias signal with the starting formation of death cross suggest the pair to extend its losses towards the support level 1.3230.

Resistance level: 1.3290, 1.3335

Support level: 1.3230, 1.3145

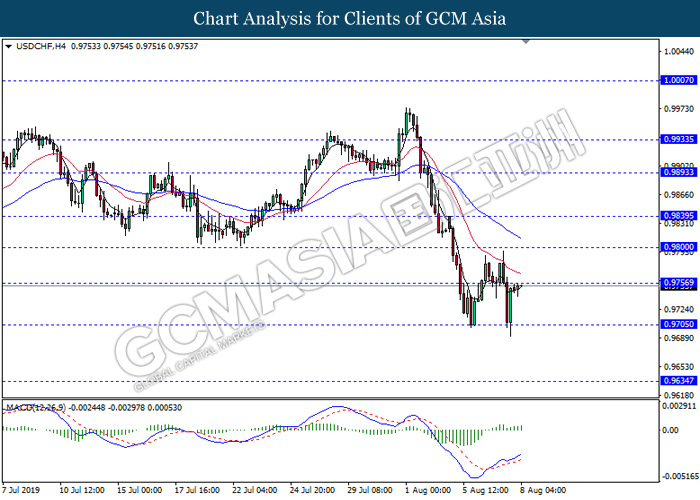

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9755. MACD which illustrate bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9755, 0.9800

Support level: 0.9705, 0.9635

CrudeOIL, H4: Crude oil price was traded higher while currently testing near the resistance level 52.90. MACD which illustrate diminishing bearish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 52.90, 54.50

Support level: 50.90, 48.45

GOLD_, H4: Gold price was traded higher following prior breakout above previous resistance level 1495.60. However, MACD which illustrate diminishing bullish momentum suggest the commodity to experience a technical correction in short term towards the support level 1495.60.

Resistance level: 1515.55, 1535.00

Support level: 1495.60, 1475.50