8 September 2022 Morning Session Analysis

US Dollar retreated following 10-year YTM eased.

The Dollar Index which traded against a basket of six major currencies retreated from its higher level following the US bond yield start to ease after hitting the highest since 2011. The riskier asset such as US stock indexes climbed the most in roughly a month, with investors brushed aside the earlier hawkish tone made by Federal Reserve on Wednesday. High-growth companies in those technology sector tend to benefit when yields retreated as it means for a lower discount rate for the analyst when they are calculating the intrinsic value for the companies. In addition, the US Dollar extend its losses following Federal Reserve expressed some of their concerns toward the economic growth in United States in future. According to Federal Reserve’s Beige Book which released on Wednesday, Fed claimed that the outlook for future economic growth remains pessimistic as rising food and rent prices have forced consumers to switch spending into essentials product instead of luxury goods. Nonetheless, investors would currently continue to scrutinize the US Federal Reserve President Jerome Powell’s speech on Thursday as well as US Consumer price data for next week to receive further trading signal. As of writing, the Dollar Index depreciated by 0.62% to 109.50.

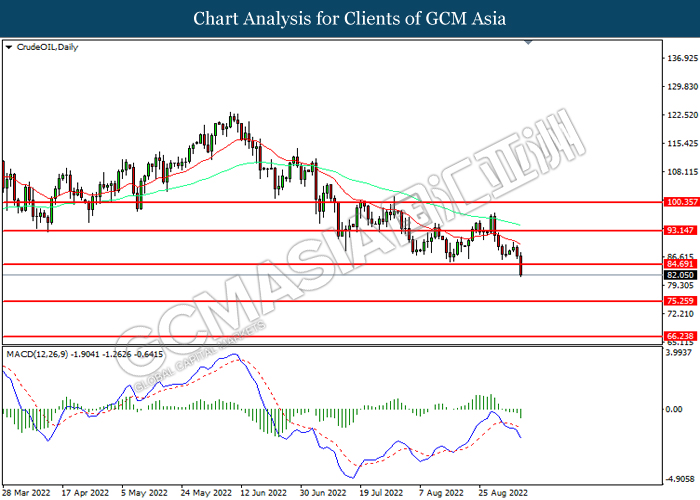

In the commodities market, the crude oil price slumped 0.03% to $81.90 per barrel as of writing. The oil market edged lower following the released of US Inventory data. According to American Petroleum Institute (API), the US API Weekly Crude Oil Stock came in at 3.645M, exceeding the market forecast at -0.733M. On the other hand, the gold price surged 0.03% to $1716.85 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:15 EUR ECB Interest Rate Decision (Sep)

20:45 EUR ECB Press Conference

21:10 USD Fed Chair Powell Speaks

22:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Sep) | 0.00% | 0.50% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.75% | – | – |

| 20:30 | USD – Initial Jobless Claims | 232K | 240K | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 3.326M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 109.70, 112.65

Support level: 104.85, 101.30

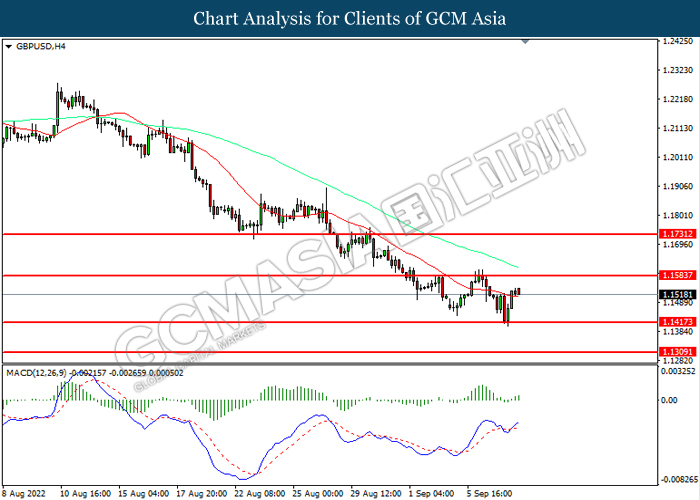

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.1585, 1.1730

Support level: 1.1415, 1.1310

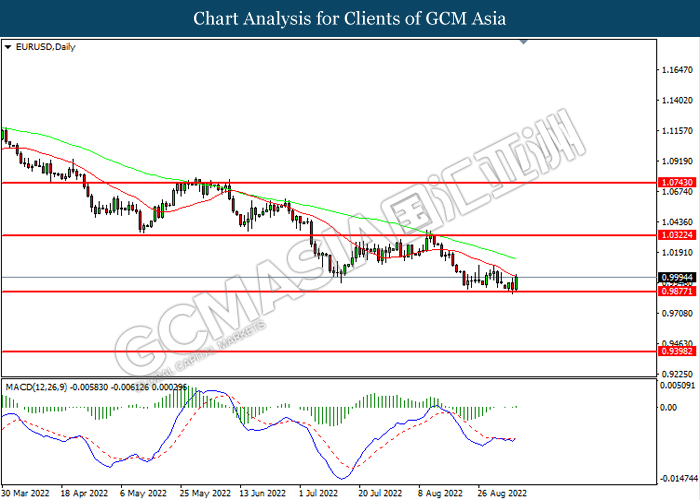

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0320, 1.0745

Support level: 0.9875, 0.9400

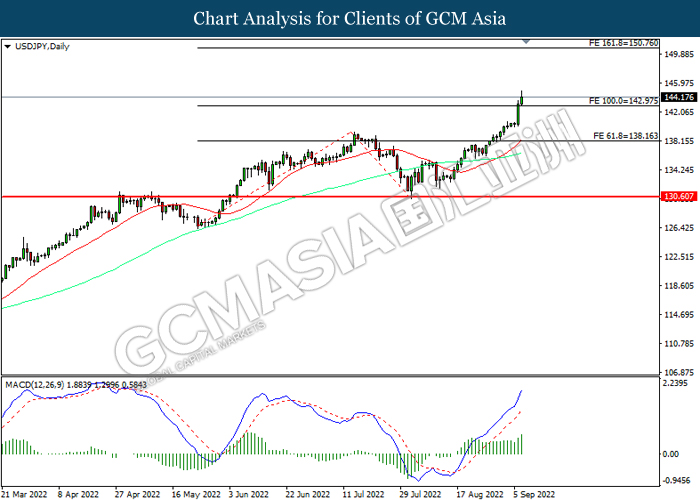

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 150.75.

Resistance level: 150.75, 160.00

Support level: 142.95, 138.15

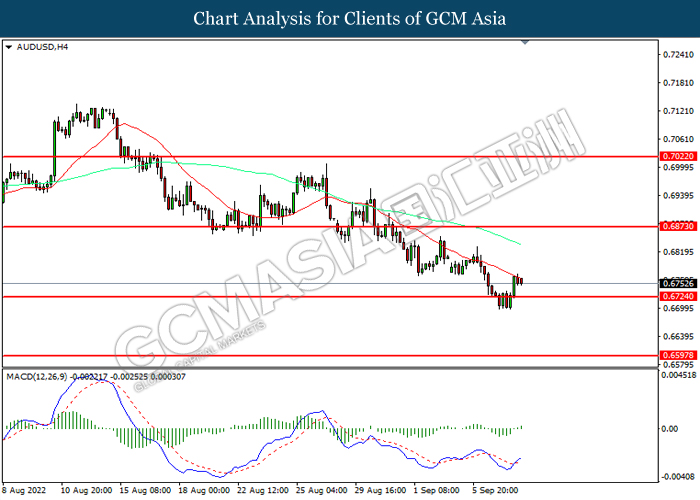

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6875, 0.7020

Support level: 0.6725, 0.6595

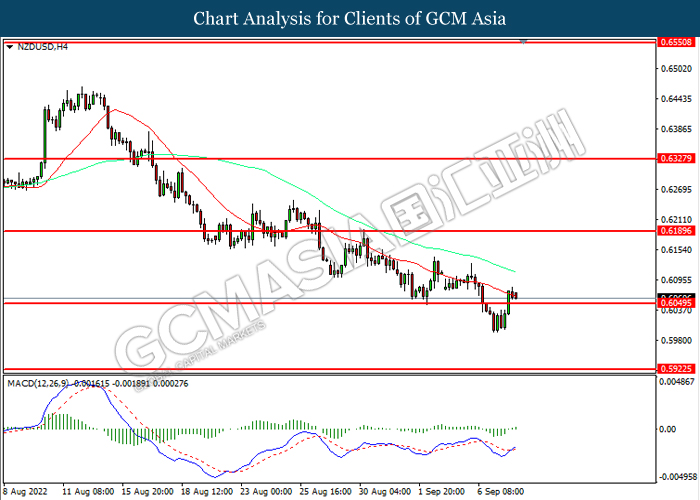

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6190, 0.6330

Support level: 0.6050, 0.5920

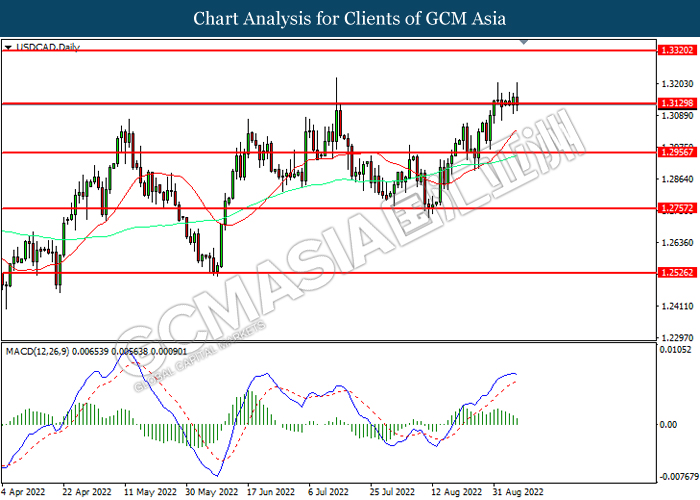

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3130, 1.3320

Support level: 1.2955, 1.2755

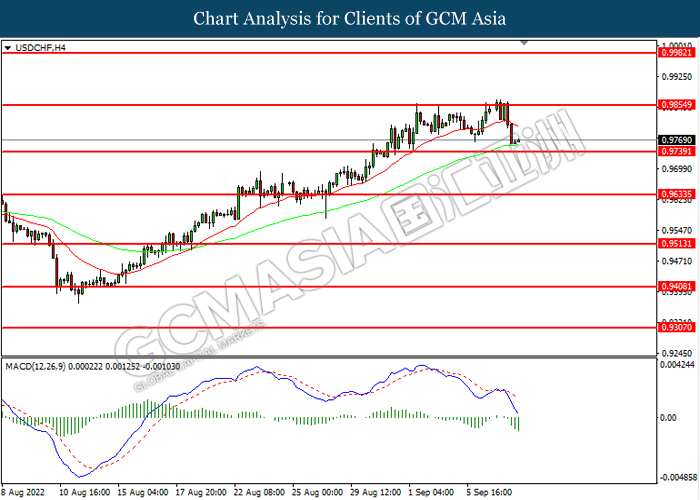

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.9855, 0.9980

Support level: 0.9740, 0.9635

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 84.70, 93.15

Support level: 75.25, 66.25

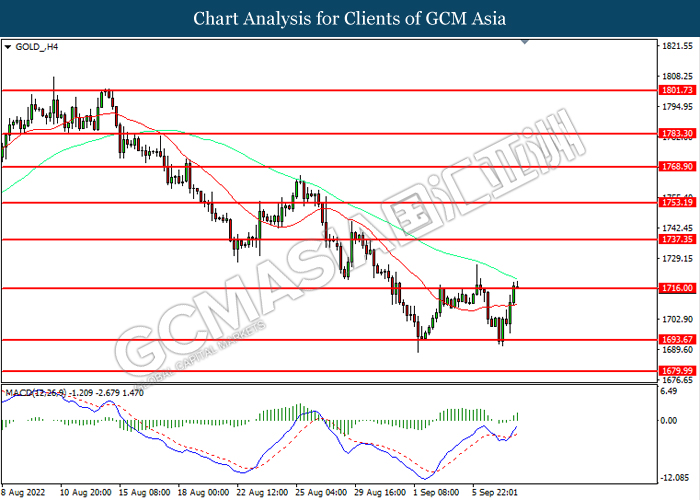

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1716.00, 1739.80

Support level: 1693.65, 1680.00