8 November 2022 Afternoon Session Analysis

Greenback stunned ahead of US mid-term election.

The dollar index, which gauges its value against a basket of six major currencies, hovered near the 10-day low as the market participants remain cautious against the US mid-term election. At this point in time, the Senate is currently evenly split between 50 Democrats and 50 Republicans. Despite that, vice president Kamala Harris has cast a tie-breaking vote for Democrats, where the Democrats currently have the slimmest majority in the Senate. In this time round, 35 out of 100 Senate seats are up for election, whereby 14 Democrats and 21 Republican seats will be elected in the mid-term election. With that, there is a high possibility that Republicans will take over the control of the Senate. On the other side, the House currently has 221 Democrats, 212 Republicans, and two vacancies. With the political uncertainty heightened, it is likely to boost the appeal of the safe haven currencies as well as safe haven commodities. As of writing, the dollar index rose 0.21% to 110.35.

In the commodities market, the crude oil price edged down by -0.50% to $91.95 per barrel as the Chinese Health Official vowed that they are not considering easing the Covid-19 restriction at this point in time. Besides, the gold price dropped by -0.30% to $1670.15 per troy ounce following the rebound in the dollar index market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

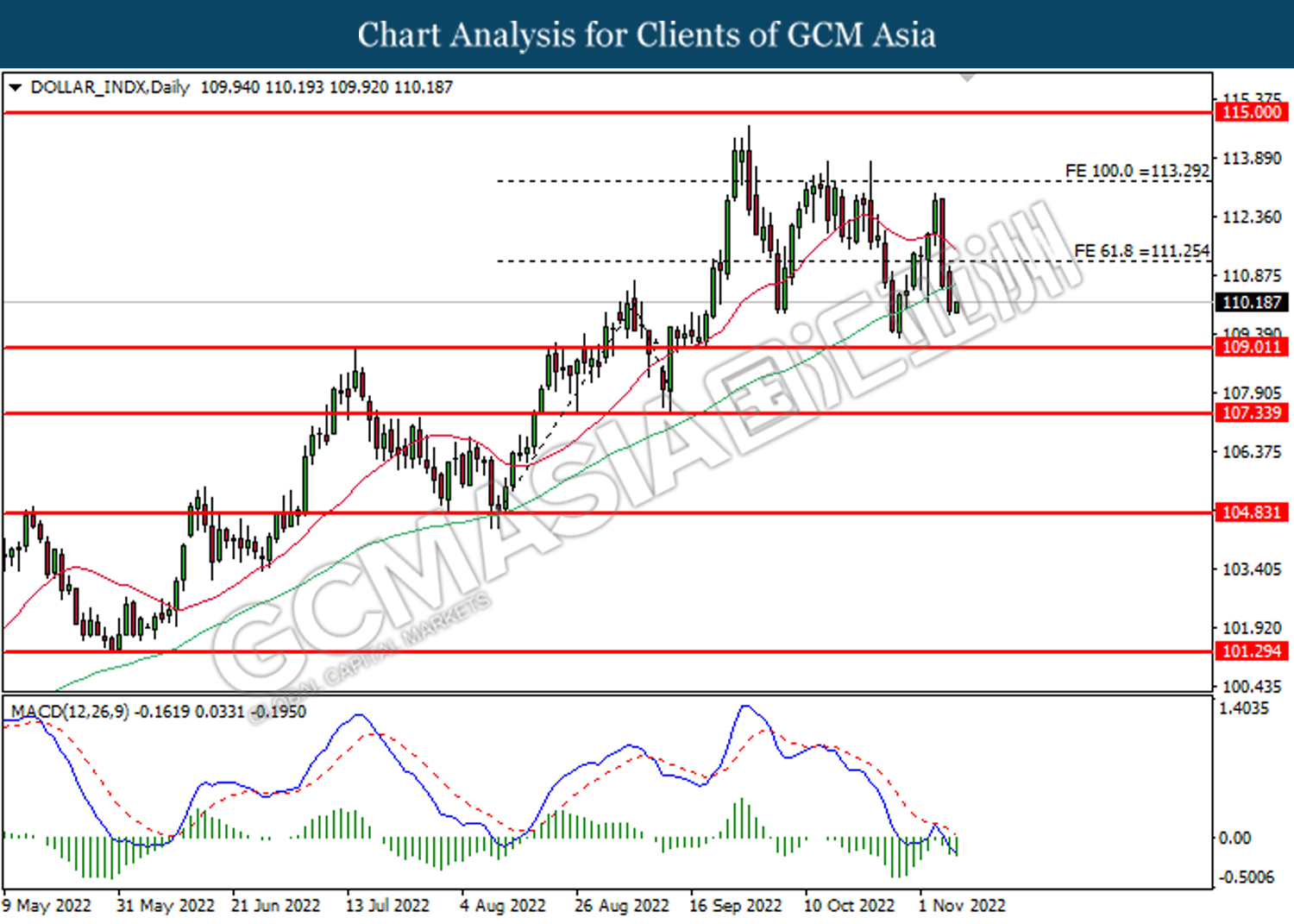

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 111.25. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 109.00.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

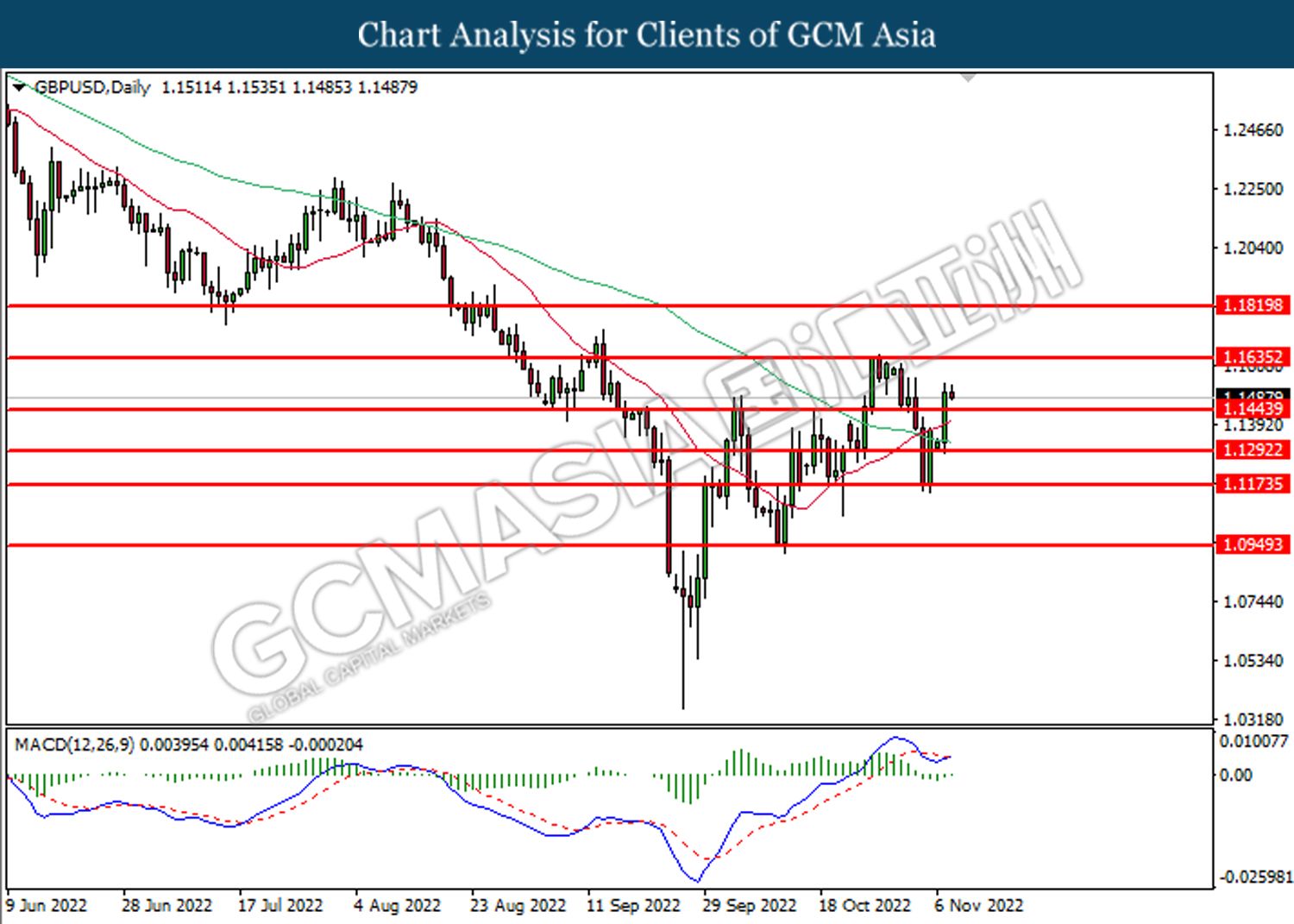

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.1445. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1635.

Resistance level: 1.1635, 1.1820

Support level: 1.1445, 1.1290

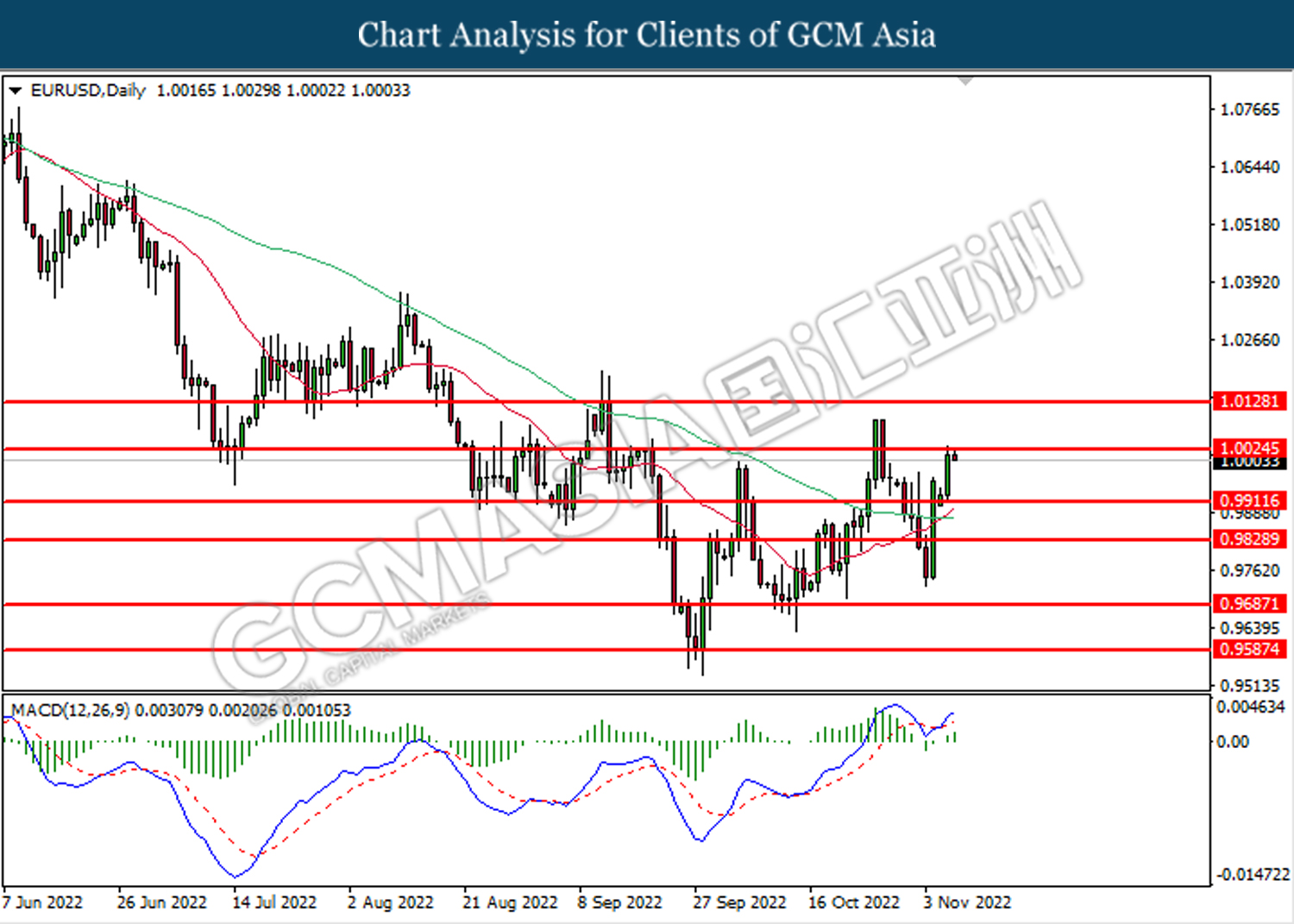

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 0.9910. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0025.

Resistance level: 1.0025, 1.0130

Support level: 0.9910, 0.9830

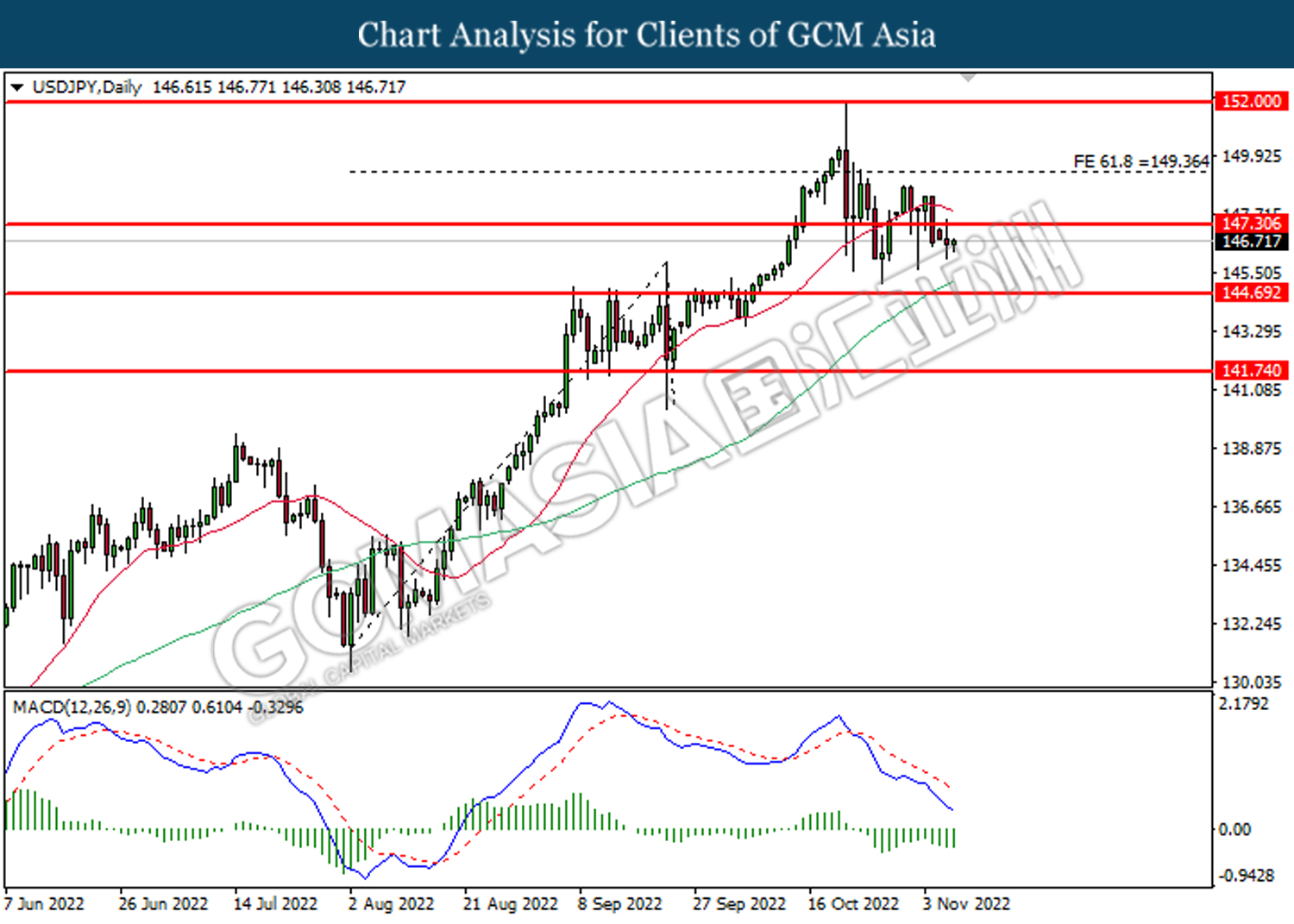

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level at 147.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 144.70.

Resistance level: 147.30, 149.35

Support level: 144.70, 141.75

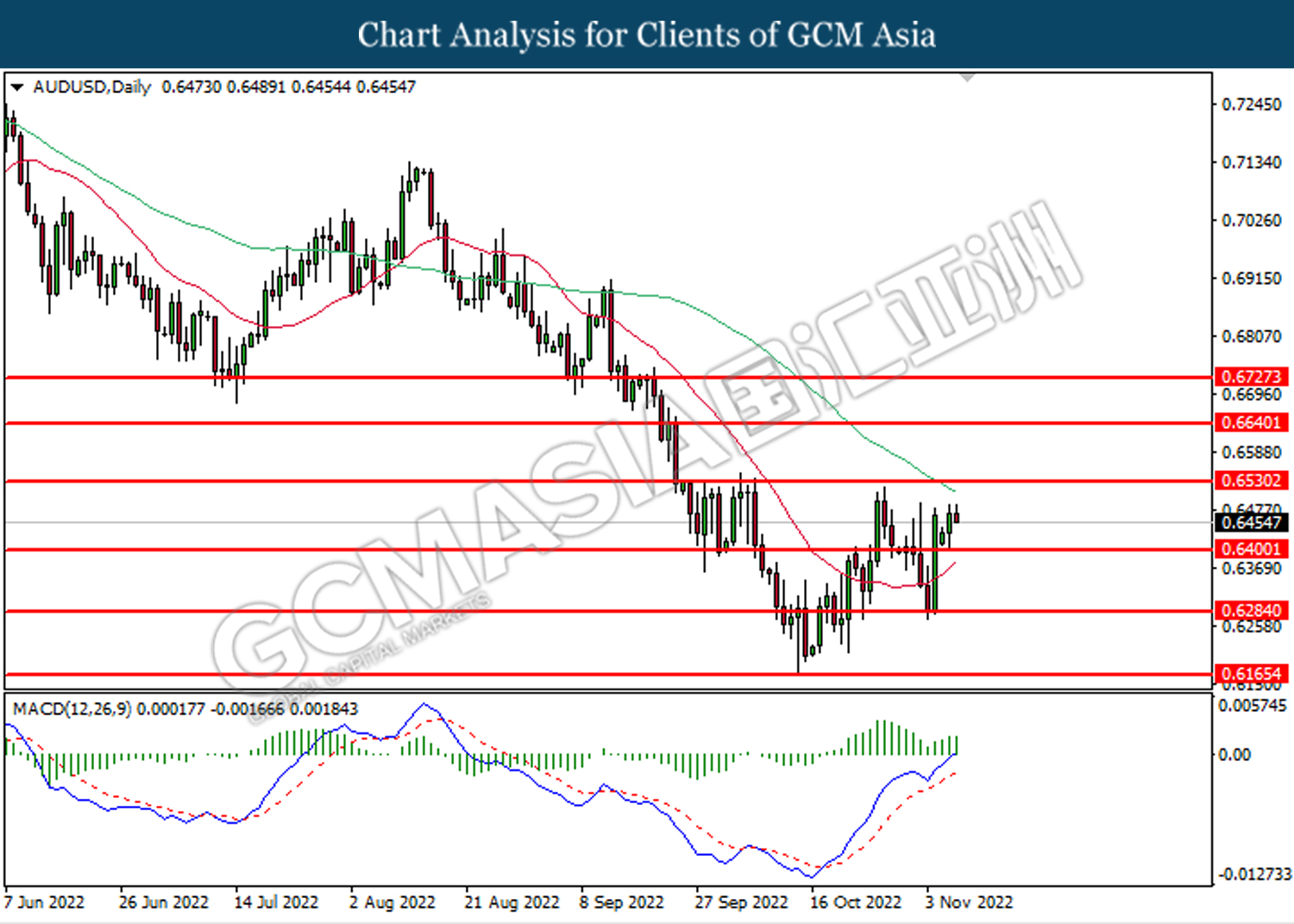

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level at 0.6400. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6530.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

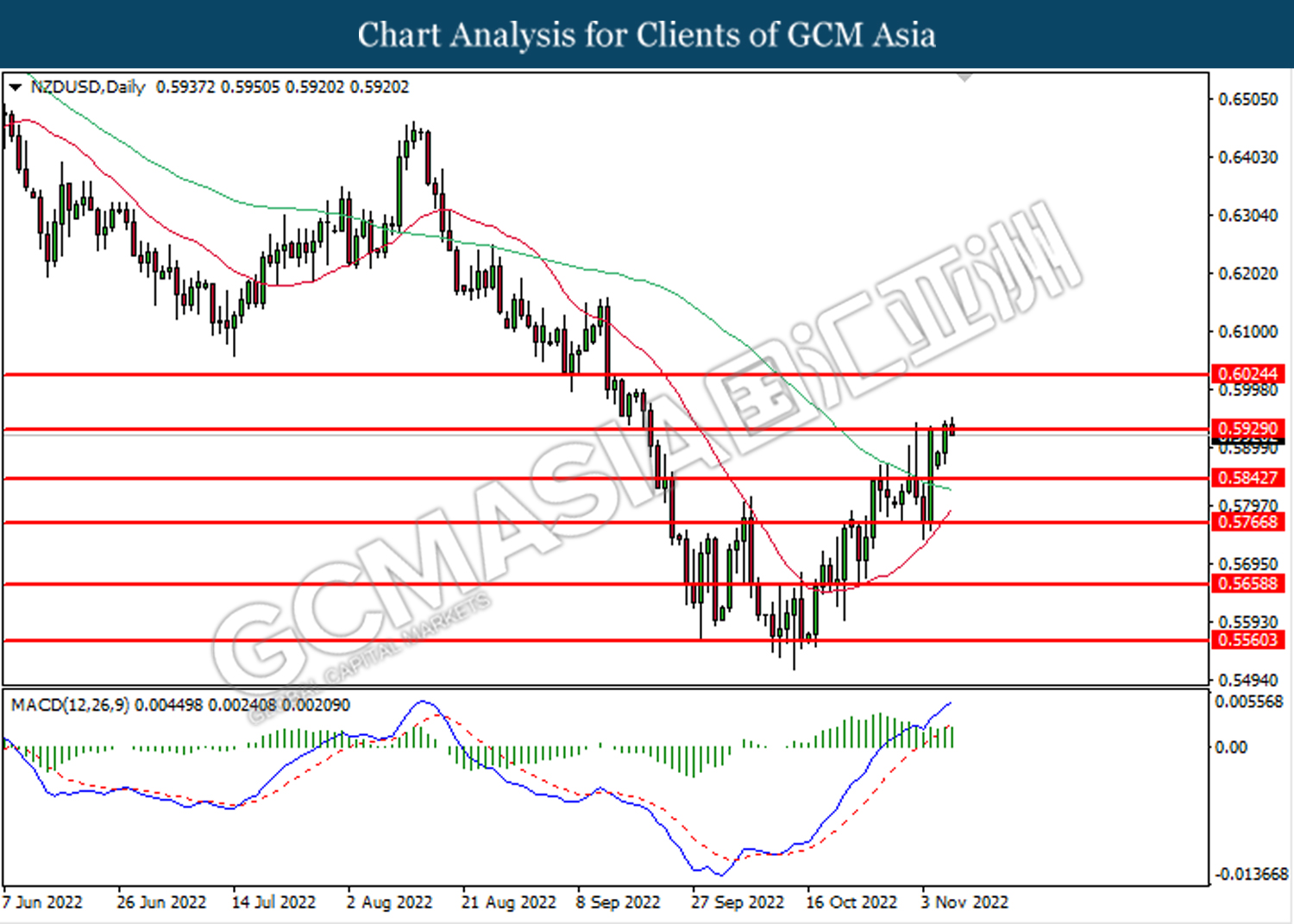

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5930. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.5930, 0.6025

Support level: 0.5845, 0.5765

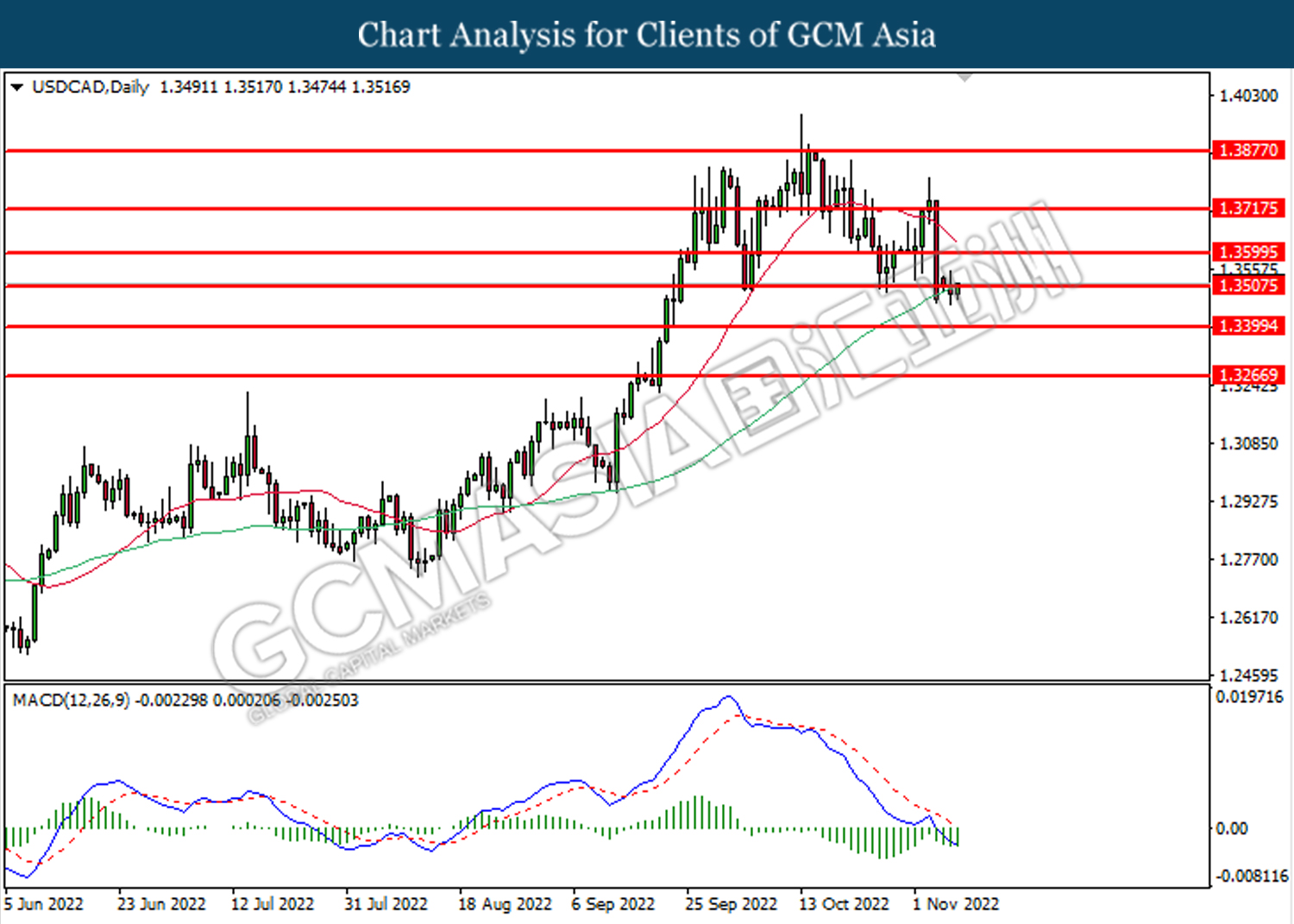

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3505. However, MACD which illustrated bearish bias momentum suggests the pair to undergo technical correction in short term.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

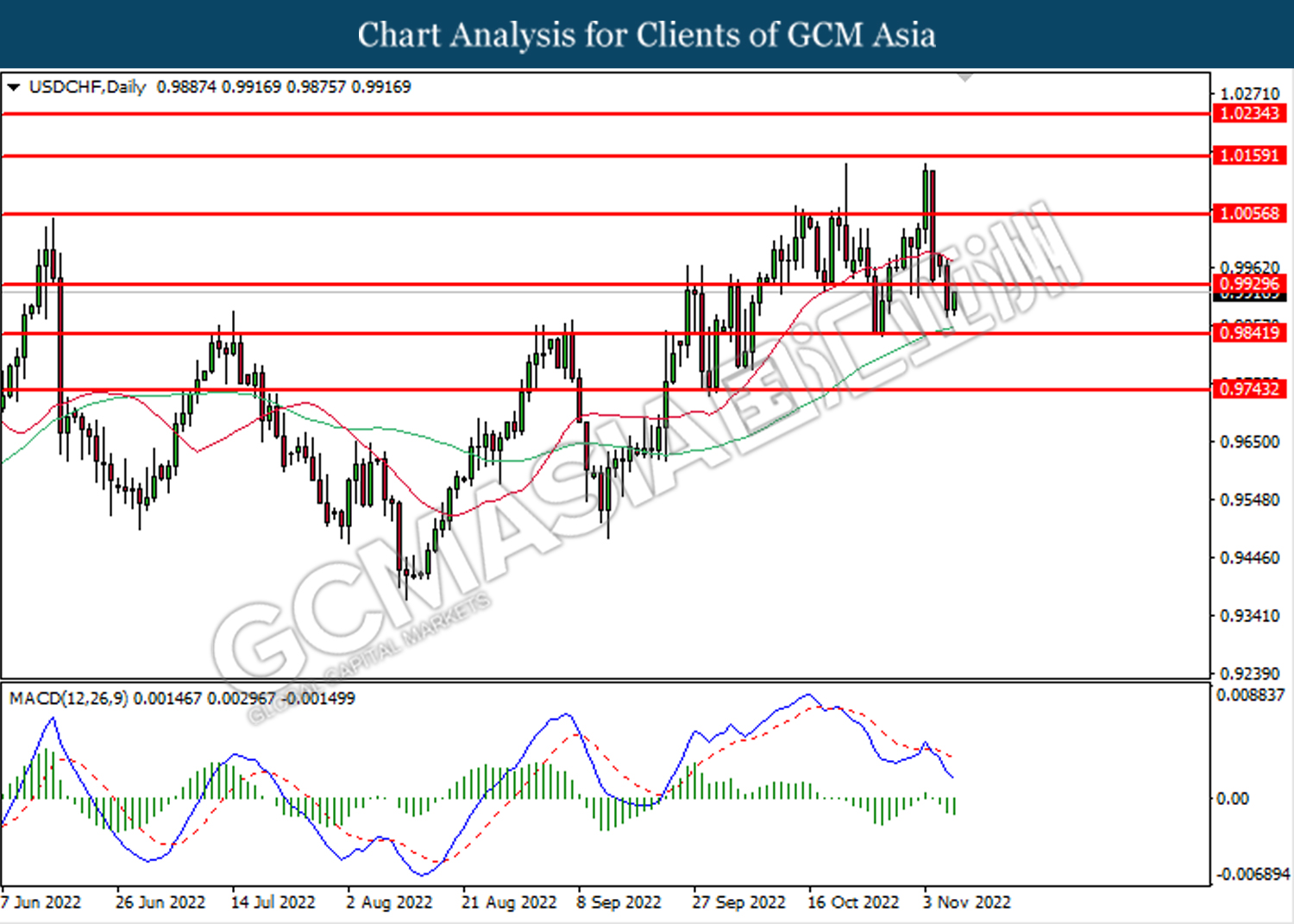

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9930. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9840.

Resistance level: 0.9930, 1.0055

Support level: 0.9840, 0.9745

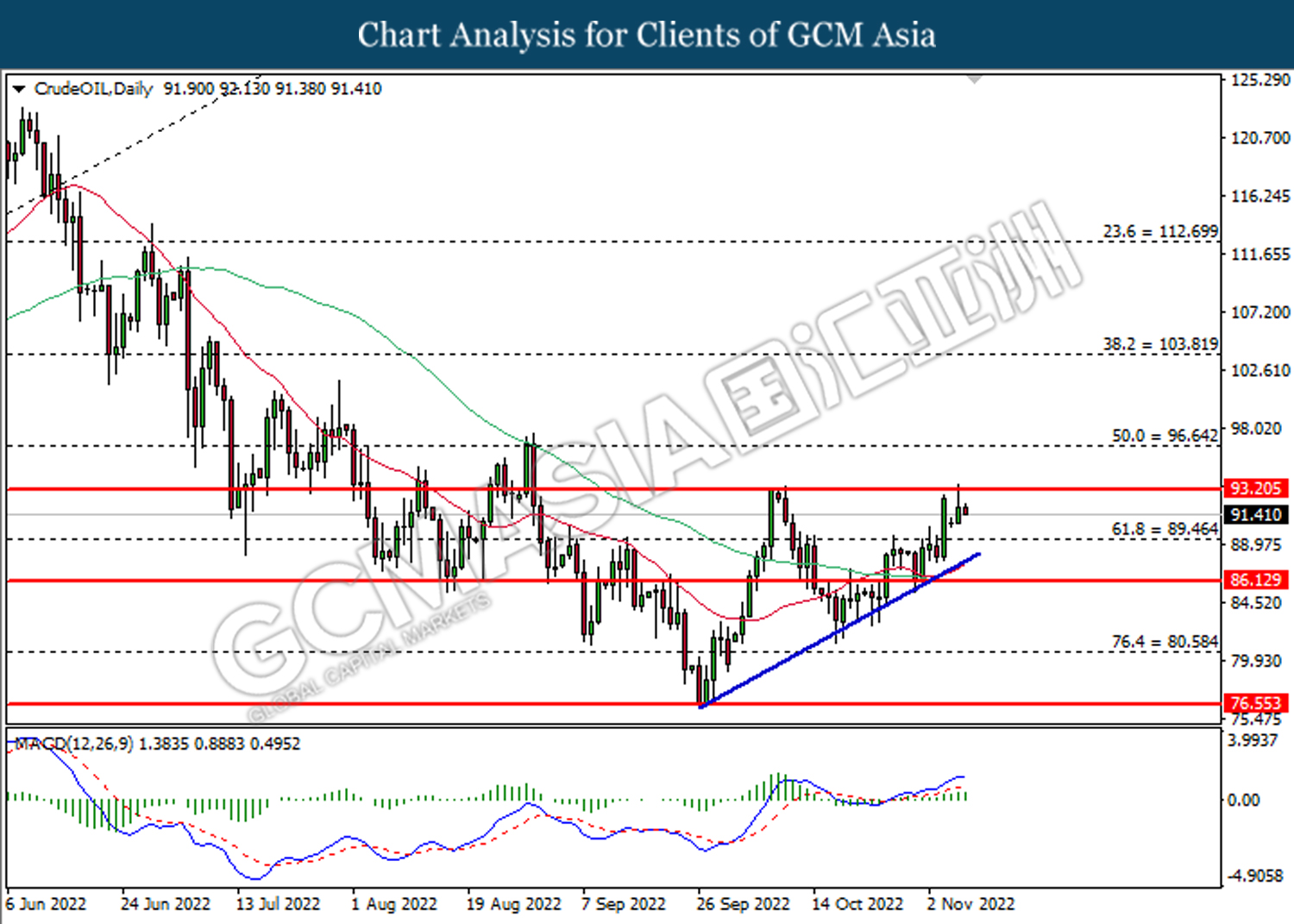

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 93.20.

Resistance level: 93.20, 96.65

Support level: 89.45, 86.15

GOLD_, Daily: Gold price was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the trend line.

Resistance level: 1693.35, 1726.15

Support level: 1661.40, 1627.60