8 November 2022 Morning Session Analysis

US Dollar beaten down over weak labor market.

The Dollar Index which traded against a basket of six major currencies extended its losses on yesterday over the sell-off sentiment caused by the fragile US labor market. Last week, the US Unemployment rate rose higher than the market expectations, which indicated that the current US labor market weakened. Thus, it reduced the odds of aggressive rate hike from Fed in the December meeting, as well as dragged down the appeal of US Dollar. In order to anticipate the interest rate decision from Fed, investors would continue to scrutinize the announcement of CPI data which scheduled on the upcoming Thursday. As of now, market participants would highly eye on the US midterm elections, as it related to the political stability of the US. Currently, Democratic and Republican, both parties’ supports are roughly tied and it might lead to political party rotation. As of writing, the Dollar Index depreciated by 0.66% to 110.04.

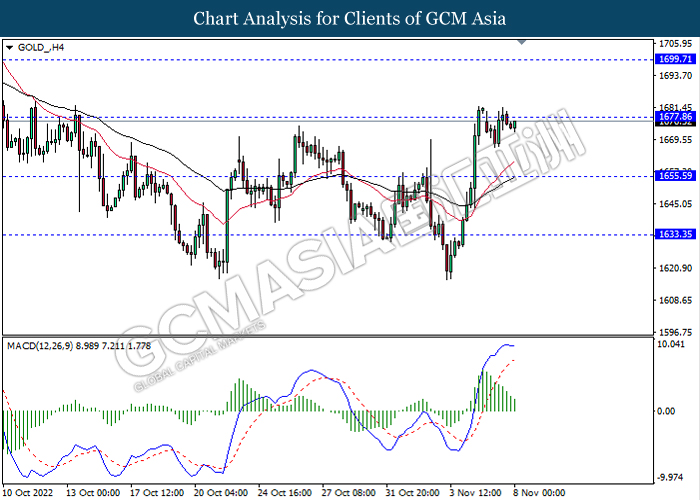

In the commodities market, the crude oil price rallied by 0.26% to $92.03 per barrel as of writing following the sanctions against Russia oil would likely to diminish the supply of oil. On the other hand, the gold price dipped by 0.12% to $1675.56 per troy ounce as of writing over the US Dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

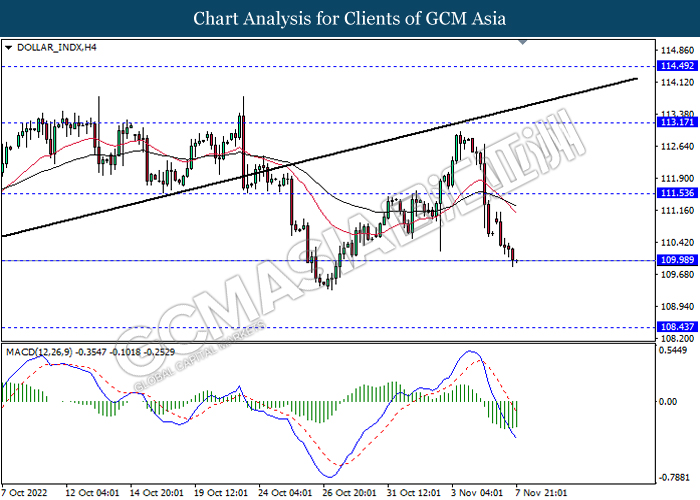

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

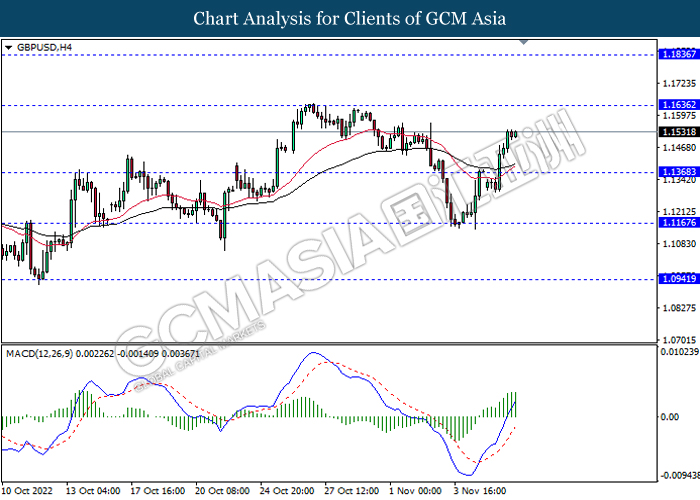

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

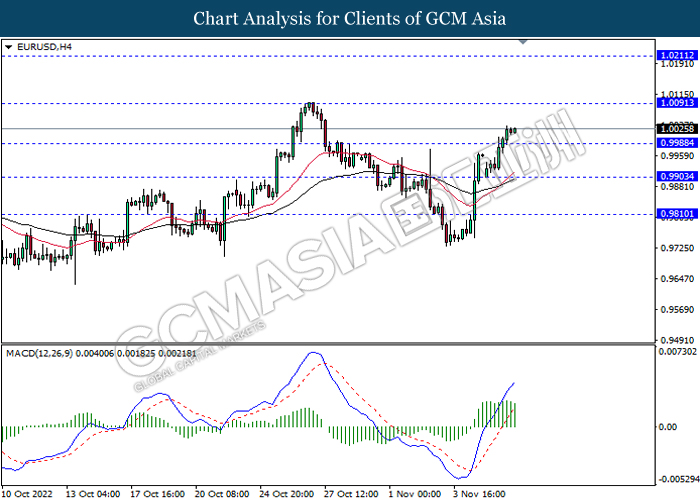

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0090, 1.0210

Support level: 0.9990, 0.9905

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

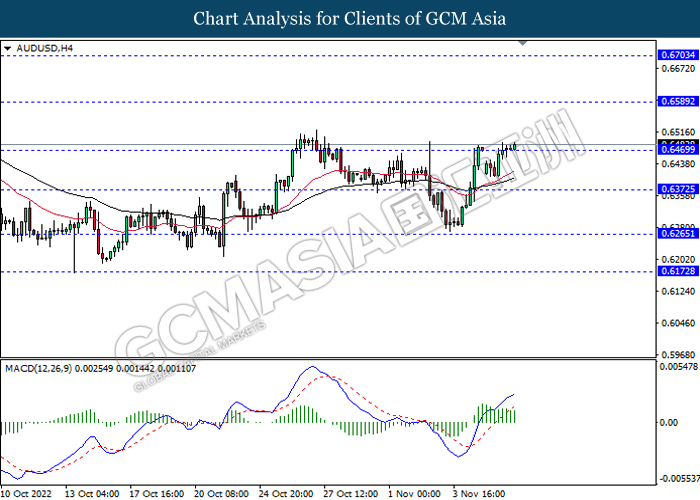

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6590, 0.6705

Support level: 0.6470, 0.6370

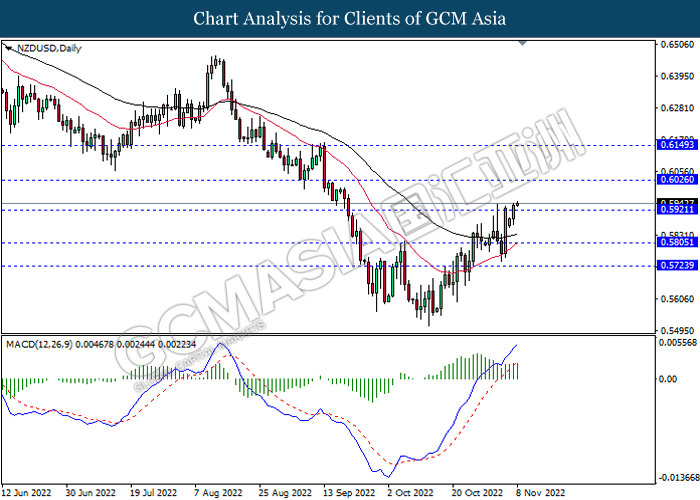

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6025, 0.6150

Support level: 0.5920, 0.5805

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

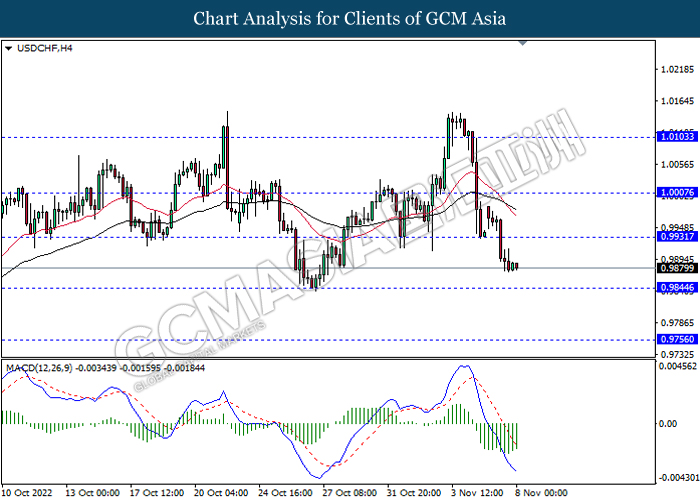

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9930, 1.0005

Support level: 0.9845, 0.9755

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 92.50, 95.45

Support level: 89.00, 86.05

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1677.85, 1699.70

Support level: 1655.60, 1633.35