8 December 2022 Afternoon Session Analysis

Dollar lingered ahead of long-waited economic data.

The dollar index, which was traded against a basket of six major currencies, hovered near the level of 105.00 since the beginning of the week as the market participants are waiting for more economic data to scrutinize the direction of the currency. Following the announcement of the ISM Non-Manufacturing PMI data, the dollar index has experienced a rather slow movement. Despite, we may notice that the dollar index somehow still recorded some gains during the previous trading session as the risk-off environment urged the investors to fly into safe haven currency. At this juncture, the market participant remains cautious while waiting for the Initial Jobless Claims data. On the other side, the pair of USD/CAD surged amid expected rate hike from the Bank of Canada (BoC). Yesterday, the official members of BoC adjusted its cash rate from 3.75% to 4.25%, in line with the expectation of the consensus. As of writing, the pair of USD/CAD rose 0.24% to 1.3685.

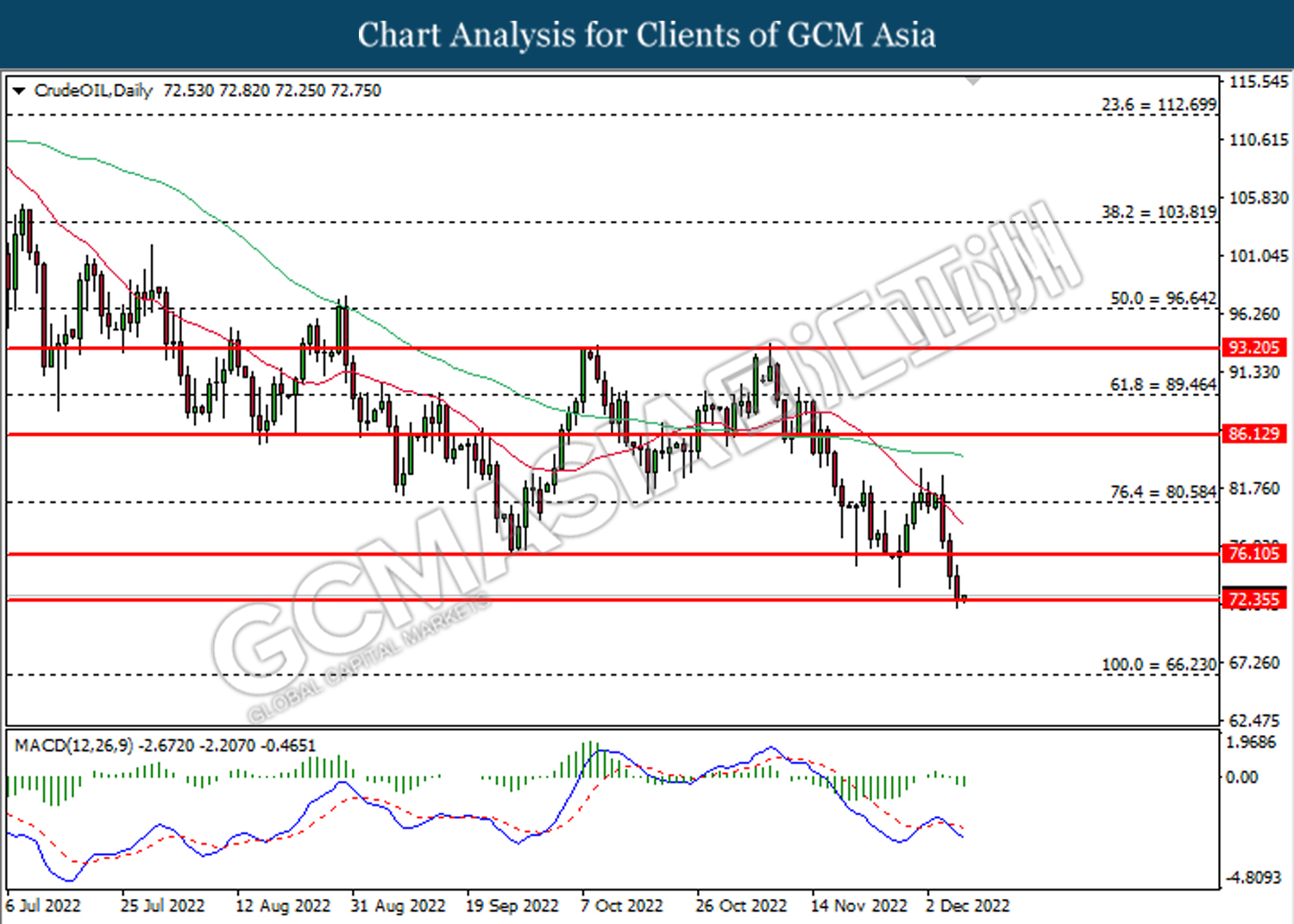

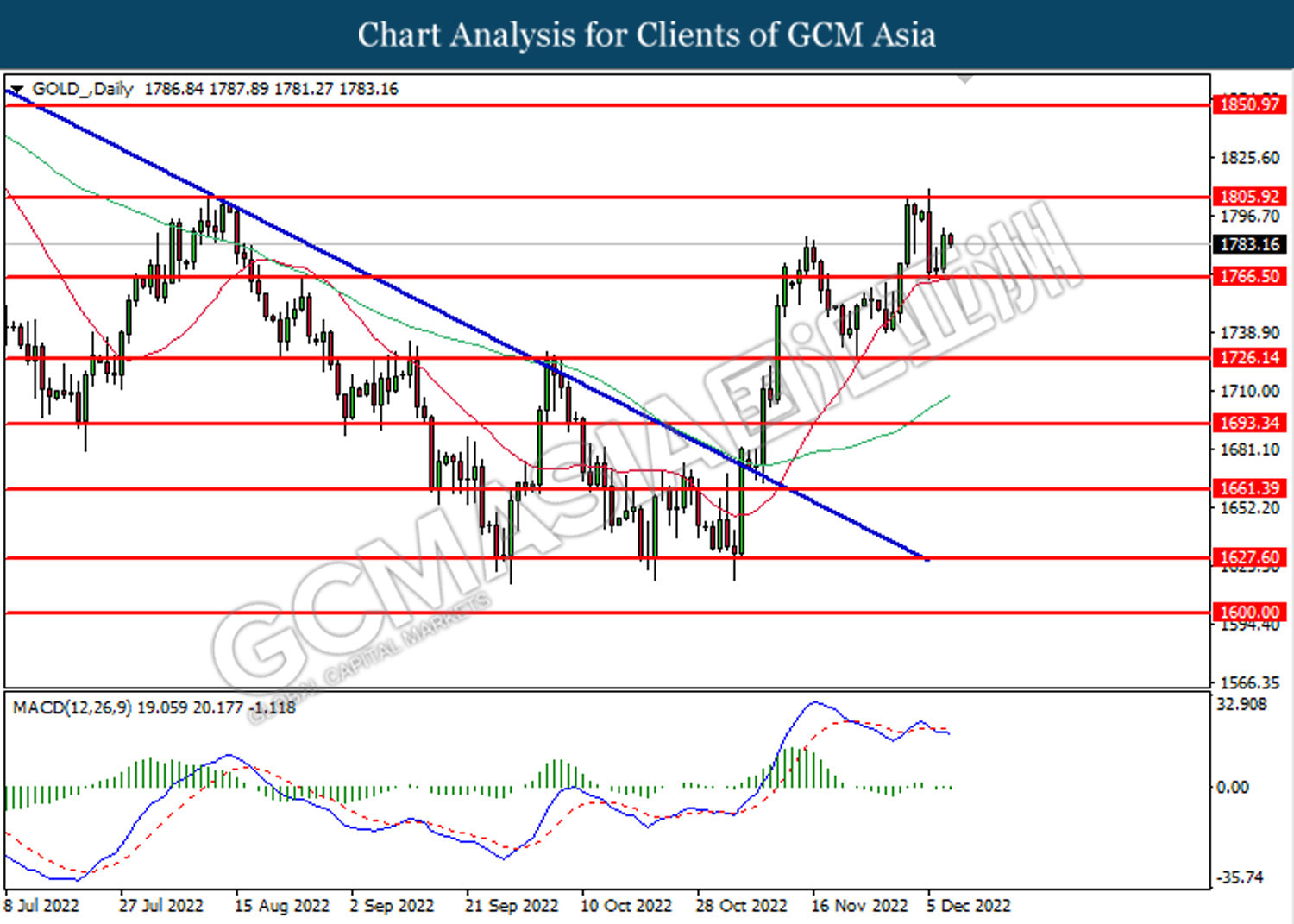

In the commodities market, the crude oil price rebounded by 0.22% to $72.85 per barrel after slumping more than 4% yesterday amid the stockpiles of distillates stock and petrol in the US. Besides, the gold prices dropped -0.22% to $1782.15 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 225K | 230K | – |

Technical Analysis

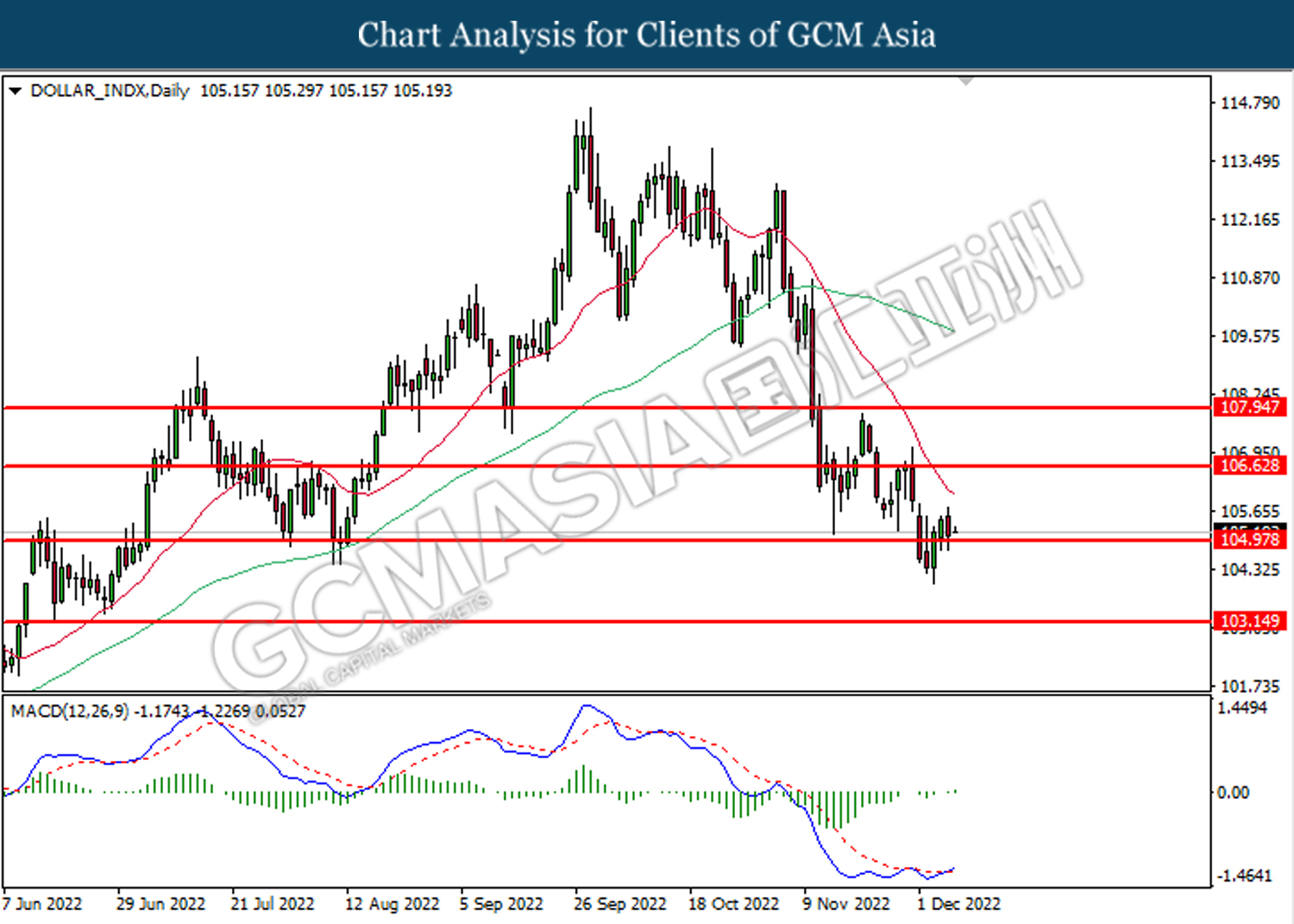

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 105.00. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 107.95

Support level: 105.00, 103.15

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. However, MACD which illustrated bearish bias momentum suggest the pair to undergo short term technical correction.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

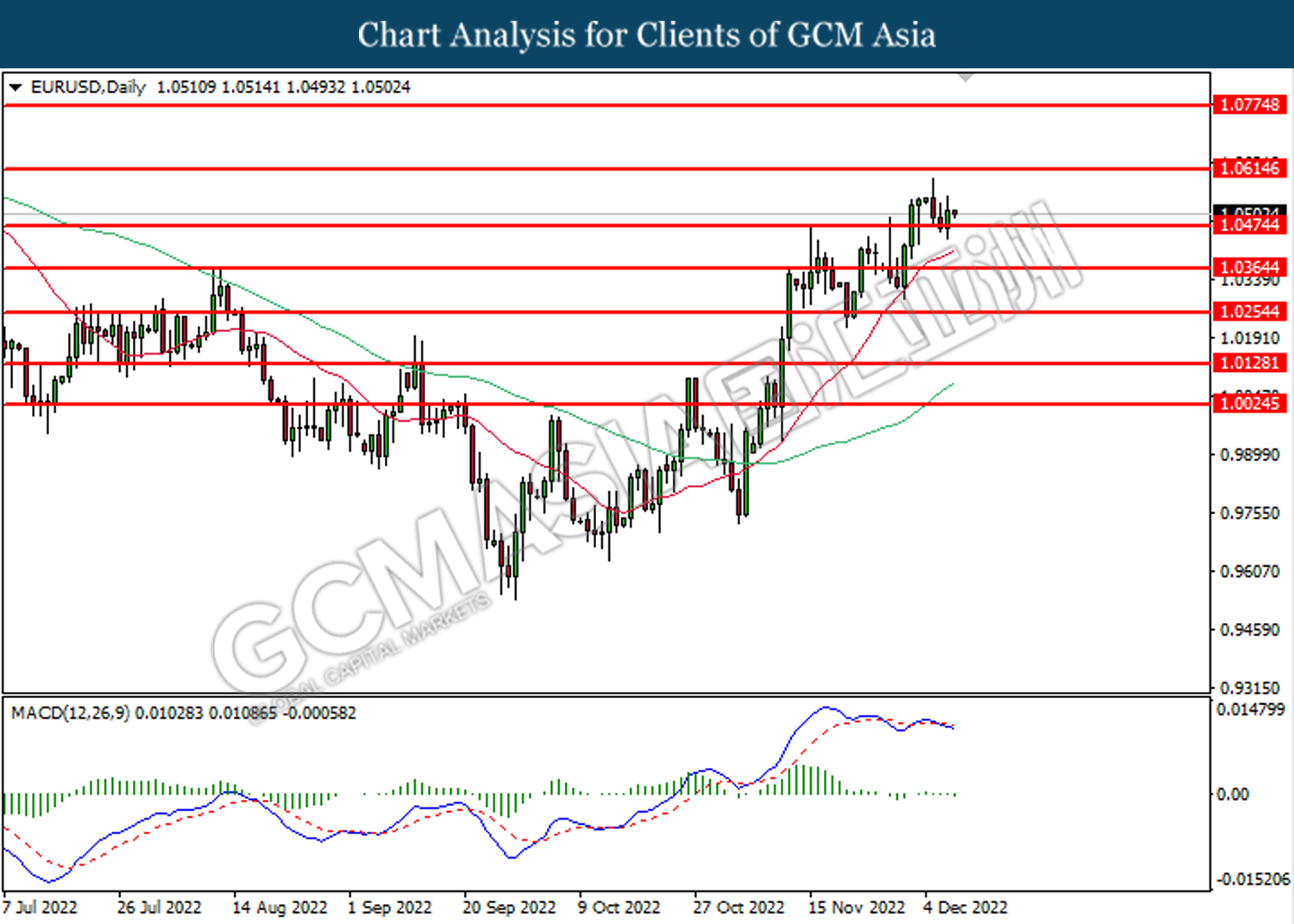

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0475. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

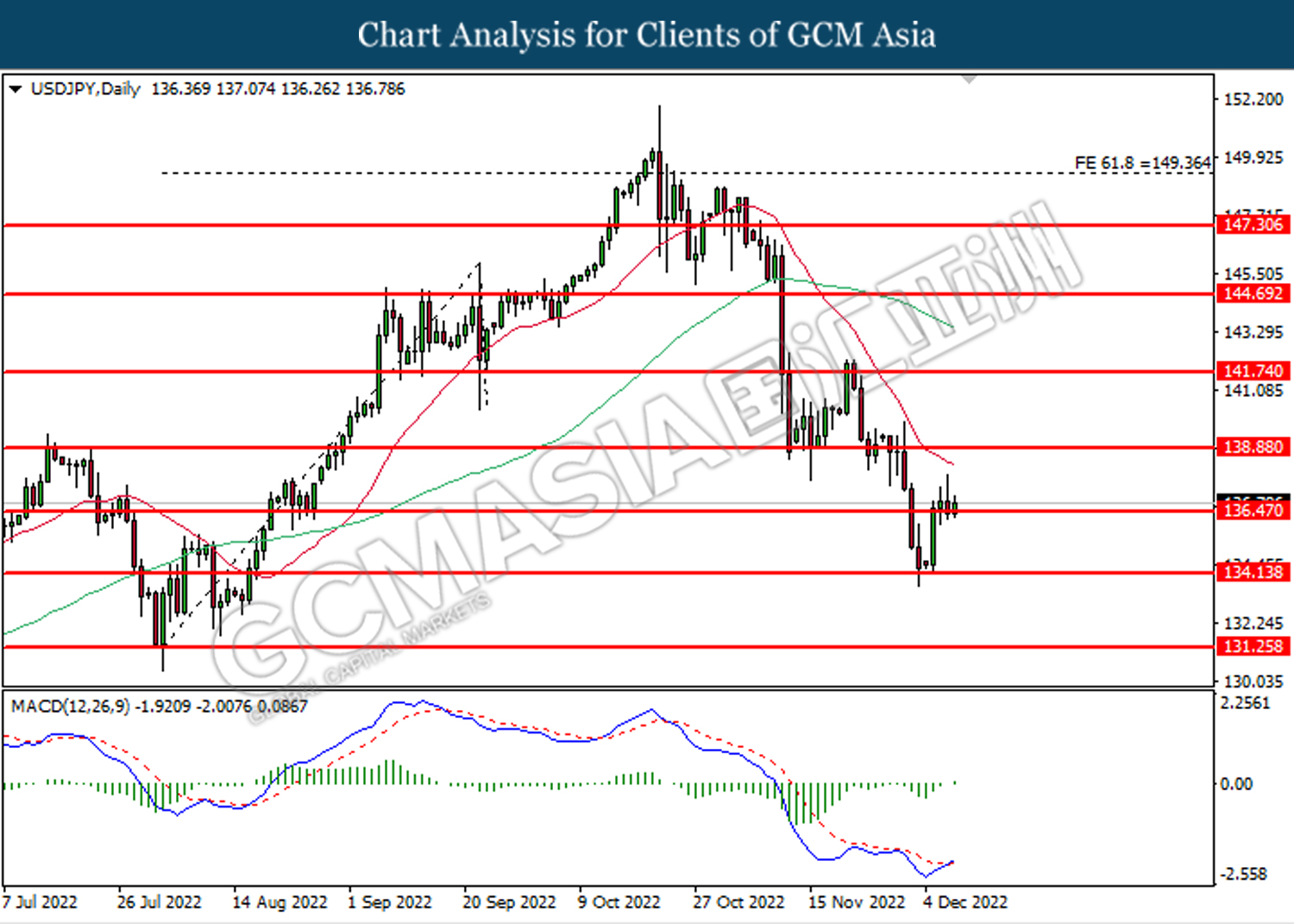

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

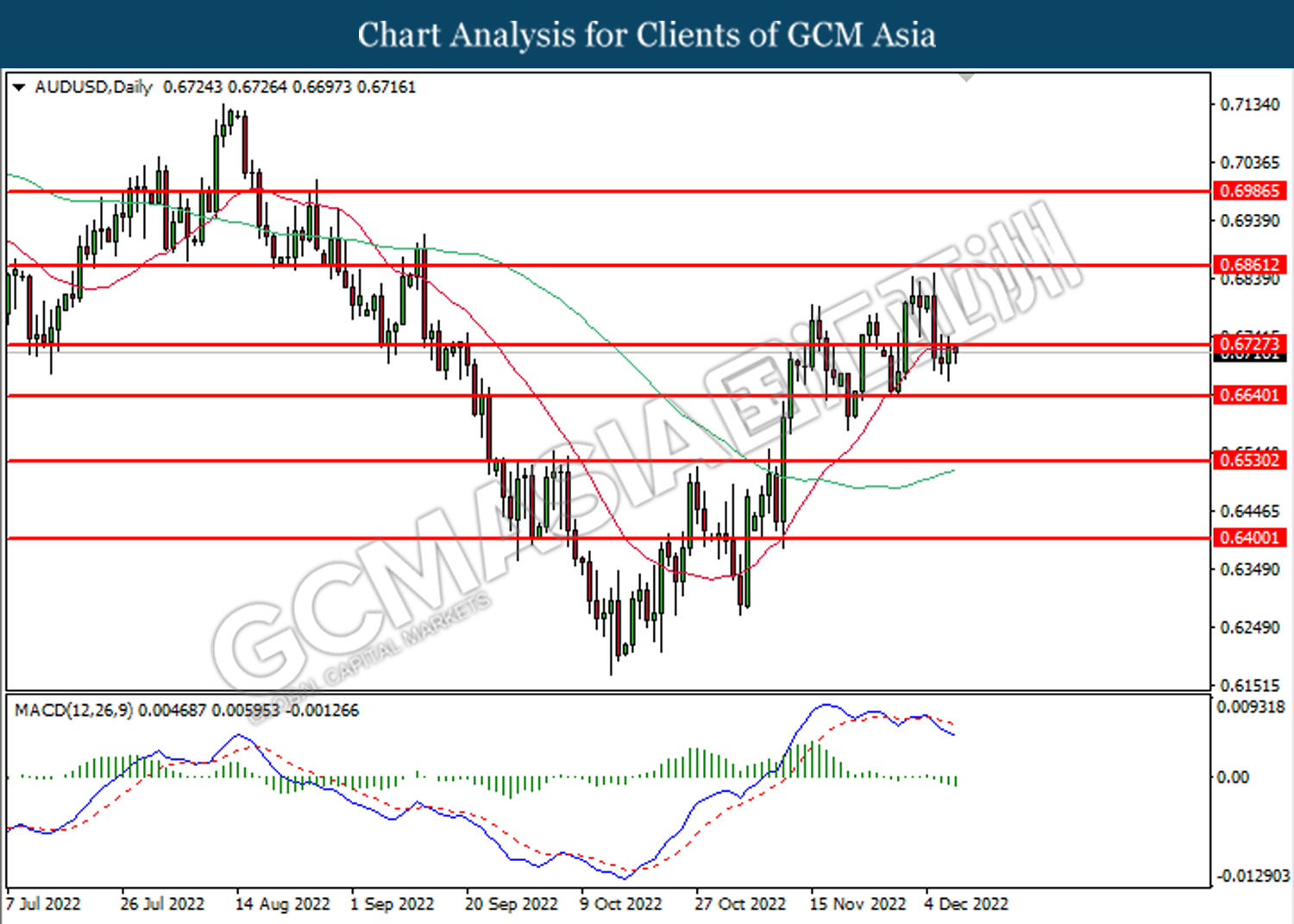

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

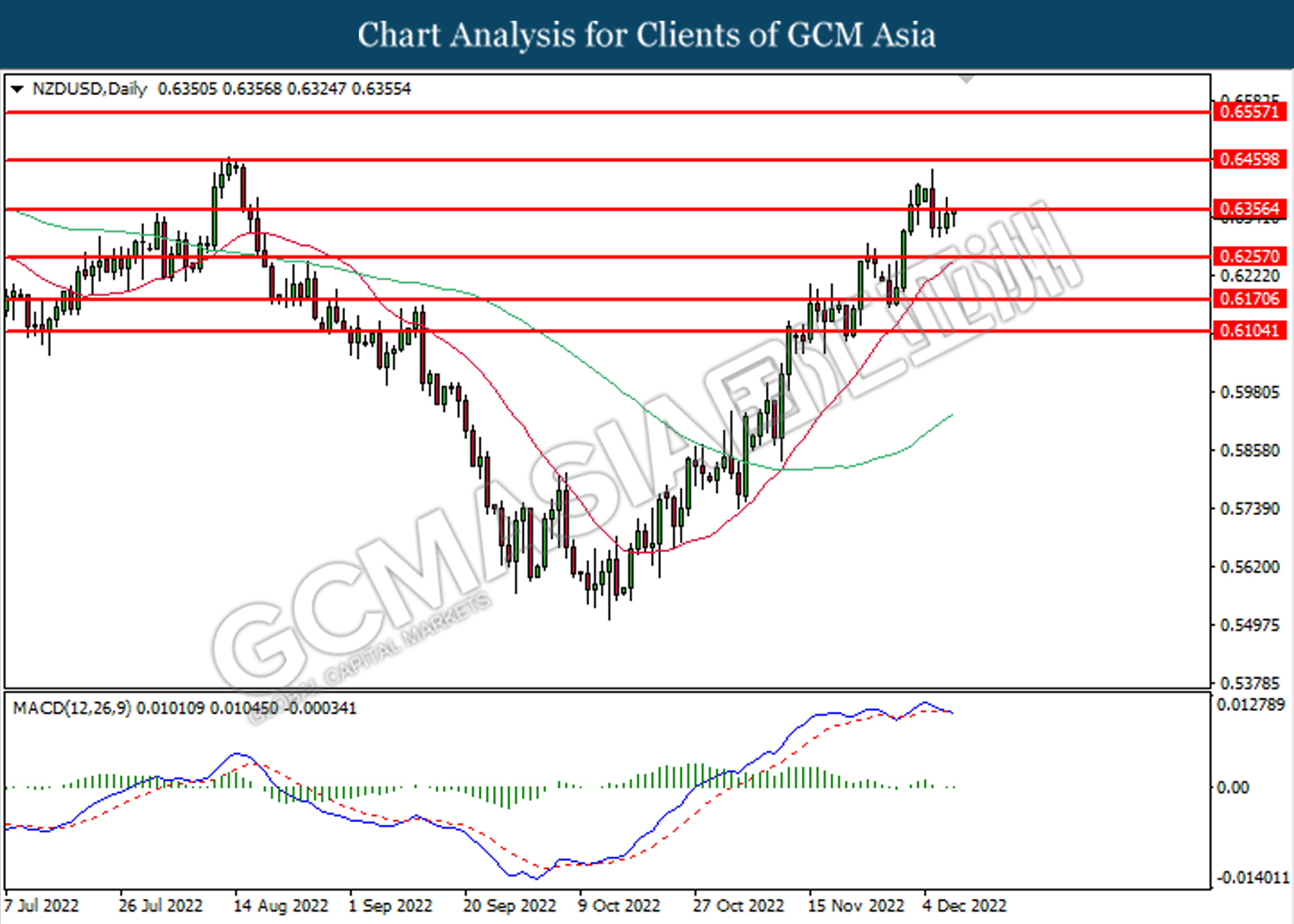

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend it gains toward the resistance level at 1.3740.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

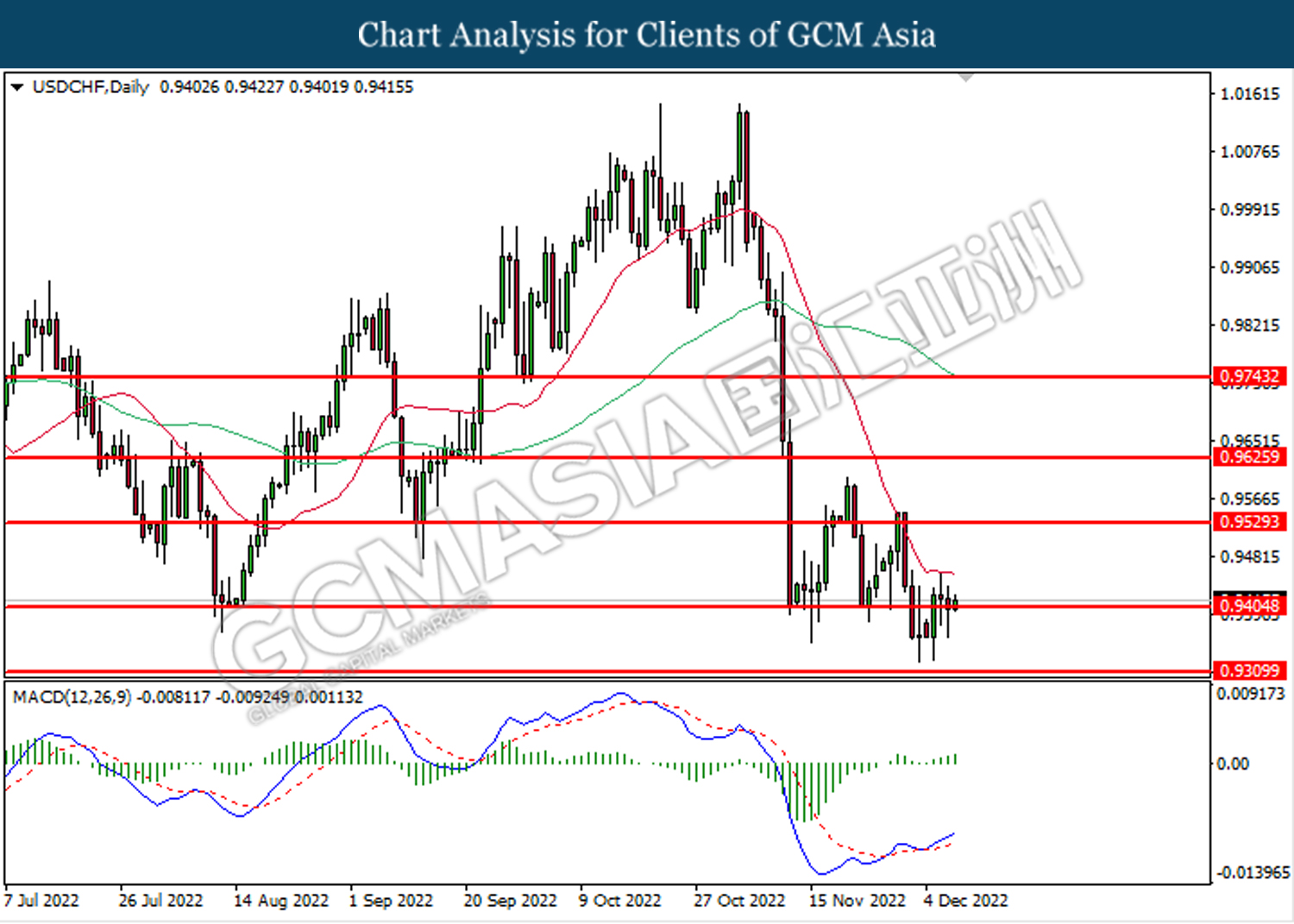

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9530.

Resistance level: 0.9530, 0.9625

Support level: 0.9405, 0.9310

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 72.35. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 76.10, 80.60

Support level: 72.35, 66.25

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1766.50. However, MACD which illustrated bearish bias momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 1805.90, 1850.95

Support level: 1766.50, 1726.15