09 January 2023 Afternoon Session Analysis

Canadian dollar jumped amid positive labor data.

The Canadian dollar, which was majorly traded by the global investors, skyrocketed following the release of an upbeat job data. According to the Statistics Canada, Canada Employment Change jumped from the prior month reading’s 10.1K to 104.0K, mirroring the high resiliency of the nation’s labor market. With the backdrop of hot labor data, it provided Bank of Canada (BoC) with much more spaces for rate hike move in the coming meeting. In order to curb the sky-high inflation, the BoC has been raising the interest rate aggressively since Jan 2022. The cash rates have been adjusted upward from the low level at 0.25% to 4.25% as of the meeting in December 2022. On the other sides, the currency pair of USD/CAD plummeted further after US services sector showed contraction in the month of December. According to the PMI, US Services PMI came in at 49.6, missing the consensus forecast at 55.0. It is noteworthy to highlight that the services sector accounted for two third of the overall US economic activities. As of writing, the pair of USD/CAD plunged -0.23% to 1.3410.

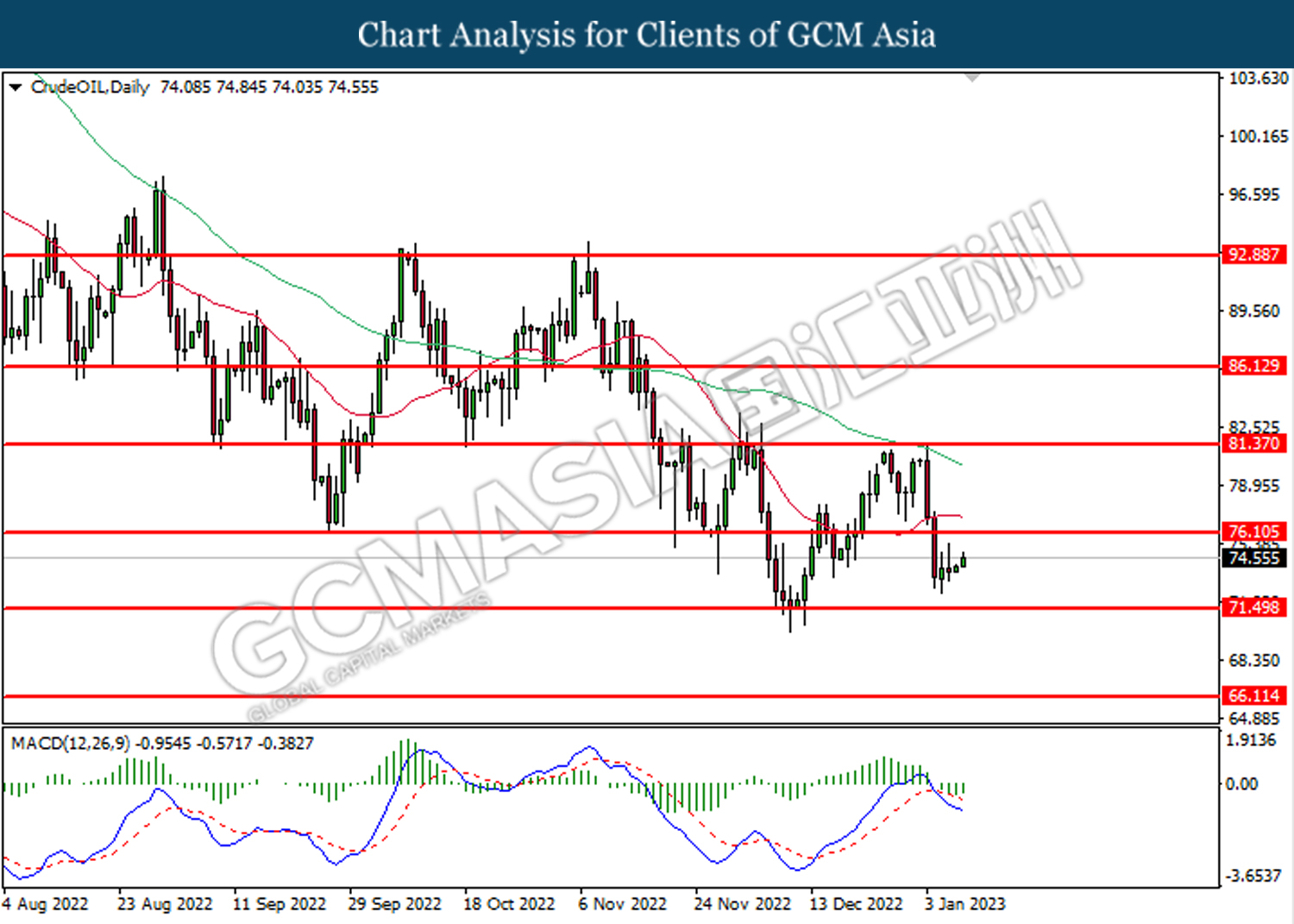

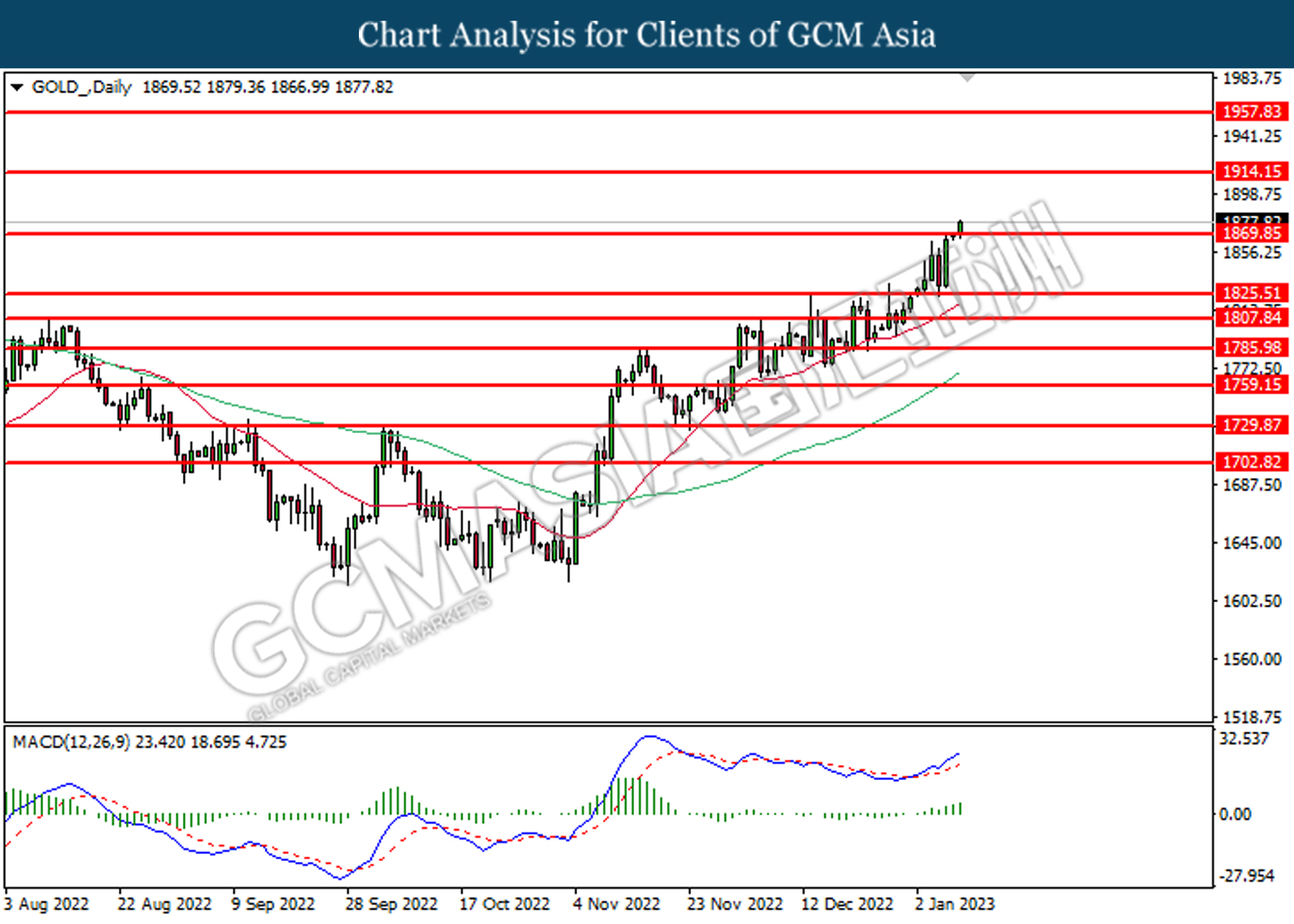

In the commodities market, the crude oil price rose by 0.43% to $74.55 per barrel as the weakening of dollar index reduced the cost of oil for the non-US buyers. Besides, the gold prices rose 0.60% to $1877.50 per troy ounce after the US released a weaker-than-expected services PMI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

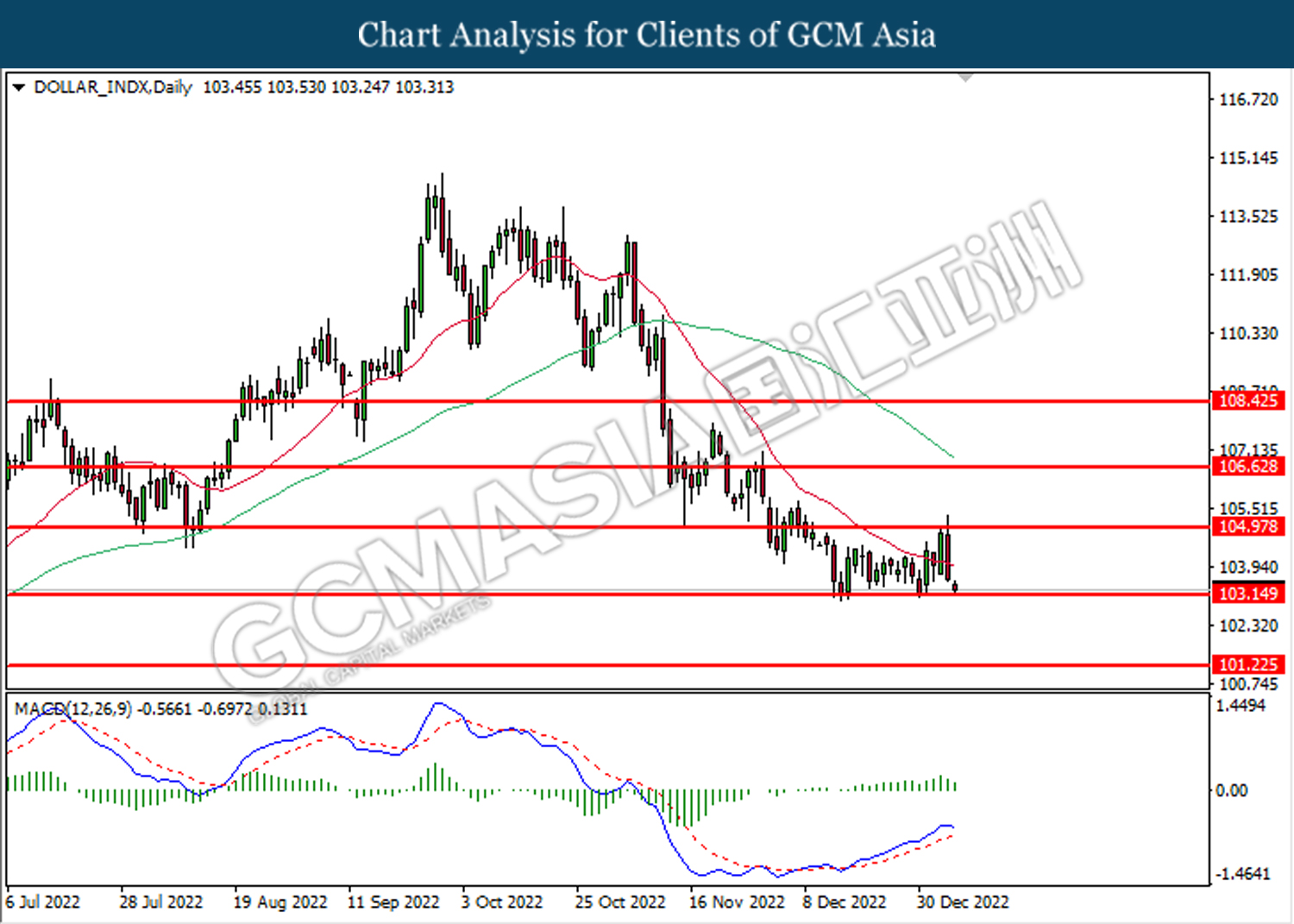

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

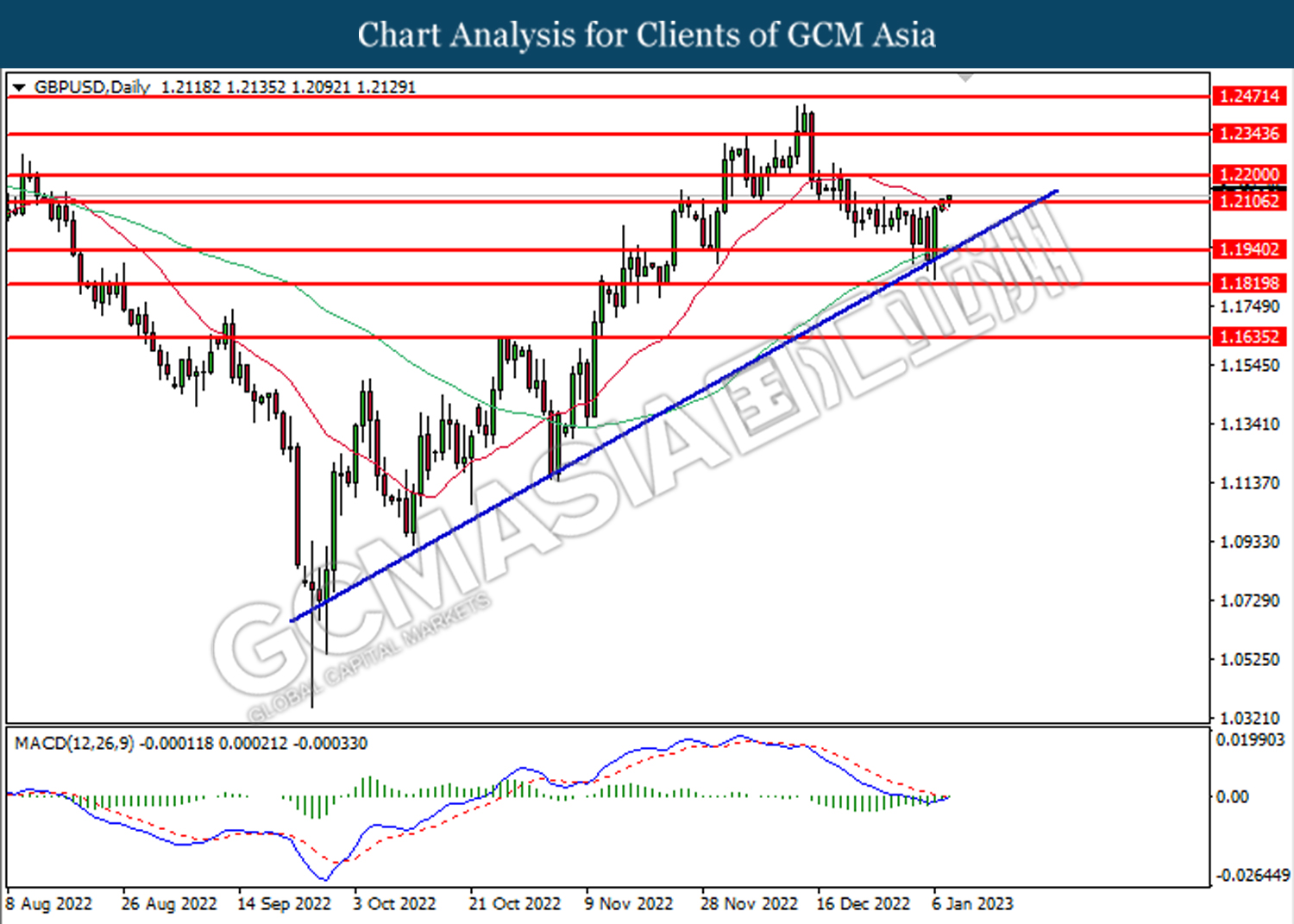

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

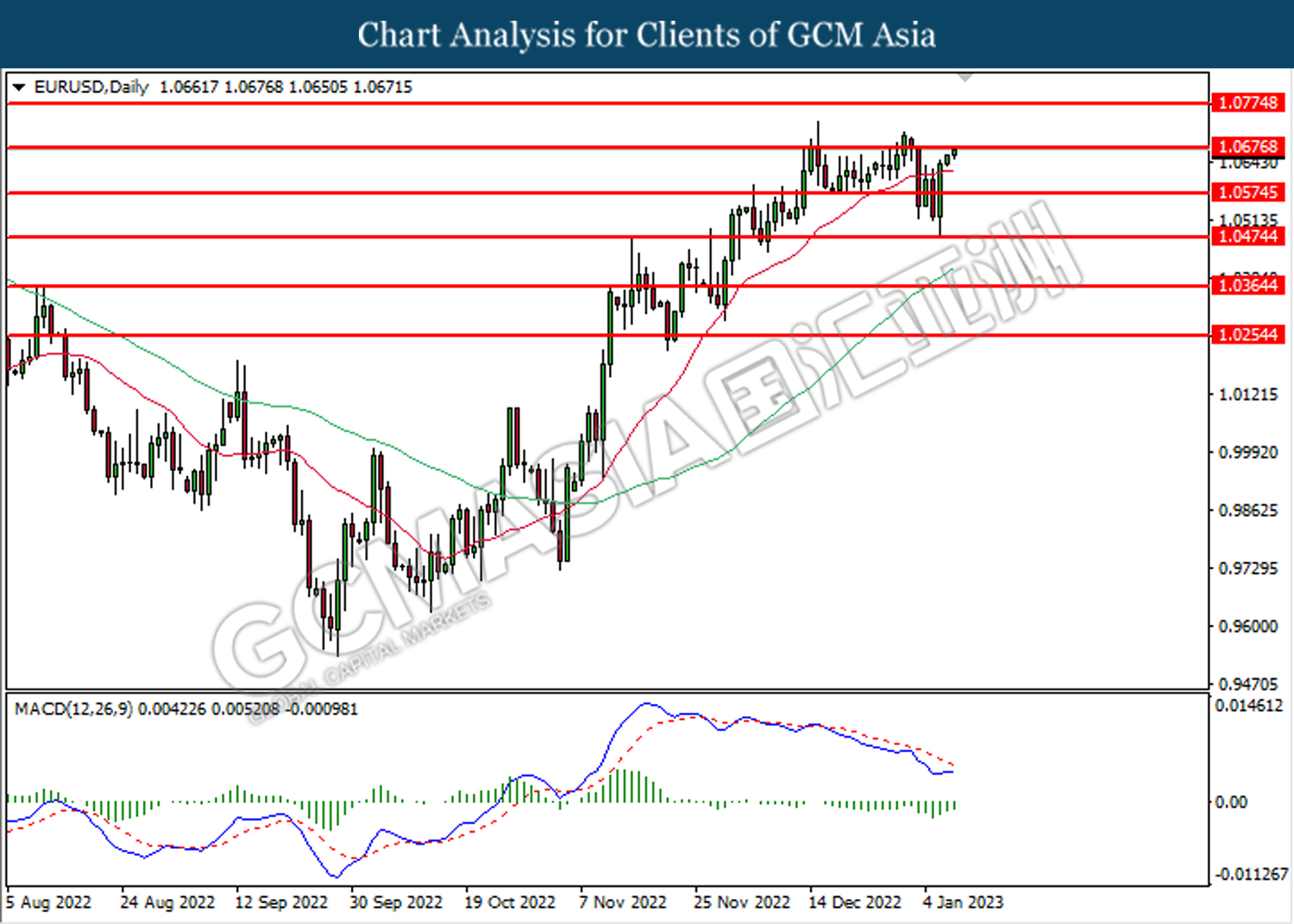

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0675, 1.0775

Support level: 1.0575, 1.0475

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 131.25. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

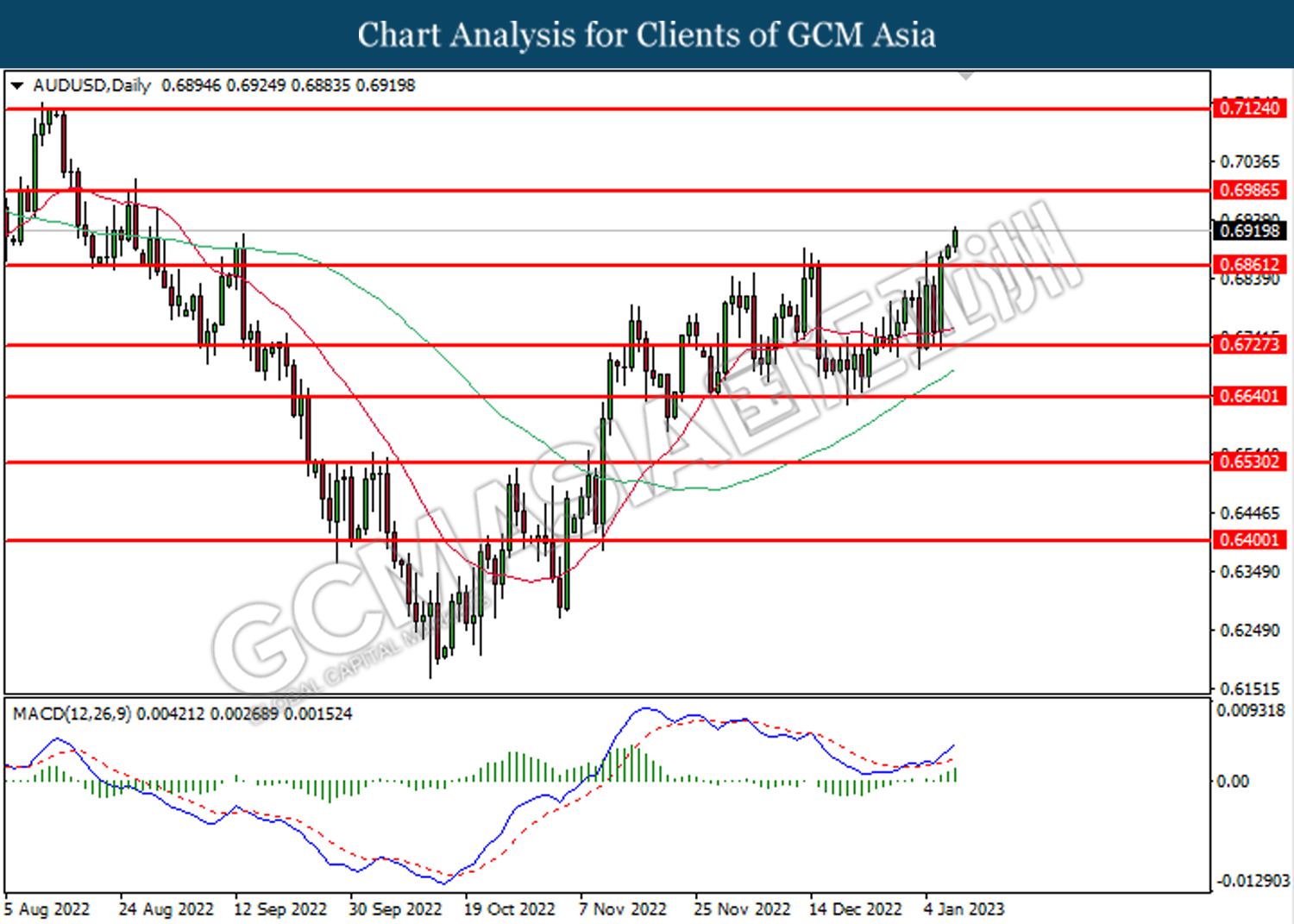

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.6860. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

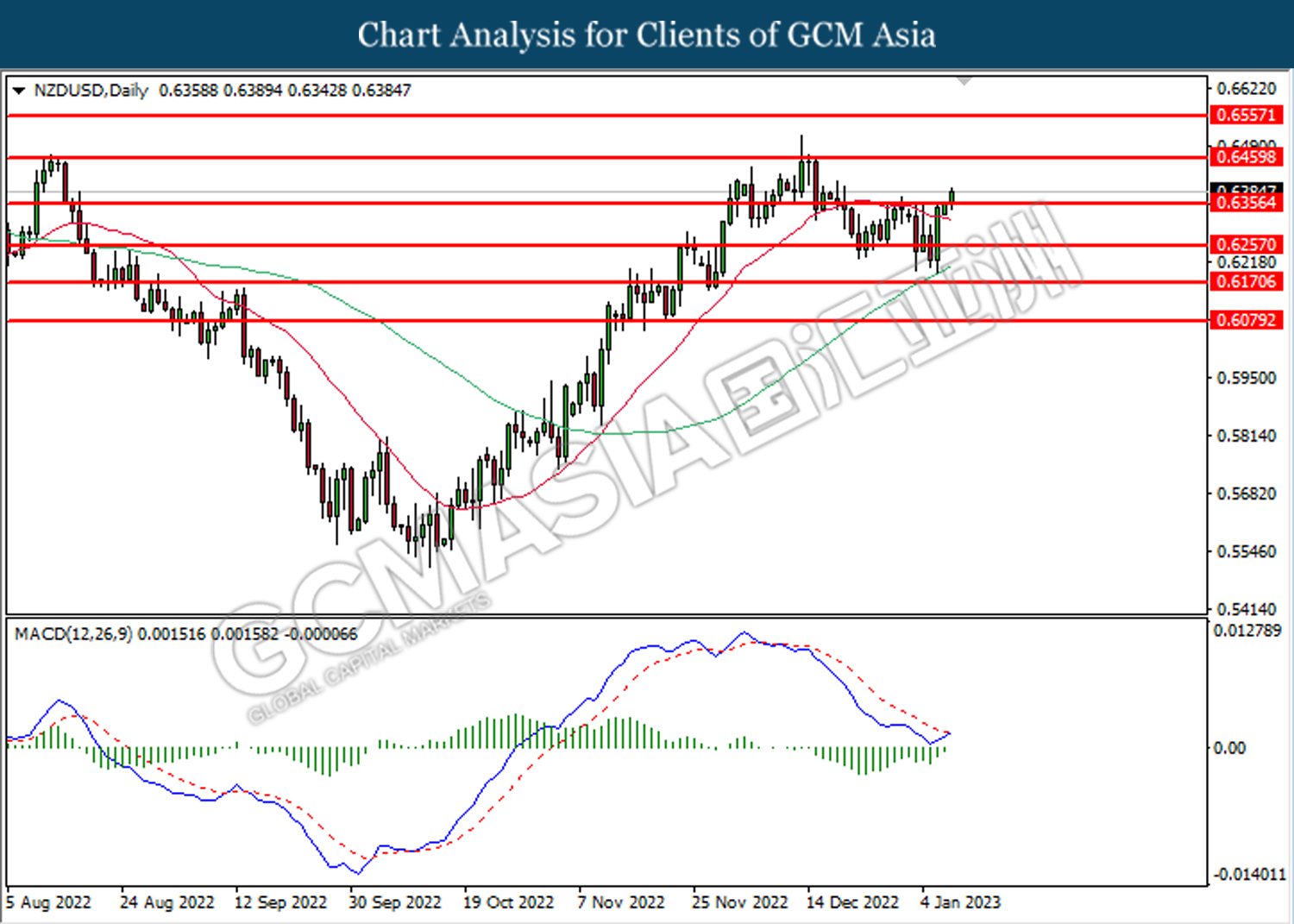

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6355. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level at 1.3400.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

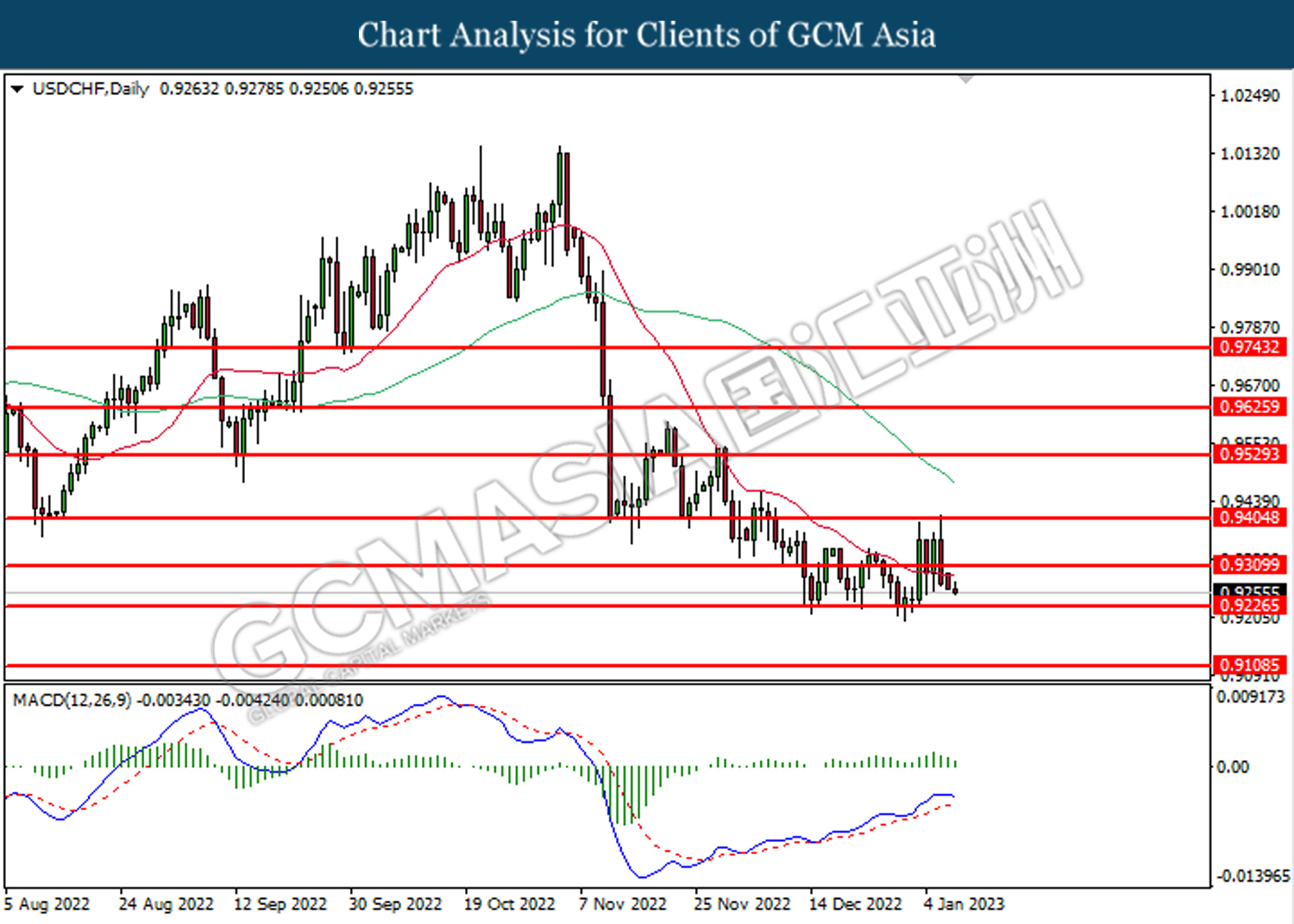

USDCHF, Daily: USDCHF was traded lower following prior breakout below the support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the lower level. However, MACD which illustrated bearish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 76.10, 81.35

Support level: 71.50, 66.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1869.85. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1869.85, 1914.15

Support level: 1825.50, 1807.85