9 January 2023 Morning Session Analysis

Greenback plunged with mixed economic data.

The Dollar Index which traded against a basket of six major currencies slumped on Friday night despite a series of upbeat employment data. According to Bureau of Labor Statistics, the US Nonfarm Payrolls in December posted at the reading of 223K, exceeding the consensus forecast of 200K. Besides, the unemployment rate in December was reduced for the second month in a row. Nonetheless, if it went into details, the figures of NFP data was notched down from the prior, which indicating the job opportunity was easing. On the other hand, the weakened of wage growth had also put some sell-off pressure on US Dollar. The US Average Hourly Earnings YoY for December notched down from the previous reading of 4.8% to 4.6%, missing the market expectation of 5.0%. With that, it indirectly shown the easing economy momentum in the US, which diminishing worries about Fed’s interest rate hiking path. Furthermore, the US ISM Non-Manufacturing data had given a weaker-than-expected figures, which spurred further bearish momentum toward US Dollar. As of writing, the Dollar Index edged down by 0.08% to 103.56.

In the commodities market, the crude oil price rose by 0.50% to $74.10 per barrel as of writing following the weaker dollar had boosted demand for oil as dollar-denominated commodities become cheaper for holder of other countries. On the other hand, the gold price appreciated by 0.07% to $1869.55 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day JPY Japan – Respect for the Aged Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

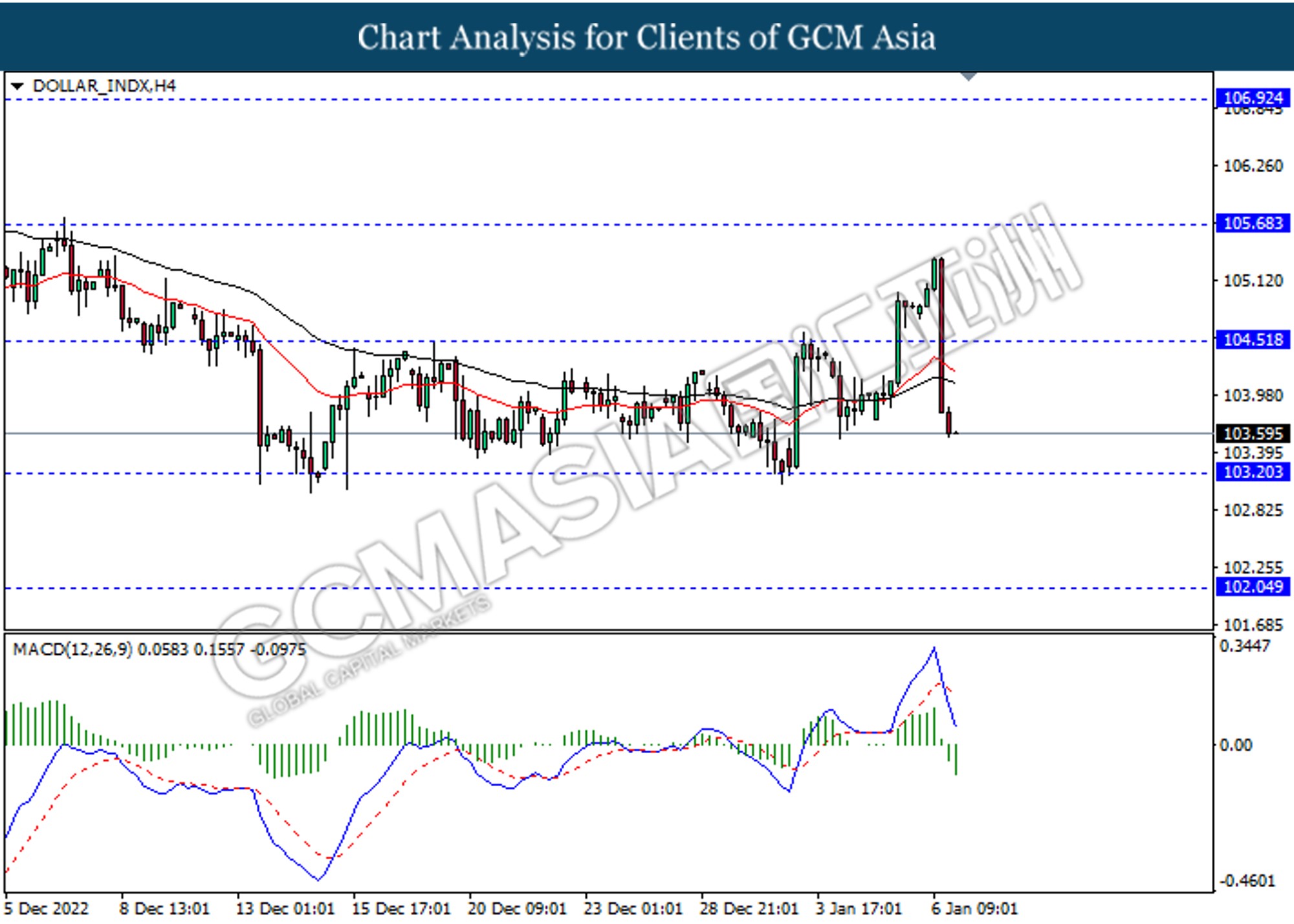

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.70

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

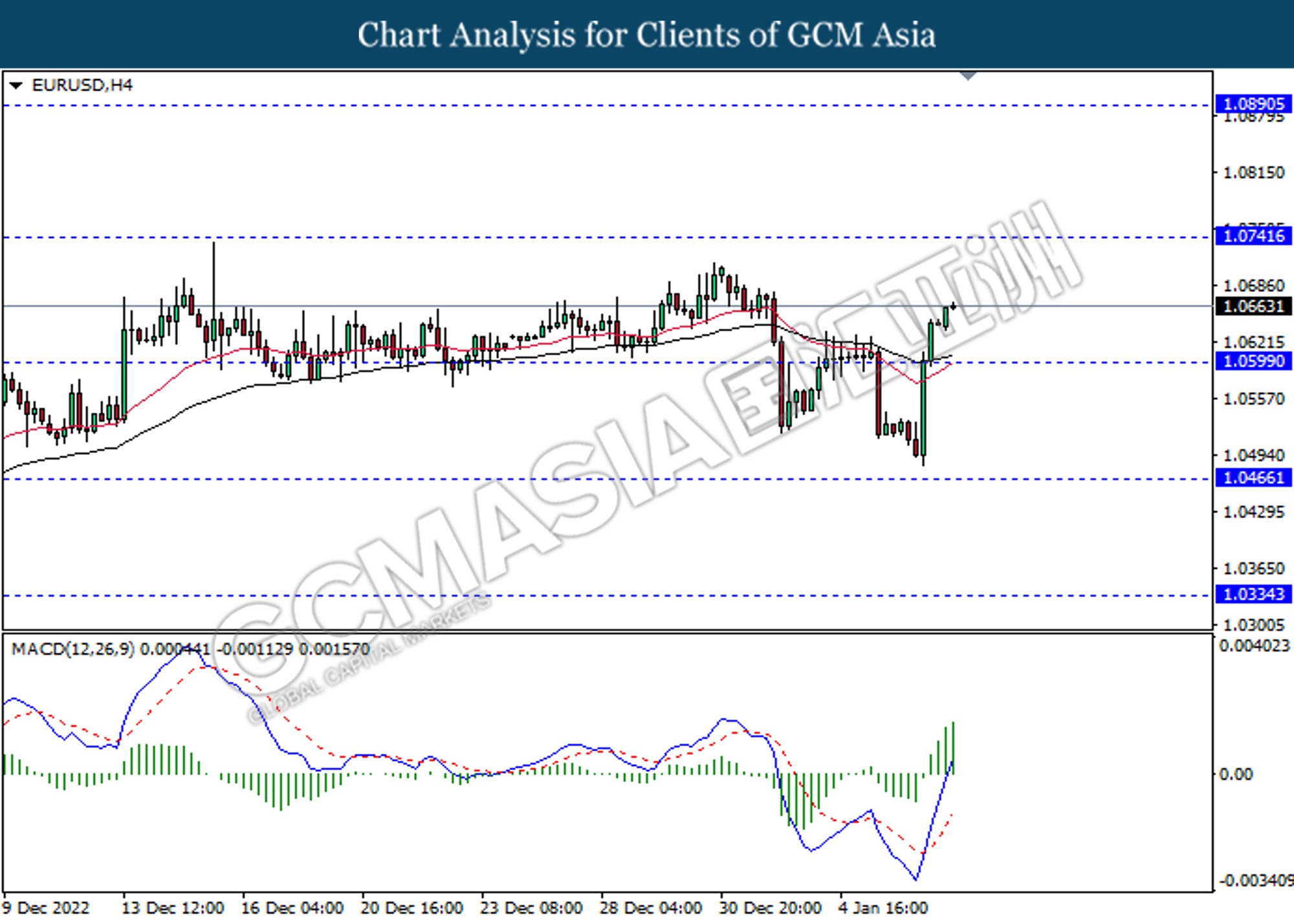

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

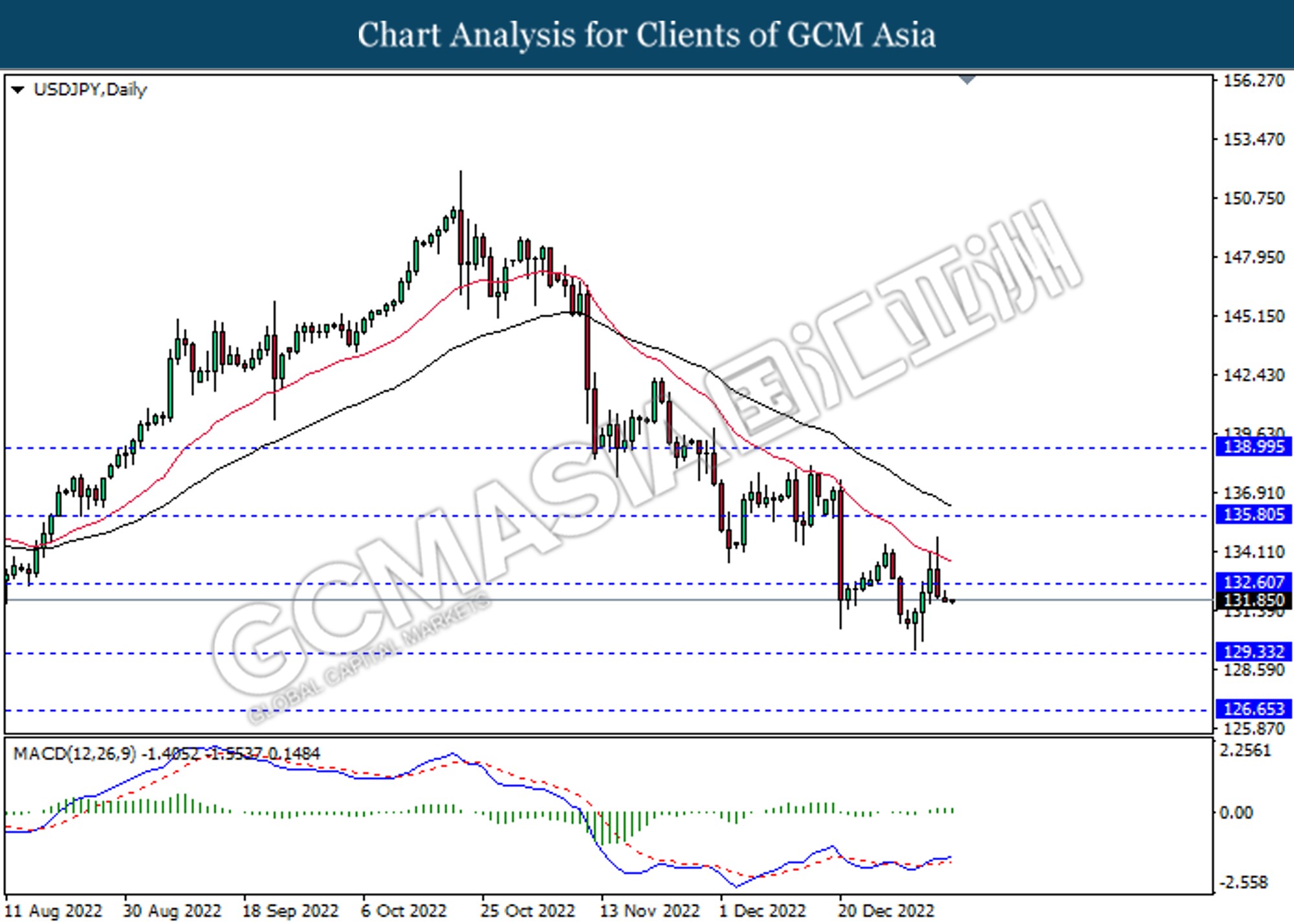

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

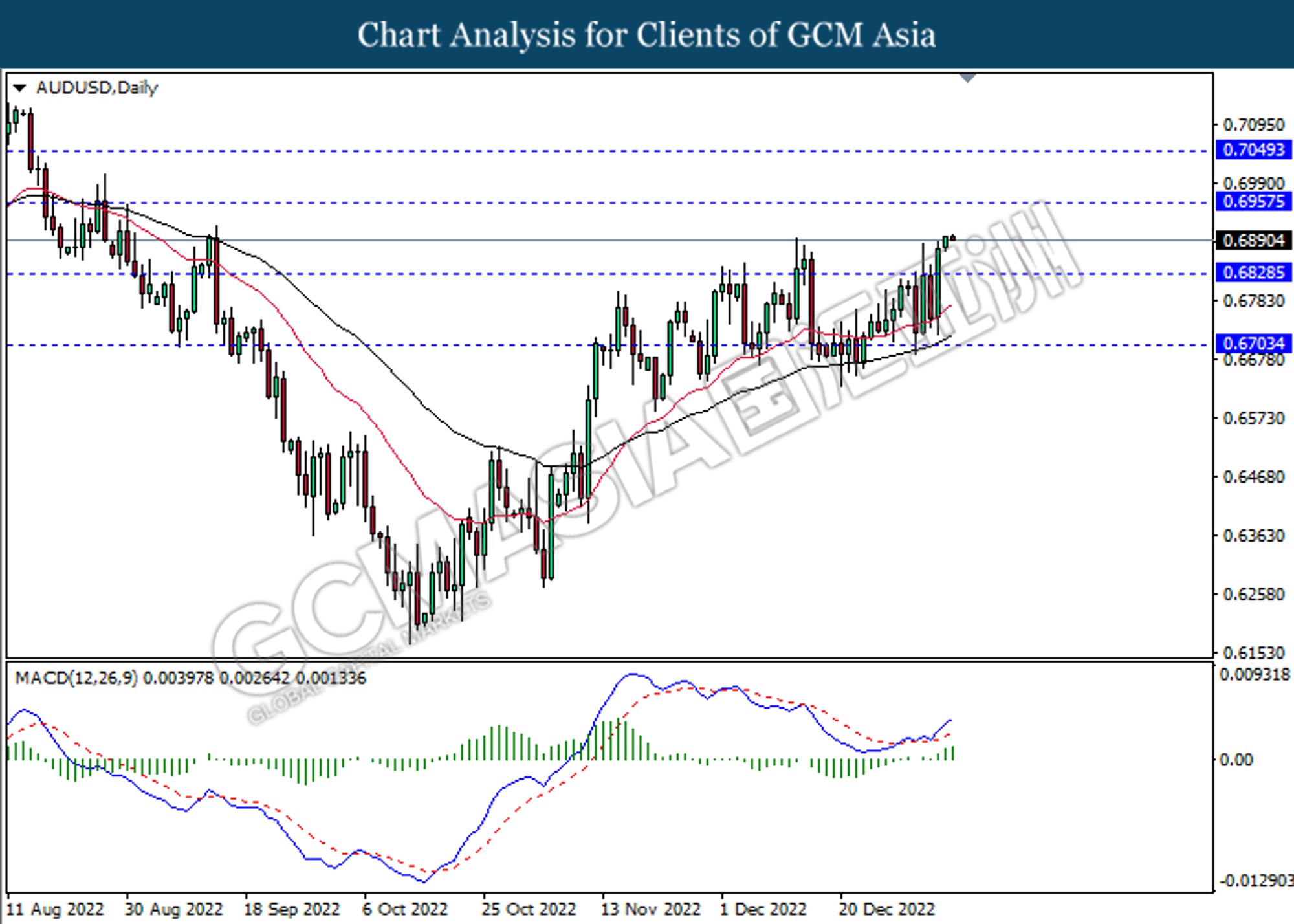

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

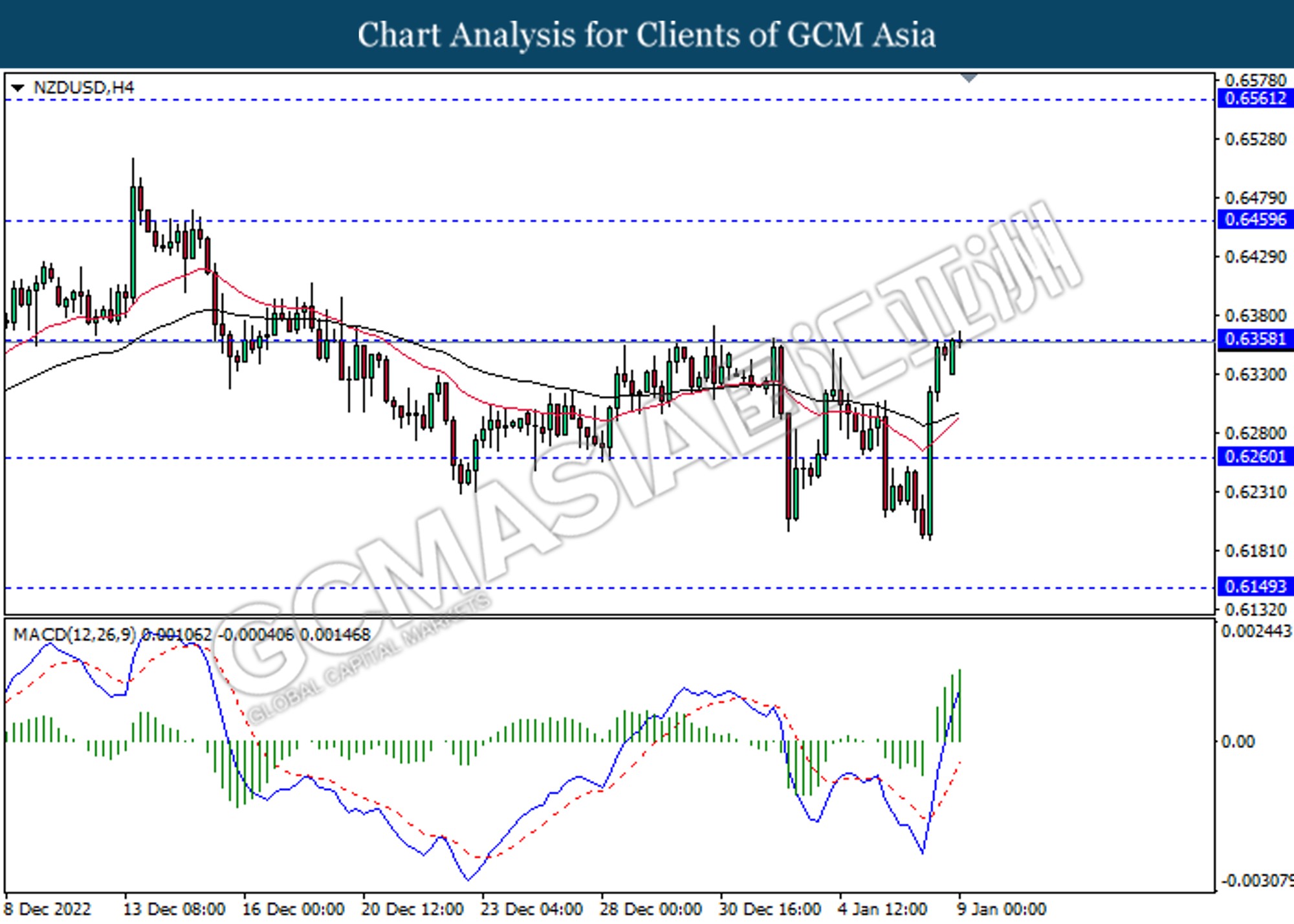

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

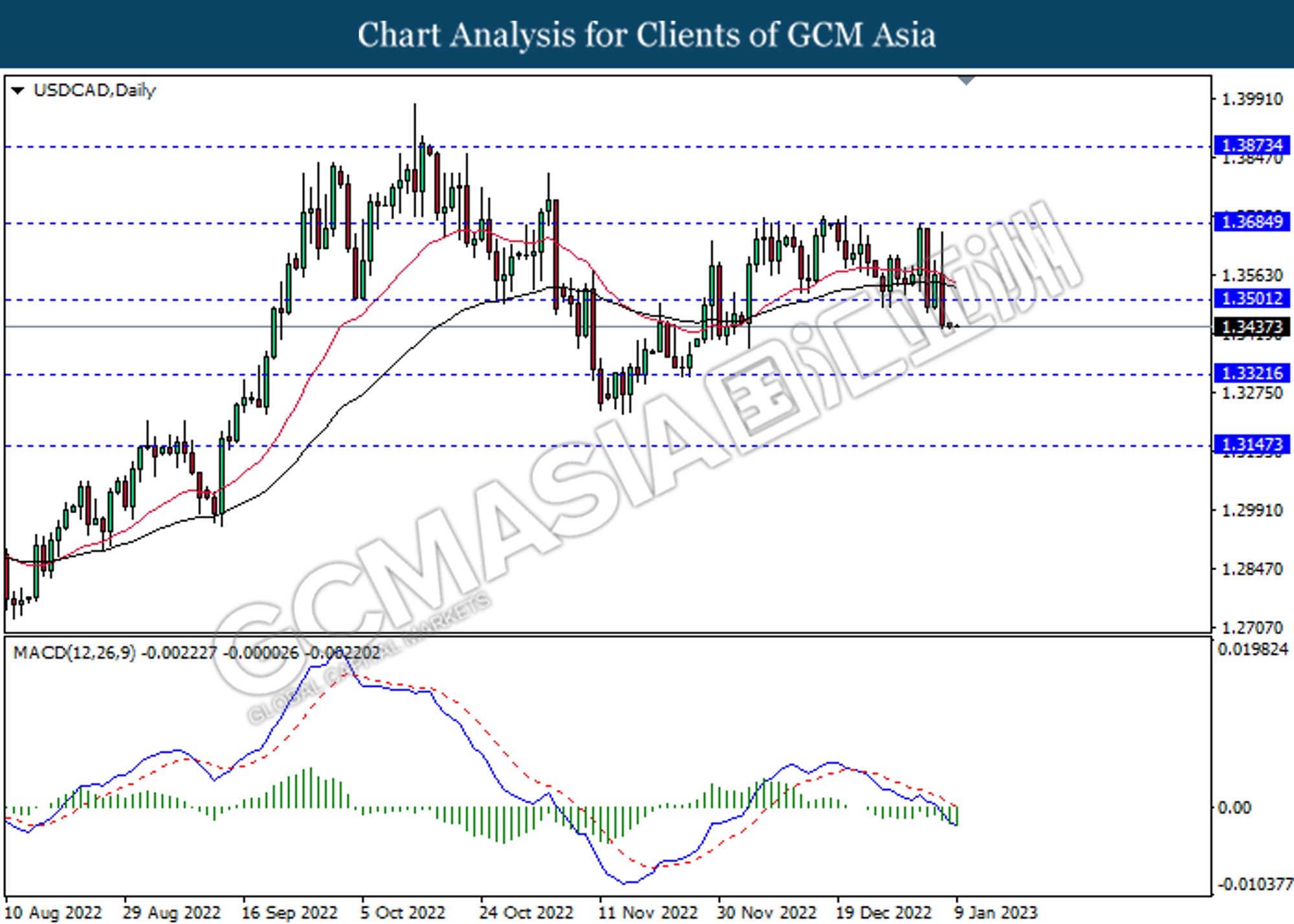

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

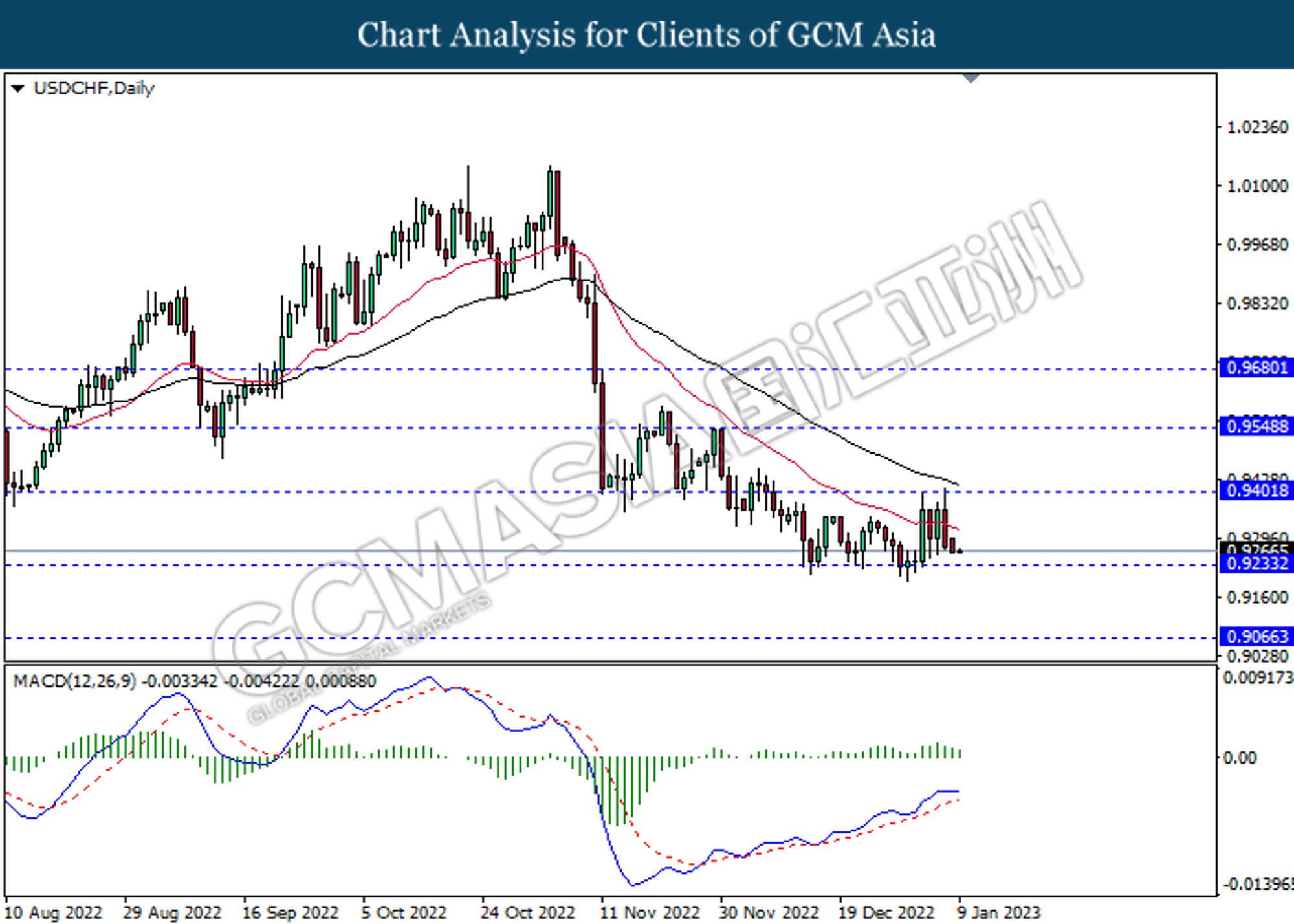

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses of successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity extend its gains.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00