09 February 2022 Afternoon Session Analysis

Australia Dollar surged amid risk-on mood.

The riskier asset such as the Australian Dollar rebounded significantly from lower level amid rising risk appetite in the global financial market following the positive development from Covid-19 pandemic, which spurring bullish momentum on the Australia Dollar. According to the World Health Organization, they officially claimed that the evidence is showing that the Omicron coronavirus variant is only affecting the upper respiratory tract, causing milder symptoms than previous variants while resulting in low death rates. Despite the case numbers due to Omicron variant have soared significantly across the world, some countries including United States have reduce the isolation or quarantine periods in a bid to allow people to return to work or school. As of writing, AUD/USD appreciated by 0.24% to 0.7162.

In the commodities market, the crude oil price depreciated by 0.32% to $89.75 per barrel as of writing. The oil price retraced from its higher level following the talks between United States and Iran resumed. Market participants speculated that Iran could increase more global oil supplies if both parties achieved consensus while United States removed the sanctions on Iran. On the other hand, the gold price appreciated by 0.14% to $1828.35 per troy ounces as of writing amid the global inflation risk continue to increase the appeal for the inflation-hedged commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.046M | 0.369M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 95.95. MACD which illustrated increasing bearish momentum suggest the index to extend its losses towards support level at 94.55.

Resistance level: 95.95, 96.80

Support level: 94.55, 93.25

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.3595. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3595, 1.3715

Support level: 1.3450, 1.3340

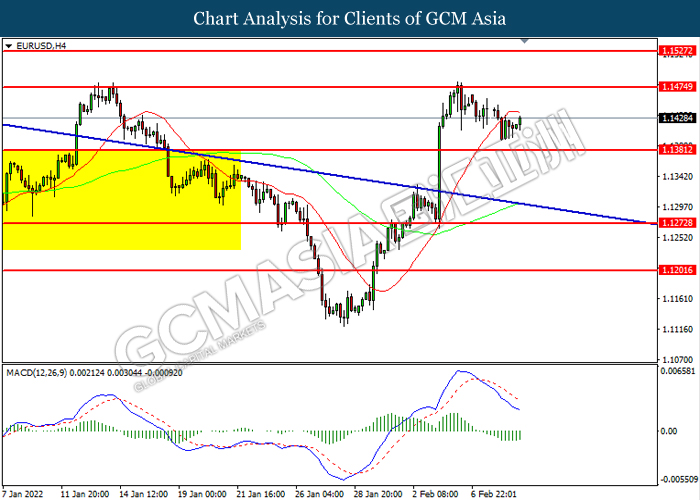

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1475. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.1380.

Resistance level: 1.1475, 1.1525

Support level: 1.1380, 1.1275

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 115.40. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 115.40, 116.25

Support level: 113.65, 112.85

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7125. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.7205.

Resistance level: 0.7205, 0.7270

Support level: 0.7125, 0.7040

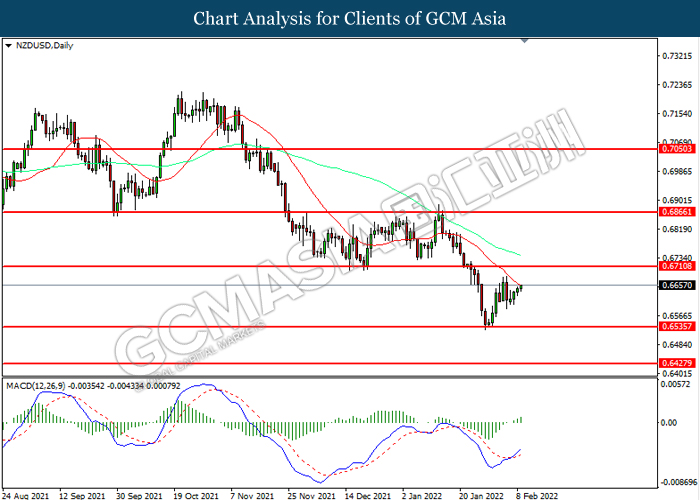

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6710. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6710.

Resistance level: 0.6710, 0.6865

Support level: 0.6535, 0.6430

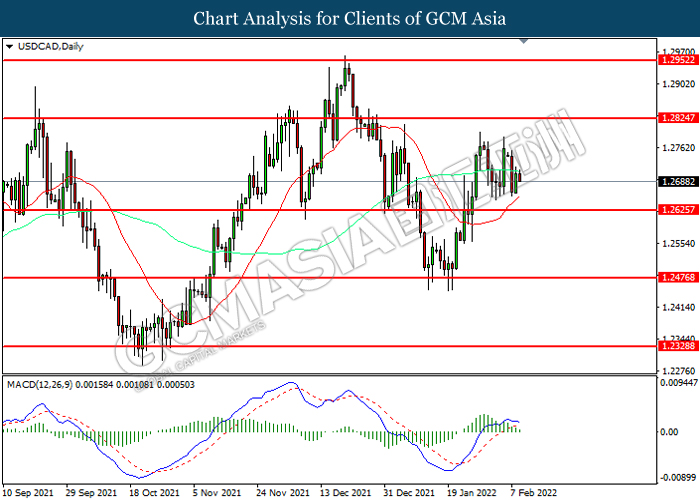

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2625. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2825, 1.2950

Support level: 1.2625, 1.2475

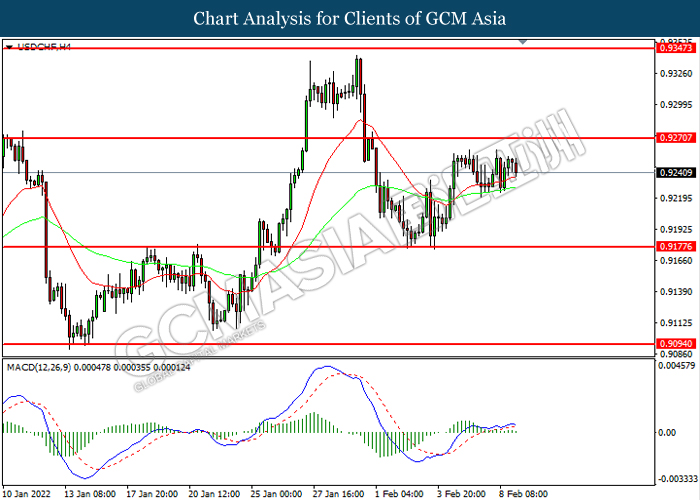

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level at 0.9270. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.9180.

Resistance level: 0.9270, 0.9345

Support level: 0.9180, 0.9095

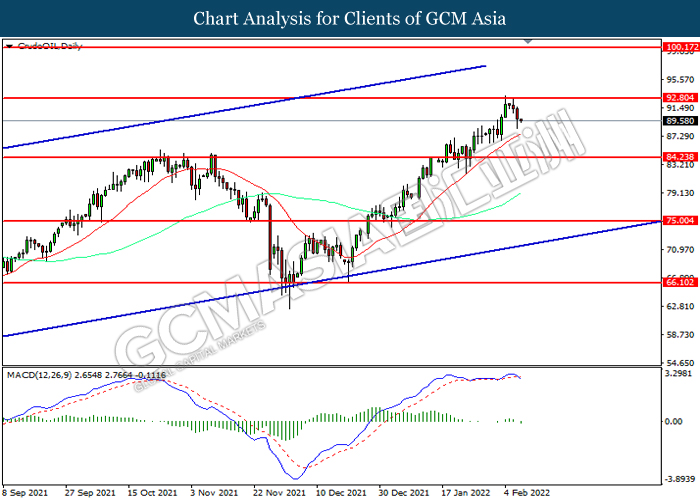

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 92.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 88.55.

Resistance level: 92.80, 100.15

Support level: 84.25, 75.00

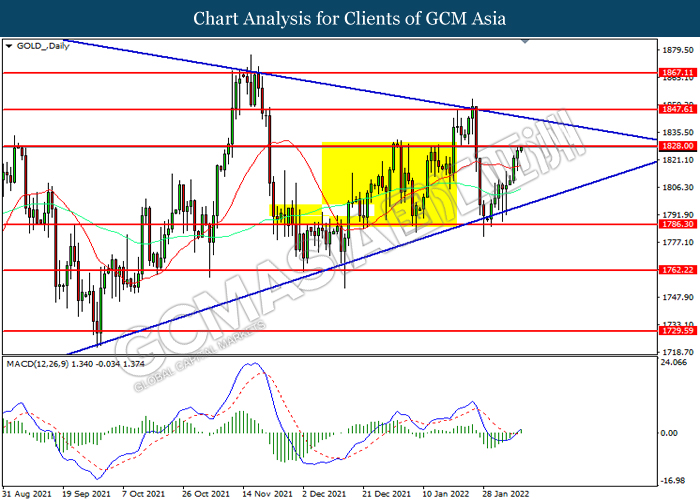

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1828.00. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1828.00, 1847.60

Support level: 1786.30, 1762.20