9 February 2022 Morning Session Analysis

ECB thwarts Euro hawks.

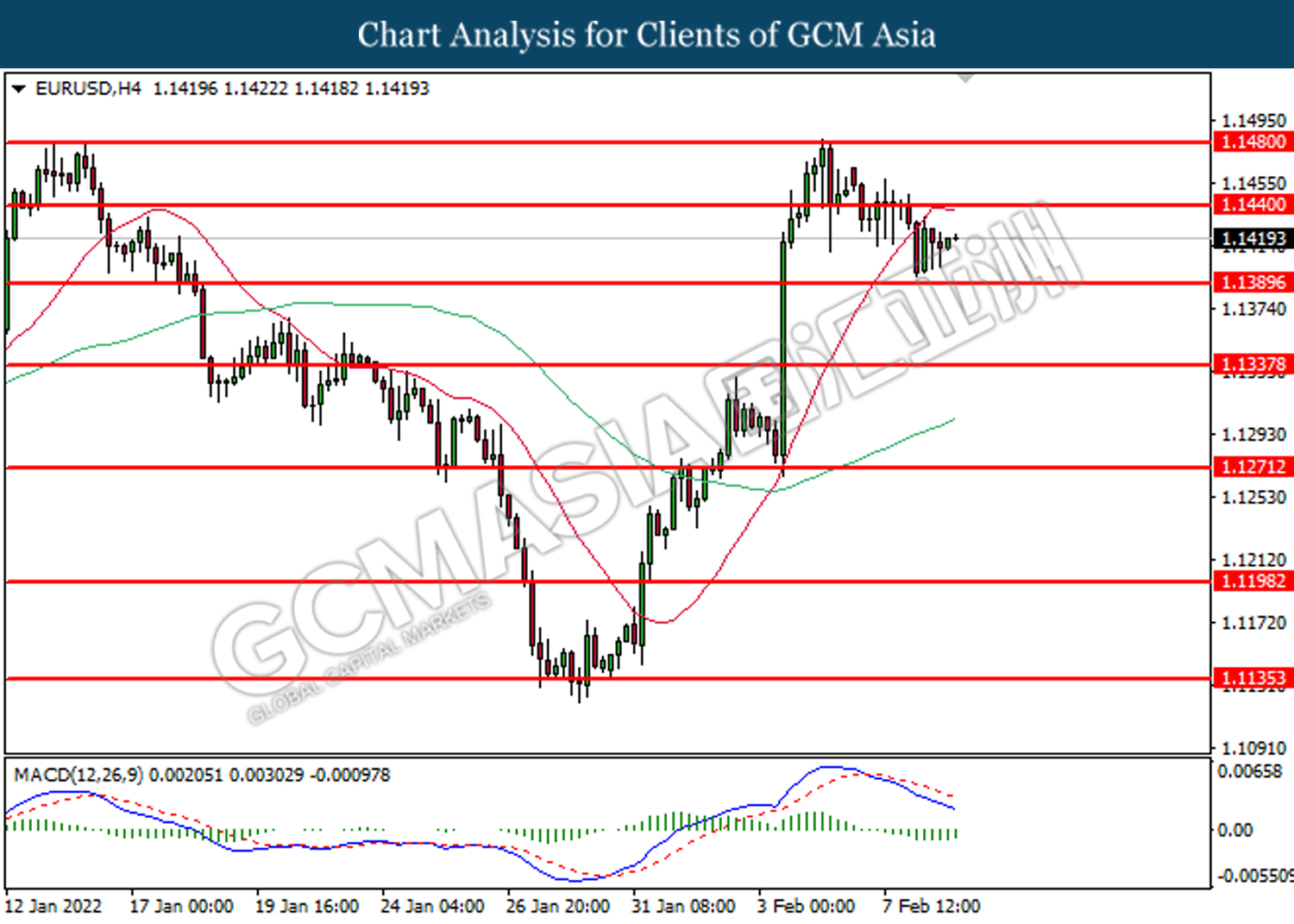

Euro was sold substantially on yesterday night following dovish stance given by European Central Bank (ECB). On yesterday, ECB President Christine Lagarde stated that high inflation rate in the EU is more likely to diminish in the mid-term and stabilizes near their targeted range of 2%. The comment was given following assessment upon current economic condition which does not provide any further signals that supports for a persistently high inflationary pressure in the near future. In addition, Lagarde commented that EU’s current inflation rate is well under control while slight tightening in monetary policy may be required in the mid-term to bring it back closer to their targeted range. Lagarde’s latest statement contradicts with last week’s policy meeting signals which suggests for a faster pace of tightening with possibility of a rate hike at the end of the year. As of writing, EUR/USD was down 0.03% to 1.1414.

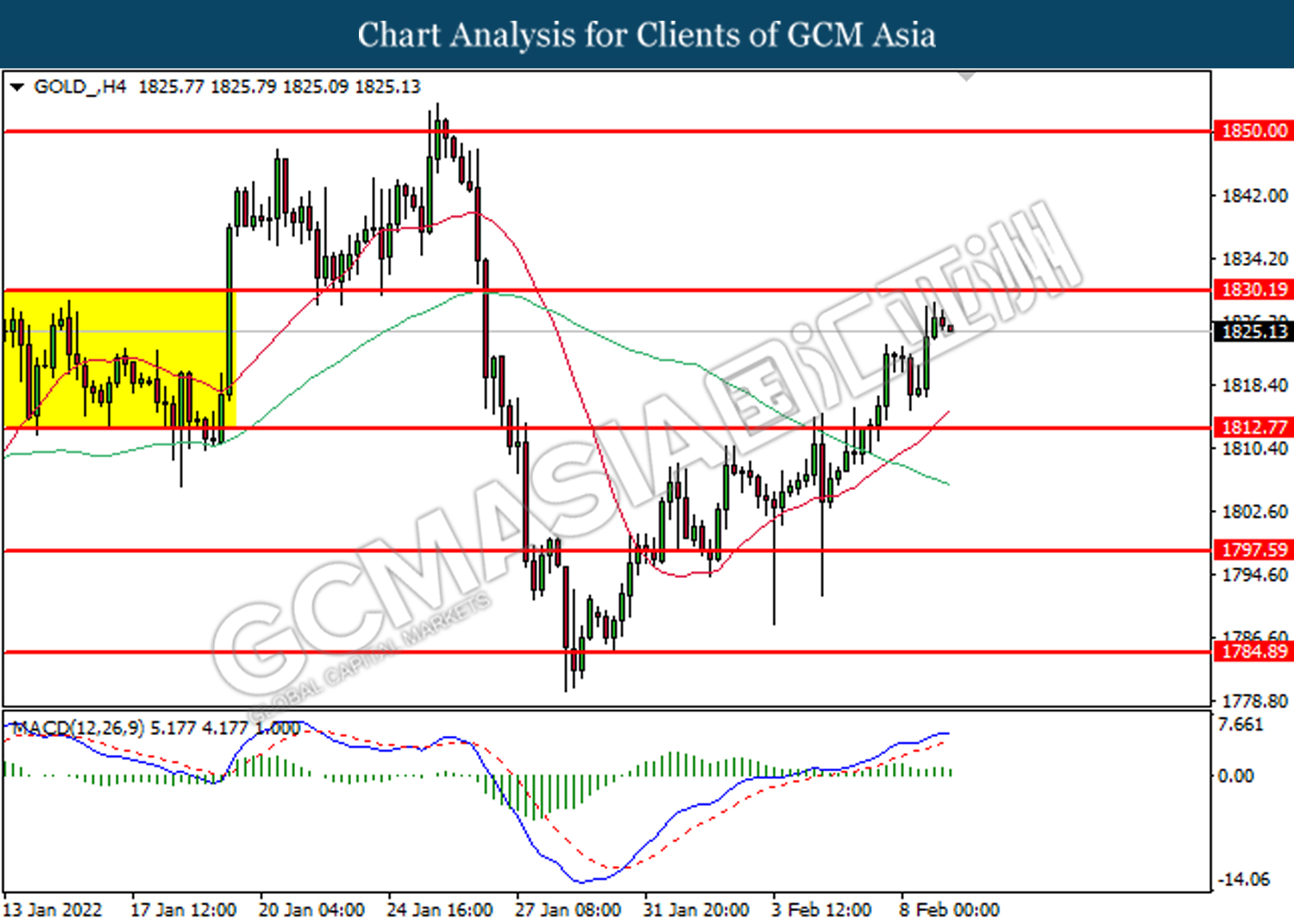

In the commodities market, crude oil price was up 0.05% to $89.73 per barrel after American Petroleum Institute reported a draw in oil inventories last week by 1.1 million barrels. On the other hand, gold price ticks up 0.01% to $1,825.97 a troy ounce due to rising inflation risk in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | -1.046M | 0.369M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests the index to be traded higher in short-term.

Resistance level: 95.80, 96.60

Support level: 94.75, 93.55

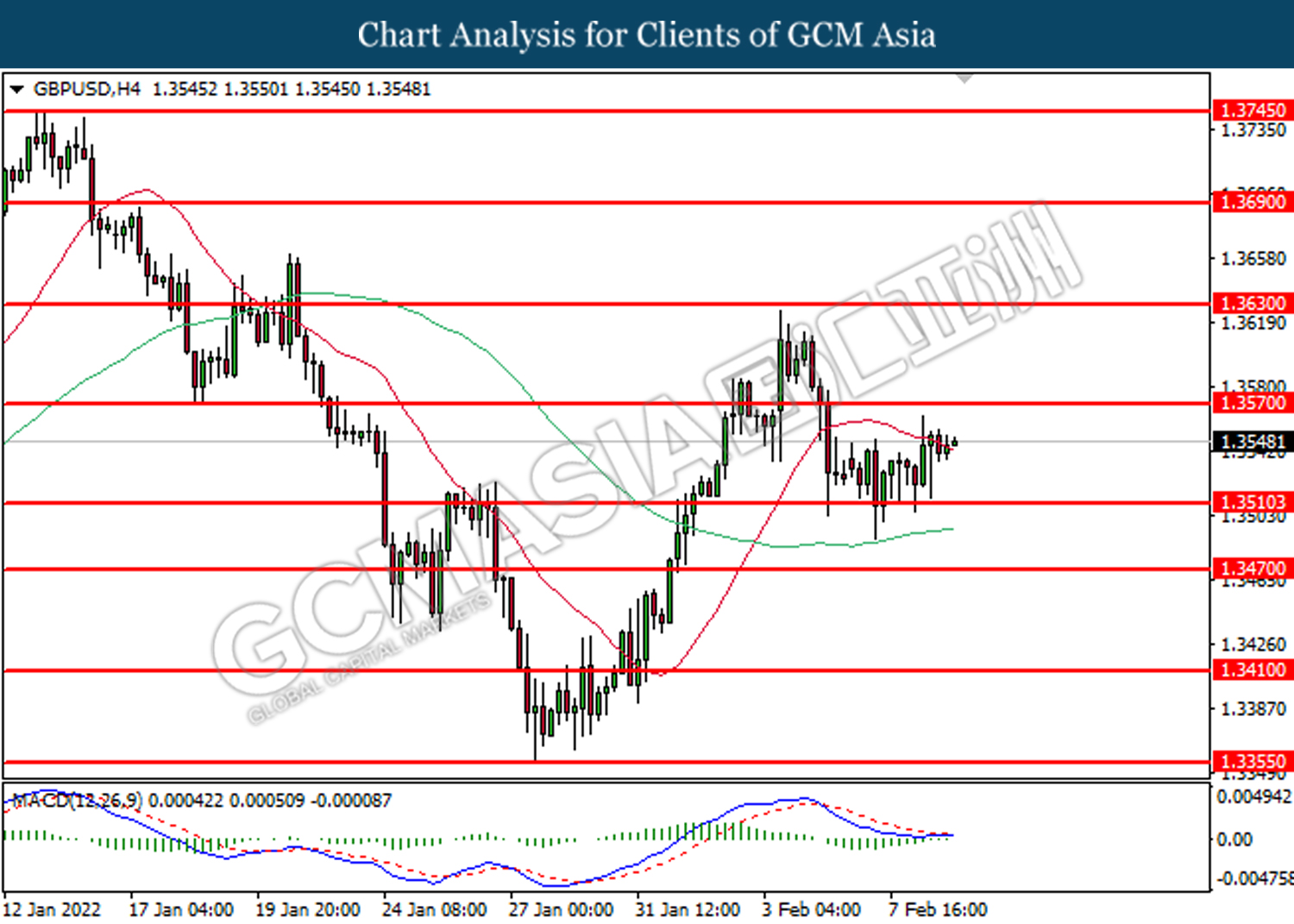

GBPUSD, H4: GBPUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher in short-term.

Resistance level: 1.3570, 1.3630

Support level: 1.3510, 1.3470

EURUSD, H4: EURUSD was traded higher following prior rebound from lower level. MACD which illustrate diminished bearish signal suggests the pair to be traded higher after breaking its resistance level.

Resistance level: 1.1440, 1.1480

Support level: 1.1390, 1.1340

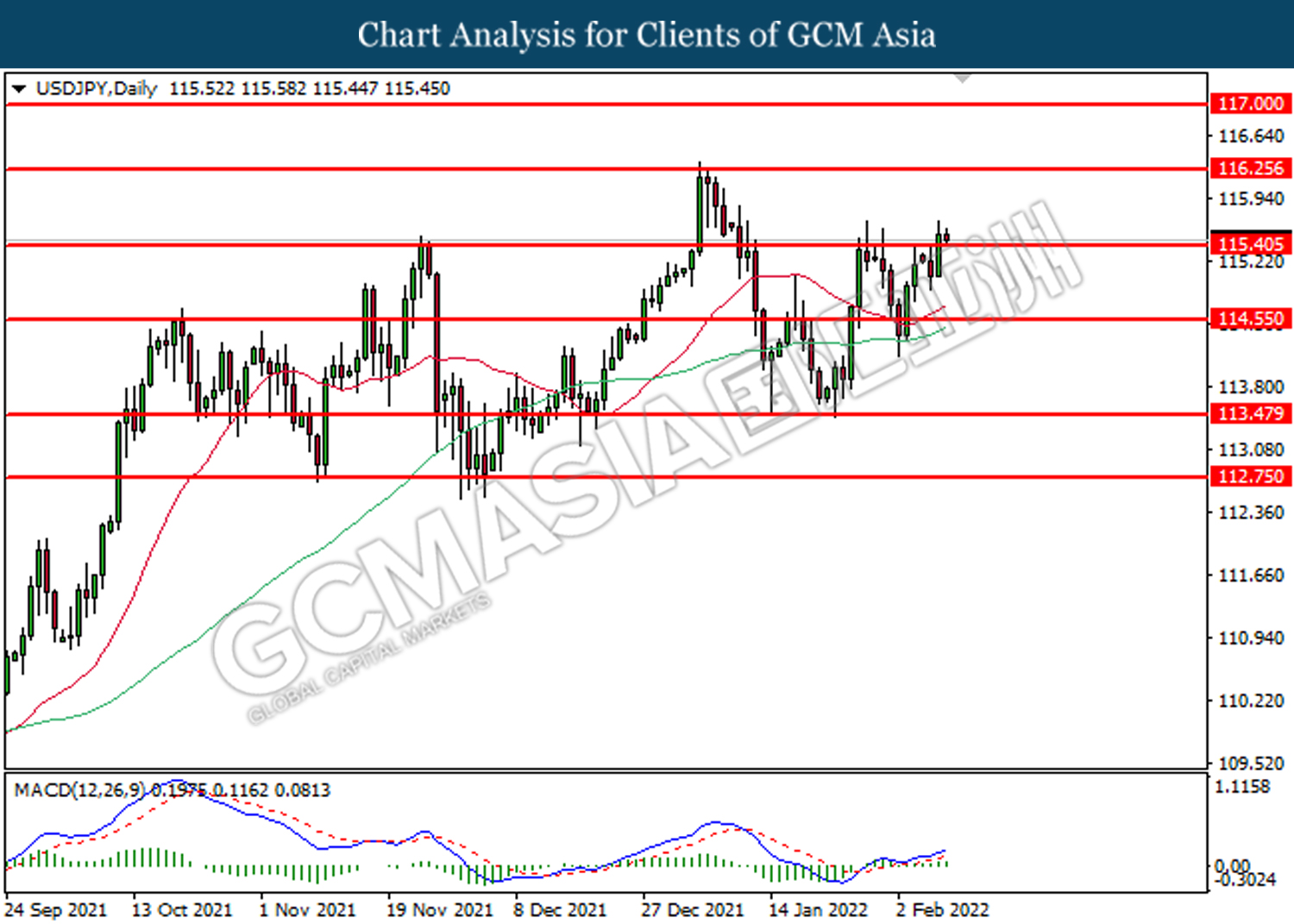

USDJPY, Daily: USDJPY was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 116.25, 117.00

Support level: 115.40, 114.55

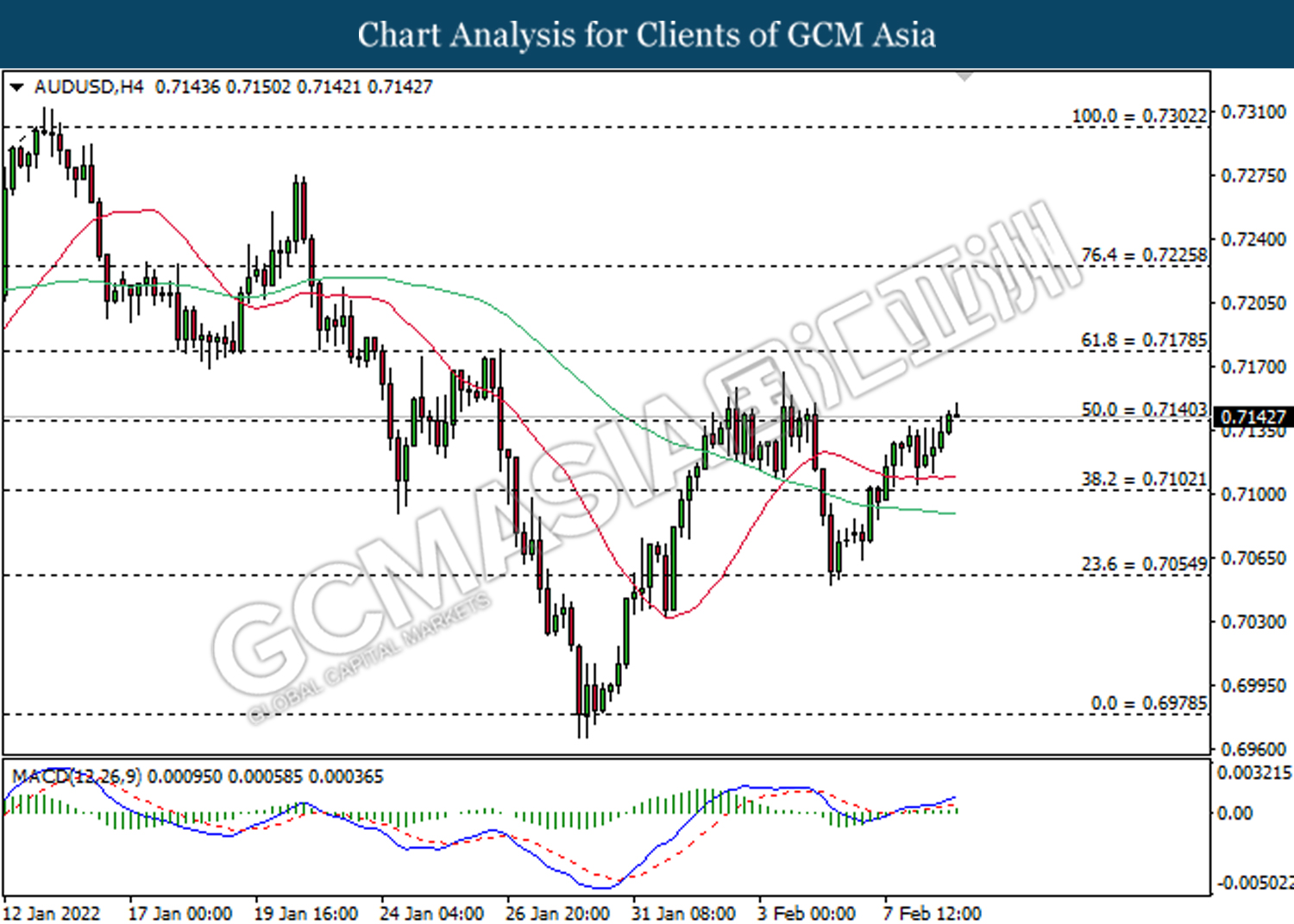

AUDUSD, H4: AUDUSD was traded higher following prior rebound from lower level. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.7180, 0.7225

Support level: 0.7140, 0.7100

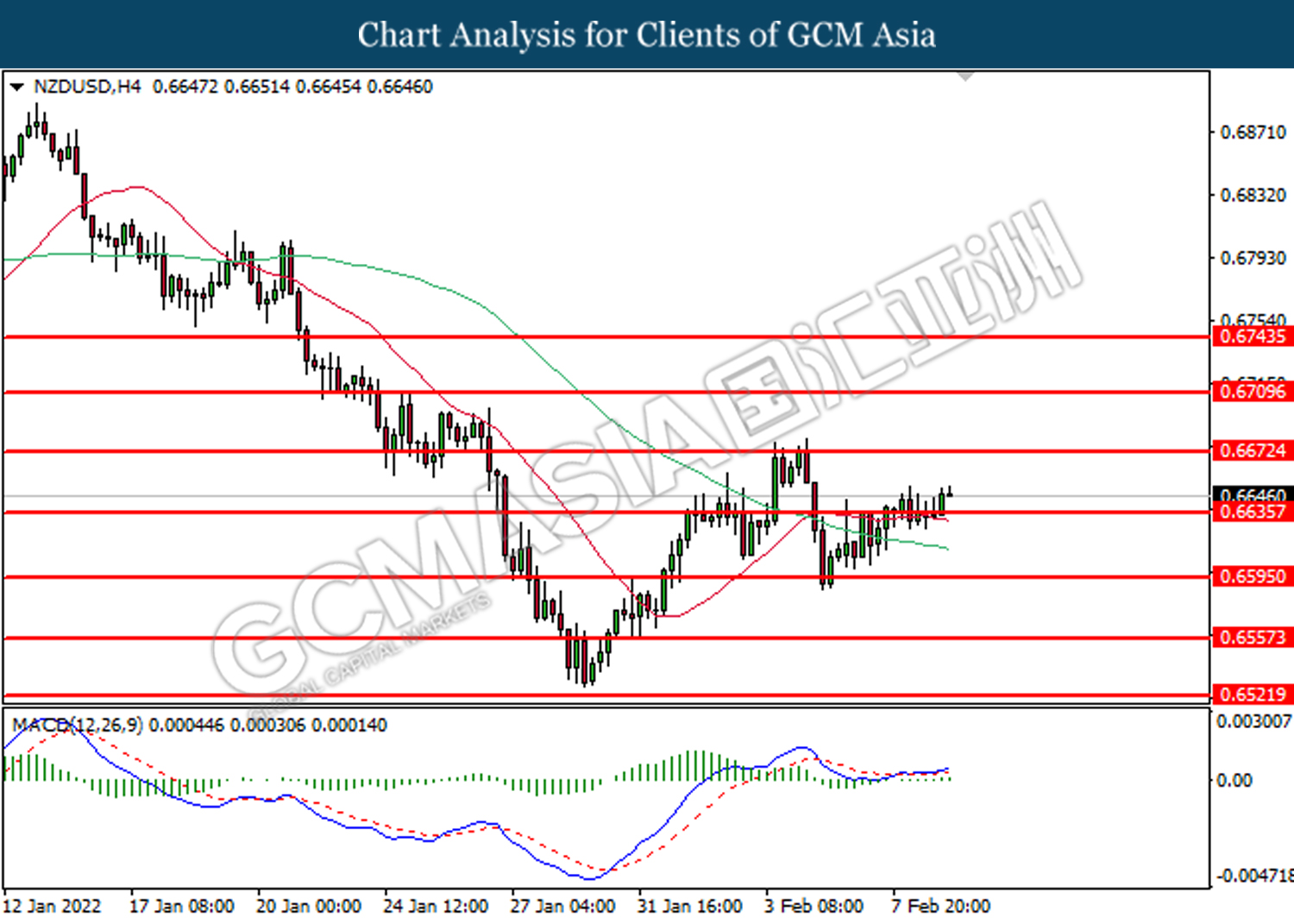

NZDUSD, H4: NZDUSD was traded higher following prior rebound from lower levels. MACD which illustrate bullish signal suggests the pair to be traded higher in short-term.

Resistance level: 0.6670, 0.6710

Support level: 0.6635, 0.6595

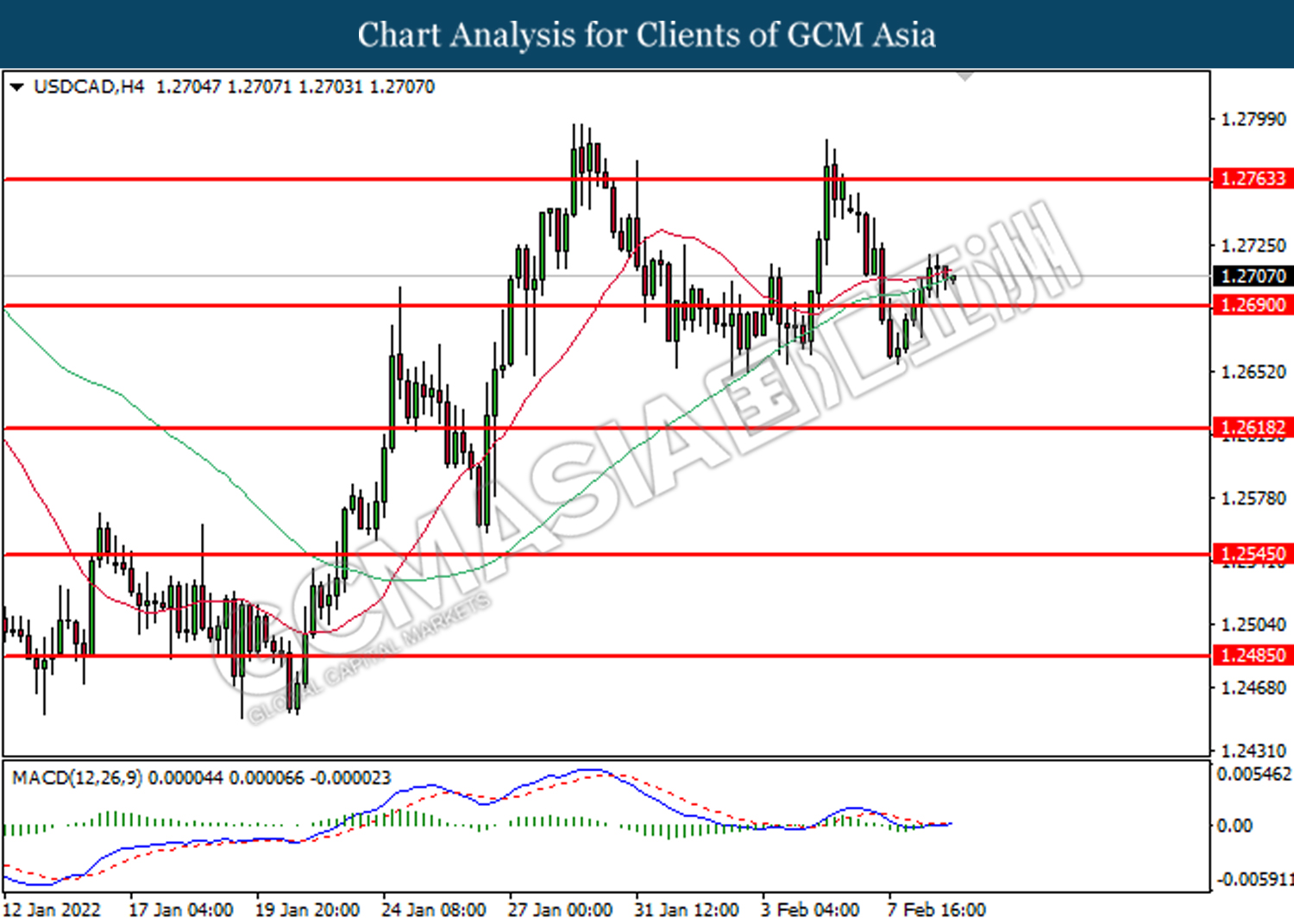

USDCAD, H4: USDCAD was traded lower following prior retracement from higher levels. MACD which illustrate bearish momentum suggests the pair to be traded lower in short-term.

Resistance level: 1.2765, 1.2835

Support level: 1.2690, 1.2620

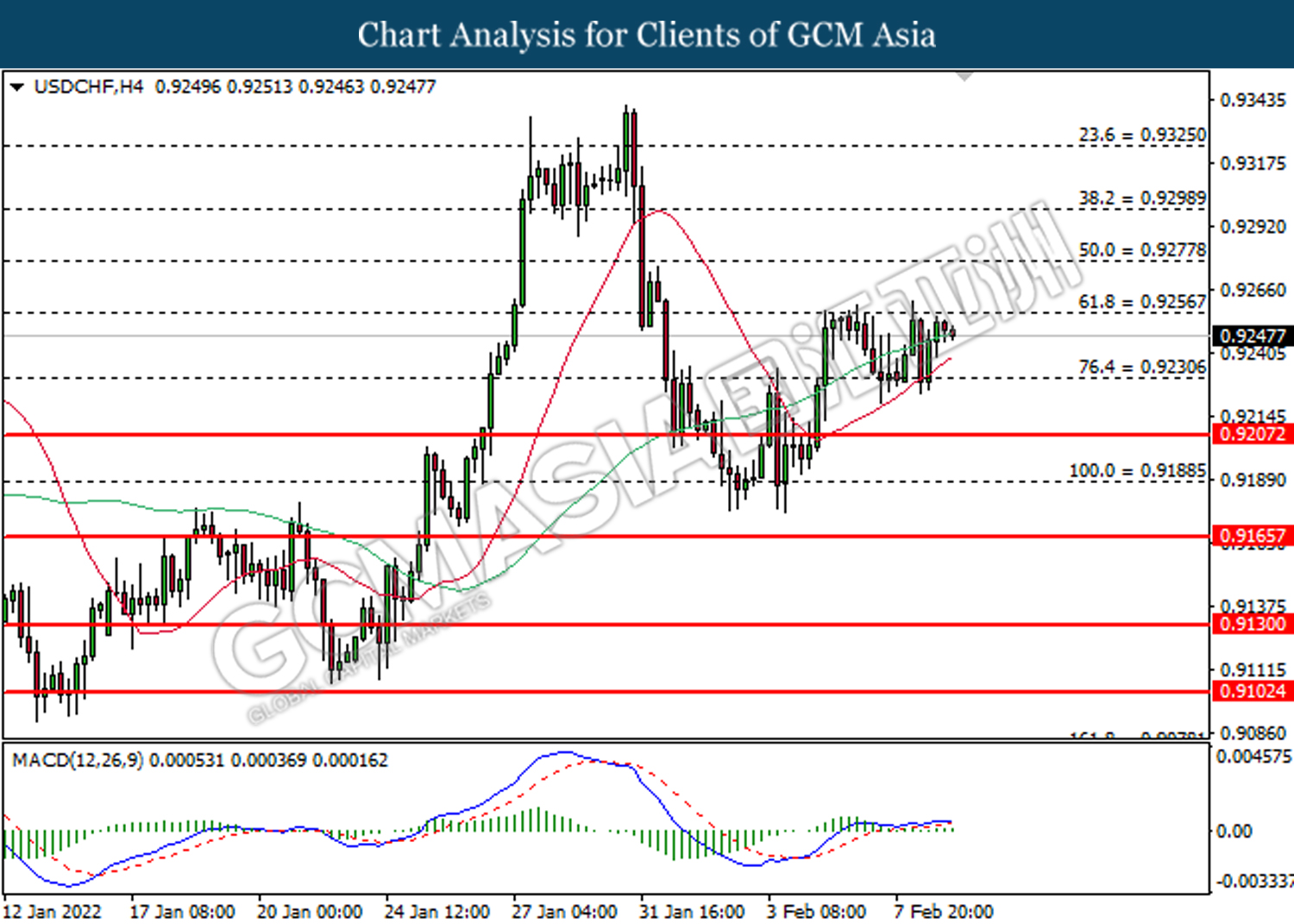

USDCHF, H4: USDCHF was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests the pair to be traded lower in short-term.

Resistance level: 0.9255, 0.9280

Support level: 0.9230, 0.9210

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from lower levels. MACD which illustrate diminished bearish signal suggests its price to be traded higher in short-term.

Resistance level: 91.00, 93.15

Support level: 89.50, 87.40

GOLD_, H4: Gold price was traded lower following prior retracement from higher levels. MACD which illustrate diminished bullish signal suggests its price to be traded lower in short-term.

Resistance level: 1830.20, 1850.00

Support level: 1812.80, 1797.60