9 February 2023 Afternoon Session Analysis

EUR rebound amid hawkish statement from ECB council members

The euro, one of the most traded currency in the foreign exchange market, rebounded after 3 consecutive days of downward trends. The rebound in the euro market was mainly attributed to the hawkish statement from the Europe Central Bank (ECB) council member Martins Kazaks. Kazaks argued that the euro inflation is still tilted on the upside and should raise the rate significantly to curb the sky-high inflation. Besides, the weakness of dollar market also supported a rebound in the euro market after the Fed chairman Jerome Powell’s less hawkish statement. Powell mentioned that the disinflation situation occurred in the US economy urged the dollar to drop. However, the rebound trends of the EUR were offset by the statement from Knot, the Dutch central bank governor. Knot mentioned that the inflation around the peak and the sharp decrease in energy prices could bring down the inflation faster than projection. This statement led investors to expect slowing in a rate hike for the upcoming ECB monetary policy decisions. Due to market uncertainty, investors are waiting for more cues from the upcoming EU economic forecast. As of writing, the EUR/USD gained 0.20% to $1.0730.

In the commodity market, the crude oil price depreciated by -0.10% to $78.40 per barrel as of writing following a 3-day rally amid Fed uncertainty and US inventory build. In addition, the gold price appreciated by 0.04% to $1891.50 per troy ounce as of writing amid the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:45 GBP BoE MPC Treasury Committee Hearings

18:00 EUR EU Economic Forecasts

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Jan) | 8.6% | 9.2% | – |

| 21:30 | USD – Initial Jobless Claims | 183K | 194K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

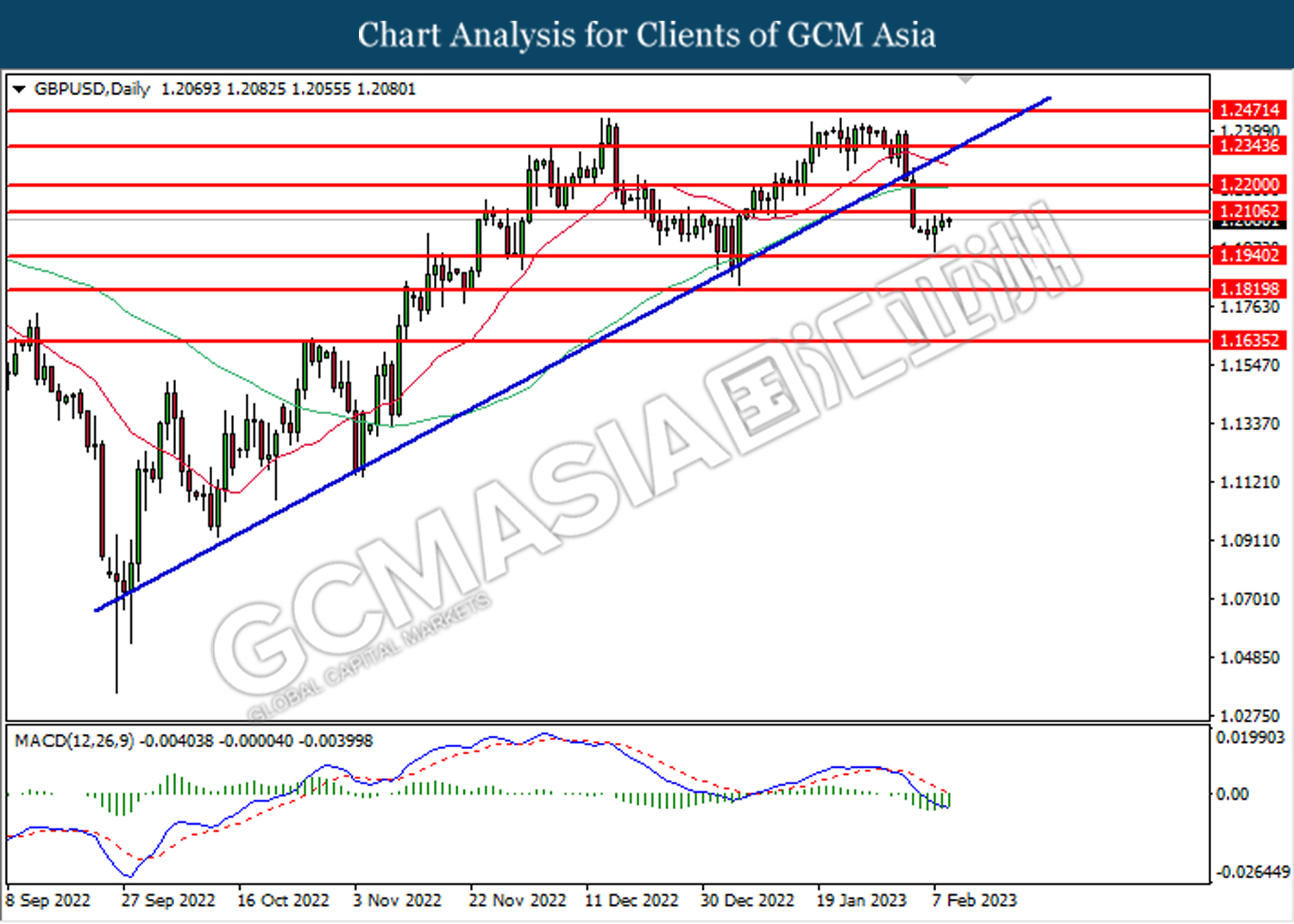

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2105. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

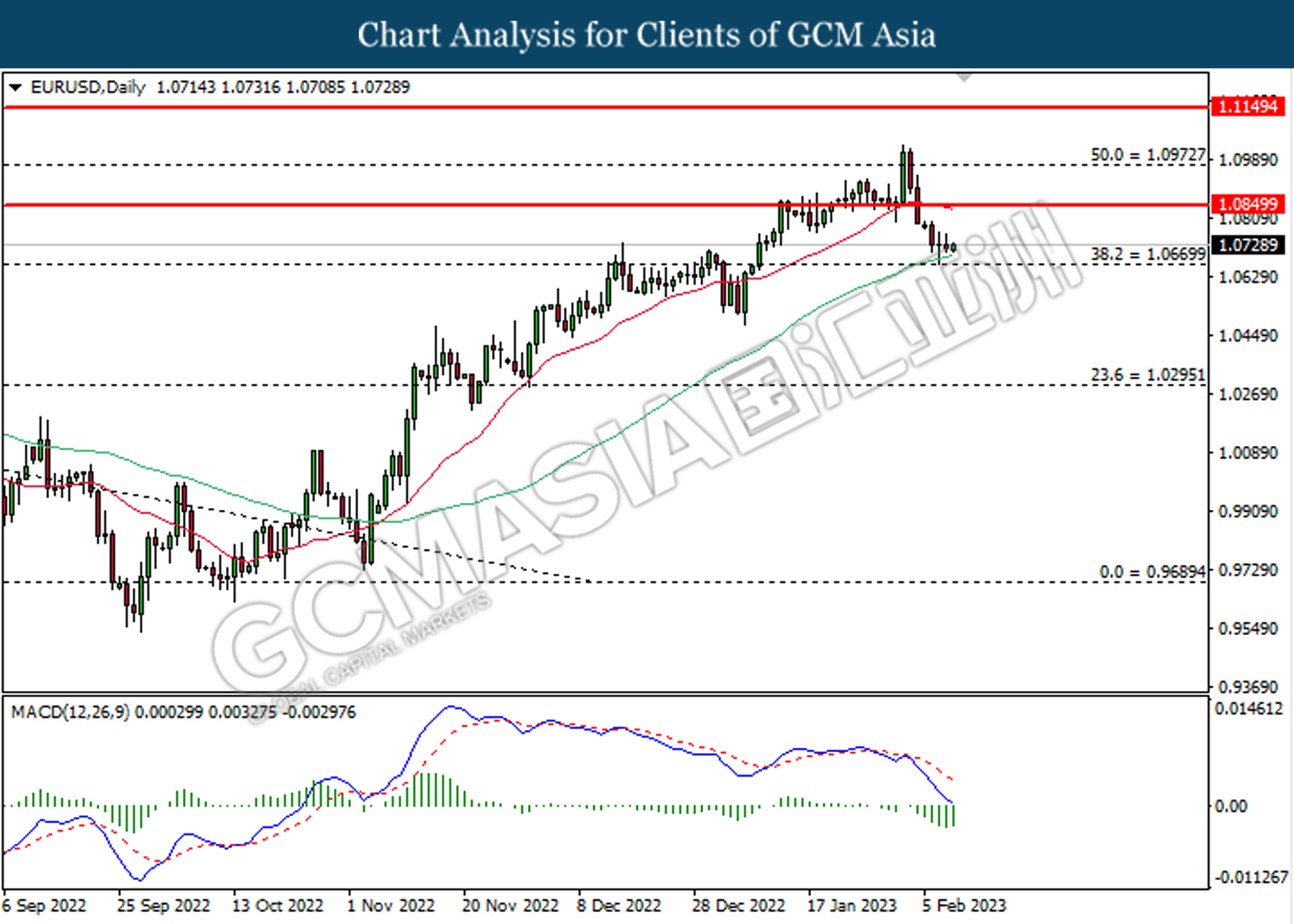

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level at 1.0850. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0670.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

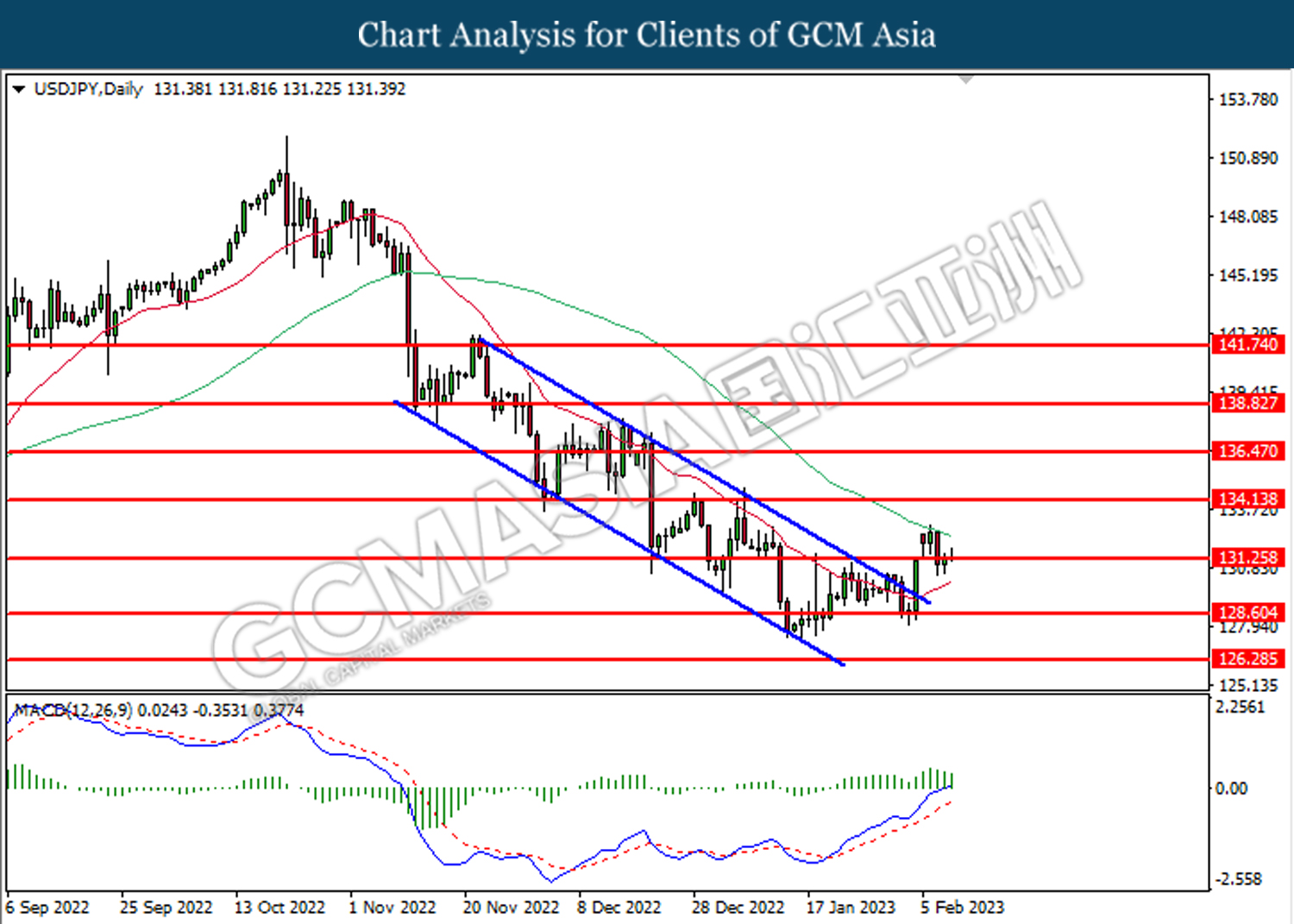

USDJPY, Daily: USDJPY was traded higher while currently retesting the resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

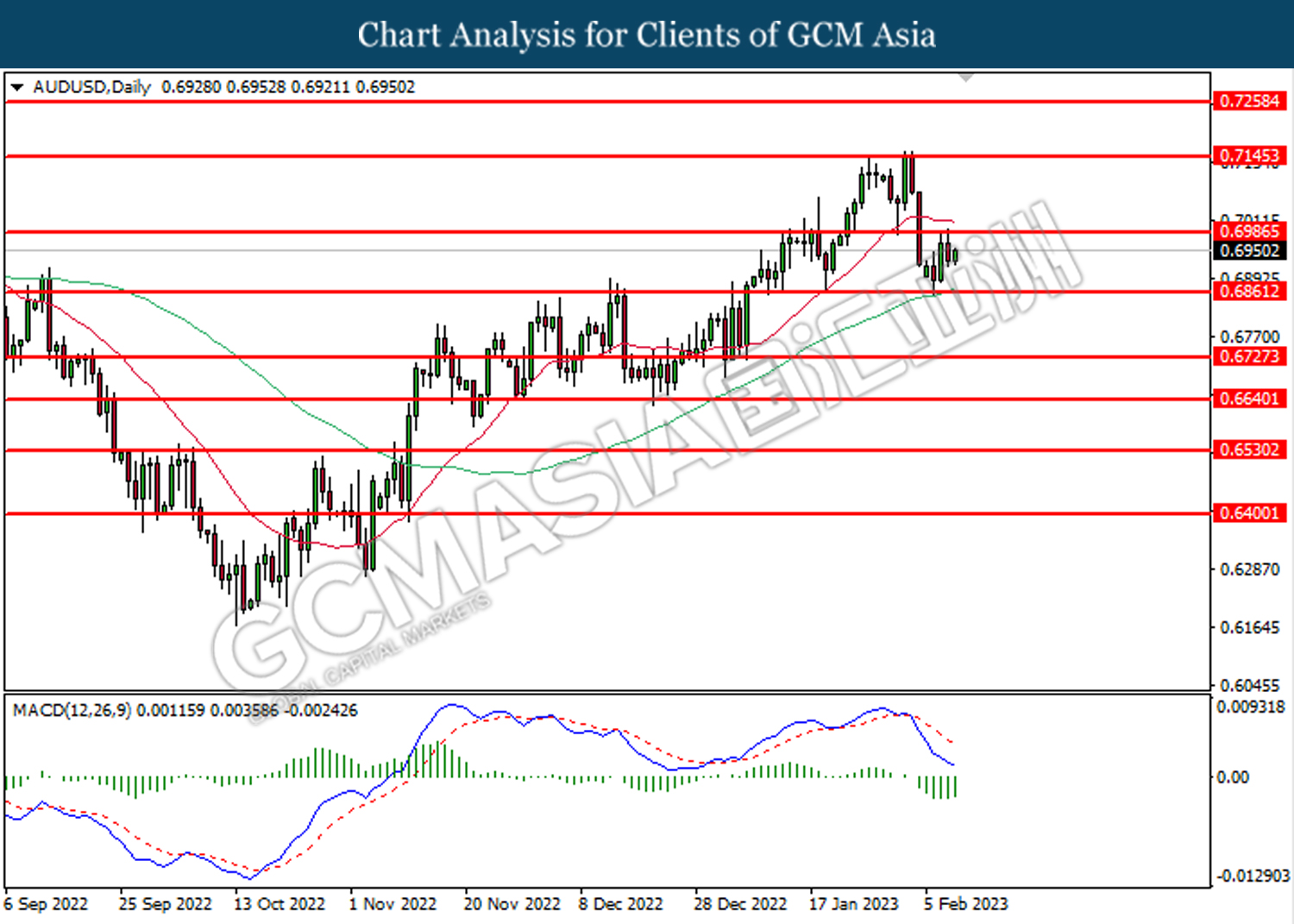

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the support level at 0.6860. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6985.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

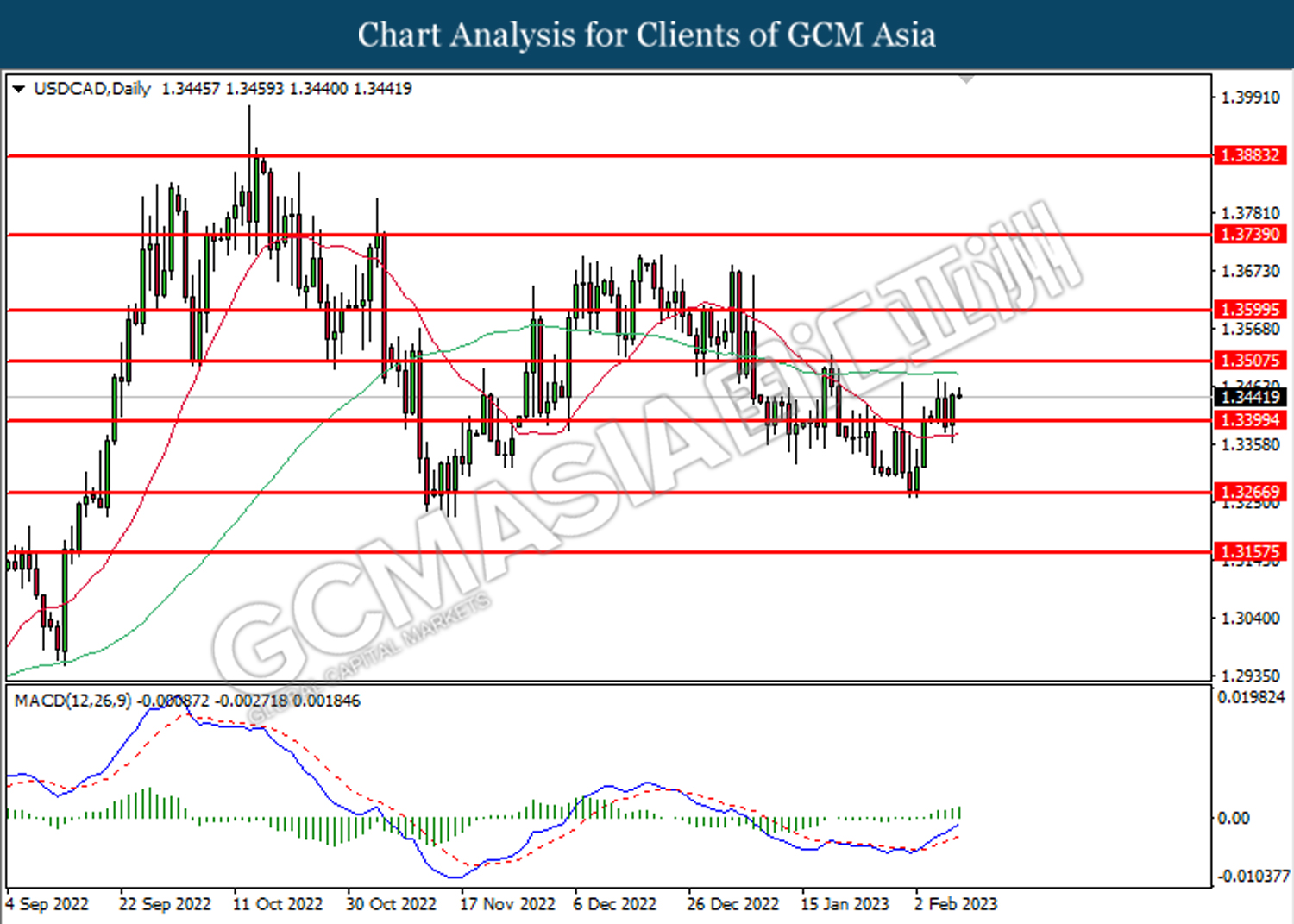

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3400. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3505.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

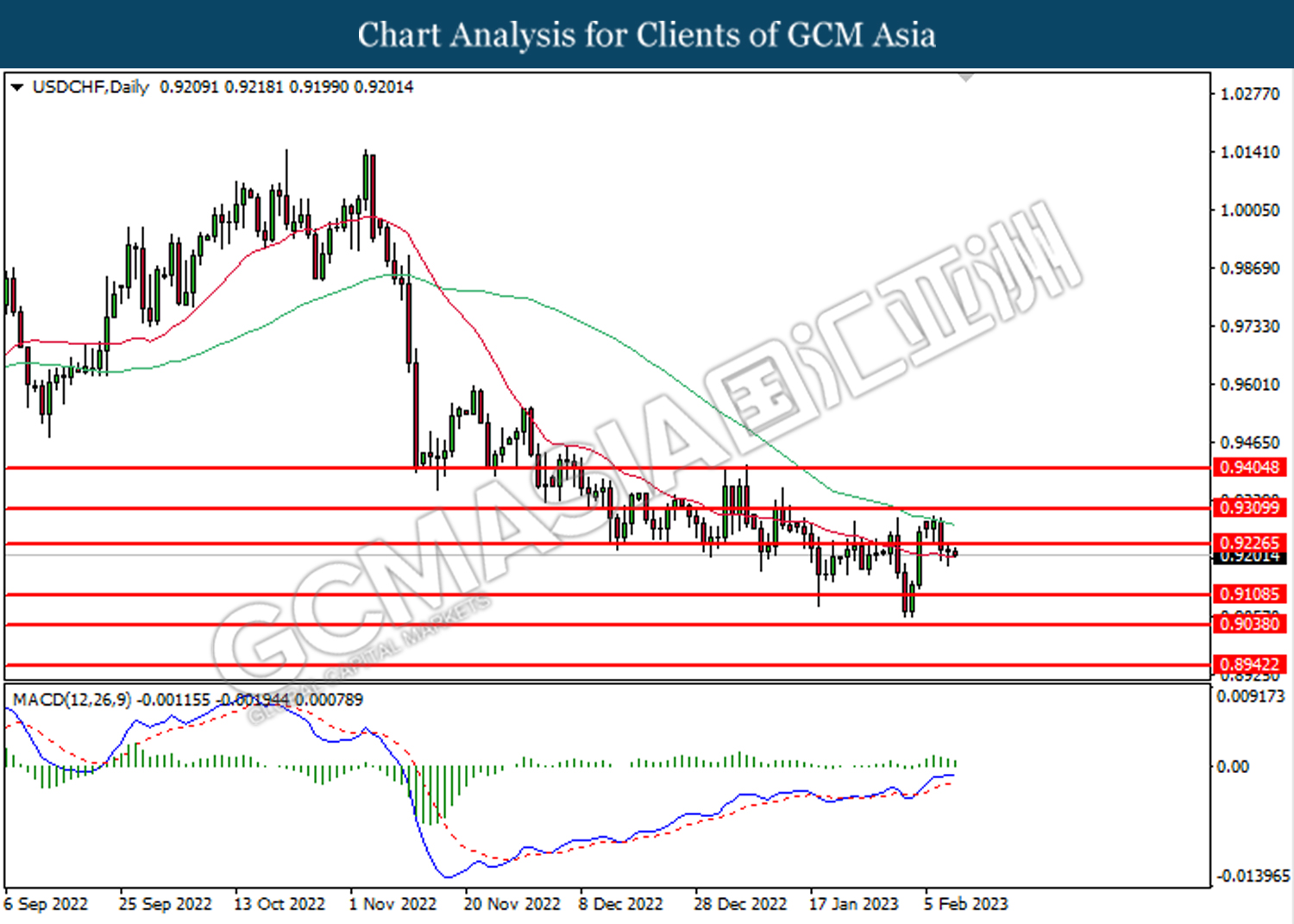

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

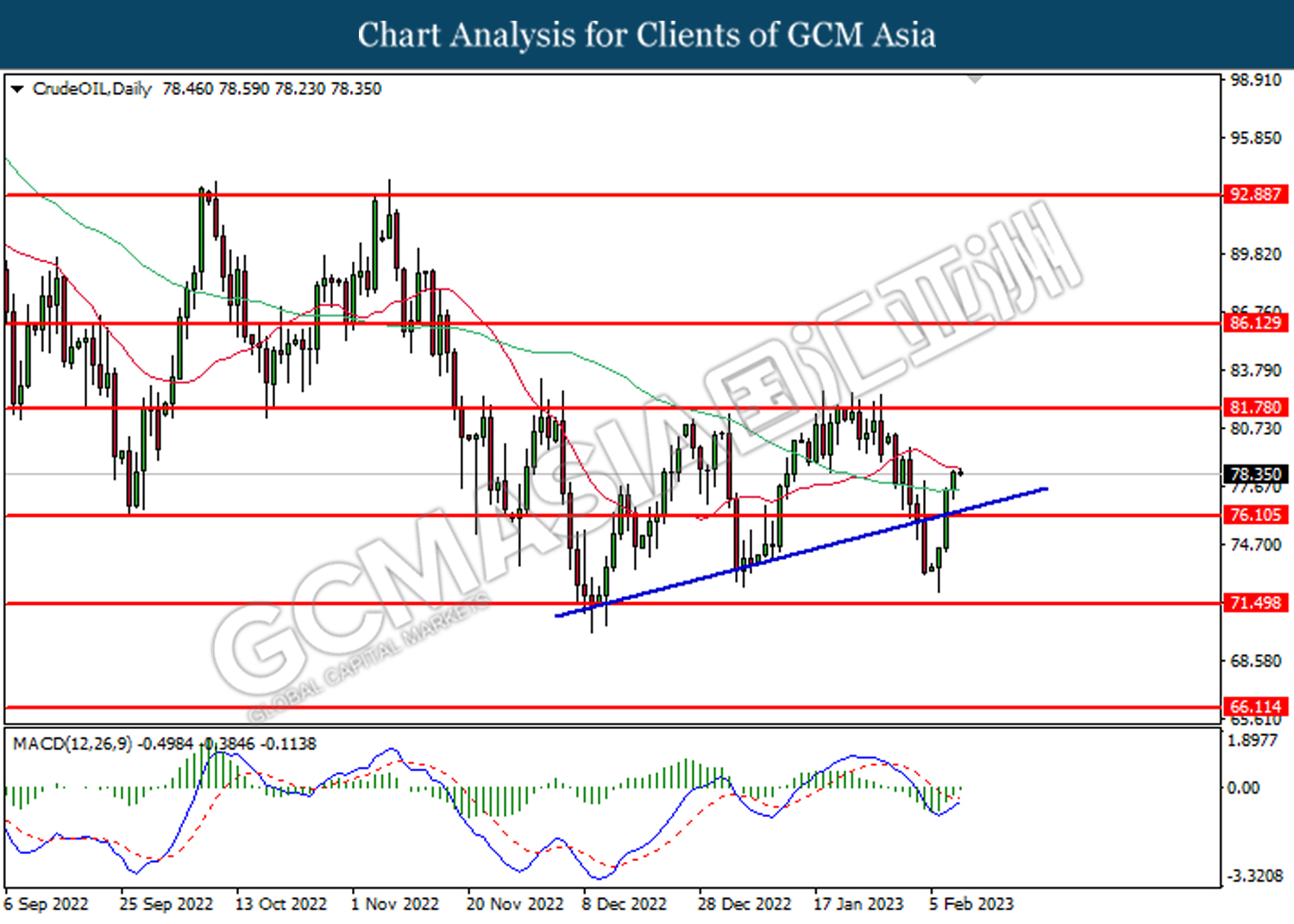

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

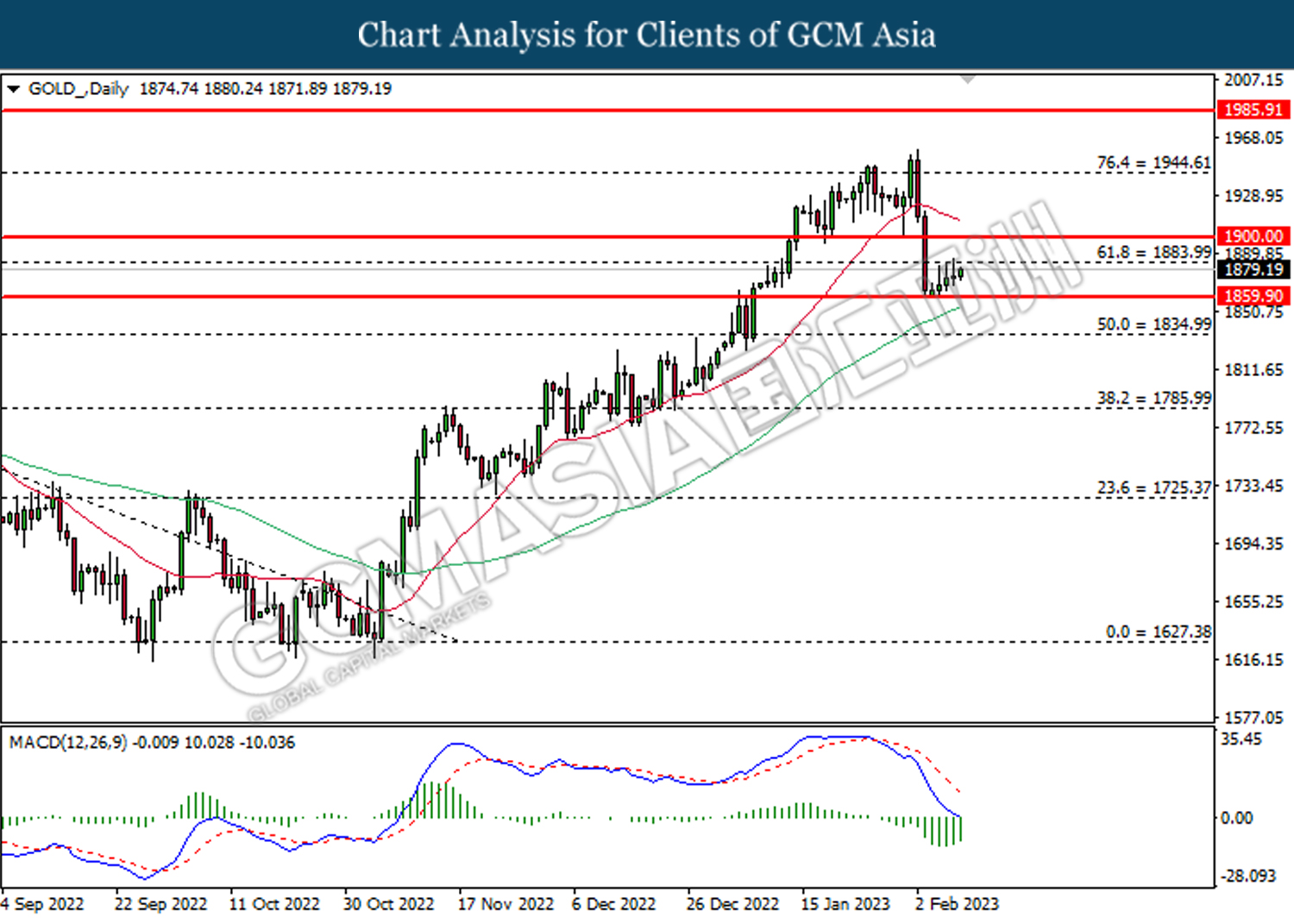

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1884.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1884.00.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00