9 February 2023 Morning Session Analysis

US Dollar rose, buoyed by Fed’s hawkish speech.

The Dollar Index which traded against a basket of six major currencies found its ground on yesterday over the Fed member hawkishness. According to Reuters, the Federal Reserve Governor Christopher Waller claimed on Wednesday that the path for bring down the sky-high inflation would be a ‘long journey’, while the interest rate might be stay at high level for longer period. Fresh concerns about inflation had risen following the upbeat employment data, which showing 517,000 job creation in January and a dip in unemployment to 3.4%, a 53-year low. With that, a strong labor market would likely to boost wages rate in the US, whereas it run counter to the purpose of aggressive rate hike plan. Besides that, another Fed member, New York Federal Reserve President John Williams said that Fed would possible to raise its rate to the range of 5% to 5.25%, and it still was an acceptable level. For now, most of investors were anticipating another 25 basis points hike in the next meeting, whereby the likelihood has reached 92.2%, according to the CME FedWatch Tool. As of writing, the Dollar Index appreciated by 0.04% to 103.33

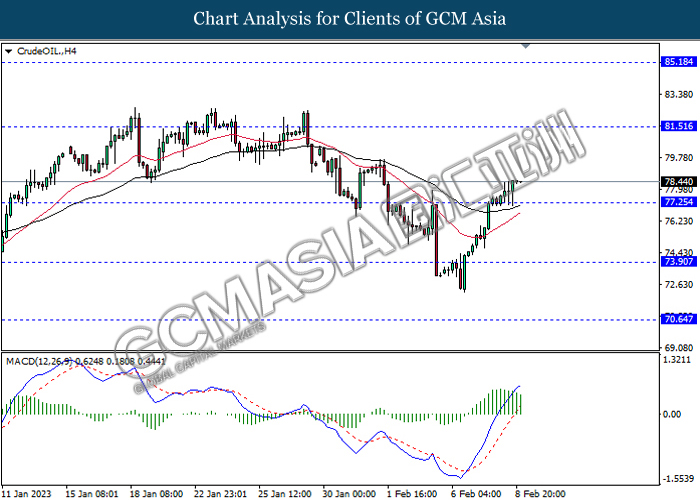

In the commodity market, the crude oil price edged up by 0.01% to $78.48 per barrel as of writing following the increase in crude oil inventories was less than expected. According to EIA, the US Crude Oil Inventories was raised by 2.423M barrels, which is lower than the consensus forecast of 2.457M barrels. In addition, the gold price depreciated by 0.07% to $1874.70 per troy ounce as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:45 GBP BoE MPC Treasury Committee Hearings

18:00 EUR EU Economic Forecasts

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Jan) | 8.6% | 9.2% | – |

| 21:30 | USD – Initial Jobless Claims | 183K | 194K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

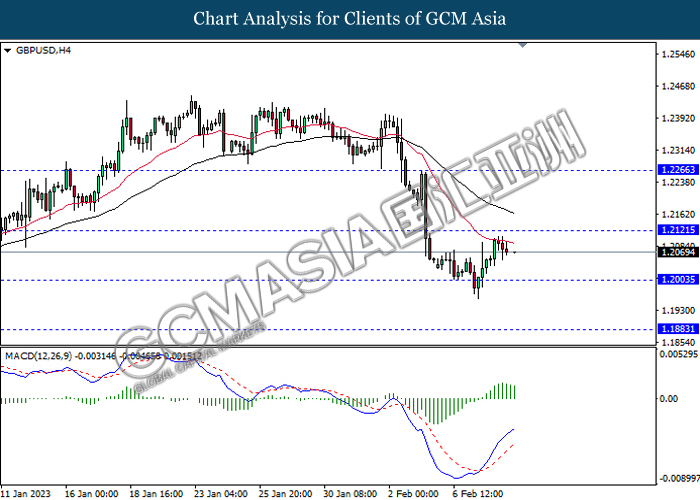

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

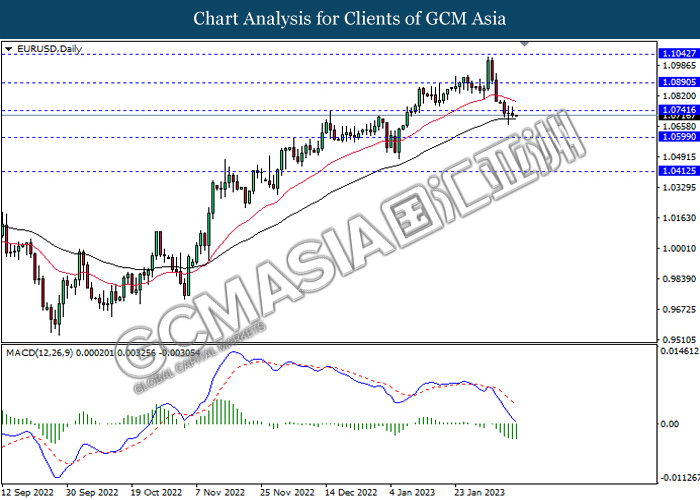

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

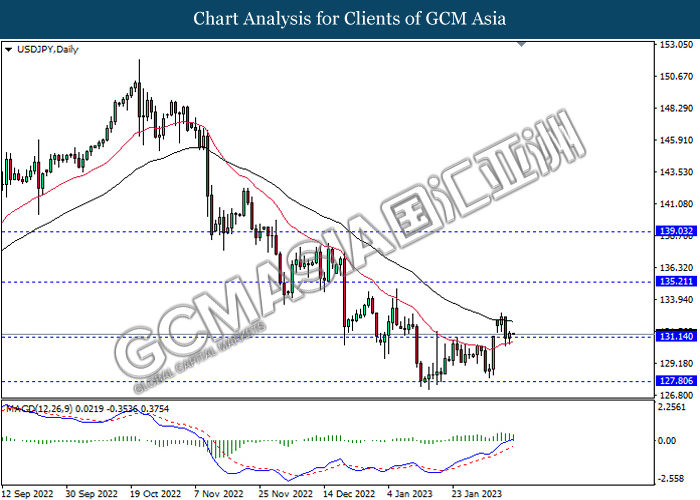

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

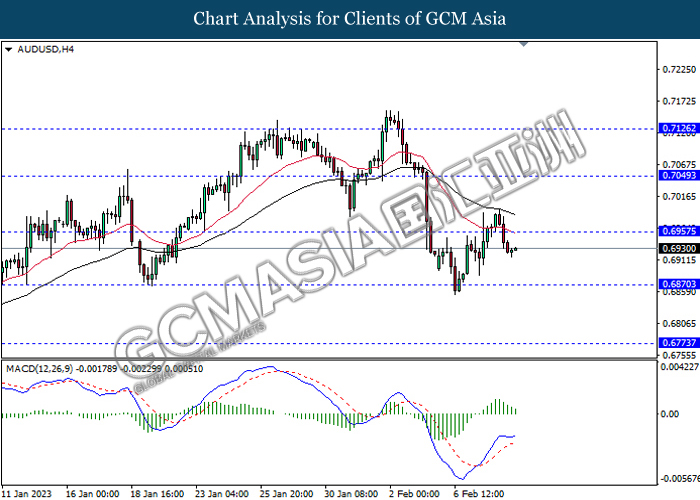

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6955, 0.7050

Support level: 0.6870, 0.6775

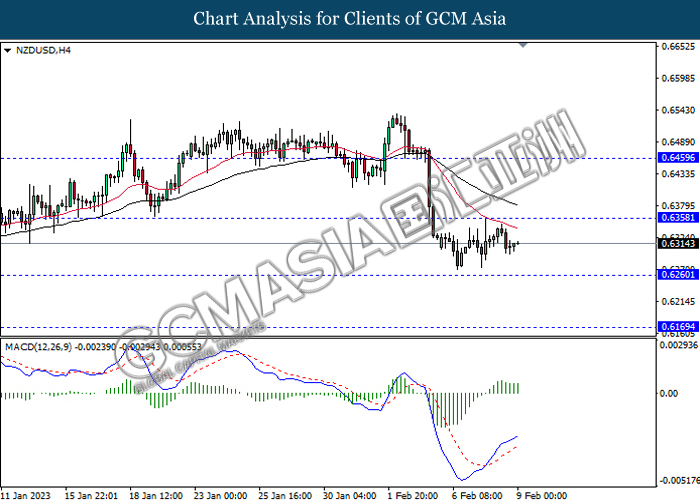

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

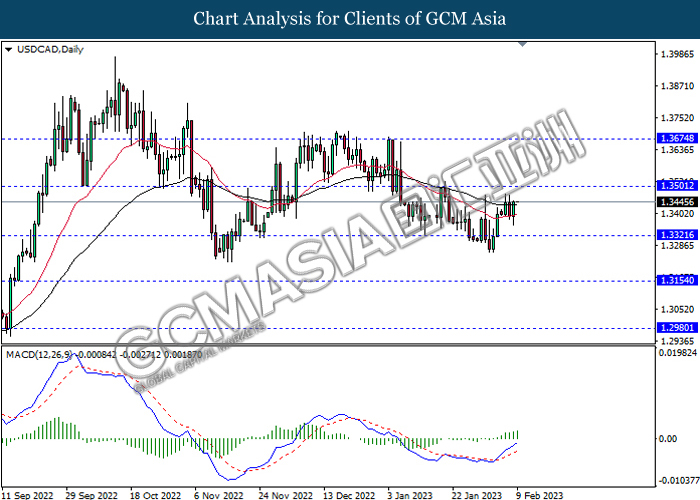

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

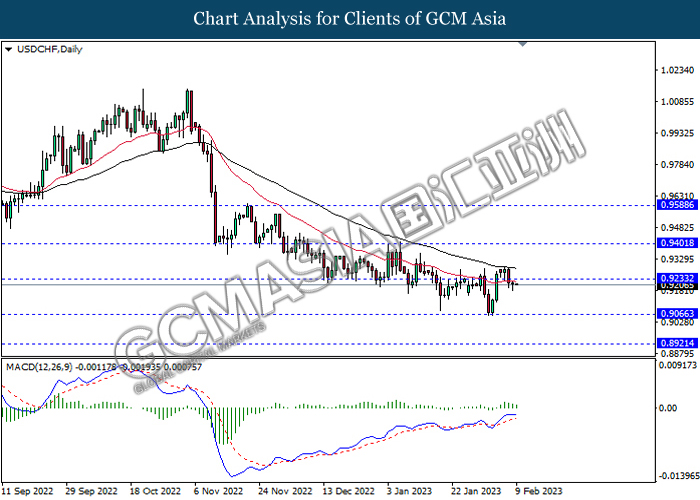

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

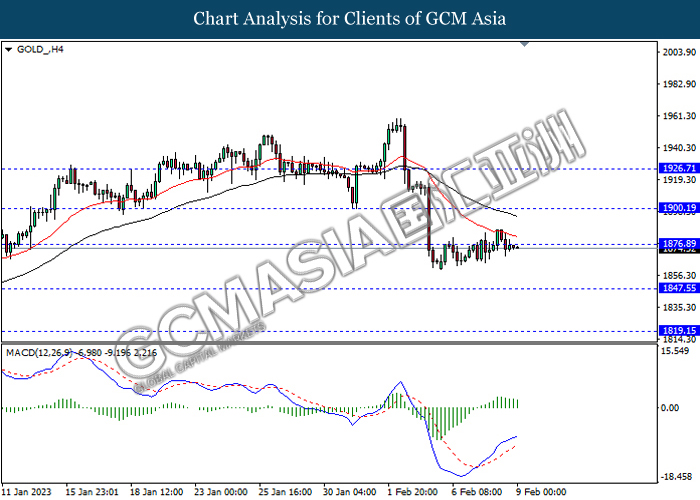

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15