9 March 2022 Afternoon Session Analysis

Euro rebounded amid expectation upon latest economic stimulus.

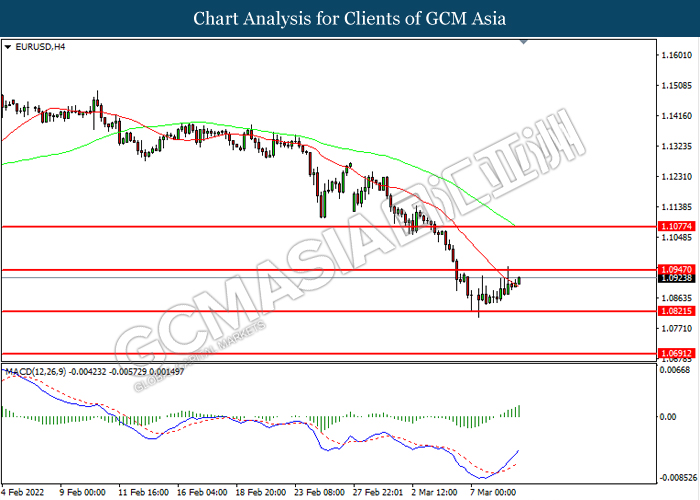

The Euro rebounded on Wednesday ahead of this week’s central bank meeting, while commodity currencies eased from recent peaks as investors reckoned war-driven surges in energy, grains and metals could end up crimping demand in the long run. Such a move could mean stimulus and a step toward a fiscal union, as the European Central Bank was deciding to increase fiscal spending to offset the impact of Russia-Ukraine conflict. However, the overall trend for Euro still remained bearish over the backdrop of rising tensions between Russia and Ukraine. According to Ukraine, the third rounds of talks has only resulted in small progress between Russia-Ukraine. Hence, investors would continue to scrutinize the latest updates with regards of tensions between Russia-Ukraine to receive further trading signal. As of writing, EUR/USD appreciated by 0.23% to 1.0924.

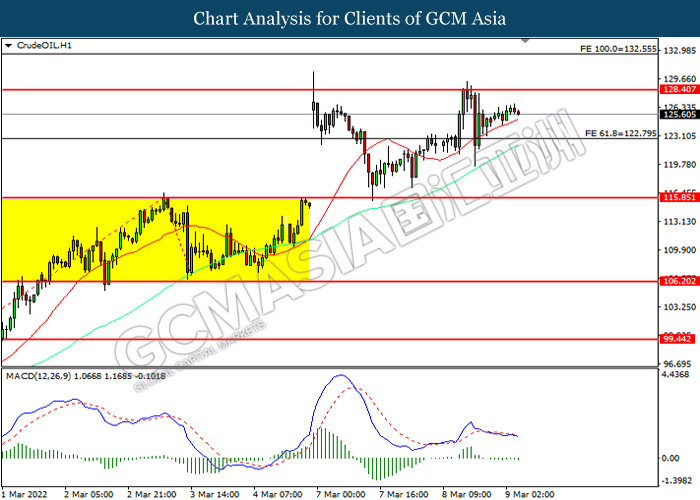

In the commodities market, the crude oil price slumped 0.05% to $125.40 per barrel as of writing over the backdrop of bearish inventory data. According to American Petroleum Institute, US API Weekly Crude Oil Stock came in at 2.811M, higher than market forecast at -0.833M. On the other hand, the gold price appreciated by 0.22% to $2055.05 per troy ounces as of writing as investors enter gold market in order to hedge against inflation risk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:00 | USD – JOLTs Job Openings (Jan) | 10.925M | 10.925M | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | -2.597M | – | – |

Technical Analysis

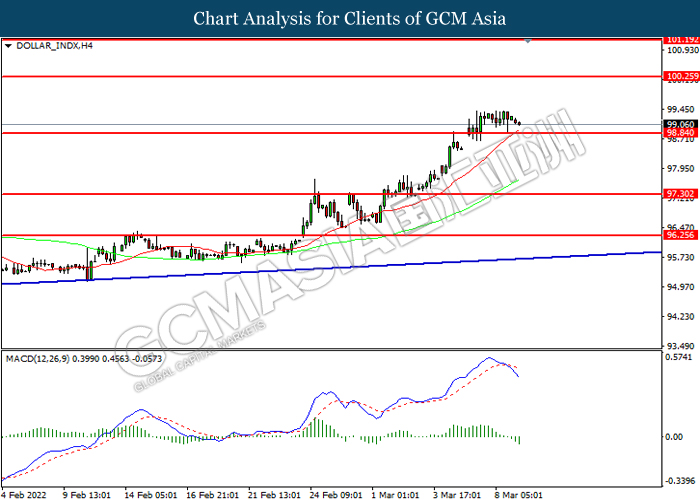

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 98.85. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level at 100.25.

Resistance level: 100.25, 101.20

Support level: 98.85, 97.30

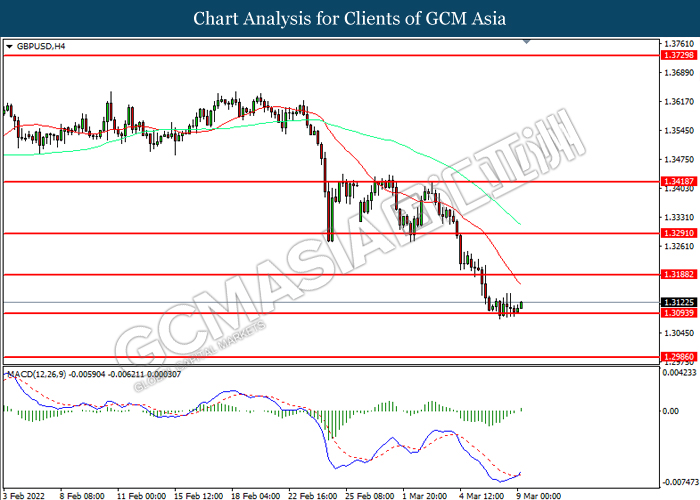

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.3095. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 1.3190, 1.3290

Support level: 1.3095, 1.2985

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0945. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0945, 1.1075

Support level: 1.0820, 1.0690

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout the resistance level.

Resistance level: 115.70, 116.25

Support level: 114.60, 113.65

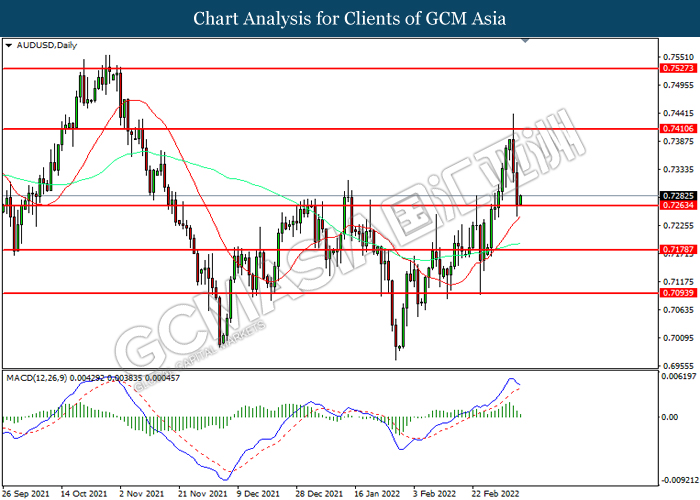

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7410. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.7410, 0.7525

Support level: 0.7265, 0.7180

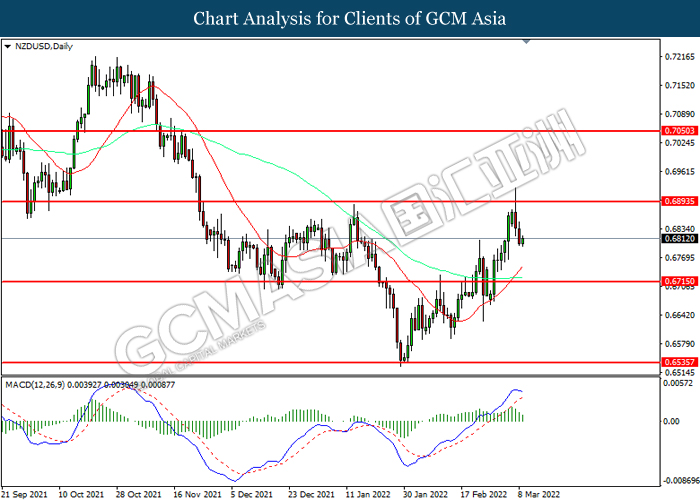

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 0.6715.

Resistance level: 0.6895, 0.7050

Support level: 0.6715, 0.6535

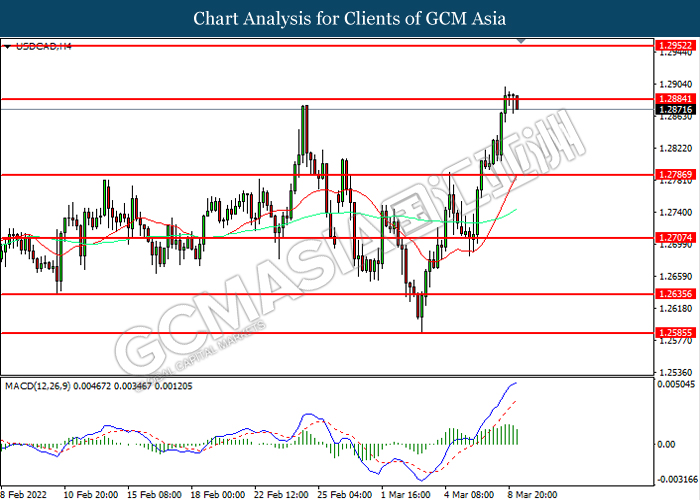

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.2885. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 1.2885, 1.2950

Support level: 1.2785, 1.2705

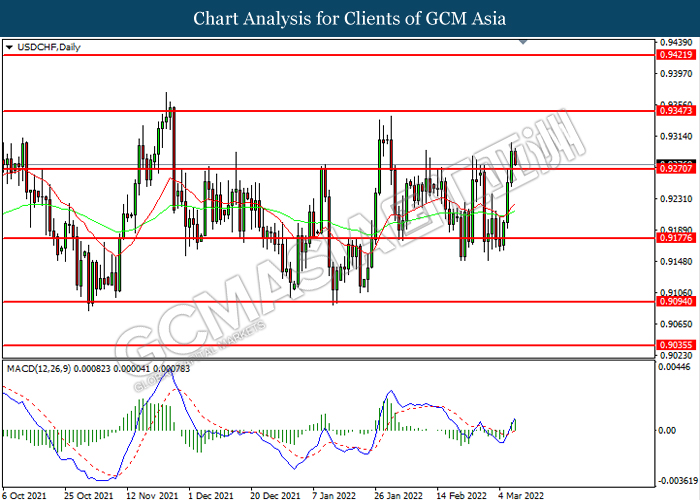

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.9345.

Resistance level: 0.9345, 0.9420

Support level: 0.9270, 0.9175

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from lower levels. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower amid technical correction.

Resistance level: 128.40, 132.55

Support level: 122.80, 115.85

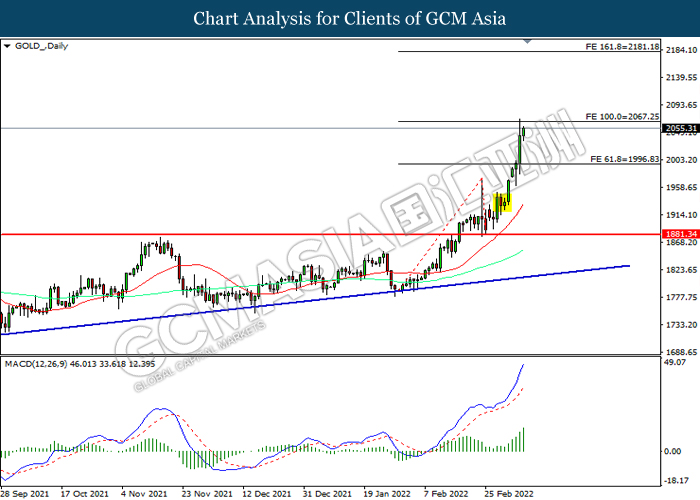

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2067.25. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2067.25, 2181.20

Support level: 1996.85, 1881.35