9 May 2022 Morning Session Analysis

US Dollar rallied on upbeat economic data.

The Dollar Index which traded against a basket of six major currencies edged up on Monday over the upbeat economic data. According to Bureau of Labor Statistics, US Nonfarm Payrolls recorded at the reading of 428K, exceeding the market forecast of 391K. Nonfarm Payrolls measures the change in the number of people employed during the previous month, which excluding the farming industry. The higher than expected reading indicates that there are more people are employed in US, which brought positive prospects toward economic progression in US. Besides, according to Reuters, the long-dated US Treasury yields surged and global stock markets slid further on Friday following the inflation concerns. The war-driven inflation would likely to lead Federal Reserve to imply another aggressive rate hike in the next FOMC meetings, prompting investors to shift their capitals toward safe-haven Dollar. Nonetheless, the gains of Dollar Index was limited amid the rise of US Unemployment Rate. The US Unemployment Rate came in at the reading of 3.6%, which exceeding the market forecast of 3.5%, according to Bureau of Labor Statistics. The higher unemployment rate would likely to drag down the economic development in US, which beat down the appeal for the US Dollar. As of writing, the Dollar Index appreciated by 0.10% to 103.80.

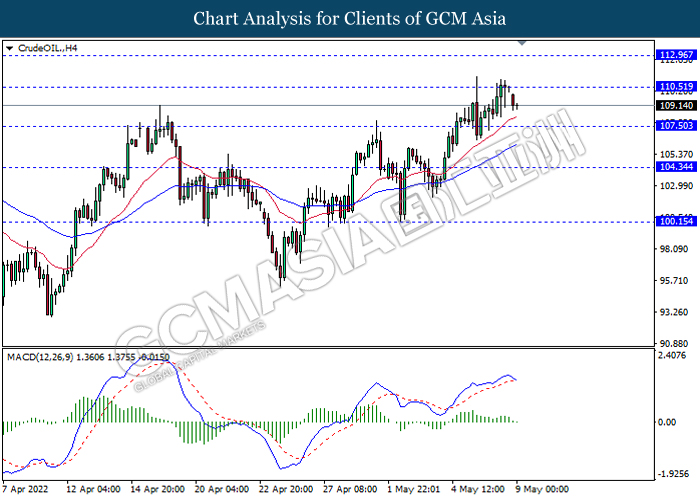

In commodities market, crude oil price depreciated by 0.70% to $107.00 per barrel as of writing over the backdrop of Saudi Arabia lowered the price of its Arab Light crude grade to Asia and Europe for the month of June. On the other hand, gold price eased by 0.14% to $1880.08 per troy ounces as of writing on the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

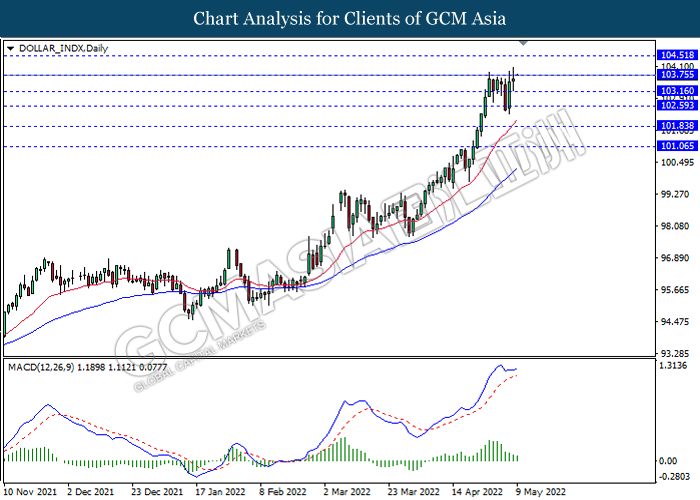

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 104.50

Support level: 103.15, 102.60

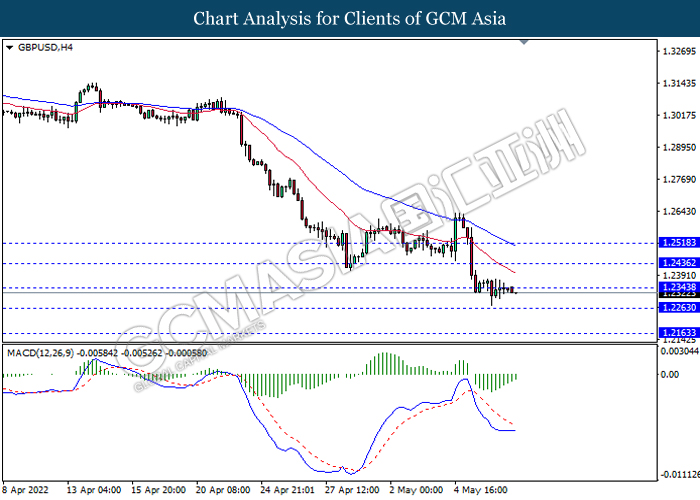

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2345, 1.2435

Support level: 1.2265, 1.2165

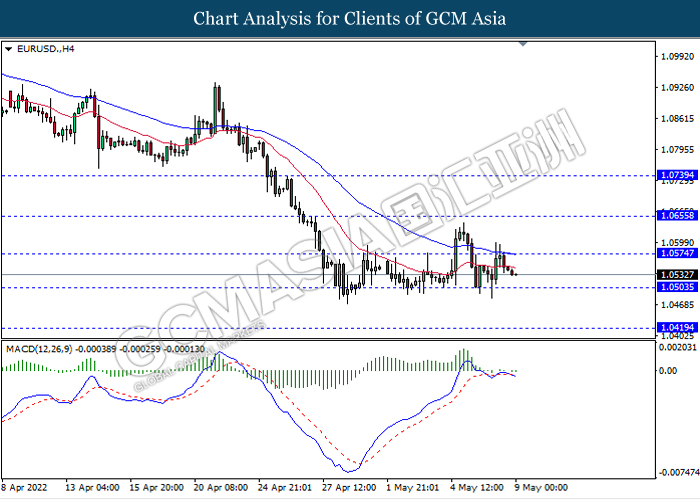

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

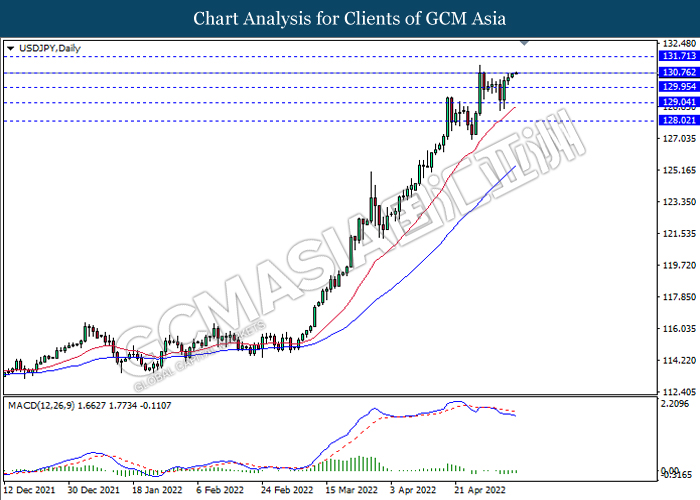

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains if successfully breakout the resistance level.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7075, 0.7160

Support level: 0.6995, 0.6925

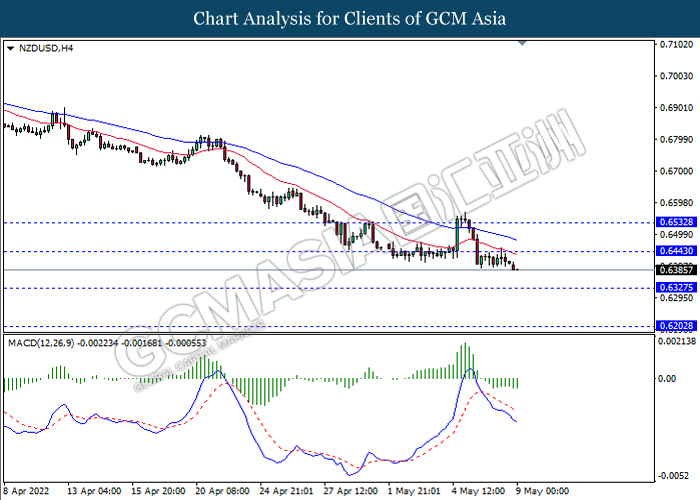

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6445, 0.6530

Support level: 0.6325, 0.6200

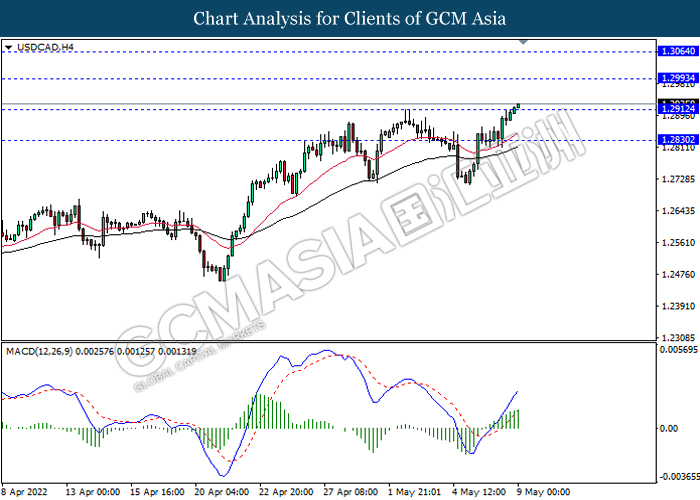

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2995, 1.3065

Support level: 1.2910, 1.2830

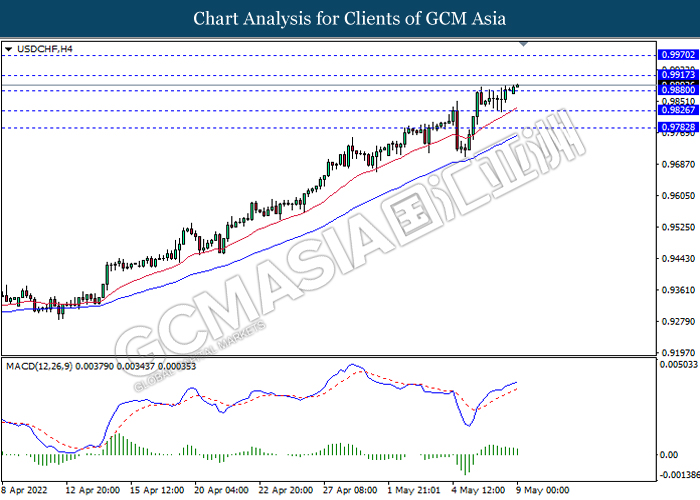

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9915, 0.9970

Support level: 0.9880, 0.9825

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 110.50, 112.95

Support level: 107.50, 104.35

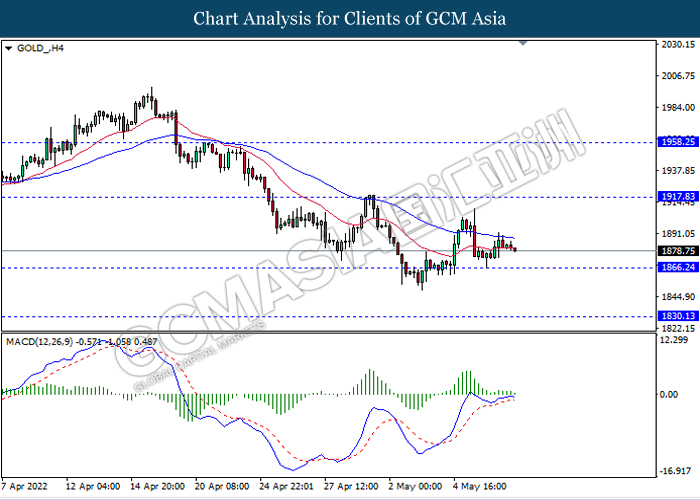

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1917.85, 1958.25

Support level: 1866.25, 1830.15