9 May 2023 Afternoon Session Analysis

The Aussies traded sideway after mixed economic data announced。

The Australian dollar, one of the major traded currencies, was steady against the greenback after the mixed economic data was released during the Asian trading hours. Earlier in the day, the Australian Q1 retail sales shrank to -0.6% in line with market expectations, down from -0.3% in the previous reading. The recent data showed that Australian retails sales have fallen for the second straight quarter, a sign that high-interest rates and the high cost of living are effective and curb consumer spending. However, the retail sales in the month perspective are showing some signs of improvement. Monthly retail sales in March improved to 0.4% in line with market expectations, higher than the prior reading of 0.2%. The main attributes of the growth came from food retail and restaurant service which increase by 1.0% and 1.5% respectively. Apart from the mixed monthly retail sales data, the pair of AUDUSD also bear the burden of caution sentiment over China’s import and export economic data, as China is Australia’s second-largest trading partner. China’s April trade balance was recorded at $ 90.21 billion versus $71.60 billion expectations and $88.19 billion. The trade balance surplus amid exports in the country surged as the export grew by 8.5% vs 8.0% expectations and imports shrank -7.9% vs -5.0%. It is worth mentioning that China’s exports and imports both declined in April, with the previous readings of exports and imports being 14.8% and -4.1% respectively. Therefore, the pair of AUD/USD continues its slideway trend. As of writing, the AUDUSD teeters by -0.15% to $0.6775 as investors eye on US debt ceiling issues.

In the commodities market, crude oil prices are down by -0.83% to $72.56 per barrel after China imports data showing some softening in demands. Besides, gold prices ticked up by 0.10% to $2023.47 per troy ounce as investors await US inflation data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

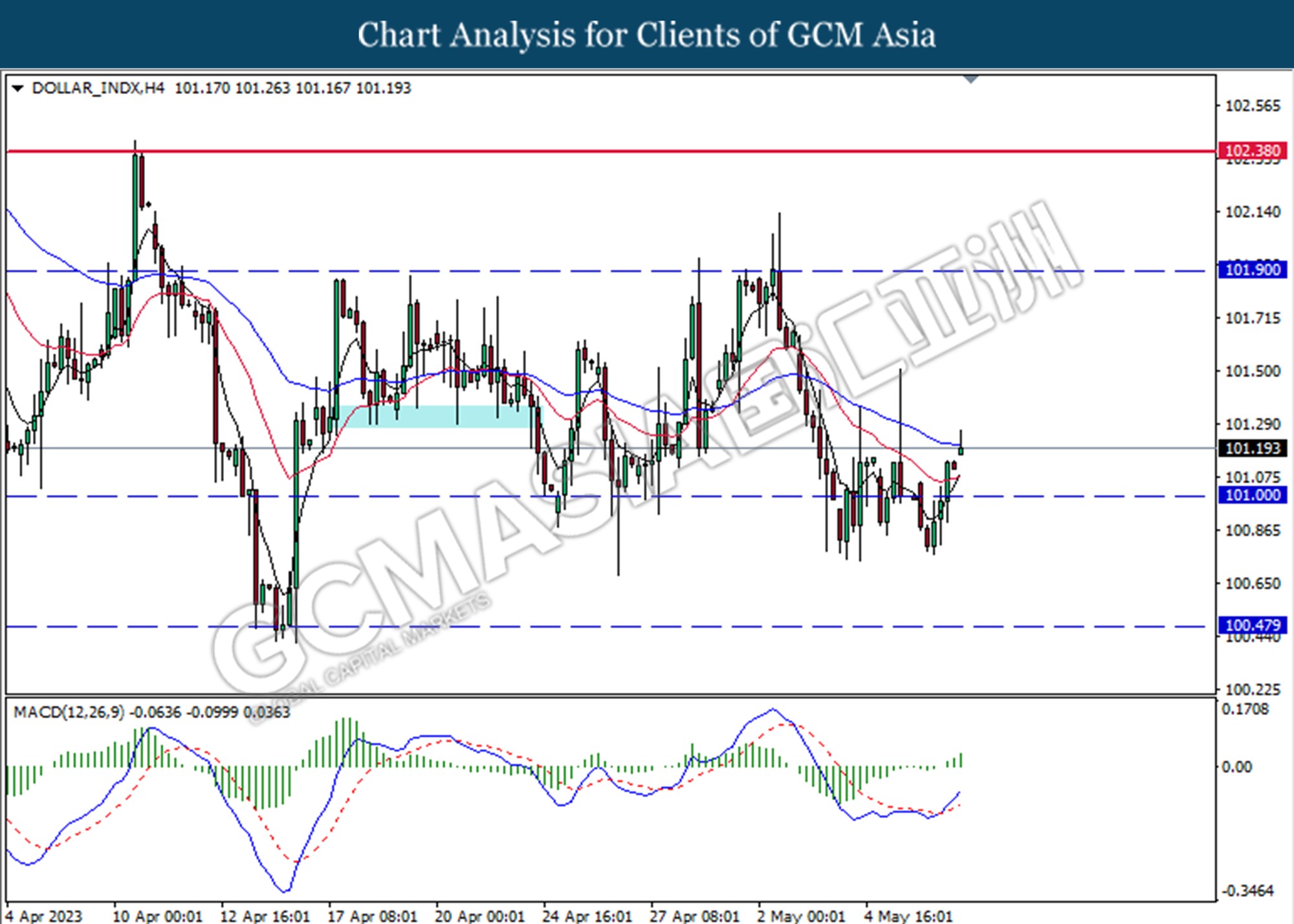

DOLLAR_INDX, H4: Dollar index was traded higher following a prior break above the previous resistance level at 101.00. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

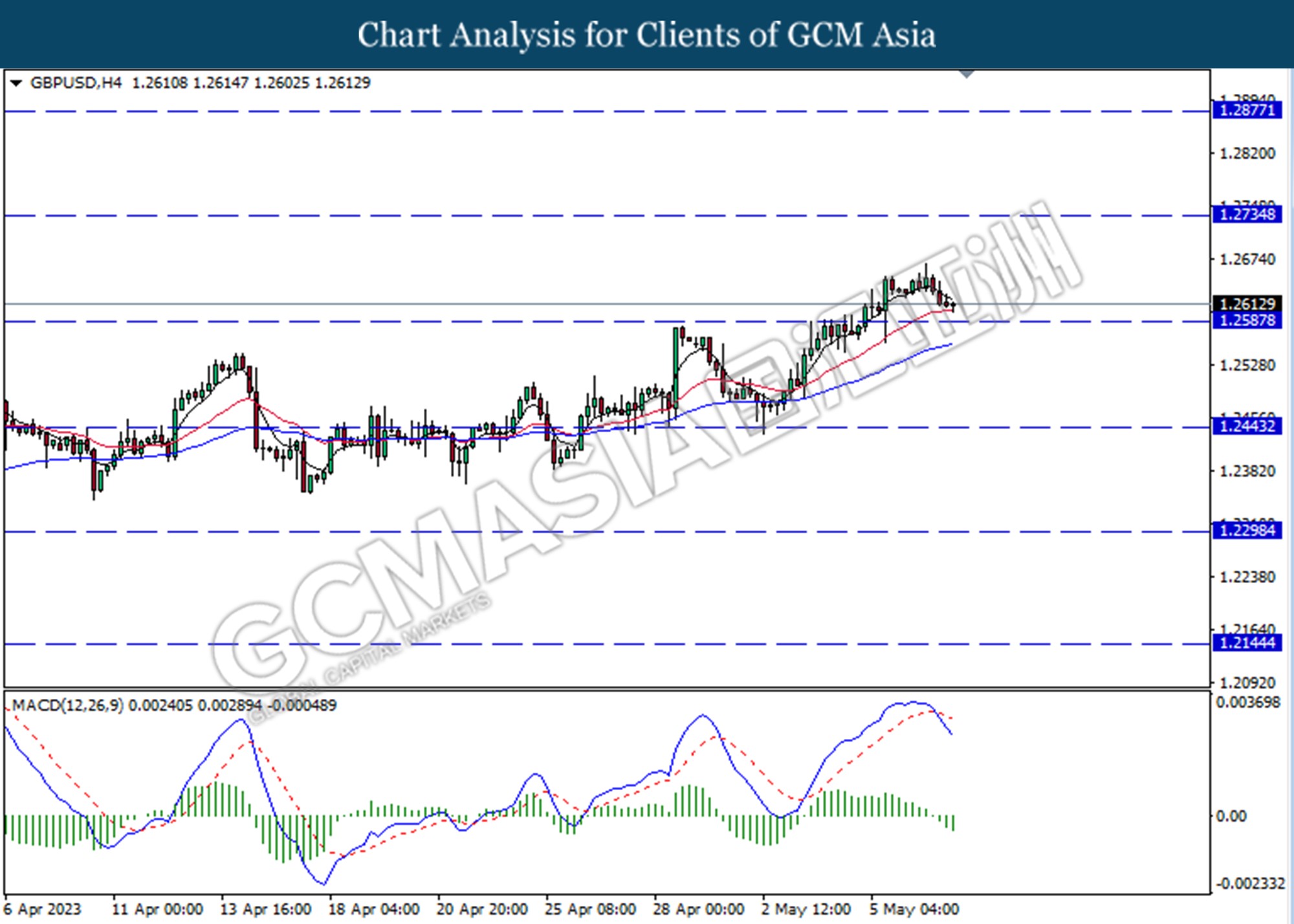

GBPUSD, H4: GBPUSD was traded lower while following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2600.

Resistance level: 1.2735, 1.2880

Support level: 1.2600, 1.2445

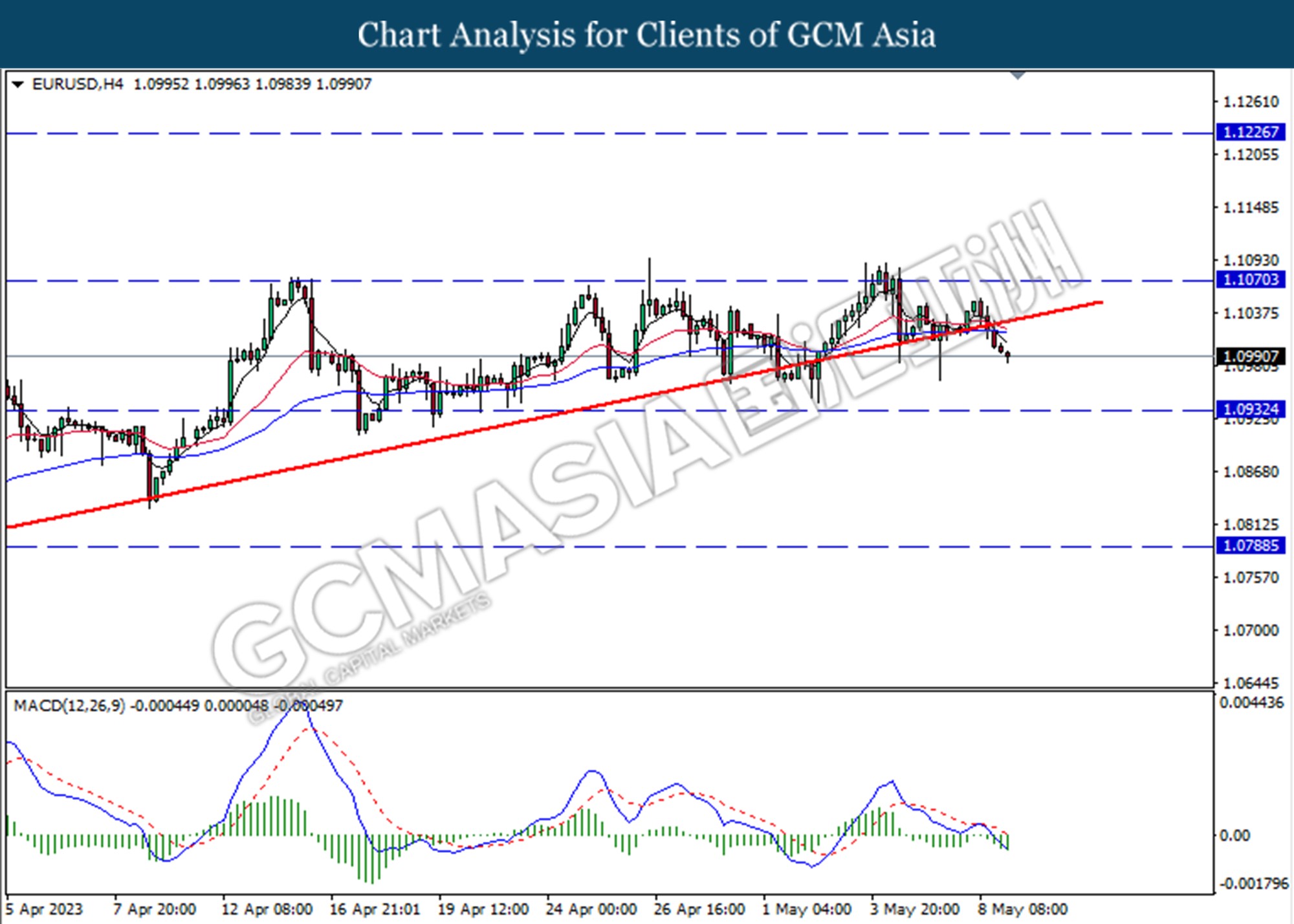

EURUSD, H4: EURUSD was traded lower following a prior break below the upward trend line. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0935.

Resistance level: 1.1070, 1.1225

Support level: 1.0935, 1.0790

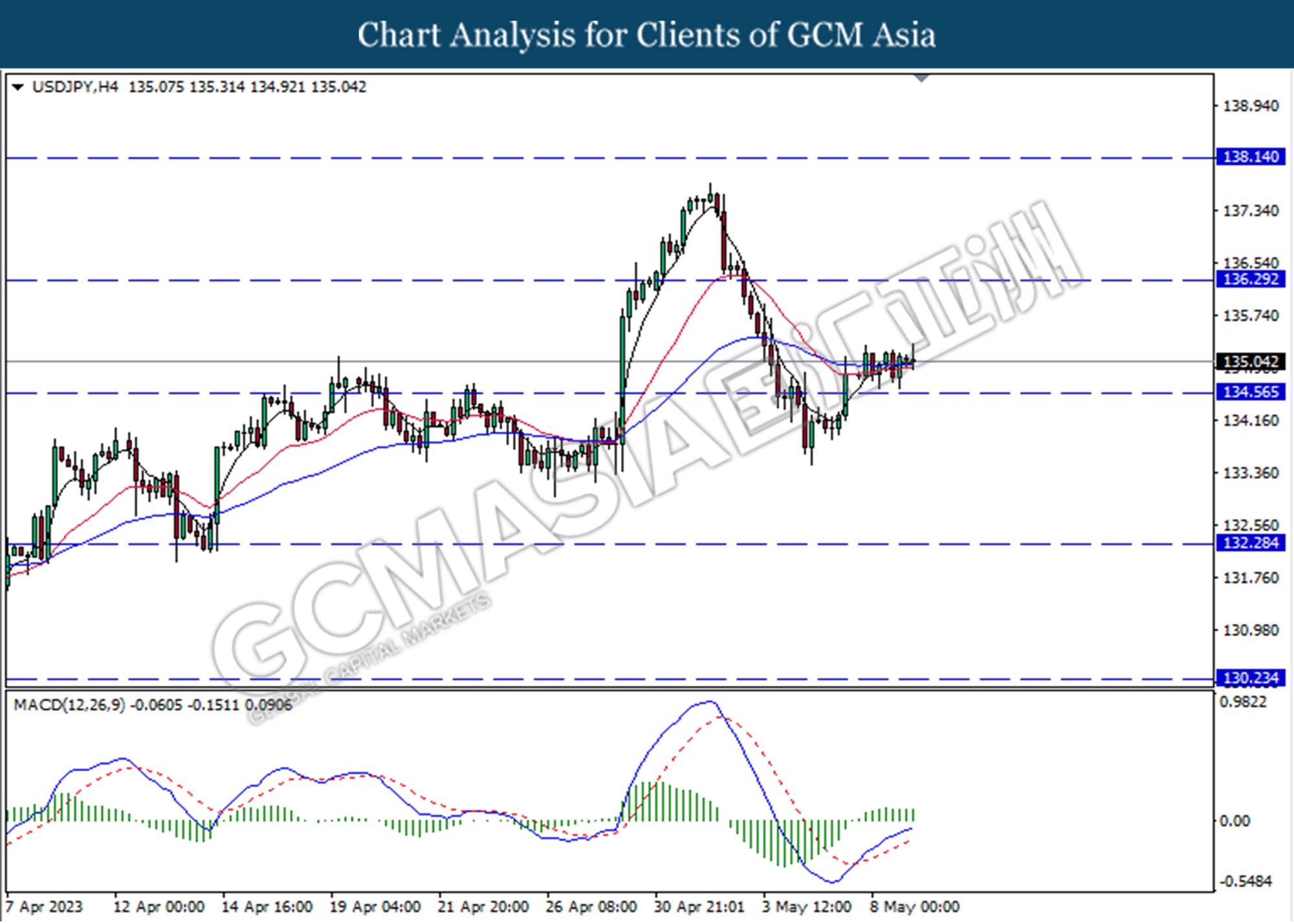

USDJPY, H4: USDJPY was traded higher following a prior rebound from the support level at 134.55. MACD which illustrated bias momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

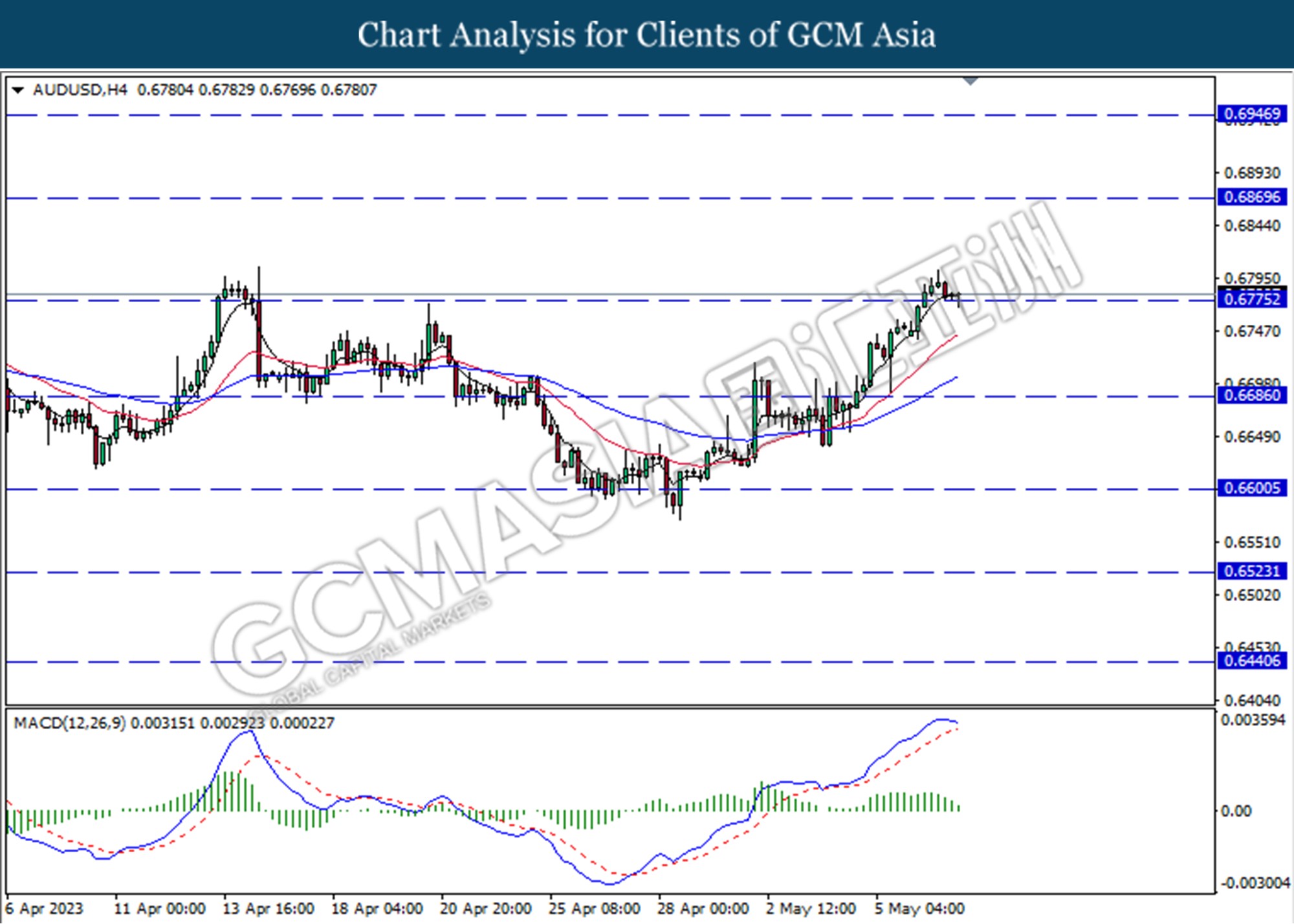

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level at 0.6775. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses after it successfully breakout below the support level.

Resistance level: 0.6870, 0.6945

Support level: 0.6775, 0.6685

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 0.6325.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

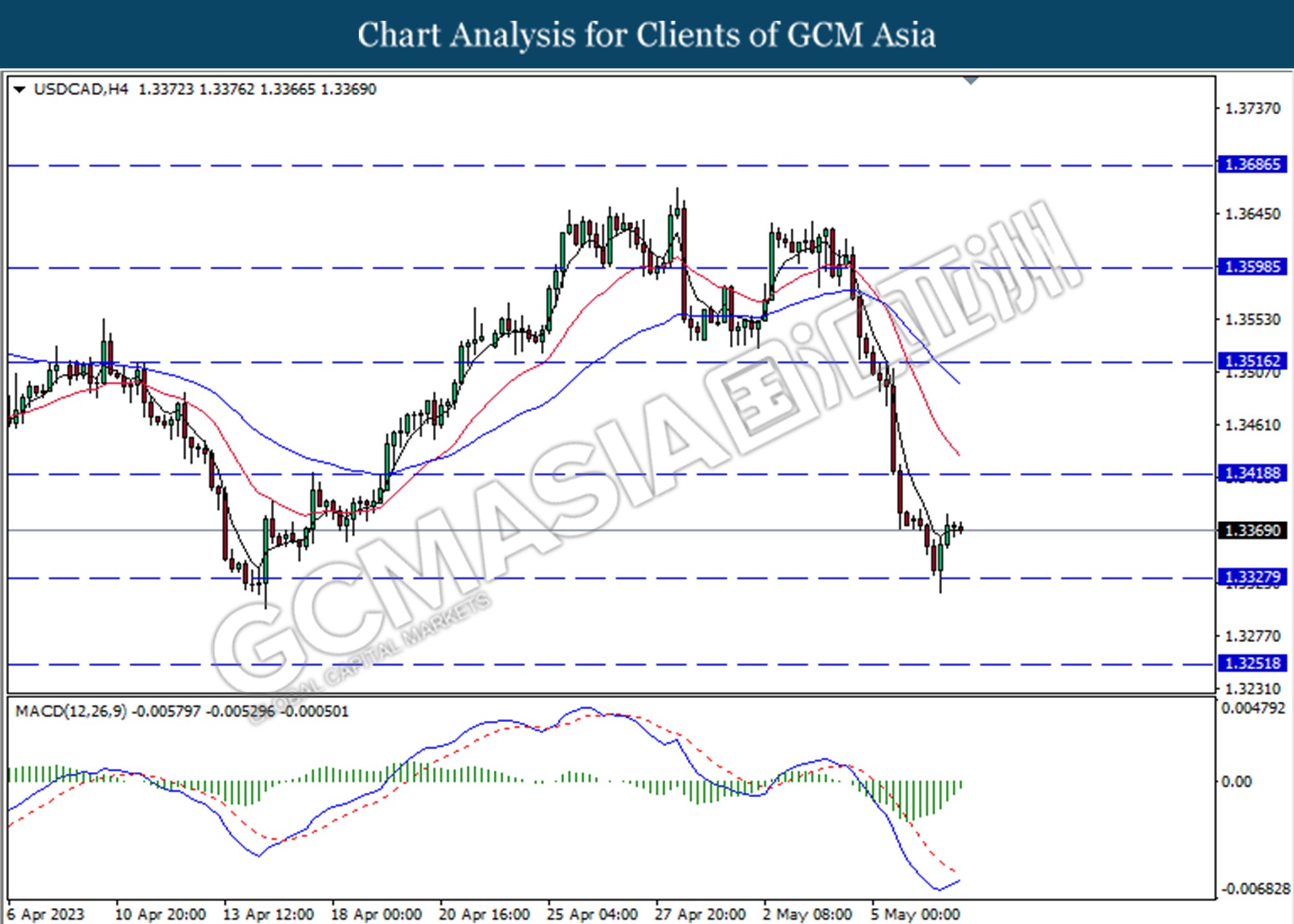

USDCAD, H4: USDCAD was traded higher following the prior rebound from the support level at 1.3330. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

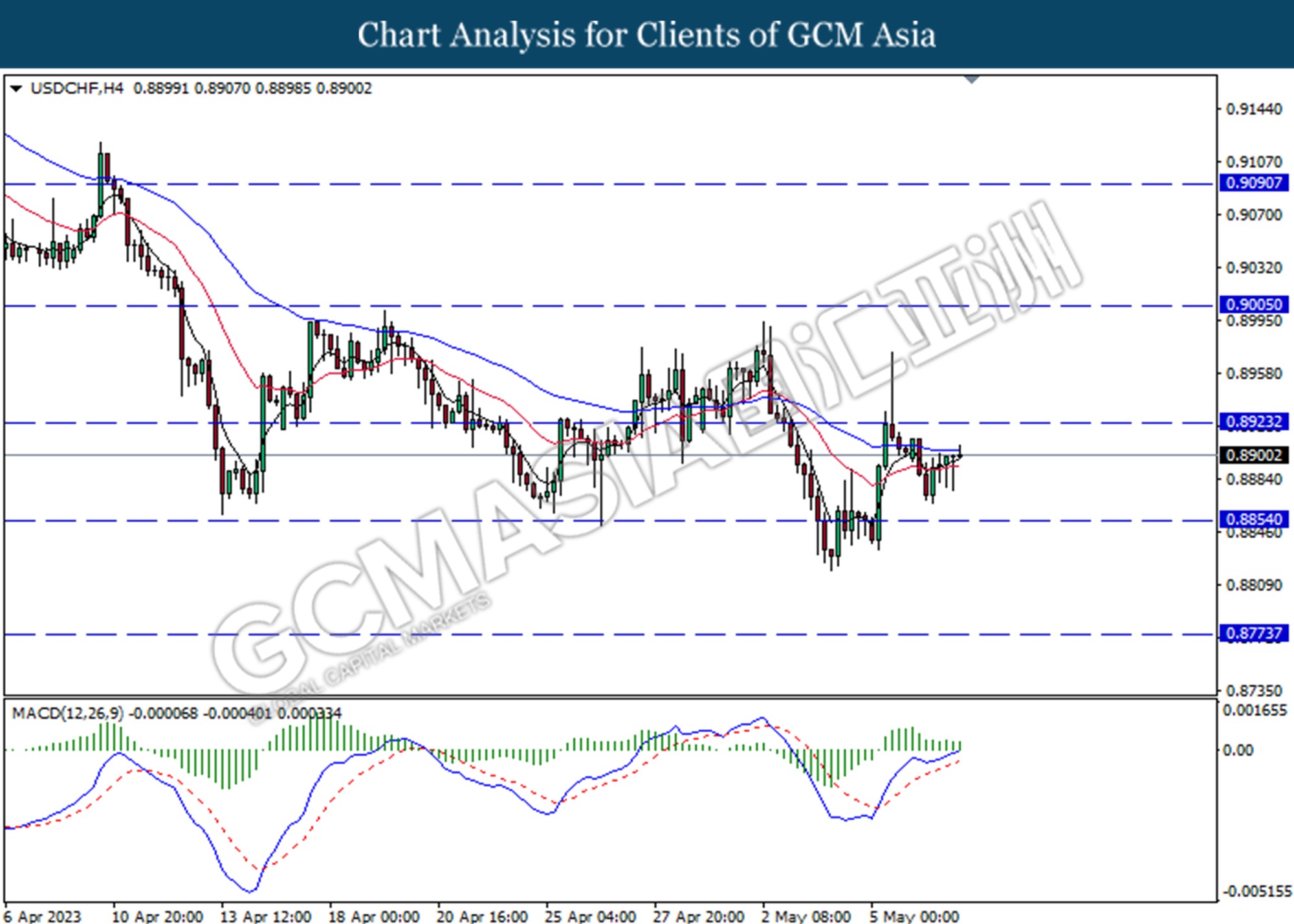

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

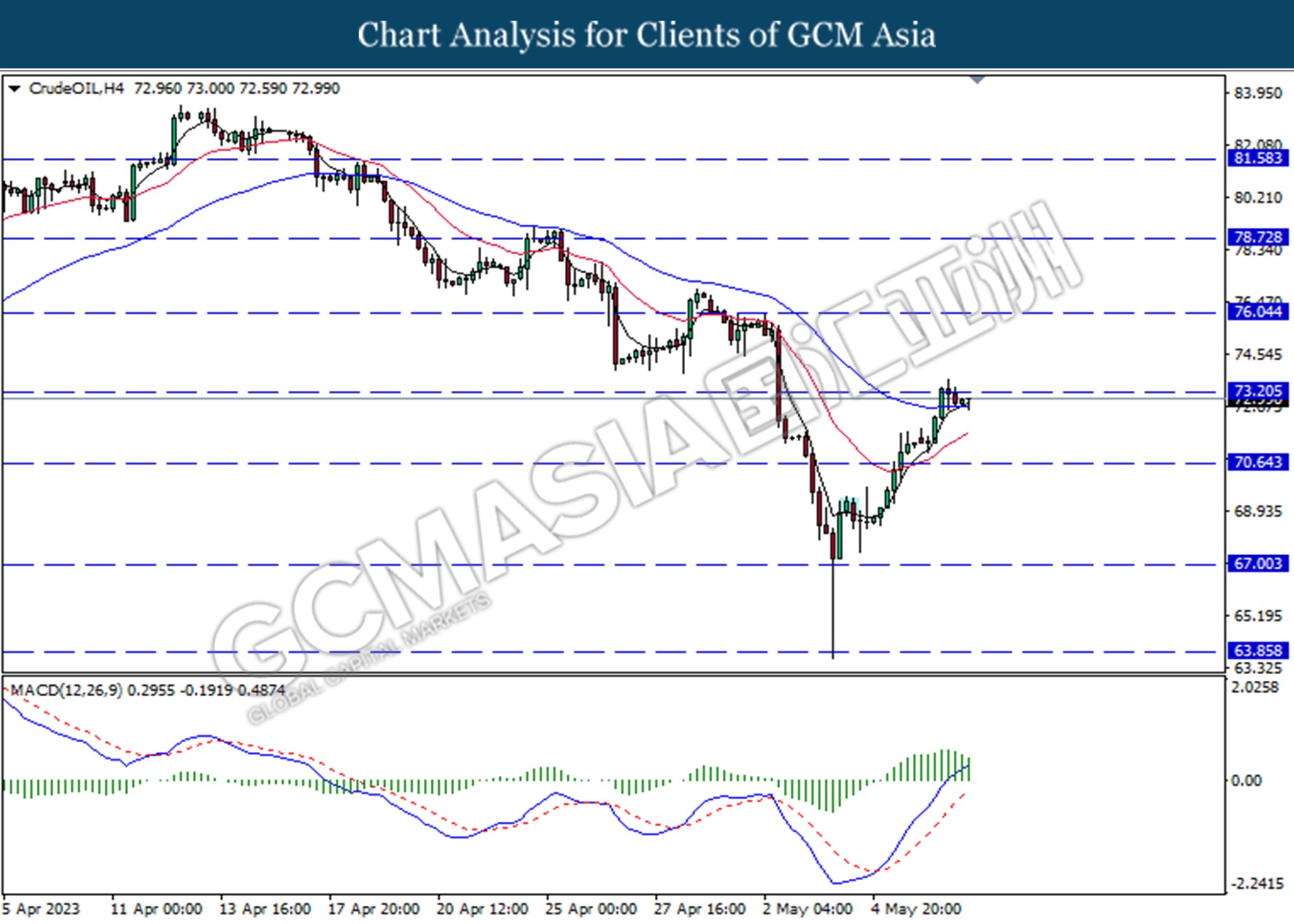

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the resistance level at 73.20. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

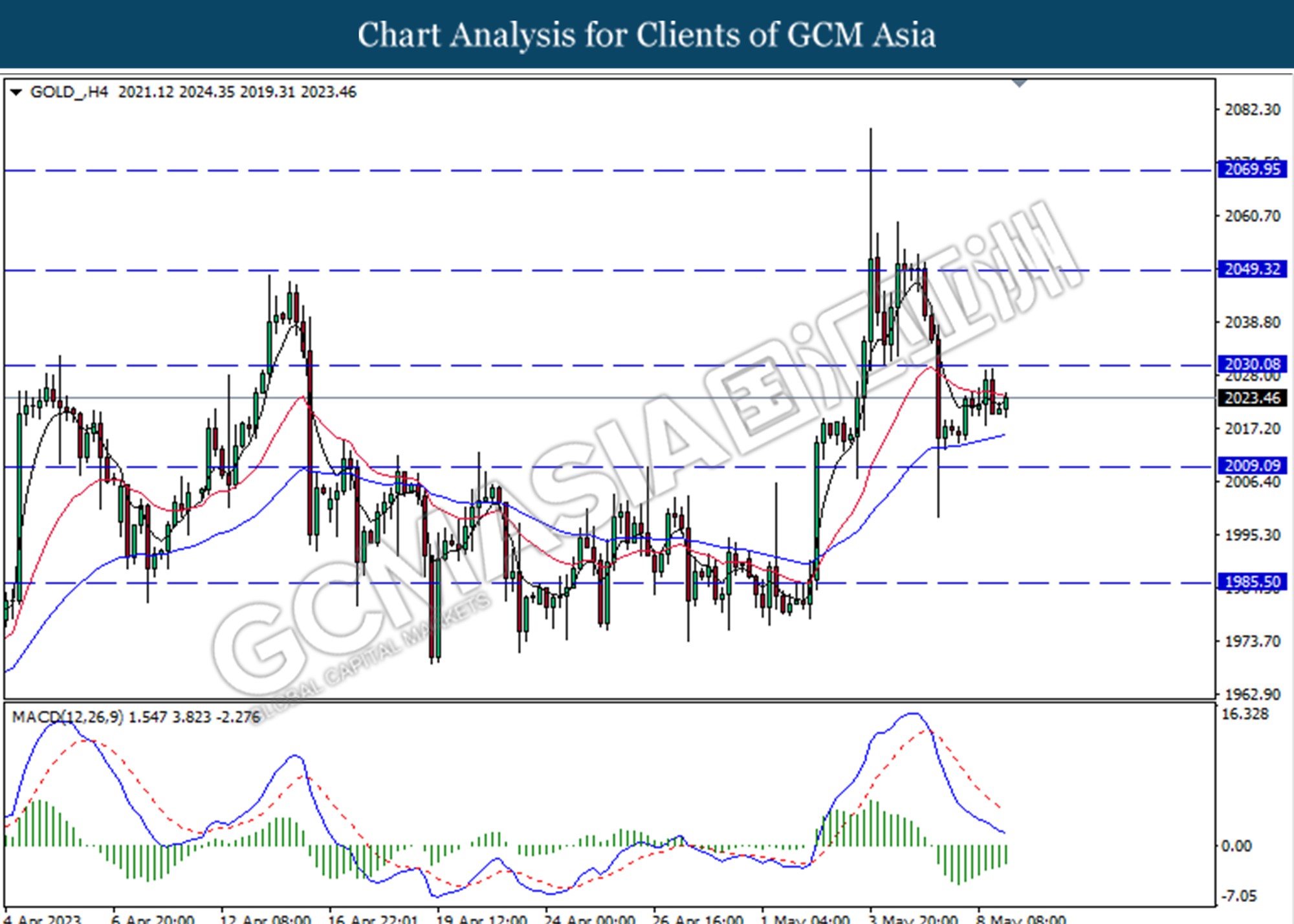

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level at 2030.10

Resistance level: 2030.10, 2049.30

Support level: 2009.10, 1985.50