9 May 2023 Morning Session Analysis

US Dollar muted as investor awaits for inflation figure.

The dollar index were remained relatively weaker against other major currencies as the investors cautiously await the inflation figure to gauge if the Federal Reserve (Fed) would finally stop their rate hike plan at the level of 5.25%. Last week, the Fed decided to increase its interest rate by another 25 basis point despite the risk of banking crisis. In the Fed’s Press Conference, the remarks that given by the chairman of Fed were ambiguous, where he did not signaled if the Fed would start pausing the rate hike plan in the next meeting. As such, the investors are paying their attention on the long-awaited CPI data as a weaker-than-expected reading would support the case for the Fed to maintain its interest rate at the current level, but a stronger-than-expected result would bolster expectations that the Fed would keep the interest rate at high level for an extended period of time. On top of that, the investors are also eyeing the talk between President Joe Biden and Congressional members. According to Reuters, the US President Joe Biden, top Republicans and Democrats will finally meet up later today, aiming to resolve the head-butting situation between two parties over the $31.4 trillion U.S. debt ceiling and avoid a crippling default by the end of May. As of writing, the dollar index edged up by 0.17% to 101.40.

In the commodities market, crude oil prices edged up by 1.97% to $72.80 per barrel while the investors are waiting for the trade data from largest oil importer, China. Besides, gold prices ticked up by 0.04% to $2022.25 per troy ounce ahead of Wednesday’s inflation data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

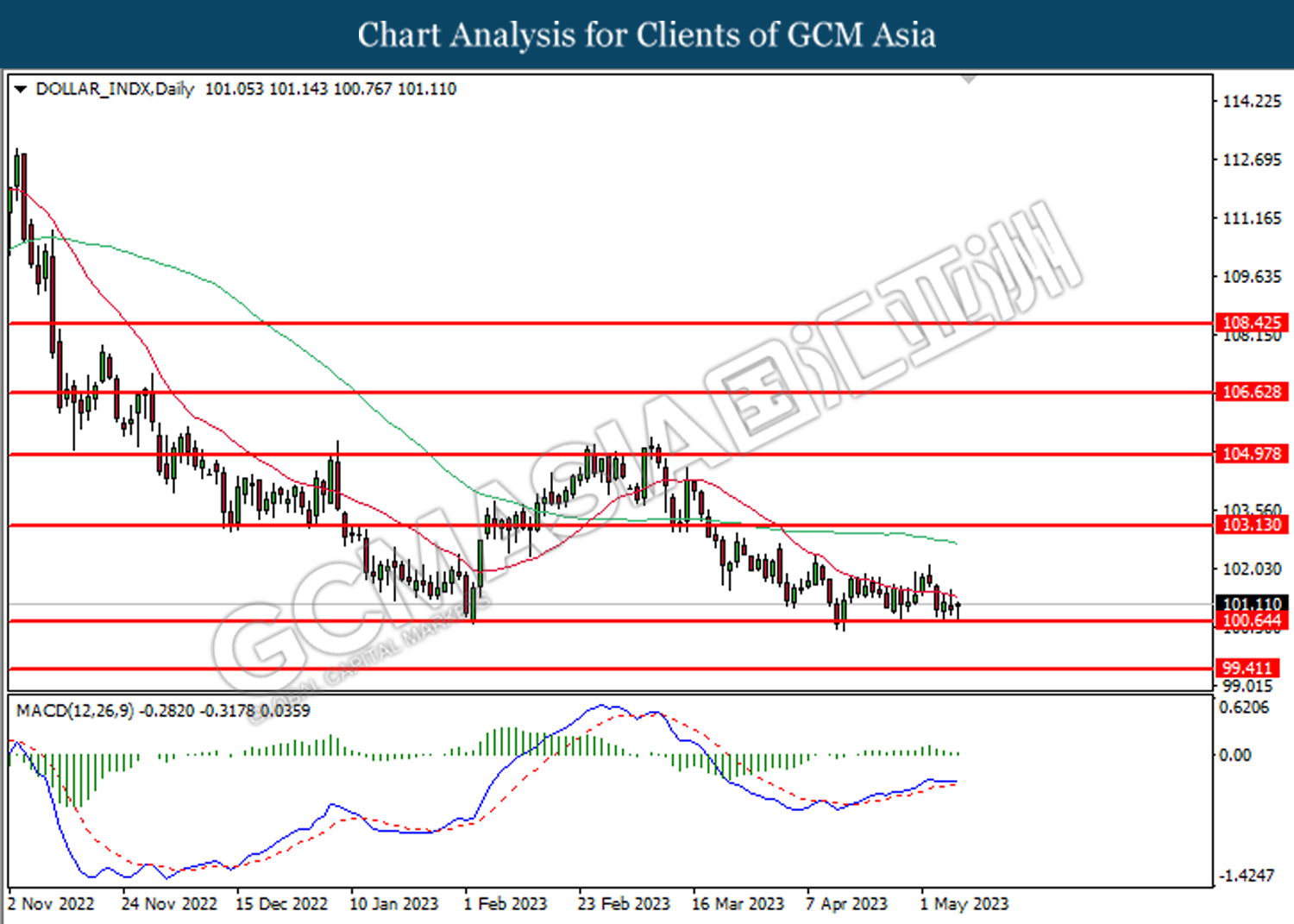

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

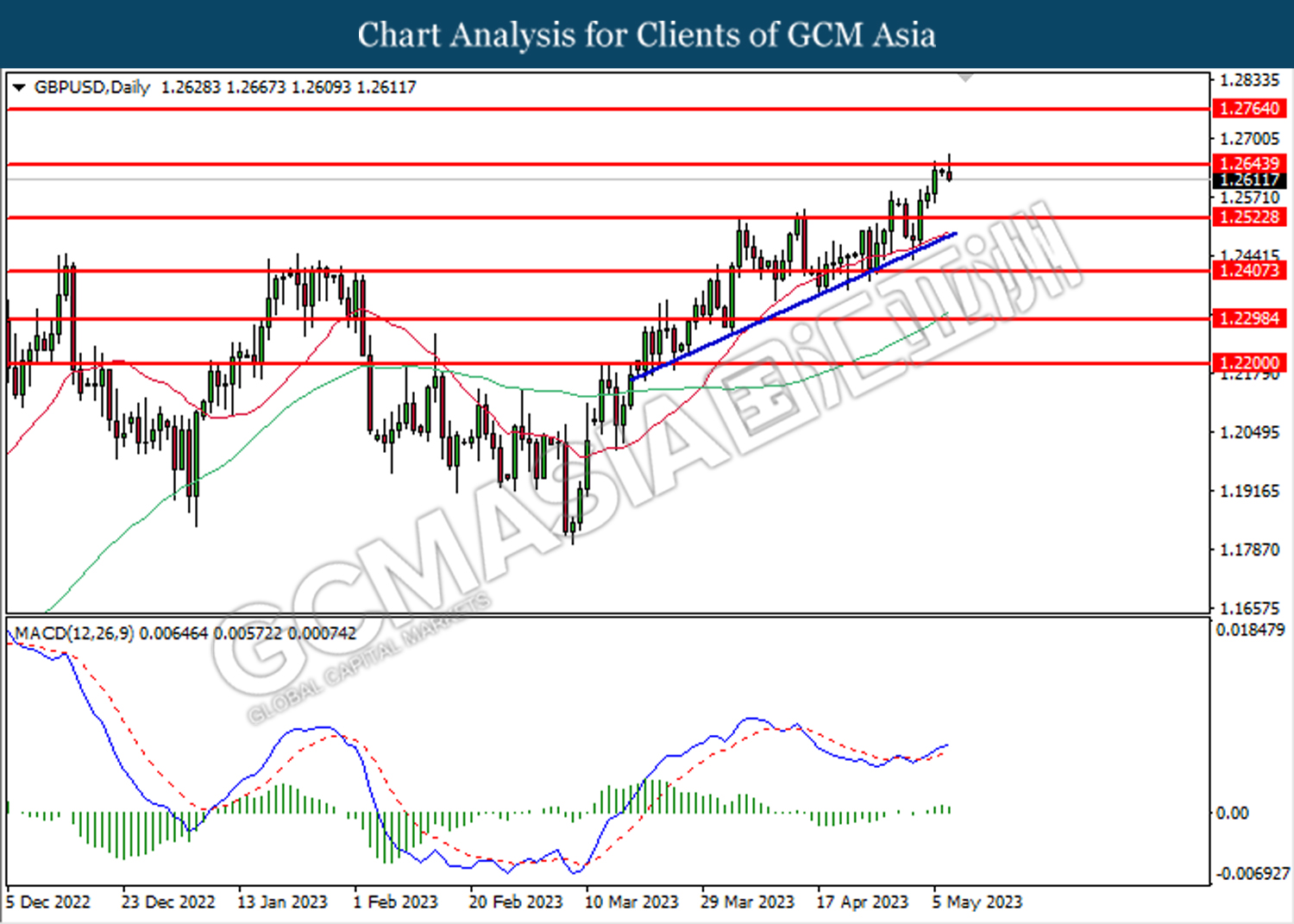

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

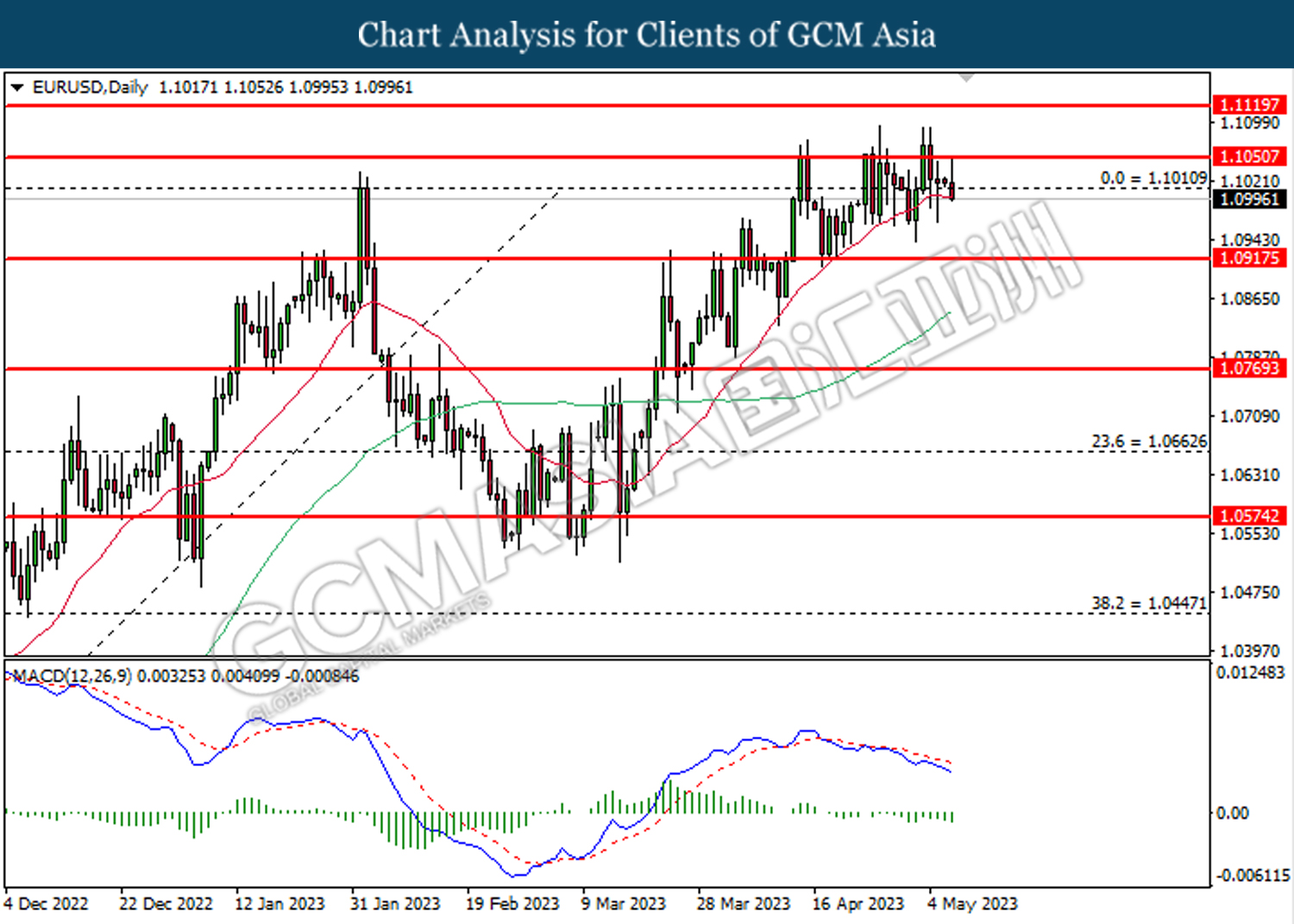

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

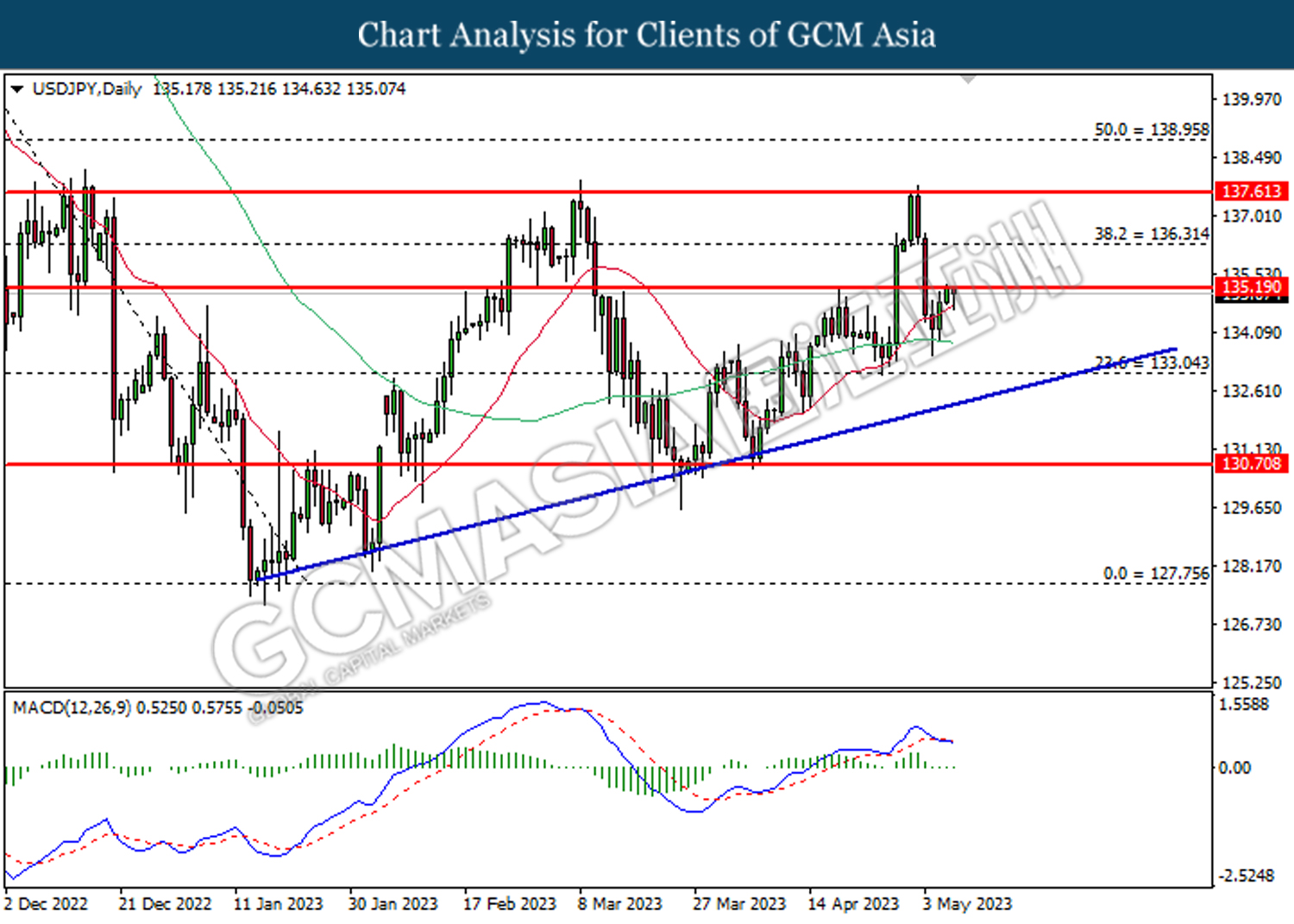

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

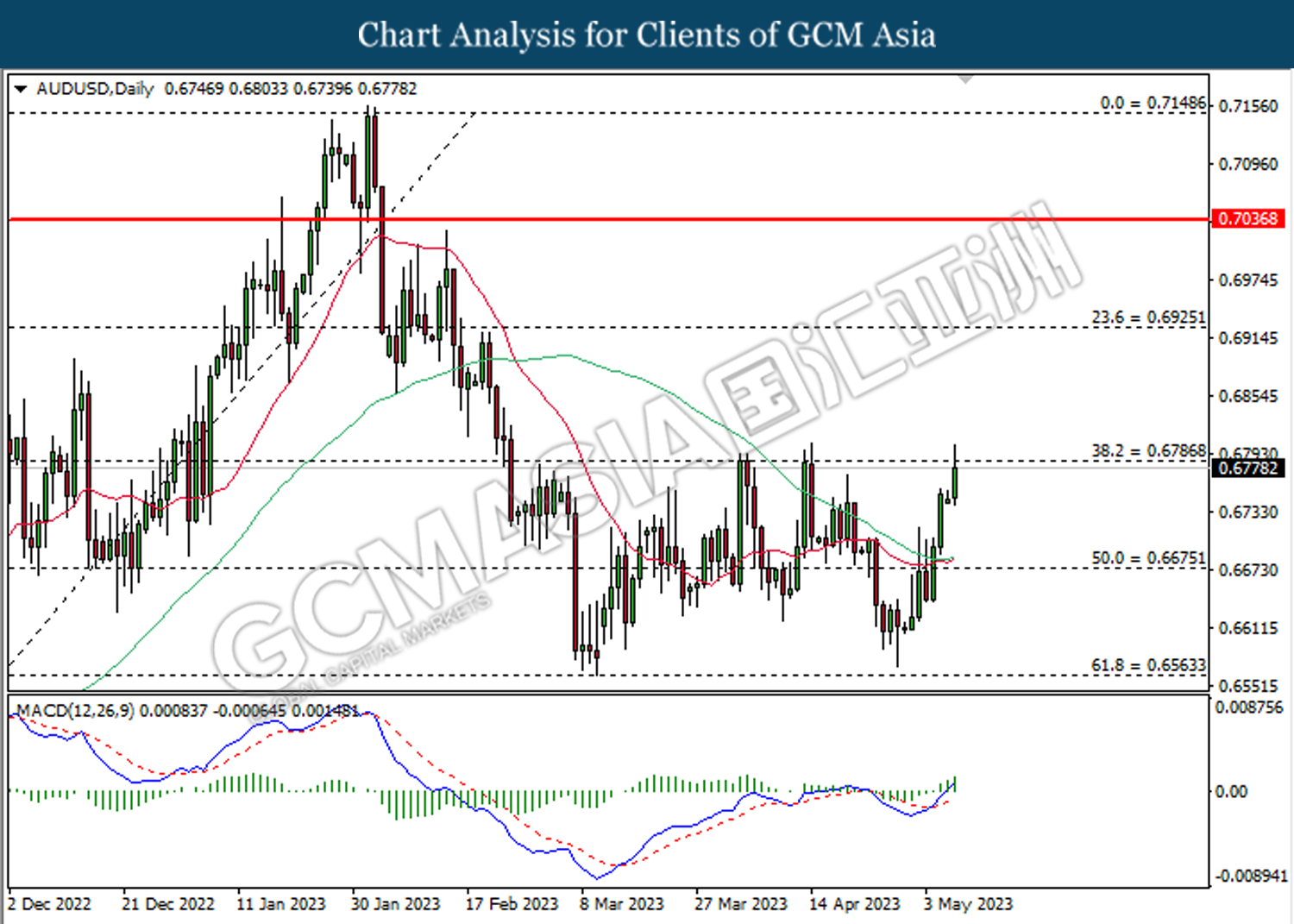

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

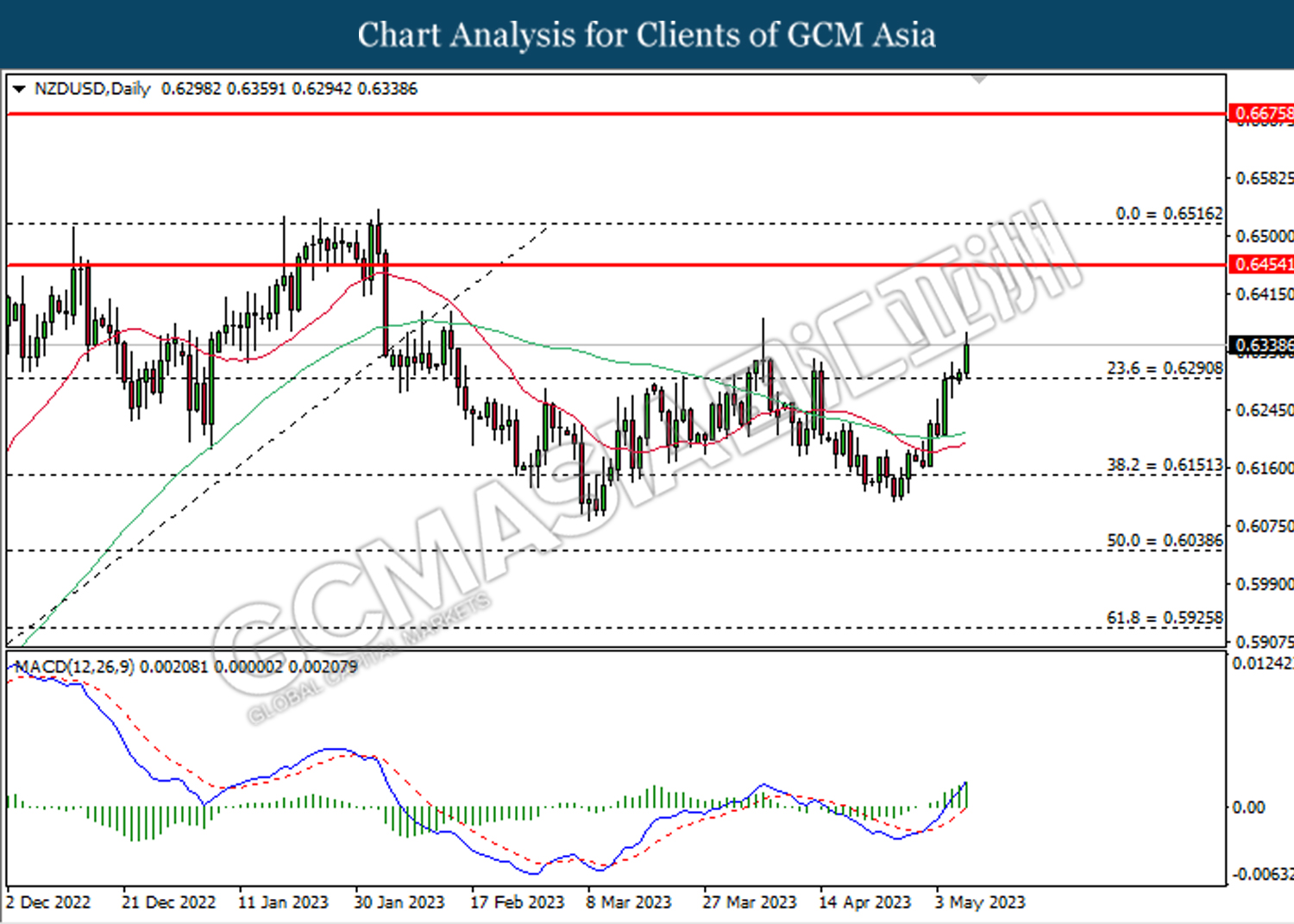

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

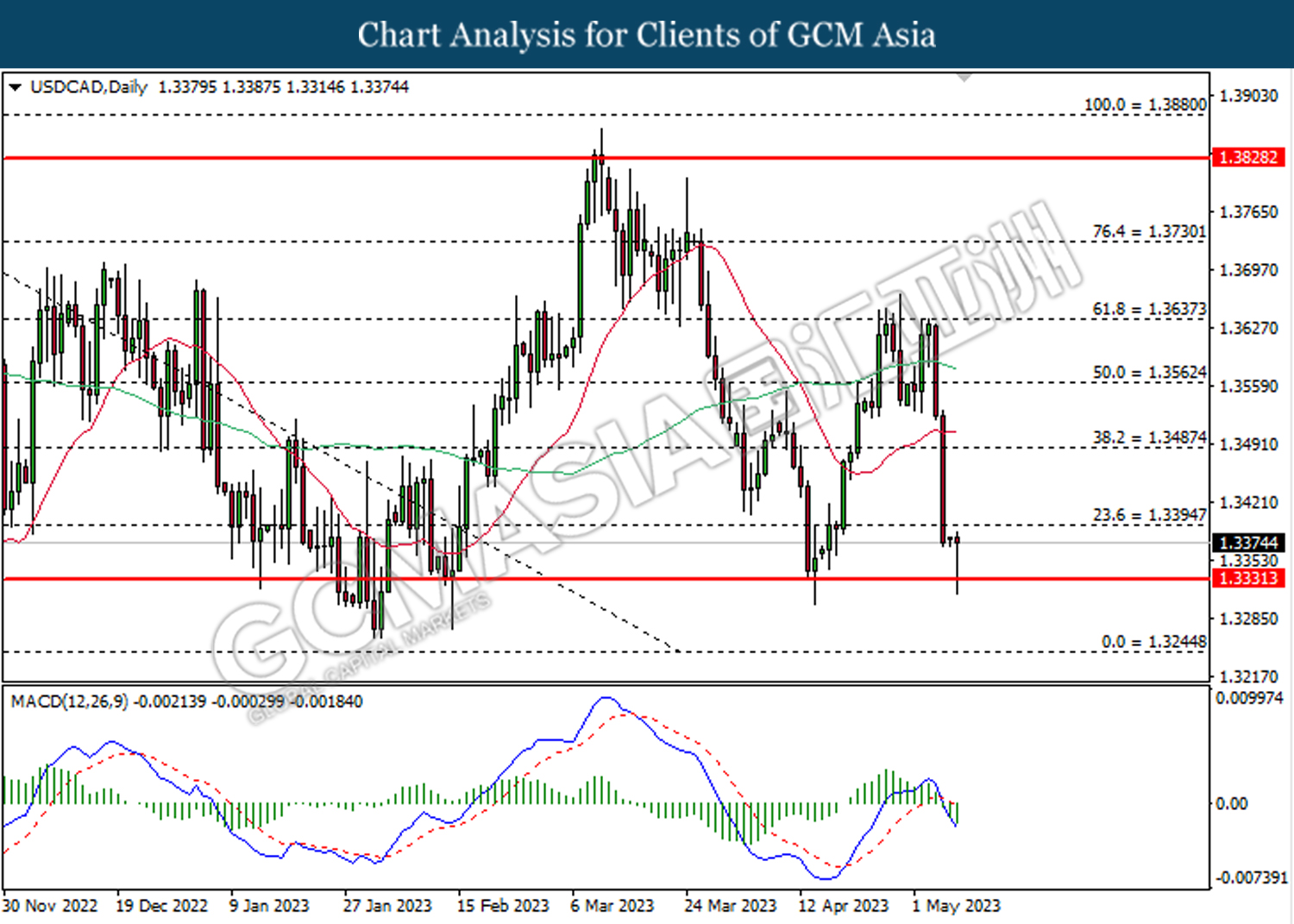

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

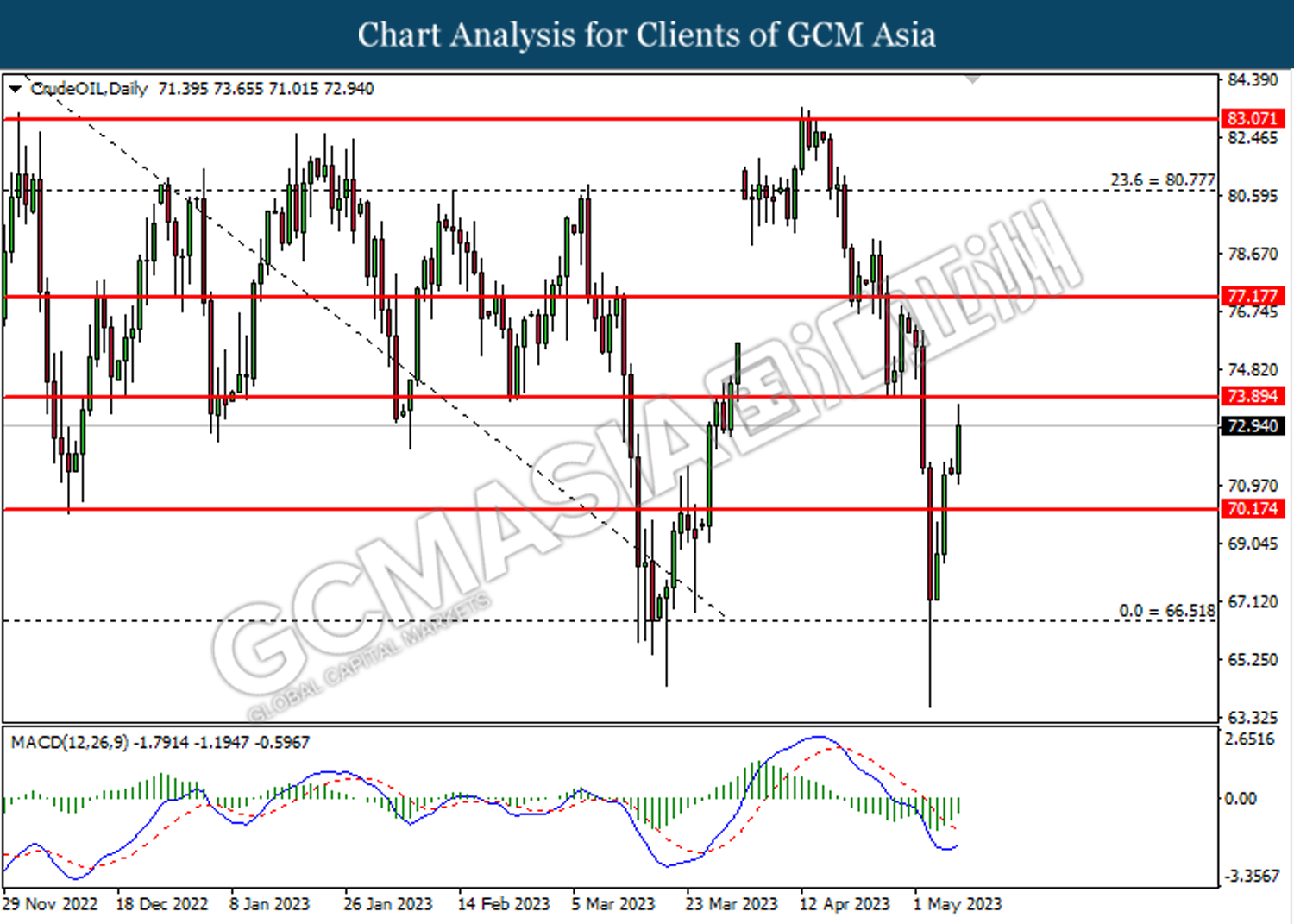

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

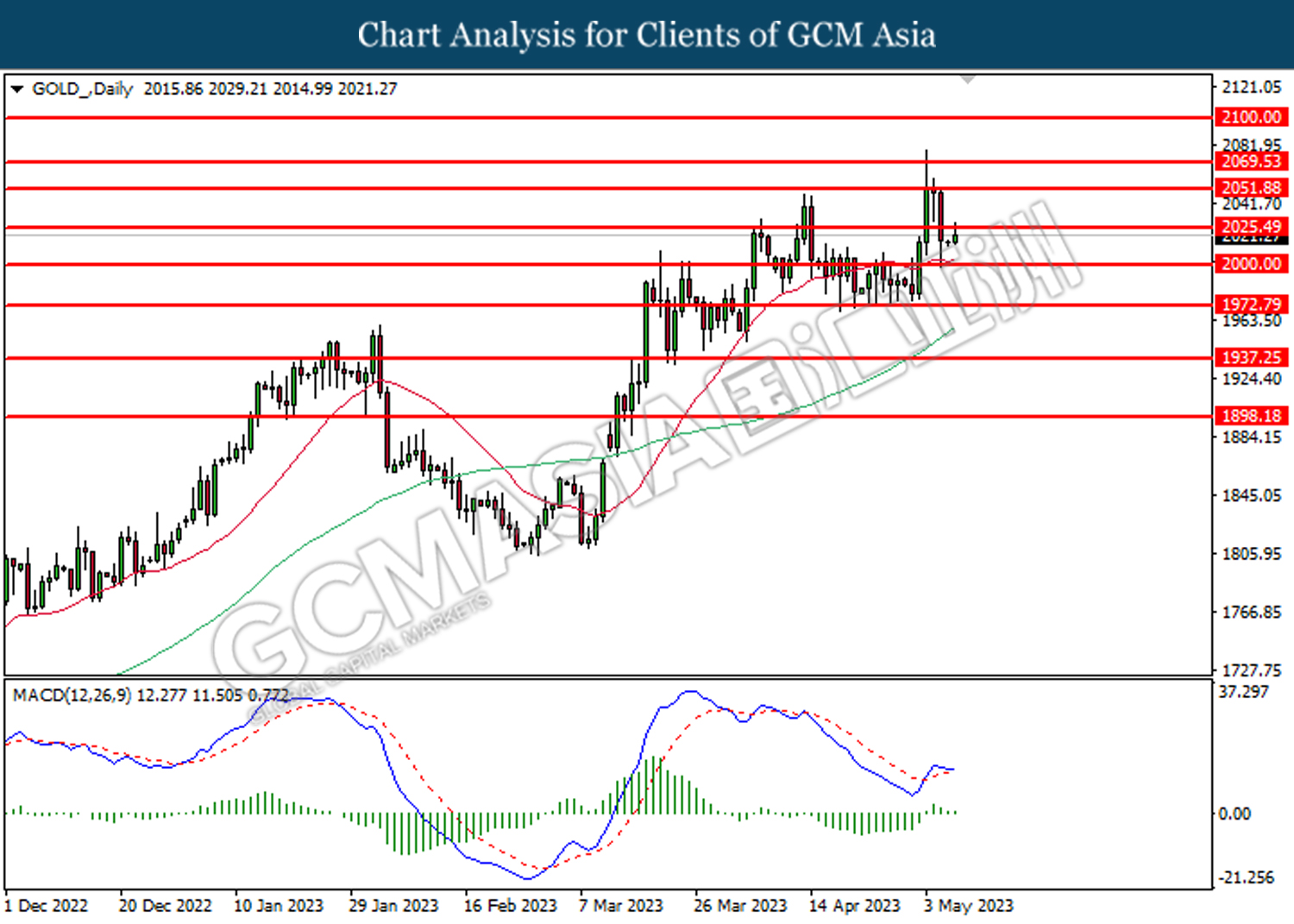

GOLD_, Daily: Gold price was traded higher while currently retesting the resistance level at 2025.50. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80