9 June 2022 Afternoon Session Analysis

US 10-year Treasury yield rose, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies spiked since Wednesday amid the backdrop of rising risk-off sentiment, which spurred bullish momentum on the safe-haven Dollar. According to CNBC, the US 10-year Treasury yields rose since yesterday to 3.055%. The rising of treasury yields would likely to increase the risk-free return of investors, which sparkling the appeal of US Dollar. It had also prompted investors to shift their capitals from stock markets to US Dollar, leading US stock market to slump. Besides, the Dollar Index extended its gains over the Bank of Japan (BoJ) remained its dovish tone. According to Reuters, the Bank of Japan remains one of the few global central banks to maintain a dovish stance while others have adopted tightening policies of hiking interest rates to combat inflation. It would likely to stoke a shift market sentiment toward other currencies which having better prospects such as US Dollar, as BoJ continue to remain its loosing monetary policy would drag down the risk-off return of investors in Japan. As of writing, the Dollar Index appreciated by 0.08% to 102.62.

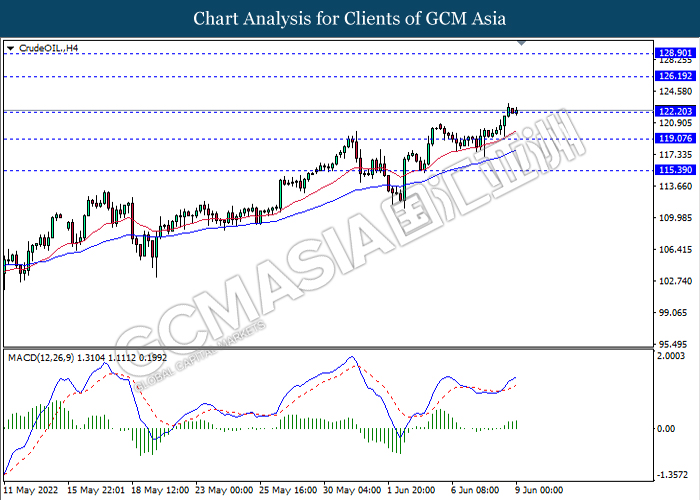

In the commodities market, crude oil price edged up by 0.01% to $122.12 per barrel as of writing over the positive data on U.S. gasoline consumption set aside fears of demand destruction from record high fuel prices. On the other hand, gold price depreciated by 0.14% to $1853.90 per troy ounce as of writing following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:45 EUR ECB Monetary Policy Statement

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Jun) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Jun) | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 210K | – |

Technical Analysis

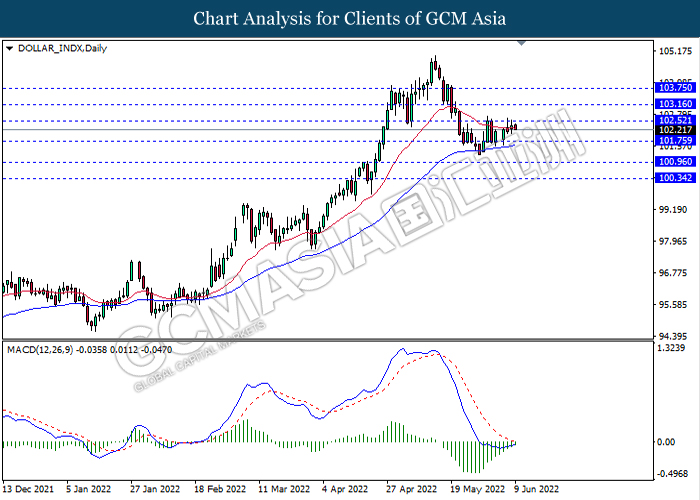

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

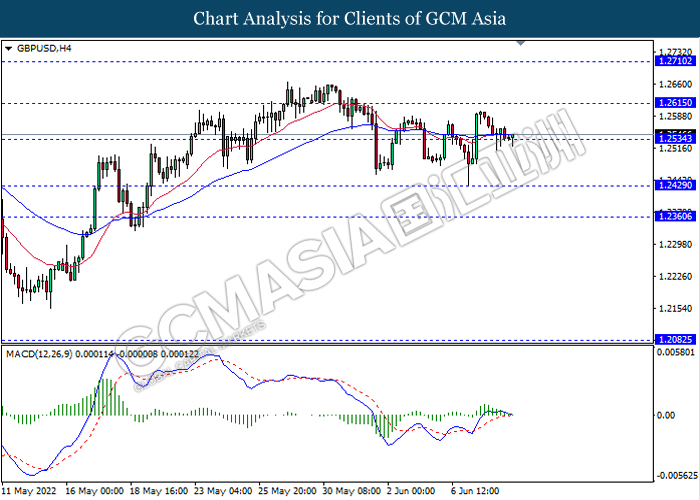

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

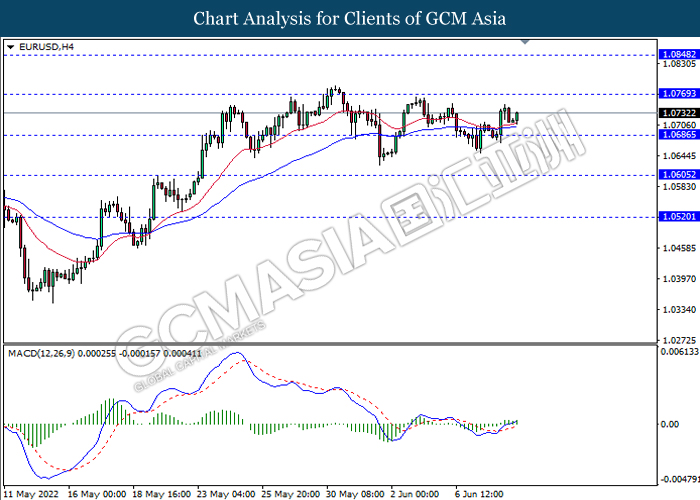

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

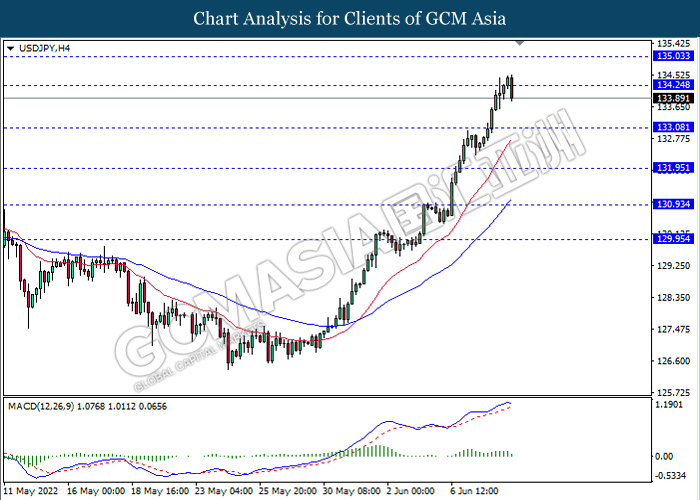

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

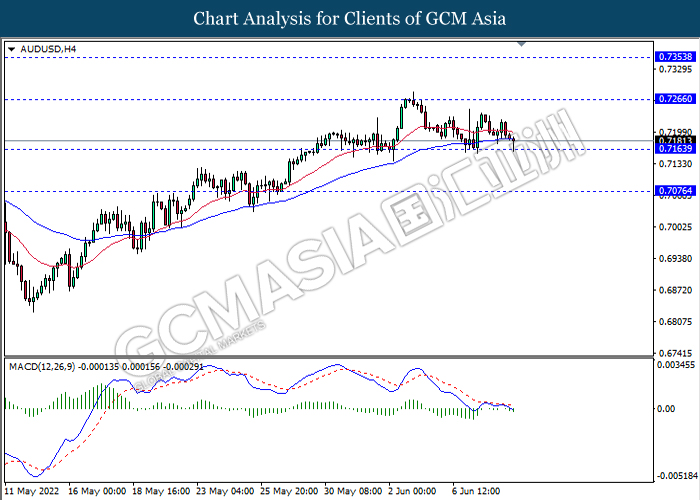

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7265, 0.7355

Support level: 0.7165, 0.7075

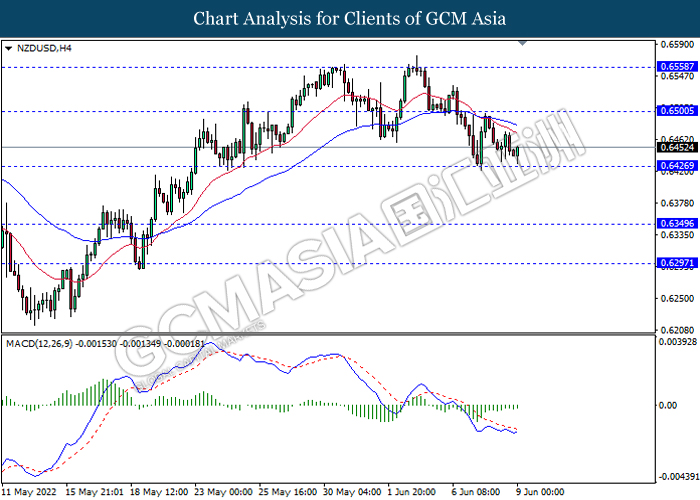

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6500, 0.6560

Support level: 0.6425, 0.6350

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

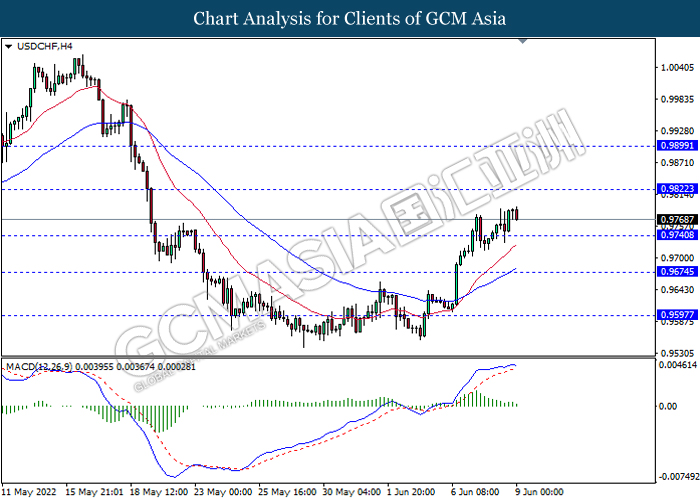

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9820, 0.9900

Support level: 0.9740, 0.9675

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 126.20, 128.90

Support level: 122.20, 119.05

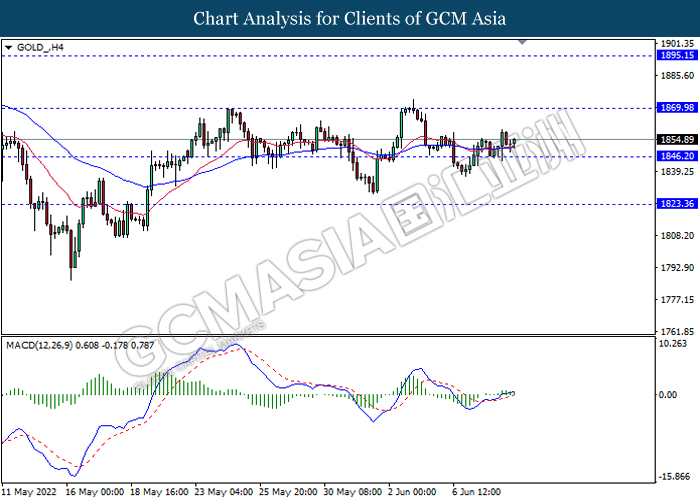

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1870.00, 1895.15

Support level: 1846.20, 1823.35