9 June 2022 Morning Session Analysis

Euro spiked ahead of ECB interest rate decision.

The Euro, which was widely traded by the global market participants jumped ahead of a European Central Bank (ECB) policy announcement. At this juncture, ECB is expected to maintain its interest rate at current level, while expressing a hawkish stance with interest rate hikes to begin in July. Investors reckon that the rate hike cycle in Eurozone would start in July, and there will be a 75 basis point of hikes by the month of September. With that, any message that does not signal an openness to a rate hike would likely fall short of the market’s hawkish expectations and push euro to a lower level. Shifting to the economic data, a series of upbeat data has shown that inflation remains at an elevated level, and it even hit a record high in May. High inflationary pressures across the Eurozone shows that it is necessary for ECB to increase their interest rate in order to cool down the overheating economy. As of writing, the pair of EUR/USD up 0.04% to 1.0720.

In the commodities market, crude oil prices down by 0.05% to $123.15 as of writing as U.S. demand for gasoline keeps rising despite some stockpiles were being found in the recent EIA inventories data. Besides, gold prices up 0.04% to $1853.90 per troy ounce while dollar lingered above the level of 102.00.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:45 EUR ECB Monetary Policy Statement

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Jun) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Jun) | 0.00% | 0.00% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 210K | – |

Technical Analysis

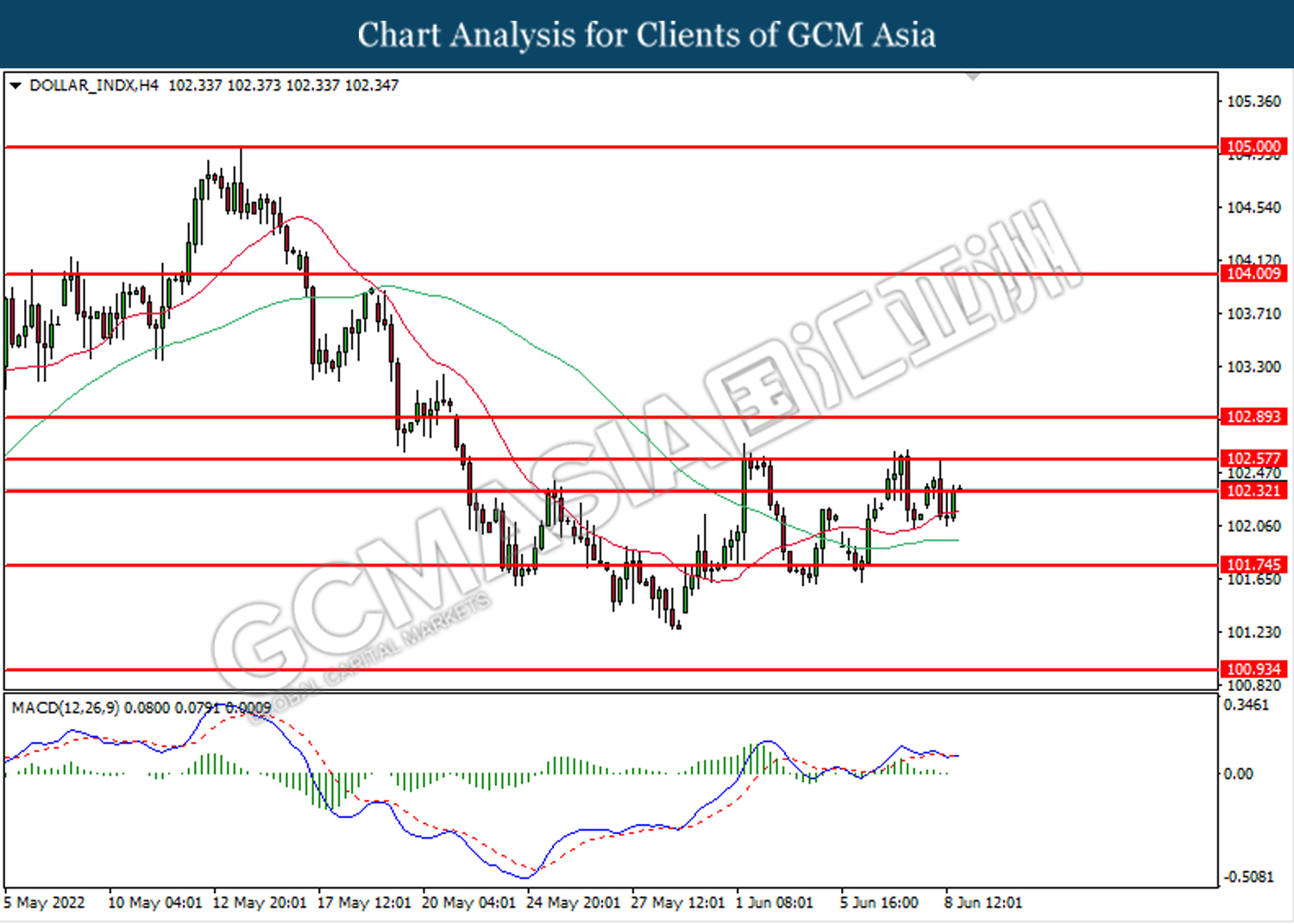

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 102.30. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 102.30, 102.55

Support level: 101.75, 100.95

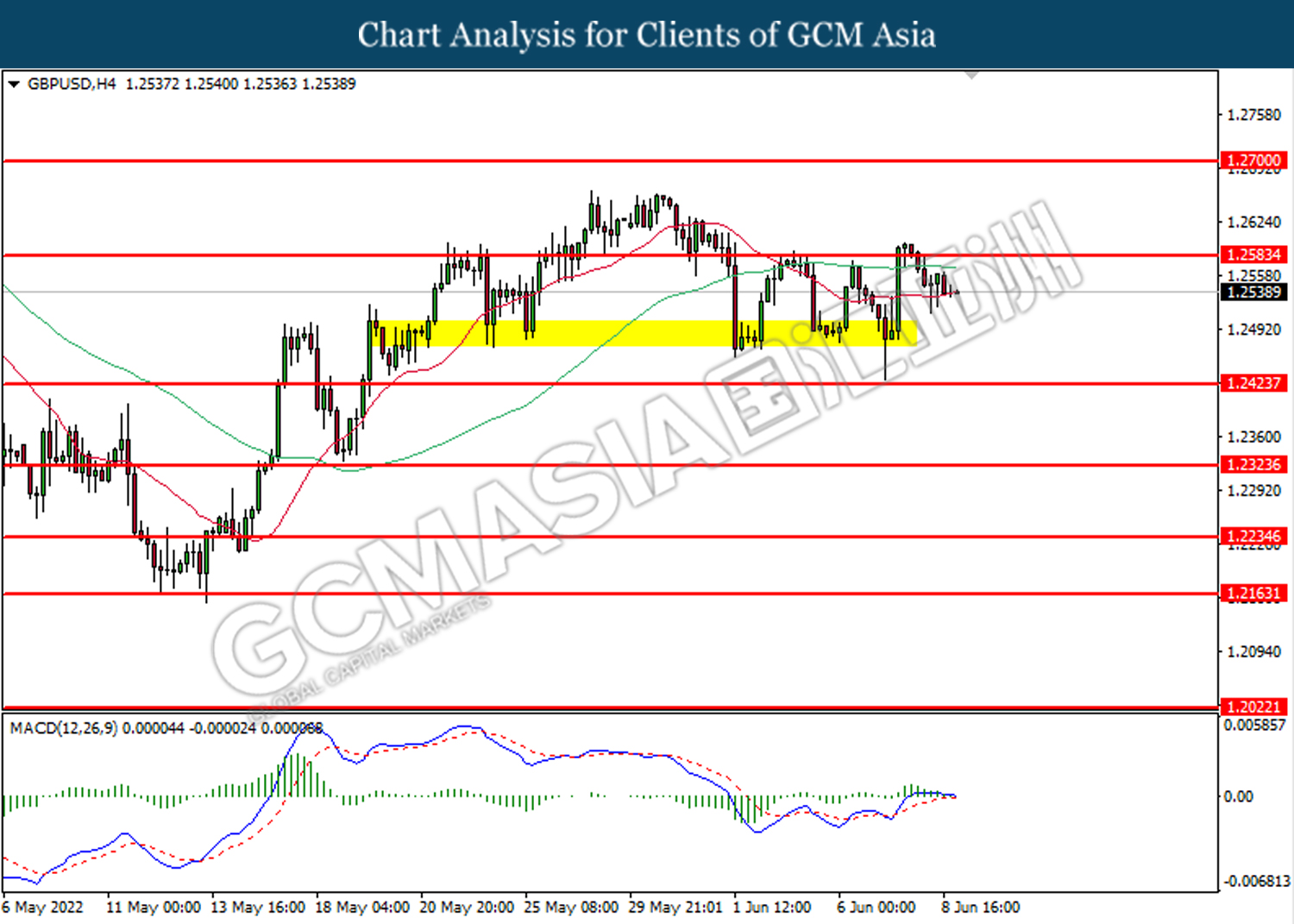

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2585. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2425.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

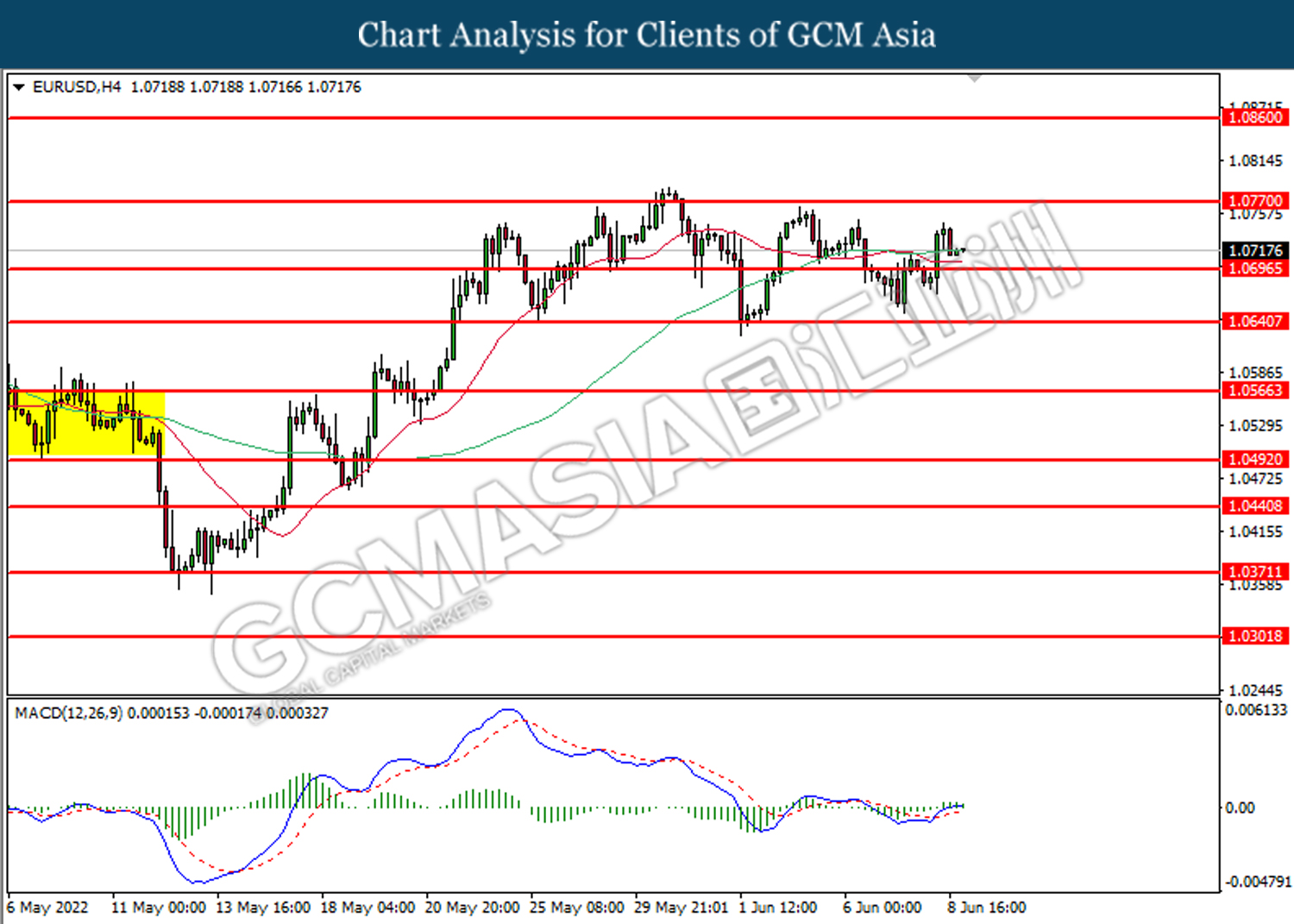

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0695. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0860

Support level: 1.0695, 1.0640

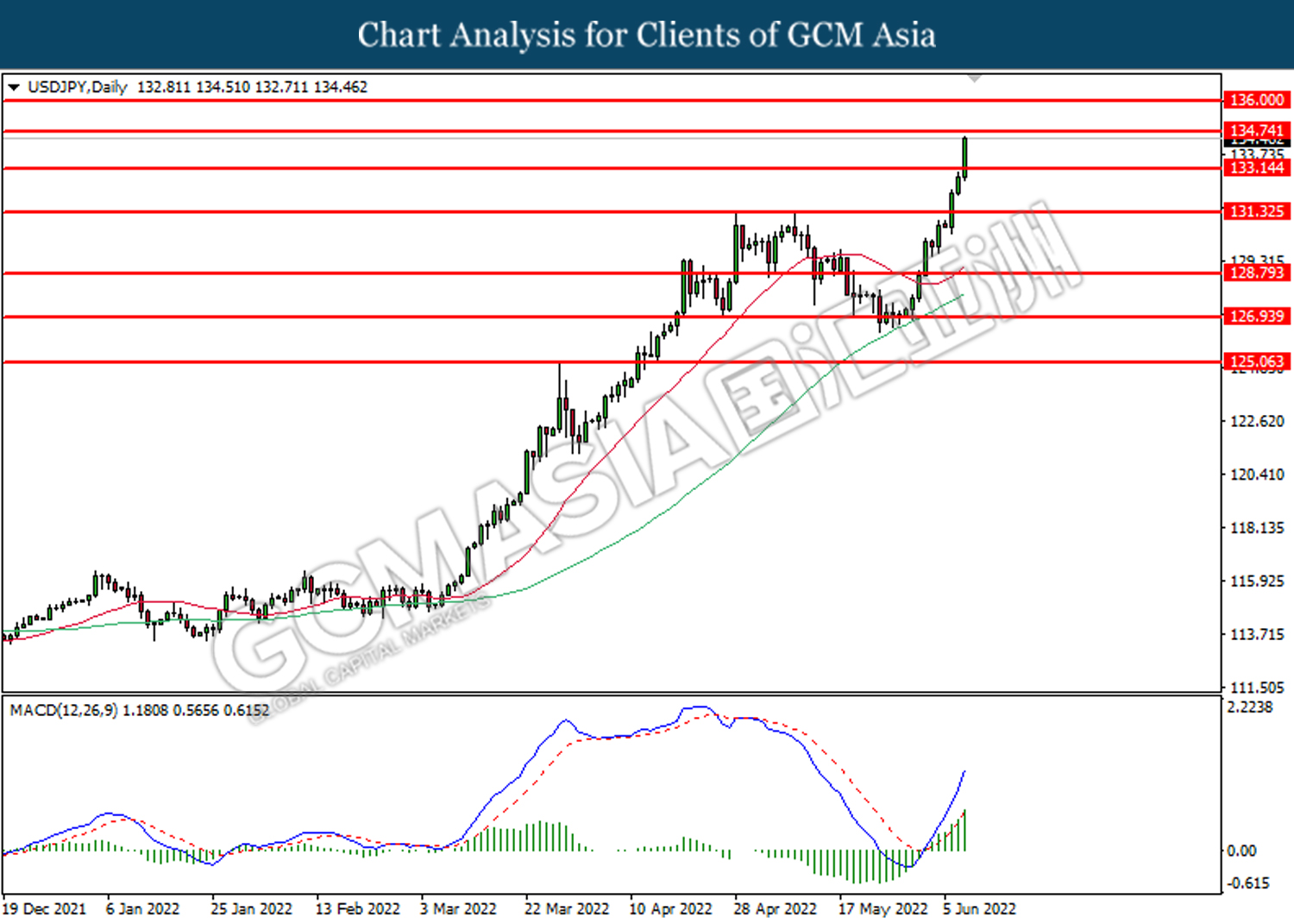

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 133.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.7260. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the lower level.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

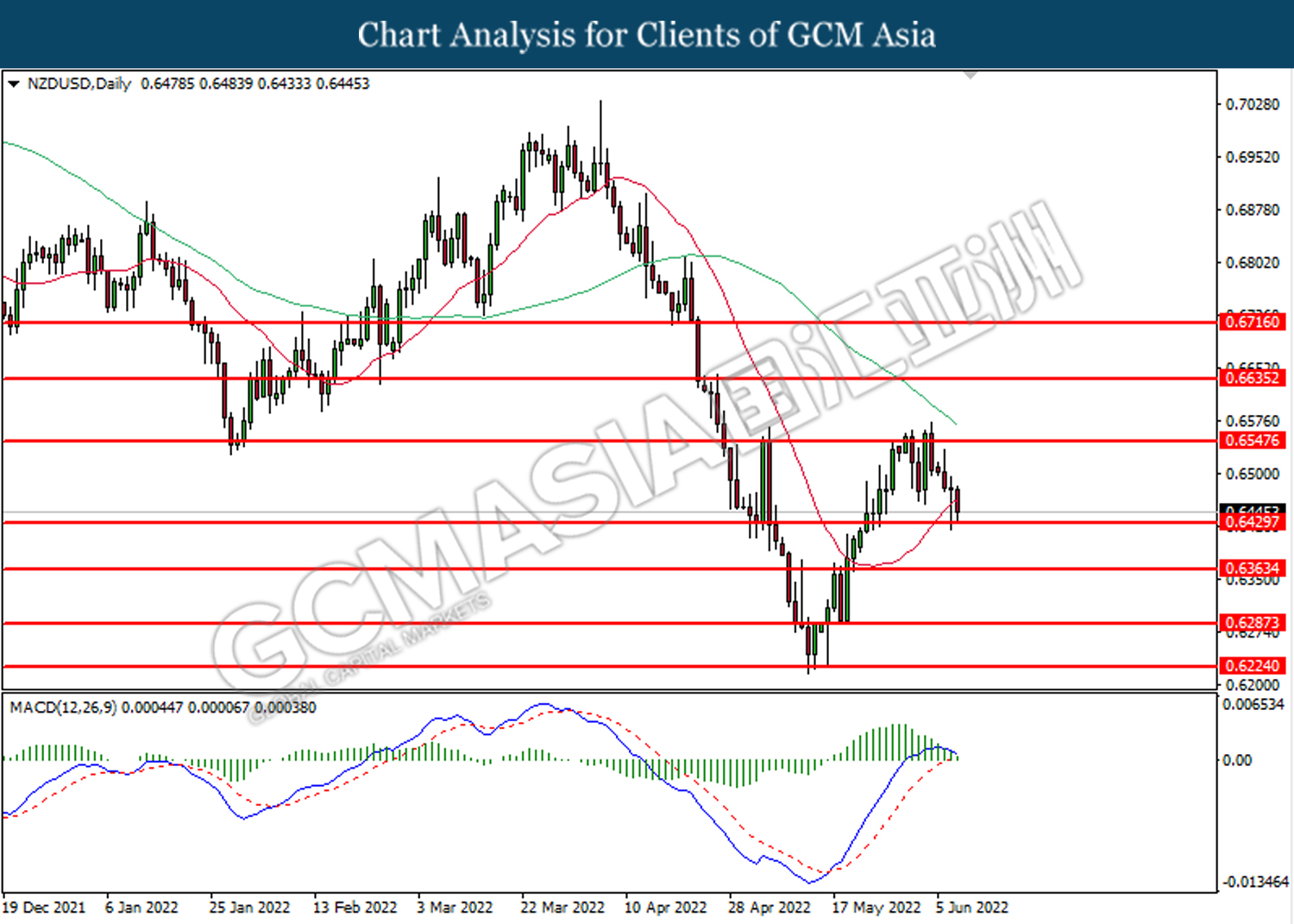

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6430. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

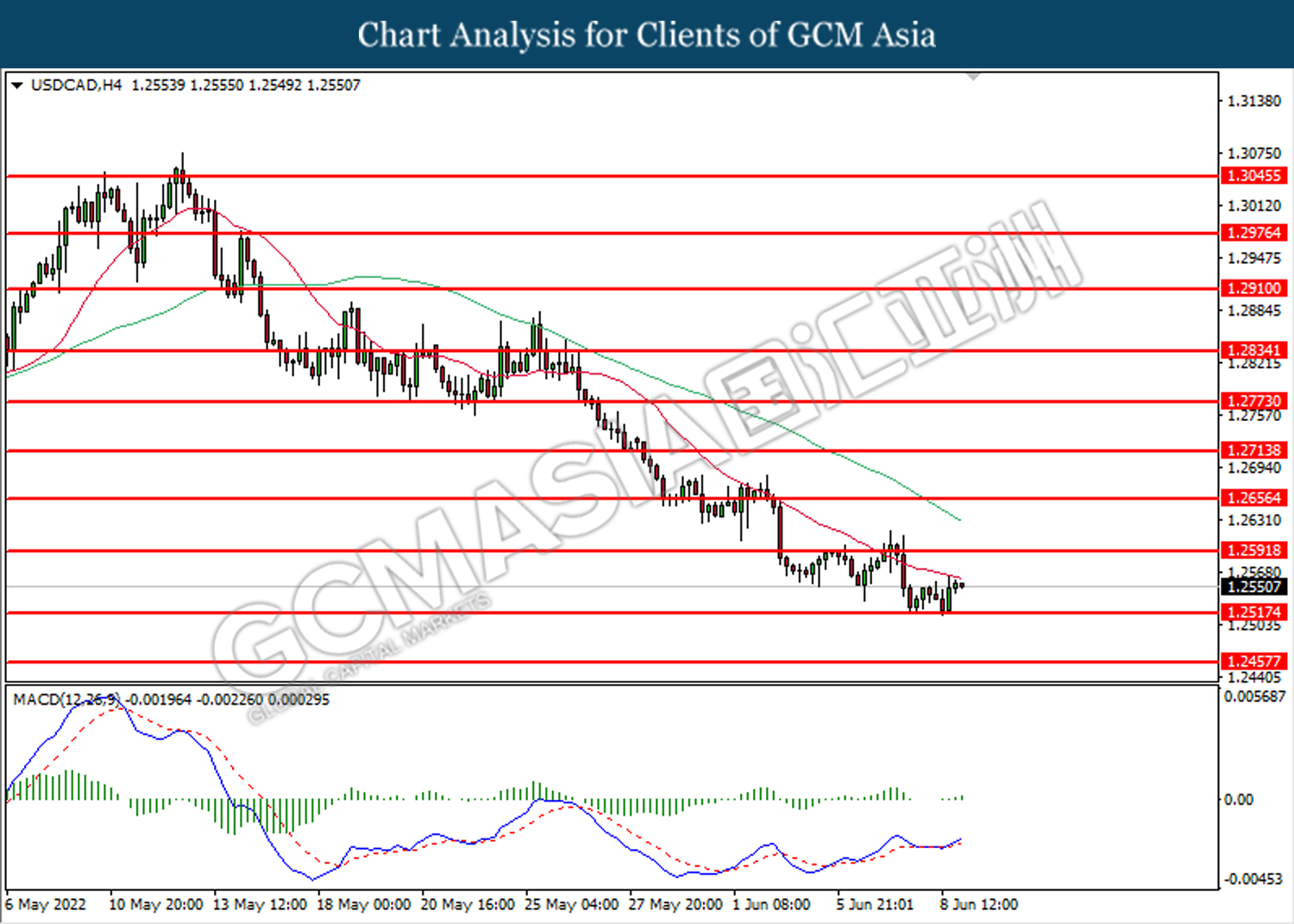

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.2515. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2655

Support level: 1.2515, 1.2455

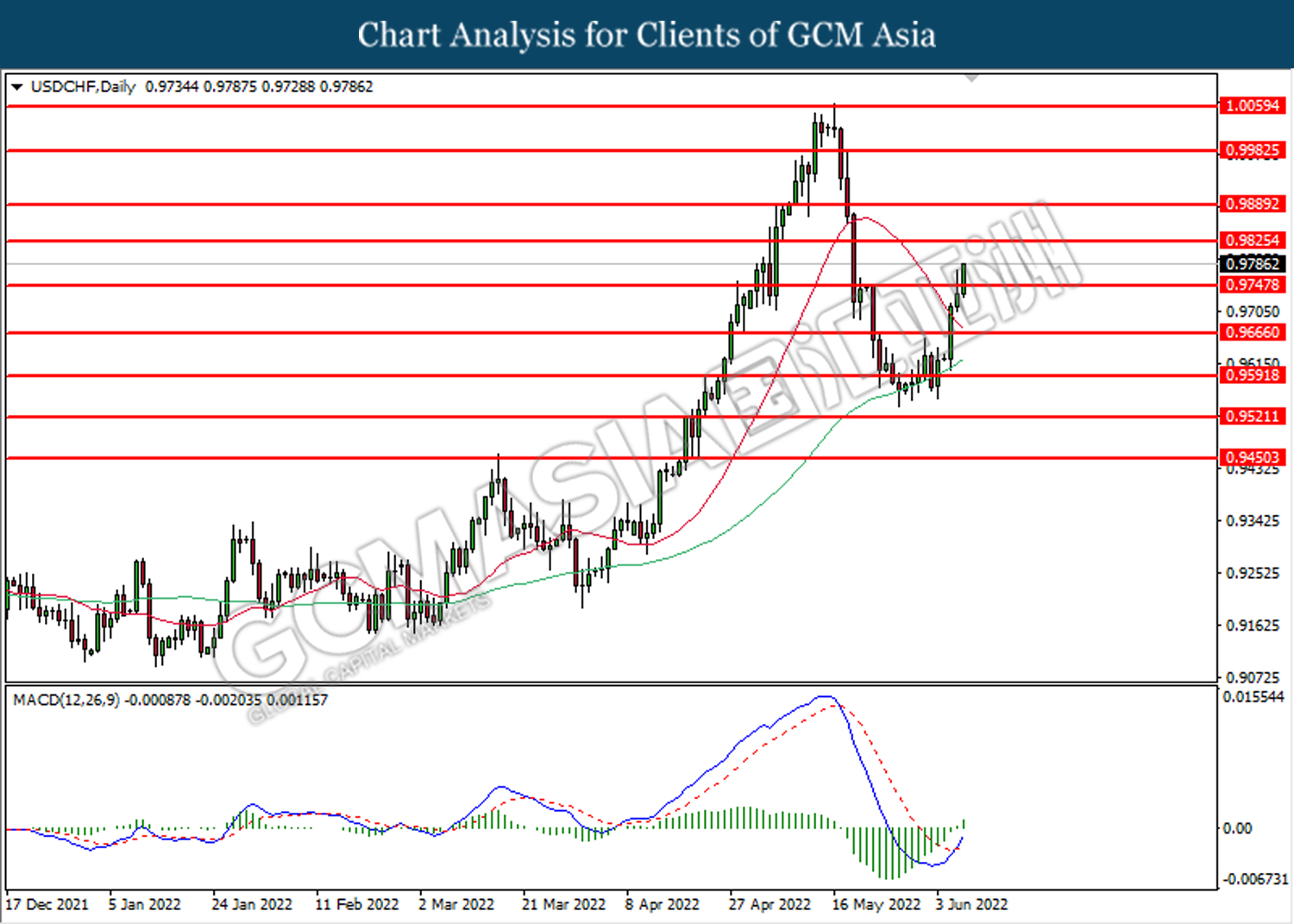

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9750. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after its candle successfully closed above the resistance level.

Resistance level: 0.9750, 0.9825

Support level: 0.9665, 0.9590

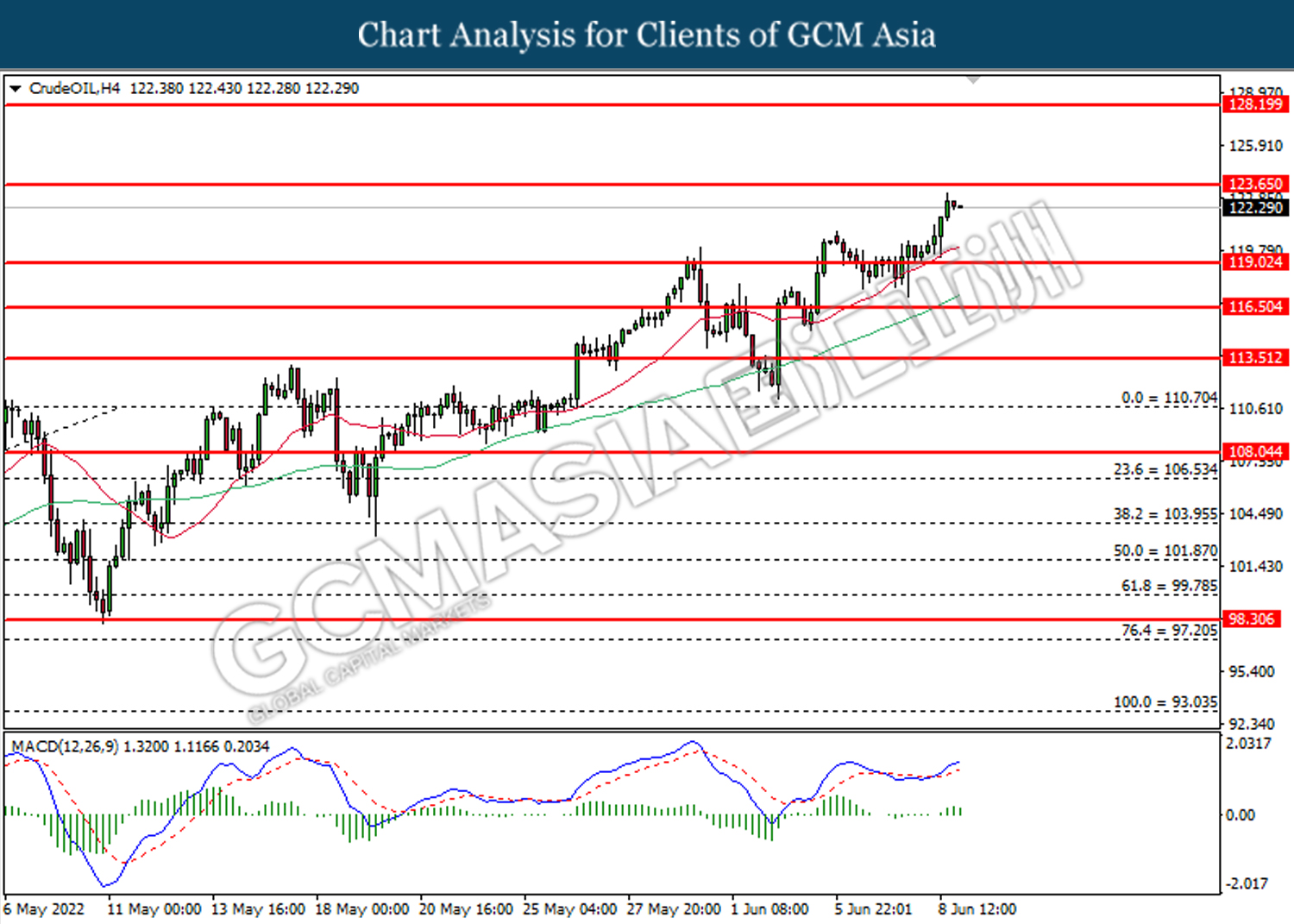

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 119.00. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 123.65

Resistance level: 123.65, 128.20

Support level: 119.00, 116.50

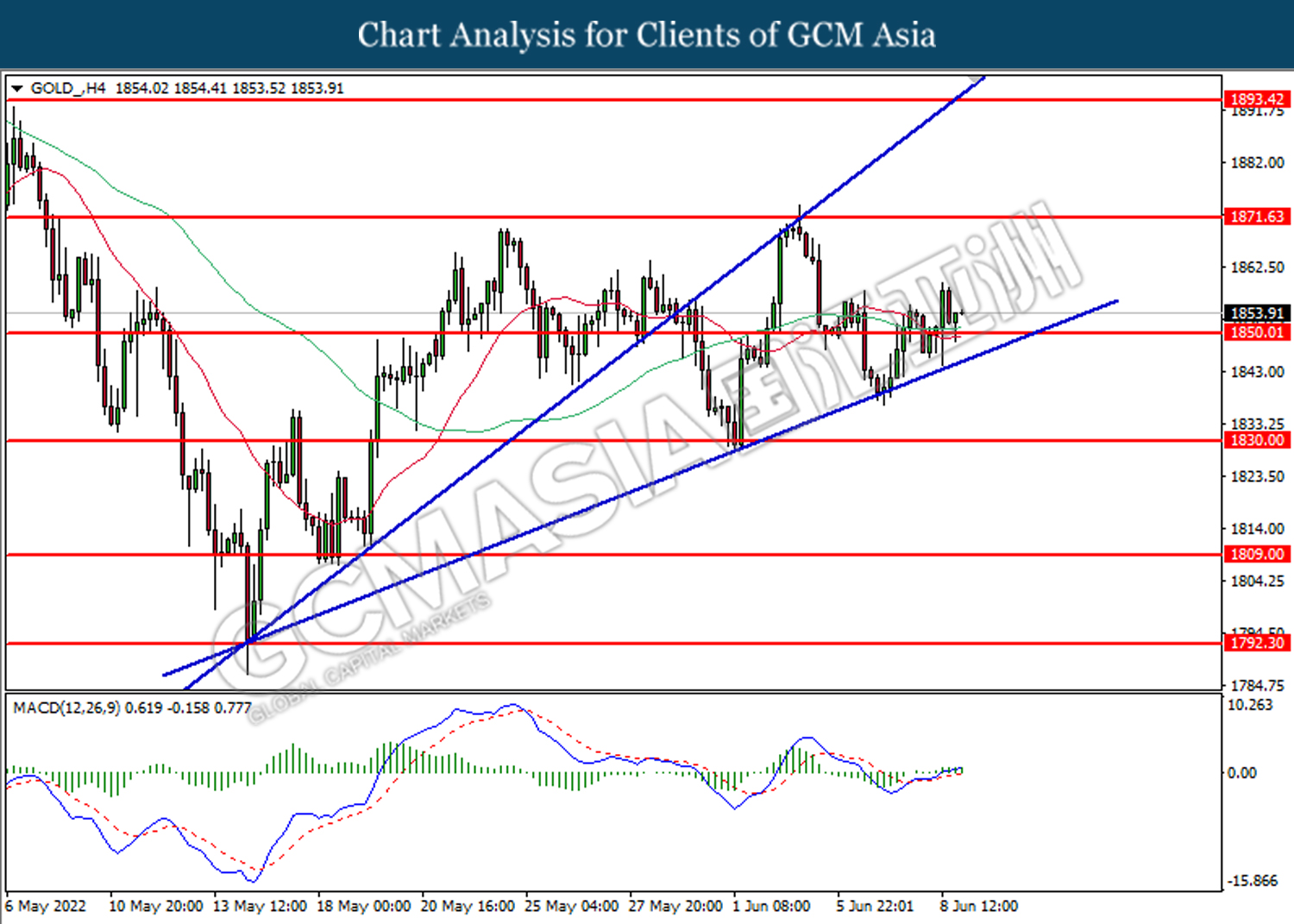

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1850.00. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1871.65.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00